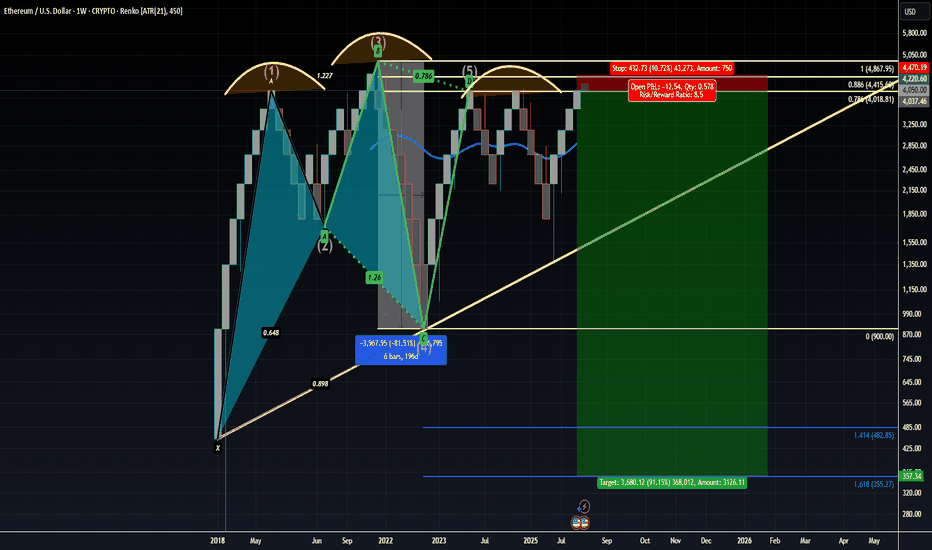

Ethereum Struggles to Complete above the 0.786 Bearish 5-0 ZoneWhile on the intra-bar price action on ETH has gotten pretty excited above the 0.786 it is still worth considering that ETH has not completed any bars above the 0.786 since the breakout and that at a moments noticed much of the current price action above the main 0.786 PCZ could later find itself being filtered out of the Renko charts as a whole depending on how many Average True Ranges above the 0.786 PCZ ETH possible move.

Based on the fact that the current candle is simply still in the projection phase I'd caution longs here and remain accumulative of longer dated puts. There is also a 2x leveraged ETF of ETH called ETHU which has OTM monthly call options trading at 20-40 dollar premiums. I'd consider farming off of those premiums in the form of Bear Vertical Spreads as a way to hedge off the costs of holding the long puts.

Overall, we are still trading at the PCZ of the Bearish 5-0 which seems to also be in the similar shape of a Bearish Head and Shoulders pattern; the measure move of which could take ETH down to around $355 upon the break of $1,600

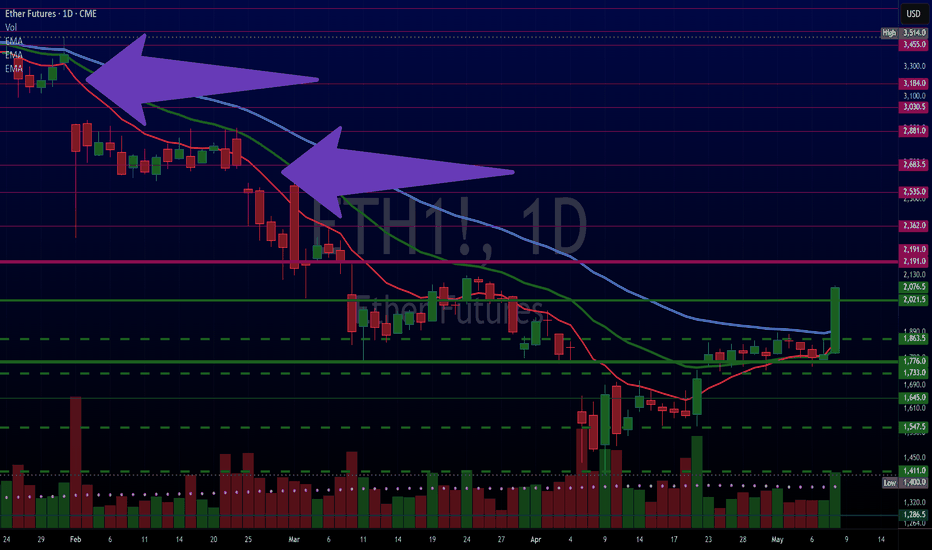

Ethu

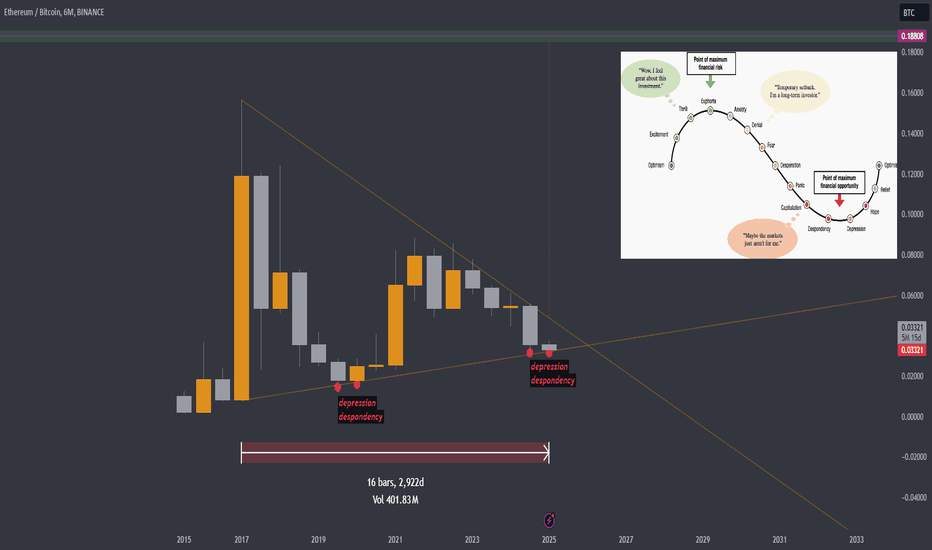

ETHEREUM: Thousand-Day Blood WarThousands of days have passed during ETHBTC’s extended consolidation phase. Market participants are beginning to lose conviction, but historically, this is precisely when the greatest financial opportunities emerge. We are approaching the final stages of this prolonged accumulation period—what may feel like the most challenging days before the trend decisively shifts.

When this breakout occurs, it is poised to deliver a sustained, substantial move to the upside, potentially spanning months. The technical setup is clear: the prolonged compression in price and diminishing volatility signal that the market is preparing for a significant expansion.

Periods like these, where sentiment is subdued, often lay the groundwork for the most transformative moves. The data supports this: volume is stabilizing, price action is tightening, and the market is primed for a decisive inflection point. Those who remain disciplined and patient are often the ones who capitalize most effectively when the momentum returns.

The time to prepare is now. Markets reward foresight, and those who position themselves ahead of the breakout stand to benefit disproportionately. This is not merely a rally on the horizon—it’s the culmination of years of market development, and the opportunity it presents should not be underestimated.