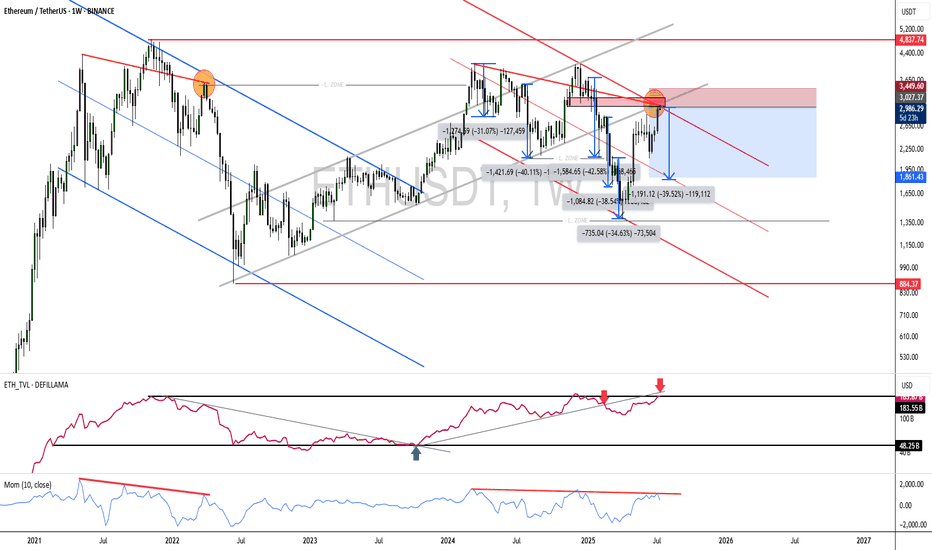

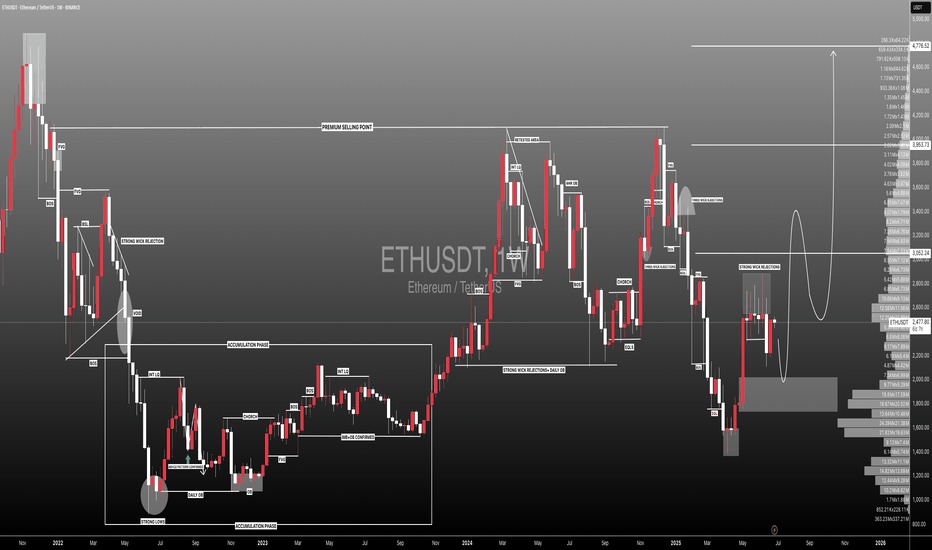

Is ETH overextended and due for a correction?For those holding ETH, this is a good point to set up a hedge using derivatives.

If the price keeps going up (which I think is unlikely at this moment—perhaps it will move sideways), buying at these levels is crazy.

In fact, there’s been a recent rally, full of people on X and YouTube saying this is the big moment to buy… That immediately raises a red flag for me!

And what about the FEDFUNDS? Have you taken a look? Haha, just something to think about.

--

After a long time away from TradingView and the community, I’m back to breathe some life into it!

Missed you all — let’s enjoy life and make the most of what it has to offer!

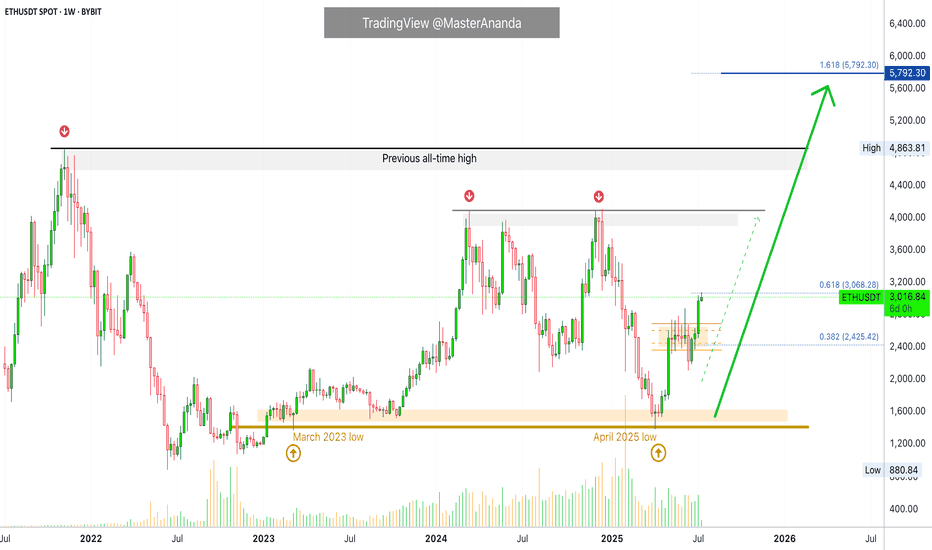

ETHUSDT

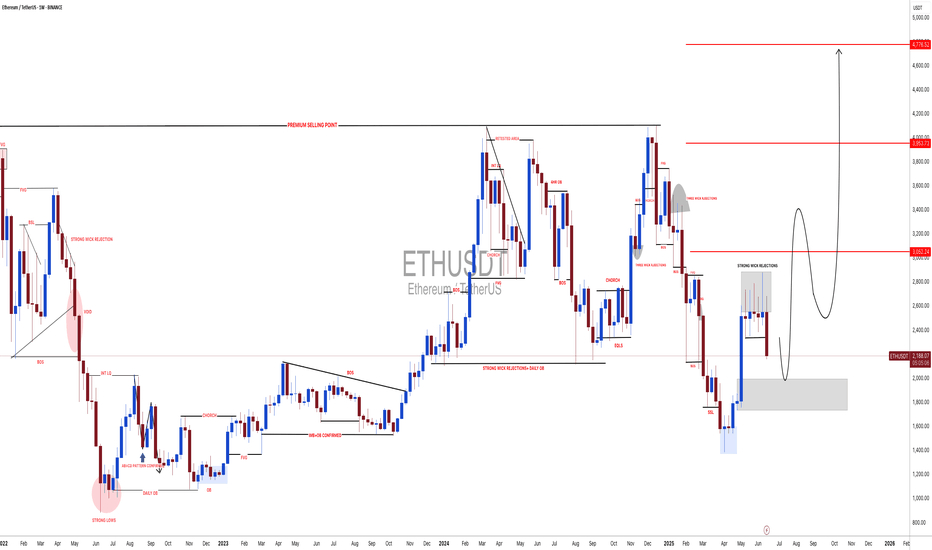

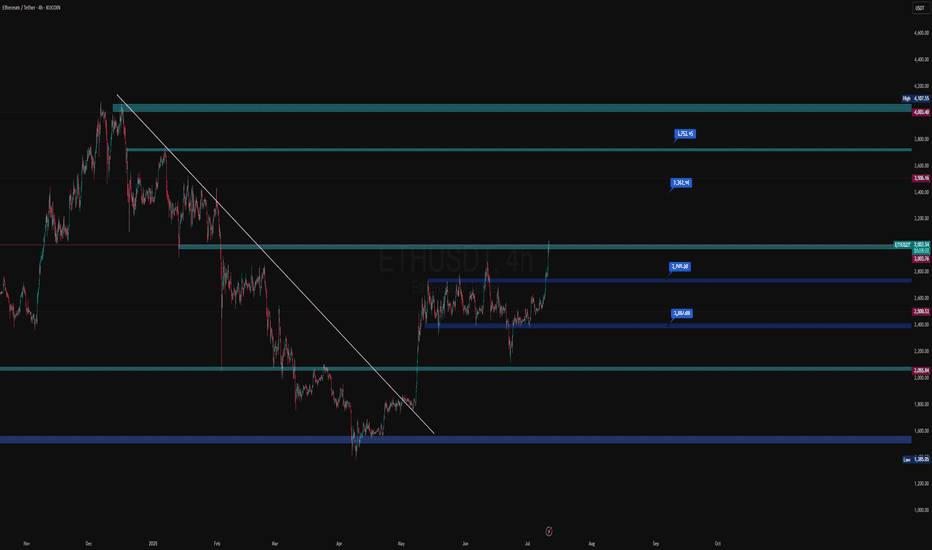

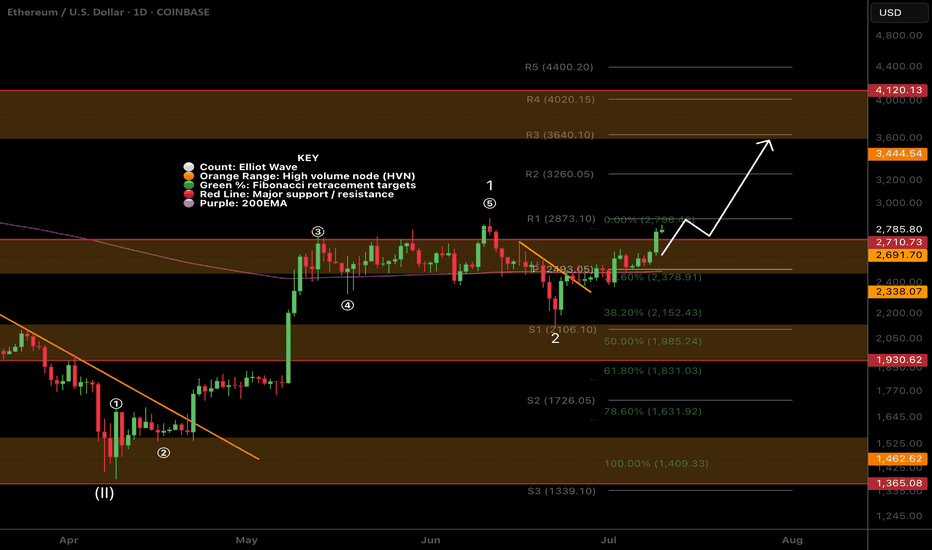

Can a Bear Market Start With Ethereum At $3,000?Ethereum produced sideways action for 49 days, 7 weeks. Immediately after seeing this I realized the next logical step was a bullish breakout, and the market moved up. But this isn't all. Ethereum is still trading at $3,000, more than $1,800 away from its all-time high.

Now, thinking about the doubt that always creeps up when the market becomes bullish confirmed, I want to clear things up if at least for you. While others can continue to doubt and will continue to do so, many others will even SHORT and lose everything, you will be happy knowing that the market will experience additional growth. You will also be making profits as the market grows. You will be happy because you know for a fact, based on data, that we are set to experience sustained long-term growth.

A bear market can only develop after a bull market. A bull market ends in a major high or new all-time high. Current conditions for ETHUSDT are far from being "peaky." There is no new all-time high. Actually, prices are still relatively low.

First Ethereum needs to challenge its previous all-time high, create a new one and then we can talk about a bear market or correction. We know for a fact that Ethereum is bullish based on recent price action and the chart. We know for a fact that Ethereum will grow because Bitcoin is already high up. Ethereum is the #2 Crypto and what Bitcoin does it tends to follow.

Bitcoin is super strong but this is not to be confused as weakness. Weakness comes when the market has been growing for too long, growth becomes heavy and a drop happens next. Strength happens when the market has been sideways for months, breaks up and produces a major advance (now). This type of pattern predicts additional growth.

Bitcoin is the king and what Bitcoin does the rest follows. You can expect additional growth.

The reason why the bullish cycle is not yet over is because prices are still too low. Many altcoins are trading near all-time lows. Think about it. A bear market develops from all-time highs and bull markets develop from all-time lows. We are only at the start of a major bullish cycle, phase and wave.

The proof is in the chart. A major low was hit 7-April 2025, the lowest since March 2023. This marks the end of the correction and the start of the 2025 bullish phase. I don't know if Ethereum will grow for years or only for a few months. I know with 100% certainty that the Cryptocurrency market will continue to grow. You can bet your house on it.

Thanks a lot for your continued support.

Namaste.

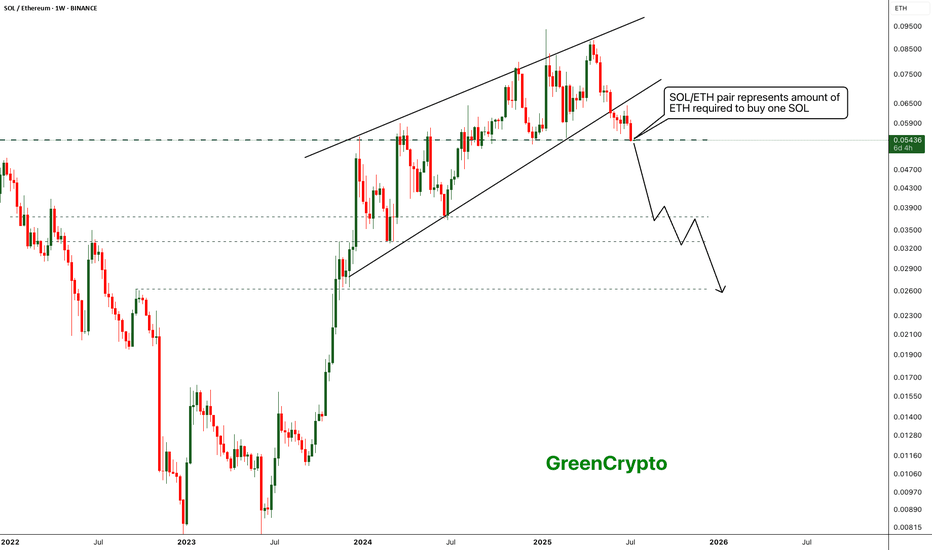

Ethereum is outshining Solona- Ethereum is finally outshining Solona

- ETH/SOL pair has broke down from the raising wedge pattern indicating clear bearish sentiment

- with the current bearish trend, we can expect the SOL/ETH pair to drop further down to 0.02630 range..

- This is clear sign the holder are preferring ETH or SOL

Stay tuned for more updates

Cheers

GreenCrypto

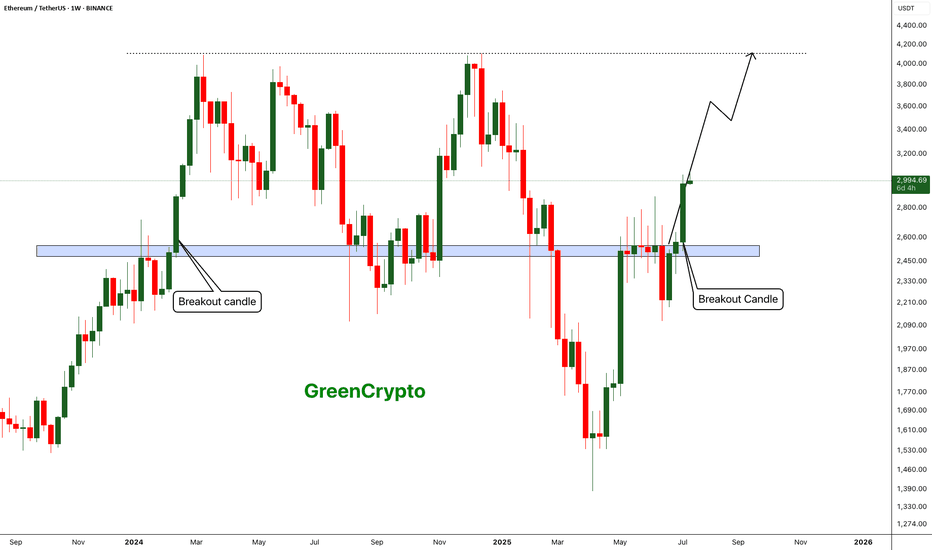

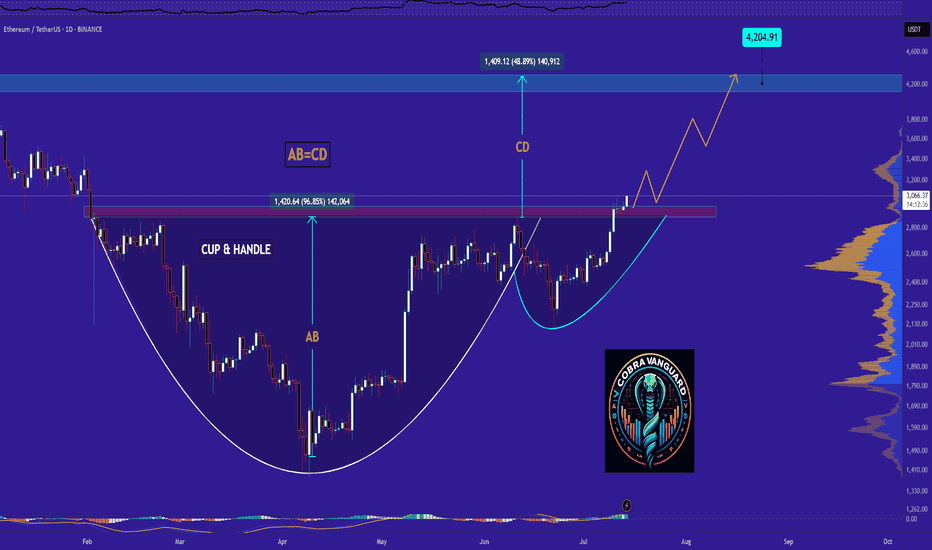

ETH - Confirmed target is 4100- After successfully breakout from the major resistance price is heading towards the next resistance line.

- From the previous all time high, we have a clear resistance around 4100 range.

- We can expect this bullish trend to continue easily and reach the next resistance around 4100.

Stay tuned for more updates

Cheers

GreenCrypto

#ETHUSDT: Time For Big Price Distribution! Get Ready $5000ETH is currently in distribution and is on our target list. We expect a smooth price movement, potentially reaching $3100, $3800, and $5000. Use the entry zone to take a position; anything below the entry will invalidate the idea. Please use accurate risk management while trading.

Like, comment, and share this idea to encourage us to post more.

Team Setupsfx_

#ETHUSDT: Currently On The Way Towards Filling The FVG?ETCUSDT is currently experiencing a significant correction as the price approaches a pivotal juncture where a substantial bullish price reversal is anticipated, potentially propelling it to new all-time highs or even surpassing them. It is imperative to exercise meticulous risk management and conduct your own thorough analysis before engaging in any cryptocurrency trading or investment activities.

Should the price indeed undergo a major correction, it is likely to decline to our second designated area, where it is anticipated to fill the liquidity gap and subsequently reverse course, continuing its trajectory towards our established targets.

Please consider this analysis as a secondary influence only, or even solely for educational purposes. It is crucial to conduct your own independent analysis and risk management prior to engaging in any cryptocurrency trading or investment endeavours, as they inherently carry substantial financial risks.

We extend our best wishes and encourage you to trade safely and responsibly.

Should you wish to demonstrate your support, you are welcome to express your appreciation through likes, comments, or sharing this information.

Thank you for your consideration.

Have a pleasant weekend.

Team Setupsfx_

Resistance zone: 3265.0-3321.30

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(ETHUSDT 1D chart)

It is showing an upward breakout of the important zone of 2419.83-2706.15.

We need to see if the price can be maintained by rising above the Fibonacci ratio of 0.5 (2788.93).

If so, it is expected to rise to the resistance zone of 3265.0-3321.30.

The important zone of 2419.83-2706.15 is the support and resistance zone that can lead to a full-fledged uptrend.

Therefore, if it falls below this zone, we should stop trading and watch the situation.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

ETH/USD Setup | Thief Trading Blueprint for Profit.🔥🚨THE ETHEREUM HEIST PLAN: Thief-Style Trading Blueprint for Maximum Gains🚨🔥

💰Thief Mode: Activated | Time to Rob the Bulls 💰

📢🌍 Hello Money Makers, Crypto Crooks & Chart-Breaking Bandits! 🐱👤🤑💸

Welcome to the “Thief Trading Style” breakdown — a high-stakes, high-reward crypto market blueprint built on deep technical & fundamental intel. This isn’t your average strategy… it’s a full-blown heist on the ETH/USD market!

🧠 THE MASTER PLAN (ETH/USD – Day & Swing Trade)

🔎 Based on our Thief Mode analysis — blending market sentiment, trend psychology, and price action — Ethereum is ripe for a bullish robbery. We’re setting up shop at high-risk liquidity traps and targeting bearish overconfidence.

💥ENTRY STRATEGY – "The Vault Is Open, Time to Strike!" 💥

🟢 Go Long:

Swipe in on bullish momentum.

🕒 Set Buy Limit Orders at key pullback zones (swing highs/lows from 15m or 30m timeframes).

💼 Use DCA (Layered Orders) for multiple precision entries. The more layers, the stronger the loot stack.

🛑STOP LOSS – "Thief Rule: Don’t Get Caught"

📍Place SLs at logical swing highs/lows using the 1H timeframe

💡 Adjust according to lot size & how many entries you're stacking

Risk smart, steal smarter!

🎯TARGET – "Make the Escape at 2850.0 or Jump Early if Cops Close In!"

📌Set TP at 2960.0, or

📌Exit early if the market starts turning shady (exit before reversal signs appear)

⚔️SCALPER'S CODE – "Fast Hands Only!"

🧲Only scalp Long-side plays

🧠Use trailing SLs to protect stolen profits

💼Big wallets? Front-run the move

🪙Smaller bags? Team up with swing traders and follow the blueprint.

🚨MARKET CONTEXT – Why This Heist is Bulletproof

💥ETH/USD is showing bullish energy due to:

Macro & Fundamental Drivers

On-Chain Metrics showing accumulation

Sentiment Analysis leaning toward over-leveraged bears

Intermarket Correlation signaling rotation into altcoins

🔗Stay sharp, keep updated with: COT Reports, Macro Calendar, Crypto News Feeds

⚠️NEWS RELEASE WARNING – "Robbers Hate Surprises"

📛Avoid new entries during major news releases

📈Use Trailing Stop Losses to lock in profits

⛔Don’t leave positions unmanaged during volatility spikes

💖LOVE THE PLAN? THEN BOOST THE GANG!

🎯Tap the 🔥 Boost Button 🔥 and show support for the Thief Trading Style!

The more boosts, the more plans drop — let’s build a community of smart traders robbing the market legally (😉).

✍️DISCLAIMERS

📌This analysis is for educational purposes only — not financial advice.

📌Always trade within your own risk management rules.

📌Market conditions change fast — adapt, evolve, and don’t trade blindfolded.

🚀Stick around for more blueprints — the next heist is always just around the corner.

Until then… Lock. Load. Loot. 🐱👤🤑💰

ETH/USD ROBBERY IN PROGRESS! Long Now, Exit Before Bears Attack!🚨 ETH/USD HEIST ALERT: Bullish Loot Before the Trap! 🚨

Thief Trading Style: Steal Profits & Escape Before the Cops Arrive!

🌟 Greetings, Market Pirates & Profit Bandits! 🌟

(Hola! Oi! Bonjour! Hallo! Marhaba!)

🔥 The Ethereum vault is WIDE OPEN! Time to execute the Thief Trading Strategy—bullish momentum is primed for a heist. Long entries only! Target the highs, then vanish before the overbought trap snaps shut.

🔑 Heist Plan (Day/Swing Trade)

🎯 Entry: "The vault is unguarded—swipe bullish loot at any price!"

Pro Tip: Use buy limits within 15-30min for pullback entries (recent swing lows/highs).

🛑 Stop Loss:

Thief SL (4H): 2240.0 (Nearest swing low)

Adjust SL based on risk, lot size & multiple orders.

🏴☠️ Target: 2800.0 (or escape earlier if bears ambush!)

⚡ Scalpers’ Quick Loot:

Only scalp LONG!

Big wallets? Charge in! Small wallets? Join swing traders & rob smart.

Trailing SL = Your Escape Rope!

📢 Why Ethereum?

🐂 Bullish momentum + strong fundamentals = Perfect heist conditions!

(Check COT reports, macro trends & sentiment— check 👉🔗!)

⚠️ WARNING: Cops (Bears) Are Setting Traps!

Avoid fresh trades during news!

Trailing SL = Lock profits & run!

💥 BOOST THIS HEIST!

🔥 More boosts = Faster profits!

🚀 Daily robberies = Easy money!

Stay tuned—next heist coming soon! 🤑💎 (Like & Follow for more loot!)

You Seek Profit, they seek you !who?Every time you think the market’s about to crash, it pumps.

And when you’re sure it’s time to enter, it dumps.

Maybe it’s time to ask a serious question: Who’s really hunting whom?

Hello✌

Spend 3 minutes ⏰ reading this educational material.

🎯 Analytical Insight on Ethereum:

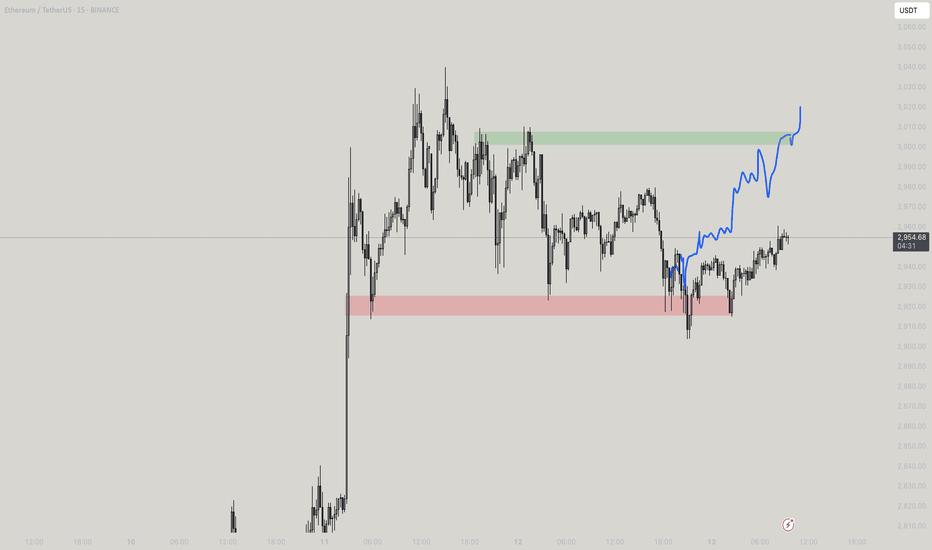

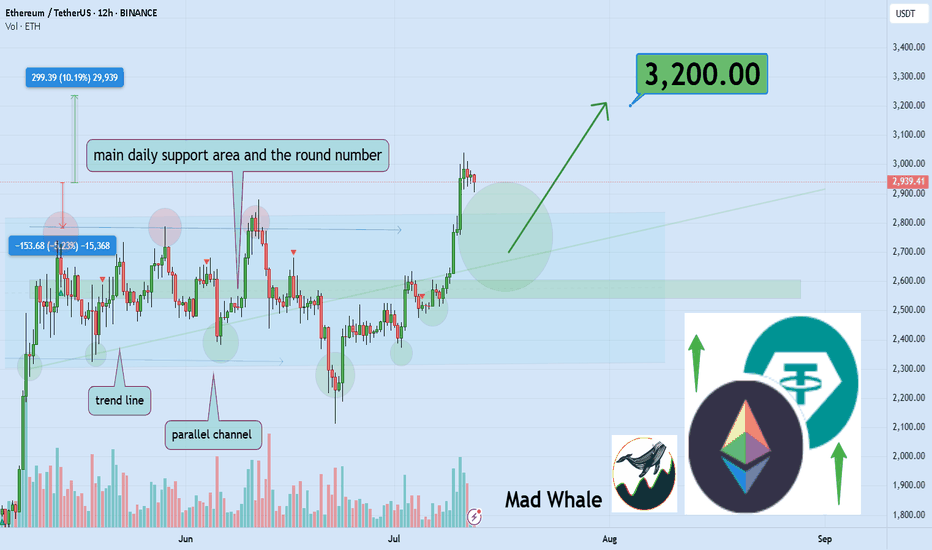

As noted earlier, after several days of sideways action, BINANCE:ETHUSDT has confidently broken above its parallel channel. 🚀 This breakout sets the stage for a potential gain of at least 10%, targeting around 3200. There is also a chance for a retest of the channel’s upper boundary before continuing higher. 🔄

Now, let's dive into the educational section,

🎯 The Modern Market Hunters

Markets today aren’t simple anymore. Behind every candle lies a strategy, an algorithm designed for one thing:

Profiting from your fear and greed.

In crypto, liquidations have turned from a mere term to a deadly tactic. When you enter a position, exchanges know exactly where your stops are. Often, price moves are designed to trigger liquidations of traders like you.

🛠 TradingView’s Tools to Spot the Traps

In a market where hunters are always one step ahead, TradingView’s default tools can be your secret weapon. You just need to know where and what to check:

Volume Profile (Range & Fixed): Shows where real money volume has entered, not just pretty candles.

Liquidity Zones Indicators: Pinpoints exact areas where stops cluster the prime hunting grounds.

Order Block Detection Scripts: Marks zones where whales place heavy orders, always moving against retail trader sentiment.

Set these tools on 1H to 4H timeframes and focus on overlapping areas. This way, you can spot traps before they activate, not after.

🔬 How Are Traps Actually Set?

Markets first build a nice trend, making everyone FOMO in. Then, a sudden shadowy candle crashes the party.

This is called a liquidity sweep or stop hunt.

Signs are clear:

Sudden volume spikes

Positions quickly flipping to profit or loss

Long shadows on candles signaling stop grabs

This is exactly where Open Interest and Liquidity Maps come in handy. They reveal the hunting map before your eyes.

🧠 Your Mind Is The Biggest Liquidity Map

The biggest traps are built inside traders’ minds. When the market moves against you, you panic and set stops.

But that’s exactly the lesson market makers want you to learn: don’t react emotionally.

Instead, a pro trader uses others’ behaviors as cues before market moves.

While you focus on profit, whales focus on your biggest fear: stop loss.

🔄 Your Greed Is Their Data

Every stop you set is a data point for them. You chase profit, they chase your surrender.

Lots of long volume in one zone? Price gets dragged down.

Everyone’s short? Expect a fake pump.

Volume is a footprint, and they track emotional traders like a bloodhound.

🚧 Escape The Trap, Don’t Predict The Market

Pro trader’s formula:

Don’t try to predict track.

When you realize the market isn’t moving naturally but hunting orders, your mindset shifts. You become a tracker, not a soothsayer.

📉 Every Candle Can Be A Killer If You’re Unaware

When a big opposing candle hits your position, ask:

Are we all thinking the same thing?

If yes, you’re likely the next target.

📌 Final Summary

If you only chase profit, you miss the fact the market is hunting you.

The only way out: know they play with your info, not just the charts.

Trading blindfolded is walking into the wolf’s den.

✅ What To Do Next?

Learn to analyze other traders’ moves, not just price action.

Use TradingView tools to see behind the candles.

You’re not here to be hunted you’re here to hunt. So this time, guess where everyone’s stop will be before entering!

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

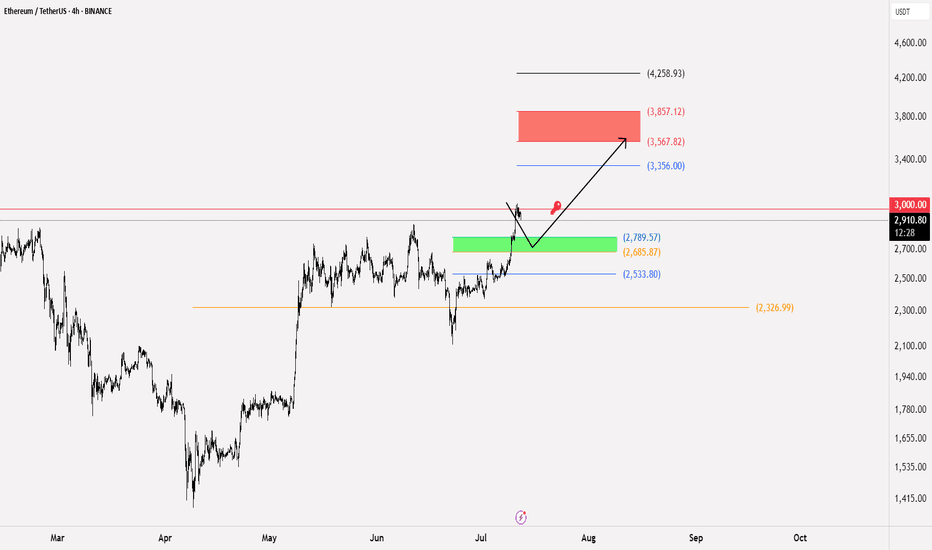

Ethereum Idea and Buying Plan⚪️ CRYPTOCAP:ETH

We mentioned earlier that our goal is 3290 - 3473 which is the gap formed in CME contracts

⭕️ Currently, for speculative thinking or looking to enter the support range after all this rise is between 2789.57 to 2685.87

🚨 The important thing is to stay above 2326 to support the continuation of the rise strongly

🔼 The key to the rise will be maintaining movement above 3000 on the 4h and 1d frames

📄 The closest targets for this model, upon meeting the conditions, are 3356 reaching the range of 3567 - 3857

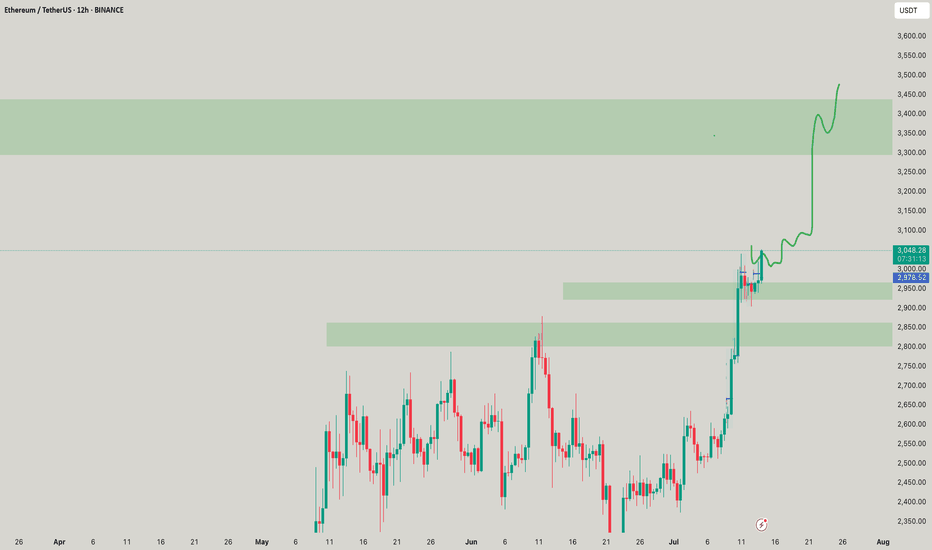

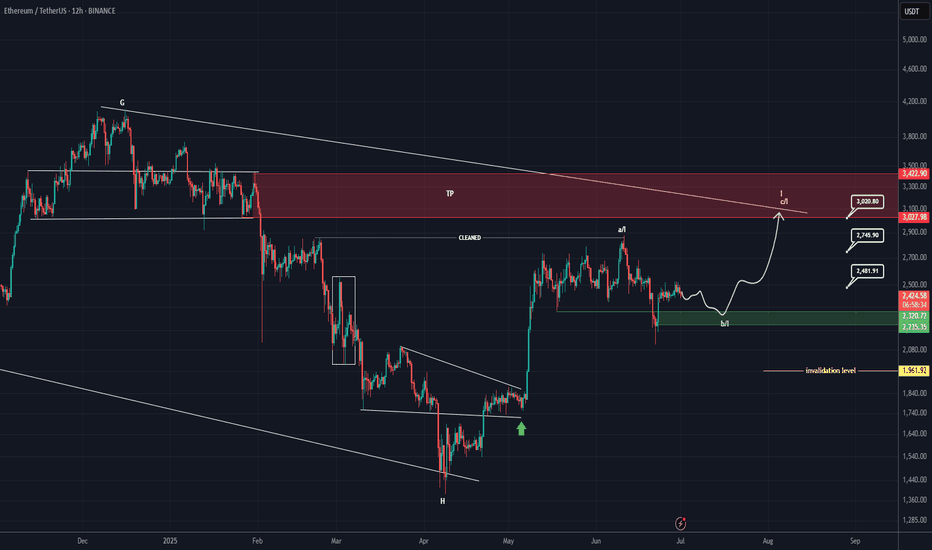

ETH New Analysis (12H)This analysis is an update of the analysis you see in the "Related publications" section

The previous analysis is still valid | its timeframe is higher, but in this update, we've moved to the lower timeframes.

It seems a valid bottom has been formed on Ethereum, and we may not see a lower low, provided that the price doesn't move higher first but instead drops directly into our support zone. If that happens, the price could potentially move upward from there.

Ethereum seems to be searching for a support zone to reach higher levels. The marked area could potentially launch the price upward.

In this analysis, the support zone, targets, and invalidation level have been updated.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

ETH Long / Buy SetupAs of many times mentioned that, will short eth above 3k or 3k, but it still shows Bullish momentum no sign of weakness, maybe this entry triggers during weekend due too low volume, search for ifvg, if any 1D or 4hr Bullish fvg truns into bearish ifvg then will take short on ETH. For now will take long with SL and proper risk management.

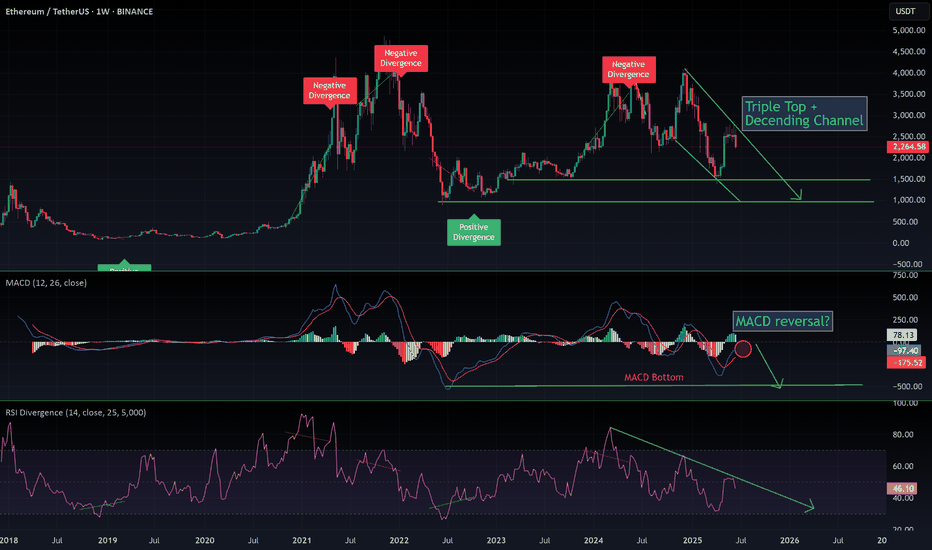

$ETH: The 1-week chart is an absolute disaster!Once again, I want to make it clear: I’m naturally a bull. But I live in Thailand, far from the noise of influencers shouting "buy, buy, buy!" I’ve learned my lesson—when they scream buy, you get rekt. That’s why I rely solely on the charts.

Charts are just mathematics—they don’t lie. So here’s my honest interpretation of what I’m seeing for Ethereum:

🕐 Daily Outlook

Yes, we might see a few nice bounces in the short term. But if your plan is to hold ETH, you should be paying attention to higher timeframes, especially the weekly.

📉 Weekly Chart — It's Ugly

We’re clearly in a descending wedge, and overall, ETH is bearish. Don’t be fooled by the hype or the people trying to take your money.

- RSI is bearish, with a strong bearish divergence still unfolding.

- MACD is on the verge of a bearish crossover, and what’s worse, it’s doing that without even touching the neutral zone—a major red flag.

The last time we saw this setup? November 2021. The price crashed below $1,000.

🔍 Where’s the Support?

This cycle, the support zone looks closer to $1,500, mainly due to institutional interest and the ETF narrative. A full retracement seems unlikely, but technically speaking—it’s still a possibility.

🤔 Why Is This Happening Despite Institutional FOMO?

Here’s the key: ETH has staking, and every month, new CRYPTOCAP:ETH is minted to pay stakers. This creates constant inflation. On top of that, many stakers compound their rewards, accelerating the inflation. And guess what? These same stakers are selling as soon as ETH pumps.

So fundamentally, Ethereum is under pressure because of its own staking mechanics—a system flaw that creates long-term selling pressure.

Do your own research (DYOR). I could be wrong—but at least I’m not trying to sell you a course.

ETHUSD h4 next move downThe resistance at 1.36554 may be weak due to:

Multiple taps already

Reduced seller interest

A breakout above this zone could trigger short covering → sharp rally

✅ 2. Higher Low Structure

Recent low at 1.35475 held strong

Current consolidation appears like a bullish flag or accumulation range

Could indicate continuation, not rejection

✅ 3. Fakeout Reversal Setup

If price dips into the support at 1.35475 again, it might:

Trap breakout traders

Reverse and form a new impulse leg upward

Target = 1.3700–1.3750 zone

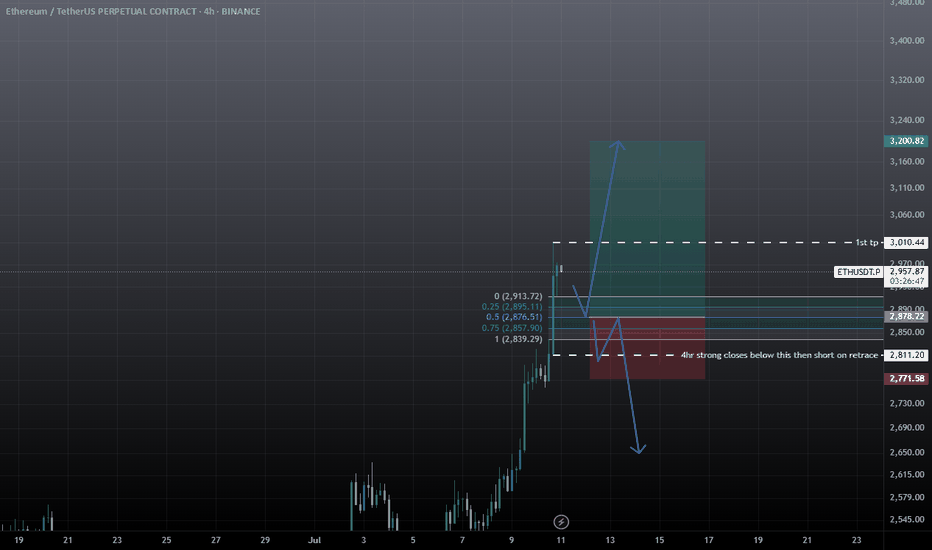

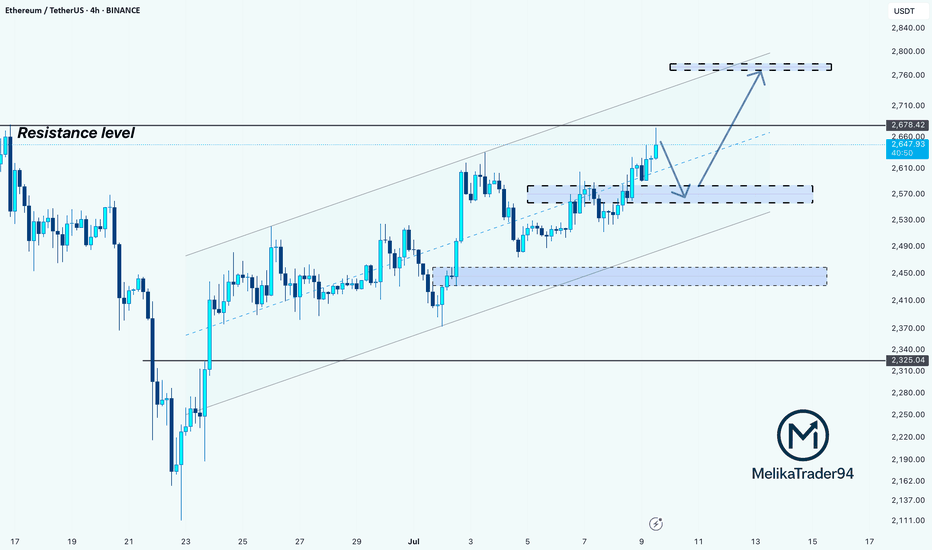

ETH Pullback Before Next Rally? Hello guys!

Ethereum is currently testing a strong resistance zone around the $2,678 level, which has previously acted as a key barrier. Price action has been climbing steadily within an ascending channel, indicating a clear bullish trend in play.

However, since ETH is right at the resistance, we could see a short-term correction or pullback toward the $2,560–$2,580 support range (highlighted zone), which also aligns with the midline of the channel and previous consolidation structure.

If this support holds, a healthy bounce from this area would likely push ETH toward the next bullish target around the $2,760–$2,800 zone, which sits near the upper boundary of the current channel.

$ETH clear for an impulsive move to $3600?CRYPTOCAP:ETH has slowly but surely cleared resistance, with just the swing high to tackle which will activate another trade signal in my Trade Signals Substack.

Major support High Volume Node, daily pivot and daily 200 EMA proved tough support and demand continues to come in.

ETFs had an astonishing amount of inflows yesterday at $200M+

Analysis is invalidated below $2100

Safe trading

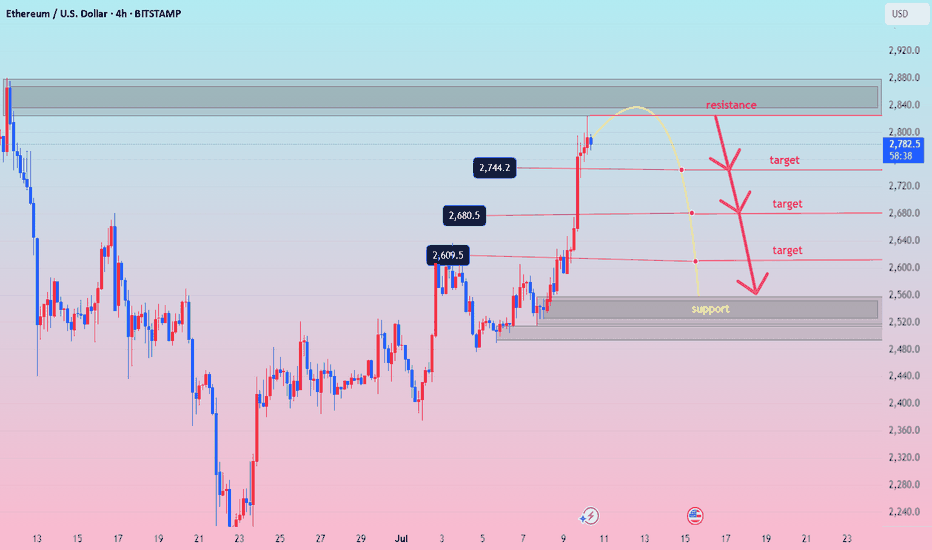

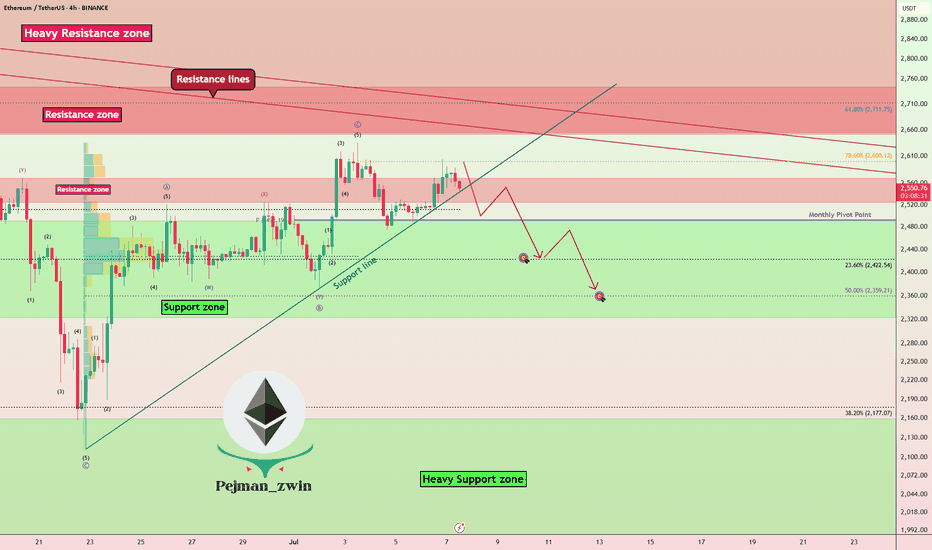

Ethereum Analysis – Vitalik’s Gas Cap Proposal Adds PressureToday, I want to show you the possible moves for Ethereum ( BINANCE:ETHUSDT ) this week.

Please stay with me .

Let’s first take a look at the important news that has come for Ethereum in the last 24 hours :

Ethereum’s Gas Cap Proposal Sparks Concerns

Ethereum co-founder Vitalik Buterin recently proposed EIP-7983 , introducing a gas limit cap to prevent potential DoS (Denial of Service) attacks on the network.

Bearish Takeaways:

This proposal reveals a current vulnerability in Ethereum’s infrastructure. If gas limits grow unchecked, nodes may fail to sync, leading to possible network instability.

Imposing a gas cap could temporarily reduce transaction throughput, affecting DeFi protocols and NFT platforms that rely on Ethereum’s scalability.

The market tends to react cautiously to core protocol changes, and this uncertainty could trigger short-term selling pressure.

Bullish Counterpoints:

The cap aims to strengthen the network’s long-term stability against spam and DoS attacks.

It’s still in the proposal stage, with no immediate impact on users or network performance.

Conclusion:

While the long-term impact may be positive, the short-term uncertainty and exposed risks provide a bearish narrative for Ethereum, especially amid growing competition from alternative chains.

--------------------------------------

Now let's take a look at the Ethereum chart on the 4-hour time frame .

Ethereum is currently trading near the Heavy Resistance zone($2,929-$2,652) and Resistance lines , and is also trying to break the Support line .

In terms of the Elliott Wave theory , it seems that Ethereum has completed the Zigzag Correction(ABC/5-3-5) , so we can expect the next bearish wave .

I expect Ethereum to fall to at least $2,433 AFTER breaking the Support line, and if the Support zone($2,491-$2,323) is broken, we should expect further declines.

Second Target: $2,374

Note: Stop Loss (SL) = $2,689= Worst Stop Loss(SL)

Please respect each other's ideas and express them politely if you agree or disagree.

Ethereum Analyze (ETHUSDT), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.