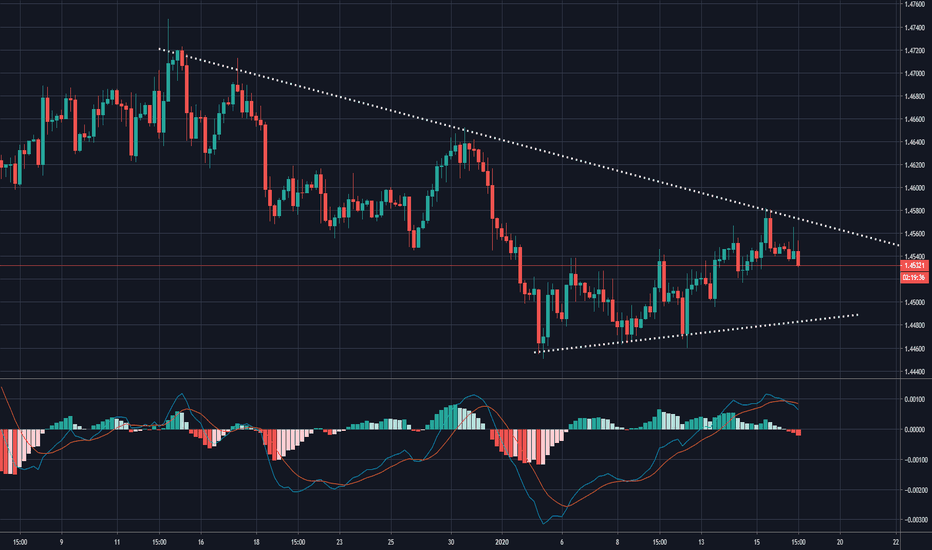

EUR-CAD

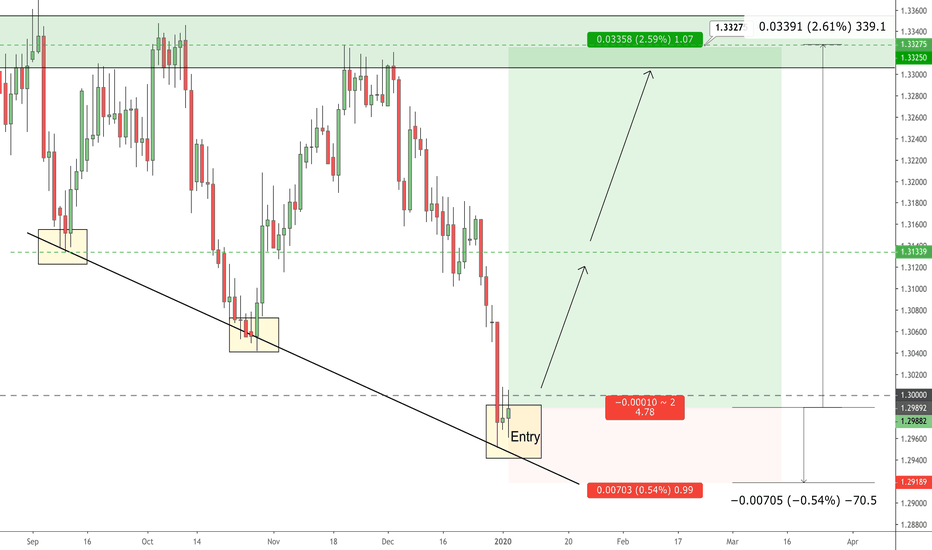

Retracement Determines Next MoveKeeping this short and sweet this week.

All the pairs I'm updating are based on Friday's big move. The focus is to determine price direction and next setups. I don't have enough info yet for the next major moves. So trade zone-to-zone.

BULL TPS:

From the 1.45942 zone…

• 1.46382

• 1.47075

• 1.47542

BEAR TPS:

• 1.45942

• 1.45571

• 1.45161

• 1.46641

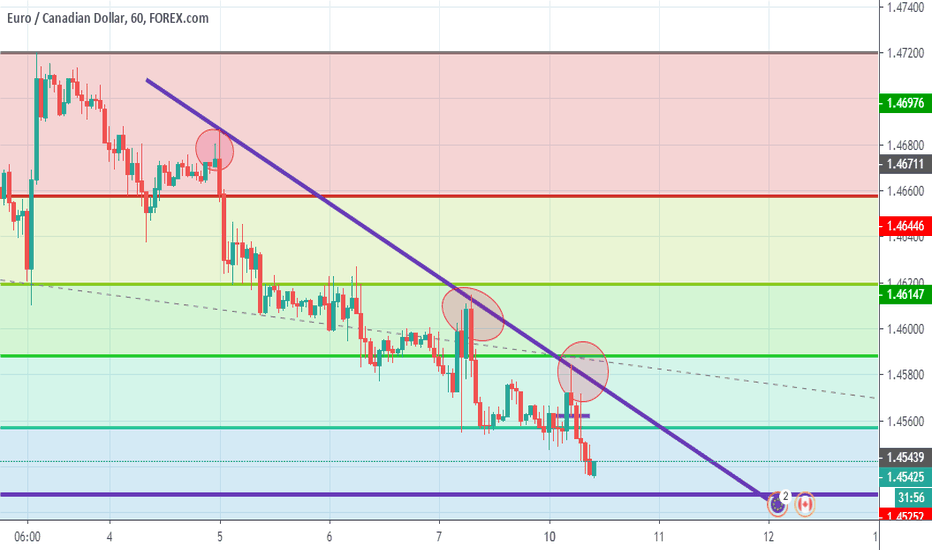

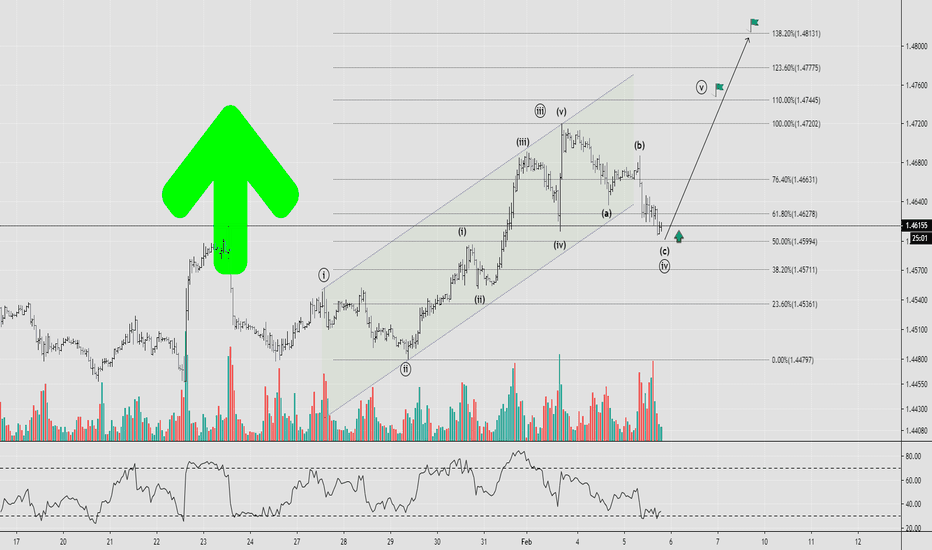

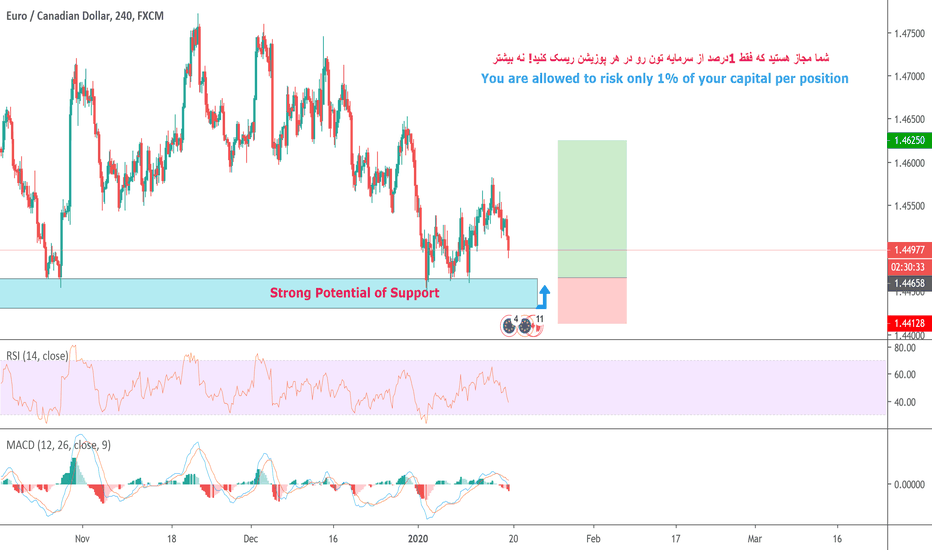

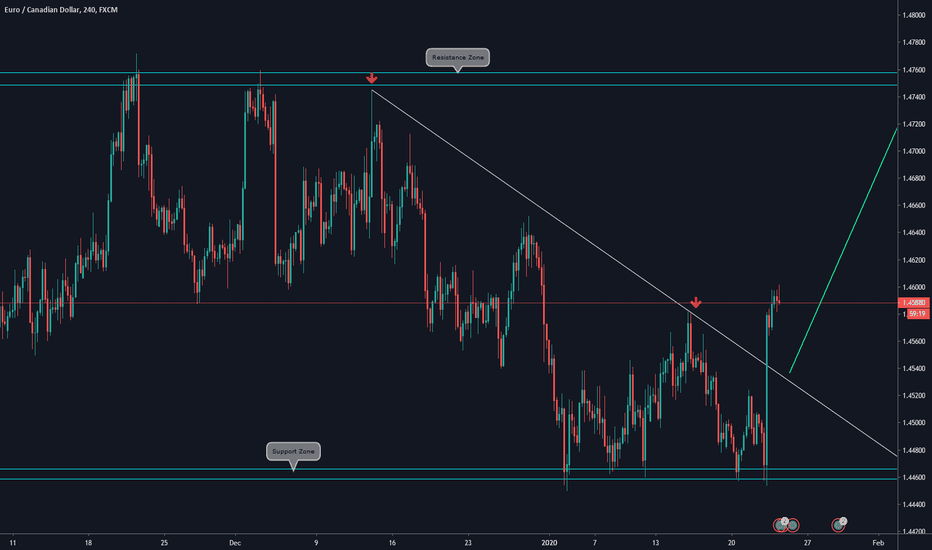

eur cad bullish begins long to resistancelong to 4 hour resistance trendline

we see impulsive move then retrace down to past .5 fib level of weekly one then buyers pushing price to .5 fib level support

now we can see support on .5 fib level weekly - now entry on support of daily trendline and .5 fib level supports - as weekly wick to the upside - great - now we can move into next impulsive move to the trendline resistance area as target

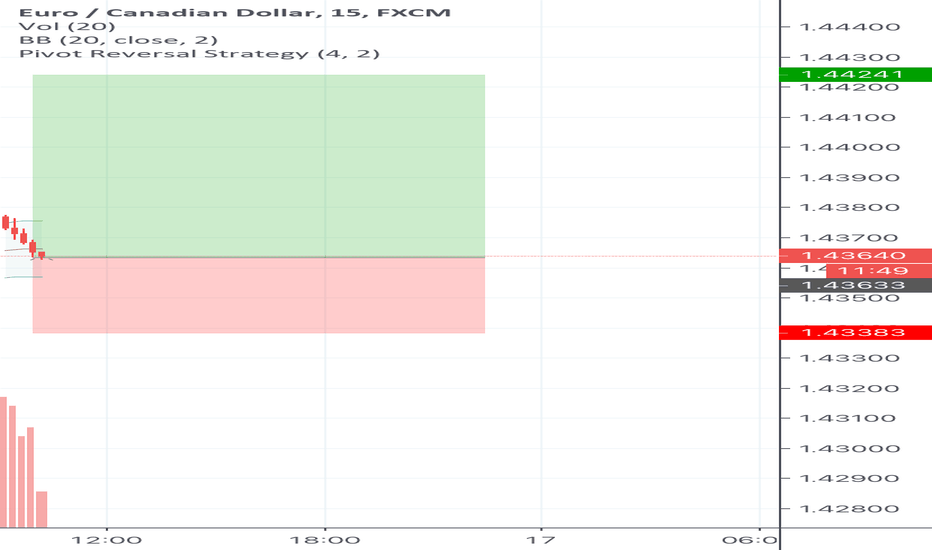

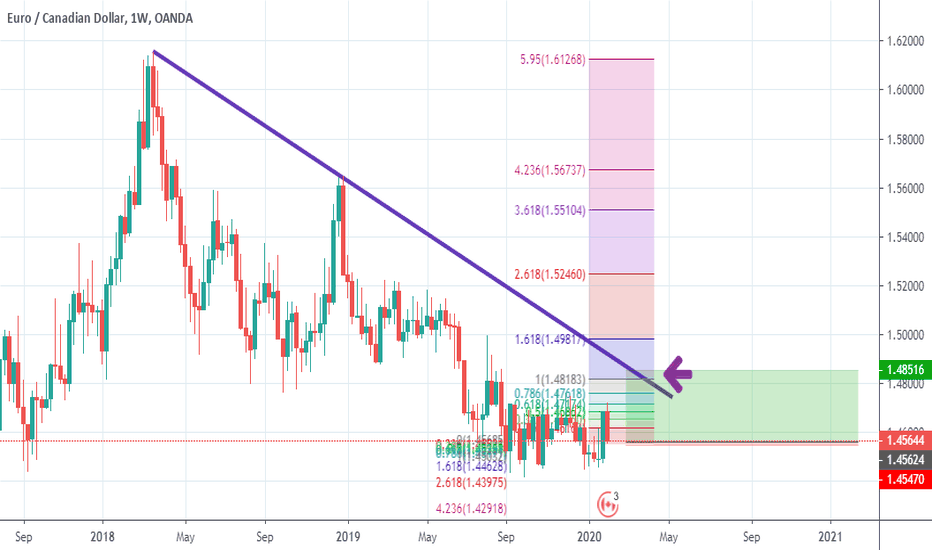

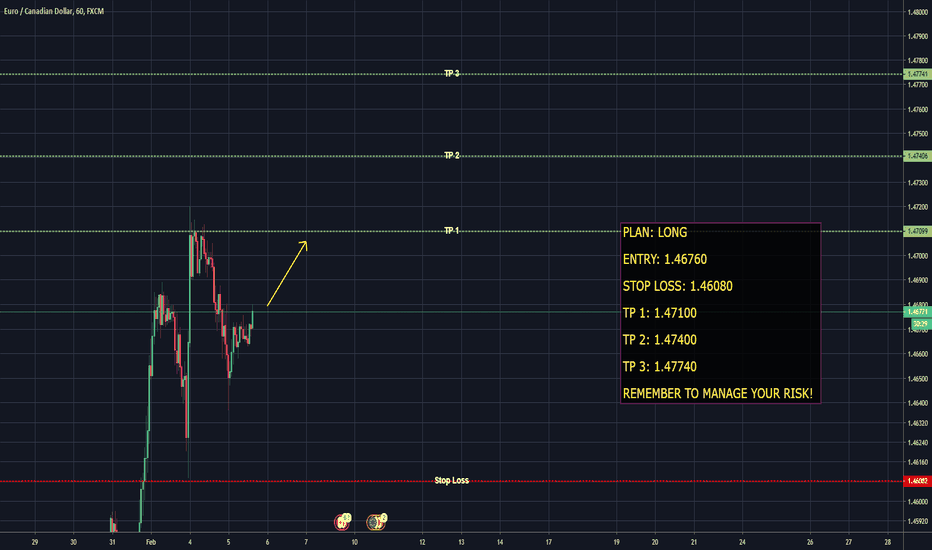

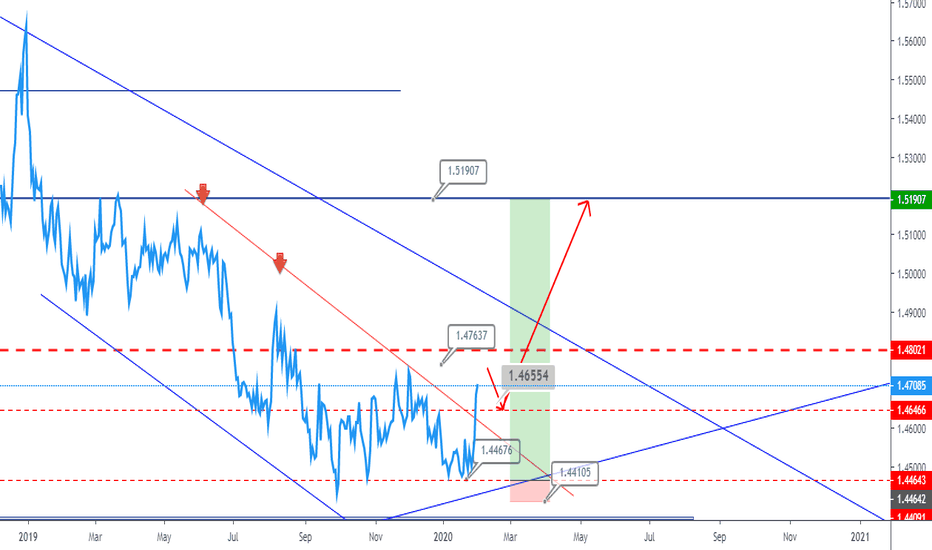

Eurcad Buy Swing FEB Week 1 Hi All ,

updated chart on this pair , we are waiting for tp1 , as you know this pair has taken forever lol , but we are still on track , the next move is rejection at 1.47637 and we might have a little sell scalp setup at the bullish extension of 1.48021 to 1.46554 where we would more buy entry to final tp .

Please note i'm not looking or actively wanting to sell euro till mid july/ aug . So will long any pullbacks .

Many Thanks .

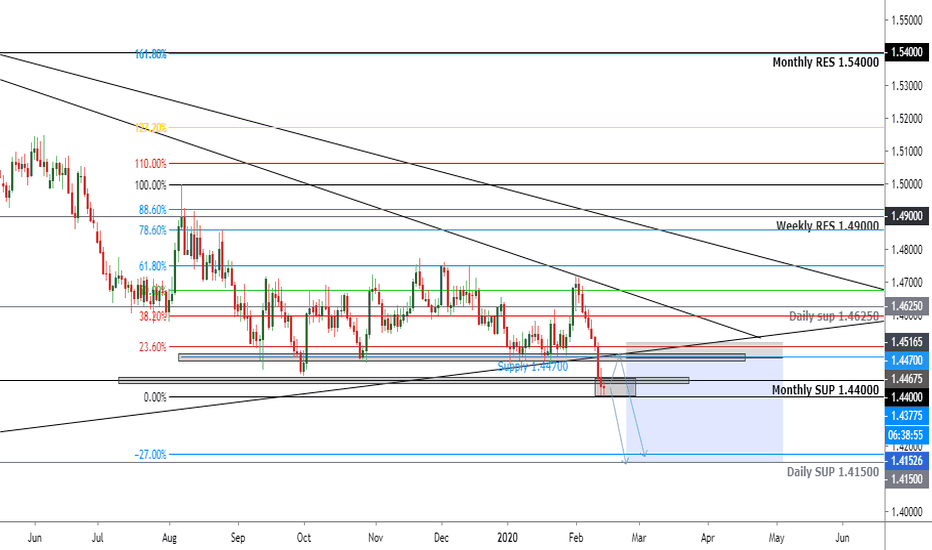

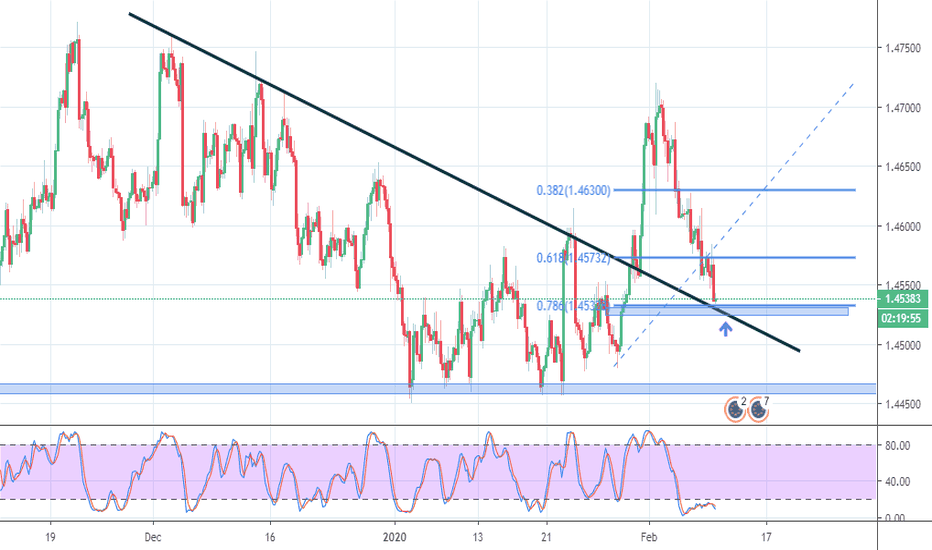

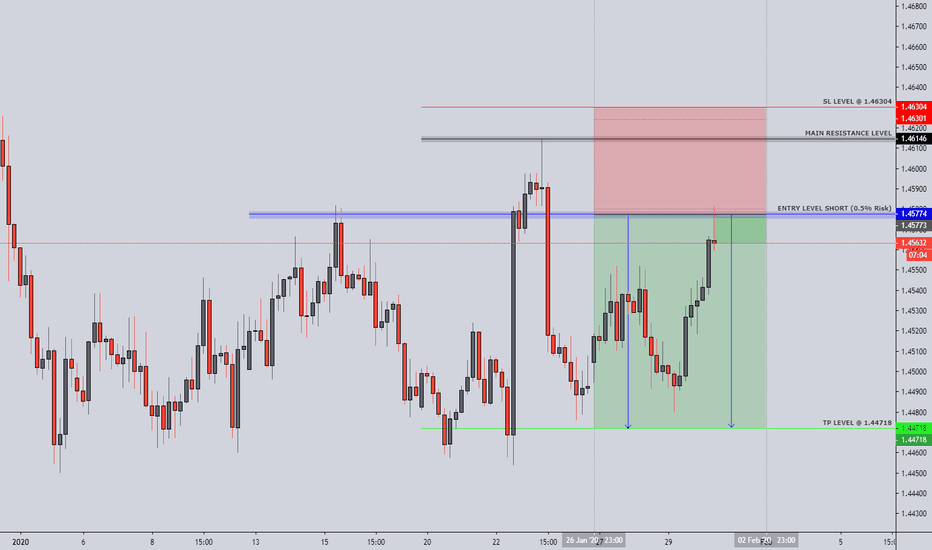

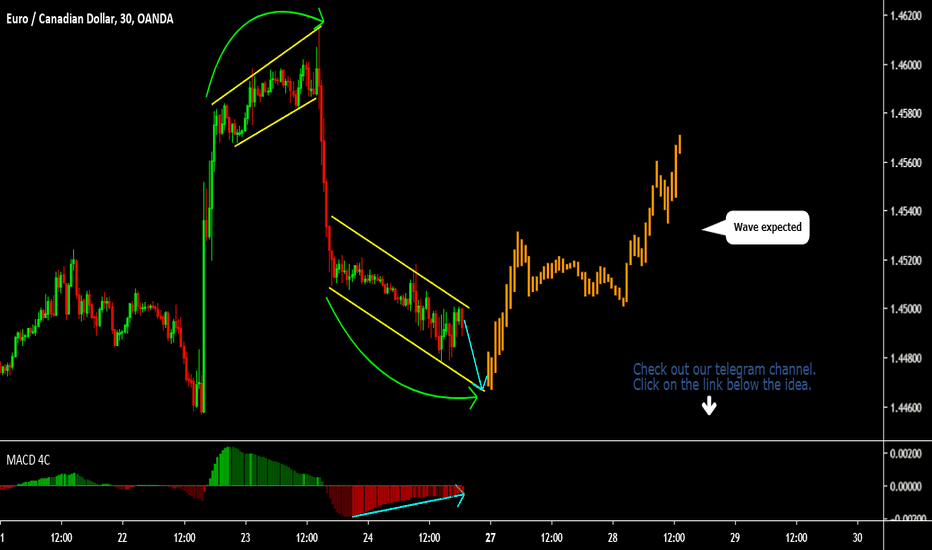

EURCAD - FOREX - 30. JAN. 2020Welcome to our weekly trade setup ( EURCAD )!

-

1 HOUR

Bullish break above previous H1 Highs.

4 HOUR

Prices came back to previous resistance zone.

DAILY

Bearish market in a pullback, great short entries!

-

FOREX SETUP

SELL EURCAD

ENTRY LEVEL @ 1.45770

SL @ 1.46300

TP @ 1.44720

RR: 2.0

Use 0.5% risk!

(Remember to add a few pips to all levels - different Brokers!)

Leave us a comment or like to keep our content for free and alive.

Have a great week everyone!

ALAN

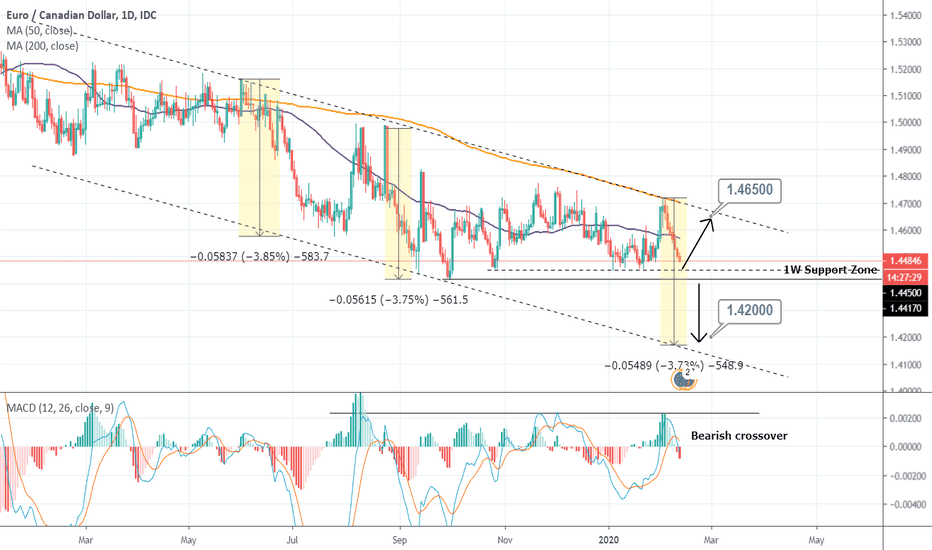

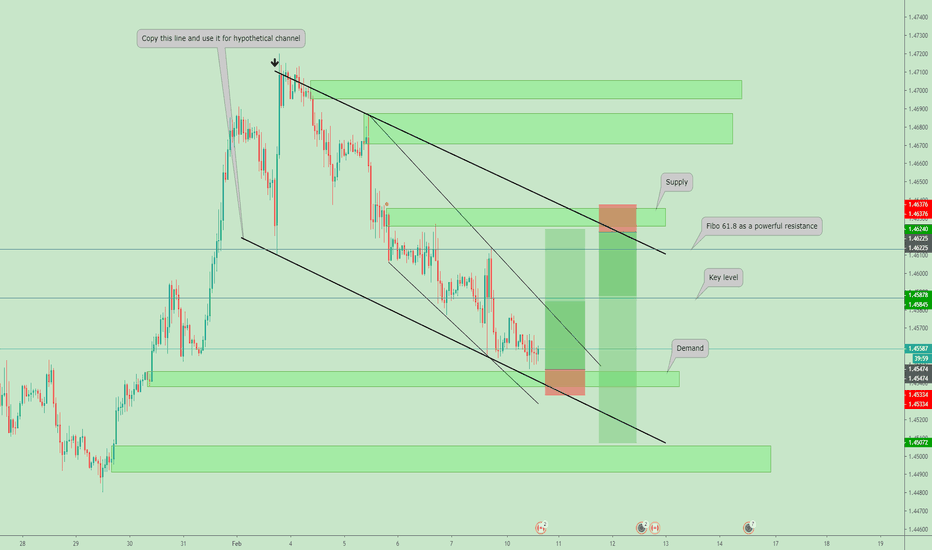

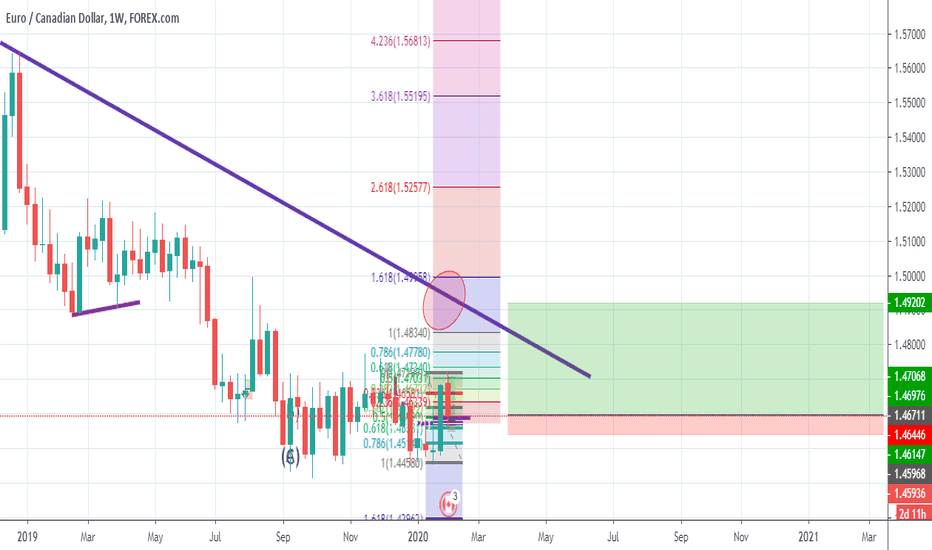

Bullish Scenario on EUR/CAD by ThinkingAntsOk4H CHART EXPLANATION:

Price was on a downtrend, but after bouncing at the Daily Support Zone (detailed on the chart below), it has broken the Descending Trendline. We are waiting for a retracement and consolidation to look for long entries on this pair.

DAILY CHART:

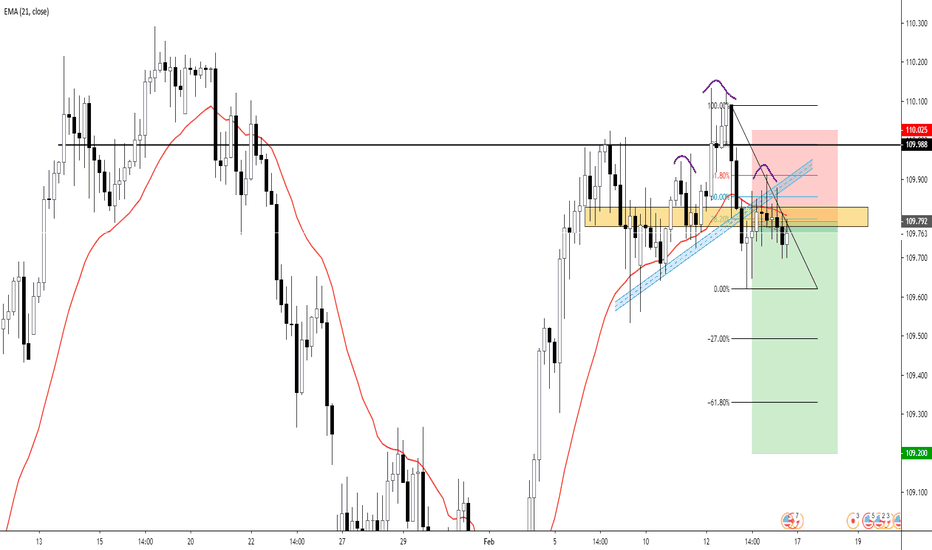

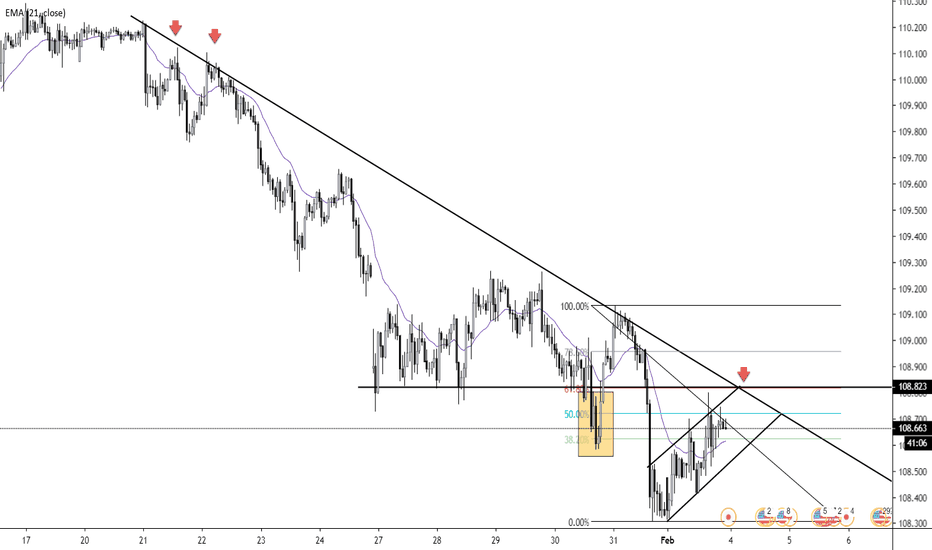

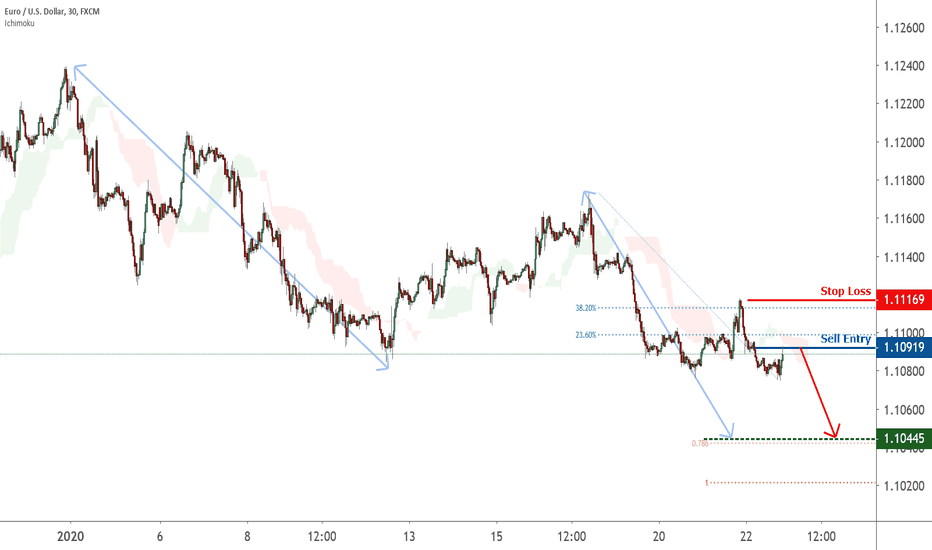

Possible trend shift in EURUSD – going short

The Tidal Shift Strategy has just sold EURUSD at 1.10835. The system recommends entering this trade at any price between 1.10751 and 1.10919. The signal was issued because our Speculative Sentiment Index has hit its most extreme positive level for the past 145 trading hours at 1.18192, which suggests that the EURUSD could be trending downwards.The 14-period Average True Range on a daily chart is 0.00067, so the stop loss has been set at 1.11169. This stop loss order is a trailing stop that will move down as the market moves down. There is no profit target for this strategy. We expect to be closed by the stop loss.Tidal Shift is a trend trading strategy that aims to catch shifts in trend using trader sentiment as an indicator. The strategy looks to buy when the Speculative Sentiment Index reaches its lowest value for the past 145 trading hours, and looks to short when it reaches its highest value for the past 145 trading hours.

Signal ID: 70356

Time Issued: Tuesday, 21 January 2020 22:00:16 GMT

Status: open

Entry: 1.10751 - 1.10919

Limit: N/A

Stop Loss: 1.11169

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here.

Past Performance is not an indicator of future results.