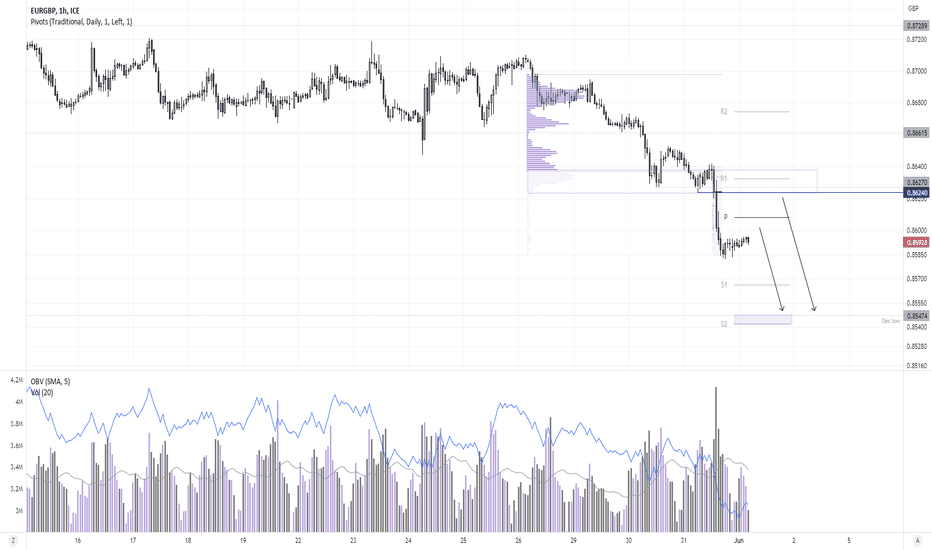

Potential swing trade short on EUR/GBP EUR/GBP has just suffered its worst month in ten, thanks to renewed bets of a more-hawkish BOE and soft inflation reports across Europe. Volumes increased during the recent leg lower to show fresh bearish bets being placed and the OBV (on balance volume) has also confirmed the move lower on prices.

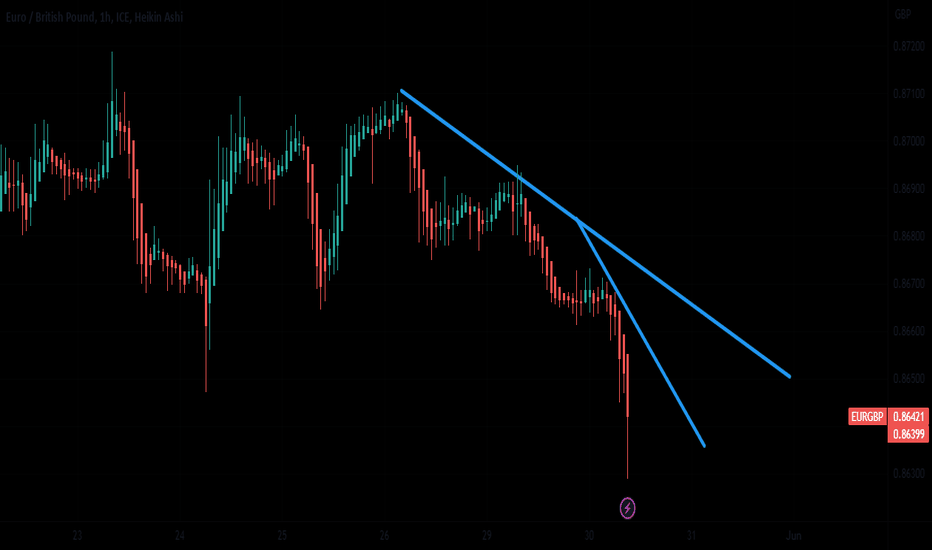

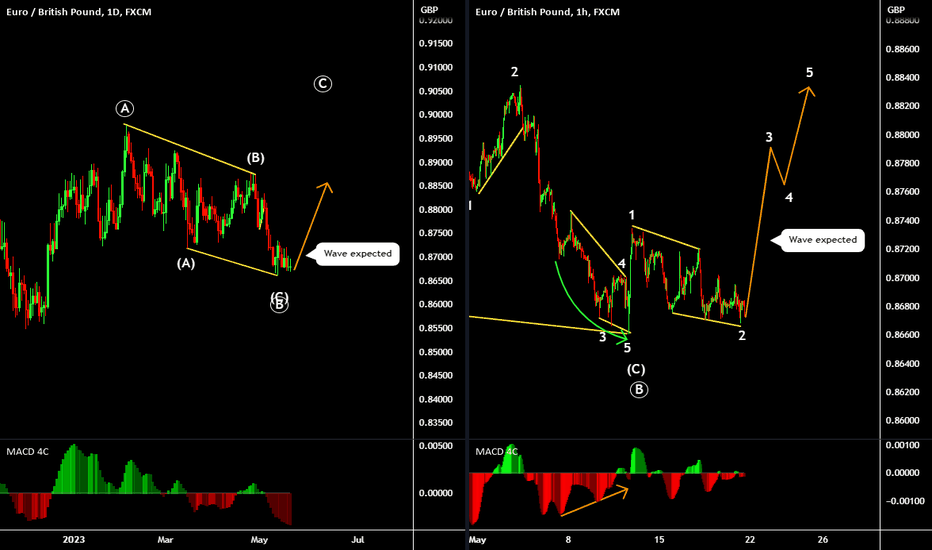

Prices are consolidating near the cycle lows on the 1-hour chart within a potential bear-flag pattern, and the flag projects an approximate target near the December low / daily S2 pivot point. A weak inflation report for the Eurozone later today could help send prices directly low.

However, should prices instead recycle higher first (which seems plausible given the magnitude of the bearish move) then bears could look to fade into the daily pivot point ~0.8610 or the volume cluster around 0.825.

Given the strength of the downtrend, we’d view a retracement higher as an opportunity to increase the potential reward to risk ratio.

Eur-gbp

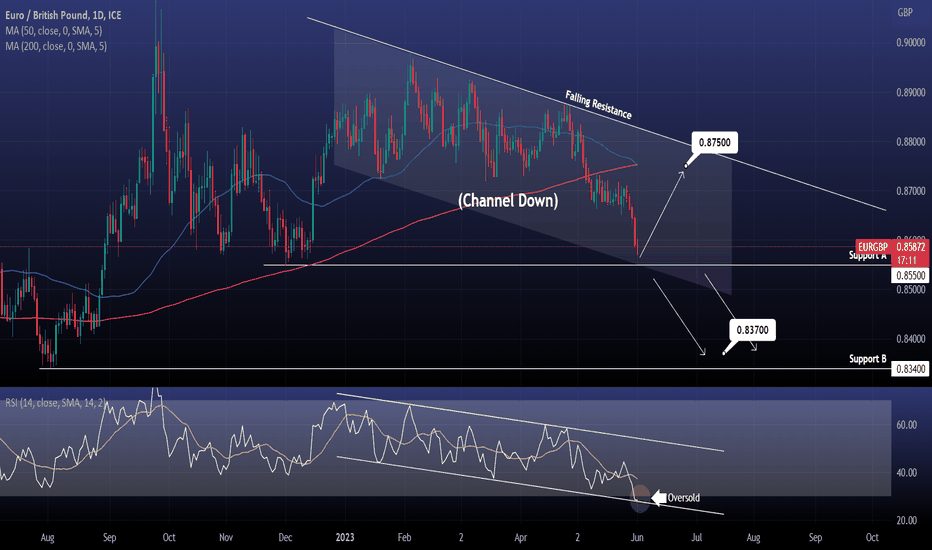

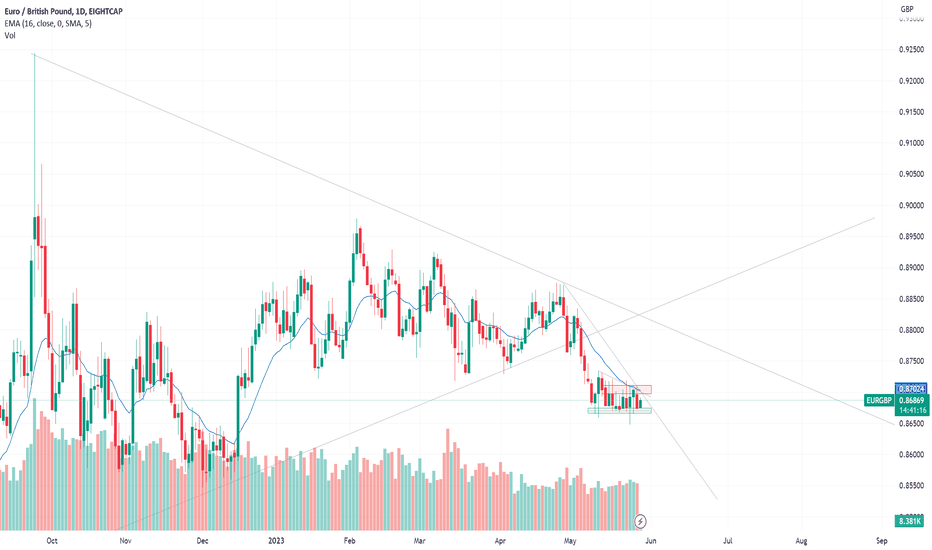

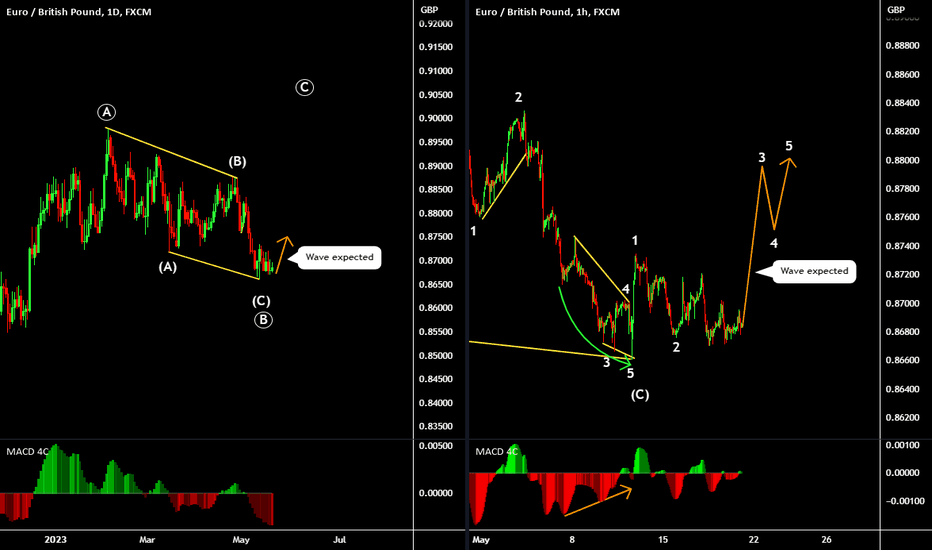

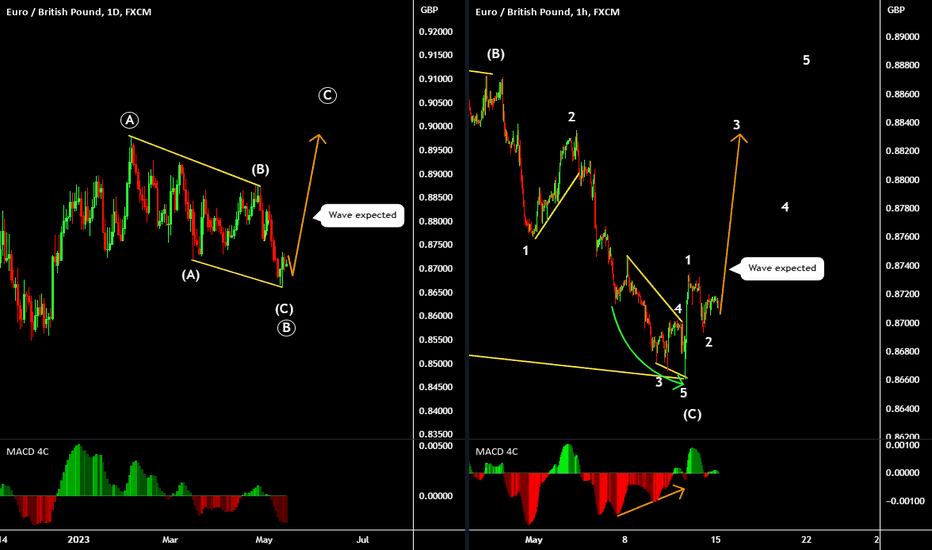

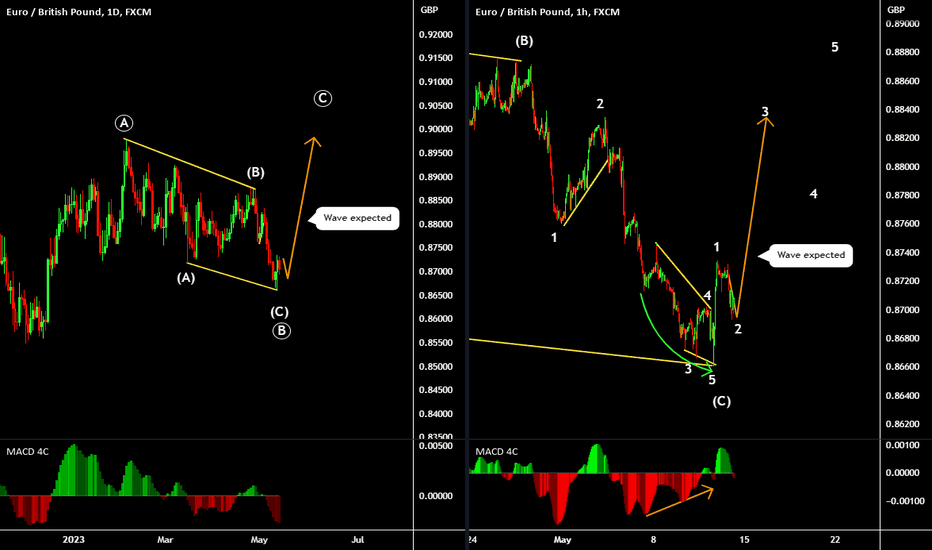

EURGBP Oversold being a great buy opportunity.EURGBP is approaching a Triple Support combination: Support A (0.85500), the bottom of the Channel Down, and the 1day RSI's Channel Down bottom.

The 1day RSI is also oversold under 30.00.

As long as the price closes over Support A, buy and target the top of the Channel Down at 0.87500.

If it closes under Support A, sell and target Support B at 0.83700.

Follow us, like the idea and leave a comment below!!

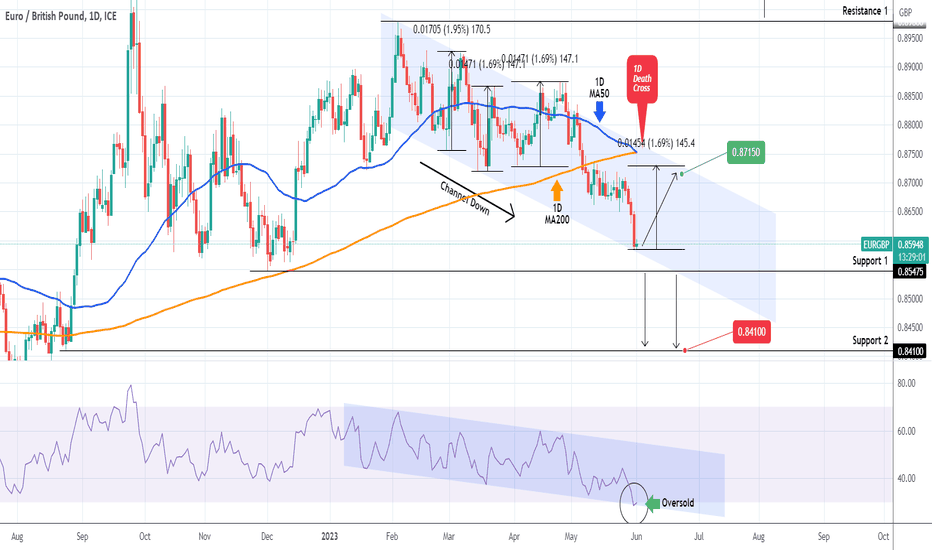

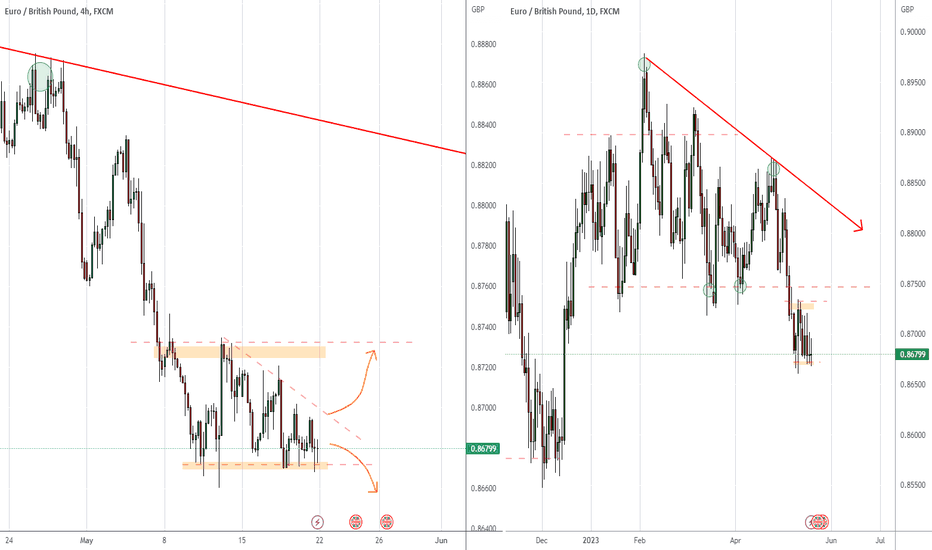

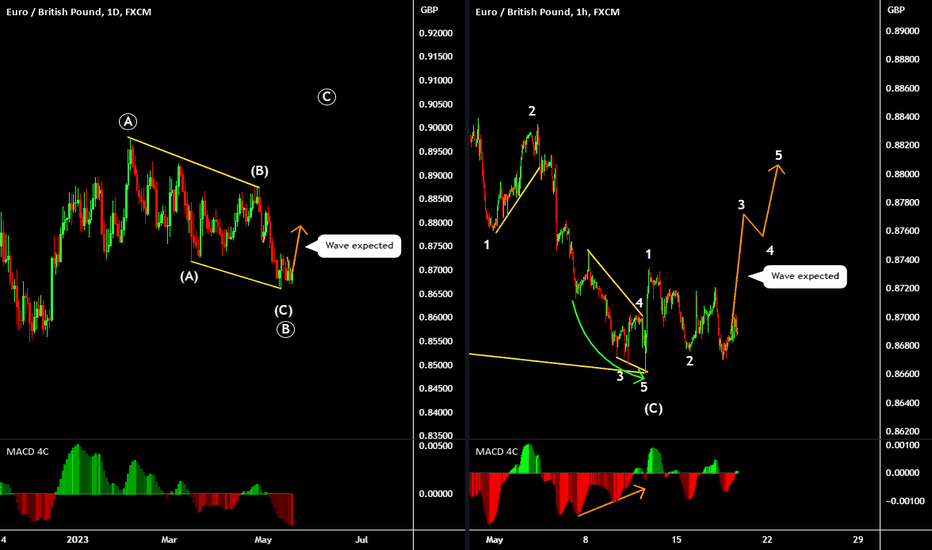

EURGBP Forming the first 1D Death Cross since January 2021!The EURGBP pair is completing today the first Death Cross on the 1D time-frame since January 21 2021. That is a strong long-term bearish signal on its own. On the short-term though, the price just hit the bottom of its 5 month Channel Down, while the 1D RSI, which is also on a Channel Down, hit its own bottom while turning oversold (below 30.00) for the first time since March 10 2021.

As a result, we've opened a buy on EURGBP, expecting a +1.69% rise, targeting the top of the Channel Down at 0.87150. If however the price closes below Support 1 (0.85475), then the selling pressure due to the 1D Death Cross will most likely pile up and we will turn bearish instead, targeting Support 2 (0.84100). The R/R ratio on this action plan is very favorable.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

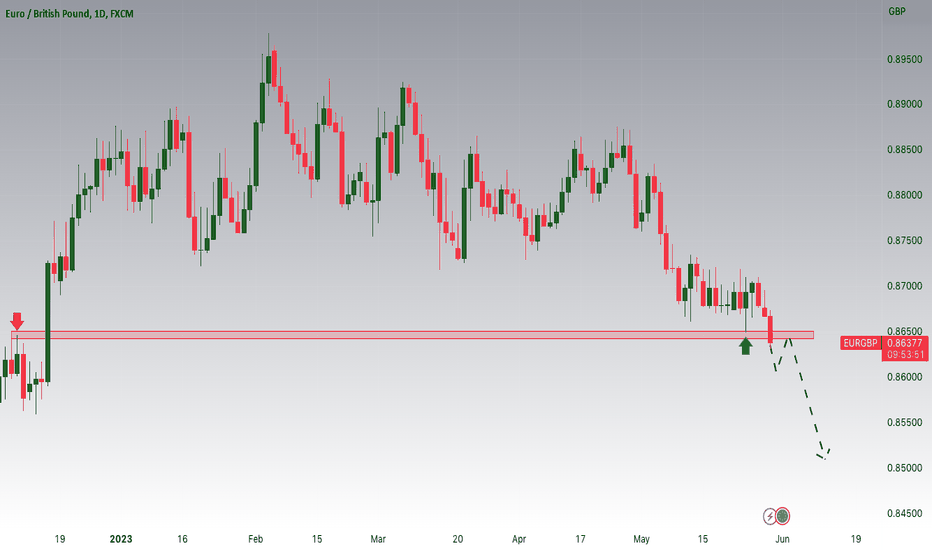

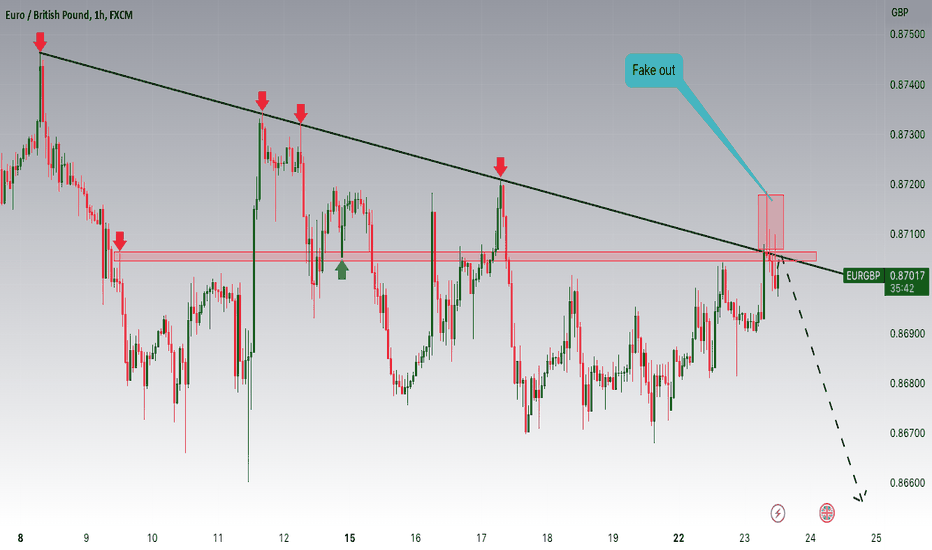

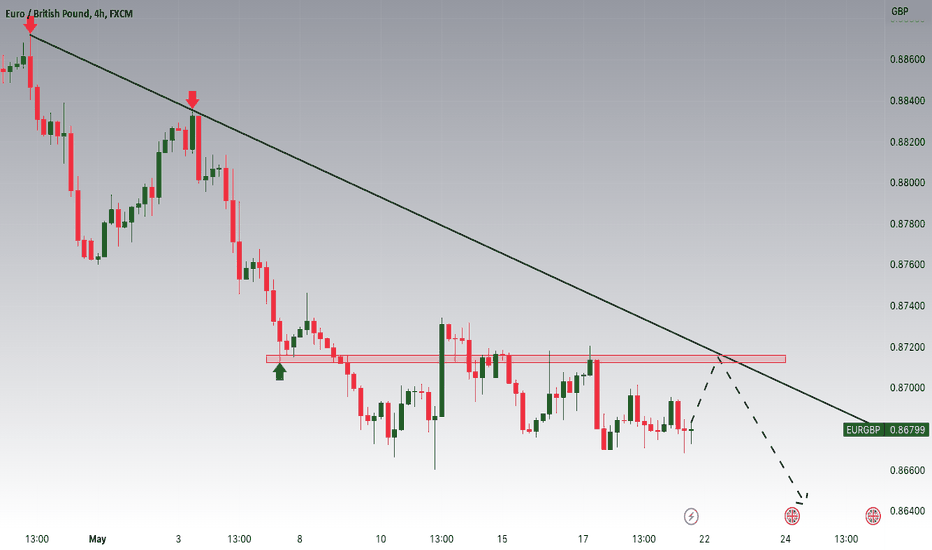

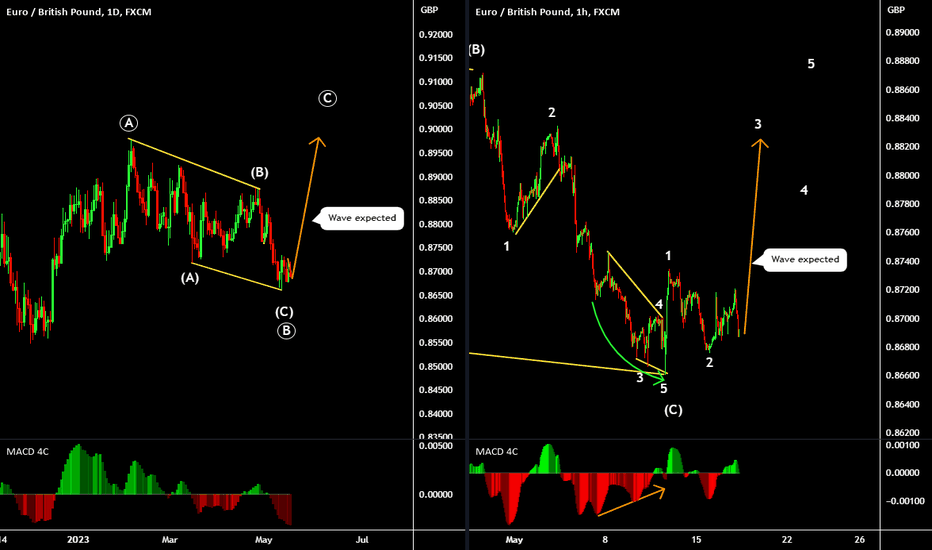

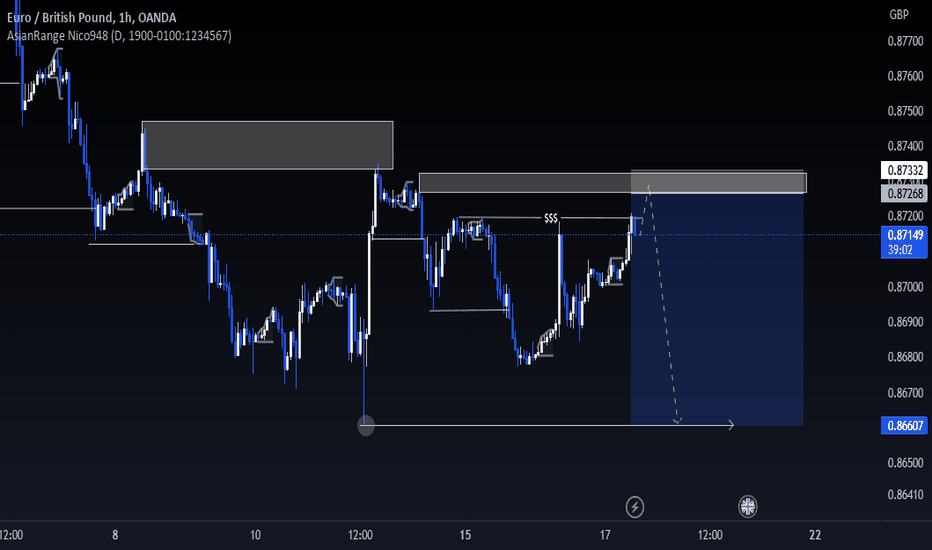

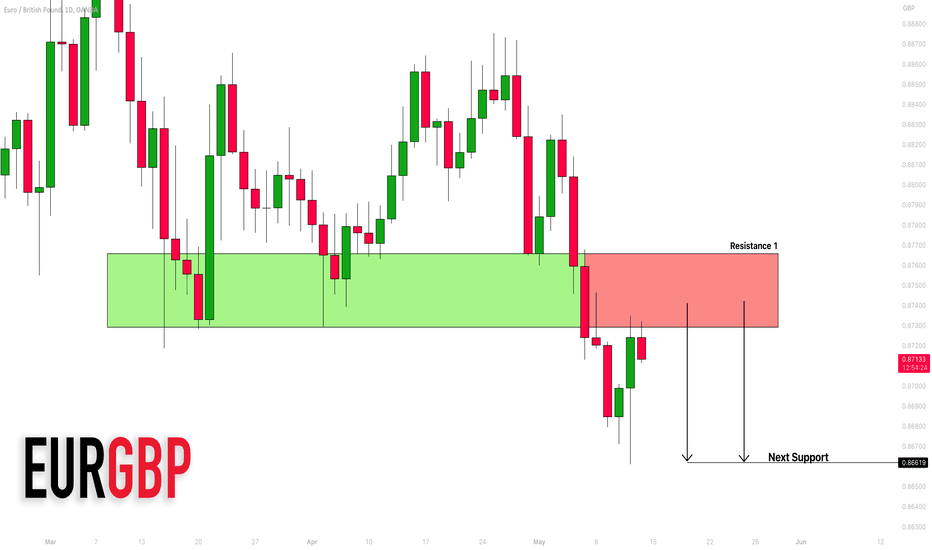

EURGBP:will GBP continue outperforming EURO?Hey Traders, in today's trading session we are monitoring EURGBP for a selling opportunity around 0.86500 zone, EURGBP broke an important support level and currently we are waiting for a correction in order to see a potential retrace of the break out towards more lows.

Trade safe, Joe.

EURGBP: Could we see a new breakout? Today's focus: EURGBP

Pattern – Range/Descending Triangle

Possible targets – .8600

Support – .8670

Resistance – .8705

Today’s update, will we see the EURGBP make a new push lower, confirming its descending triangle pattern? Price broke the main trend setting up its first leg lower. From that point, we have seen a consolidation set-up with a bearish pattern in the mix. Descending triangle patterns are seen as bearish patterns if they are set up in a new decline. So far, we have the new decline, but we need to see if sellers can confirm the pattern with a breakout through .8670 support.

If today’s rally fails to fade and if we see a new rally through range resistance, this will be a worry and could be telling that the pattern could fail.

Let’s see over today and tomorrow if sellers can regain control and maybe set up a confirmation.

Thanks for stopping by. Good trading, and have a great day.

EURGBP: EURO Struggles to outperform GBPHey Traders, in today's trading session we are monitoring EURGBP for a selling opportunity around 0.87 zone, EURGBP is trading in a downtrend and we have noticed a fake out, price got below the trend again and currently in a correction phase in which it is approaching the major trend at 0.87 support and resistance zone.

Trade safe, Joe.

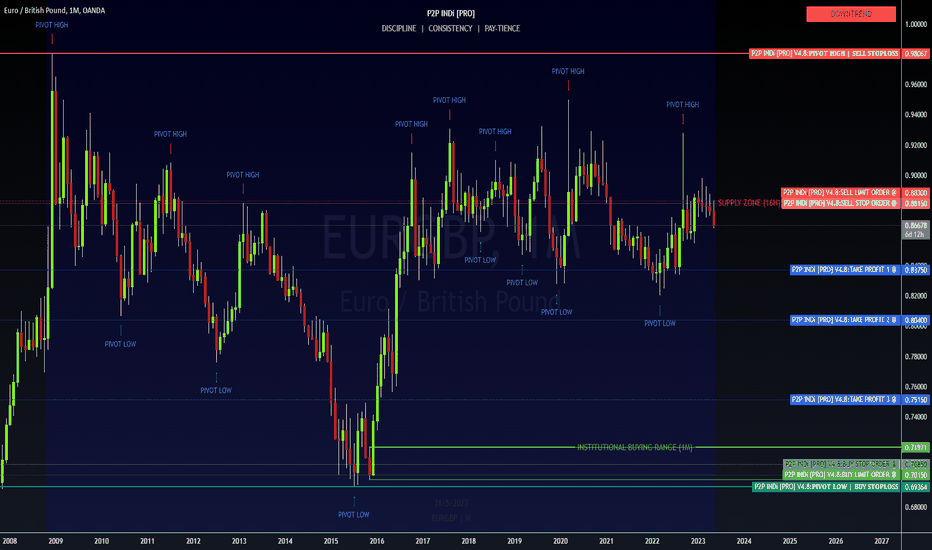

✨ NEW: EURGBP...DT (1M/16H) ✨ POSITION TRADE ✨✨ NEW: EURGBP...DT (1M/16H) ✨ POSITION TRADE ✨

SLO1 @ 0.8830 ⏳

SLO2 @ 0.8815 ⏳

TP1 @ 0.8375 (shaving 25%)

TP2 @ 0.8040 (shaving 25%)

TP3 @ 0.7515 (shaving 25%)

TP4 @ 0.7200 (closing ALL Sell Orders)

BLO1 @ 0.7085 ⏳

BLO2 @ 0.7015 ⏳

As of today, May 25, 2023, the EURGBP pair is trading at 0.8669. The pair has been in a downtrend since the beginning of the year, and a few factors are contributing to this trend.

First, the European Central Bank (ECB) has been more cautious about raising interest rates than the Bank of England (BoE). The ECB is worried about the impact of higher interest rates on the Eurozone economy, which is still recovering from the COVID-19 pandemic. The BoE, on the contrary, is more concerned about inflation and has raised interest rates several times in recent months. This monetary policy difference makes the pound more attractive than the euro.

Second, the UK economy is doing better than the Eurozone economy. The UK economy grew by 0.8% in the first quarter of 2023, while the Eurozone economy grew by only 0.2%. This growth differential is making the pound more attractive than the euro.

Third, the war in Ukraine is also weighing on the euro. The war has caused uncertainty in the global economy, and investors are looking for safe-haven assets, such as the pound.

The fundamental factors point to a continued decline in the EURGBP pair. However, it is essential to remember that the market is unpredictable, and there is always the possibility of a reversal.

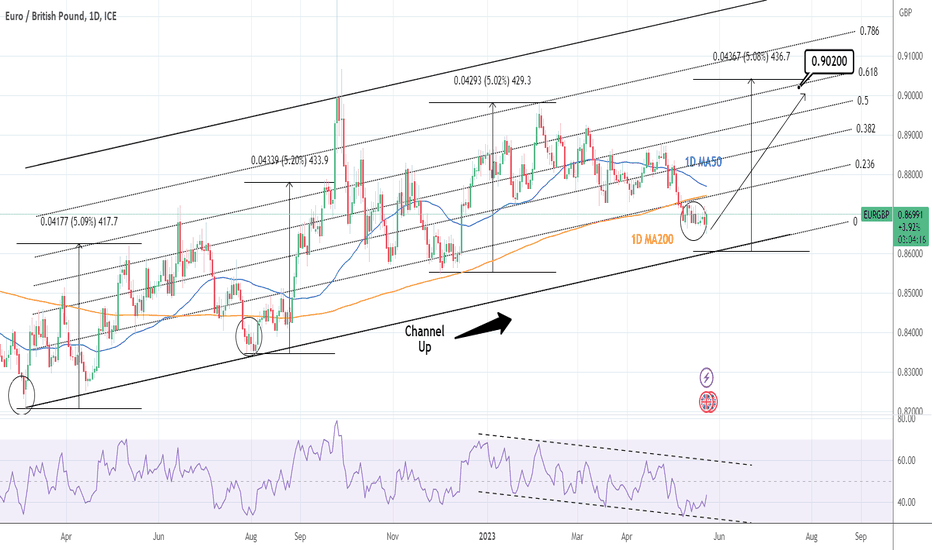

EURGBP: Near its bottom. Long term Buy.EURGBP is consolidating under the 1D MA200 for the 11th consecutive day which keeps the 1D time-frame near neutrality, despite the marginally red technical indicators (RSI = 43.260, MACD = -0.003, ADX = 36.781). This is a standard bottom formation and since the 1D RSI is rising after hitting the Channel's bottom, the signal gets stronger.

The standard rally inside this Channel Up that extends for more than 1 year, is +5.00%. We are extending our downside tolerance, assuming a potential bottom on the HL of the Channel Up, so taking a +5.00% rise from there gives us a bullish Target marginally over the 0.618 Fibonacci level. Our TP is 0.90200.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

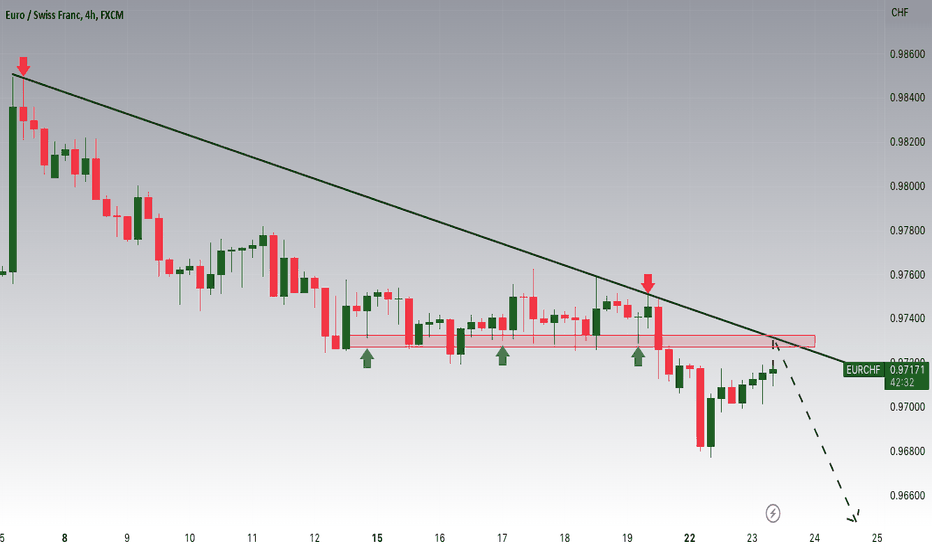

EURCHF Potential DownsidesHey Traders, in today's trading session we are monitoring EURCHF for a selling opportunity around 0.97300 zone, EURCHF is trading in a downtrend and currently seems to be in a correction phase in which it is approaching the major trend at 0.97300 support and resistance zone.

Trade safe, Joe.

EURGBP:Will the Pound continue outperforming EURO?Hey Traders, in tomorrow's trading session we are monitoring EURGBP for a selling opportunity around 0.87150 zone, EURGBP is trading in a downtrend and currently seems to be in a correction phase in which it is approaching the major trend at 0.87150 support and resistance zone.

Trade safe, Joe.

Eurgbp more bias on the downside

**Find out more from my Tradingview Stream this week**

***************************************************************************************

Hello there!

If you like my analysis and it helped you ,do give me a thumbs ups on tradingview! 🙏

And if you would like to show further support for me, you can gift me some coins on tradingview! 😁

Thank you!

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

The author/producer of these content shall not and will not be responsible for any form of financial/physical/assets losses incurred from trades executed from the derived conclusion of the individual from these content shared.

Thank you, and please do your due diligence before any putting on any trades!

EUR GBP - FUNDAMENTAL ANALYSISThe Pound to Dollar (GBP/USD) exchange rate hit 12-month highs at 1.2675 on May 10th before a retreat to 1.2400 amid a dollar rebound.

The Pound to Euro (GBP/EUR) exchange rate also hit 2023 highs close to 1.1550 before settling just above 1.1500.

Pound Sterling: UK Outlook Half Full or Half Empty

The UK fundamentals have improved over the past few months with an important boost from lower energy prices.

Markets assume that the UK government is now embracing convention policies, increasing the importance of monetary policies.

The latest UK GfK consumer confidence data recorded a further improvement to a 15-month high.

Although the PMI data records a further contraction, there has been further expansion in services.

The Bank of England now forecasts limited growth for 2023 and 2024 and abandoned its call of a shallow and extended recession.

According to HSBC; “We no longer see a recession, and are now forecasting a rise of 0.4% in GDP in 2023. While this looks very poor compared with 2022’s 4.1%, in fact, it’s an acceleration.”

The UK economy has, however, continued to under-perform in global terms. GDP is still 0.5% below the pre-covid peak and the worst performance in the G10 area.

According to Rabobank; “It is our view that GBP’s gains since early March suggest that a lot of better news regarding UK fundamentals is already baked into the price.

It added; “However, there is a strong distinction between ‘better’ and ‘strong’ fundamentals, and the UK continues to fall significantly short of the latter measure.

According to MUFG; “UK Economic resilience helped by the improved energy terms of trade will help provide support and improve the UK’s trade and fiscal position which will further help provide support for the pound.”

Bank of England Watching Inflation Very Closely

The Bank of England (BoE) increased interest rates by a further 25 basis points to 4.50% at the May policy meeting.

The headline inflation rate will inevitably decline sharply in the short term, primarily due to base effects.

The latest inflation data will be published on May 24th. Consensus forecasts are for the headline rate to decline to 8.2% from 10.1% due to the fact that prices surged last April due to the increases in energy prices.

The core rate is expected to be more stubborn with a small decline to 6.1% from 6.2%.

The Bank of England is concerned that underlying inflation pressures will persist and potentially force further interest rate hikes.

According to ING; “We continue to think that further tightening is unlikely. Wage disinflation can allow the BoE to pause at its 22 June meeting.”

Goldman Sachs is more positive surrounding the Pound and more hawkish surrounding the BoE.

It notes; “Despite being vulnerable to further bouts of risk-off, we remain constructive on Sterling, especially after the latest BoE meeting.

Goldman adds; “While the Bank’s significant forecast upgrades to growth and inflation present a higher bar for the incoming data to beat, it also reflects the risk of higher inflation persistence that would require additional monetary policy tightening.

Goldman expects that the BoE will raise rates to 5.0%.

BNPP expects the medium-term BoE stance will be more dovish; “We remain of the view that the BoE will begin easing through Q1 2024, and at 3.5% we have a significantly lower end-2024 expectation on Bank Rate than the market (around 42bp higher). This adds to our view that there is a hawkish mispricing, especially as we move into the first quarter of next year.”

To some extent, the BoE is caught in the middle of the ECB and Federal Reserve inflation battles.

According to BNPP; “The ECB is the most hawkish in that it has retained a clear bias for further tightening. The Fed, by contrast, has more explicitly signalled a bias to pause. We think the BoE has a bias to tighten further, but it is by no means explicit.”

ECB Committed to Inflation Fight

The ECB increased interest rates by a further 25 basis points at the May meeting with the refi rate at 3.75%.

The bank remains committed to battling inflation but has not provided guidance on further rate hikes.

Nordea expects that the ECB will maintain a hawkish stance; “The economy has been holding up relatively well, the labour market remains hot and with services inflation still accelerating in April, the ECB is lacking evidence of inflation returning to target in a timely manner. We think the ECB will hike rates by 25bp in both June and July.”

Nordea expects that GBP/EUR will weaken to 1.11 at the end of 2023 with a further slide to 1.08 at the end of 2024.

Lower Gas Prices still Euro Positive

MUFG notes; “After a period of strong outperformance, cyclical stocks are now underperforming again. Is this a reflection of bad news emerging or more a reflection of excessive optimism correcting back to a more realistic level?

The bank points to a further decline in gas prices with European prices trading close to 2-year lows.

In this context, it adds; “For now we would be in the latter camp with no real deterioration in the data or news flow to warrant a reassessment of the outlook.”

MUFG expects lower energy prices will support the UK and Euro-Zone outlooks. In this context, it has an end-2023 GBP/EUR forecast of 1.14.

Danske Bank expects that GBP/EUR will trade in a 1.14-1.15 range for much of the time due to similar fundamentals.

Federal Reserve Stance Crucial

The Federal Reserve increased interest rates by a further 25 basis points to 5.25% at the May policy meeting.

The central bank did adjust its rhetoric and suggested that there may be a pause at the June meeting to assess developments.

The Fed has consistently stated that interest rates are not expected to be cut this year.

There is an important divergence in investment bank interest rate forecasts.

Danske Bank expects that the Fed will not cut rates and that tighter financial conditions will underpin the dollar.

It adds; “In line with market expectations, we think the Fed has delivered its last rate hike for this hiking cycle. However, we think the current 65bp of rate cuts priced for the rest of the year is too aggressive.”

ING, however, expects the economy will deteriorate more sharply over the second half of the year and this will force the Fed to cut rates more aggressively.

The bank expects that the Fed will cut interest rates by 100 basis points by the end of 2023.

These interest rate expectations are crucial in determining dollar forecasts and the GBP/USD outlook.

According to ING; “Based on our overall dollar view, GBP/USD should be heading higher this year. 1.33 is our target for year-end.”

Danske Bank, however, expects the Federal Reserve stance and tightening financial conditions will undermine the Pound.

It has a 6-month GBP/USD forecast of 1.20 and a 12-month forecast of 1.17.

Rabobank has a 3-month GBP/USD forecast of 1.22.

EUR GBP - FUNDAMENTAL ANALYSISForeign exchange analysts at BNP Paribas suggest the Euro (EUR) is tipped to rise against the Pound Sterling (GBP) in the near-term outlook.

They believe that although UK data has been surprisingly strong recently, the underlying data strength remains subdued.

"UK data have been surprisingly strong recently, but surprises tend to mean revert and underlying data strength remains subdued," says Oliver Brennan, FX Volatility Strategist at BNP Paribas.

The analyst says, "Short-GBP positioning has also been a tailwind for GBP this year. But now that the client survey component of GBP positioning – a proxy of real-money positioning – has flipped from short to long, the positioning backdrop may be clean."

Euro to Pound (EURGBP) Exchange Rate Tipped to Gain

Although UK data has shown unexpected strength, the overall vigour of the data remains low.

The analyst suggests a mean reversion tendency in the data surprises, hinting at a likely change of course.

Additionally, the shift in GBP positioning from short to long suggests a fresh slate for the currency's performance, presenting an attractive opportunity for GBP short positions.

The analyst also anticipates a singular additional hike at the Bank of England's forthcoming meeting, but sees the risk leaning more towards no change than a hawkish shift.

He notes, "We expect one further hike at the Bank of England’s next meeting, but the risk is skewed more towards no change than towards a more-hawkish shift."

However, Brennan emphasises the importance of timing in entering GBP short positions, given the positive GBP carry and the uncertainty surrounding the weakening economy's potential impact on the Bank of England's stance.

"All the above factors support re-entering short GBP positions. But the combination of positive GBP carry and uncertainty around when a weakening economy may trigger a change in BoE stance means timing the weakness is as important as identifying the opportunity," Brennan adds.

Brennan proposes a trade strategy that seeks to capitalise on this analysis by initiating a long EURGBP position via a digital call with a knockout above the recent range high.

He explains, "We structure a long EURGBP position via a digital call with knockout above the recent range high. The knockout makes the structure less than half the equivalent single digital premium. Theta is positive at inception, and the structure decays shorter-GBP delta over time."

Despite the current low level of implied volatility in Euro to Pound exchange rate (EURGBP), which is in line with most G10 FX pairs over the past month, Brennan cautions that it is not yet a cheap currency.

EUR GBP - FUNDAMENTAL ANALYSISPound Sterling Forecast: Extended Range Trading for EUR/GBP

Danske expects that the Bank of England will increase interest rates for a final time in June. It notes that at least one further rate hike is priced in by markets which will limit scope for Pound buying.

It does, however, consider that the Pound is slightly undervalued which will underpin the currency.

Overall, the bank summarises; “At present, we do not see the relative growth outlook or global investment environment to create significant divergence between EUR and GBP. We thus expect the cross to remain range bound around 0.87-0.88.”

EUR GBP - FUNDAMENTAL ANALYSISForeign exchange analysts at ING have updated their latest currency forecasts and predictions for the Pound Sterling

Sterling will be influenced by global economic and financial conditions. It notes; “Sterling’s correlation with risk assets has fallen a lot this year – a factor probably helping sterling at the moment.”

The Pound will still tend to be vulnerable if global risk conditions deteriorate.

The principal element behind ING’s Sterling call is that the Bank of England (BoE) interest rates have reached a peak at 4.50%.

Overall, it expects that signs of moderation in inflation and a tighter labour market will allow the BoE to avoid further rate increases.

In this context, it expects a BoE re-pricing and lower yields will undermine the Pound.

It adds; “If we’re right with our BoE call, EUR/GBP should be trading towards 0.88 by the end of June. We suspect that the effects of prior tightening will start to show up, via higher mortgage refinancing costs, in 2H23 and pitch a weak UK activity story.”

EUR/GBP is forecast to strengthen to 0.90 on a 6-12 month view.

EURGBP potential shortAfter price broke structure to the downside, it impulsively retraced and retested 4h supply zone. It then reversed, breaking structure on a smaller timeframe which gave us a shift in market structure. Price has now formed liquidity which it could potentially use to push further to the downside

EURGBP Potential DownsidesHey Traders, in today's trading session we are monitoring EURGBP for a selling opportunity around 0.87400 zone, EURGBP is trading in a downtrend and currently seems to be in a correction phase in which it is approaching the major trend at 0.87400 support and resistance zone.

Trade safe, Joe.

JoeG2H - Selling EURGBPTrade Idea: Selling EURGBP

Reasoning: Selling into horizontal resistance on the daily chart

Entry Level: 0.8709

Take Profit Level: 0.8576

Stop Loss: 0.8754

Risk/Reward: 2.9/1

Disclaimer – Signal Centre. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis , as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

EUR GBP - FUNDAMENTAL ANALYSISUK: Labor data to keep Bank of England expectations hawkish

The Bank of England has made it clear that the decision on June rate hike will be underpinned by the two sets of wage and inflation data out before the next meeting. The first of these unemployment and wage numbers will be out on Tuesday, with consensus expectations not suggesting any let up in concerns yet. Expectations are for the unemployment rate in the three months to March to hold steady at 3.8%, employment change to remain at 160k from 169k and headline earnings growth to also remain steady at 5.8% from 5.9%, whilst the ex-bonus metric is seen firming up to 6.8% from 6.6%. Firmer data could bring the expectation for a June rate hike from Bank of England higher from a 69% probability for now and bring the focus also on next CPI release on May 24. EURGBP remains on the verge of a breakout on the downside after trading in a range since the start of the year.

EUR GBP - FUNDAMENTAL ANALYSISPound Sterling briefly dipped after the GDP data on Friday, but still found support on dips with GBP/USD around 1.2530 and GBP/EUR at 1.1475.

The Pound to Dollar (GBP/USD) exchange rate strengthened to 1.2640 in an immediate response to the Bank of England policy decision on Thursday.

There was, however, a notable reversal later in the session as risk appetite deteriorated and the dollar regained territory.

In this environment, GBP/USD posted sharp losses to lows at 1.2500.

Risk conditions will remain an important element. Carl Hammer, chief strategist at SEB commented; "We are entering a more defensive state generally."

Adam Cole, chief currency strategist at RBC Capital Markets, expects choppy trading rather than sustained dollar depreciation. He added; "We're not convinced that this is a sustainable trend yet. We'll have periods when the dollar does well and the dollar does badly."

Mixed GDP data, UK Lags in Global Terms

The latest GDP data recorded a 0.3% decline for March compared with expectations of no change and following no change in February.

The first quarter, however, recorded 0.1% growth and in line with expectations which means that the UK has again avoided a technical recession.

Services declined 0.5% for March after a 0.1% retreat in February with output in consumer-facing services dipping 0.8% on the month.

Production output increased 0.7%for the month with 0.2% growth in construction output.

According to Darren Morgan from the ONS; “The fall in March was driven by widespread decreases across the services sector. Despite the launch of new number plates, cars sales were low by historic standards – continuing the trend seen since the start of the pandemic – with warehousing, distribution and retail also having a poor month.”

He added; “These falls were partially offset by a strong month for manufacturing as well as growth in gas production and distribution and also in construction.”

The ONS estimated that GDP was 0.5% below the pre-pandemic peak and the worst performance within the G10 area.

Pantheon Macroeconomics economist Samuel Tombs noted that the UK is “still at the bottom of the G7 league table”.

Nevertheless, he added; “at least the magnitude of the underperformance is not increasing relative to other countries in Europe, which have faced a similarly enormous energy price shock.”

RSM UK economist Thomas Pugh, commented; “The 0.1% q/q rise in GDP in Q1 means the UK has probably avoided a recession altogether this year.”

Nevertheless, he added; “The big picture is that the economy is still 0.5% below its pre-pandemic level and is unlikely to regain that level until the end of the year at the earliest.”

According to Victoria Scholar, head of investment at interactive investor; “Stubbornly high inflation, negative real wage growth and general cost of living pressures are weighing on the consumer, and in turn the services industry which is typically a key growth engine for the UK economy.”

Tom Stevenson, personal investing director at Fidelity International also pointed to underlying weakness; "With the key services side of the economy continuing to slow in the face of higher borrowing costs and rising prices, it still feels like we’re walking through treacle."

He added; "With inflation still in double digits, it feels depressingly like a re-run of 1970s stagflation."

KPMG economist Yael Selfin also expressed caution; "While recession is probably no longer on the cards, vulnerabilities resulting from higher borrowing costs and tighter credit are likely to dampen business and household activity this year."

Ben Jones, CBI lead economist Ben Jones was slightly more positive; “The UK economy is proving more resilient than widely expected and it looks increasingly likely that the UK will avoid a recession this year. Underlying momentum appears to be firming, with our surveys showing growth expectations for the quarter ahead creeping back into positive territory for the first time in a year.

ING summarised the situation; “Strip out all of the volatility though, and the economy seems to be reasonably stagnant.”

BoE Debate will Continue

The Bank of England increased interest rates by 25 basis points to 4.50% at the latest policy meeting which was in line with consensus forecasts. The 7-2 vote for the move was also expected as Tenreyro and Dhingra again voted against any rate hike.

The bank now expects positive GDP growth in 2023 and 2024 with no quarters of negative growth. Overall, growth forecasts were revised higher by the largest extent since the bank gained independence in 1997.

The bank also raised inflation forecasts with an important impact from the strong increase in food prices. The CPI inflation rate is now forecast at close to 5.0% at the end of 2023 from 4.0% previously.

According to ING; While we don’t exclude one final June hike, our base case is that we have reached the peak of the BoE tightening cycle as inflation will start to rapidly decelerate this year.”

ING added; “For now, however, there aren’t many convincing reasons to call for GBP underperformance against its main peers in the near term.”

Commerzbank considers that expectations are liable to fluctuate; “In the end future data will be decisive for the BoE’s next rate decision though, in addition to the April inflation data the May data will also be published.”

It added; “If a swift fall were to become obvious here, as the BoE expects, it is likely to refrain from further rate hikes and that would put pressure on Sterling. However, the risk that the BoE will do more has certainly increased since yesterday.”

According to Credit Agricole; “The comments suggested that the BoE outlook whilst not as dire as in February has not improved significantly from the stagflationary scenario that the MPC has been predicting since May 2022.”

UoB expects further GBP/USD losses; “The burst in downward momentum indicates that the downside risk is building quickly. From here, we expect GBP to drop to 1.2445; if it can break below this major support level, it could trigger a rapid decline to 1.2390.”

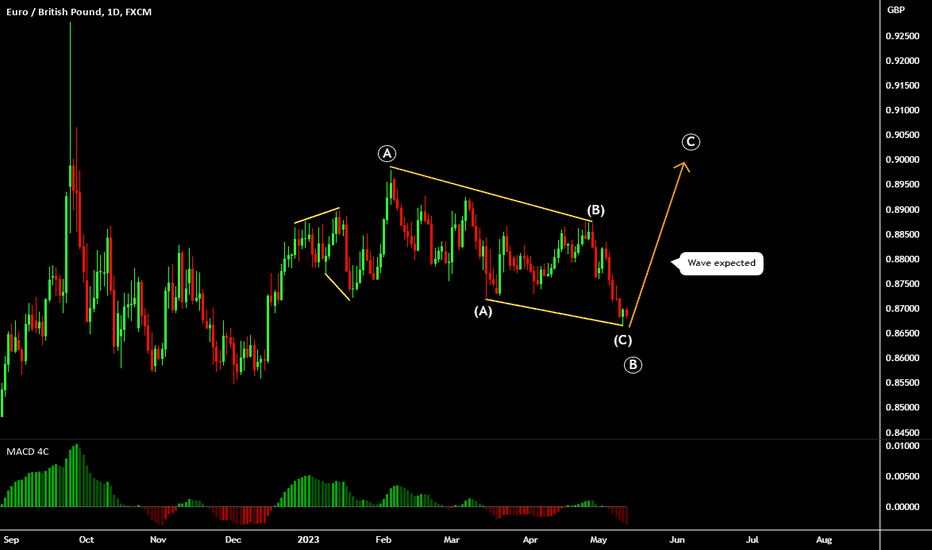

EURGBP: Bearish Wave is Coming 🇪🇺🇬🇧

After the yesterday's pullback, EURGBP reached a wide horizontal zone of supply.

0.873 - 0.8765 is the area from where the next bearish move will most likely initiate.

The next goal for the sellers will be 0.866

Because the underlined area is quite wide, look for an intraday confirmation before you sell.

❤️Please, support my work with like, thank you!❤️

EUR GBP - FUNDAMENTAL ANALYSISMonetary Policy: A Hawkish Stance?

The BoE's impending monetary policy decision is a critical factor underpinning Sterling's performance.

The analysts' consensus is that the BoE will adopt a hawkish stance, with a 25 basis point hike in the bank rate. This move would bring the bank rate to 4.50%, in line with market expectations.

"We expect the BoE to hike the Bank Rate by 25bp bringing it to 4.50%, which is fully priced by markets," says Kirstine Kundby-Nielsen, Analyst, FX Strategy at Danskebank.

She adds, "In our base case of a 25bp hike, we expect the reaction in EUR/GBP to be rather muted on the release but move slightly higher during the press conference."

Similarly, Valentin Marinov, Head of G10 FX Strategy at Credit Agricole, also foresees a rate hike.

However, he points out that the Monetary Policy Committee (MPC) may remain divided over the need for further aggressive hikes.

"We expect that the MPC will deliver a 25bp rate hike today to lift the bank rate to 4.50% but think it will remain divided on the need for further aggressive hikes," says Marinov.

Rate Hike Cycle: Nearing its Peak?

Another hotly debated topic among analysts is the trajectory of the BoE's rate hike cycle. While some believe that the current cycle is nearing its peak, others argue for its continuation, contingent on the data.

ING Economics' FX Strategist, Francesco Pesole, suggests that the BoE might be close to hitting the peak in its rate hike cycle.

He cites the primary drivers of inflation, namely food prices and core goods inflation, as temporary phenomena and expects a rapid deceleration in CPI later this year.

"Today’s 25bp hike may well be the last one in this cycle," says Pesole.

"The drivers of higher-than-projected inflation have primarily been food prices and some surprising stickiness in core goods inflation: neither of those trends look likely to be long-lasting," he adds.

On the other hand, Danskebank's Kundby-Nielsen anticipates that the BoE will communicate a 'pause' in its hiking cycle to fully assess the impact of previous rate increases.

However, she highlights that this decision will be heavily data-dependent.

"In its statement we expect the BoE to prime markets for a pause in the hiking cycle as the central bank wants to fully evaluate the effect from previous Bank Rate increases before deciding on next steps," says Kundby-Nielsen.

"However, as always, all future decisions will be data-dependent," she adds.

Outlook for the Pound Sterling: Where Next?

The impending BoE decision is also expected to have significant ramifications for the sterling.

While the overall outlook appears cautiously optimistic, the currency's fate is contingent on multiple factors, including the BoE's future monetary policy stance and the pace of economic recovery.

MUFG's Senior Currency Analyst, Lee Hardman, observes the sterling trading close to its year-to-date highs ahead of the BoE meeting.

The strengthening of the sterling, particularly against the euro, reflects the fading investor pessimism about the UK's economic outlook.

Hardman also notes the resilience of the UK economy and the persistent inflation and wage growth, which puts pressure on the BoE to maintain its rate hike cycle.

"The pound is continuing to trade close to year-to-date highs ahead of today’s BoE policy meeting," says Hardman.

"The resilience of the UK economy at the start of this year alongside still uncomfortably strong inflation and wage growth keeps pressure on the BoE to keep raising rates," he adds.

Francesco Pesole of ING Economics also discusses the sterling's recent strength, attributing it in part to aggressive market expectations of BoE tightening. However, he believes that these hawkish expectations may be excessive and could be scaled back.

"We acknowledge that part of GBP’s recent strength has been due to the market’s aggressive expectations about BoE tightening, and therefore recognise there are downside risks as those (excessive, in our view) hawkish expectations are scaled back," says Pesole.

BoE's Forward Guidance and Sterling's Reaction

Much of the sterling's reaction post-BoE decision would depend on the central bank's forward guidance. Tullia Bucco, Economist at UniCredit Bank, anticipates that the BoE will likely maintain a data-dependent approach without offering explicit rate guidance, leaving the sterling's performance hanging in the balance.

"A 25bp rate hike to 4.50% is expected, and sterling’s reaction will therefore likely mostly depend on the message that BoE Governor Bailey conveys in his press conference," says Bucco.

"The risk is that no rate guidance will be delivered today, with the BoE stressing that further rate decisions remain data dependent, which might not offer sterling much support either," she adds.

Nikesh Sawjani, Economist at Lloyds Bank, highlights that the 25bps rise would make it the twelfth consecutive hike in the current cycle which began in December 2021.

The cumulative tightening since then would total 440bp. Sawjani draws attention to the fact that current CPI inflation is much stronger than the BoE had anticipated, with March's headline CPI at a substantial 10.1%, notably above the BoE staff forecast of 9.2%.

Sawjani also anticipates an upward revision of GDP forecasts, backed by possible GDP growth in Q1 and survey evidence of improved economic confidence and activity at the start of Q2. Additionally, he expects that fiscal measures from the March Budget and lower-than-assumed energy prices will likely support real incomes, further bolstering GDP.

"New BoE economic forecasts will provide an update on the medium-term growth and inflation outlook," says Sawjani. "Overall, it seems likely that GDP forecasts will be revised higher. All else being equal, that would lead to a higher medium-term inflation profile although not sufficiently to prevent an undershoot of the 2% target in 2024 and 2025," he adds.