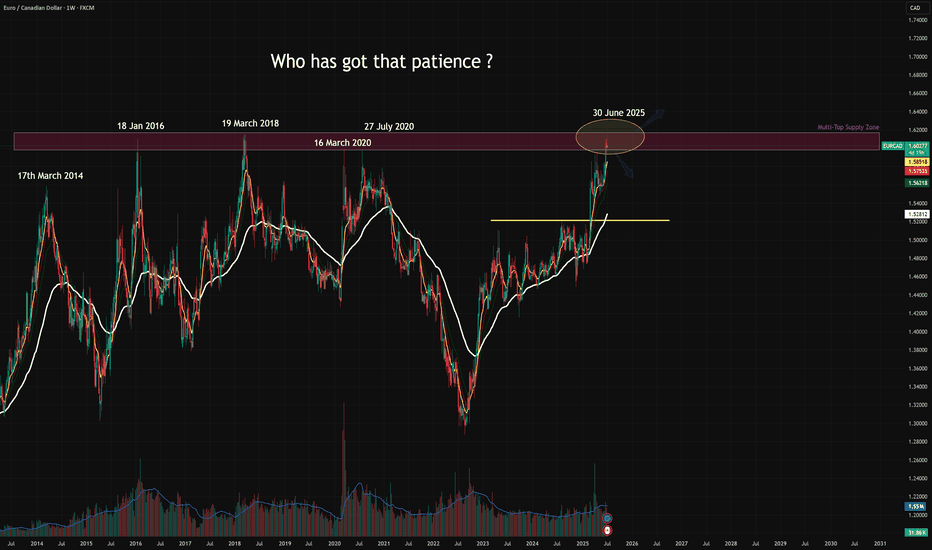

EURCAD – Over a Decade of Rejections Finally Breaking the Cycle?EURCAD is once again testing the legendary multi-year resistance between 1.60 and 1.6150, a zone that has caused at least 5 major rejections since 2014. Each of those led to significant drawdowns — yet this time, price is pressing deeper into it, potentially signaling a macro regime shift if bulls follow through.

Key Technical Observations

Timeframe: 1W

“Multi-Year Supply Zone” or “Overhead Resistance Zone”: 1.60 – 1.6150

Historical Reaction Dates:

🔸 17 Mar 2014

🔸 18 Jan 2016

🔸 19 Mar 2018

🔸 16 Mar 2020

🔸 27 Jul 2020

Current Candle (30 Jun 2025):

Pierced the zone briefly — now hovering just inside

Volume: Noticeable uptick in the last few weeks — interest is real

Structure Below: Strong accumulation base breakout around 1.5280, serving as major support now

TLDR

EURCAD is testing a monster historical supply zone (1.60–1.6150) for the 6th time in 11 years. This could be the breakout that changes the macro trend, but without confirmation, it's still a zone to respect.

Disclaimer

This is for educational purposes only. Not financial advice.