EURAED sellEUR has been on the rise, getting plenty of strength against USD, GBP, HKD and AED in particular over the last few days.

This can come to an end as early as tomorrow then the ECB is releasing their interest rate decision and hold a press conference in regards to their monetary policy.

There is also GDP news before that; let's also not forget that inflation is really low.

Therefore, if they turn dovish like the FED did recently then we could see EUR weakness across the board yet again.

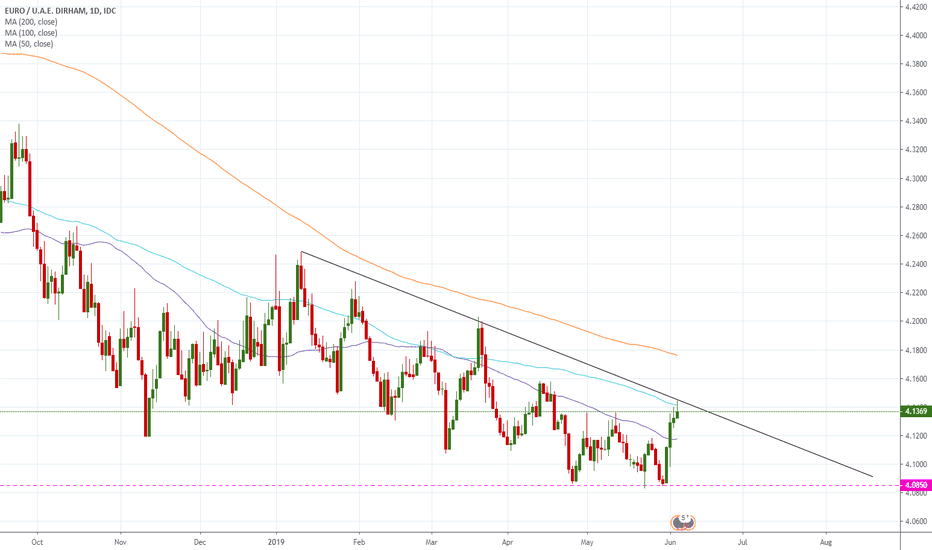

In such a scenario, we could see the EURAED rate drop closer to 4.10 or below, with the 4.11 level being the first test (50-day average) and then the 4.085 area being the first real level of support as the daily and weekly candle chart is indicating.