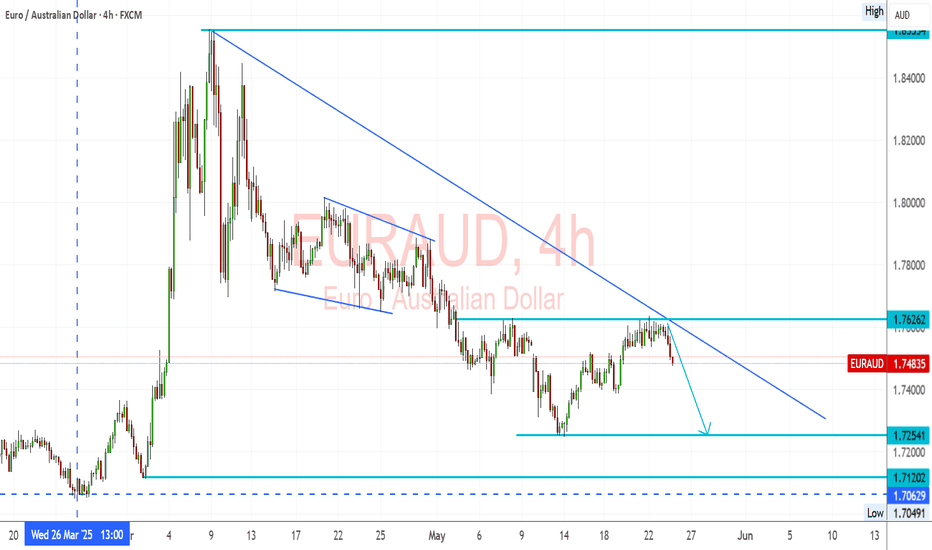

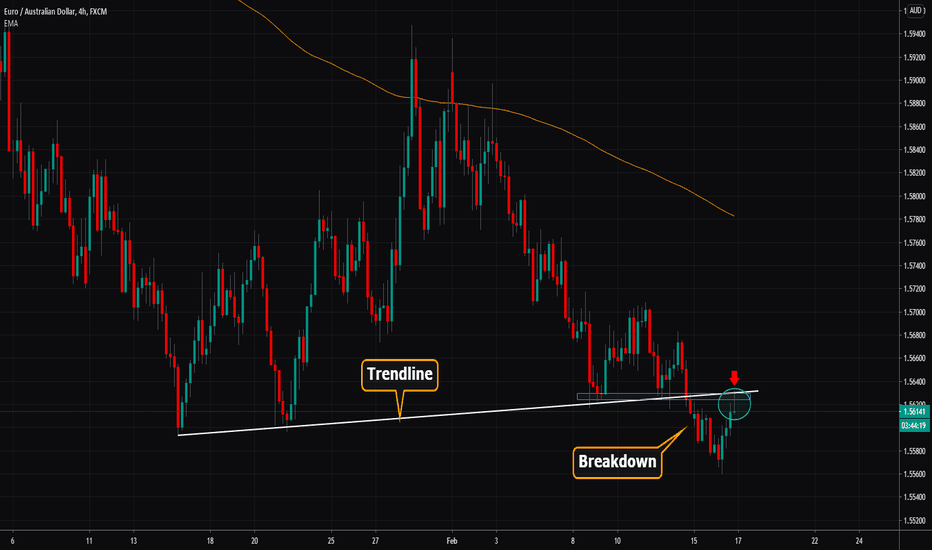

EURAUD – Trendline Holds, Bearish Setup Below 1.7626EURAUD Trend: EURAUD pair remains in a strong downtrend, marked by consistent lower highs and a descending trendline.

Resistance: 1.7626 has been retested and rejected, confirming it as a short-term ceiling.

Structure: The latest rejection from both horizontal resistance and the trendline confirms bearish intent.

🔽 Bearish Targets:

1.7254 – minor support and near-term target

1.7120 – stronger support zone

1.7060 – previous low and potential extended target

A clear break below 1.7400 could confirm continuation of the trend toward those levels.

Fundamental Overview:

🔻 EUR Weakness:

The Eurozone is slowing, particularly in Germany and France.

ECB remains cautious; recent comments show concern about tight financial conditions and sticky inflation.

Political uncertainties and mixed data prints are adding pressure.

🟢 AUD Support:

The RBA remains firm with hawkish language, holding rates while global peers lean dovish.

Commodities remain stable, and Australia benefits from demand out of Asia.

Domestic data (jobs and retail) shows surprising resilience.

Summary:

Bias: Bearish below 1.7626

Break Trigger: 1.7400

Target Range: 1.7250 – 1.7060

Fundamentals: Favor AUD on stronger economic footing and RBA policy tone

📉 EURAUD looks ready for another leg lower unless we see a breakout above 1.7630 with conviction.

Euraud-technical-analysis

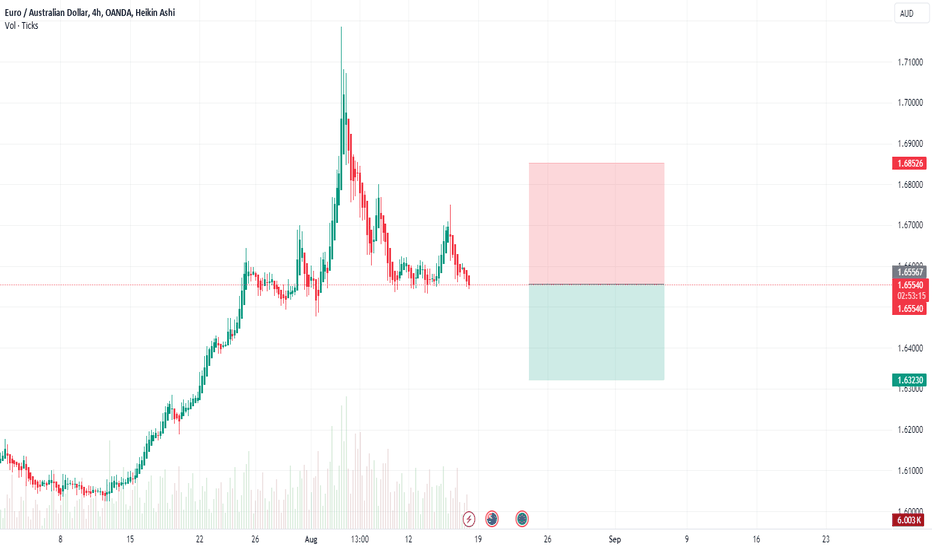

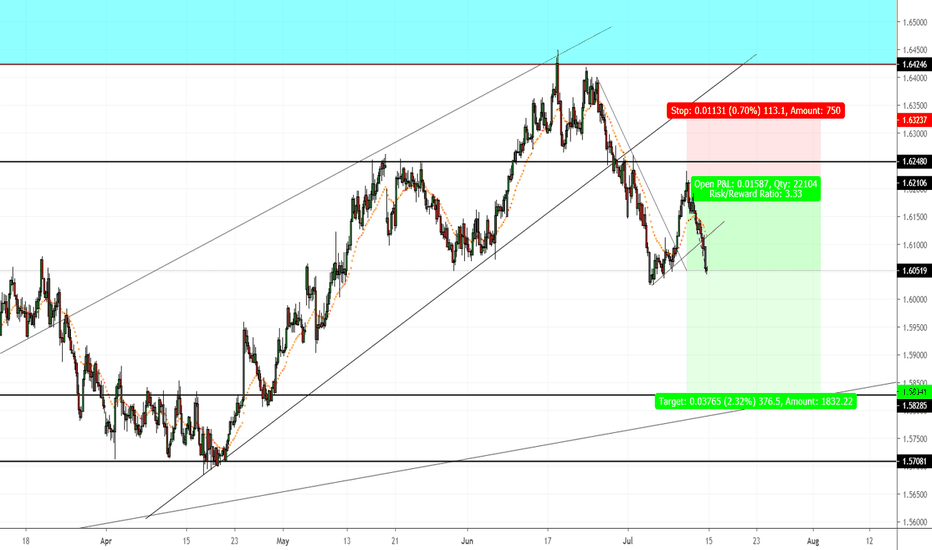

EURAUD SELL TF H4 TP = 1.6323 On the H4 chart the trend started on Aug. 06 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 1.6323

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading

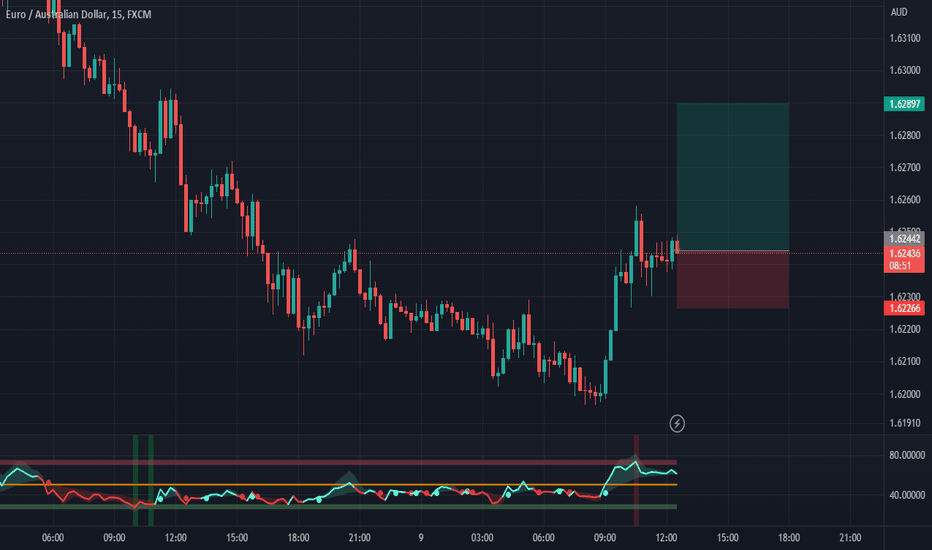

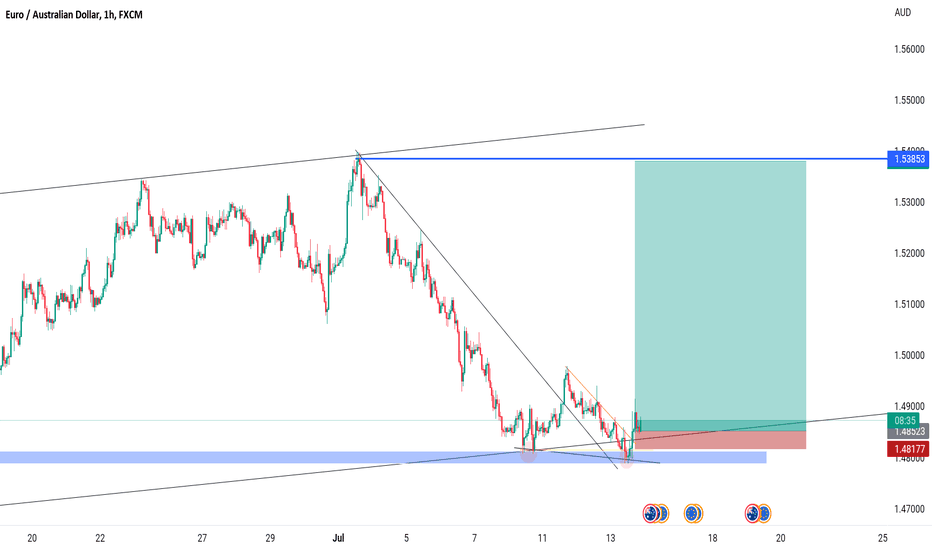

I WOULDN'T KNOW IF I'M THE ONLY SWING LOVER, BUT HERE'S 500 PIPSAs a technical analyst, just learning my fundamentals though😂, I think Eur/Aud is about to down with the head and shoulders pattern showing up, couple with the fact that its first movement for this week is a buy which think is a retracement before the real move downward.

My first post, I wouldn't mind for your comments and likes 😉.

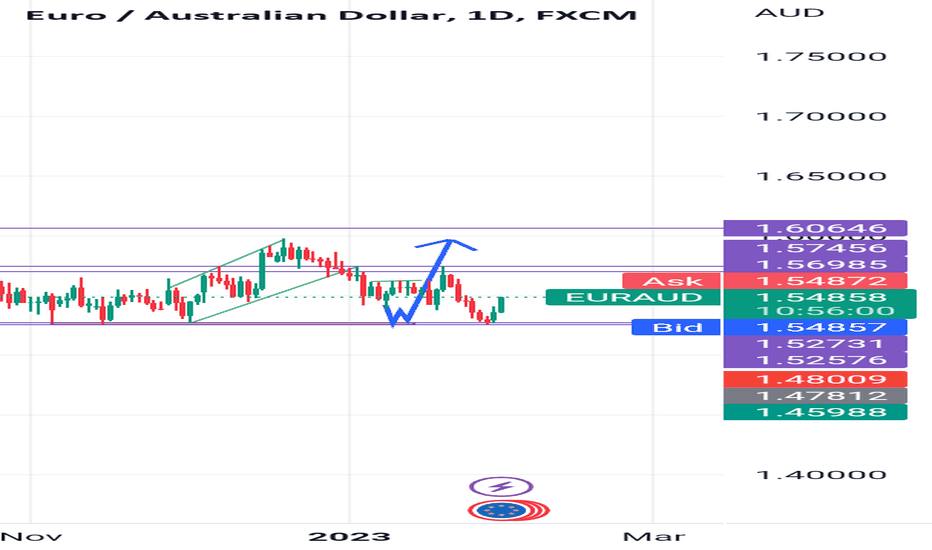

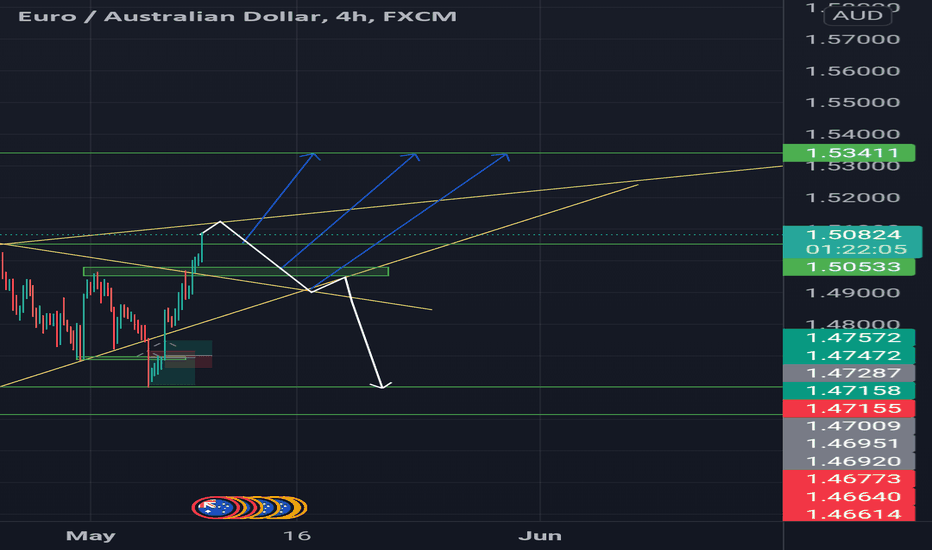

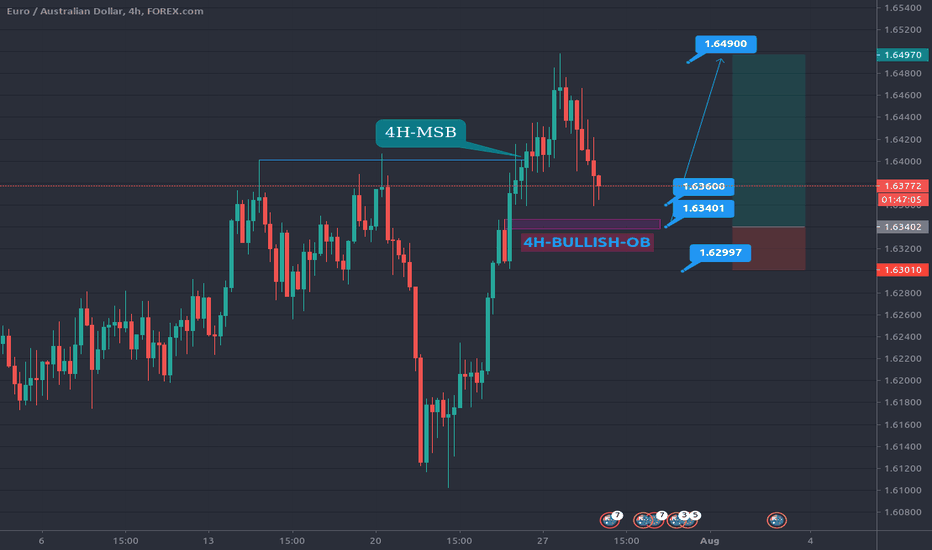

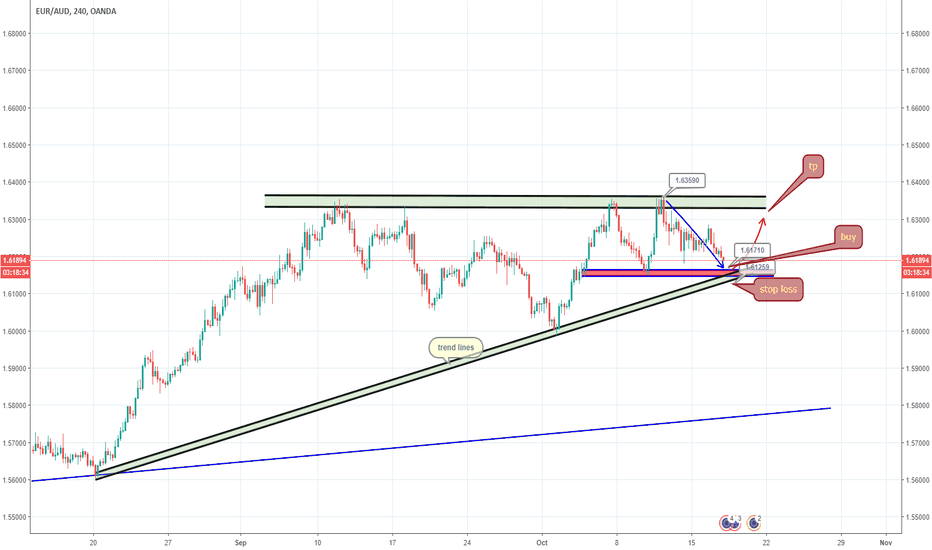

EURAUD CONTINUATION/CORRECTIONEURAUD has given a retracement on 4H after a strong market structure break to the up-side.

Aggressively, suitable entry is at CMP. however, do note a potential draw own to the 4H bullish order lock below price.

Conservatively, Enter a Buy on the OB of 1.6340 , SL at 1.6299 or 5Pips below SAID LEVEL.

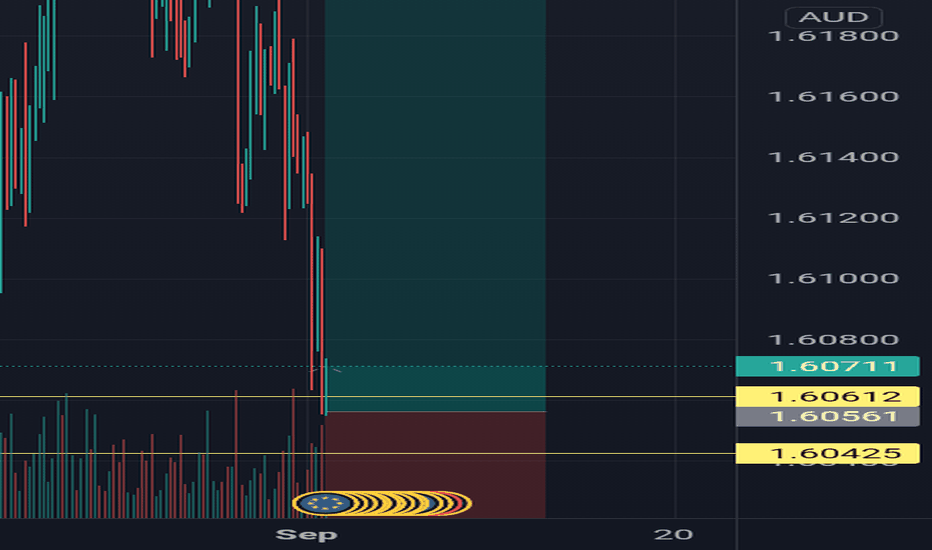

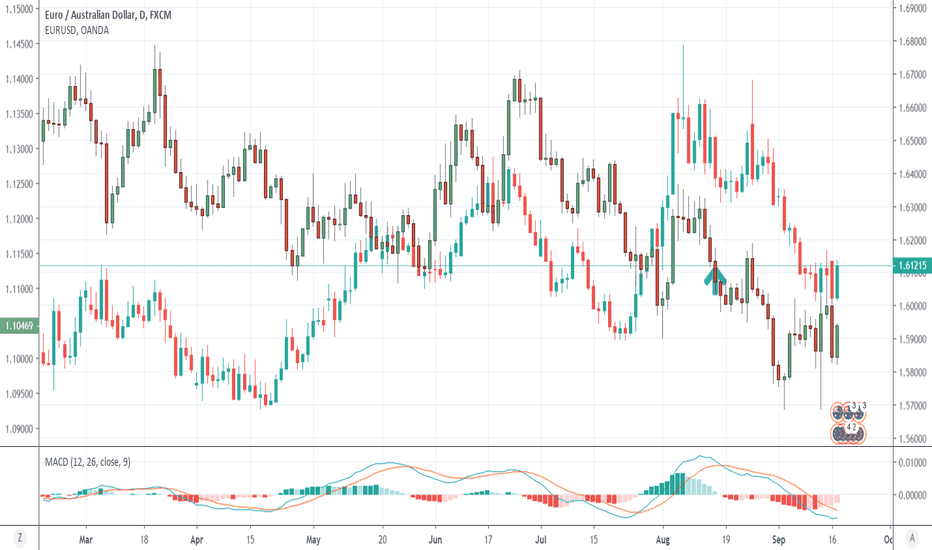

EURAUD Fundamental Analysis – September 17th 2019Here is the key factor to keep in mind today for Euro trades:

German ZEW Survey and Eurozone ZEW Survey: The German ZEW Survey Current Situation Index for September is predicted at -15.0 and the German ZEW Survey Economic Expectations Index at -38.0. Forex traders can compare this to the German ZEW Survey Current Situation Index for August which was reported at -13.5 and to the German ZEW Survey Economic Expectations Index which was reported at -44.1. The Eurozone ZEW Survey Economic Sentiment Index for September is predicted at -37.4. Forex traders can compare this to the Eurozone ZEW Survey Economic Sentiment Index for August which was reported at -43.6.

Here are the key factors to keep in mind today for Australian Dollar trades:

Australian ANZ Roy Morgan Weekly Consumer Confidence Index: The Australian ANZ Roy Morgan Weekly Consumer Confidence Index for the week of September 15th was reported at 109.3. Forex traders can compare this to the Australian ANZ Roy Morgan Weekly Consumer Confidence Index for the week of September 8th which was reported at 113.3.

Australian House Price Index: The Australian House Price Index for the second-quarter decreased by 0.7% quarterly and by 7.4% annualized. Economists predicted a decrease of 1.0% quarterly and of 7.7% annualized. Forex traders can compare this to the Australian House Price Index for the first-quarter which decreased by 3.0% quarterly and by 7.4% annualized.

RBA Minutes: RBA minutes suggested that further interest rate cuts could be enacted in order to support growth as well as inflation targets. The RBA is currently expected to cut interest rates by 25 basis points in November, but an October cut remains on the table and dependent on economic data. The RBA kept its interest rate unchanged at 1.00% at its September meeting.

Chinese New Home Prices: Chinese New Home Prices for August increased by 0.58% monthly. Forex traders can compare this to Chinese New Home Prices for July which increased by 0.59% monthly.

Should price action for the EURAUD remain inside the or breakout above the 1.6015 to 1.6165 zone the following trade set-up is recommended:

Timeframe: D1

Recommendation: Long Position

Entry Level: Long Position @ 1.6100

Take Profit Zone: 1.6430 – 1.6500

Stop Loss Level: 1.6000

Should price action for the EURAUD breakdown below 1.6015 the following trade set-up is recommended:

Timeframe: D1

Recommendation: Short Position

Entry Level: Short Position @ 1.5945

Take Profit Zone: 1.5685 – 1.5780

Stop Loss Level: 1.6015

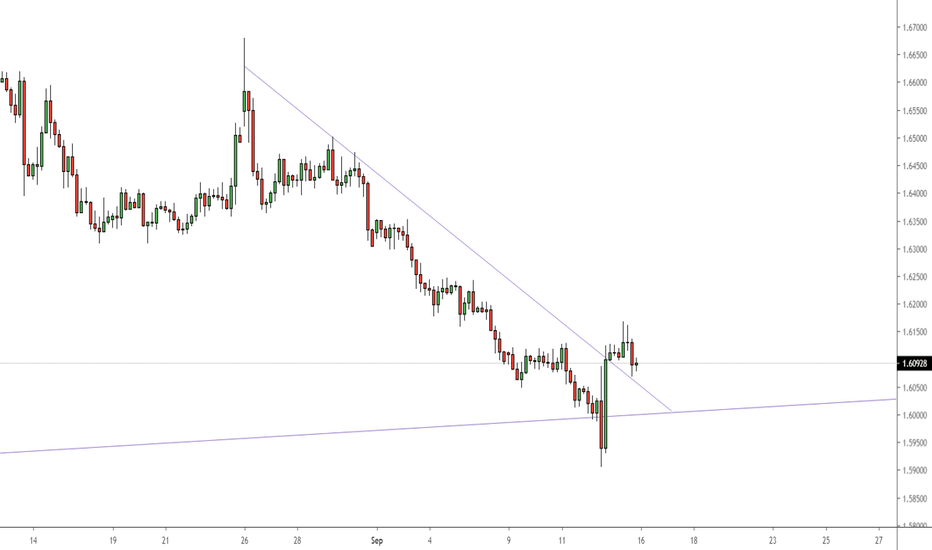

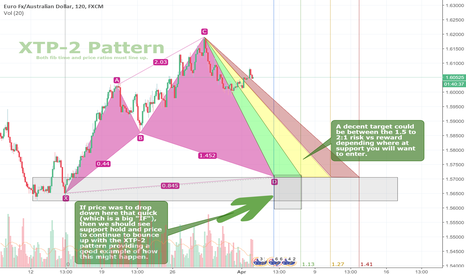

$EURAUD XTP-2 Pattern (Potential Long) IF Support Gets HitThis is a potential trade that has a greater probability of price NOT working out. However with this being said, IF the price was to come down this quick we could have a good potential long trade with a thin area of support on this XTP-2 Pattern.

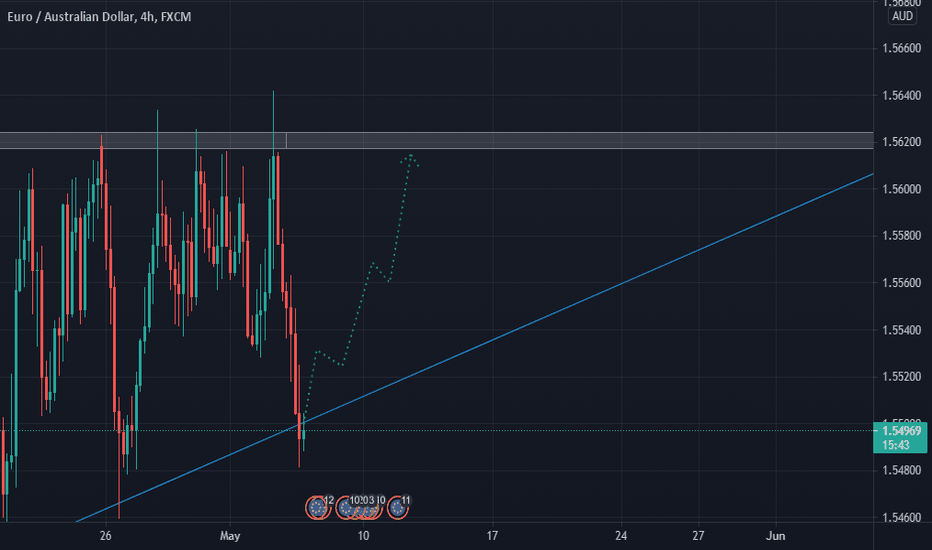

BUTTERFLY BULL |H4| LONG & SHORTEURAUD is bullish on H1, H4, Daily, and Monthly charts. We have a bullish butterfly formation but remember to look into the fundamentals for better decision on your entry choice.

Fundamentals to consider on EURO include; Services PMI and Composite PMI for Eurozone, Italy, France and Germany. Also Eurozone Retail Sales.

Fundamentals to consider on AUD include: Australian CBA Services PMI and CBA Composite PMI, Australian AiG Performance of Services Index, Australian ANZ Roy Morgan Weekly Consumer Confidence Index, Australian Current Account Balance, Australian Retail Sales, Australian RBA Interest Rate Decision.

Good Luck.