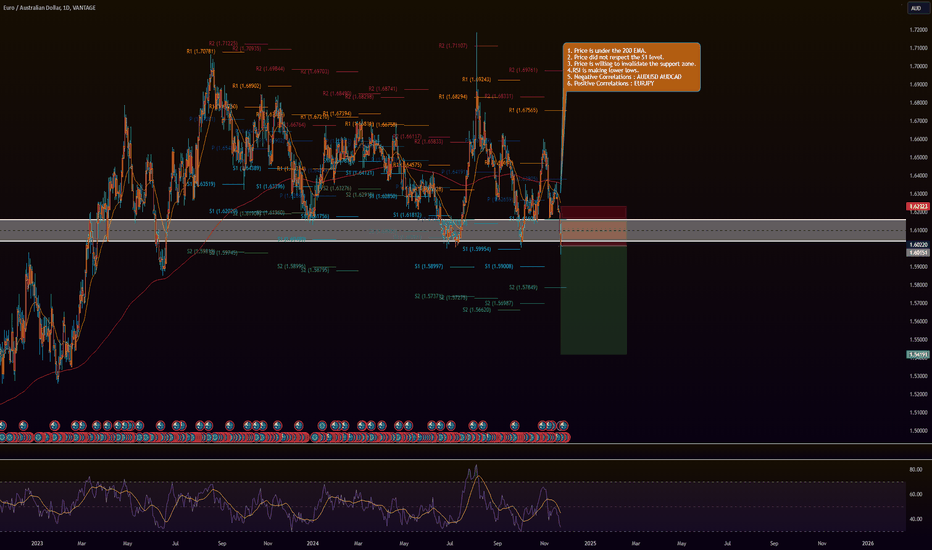

MY EURAUD SHORT IDEA 24/11/2024NOTE: THIS IS JUST A TRADE IDEA WHICH I MAY OR MAY NOT TAKE DEPENDING ON THE OPPORTUNITY PRESENTED, PRICE ACTION, AND ECONOMIC EVENTS THAT MAY HAPPEN. PLEASE DO YOUR OWN RESEARCH!

If text is glitchy please use this link

regal-marlin-2d3.notion.site

! (prod-files-secure.s3.us-west-2.amazonaws.com)

President Question Template:

1. Why do you want to trade at the first place?

2. Did you take into account the current market condition, data, high impact news and what’s going on?

3. Even if you made your FA few weeks ago, you **MUST** keep on track and update it time to time.

4. Don’t just have a bias from four weeks ago and execute a trade today based on that you had four weeks ago.

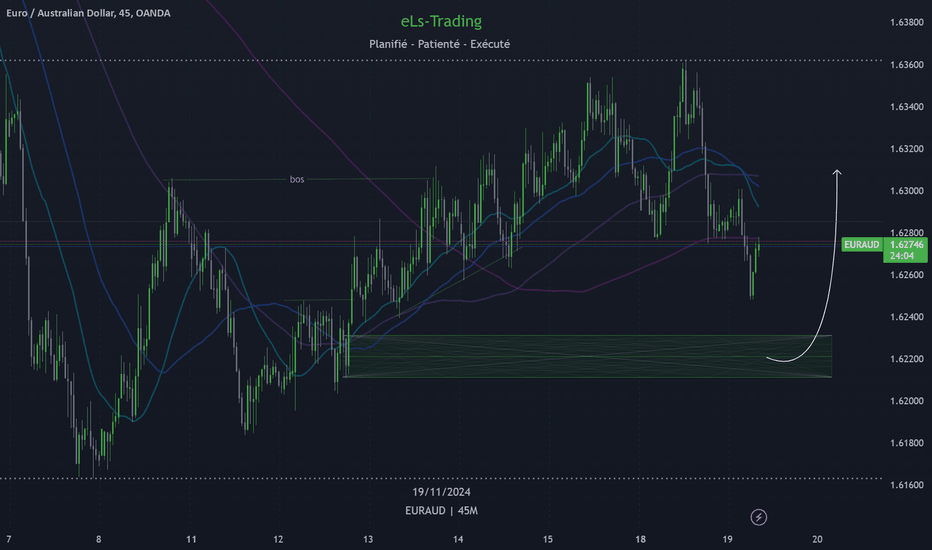

So it all started looking at www.myfxbook.com and I looked at the heatmap where it showed bearish in all time frames for EURAUD especially in the Monthly.

! (prod-files-secure.s3.us-west-2.amazonaws.com)

This gave me an idea to start shorting the currency. I looked at the chart and what I found is every economic event and data is bearish for the EURO. To support my claim you can see see that there there are many events happening on the chart and every event is putting pressure on the price.

! (prod-files-secure.s3.us-west-2.amazonaws.com)

Now it is very important for me to take into account what James says here.

www.elitetraders.io

> **EURO

Macroeconomic Factors:**

>

>

> Eurozone growth remains sluggish, with subdued inflation limiting the European Central Bank’s (ECB) ability to pivot hawkishly. Trade challenges persist, especially with the potential for US tariffs on European goods.

>

>

>

> **Key Drivers:Wage Growth:**

>

> Higher-than-expected wage growth in Germany provides mixed signals for inflation.

>

>

>

> **Geopolitical Risks:**

>

> Ongoing trade tensions with the US and challenges in the energy sector weigh on sentiment.

>

>

>

> **Outlook:Short-term:**

>

> Limited upside amid weak macro data and geopolitical concerns.

>

>

>

> **Medium-term:**

>

> Gradual recovery if energy prices stabilize and ECB policies support growth.

>

>

>

> **Long-term:**

>

> Structural reforms and green transition initiatives could underpin stronger growth.

>

> AUD

> **Macroeconomic Factors:**

>

> Declining energy prices and a weaker Australian-US interest rate spread have pressured the AUD. Domestic growth concerns persist, with a softening labor market and mixed performance in commodity exports.

>

>

>

> **Key Drivers:Monetary Policy:**

>

> The Reserve Bank of Australia (RBA) remains cautious, with markets pricing in a lower probability of rate hikes compared to peers.

>

>

>

> **Commodities:**

>

> Iron ore, a key export, faces headwinds from reduced demand in China, while the broad commodity complex shows mixed signals.

>

>

>

> **Outlook:Short-term (Next Week):**

>

> A slight rebound may occur if risk sentiment stabilizes globally, but volatility remains tied to Chinese economic data.

>

>

>

> **Medium-term (Months Ahead):**

>

> Modest appreciation expected if China's stimulus measures translate into higher demand for Australian exports.

>

>

>

> **Long-term (2025):**

>

> Structural improvements in trade balances and diversification in export markets could support AUD recovery.

>

According to what James has said, AUD will face some volatility in the next week for the short term according to risk sentiment stability and Chinese economic data. In the Medium term it depends on China’s stimulus measures which could translate into higher demand for Australian exports. As for EURO there are many weak macro data and geopolitical concerns with fear of US tariff on Euro. Euro must find good recovery in Energy prices in order for it to stabilize.

Sentiment:

! (prod-files-secure.s3.us-west-2.amazonaws.com)

! (prod-files-secure.s3.us-west-2.amazonaws.com)

! (prod-files-secure.s3.us-west-2.amazonaws.com)

! (prod-files-secure.s3.us-west-2.amazonaws.com)

! (prod-files-secure.s3.us-west-2.amazonaws.com)

! (prod-files-secure.s3.us-west-2.amazonaws.com)

COT DATA

EUR:

! (prod-files-secure.s3.us-west-2.amazonaws.com)

! (prod-files-secure.s3.us-west-2.amazonaws.com)

AUD:

! (prod-files-secure.s3.us-west-2.amazonaws.com)

! (prod-files-secure.s3.us-west-2.amazonaws.com)

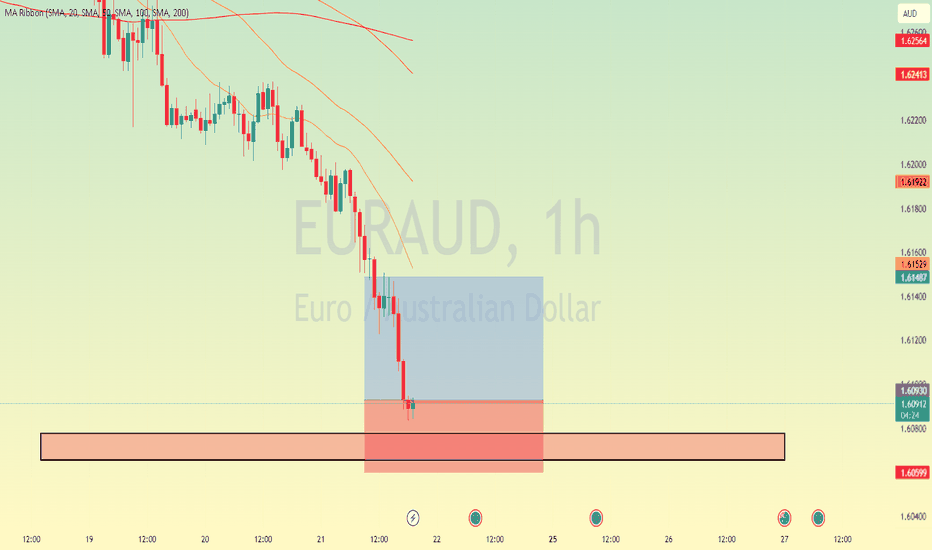

So according to the sentiment data, we can see clearly that retail traders are favoring longing the position probably due to past price action where it bounces off of the price level 1.60425 and create a support zone. But even if hypothetically there is a support zone this zone is most likely about to get invalidated. Price is below 200 EMA signaling a bearish price action for the EURAUD and we can see lower lows on the RSI. As for the COT and SMART money we can notice that they are buying AUD and selling the EURO due to negative economic status on the EURO.

! (prod-files-secure.s3.us-west-2.amazonaws.com)

Order book is showing 37 ASKS position vs 24 at the 1.62 zone. Signaling more Sell positions are present at that level giving a solid resistance zone.

! (prod-files-secure.s3.us-west-2.amazonaws.com)

Calendar:

! (prod-files-secure.s3.us-west-2.amazonaws.com)

AUD CPI expected to be 2.5% by WED NOV 27 which is BULLISH especially if the number is higher than 2.5%.

! (prod-files-secure.s3.us-west-2.amazonaws.com)

EUR German Prelim CPI m/M

! (prod-files-secure.s3.us-west-2.amazonaws.com)

We can notice that that inflation is cooling down.

Correlations:

I noticed negative correlation with AUDUSD and AUDCAD but there is also a positive correlation with EURJPY.

! (prod-files-secure.s3.us-west-2.amazonaws.com)

! (prod-files-secure.s3.us-west-2.amazonaws.com)

! (prod-files-secure.s3.us-west-2.amazonaws.com)

EURAUD

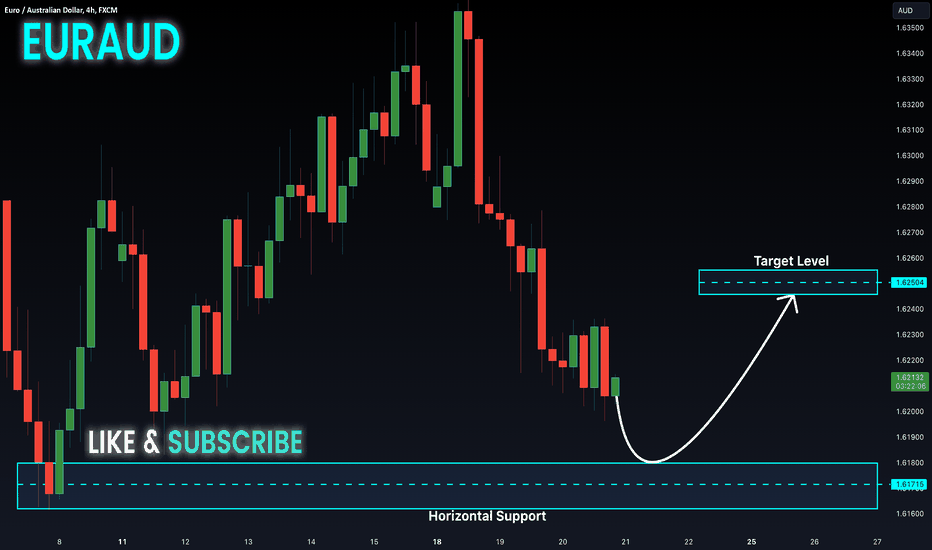

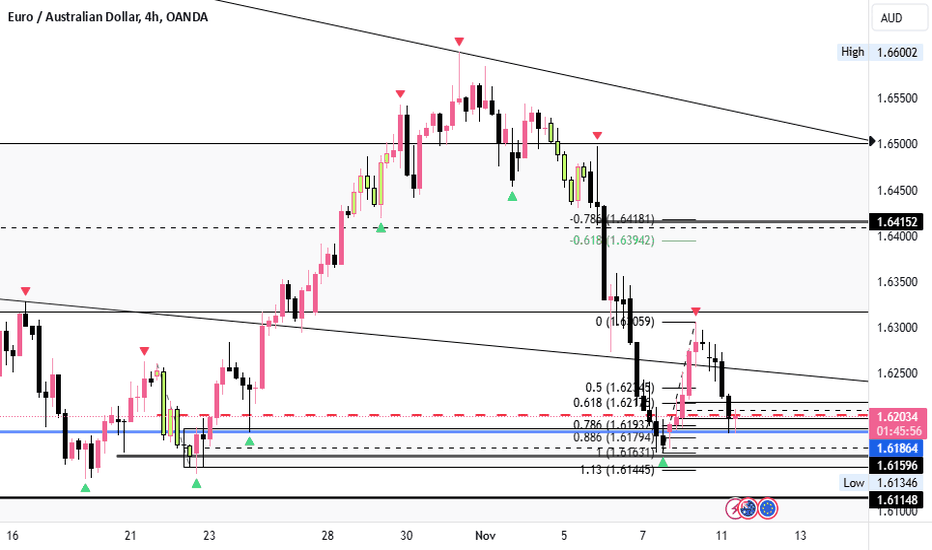

EURAUD is in The bullish DirectionHello Traders

In This Chart EUR/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today EUR/AUD analysis 👆

🟢This Chart includes_ (EUR/AUD market update)

🟢What is The Next Opportunity on EUR/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

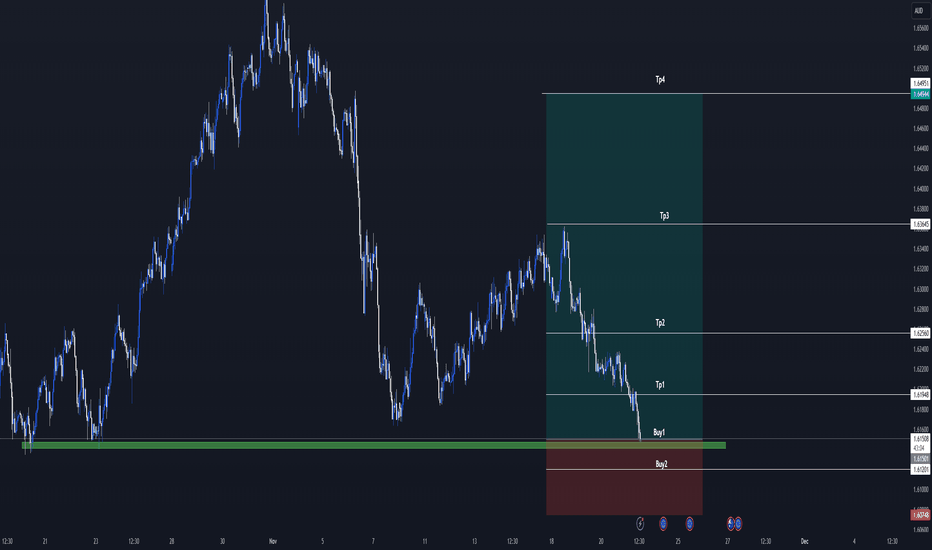

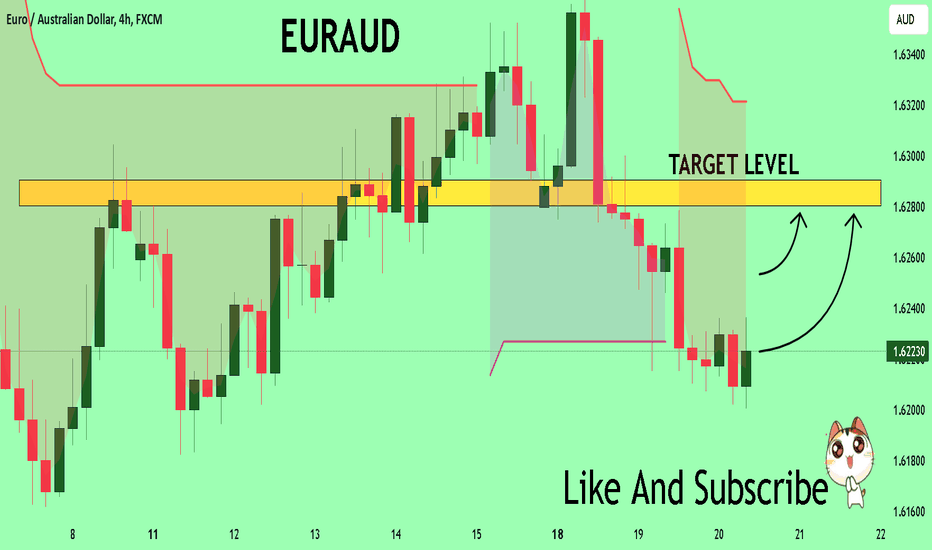

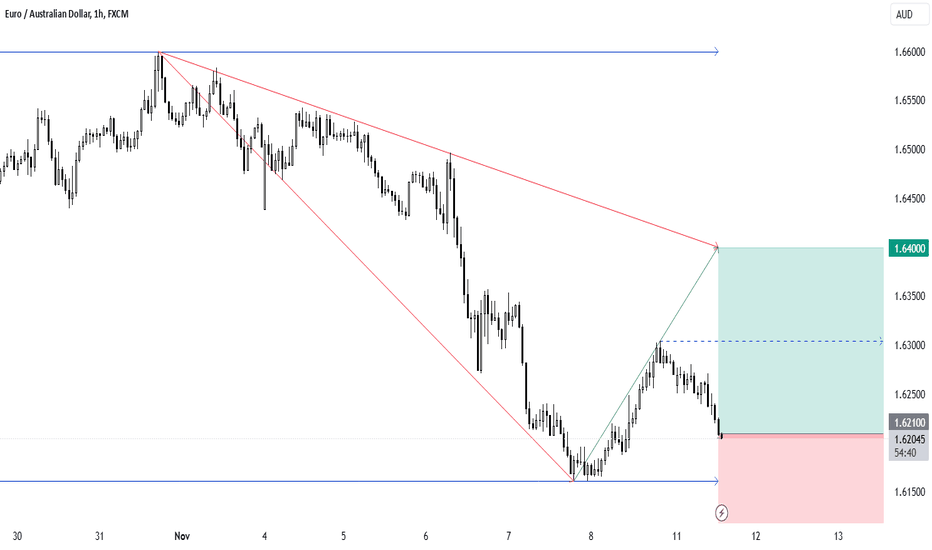

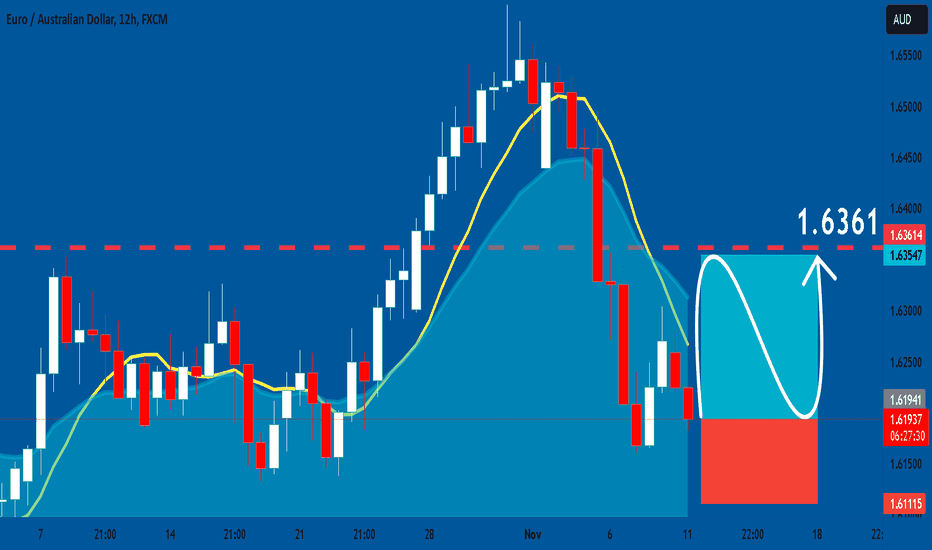

EURAUD Signal : 1H / 4H Beautiful buy !!!EURAUD 1H / 4H

Market price : 1.6150

Buy limit 1 : 1.6150

buy limit 2 : 1.6120

Tp1 : 1.6195

Tp2 : 1.6255

Tp 3: 1.6365

Tp 4 : 1.6495

SL : 1.6075 ( 60 pip )

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ❤️

Remember this is a position that was found by me and it is a personal idea not a financial advice, you are responsible for your loss and gain.

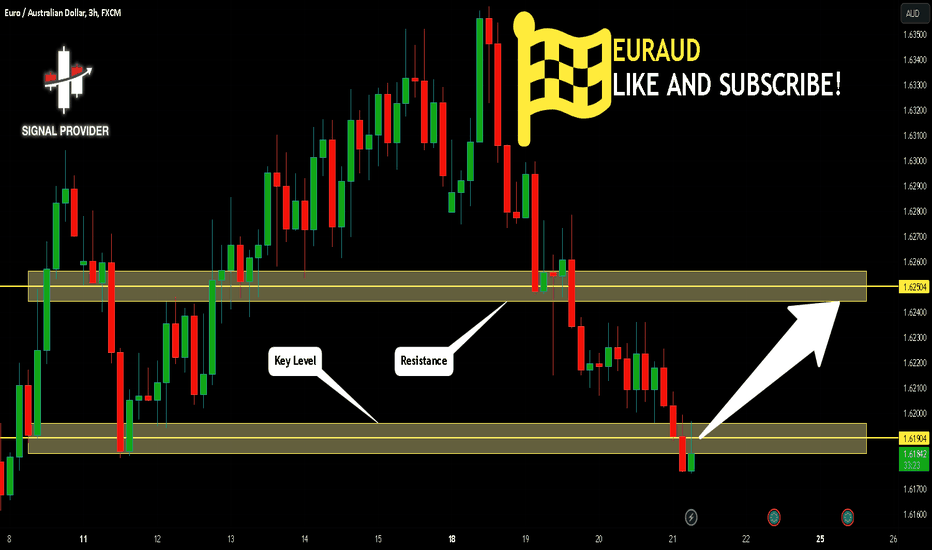

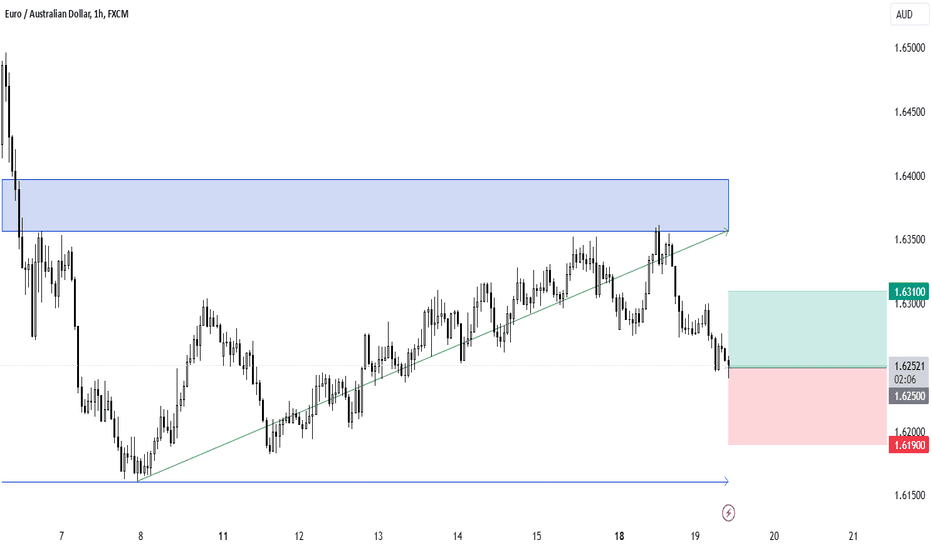

EURAUD Is Bullish! Long!

Please, check our technical outlook for EURAUD.

Time Frame: 3h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 1.619.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 1.625 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

EURAUD Trading Opportunity! BUY!

My dear subscribers,

EURAUD looks like it will make a good move, and here are the details:

The market is trading on 1.6223 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.6280

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

———————————

WISH YOU ALL LUCK

EUR/AUD BUYERS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

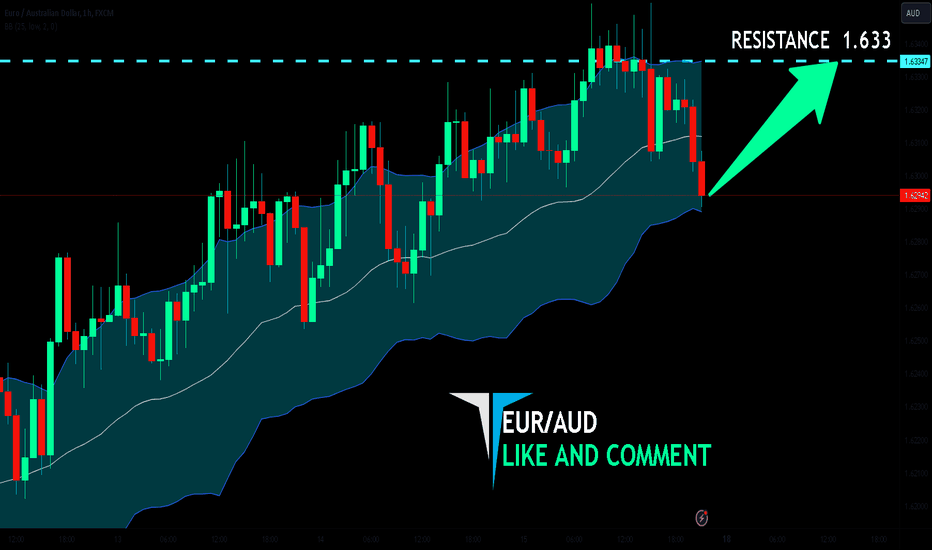

EUR/AUD pair is in the uptrend because previous week’s candle is green, while the price is obviously falling on the 1H timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 1.633 because the pair is oversold due to its proximity to the lower BB band and a bullish correction is likely.

✅LIKE AND COMMENT MY IDEAS✅

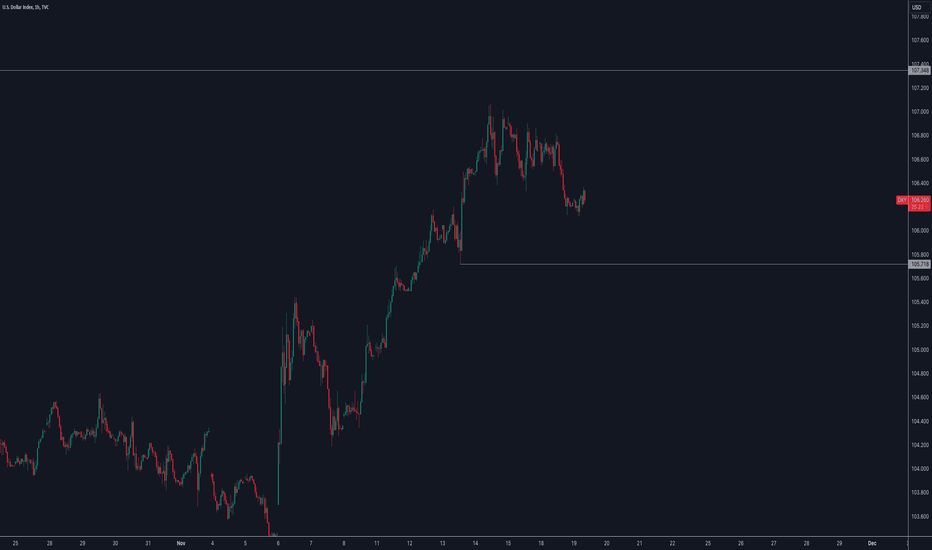

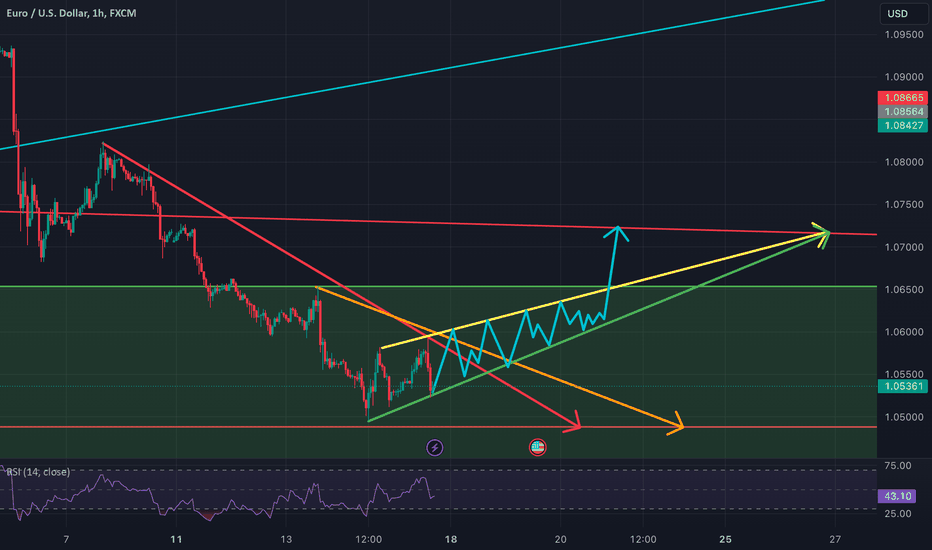

EURUSD NEXT MOVEAfter a downtrend, the fundamental lines of this asset tend to show, as BTC, a new bearish position ready to launch ;

however the downtrend might still attract the price down, causing more of a zigzag kinda pattern, only time will tell ;

these arrows show the change of direction the price is taking about now.

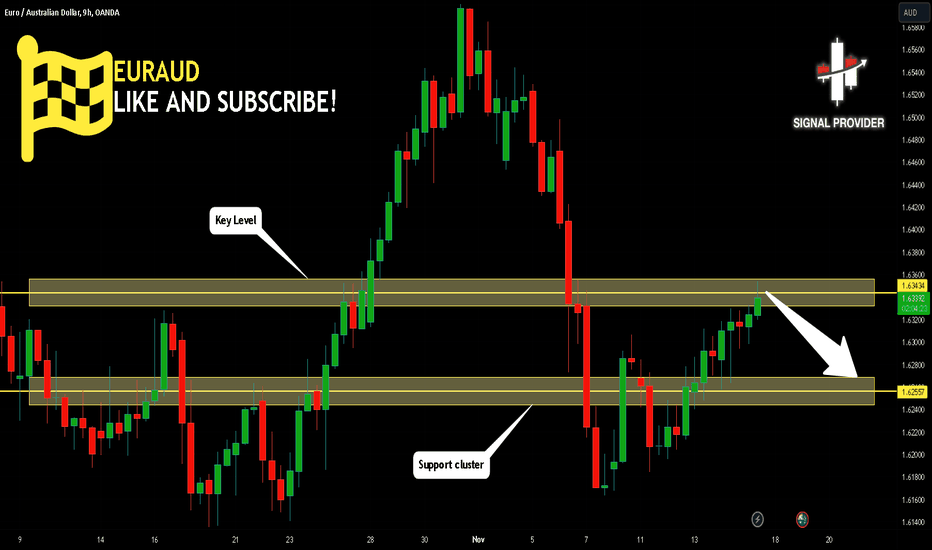

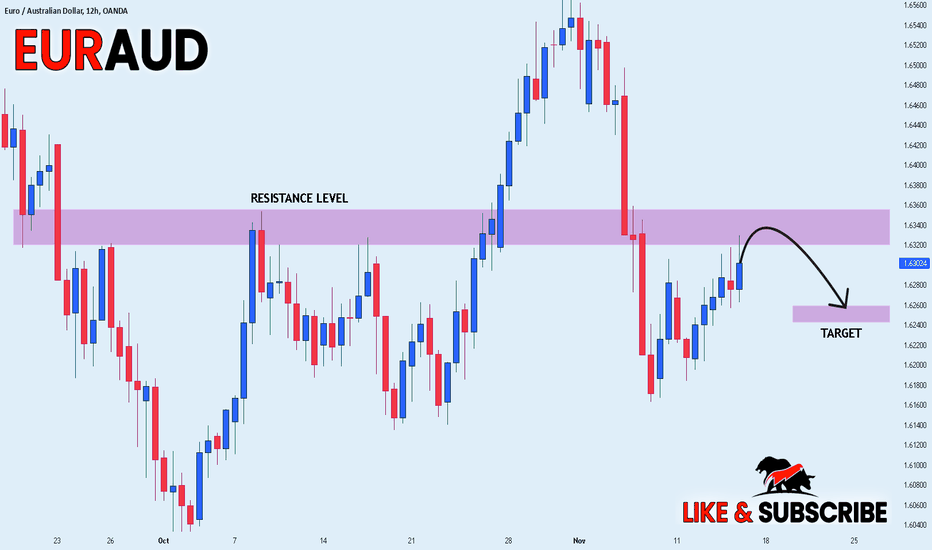

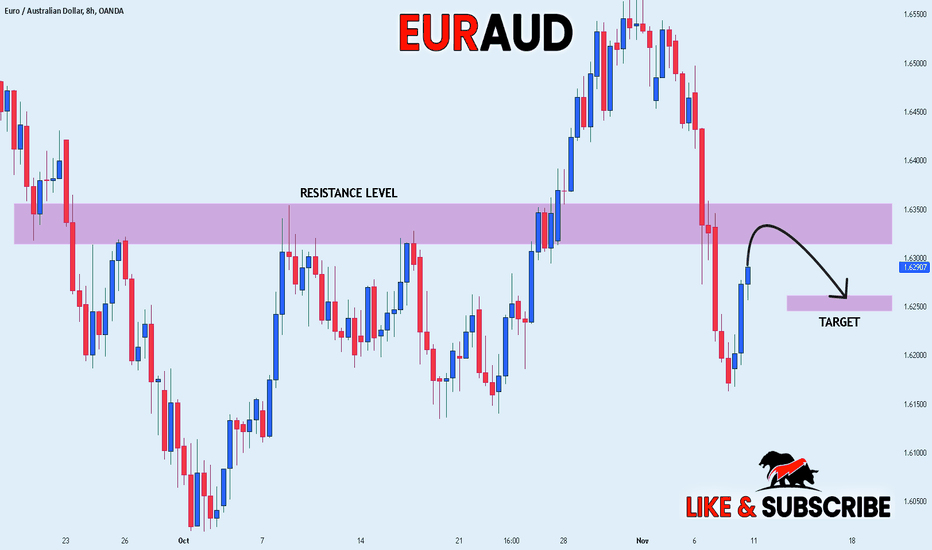

EURAUD Is Very Bearish! Short!

Please, check our technical outlook for EURAUD.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 1.634.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.625 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

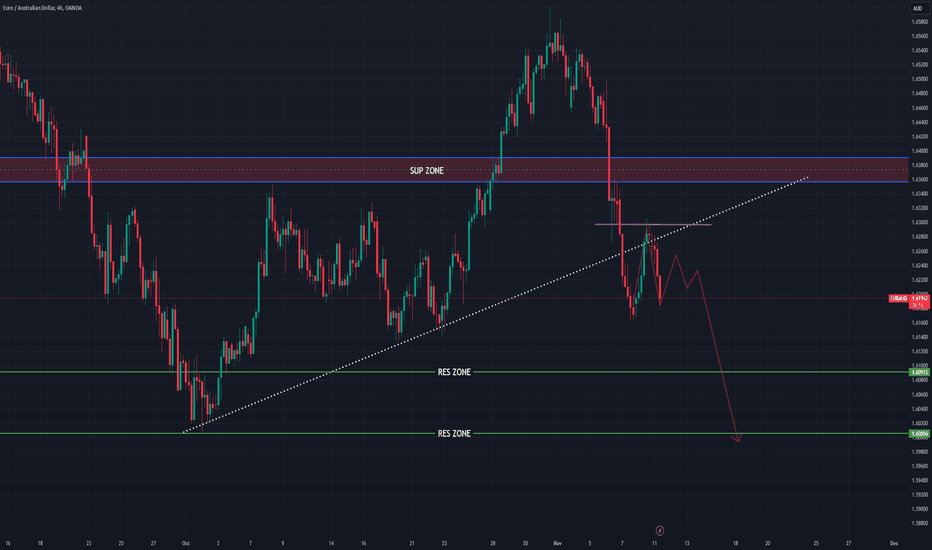

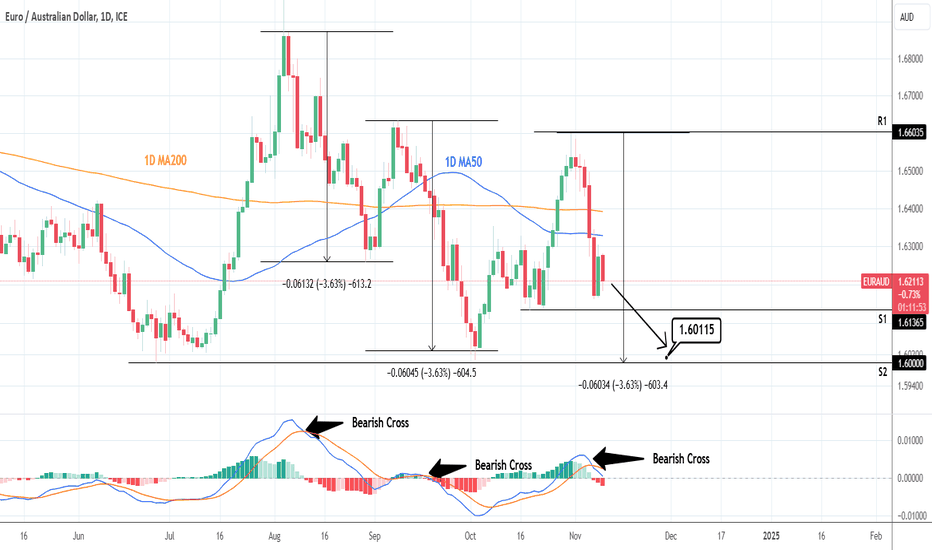

EURAUD: Failed to recover the 1D MA50. Sell signal.EURAUD is bearish on its 1D technical outlook (RSI = 42.768, MACD = -0.001, ADX = 33.915) as it reversed just before reclaiming the 1D MA50. The 1D MACD is on a Bearish Cross since last Thursday and since August 5th every such formation completed a -3.63% decline. This time such a decline would reach the S2 level exactly, which is what we're aiming for (TP = 1.60115).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

EURAUD: Bullish Continuation & Long Trade

EURAUD

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy EURAUD

Entry Level - 1.6193

Sl - 1.6111

Tp - 1.6361

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️

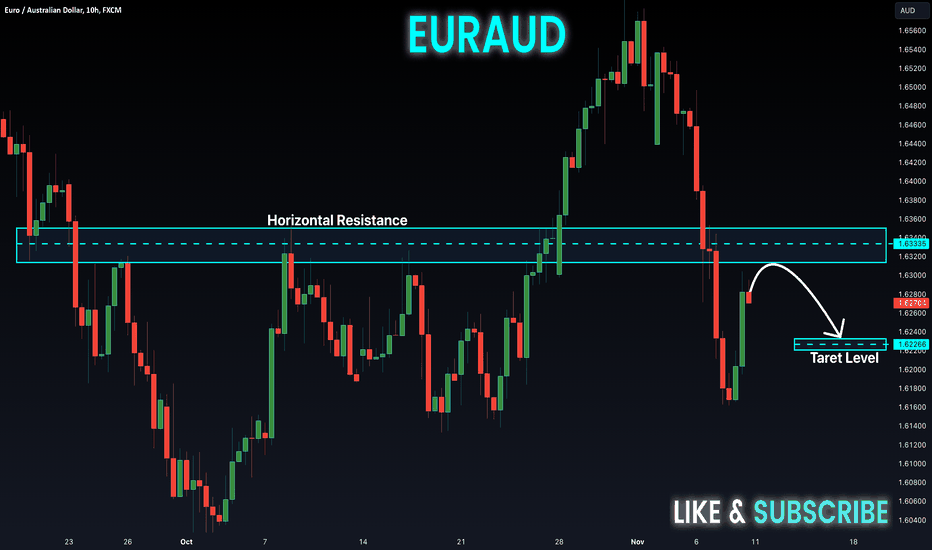

Overlap resistance ahead?EUR/AUD is rising towards the resistance level which is an overlap resistance that aligns with the 38.2% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 1.63368

Why w like it:

There is an overlap resistance level that aligns with the 38.2% Fibonacci retracement.

Stop loss: 1.64463

Why we like it:

There is a pullback resistance level that aligns with the 61.8% Fibonacci retracement.

Take profit: 1.61518

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.