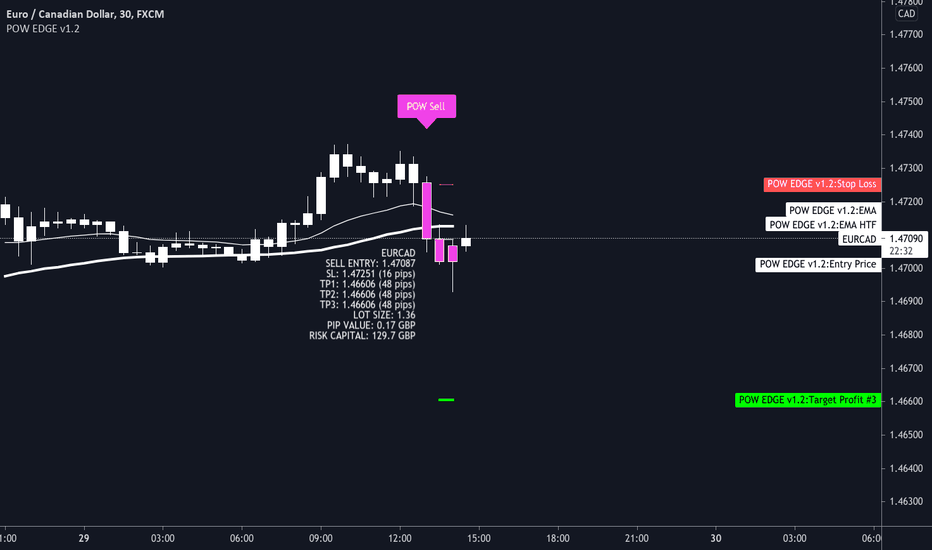

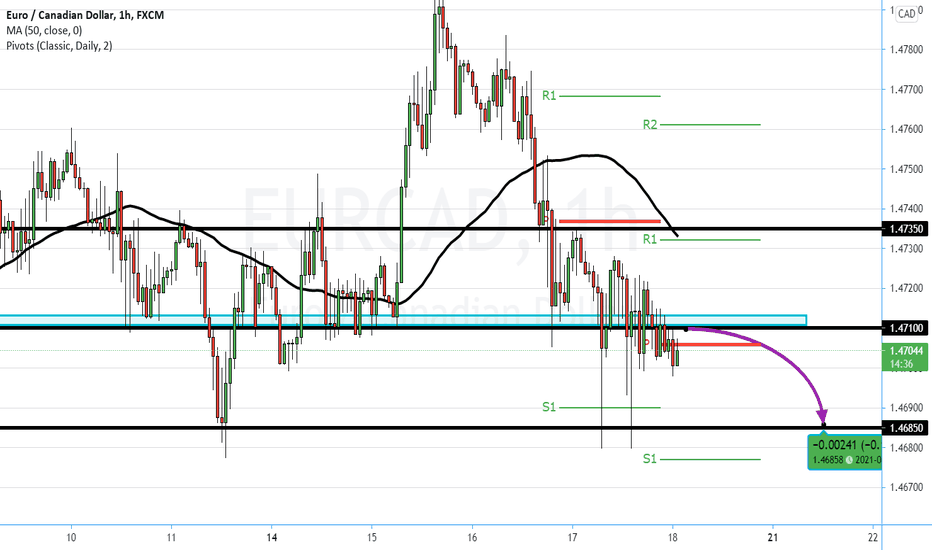

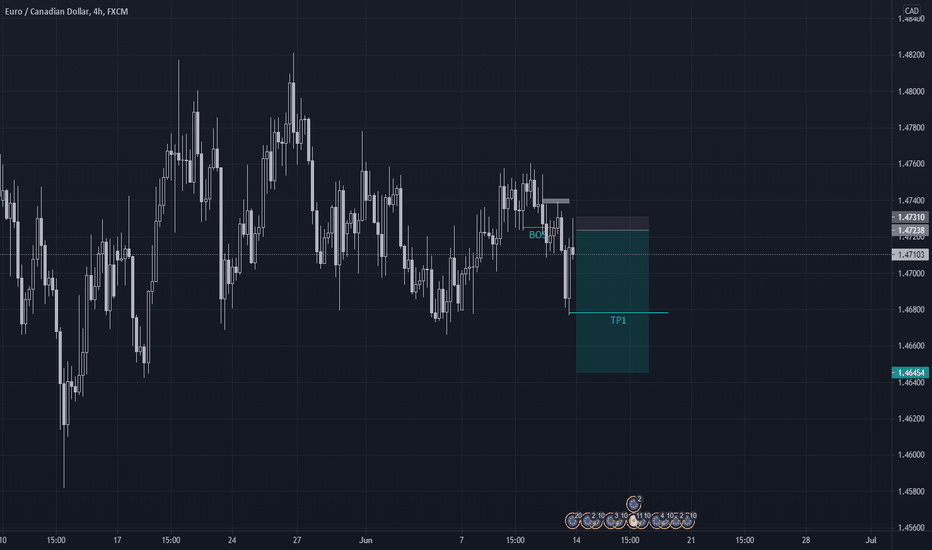

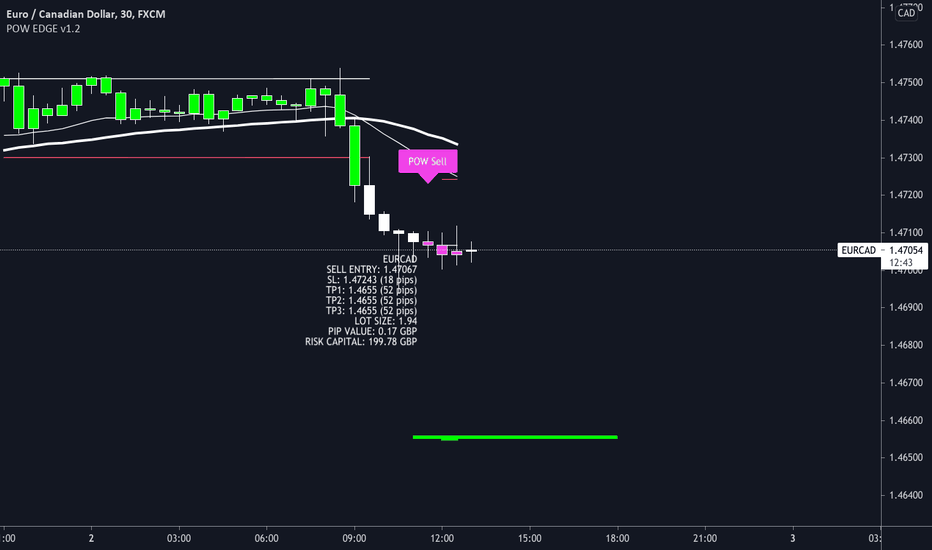

Nice short opportunity on EURCAD 📉💪Entry details are shown on the chart.

We're only looking for TP3.

Trade history can be seen below this trade idea too for full transparency.

------------------------------------------

I try and share as many ideas as I can as and when I have time. My trades are automated so I am not sat in front of a screen daily.

Jumping on random trade ideas 'willy-nilly' on Trading View trying to find that one trade that you can retire from is not a sustainable way to trade. You might get lucky, but it will always end one way.

------------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out, do they?

Also, see my 'related ideas' below to see more just like this.

The stats for this pair are shown below too.

Thank you.

Darren.

Eurcadshort

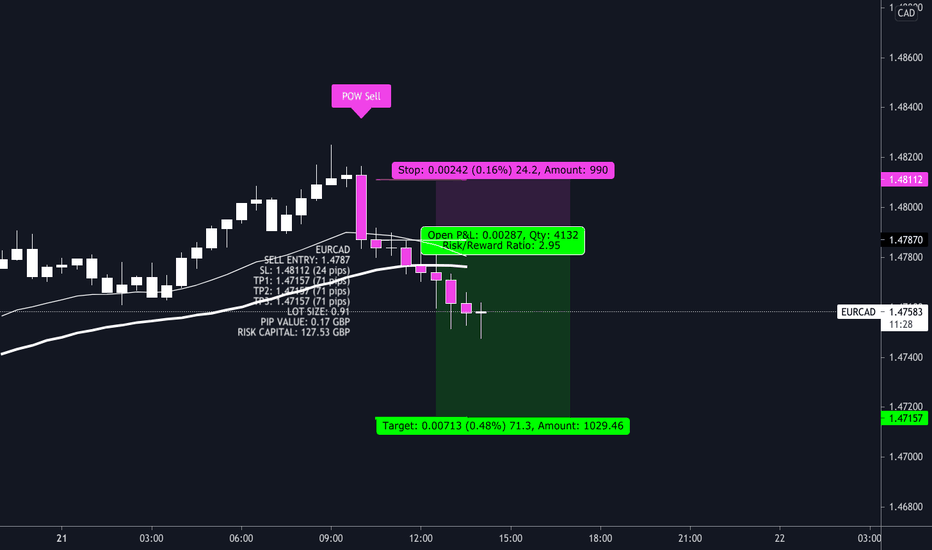

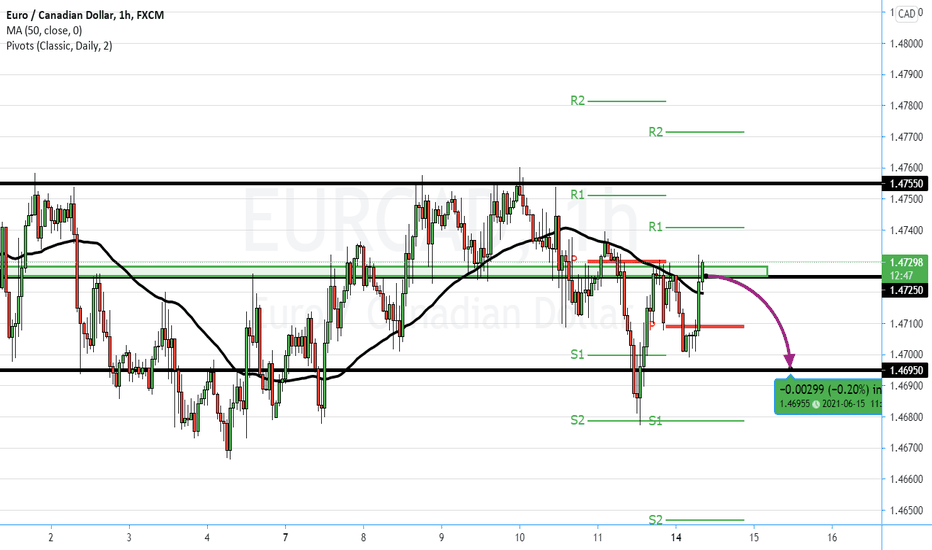

EURCAD short in progressing 👇📉Dinner time trade catch up and this trade is progressing nicely.

Entry details are shown on the chart.

We're only looking for TP3.

Trade history can be seen below this trade idea too for full transparency.

------------------------------------------

I try and share as many ideas as I can as and when I have time. My trades are automated so I am not sat in front of a screen daily.

Jumping on random trade ideas 'willy-nilly' on Trading View trying to find that one trade that you can retire from is not a sustainable way to trade. You might get lucky, but it will always end one way.

------------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out, do they?

Also, see my 'related ideas' below to see more just like this.

The stats for this pair are shown below too.

Thank you.

Darren

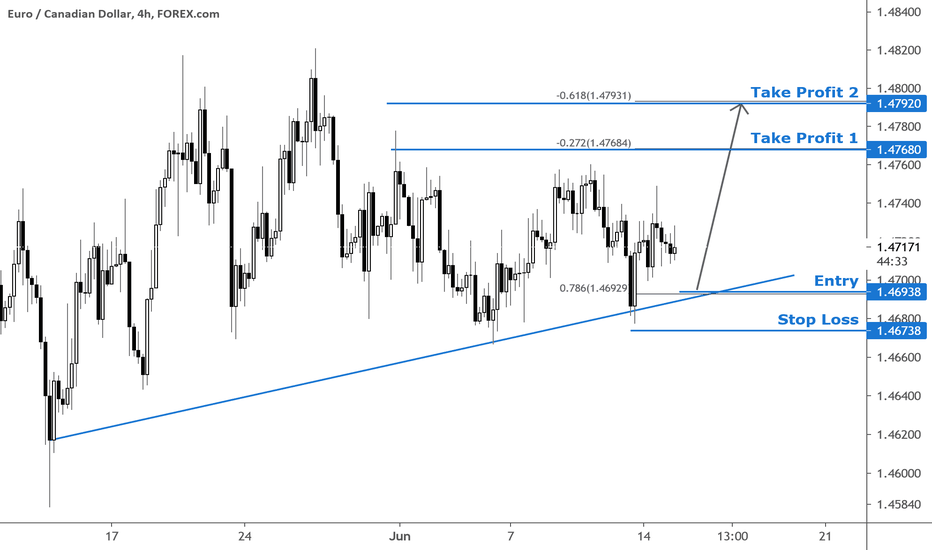

15 June: EURCAD could see a bounce hereHi everyone!

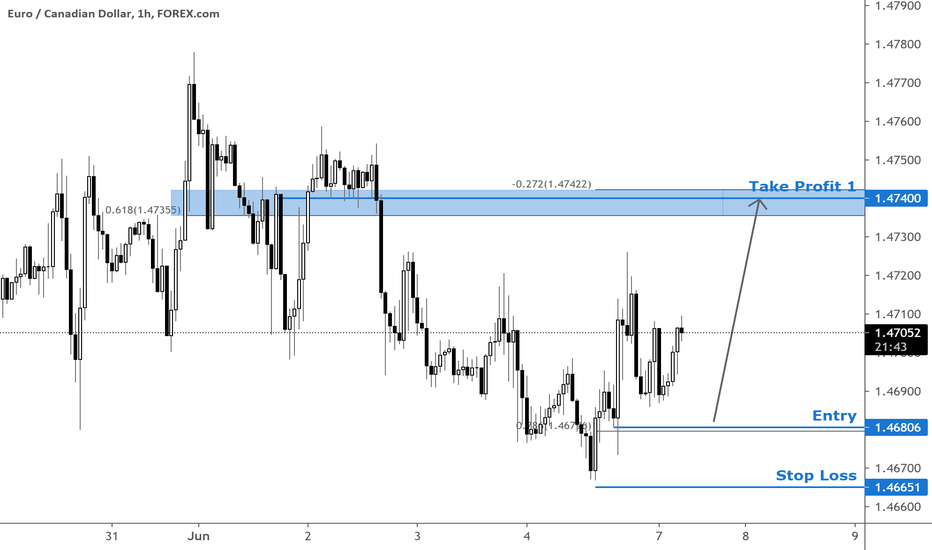

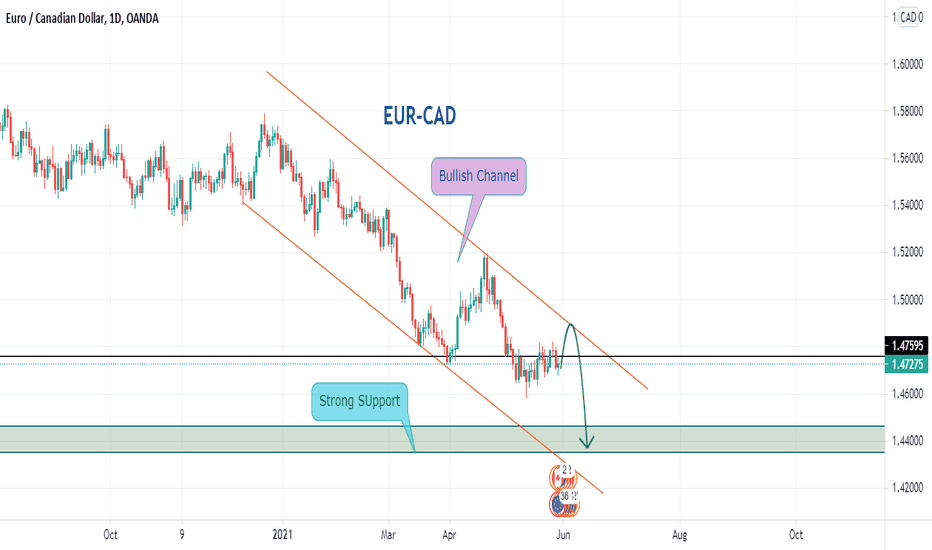

EURCAD is facing bullish pressure from our ascending trend line and could see a further upside here. Our entry is in line with the 78.6% retracement with stop loss placed slightly below the previous low. Take profit targets are at -27.2% retracement and -61.8% retracement respectively. What are your thoughts on EURCAD?

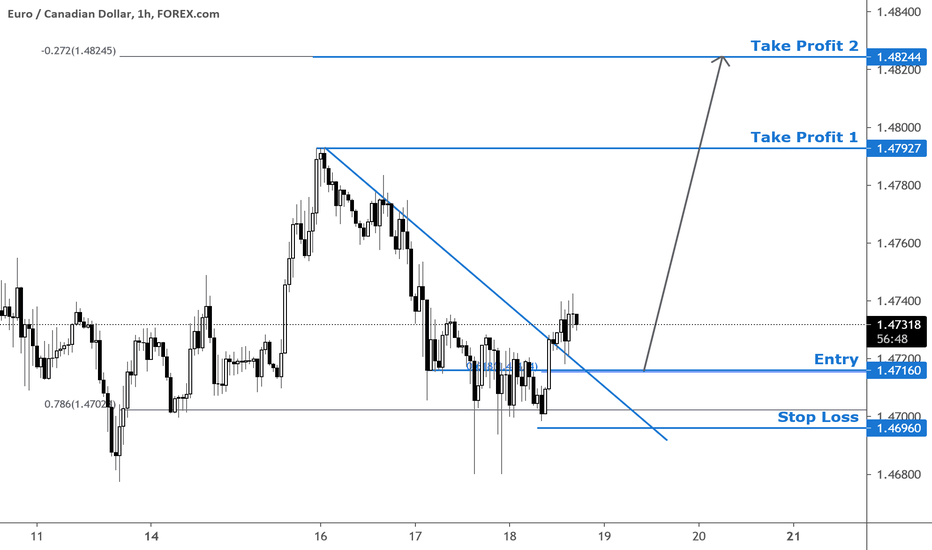

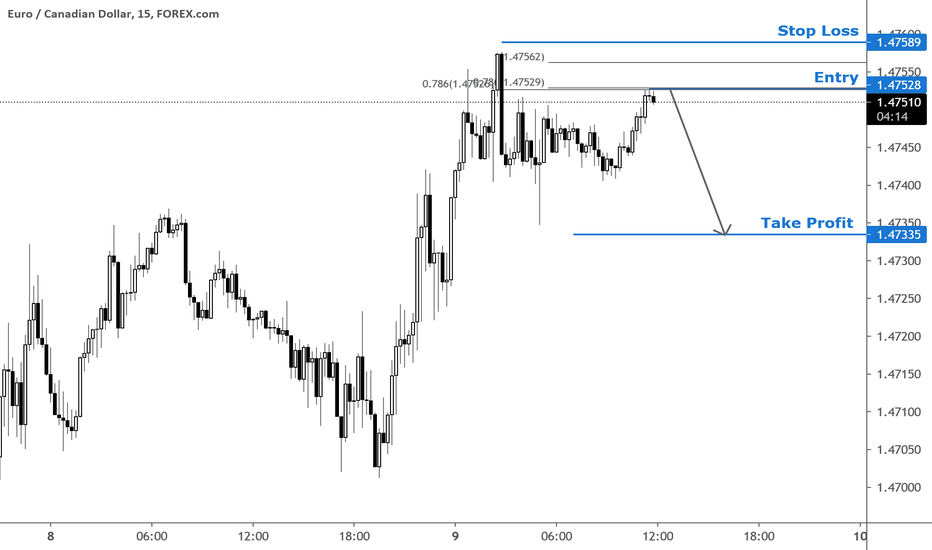

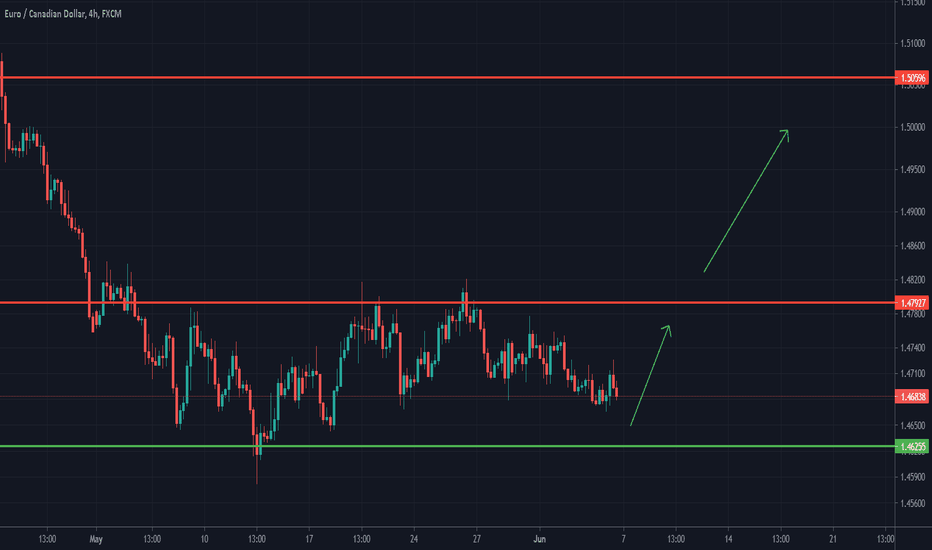

18 June: EURCAD time to buy Hi everyone!

EURCAD broke out of its descending trend line and right now we could see a pullback to test our entry. We placed our entry at the 61.8% fibonacci retracement, stop loss below the recent low. The take profit targets are based off the recent high and -27.2% retracement as the second target. What are your thoughts on EURCAD?

EURCAD - BEARISH BIAS=====

MARKET OUTLOOK

=====

EUR - BEARISH

1️⃣ The ECB agreed on Thursday to maintain an elevated pace of bond purchases while upwardly revised projections for the bloc's economic growth and inflation for 2021 and 2022.

2️⃣ ECB governing council member Gabriel Makhlouf said on Wednesday that it's too early to discuss the end of the European Central Bank's Pandemic Emergency Purchase Programme (PEPP).

CAD - BULLISH

1️⃣ Canada’s annual inflation rate quickened to 3.6% in May of 2021 from 3.4% in April and was above market expectations of a 3.5% rise. It was the highest jump in consumer prices since May of 2011.

2️⃣ The oil sector remains positive as demand for oil will increase in the summer.

=====

TECHNICAL

=====

- We're looking to short #EURCAD on SBR + pivot point level on H1 chart with stop loss above yesterday high.

=====

RISK TO THIS TRADE

=====

- This trade will hit stop loss if oil prices decline.

EURCAD - BEARISH BIAS=====

MARKET OUTLOOK

=====

EUR - BEARISH

1️⃣ European Central Bank President Christine Lagarde said that monetary and fiscal stimulus needed to be maintained until there were signs of a strong and sustainable economic recovery.

2️⃣ The European zone's trade balance this week is expected to weaken due to weakness in the trade balance in Germany.

3️⃣ Industrial production data today is forecast to be low following the decline in industrial production in Germany.

CAD - BULLISH

1️⃣ The Canadian central bank was the first among advanced economies to slow the pace weekly of government bond purchases, now traders expect the next taper to come at the next monetary policy meeting on July 14th.

2️⃣ Crude oil prices rose above $70.9 per barrel on Monday amid signs of strong fuel demand in western economies.

=====

TECHNICAL

=====

We're shorting this pair on SBR level + SMA50 area + below Friday's high + Yesterday Pivot area on H1 chart.

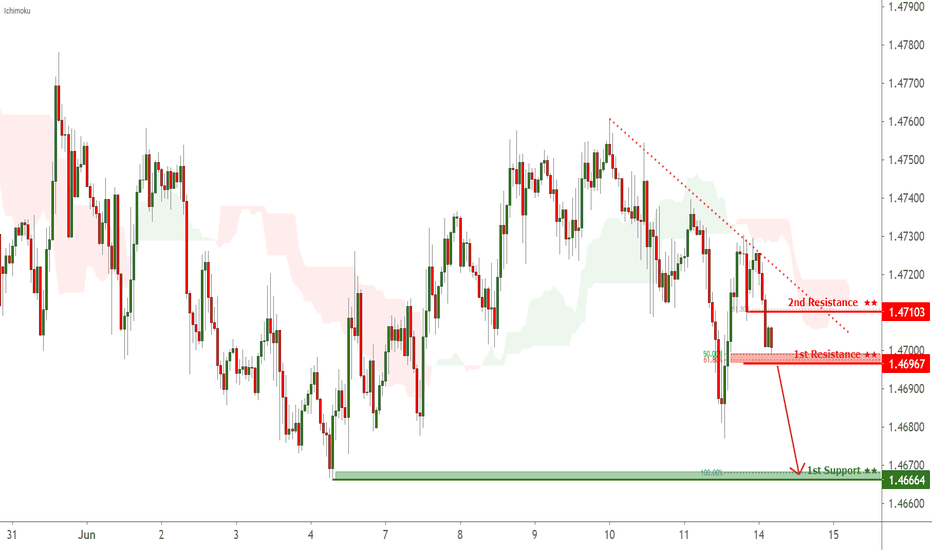

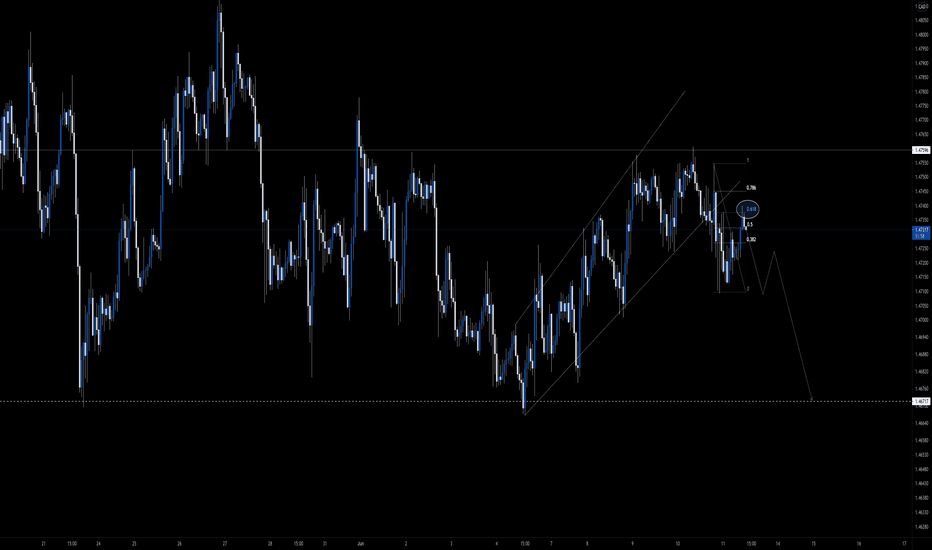

EURCAD potential for further downside Prices are pushing down to make a lower low. If prices break through entry in line with 61.8% Fibonacci retracement and 50% Fibonacci extension fibonacci confluence area, prices might push down further towards horizontal swing low support in line with 100% Fibonacci extension. If prices bounce from fibonacci confluence, prices might push up towards horizontal pullback resistance in line with 61.8% Fibonacci extension. Ichimoku cloud is also above prices, showing a bearish pressure for prices.

EURCAD might be looking for bearish movement

After the breakout of the ascending channel, the price is finding resistance on Fib golden level 0.618. Confirmation by candles is expected for a bearishness prospect before placing any trade.

*** If you like the idea, please don't be shy and click on the like button; also, comments are very welcome. | Thanks for your support!!! ***

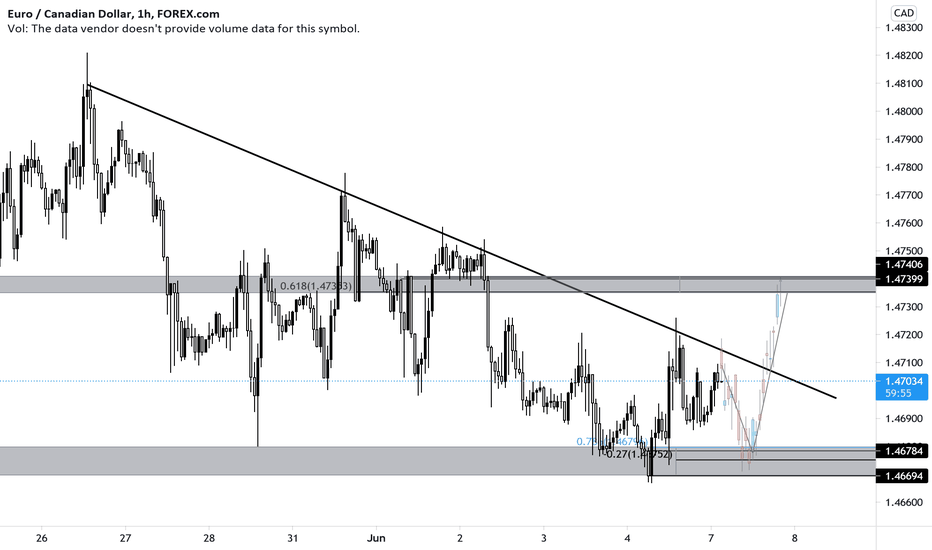

7 June: EURCAD looks good for longHello everyone!

Seeing a trend reversal on EURCAD here, on the H1, prices could see a pullback to test the entry which is in line with the 78.6% Fibonacci confluence levels where we could see a bounce here. On the daily and H4 time frame, in terms of market structure, the resistance zones have been broken. I think we could be seeing a lot more upside on EURCAD for this week. In terms of fundamentals, markets will be watching ECB and BOC interest rates decision closely although we are not expecting any changes to the rates this time. BOC might sound less dovish as compared to its peers.

Trade ideas posted here daily, follow for the latest updates. If you have any views on the currencies please type in the comments below, I'd love to hear them!

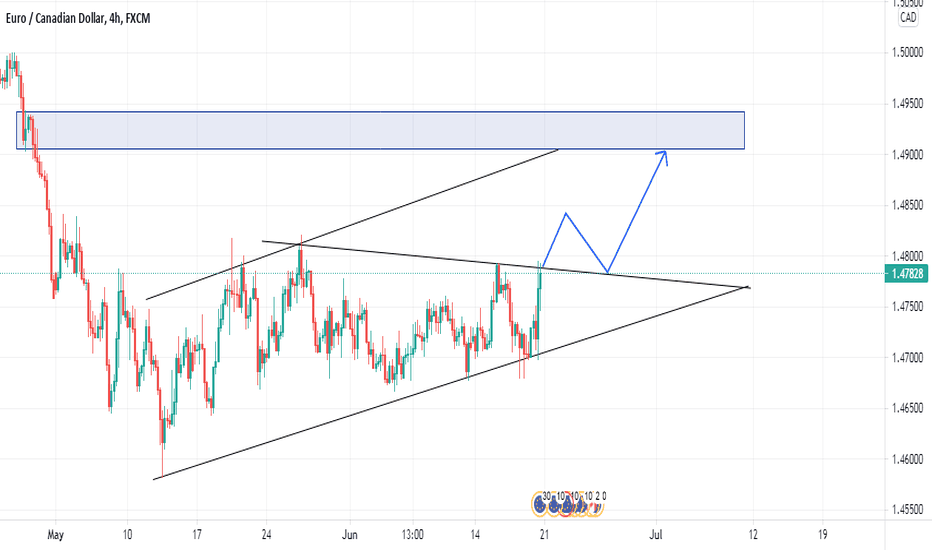

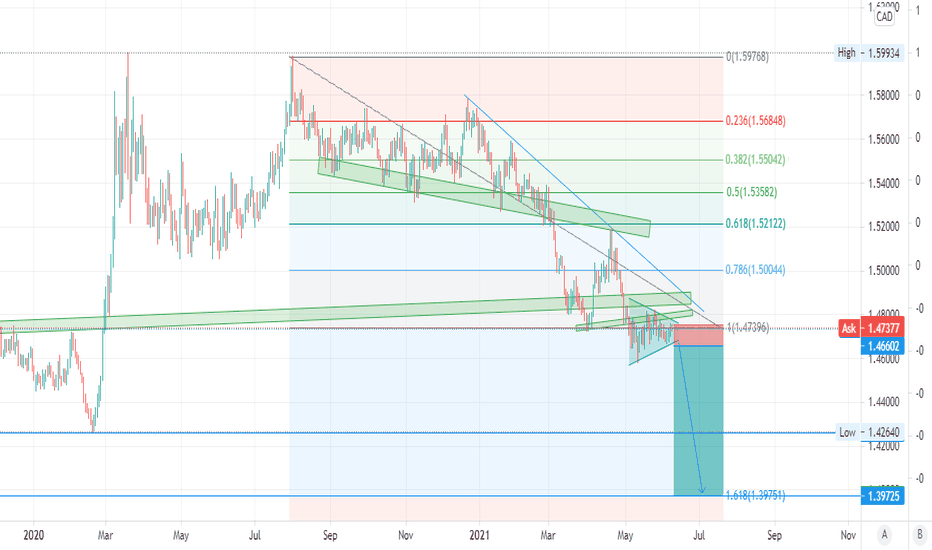

EURCAD Bearish Rollercoaster A higher time-framed bearish pennant has formed ,with CAD Interest rate statement underway ,we can expect the continuation to be executed by the bear and taking charge for a considerably long period towards the 1.40000 levels. Not only the fibonacci levels have proclaimed the movement but also strong support has been immuted into a resistance which is holding strong despite the weak employment data for May '21.

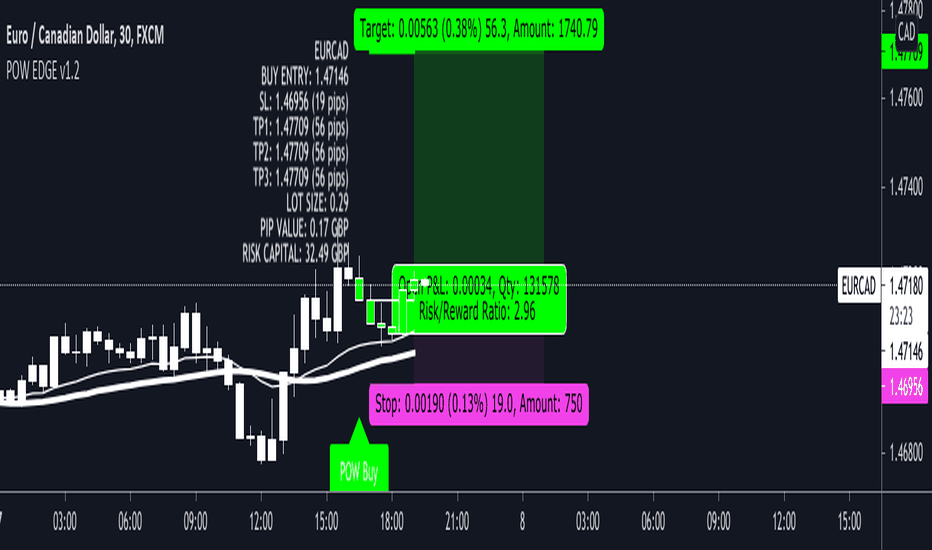

I love this EURCAD strategy 😍💪This buy is valid on our EURCAD 30M strategy.

Entry details are shown on the chart.

We're only looking for TP3.

Trade history can be seen below this trade idea too for full transparency.

As you will see this 1:3 RR strategy is a real strong one.

Do many of you guys back test your strategies?

Having a strategy tester built in to the script and knowing all the facts before placing a trade helps with keeping trading emotions in check.

------------------------------------------

I try and share as many ideas as I can as and when I have time. My trades are automated so I am not sat in front of a screen daily.

Jumping on random trade ideas 'willy-nilly' on Trading View trying to find that one trade that you can retire from is not a sustainable way to trade. You might get lucky, but it will always end one way.

------------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out, do they?

Also, see my 'related ideas' below to see more just like this.

The stats for this pair are shown below too.

Thank you.

Darren

Outlook for EURCAD: Limited downside before bounceHey everyone, I am bullish on EURCAD on the larger time frames as prices have broke the previous resistance zones. On the H1, EURCAD is facing pressure from resistance and could see limited downside to test our support area here, in line with the fibonacci confluence levels before the bounce.

This week market will also be watching closely for BOC and ECB interest rates decision though we are not likely to expect any changes in the upcoming monetary policy meeting.

EURCAD short in progress👌👍Entry details are shown on the chart.

We're only looking for TP3.

Trade history can be seen below this trade idea too for full transparency.

The strategy in use works so well on this pair 😍

------------------------------------------

I try and share as many ideas as I can as and when I have time. My trades are automated so I am not sat in front of a screen daily.

Jumping on random trade ideas 'willy-nilly' on Trading View trying to find that one trade that you can retire from is not a sustainable way to trade. You might get lucky, but it will always end one way.

------------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out, do they?

Also, see my 'related ideas' below to see more just like this.

Interested in access to my strategy so you can be in these trades the moment they're valid? Drop me a DM .

The stats for this pair are shown below too.

Thank you.

Darren

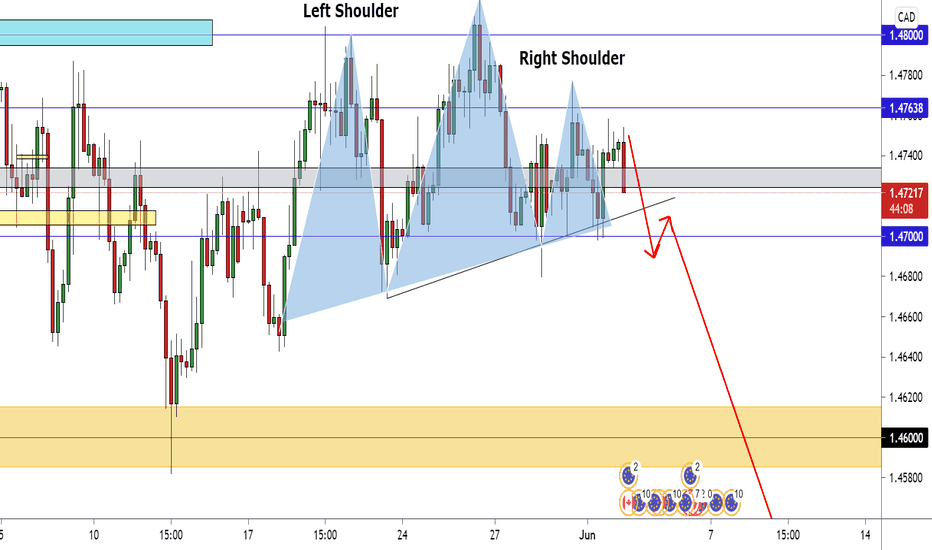

EUR/CAD Trying To Make Head&Shoulders Pattern,Short Setup HereThis is an educational + analytic content that will teach why and how to enter a trade

Make sure you watch the price action closely in each analysis as this is a very important part of our method

Disclaimer : this analysis can change at anytime without notice and it is only for the purpose of assisting traders to make independent investments decisions

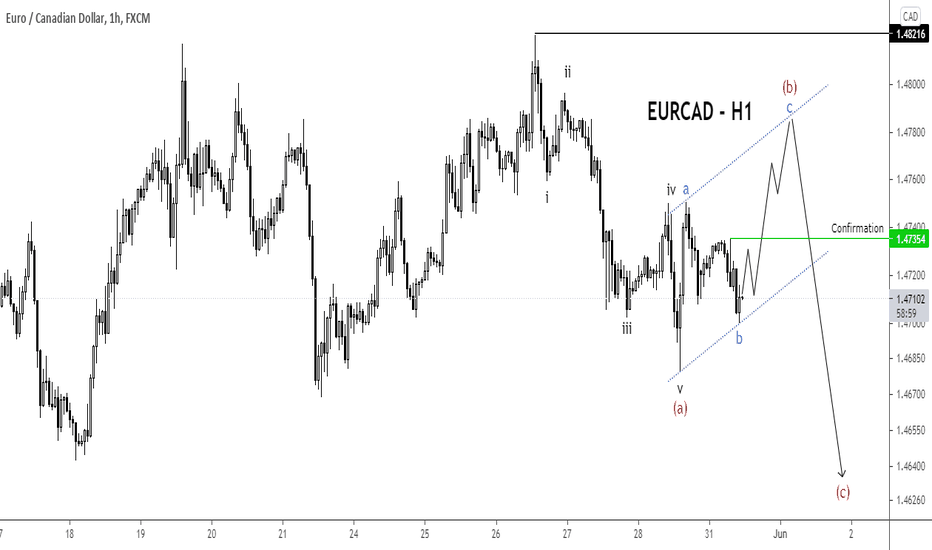

EURCAD Intraday Bullish and Swing Sell SetupHi Traders,

EURCAD decline from 1.48216 high unfolded as a five-wave impulse sequence. According to the Elliott Wave principle, a three-wave correction in the opposite direction follows every impulse move and that's what seems to be unfolding currently.

This correction has the potential to retrace 50-78.6% of the impulse, and also retest the corrective parallel channel. However, once the correction is completed the price should resume in the direction of the impulse to complete a 5-3-5 cycle.

What's your view on EURCAD? Let me know in the comment.

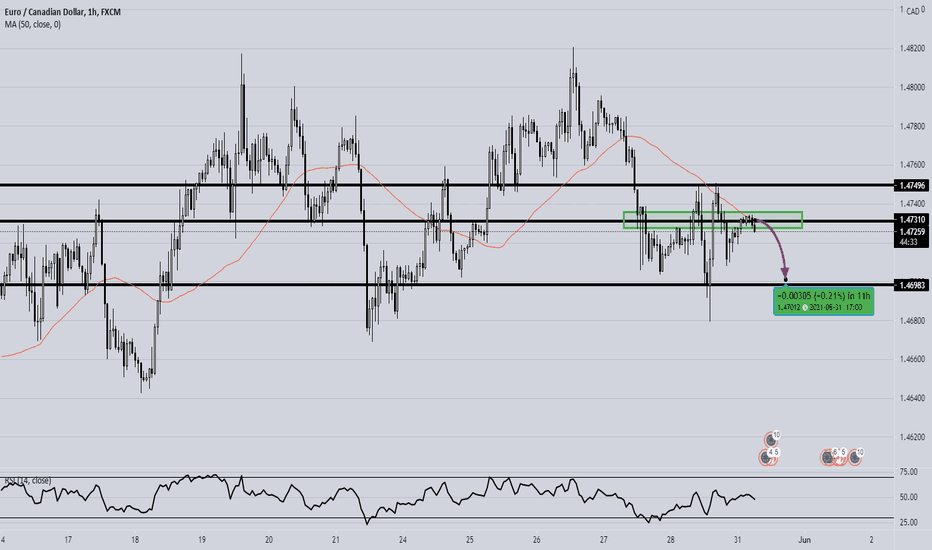

EURCAD - Bearish BiasEUR - Weak Bearish

1️⃣ A comment from European Central Bank policymaker Panetta says that it may be too early to discuss a reduction in emergency bond purchases.

CAD - Strong Bullish

1️⃣ A ramp-up in global vaccination efforts and a strong economic recovery could push the loonie higher.

2️⃣ The Canadian central bank is expected to keep its current guidance on interest rate hikes starting in the second half of 2022.

3️⃣ Rising oil prices underpinned the CAD.

=====

Technical

=====

We are selling the EURCAD at SBR + below SMA 50 on the H1 chart.

=====

Risk to this trade

=====

Any change in sentiment could turn the pair's direction.