EURCHF

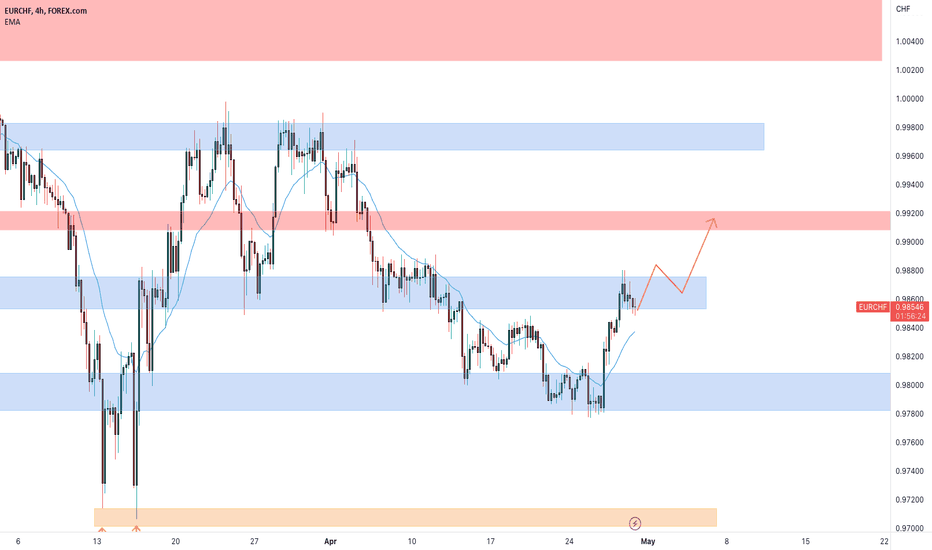

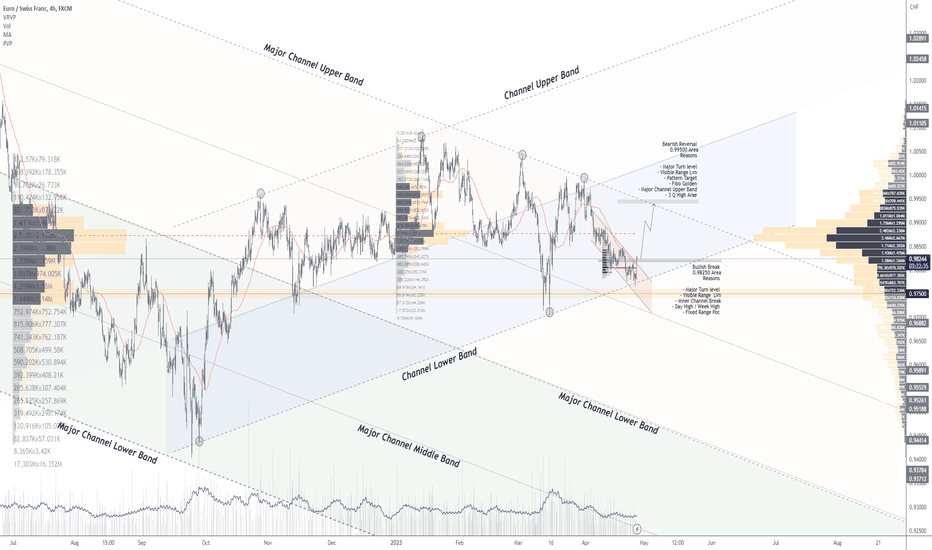

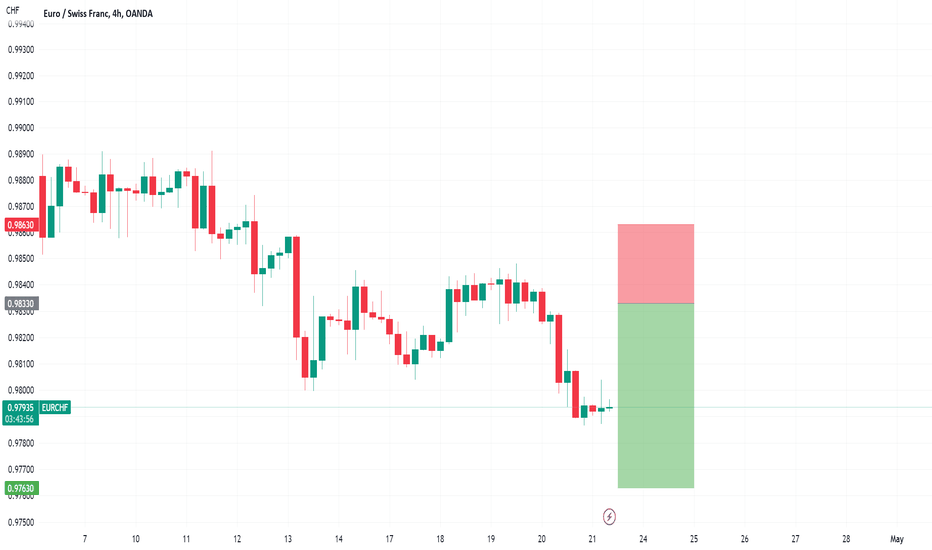

EURCHF - 4hrs ( Up + 40 PIP / Tp 1 > Full Tp 120 PIP ) Pair Name : EUR/CHF

📉Time Frame : 4hrs

Scale Type : Large Scale

Analysis Way : Volume + Classic + High & low + Market Map

Direction : / Long

➕ Educational

—————**-

🔰 Update - VIP Opportunity

————

🔰 Up + 40 PIP.

Target Hit ( 1 )

Account Growth 7.5 %

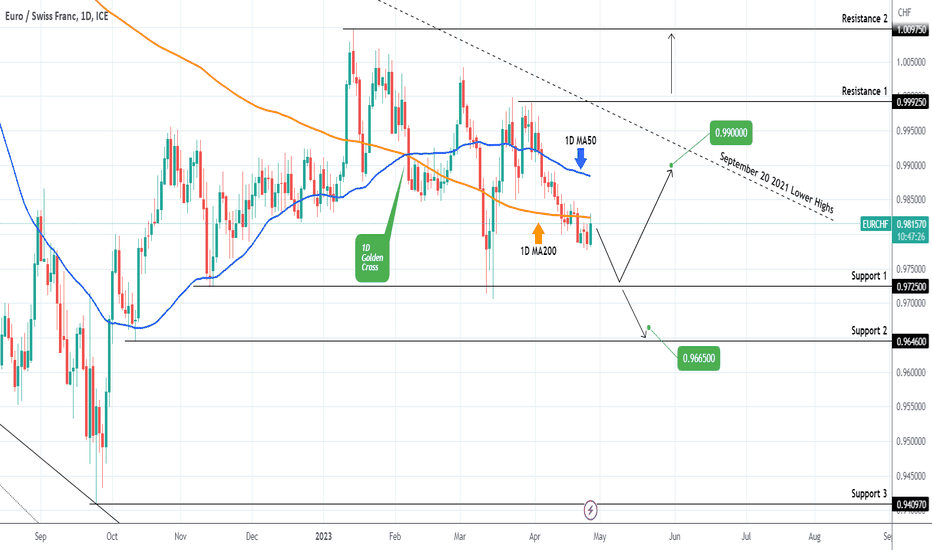

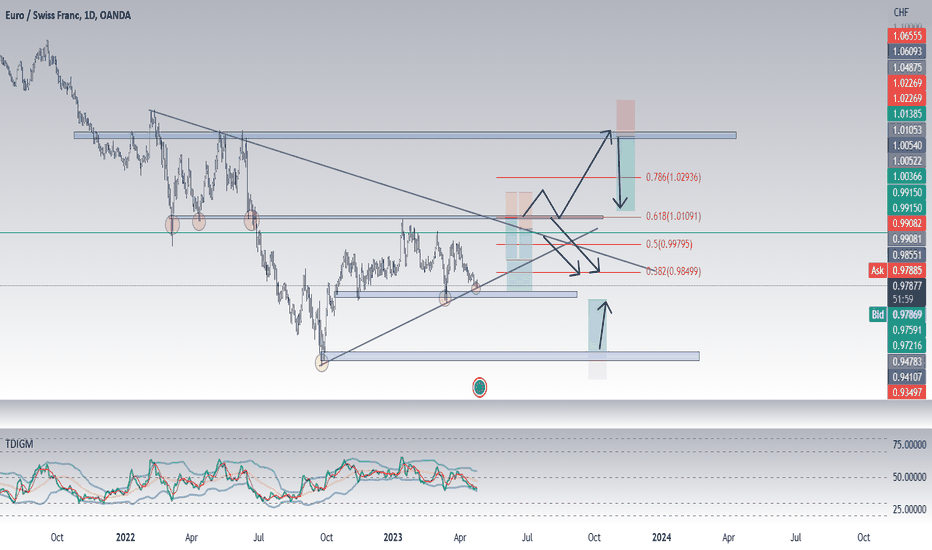

EURCHF Buy opportunity a little lower.The EURCHF pair is now trading below the 1D MA200 (orange trend-line) for the 5th straight day. This is a downtrend that started after the March 23 High. We are looking to buy lower near Support 1 (0.972500) assuming the 1D candle closes above it and target the September 2021 Lower Highs trend-line at 0.99000.

If it closes a 1D candle under Support 1, we will book the loss and take a sell position instead targeting Support 2 at 0.966500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

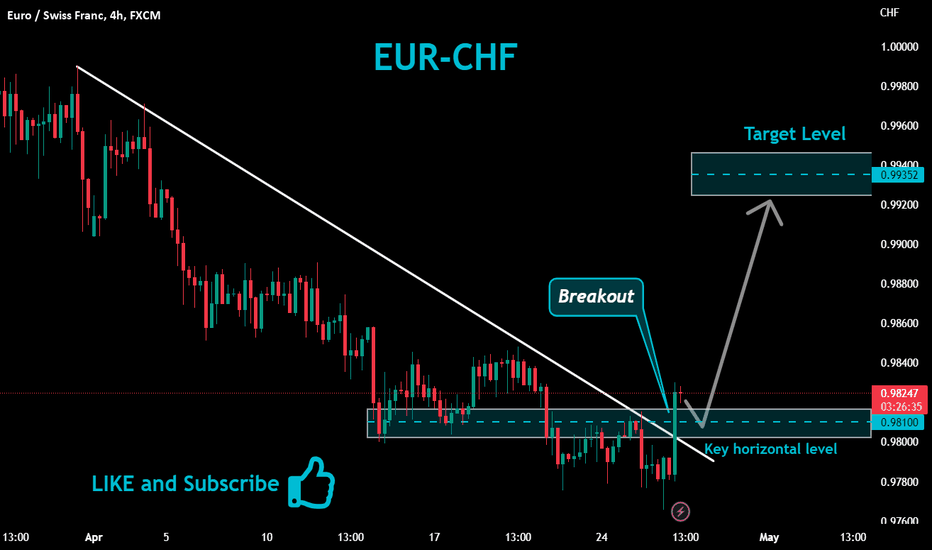

EURCHF - 4hrs ( Buy Trade Target Range 120 PIP ) 💲Pair Name : EUR/CHF

🗨Time Frame : Daily

➕Scale Type : Large Scale

------

🗒 spreading knowledge among us and to clarify the most important points of entry, exit and entry with more than 5 reasons

We seek to spread understanding rather than make money

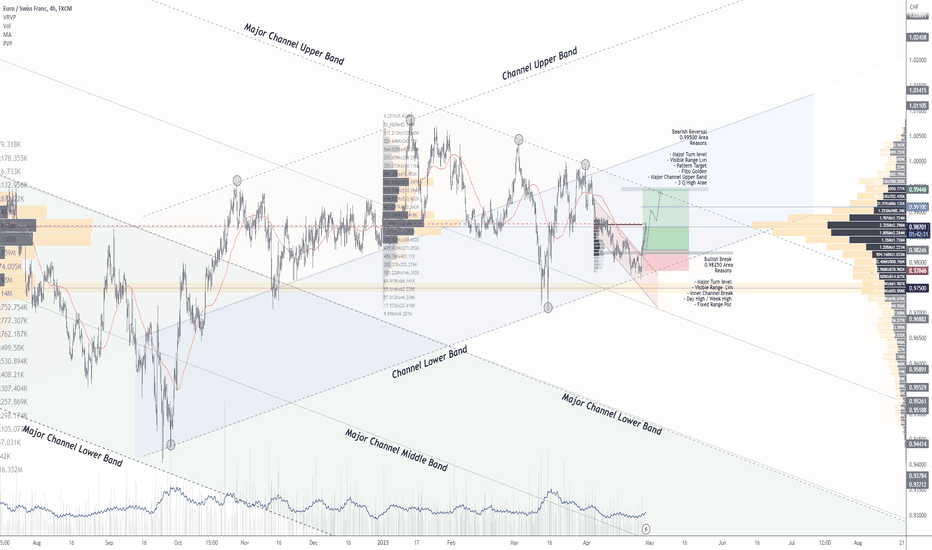

✔️ Key Technical / Direction ( ↗️ Long )

Type : Mid Term Swing

———————————

🔰Bullish Break

0.98250 Area

Reasons

🔘- Major Turn level

🔘- Visible Range LVn

🔘- inner Channel Break

🔘- Day High / Week High

🔘- Fixed Range Poc

🔰Bearish Reversal

0.99500 Area

Reasons

🔘- Major Turn level

🔘- Visible Range Lvn

🔘- Pattern Target

🔘- Fibo Golden

🔘- Major Channel Upper Band

🔘- 3 Q High Arae

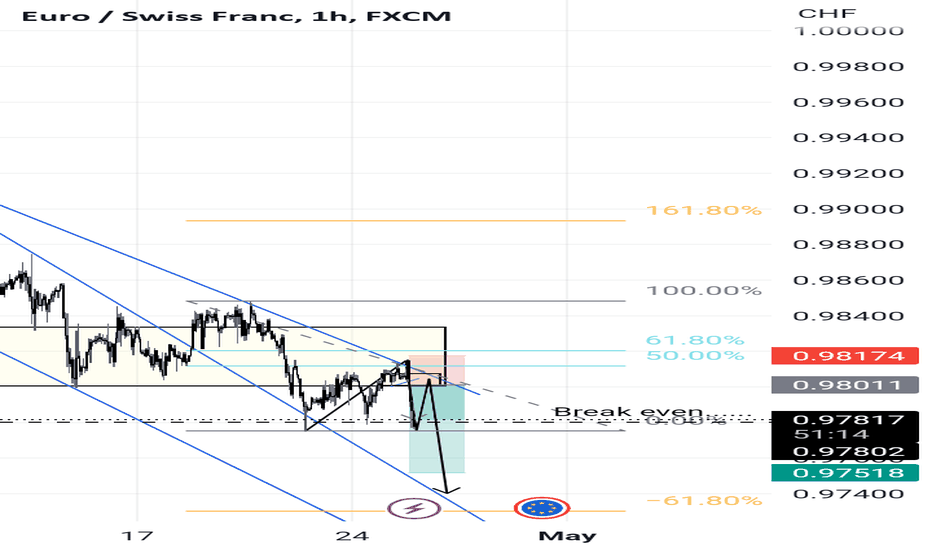

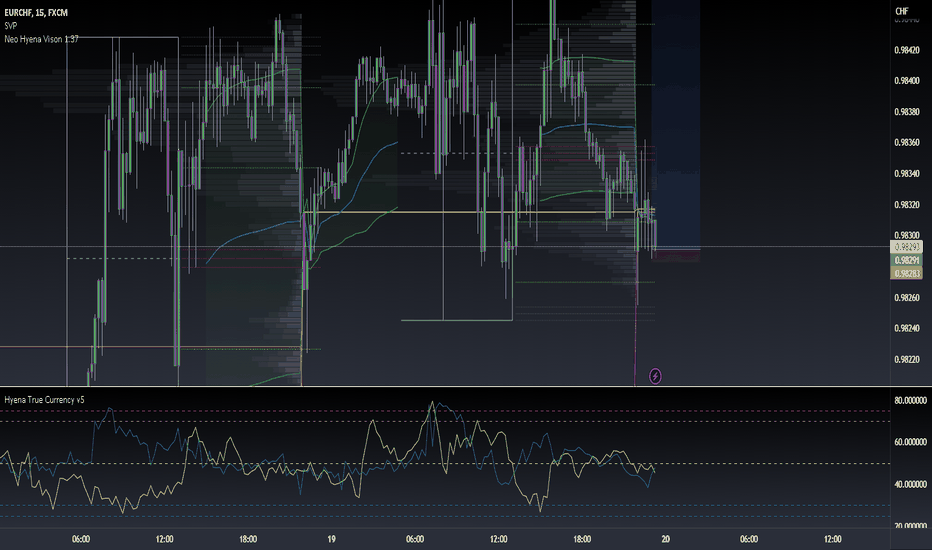

EURCHF for a lower low? 🦐EURCHF on the 4h chart got rejected by the daily resistance near the parity level.

The price started a series of lower low lower high and reached the daily support at the 0.98000 area.

The market with a series of lower low lower high is showing a bearish momentum and according to Plancton's strategy IF the market will break below i will consider a nice short order according to the CPS rules.

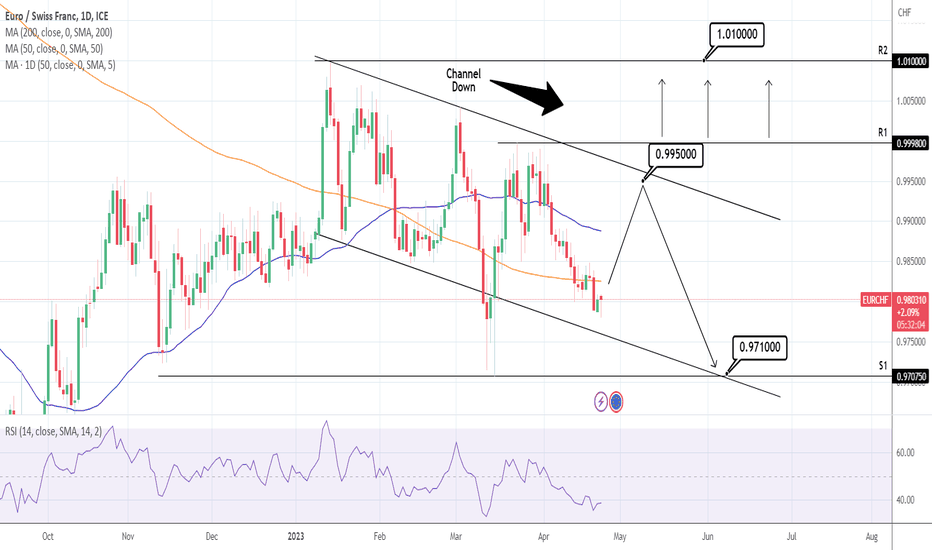

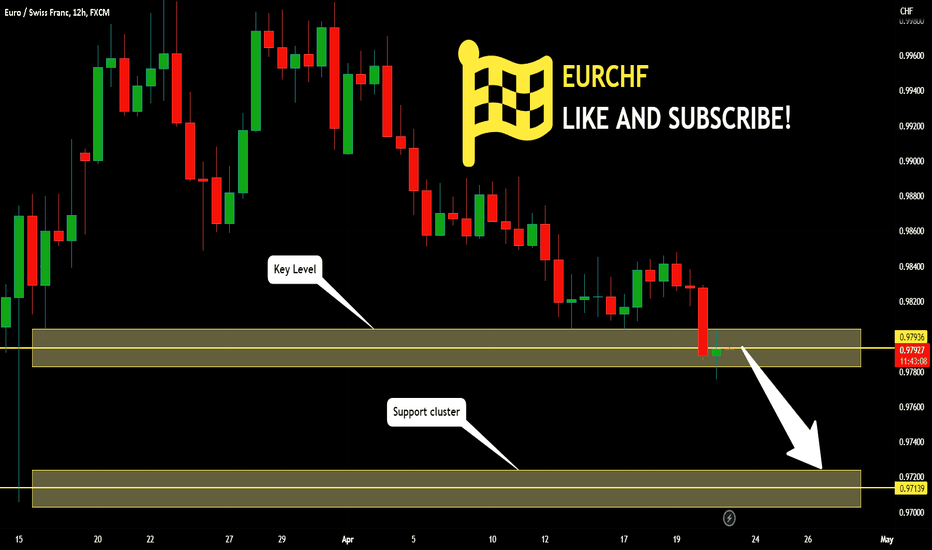

EURCHF: Buy opportunity inside this Channel Down.EURCHF is on red 1D technicals (RSI = 39.692, MACD = -0.003, ADX = 65.962) as it is trading at the bottom of the 2023 Channel Down. This is a buy opportunity targeting its top (TP = 0.99500). We will short there as long as the price closes inside the Channel Down and target S1 (TP = 0.97100). The pattern and the long term bearish trend breaks , if the pair closes above the R1, in which case we will buy and target the R2 (TP = 1.01000).

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

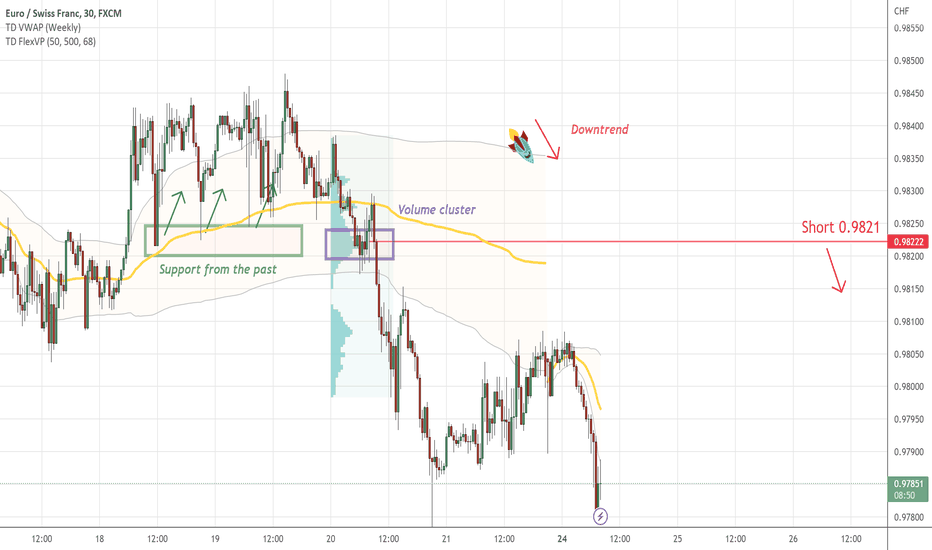

EUR/CHF Resistance 🔪On CAD/JPY is nice to see strong sell-off from the price 0.9821, there are nice to see strong volume area....

Where is lot of contract accumulated...

I thing that sellers from this area will be defend this short position...

and when the price come back to this area, strong sellers will be push down the market again...

Strong S/R zone from the past + Downtrend + Strong volume area is my mainly reason for this short trade....

Happy trading

Dale

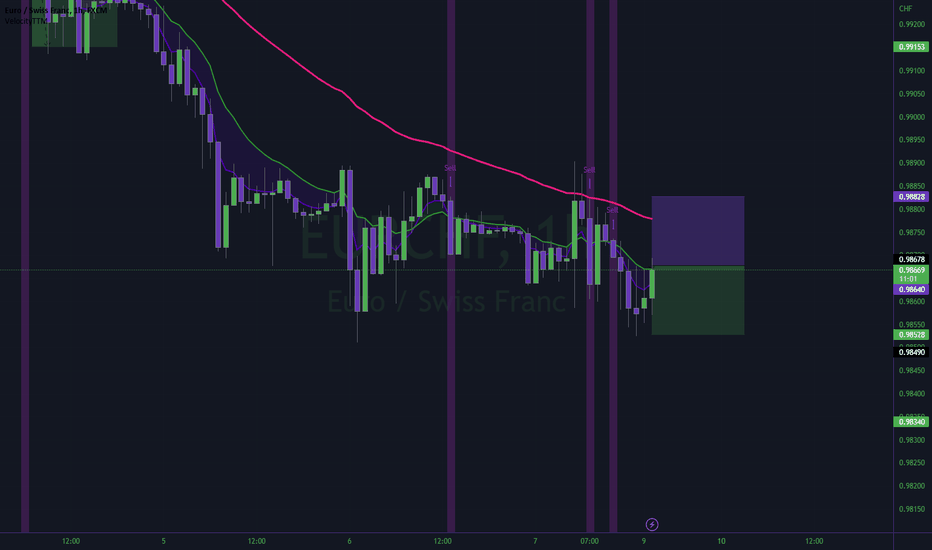

EURCHF Will Go Lower From Resistance! Sell!

Take a look at our analysis for EURCHF.

Time Frame: 12h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 0.979.

The above observations make me that the market will inevitably achieve 0.971 level.

P.S

We determine oversold condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

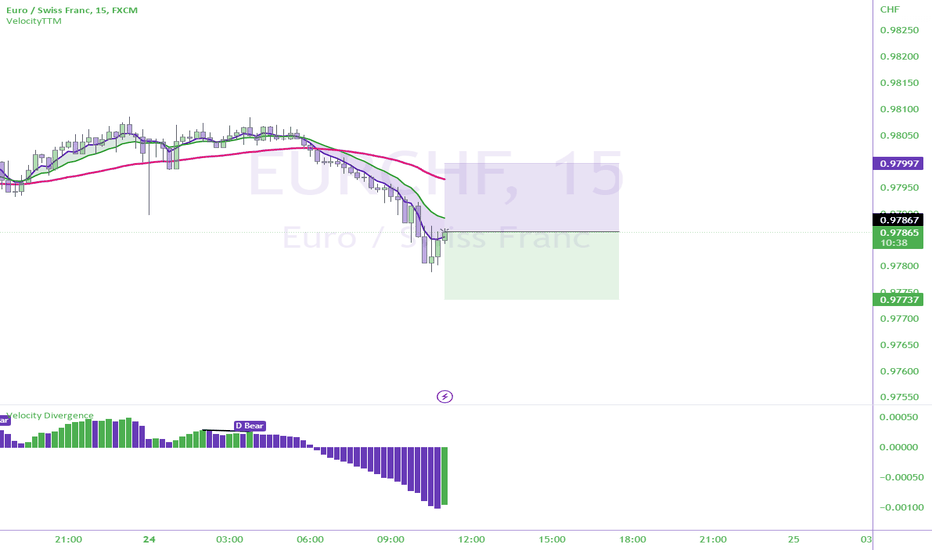

EURCHF bias remains negative.EURCHF - 24h expiry - We look to Sell at 0.9833 (stop at 0.9863)

Our short-term bias remains negative.

Intraday rallies continue to attract sellers and there is no clear indication that this trading sequence is ending.

50 4-hour EMA is at 0.9834.

The preferred trade is to sell into rallies.

We look for a temporary move higher.

Our profit targets will be 0.9763 and 0.9753

Resistance: 0.9795 / 0.9820 / 0.9840

Support: 0.9790 / 0.9775 / 0.9750

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.