Eurchfidea

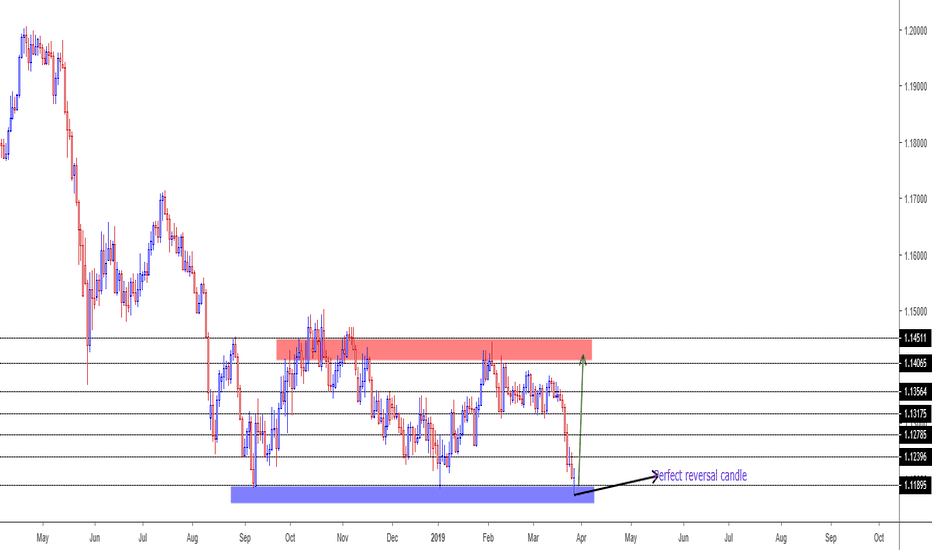

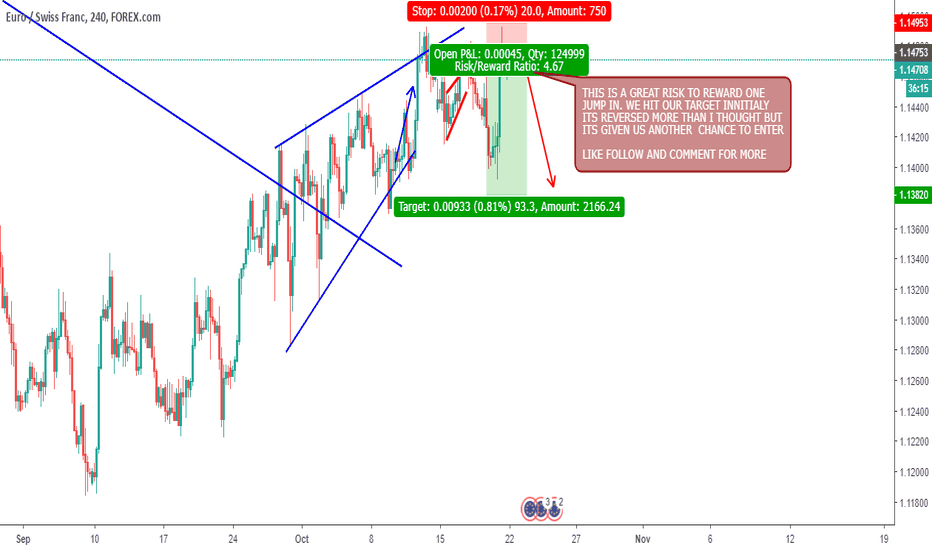

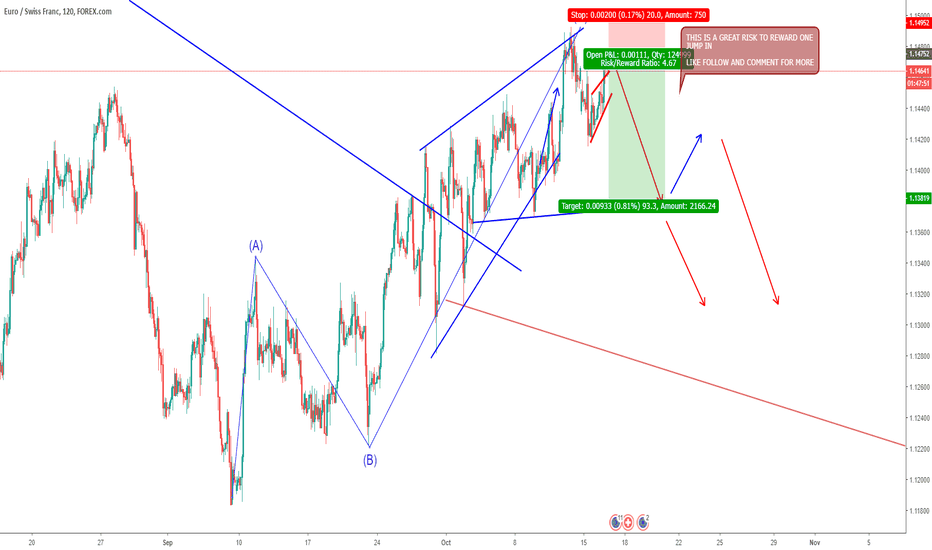

EURCHF en largo

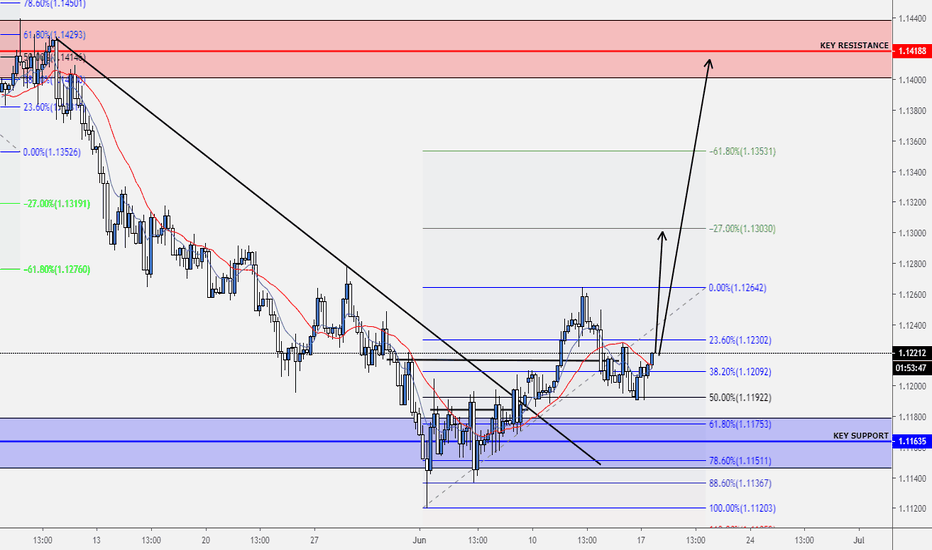

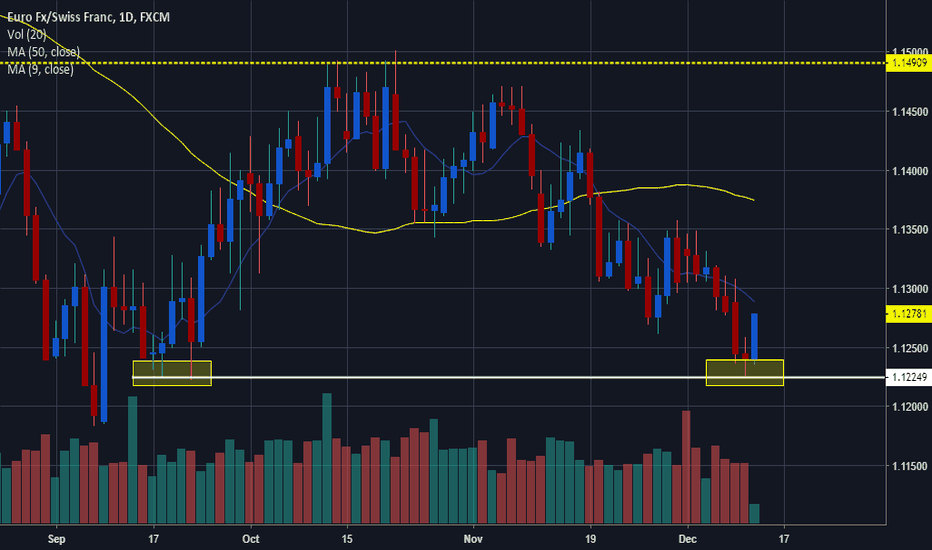

En consolidación con tendencia a la compra para formar el impulso de la onda 5

Triple piso en el nivel 61.8% del retroceso de la onda 3-4

Triple piso en el nivel 38.2% en el retroceso del último impulso en el rango de consolidación formando bandera

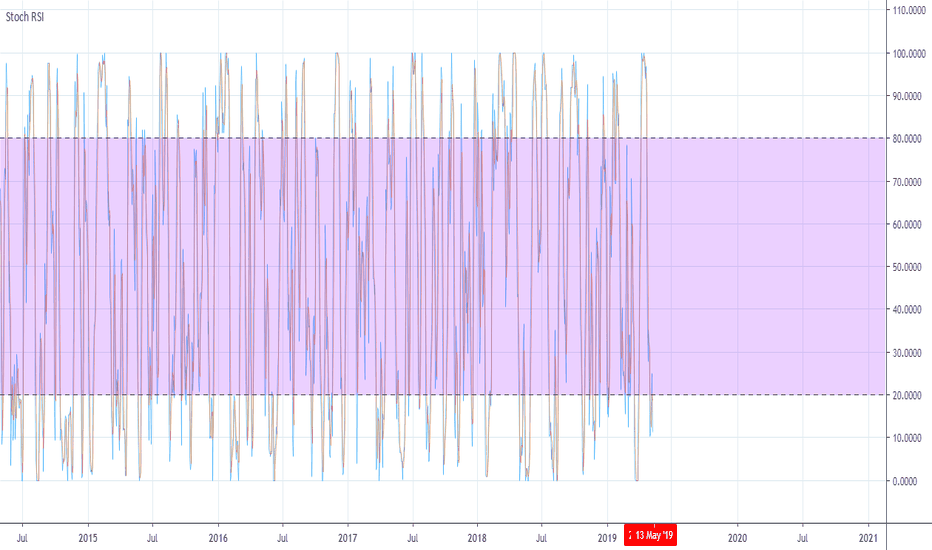

STOCH en nivel de sobre venta

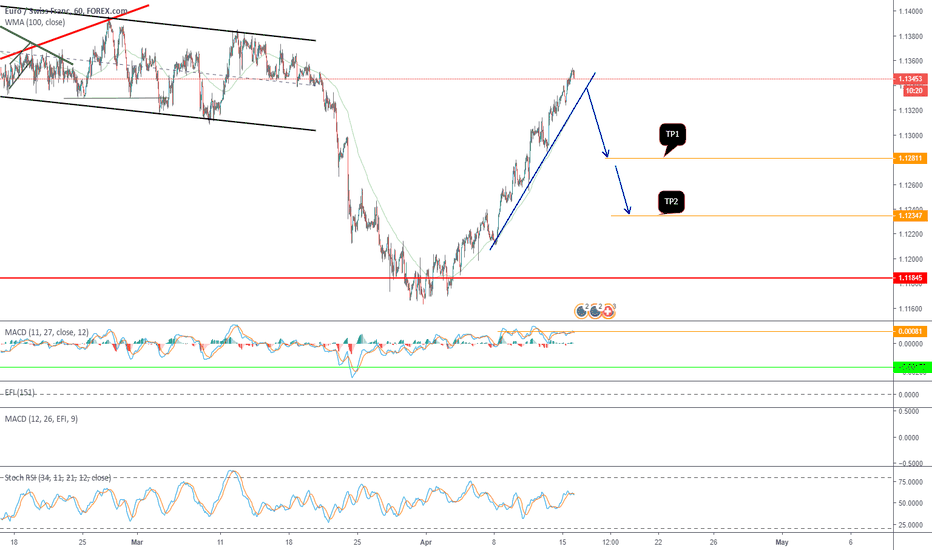

Divergencia con el MACD para entrar en compra

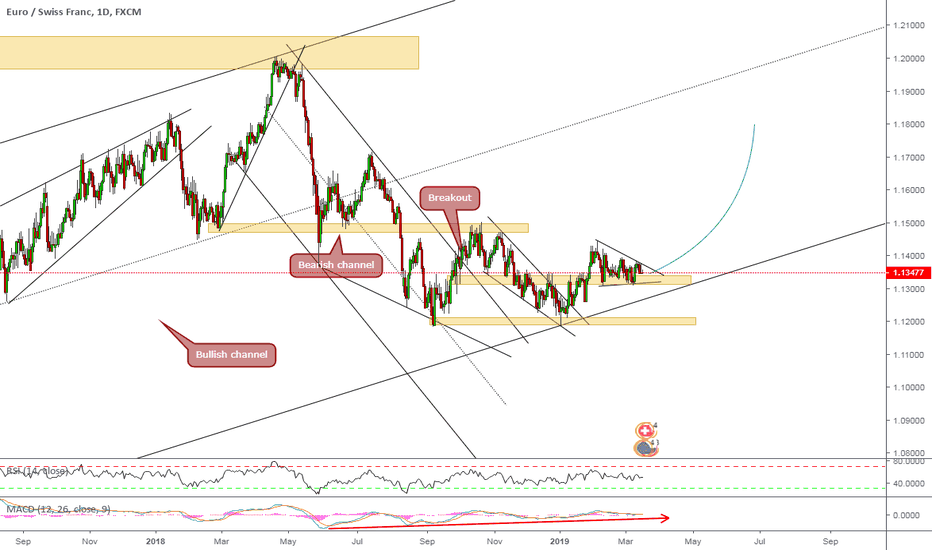

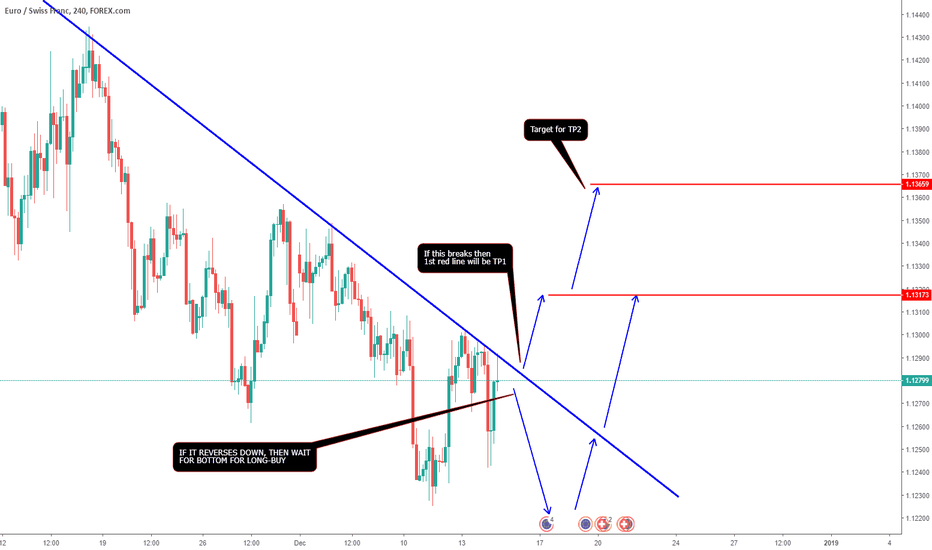

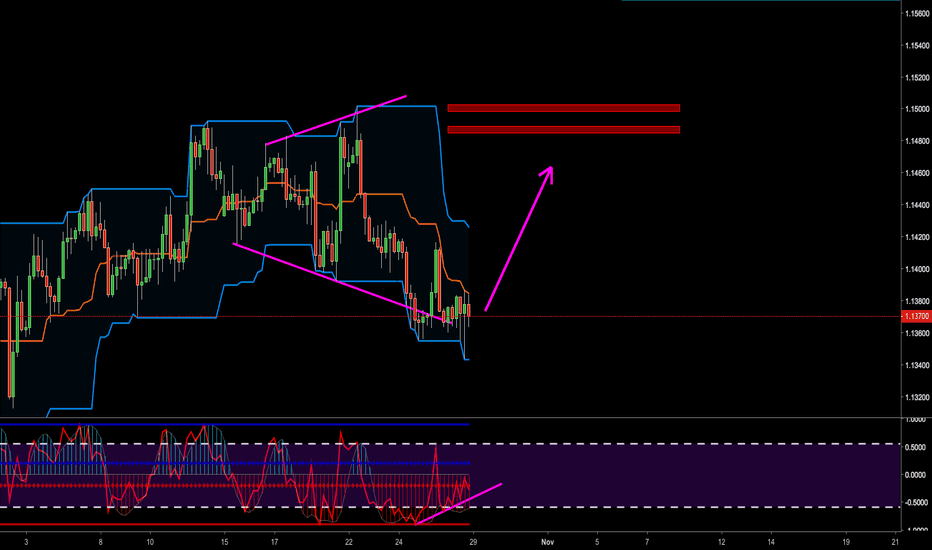

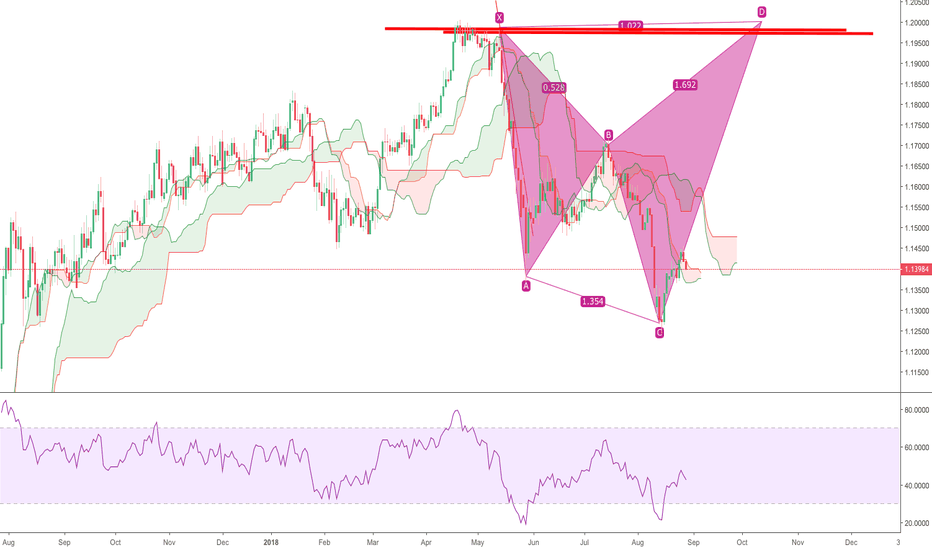

#EURCHF Time for some Bullish action?We can clearly see that FX:EURCHF is in the up-trend for 4 years.

Price bounce down from 1.20000 but, we noticed that price breakout from the bearish channel, which can indicate, it is only a pullback.

After a breakout price squeezed to fake out all early buyers.

Now we are in this triangle and, if we could get a push to up-side from this triangle then we should witness a nice bullish action

-plus, we have a nice bullish divergence.

Okay so summarizing

following analysis, I believe EURCHF have nice bullish potential, so I'm going to buy this pair in this week.

Let's go to work!

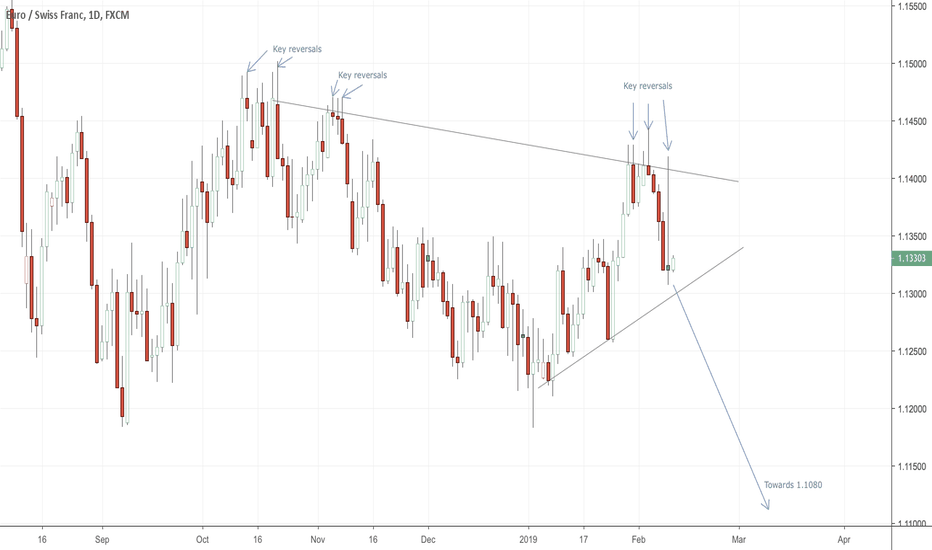

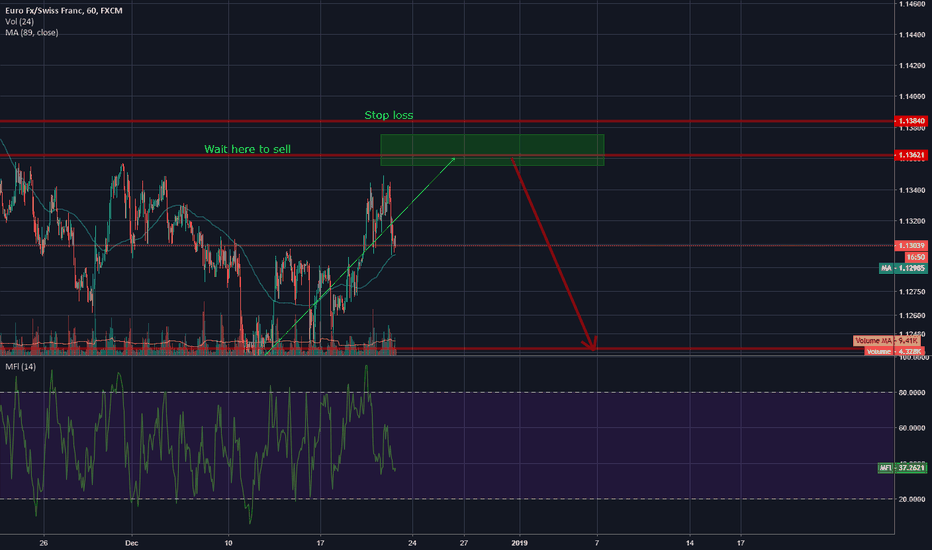

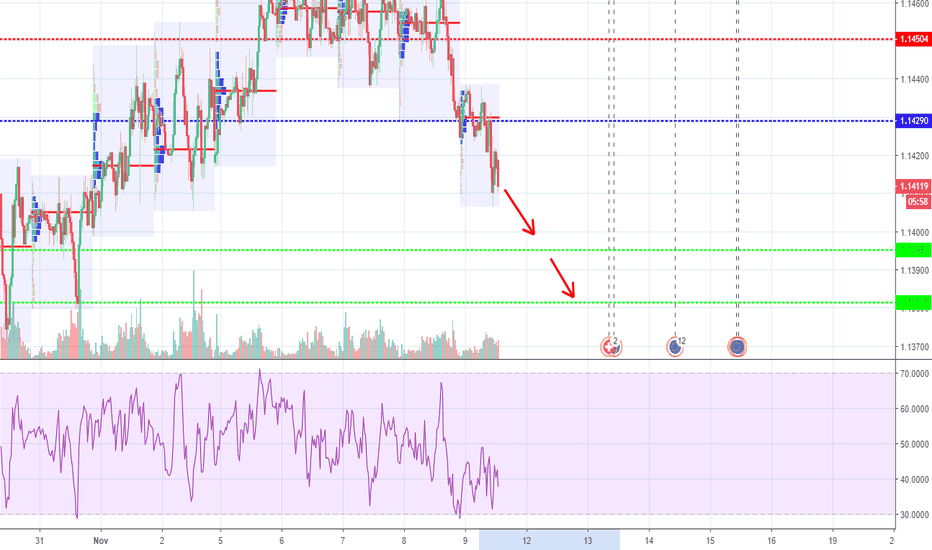

Short EURCHF.EURCHF to go lower.

The pair is confined within a range since Nov-18.

The range is more or less about 270 pips in between.

Within this range created a descending resistance line and each time it tested the line if failed with a bearish key reversal.

Expecting the pair to go lower and eventually break the support line towards 1.1080.

fb.com

Swiss franc: referendum results and reaction of the francOn Sunday, a referendum was held in Switzerland. There were two issues on the agenda: the initiative on "living money" and the law on gambling on the Internet.

The greatest fear among investors was caused by the potential radical reform of the banking sector of the country (Vollgeld). In case of a positive vote for this initiative, the country was in danger of serious shocks. But unlike the British, the Swiss had the prudence not to cut the branch on which they sit. The result of voting on this initiative is a sure failure. Accordingly, the status quo is preserved in the Swiss banking system.

As for the second issue - protecting consumers from the "harmful consequences" of online casinos from abroad, this initiative was supported. Recall, many Swiss believe that this is only the first step towards the introduction of "Internet censorship" for "unwanted sites."

In total, nothing radical has happened. So, the flash crash of the franc has been avoided. The reaction in the foreign exchange market was by and large absent, which once again we note, is conditioned by the nature of the results of the referendum. Force majeure, which could occur, did not occur, accordingly, the fundamental background did not change.

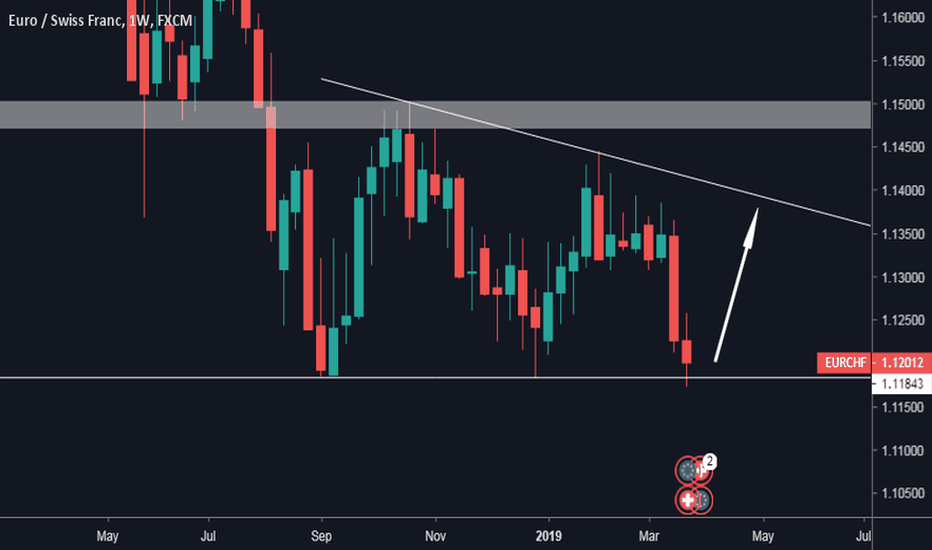

However, we still do not see any reasons for his purchases. The fundamental reason for lowering the franc this week could be the meeting of the Presidents of the United States and North Korea (scheduled for June 12). Peaceful statements from Singapore following the meeting should provoke a decrease in demand for safe-havenassets. Accordingly, the franc will become the object of sales.

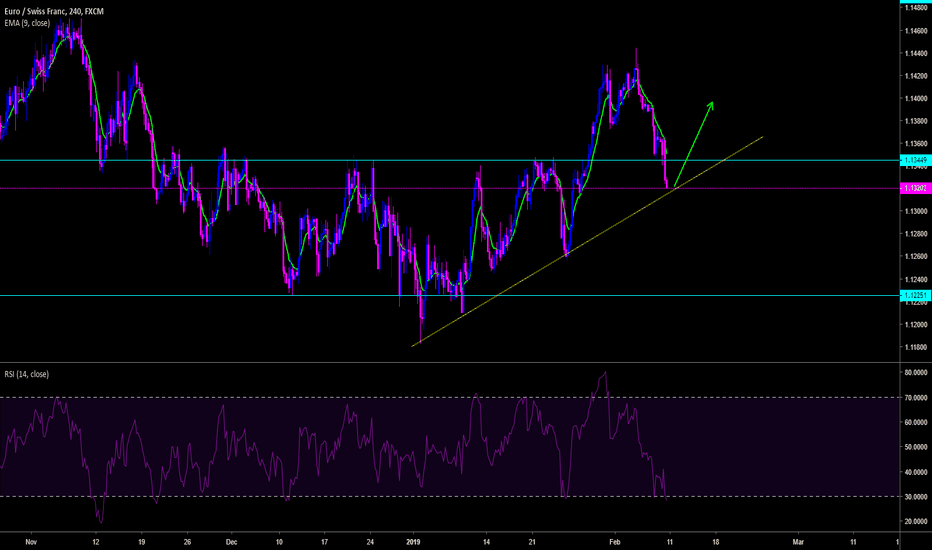

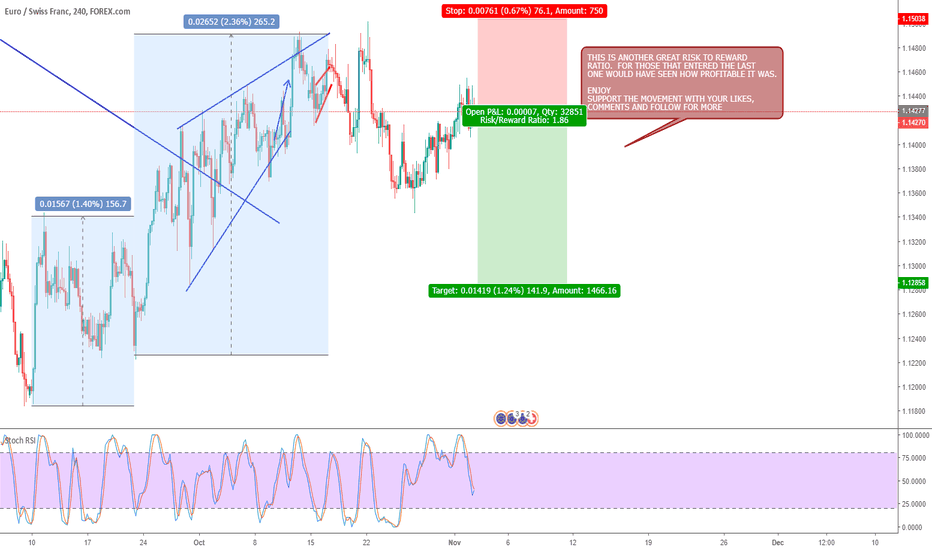

Technically, in pairs with the euro, the pound and the Japanese yen, there are good opportunities for franc sales. And the potential for its reduction in each of these cases is several hundred points. The bases are the same - these crosses are close to the boundaries of their medium-term ranges, which means that the probability of their reverse is high now.

For example, in the GBPCHF pair, the growth target is 1.35 or even 1.38. In the EURCHF cross it is about 1.18 or 1.20. As for the pair CHFJPY, the target of the current movement is the area of 108.50. As you can see, the Swiss franc has sufficient potential for decline in the foreseeable future, which is worth taking, selling it primarily against the euro, the pound and the Japanese yen.