Eurgbp!

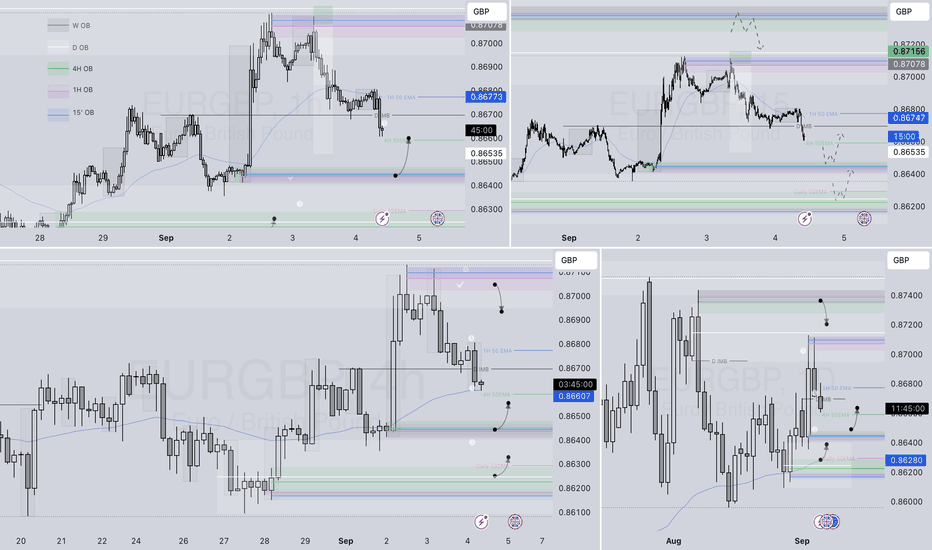

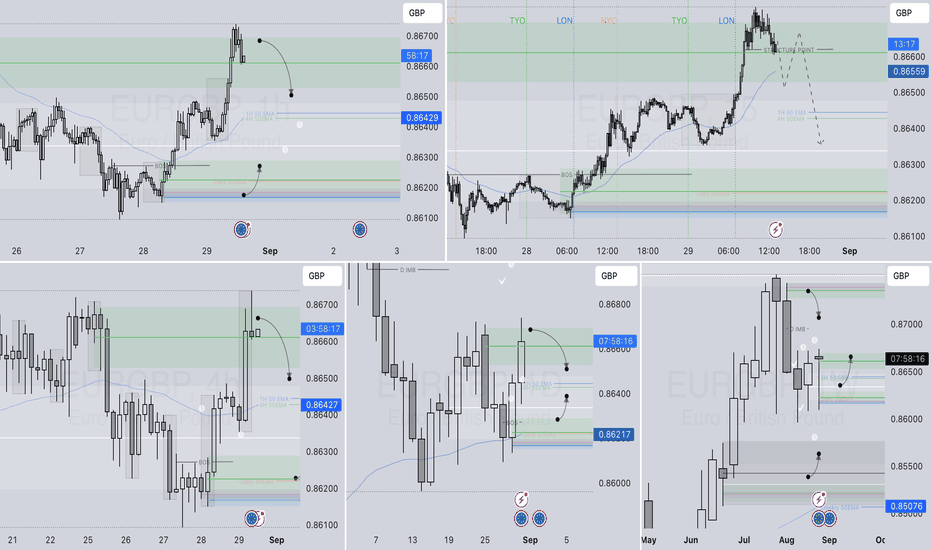

EURGBP Daily Forecast -Q3 | W36 | D4 | Y25📅 Q3 | W36 | D4 | Y25

📊 EURGBP Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:EURGBP

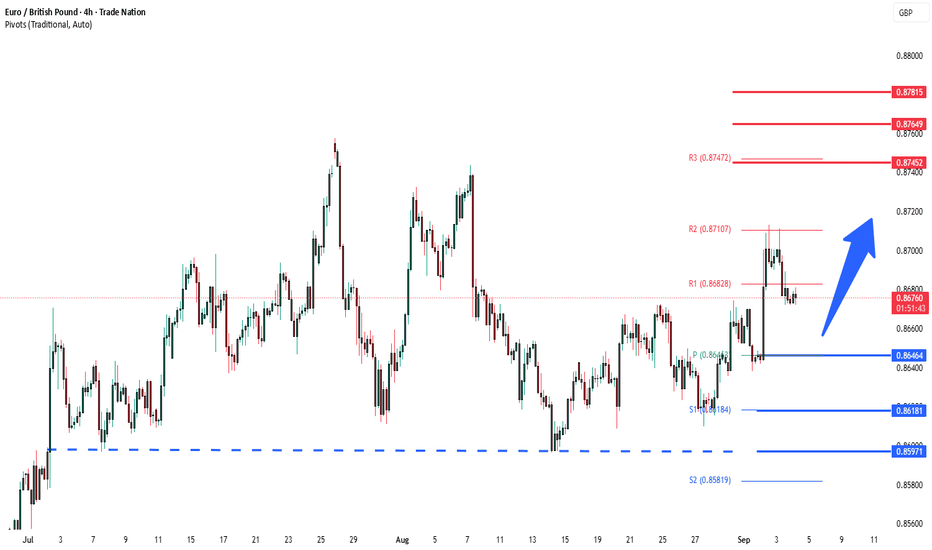

EURGBP consolidation supported at 0.8640The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.8640 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.8640 would confirm ongoing upside momentum, with potential targets at:

0.8740 – initial resistance

0.8765 – psychological and structural level

0.8780 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.8640 would weaken the bullish outlook and suggest deeper downside risk toward:

0.8620 – minor support

0.8600 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURGBP holds above 0.8640 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

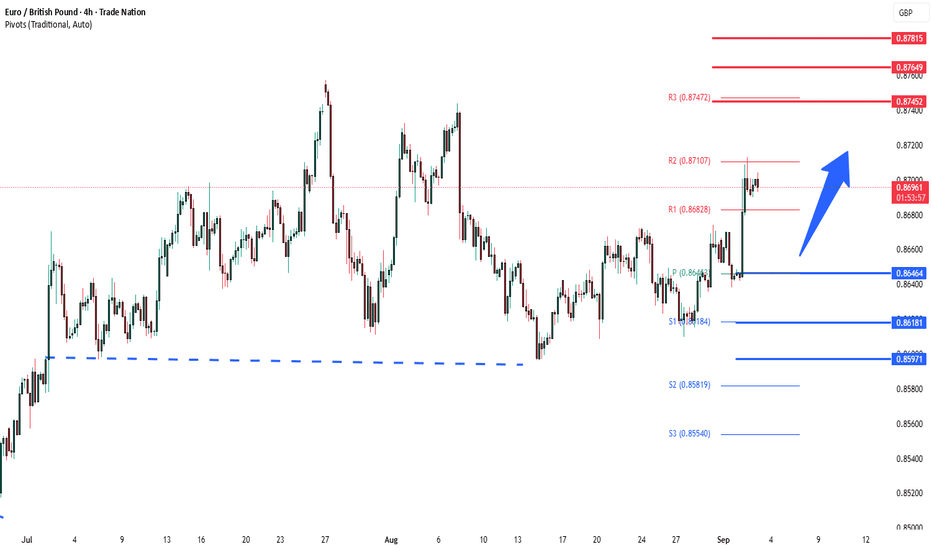

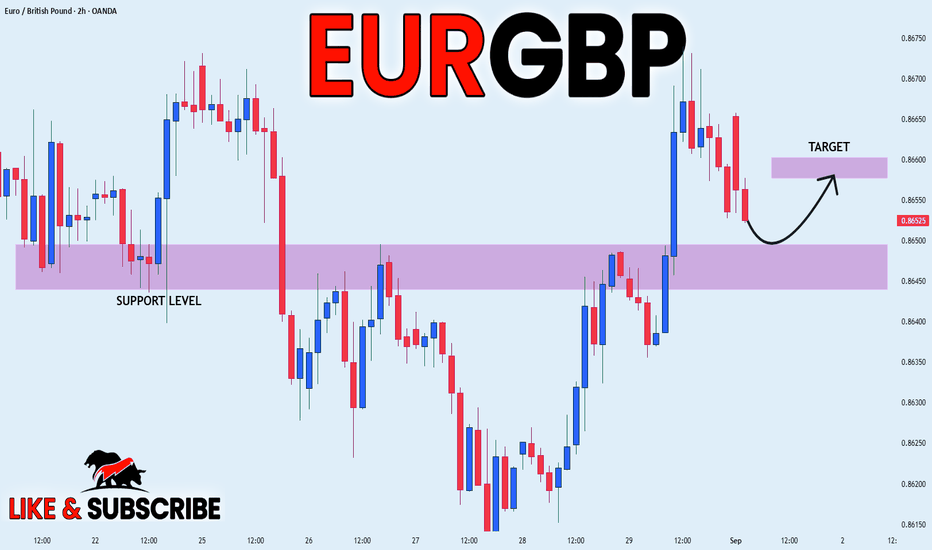

EURGBP oversold bounce supported at 0.8640The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.8640 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.8640 would confirm ongoing upside momentum, with potential targets at:

0.8740 – initial resistance

0.8765 – psychological and structural level

0.8780 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.8640 would weaken the bullish outlook and suggest deeper downside risk toward:

0.8620 – minor support

0.8600 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURGBP holds above 0.8640 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

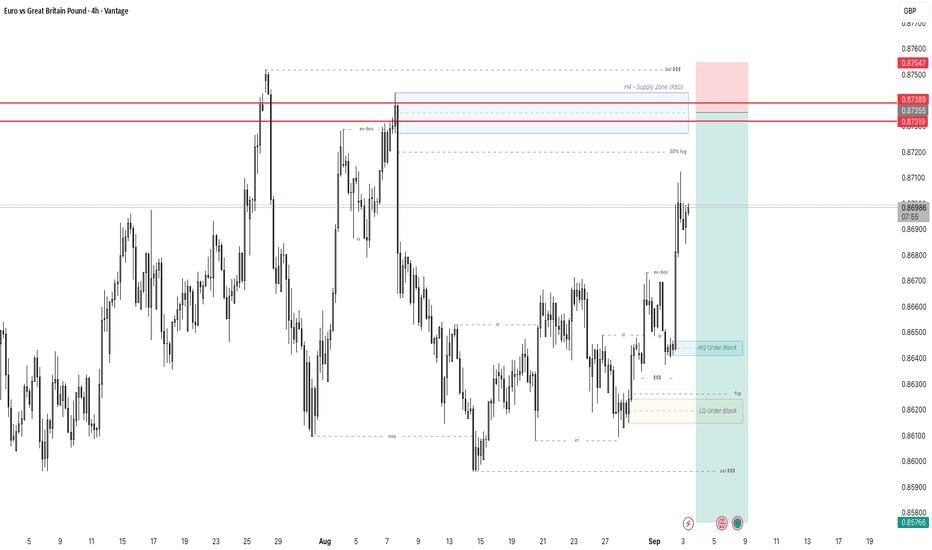

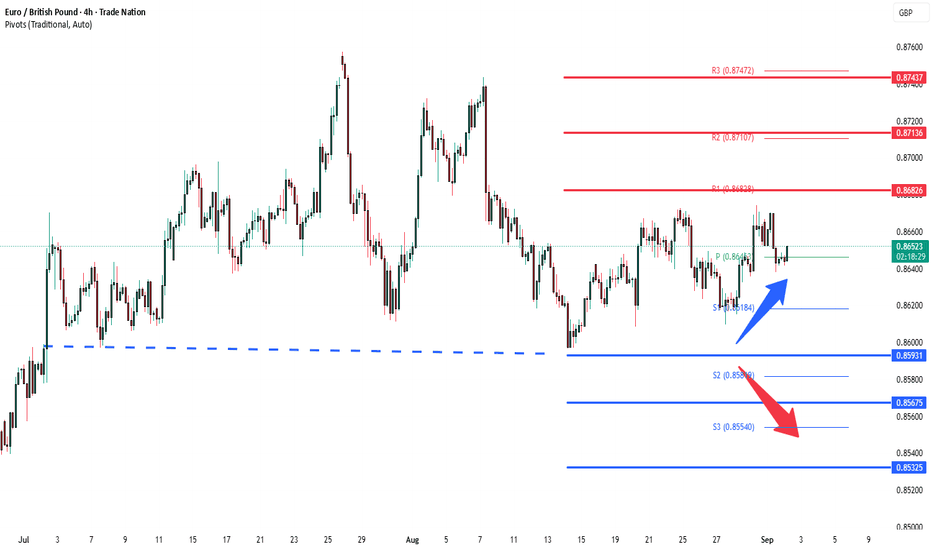

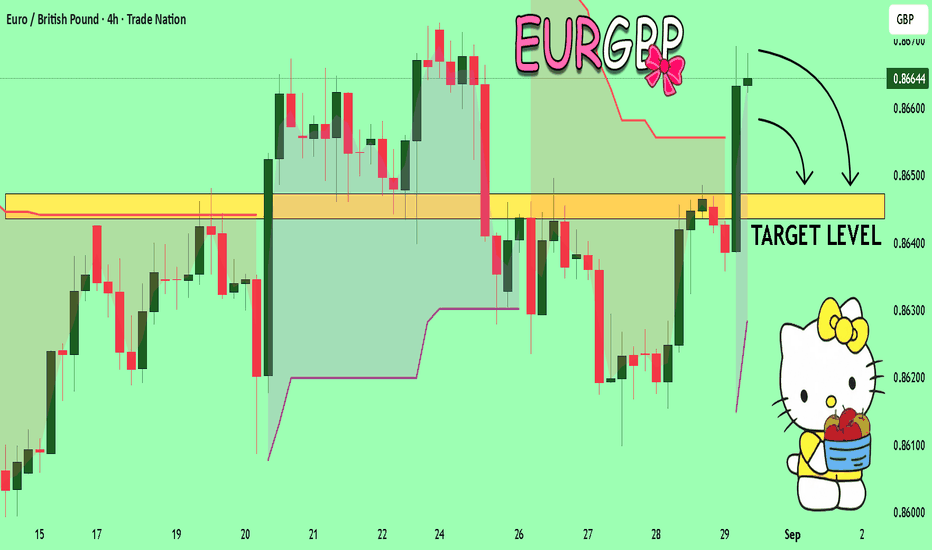

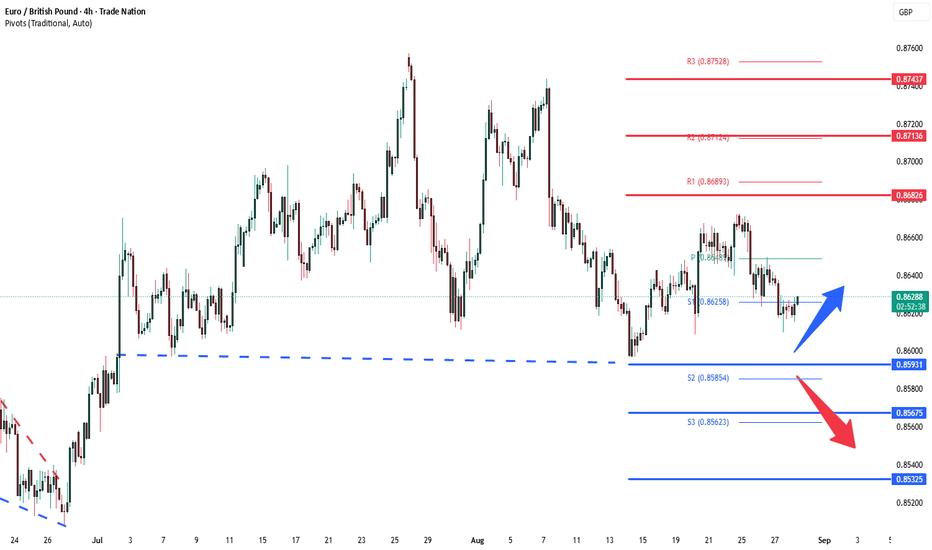

EURGBP (4H) – Swing Trade Trading PlanThis trading plan is designed to capture a potential medium-term downward move (swing trade) on the EUR/GBP pair, utilizing Smart Money Concepts to identify high-probability areas for entering a short position.

Market Context and Bias:

The current price shows a reversal or correction from a previous upward move and is approaching a key supply area on the 4-hour timeframe (H4), signaling strong potential resistance. Your trading bias is "Short," aligned with the expectation that price will be rejected at this supply area and continue downward.

Key Zones (Critical Areas):

H4 Supply Zone (Red Area): This is a crucial area where institutional players are expected to enter with short positions, generating strong selling pressure. This zone is highlighted in red and is the primary focus for entries. Place your pending short orders within or near this area, as indicated on your chart.

Fair Value Gap (FVG) / Imbalance: There is a Fair Value Gap within or near the supply zone that acts as a price magnet, potentially pulling price back to fill the imbalance before continuing downwards.

Order Block / Last Kiss: The lower part of the supply zone often contains an Order Block or "last kiss," which represents the final pullback before a significant move, making it a precise entry or pending order level for shorts.

Market Structure & Confirmation:

Break of Structure (BOS): Watch for bearish BOS on lower timeframes as price nears or reacts to the supply zone. This provides an additional confirmation for short entry.

Liquidity Grab: Look for a liquidity sweep above the recent swing highs around the supply zone. This is often an indication that Smart Money is clearing stops before pushing price lower.

Execution Plan (Pending Short):

Entry: Place pending short orders (sell limit) within or just below the H4 Supply Zone. Consider scaling into the position if you prefer to average the entries within the zone.

Stop Loss: Place your stop loss safely above the H4 Supply Zone and above the recent swing highs (or the "weak high" as labeled on the chart) to protect your capital in case the supply area breaks.

Take Profit: Target previous swing lows, Order Blocks below, and unfilled Fair Value Gaps as profit-taking areas. A large reward ratio is ideal for swing trading, aiming for FVG or Order Block targets lower down as shown on your chart.

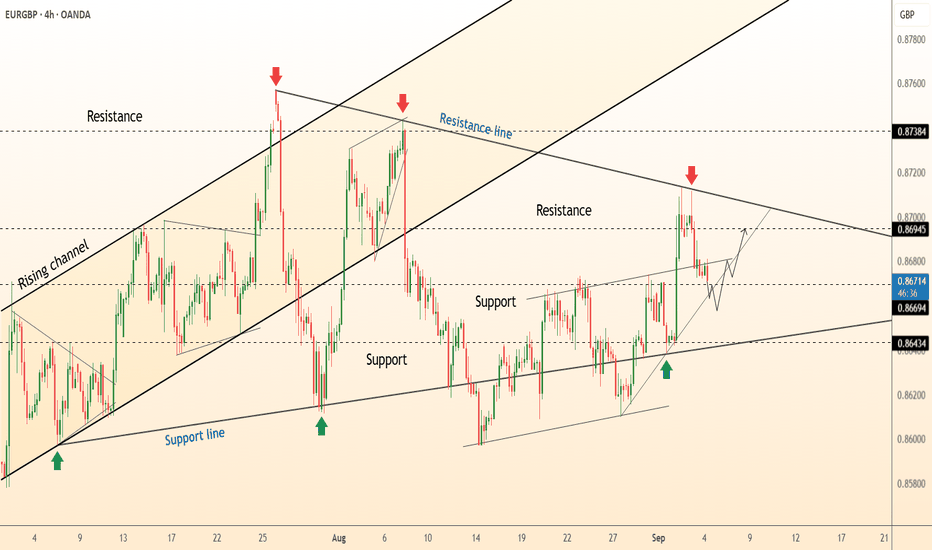

DeGRAM | EURGBP is testing the support level📊 Technical Analysis

● EUR/GBP rebounded from 0.8643 support and is consolidating inside a rising channel, holding the midline trend as dynamic support.

● A close above 0.8694 resistance would confirm bullish continuation toward 0.8738, while dips to 0.8669 remain corrective within the uptrend.

💡 Fundamental Analysis

● Euro strength is underpinned by ECB’s firm stance on maintaining restrictive rates, while sterling is capped by renewed concerns over slowing UK consumer spending.

✨ Summary

Bullish above 0.8643; targets 0.8694 → 0.8738. Invalidation on a close below 0.8640.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

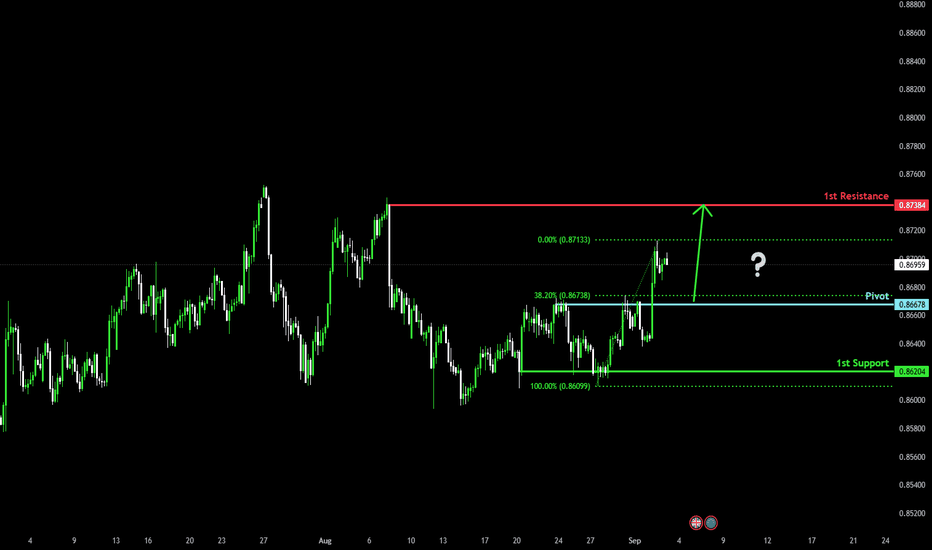

Falling towards pullback support?EUR/GBP is falling towards the pivot which has been identified as a pullback support and could bounce to the 1st resistance which acts as a swing high resistance.

Pivot: 0.8667

1st Support: 0.86204

1st Resistance: 0.8738

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

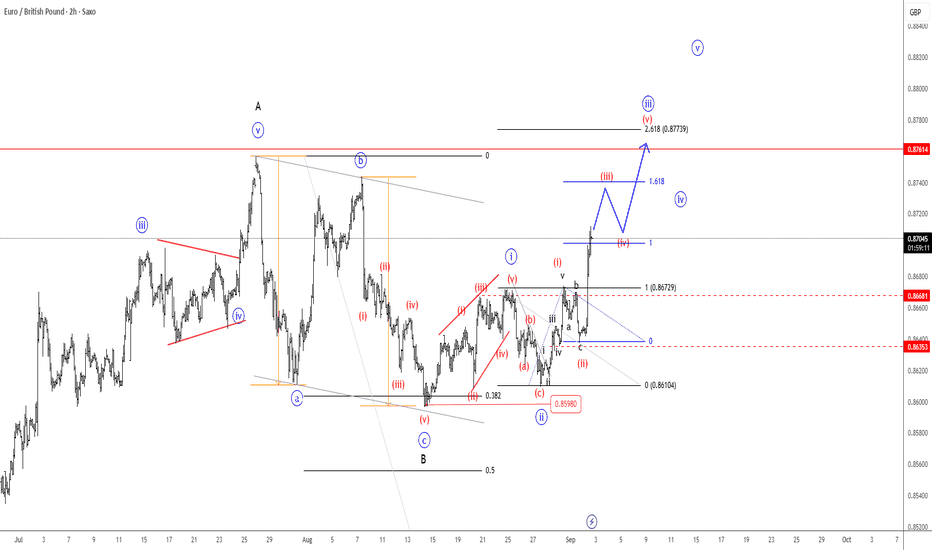

EURGBP Steps Into A New Intraday Five-Wave Bullish ImpulseEURGBP has been moving in line with expectations over the past couple of weeks. After completing a projected higher-degree abc correction in wave B, it now appears that EURGBP has entered a new intraday five-wave bullish impulse, which could drive the price back toward the July highs.

Yesterday, we identified a lower-degree abc pullback in wave (ii). Since then, the pair has been trading nicely higher within wave (iii) of “iii.” This suggests further upside potential, though traders should remain cautious of a possible subwave (iv) pullback before the move continues.

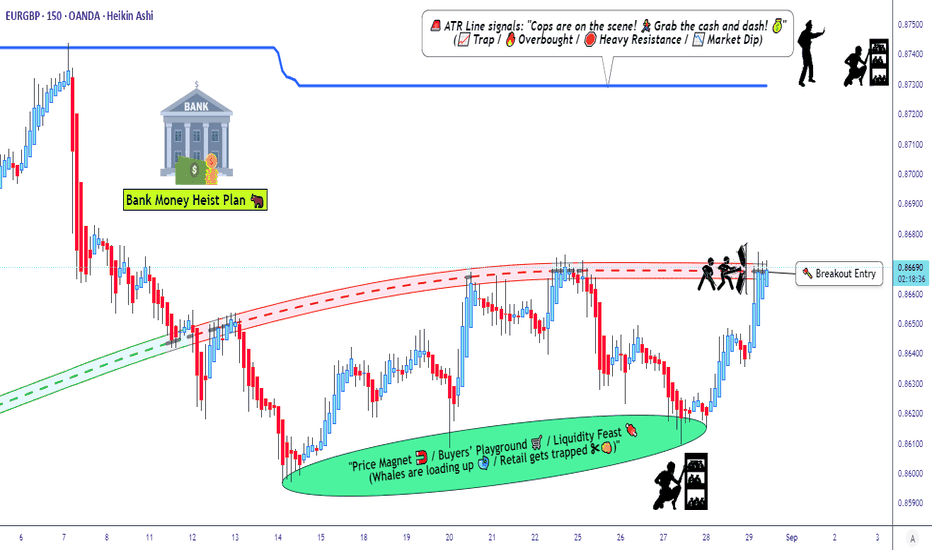

The Chunnel Escape Route – EUR/GBP Breakout Strategy!🕵️♂️💶💷 EUR/GBP "The Chunnel" Forex Bank Heist Plan 💣🚪

Dear Money Makers & Robbers, 💰🎭

Tonight’s mission is set on EUR/GBP – “The Chunnel” route. We’re planning a Bullish Heist 📈 with a slick layering strategy. Follow the steps, stay sharp, and escape before the cops (market reversals) catch us. 🚔💨

🔑 Entry Plan (Breakout & Layers)

Main Entry: Breakout @0.86700 ⚡

Thief Layer Entries:

0.86700

0.86600

0.86500

(Add more layers if you’ve got the guts, but confirm after breakout!)

📌 Set your alarm in TradingView to catch the breakout 🔔 – thieves never miss the moment.

🛑 Stop Loss – The Thief’s Safety Net

This is the Thief SL 🪤 @0.87000 (adjust based on your own heist plan & risk).

⚠️ Rule: SL only AFTER breakout, never before. Don’t trip the alarm too early.

🎯 Target – Escape Point

Target: 0.87300 🎯

👉 ATR line = police barricade 🚔🚧, so grab your loot and vanish before the chase begins.

🏴☠️ Notes for the Crew (Thief OGs)

Strategy = Multiple Limit Orders (Layering) 💎

Trade with discipline & timing, not emotion.

Adjust SL & layers to your own style.

💖 If you vibe with this Thief Heist Plan, hit the Boost Button 🔥 to fuel our robbery crew 🚀💵.

Stay tuned, another heist drops soon 🕶️🤑.

#EURGBP #ForexHeist #ThiefTrader #LayeringStrategy #ForexTrading #SwingTrade #DayTrade #ForexSignals #BreakoutStrategy #MoneyHeistFX

EURGBP Daily Forecast -Q3 | W35 | D2 | Y25

📅 Q3 | W35 | D2 | Y25

📊 EURGBP Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:EURGBP

EURGBP oversold bounce resistance at 0.8680The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.8590 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.8590 would confirm ongoing upside momentum, with potential targets at:

0.8680 – initial resistance

0.8713 – psychological and structural level

0.8745 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.8590 would weaken the bullish outlook and suggest deeper downside risk toward:

0.8567 – minor support

0.8532 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURGBP holds above 0.8590 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

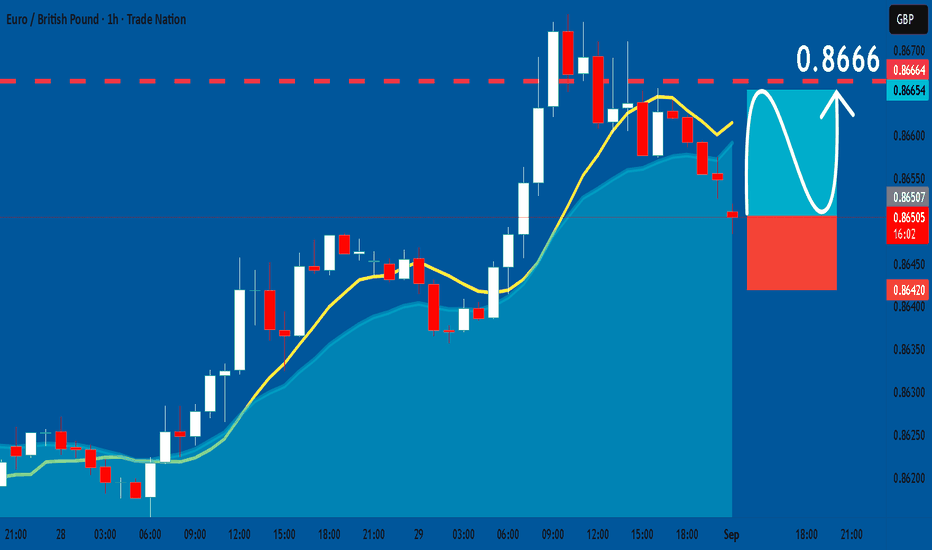

EURGBP: Long Trade Explained

EURGBP

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy EURGBP

Entry - 0.8650

Stop - 0.8642

Take - 0.8666

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

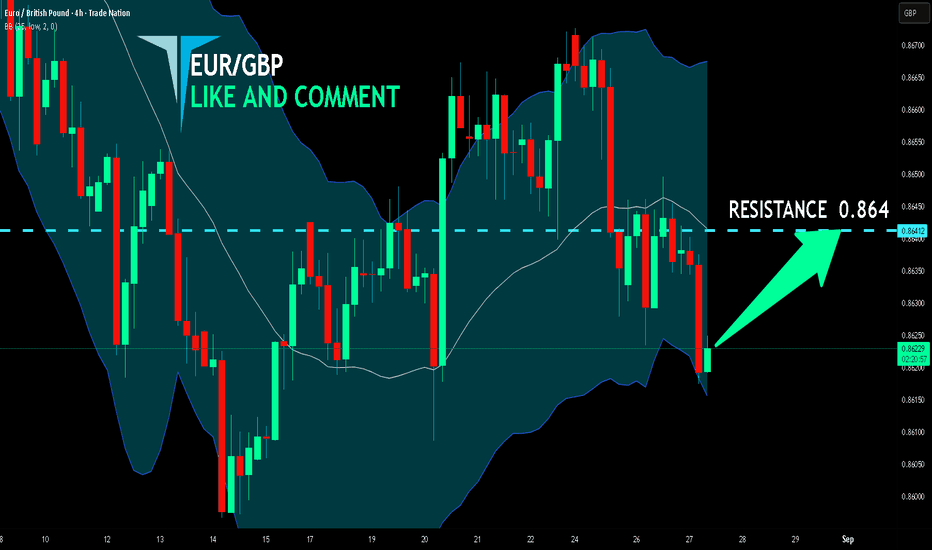

EUR/GBP BULLS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

Bullish trend on EUR/GBP, defined by the green colour of the last week candle combined with the fact the pair is oversold based on the BB lower band proximity, makes me expect a bullish rebound from the support line below and a retest of the local target above at 0.864.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Full analysis & breakdown on EURGBP and AUDUSDFull analysis & breakdown on EURGBP and AUDUSD

Not too much to dive into in terms of charts for Week 36, given the way price action closed out last week.

However, there are clear trading ranges forming on a couple of key pairs — and with them, some directional bias we can work with.

This week, I’ll be keeping a close eye on:

EURGBP

AUDUSD

Both pairs are offering defined ranges and structure-based opportunities that I’ll break down below.

FRGNT

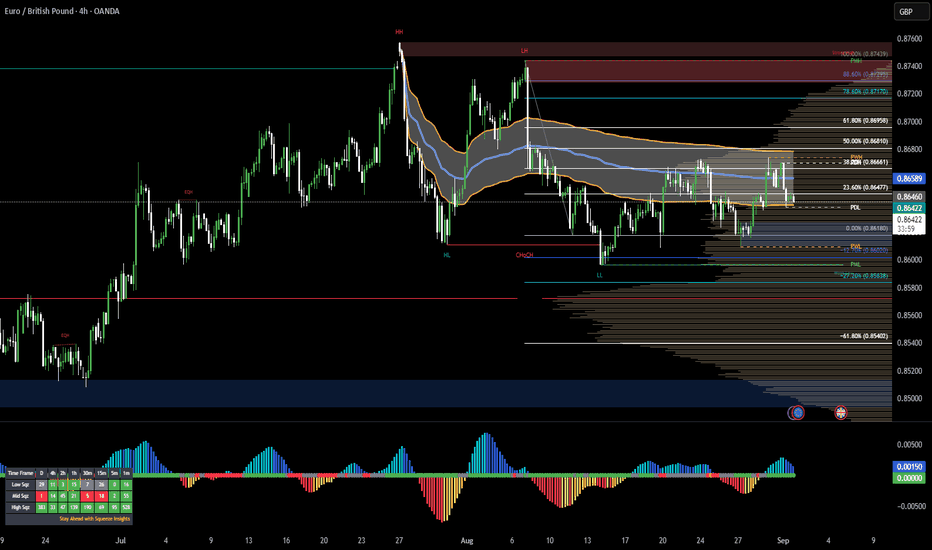

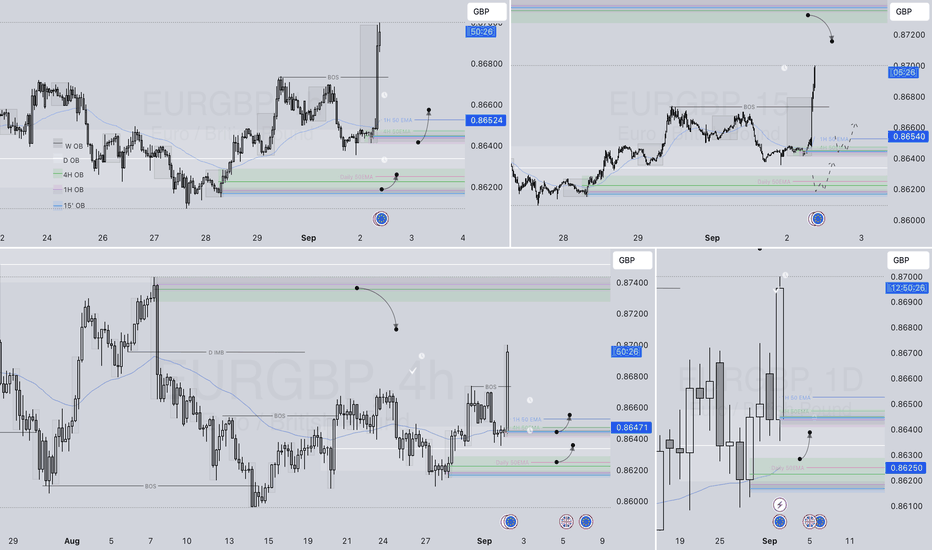

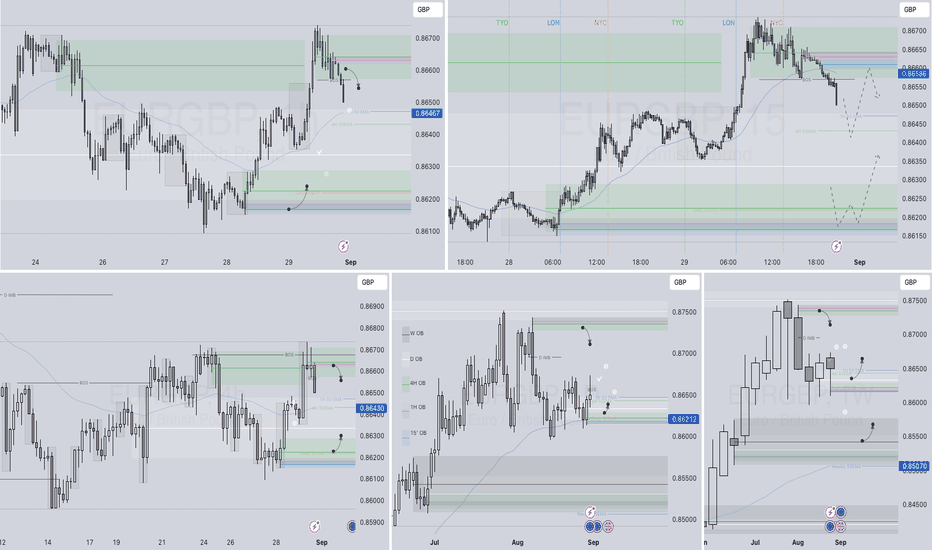

EURGBP – Q3 W36 Y25 Weekly Forecast Higher Time Frame Context (W📈 EURGBP – Q3 W36 Y25 Weekly Forecast

🧠 Higher Time Frame Context (Weekly/Daily)

Price has closed above the Higher Time Frame (HTF) 50EMA, signaling strength and suggesting a bullish bias going into Monday of Week 36.

The strong weekly candle close in W35 indicates bullish pressure from the lows, reinforcing the idea of a higher-probability long setup.

I expect a rejection from the Daily 50EMA, aligning with HTF continuation expectations.

🔔 Bias: Long — in alignment with the HTF momentum and structure.

🔄 Recent Price Action & Short-Term Trade Plan

On Friday of W35, I closed my short position toward the end of my trading period.

Despite the HTF bullish bias, price is currently rejecting a 4H order block that created a higher low on the 4H timeframe.

This suggests that intra-day pullbacks (shorts) may still play out early in the week, particularly toward key long POIs (Points of Interest).

⚠️ Caution & Adjustments

I remain tentative about holding shorts, as the trading range is tight and higher time frame pressure is building to the upside.

My focus will shift to watching price react to long POIs, where I will:

Wait for a break of structure (BOS) on the lower timeframes (15M 5M 1M)

Enter on the pullback for a long, aiming for a higher high on the 4H chart by mid-week.

🧭 Execution Summary

Aspect Outlook / Plan

Higher Time Frame Bias ✅ Bullish – Strong weekly close above 50EMA

Current Price Action 🔄 Intra-day short-term rejection from 4H OB

Shorts ⚠️ Possible early-week pullbacks — small range, manage risk tightly

Long Plan 🟢 Await long POI tap + LTF BOS for long continuation

Target 🎯 Potential higher high on 4H by mid-W36

🧠 Final Thoughts

“Let price come to you. Let structure confirm it.”

Patience is key early in the week — I’ll be waiting for confirmation before positioning long, while allowing short-term shorts to play out cautiously.

FRGNT

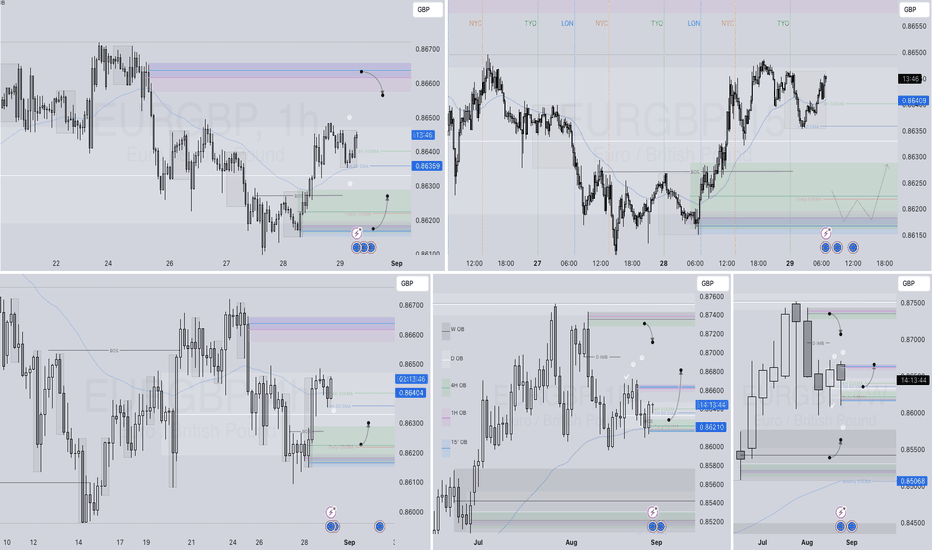

EURGBP – Potential Short Setup (London/NY Crossover) Q3 | W35 |

📉 EURGBP – Potential Short Setup (London/NY Crossover)

Q3 | W35 | D29 | Y25

🧠 Setup Overview:

Asia session highs filled ✅

Post-London showed bullish pressure, but we’re now looking for NY to sell from the highs 📉

Anticipating a 4H bearish candle close (classical formation) for confirmation

📌 Key Confluences:

Price is expected to pull back into 4H imbalance, aligning with:

A projected Lower Low on the 15m

Formation of a new Order Block + Void

This area will serve as a refined short POI for continued downside movement

🎯 Target:

Shorts aligned with 4H trend continuation, aiming toward the Daily 50EMA

🧠 Execution Plan:

Wait for 4H candle confirmation + 15m BOS

Look for entry at OB/void zone within 4H imbalance

Risk remains capped — no confirmation = no trade

Discipline over prediction. Let structure lead.

– FRGNT

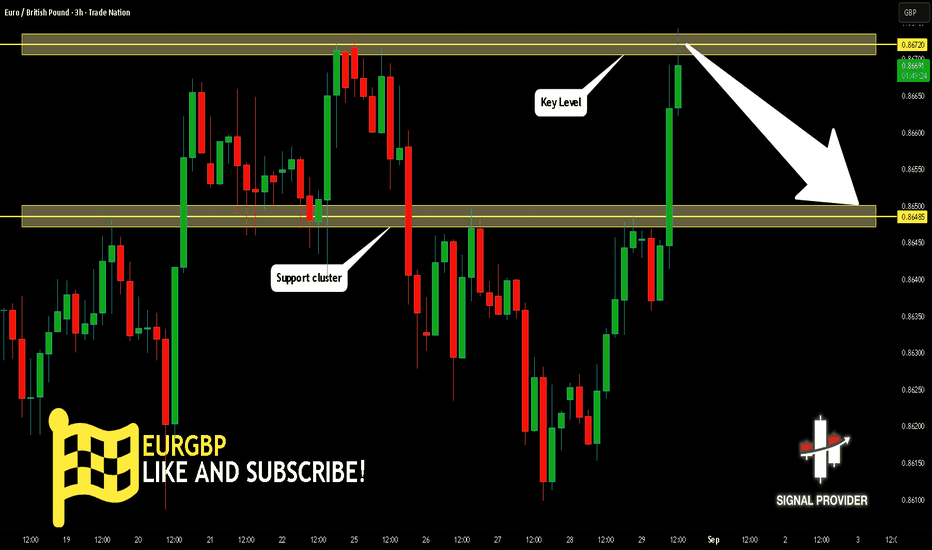

EURGBP Will Move Lower! Sell!

Here is our detailed technical review for EURGBP.

Time Frame: 3h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 0.867.

Taking into consideration the structure & trend analysis, I believe that the market will reach 0.864 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURGBP Will Collapse! SELL!

My dear friends,

Please, find my technical outlook for EURGBP below:

The price is coiling around a solid key level - 0.8665

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 0.8647

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURGBP – Daily Chart Analysis Q3 | W35 | D29 | Y25📊 EURGBP – Daily Chart Analysis

Q3 | W35 | D29 | Y25

🕯️ The previous daily candle closed bullish, and notably above the 50EMA. This is a key technical signal that shifts our short-term bias to the upside, suggesting bullish momentum is in play.

📈 Based on this close, I’ll be focusing on long opportunities from the lows, targeting areas where price may look to mitigate inefficiencies left behind.

🔍 Key Technical Breakdown:

The bullish daily candle created a 4H Order Block and left an imbalance below, both of which sit within a broader daily Point of Interest (POI).

Within this POI, there are clear 1H and 15-minute order blocks and voids, acting as refined zones of interest for potential entries.

These areas mark where I’ll be paying close attention to price reaction and structure.

🧠 Execution Plan:

I’m not entering blindly at the POI.

I’ll be monitoring lower timeframes (M15/M5) for a clean break of structure (BOS) or a liquidity sweep followed by bullish intent.

Only after confirmation will I look to enter long — risk remains capped and measured.

If price fails to hold the POI or shows strong bearish momentum, I’ll step aside and wait for clarity.

📌 Key Takeaways:

The bias is bullish only with confirmation — stay mechanical, not emotional.

Structure > impulse — don’t let a single bullish candle dictate your entry.

Maintain solid risk management — max 1% risk per trade, with clear invalidation levels.

Let the market come to you. No confirmation = no trade.

FRGNT

FX:EURGBP

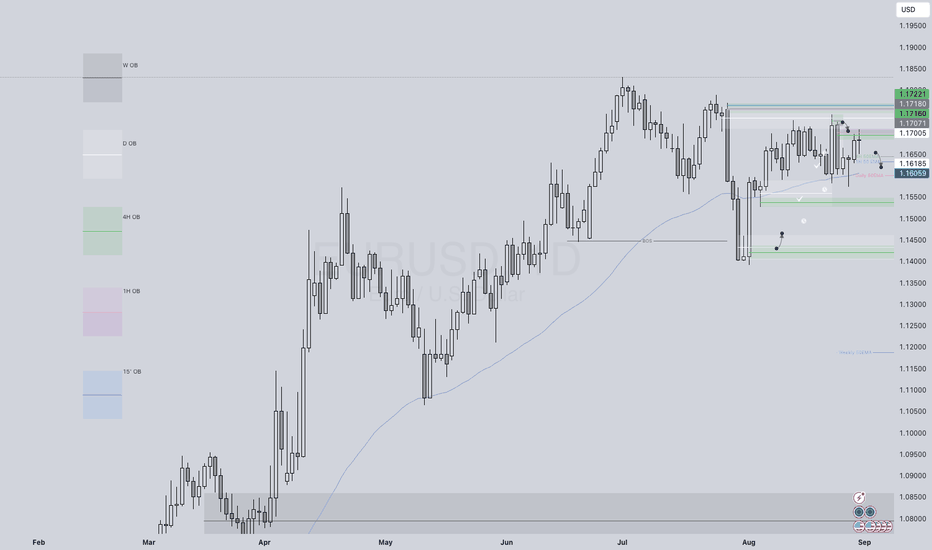

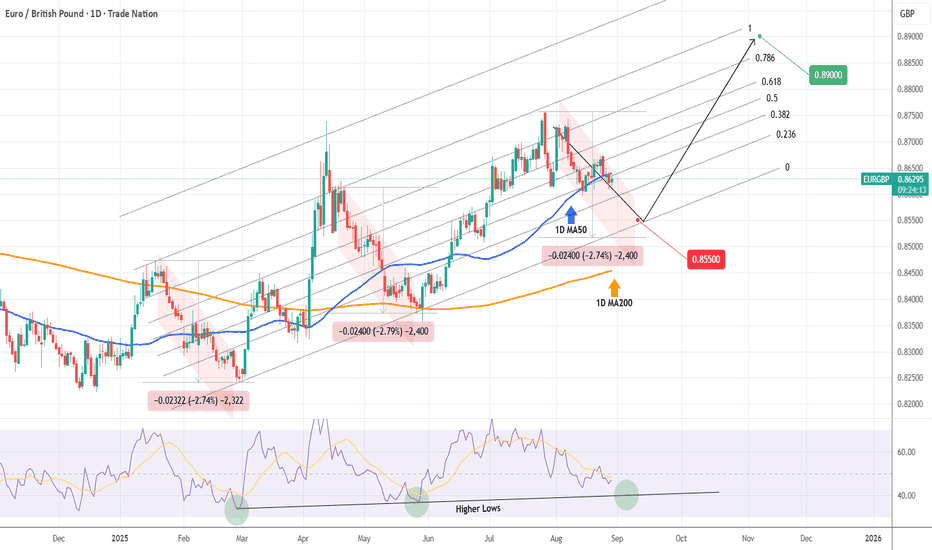

EURBGP Sell this Leg and buy at the bottom.Last time we took a look a the EURGBP pair (July 11, see chart below), we gave a buy signal inside the Channel Up, which quickly hit our 0.87400 Target:

This time the price has found itself on a decline, the latest Bearish Leg of the Channel Up. The previous two declined by -2.75% before bottoming and reversing. The 1D RSI Higher Lows can be an additional indicator as to where the Low can be priced.

We expect the pair to reach at least 0.85500 before starting the new Bullish Leg, which we believe will extend all the way near the top (1.0 Fibonacci) of the Channel Up. Our Target will be 0.8900.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EURGBP Topping H & S developing, "neckline" at 0.8590The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.8590 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.8590 would confirm ongoing upside momentum, with potential targets at:

0.8680 – initial resistance

0.8713 – psychological and structural level

0.8745 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.8590 would weaken the bullish outlook and suggest deeper downside risk toward:

0.8567 – minor support

0.8532 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURGBP holds above 0.8590 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.