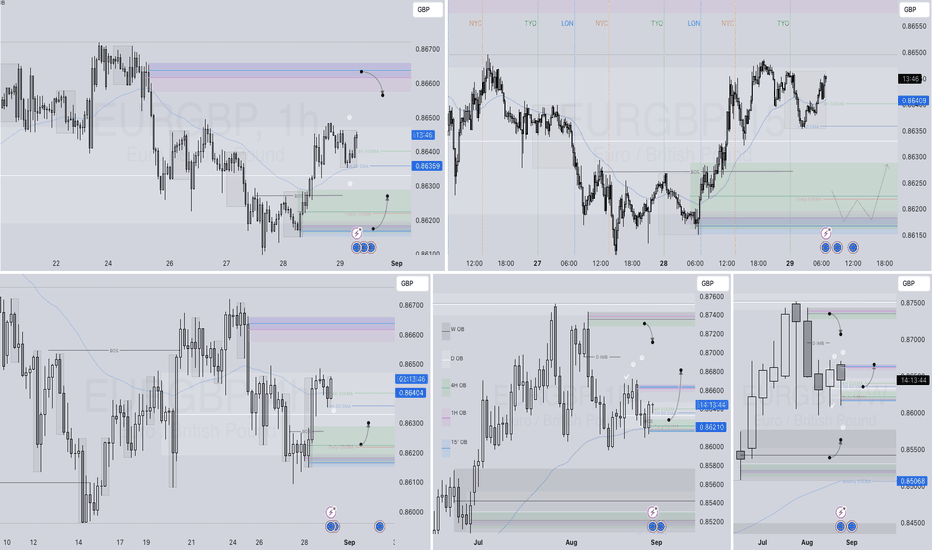

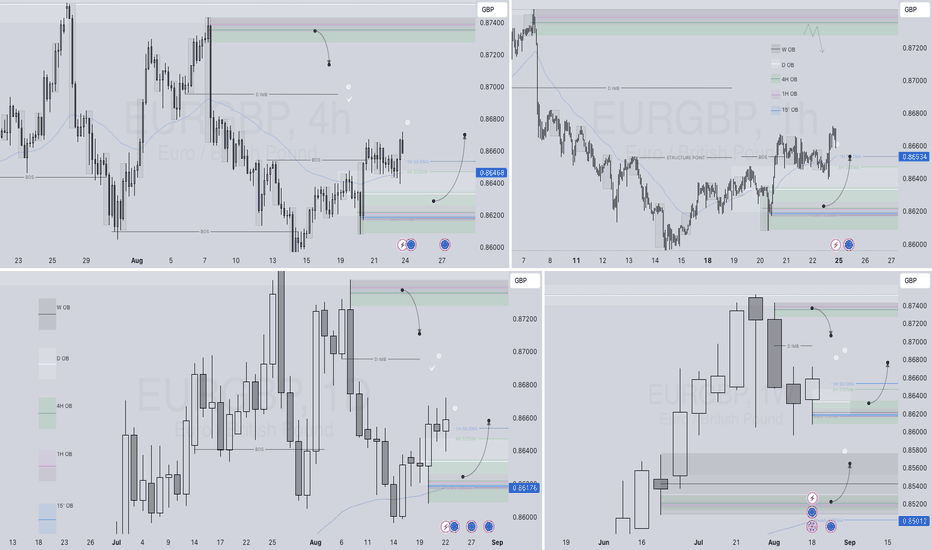

EURGBP – Daily Chart Analysis Q3 | W35 | D29 | Y25📊 EURGBP – Daily Chart Analysis

Q3 | W35 | D29 | Y25

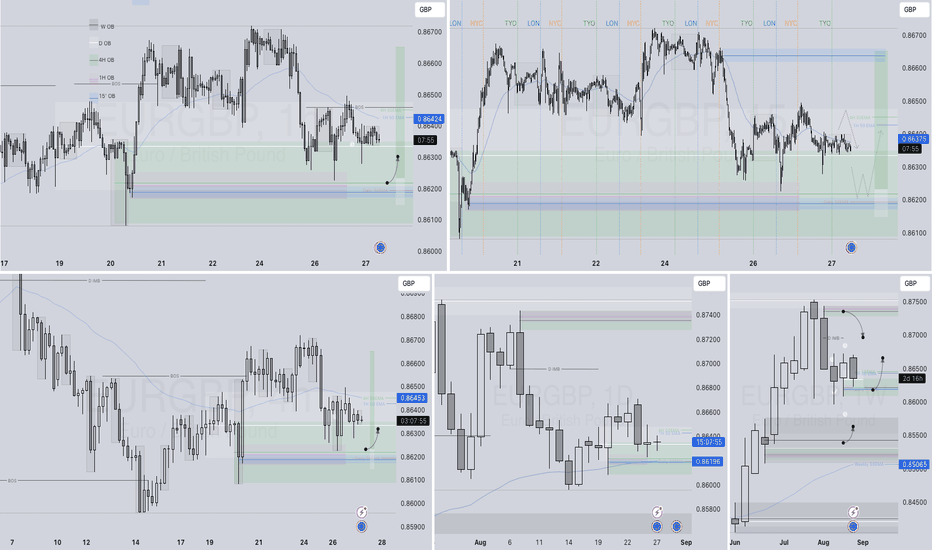

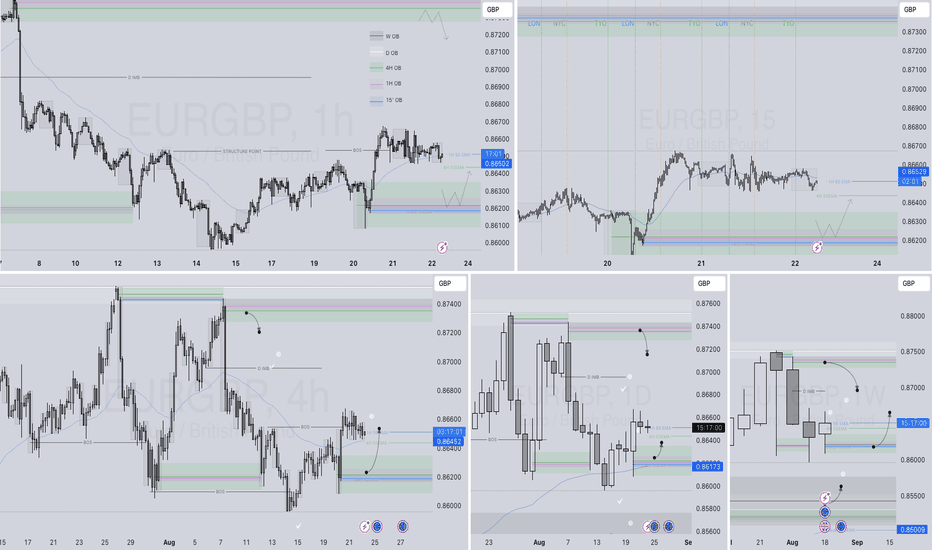

🕯️ The previous daily candle closed bullish, and notably above the 50EMA. This is a key technical signal that shifts our short-term bias to the upside, suggesting bullish momentum is in play.

📈 Based on this close, I’ll be focusing on long opportunities from the lows, targeting areas where price may look to mitigate inefficiencies left behind.

🔍 Key Technical Breakdown:

The bullish daily candle created a 4H Order Block and left an imbalance below, both of which sit within a broader daily Point of Interest (POI).

Within this POI, there are clear 1H and 15-minute order blocks and voids, acting as refined zones of interest for potential entries.

These areas mark where I’ll be paying close attention to price reaction and structure.

🧠 Execution Plan:

I’m not entering blindly at the POI.

I’ll be monitoring lower timeframes (M15/M5) for a clean break of structure (BOS) or a liquidity sweep followed by bullish intent.

Only after confirmation will I look to enter long — risk remains capped and measured.

If price fails to hold the POI or shows strong bearish momentum, I’ll step aside and wait for clarity.

📌 Key Takeaways:

The bias is bullish only with confirmation — stay mechanical, not emotional.

Structure > impulse — don’t let a single bullish candle dictate your entry.

Maintain solid risk management — max 1% risk per trade, with clear invalidation levels.

Let the market come to you. No confirmation = no trade.

FRGNT

FX:EURGBP

Eurgbp!

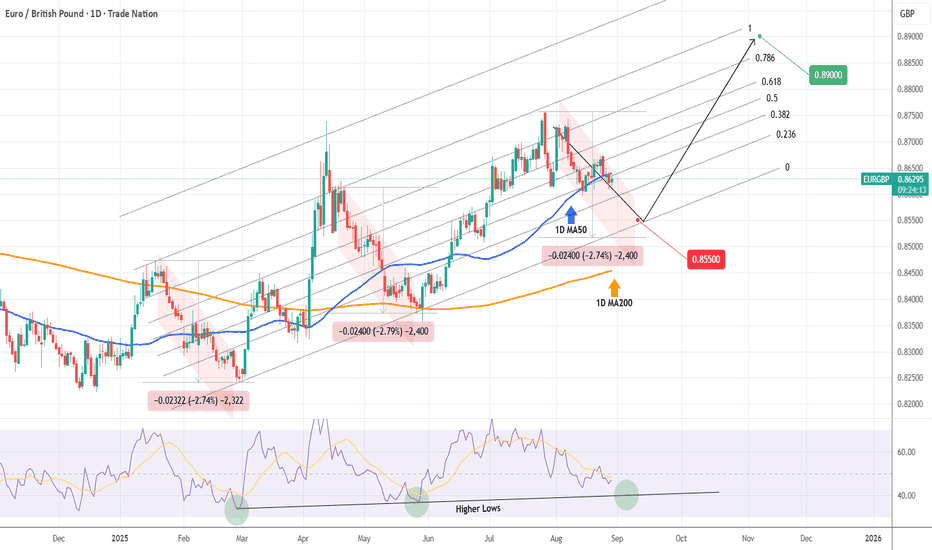

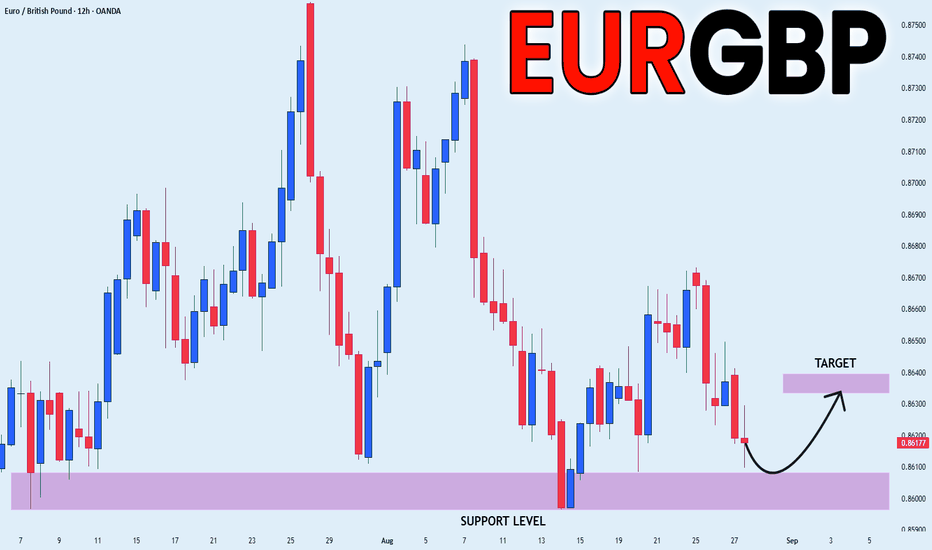

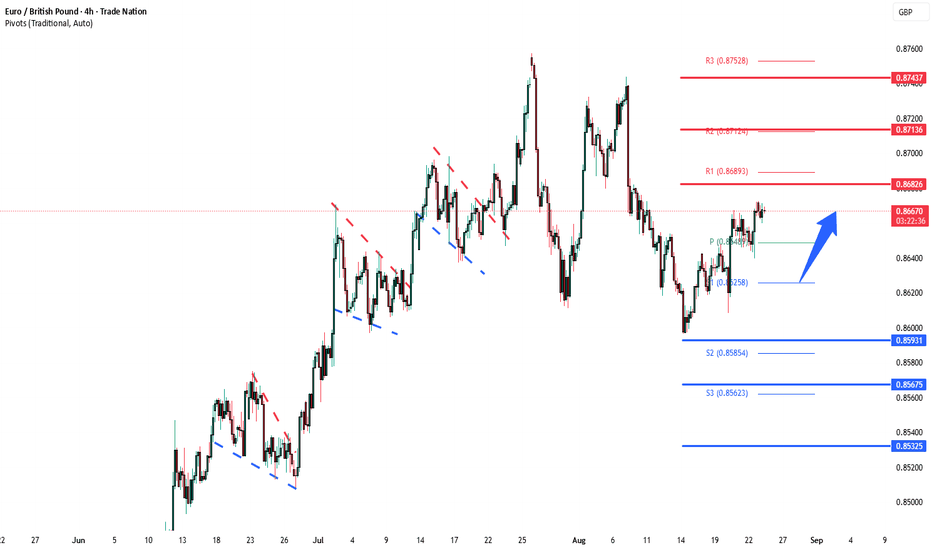

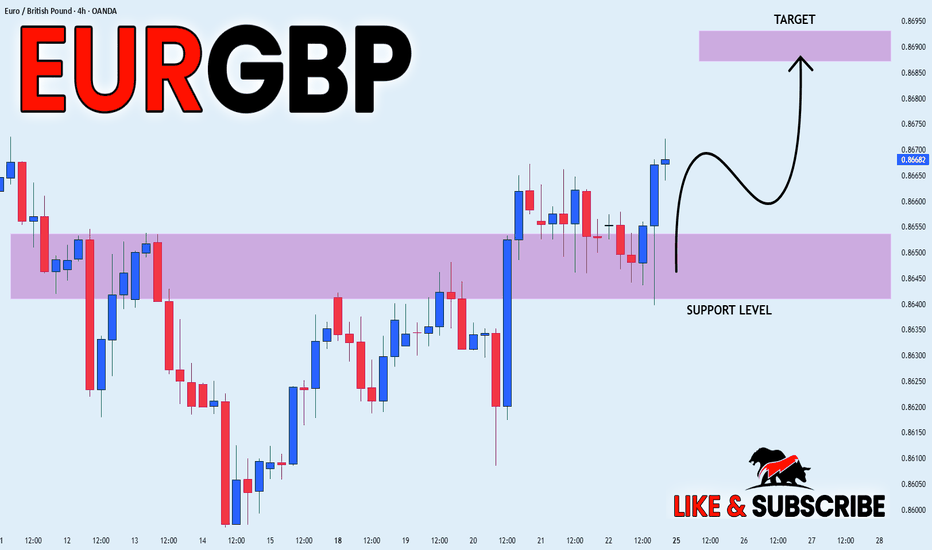

EURBGP Sell this Leg and buy at the bottom.Last time we took a look a the EURGBP pair (July 11, see chart below), we gave a buy signal inside the Channel Up, which quickly hit our 0.87400 Target:

This time the price has found itself on a decline, the latest Bearish Leg of the Channel Up. The previous two declined by -2.75% before bottoming and reversing. The 1D RSI Higher Lows can be an additional indicator as to where the Low can be priced.

We expect the pair to reach at least 0.85500 before starting the new Bullish Leg, which we believe will extend all the way near the top (1.0 Fibonacci) of the Channel Up. Our Target will be 0.8900.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

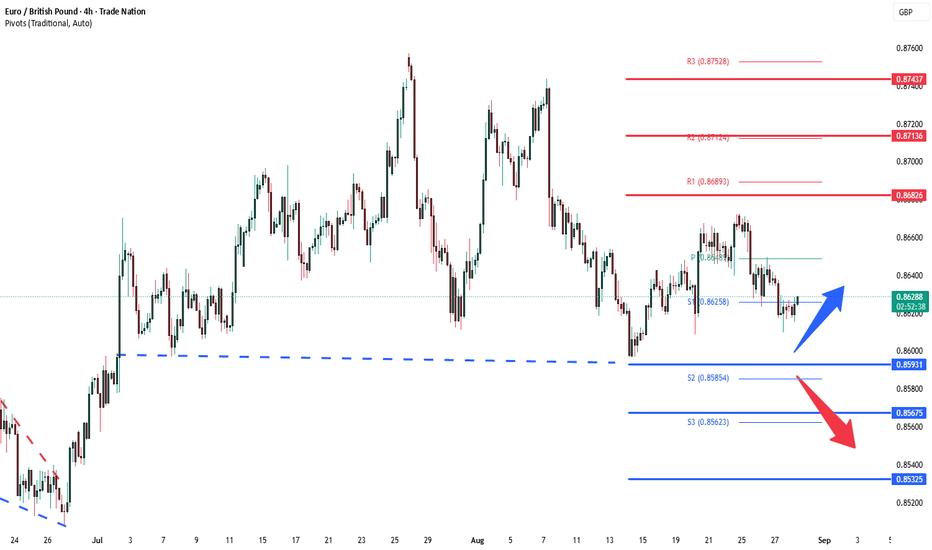

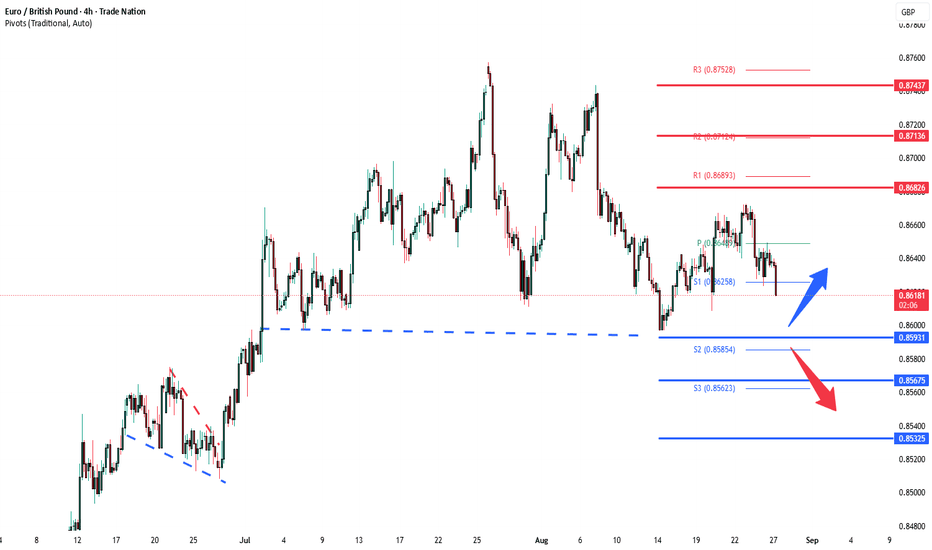

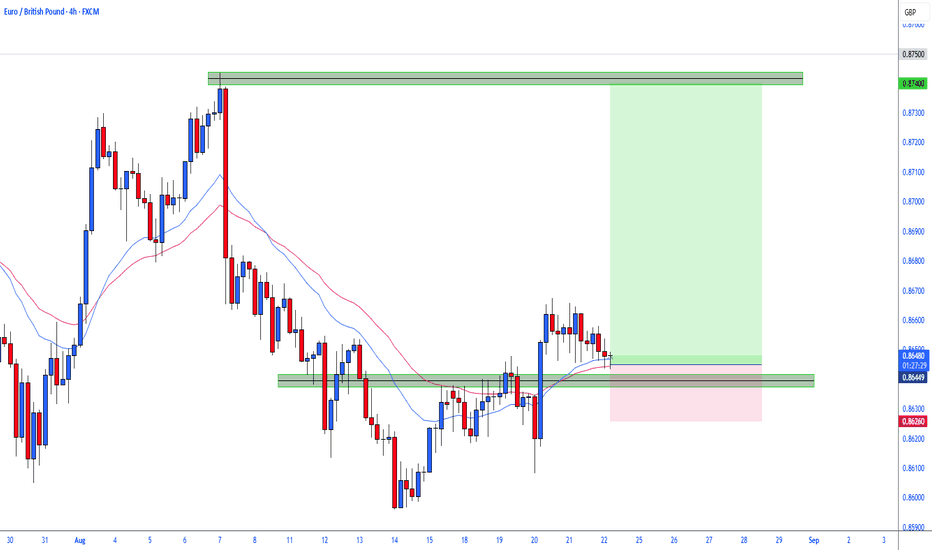

EURGBP Topping H & S developing, "neckline" at 0.8590The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.8590 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.8590 would confirm ongoing upside momentum, with potential targets at:

0.8680 – initial resistance

0.8713 – psychological and structural level

0.8745 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.8590 would weaken the bullish outlook and suggest deeper downside risk toward:

0.8567 – minor support

0.8532 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURGBP holds above 0.8590 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURGBP – DAILY FORECAST Q3 | W35 | D28 | Y25📊 EURGBP – DAILY FORECAST

Q3 | W35 | D28 | Y25

🔍 Daily Forecast | EURGBP

Here’s a concise breakdown of the current chart setup 🧠📈:

📌 Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

We wait for a confirmed break of structure 🧱✅ before executing any position.

This keeps us disciplined, and in sync with what the price action is actually telling us — not what we want it to say.

📈 Risk Management Protocols

🔑 Core Principles:

Max 1% risk per trade

Execute only at pre-identified levels

Use alerts, not emotion

Stick to your RR plan (minimum 1:2)

🧠 You’re not paid for how many trades you take — you're paid for how well you manage risk.

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work for you. 🎯📊

FRGNT

FX:EURGBP

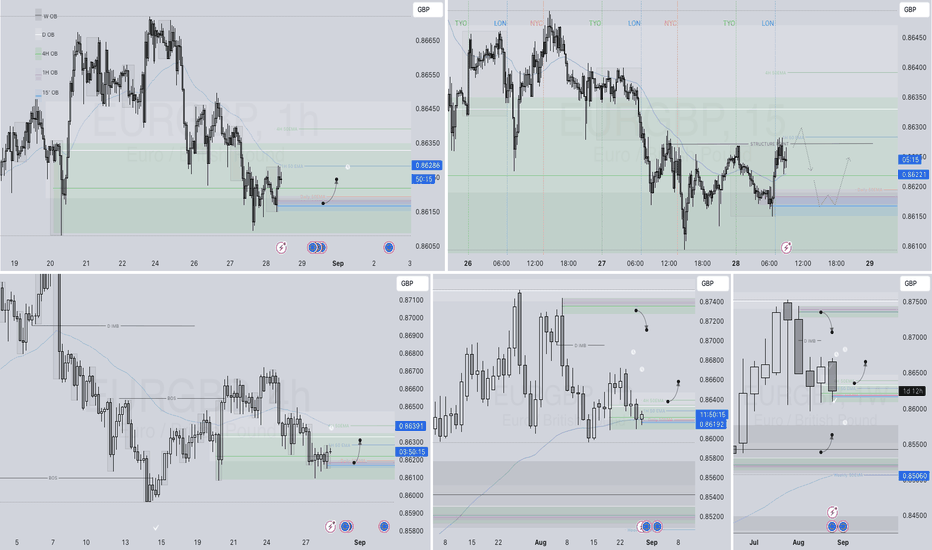

EURGBP: Price Action & Swing Analysis

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current EURGBP chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURGBP reaching pivotal support zone at 0.8590The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.8590 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.8590 would confirm ongoing upside momentum, with potential targets at:

0.8680 – initial resistance

0.8713 – psychological and structural level

0.8745 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.8590 would weaken the bullish outlook and suggest deeper downside risk toward:

0.8567 – minor support

0.8532 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURGBP holds above 0.8590 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURGBP Daily Forecast — Q3 W35 D37 Y25📊 EURGBP Daily Forecast — Q3 W35 D37 Y25

Good morning traders,

EURGBP is currently holding just above the Daily 50 EMA — a key potential rejection zone that supports a bullish outlook. 📍

We're also sitting within a High Timeframe (HTF) Daily Order Block, adding significant confluence to a long bias. 🟢

🔎 Top-Down Analysis:

📆 Daily: Price above 50 EMA + HTF OB

🕓 4H: Subtle Break of Structure (BoS) visible

🕐 1H: BoS is clean and confirmed — indicating growing bullish pressure

This multi-timeframe alignment strengthens the long idea. ✅

🎯 Execution Plan:

Use the 1H BoS zone as your area of interest

🔽 Drill down to the 15-min OB within that zone for precise entries

📉 Await a BoS on the 1' or 5' timeframe for aggressive entries

📈 Or wait for a 15' BoS for a more conservative confirmation

Once confirmed, we’re looking to execute a long trade from this zone.

🧠 Final Thoughts:

Stack confluences ✅

Trust your top-down analysis 📊

Manage risk and execute confidently 🛡️

Best of luck today — trade safe, and trade well.

FRGNT

FX:EURGBP

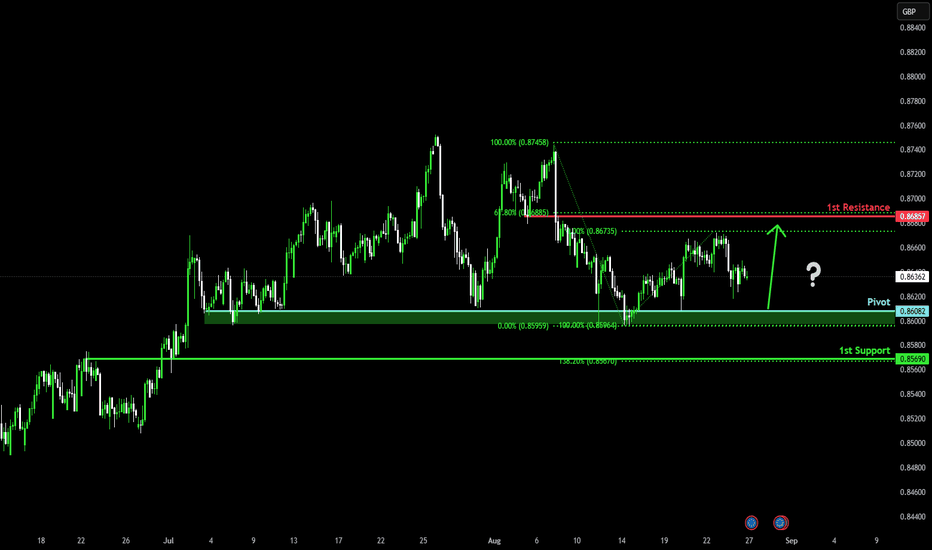

Falling towards major support?EUR/GBP is falling towards the pivot and could bounce to the 1st resistance which acts as a pullback resistance.

Pivot: 0.8608

1st Support: 0.8569

1st Resistance: 0.8658

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

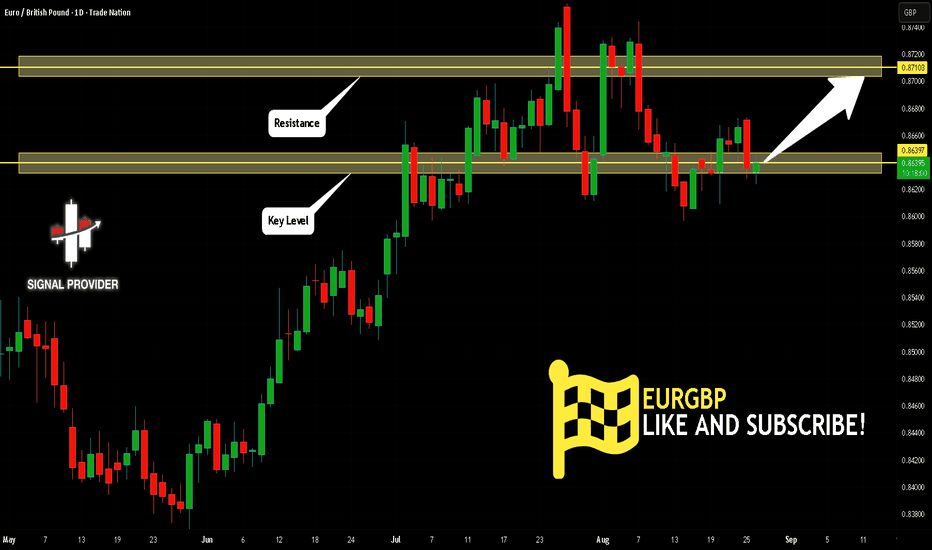

EURGBP Will Grow! Buy!

Take a look at our analysis for EURGBP.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 0.863.

Considering the today's price action, probabilities will be high to see a movement to 0.871.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

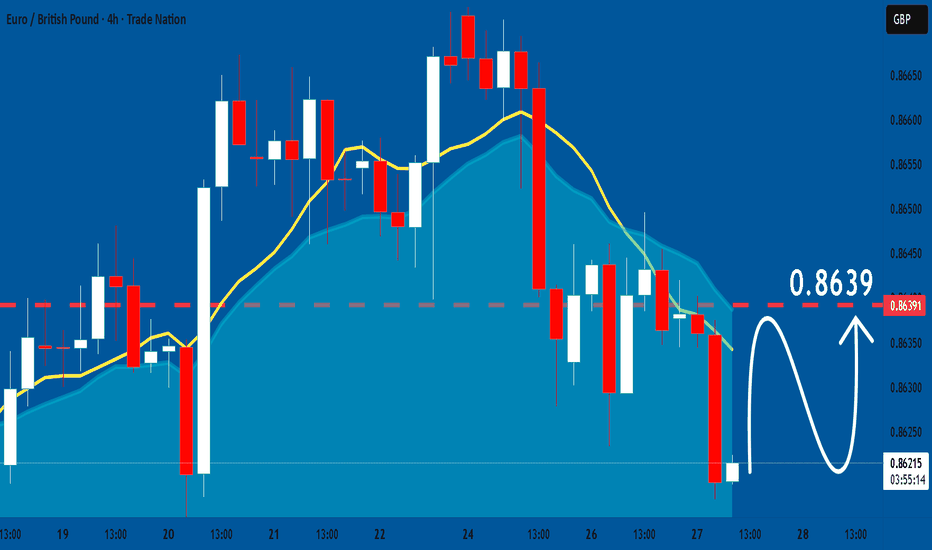

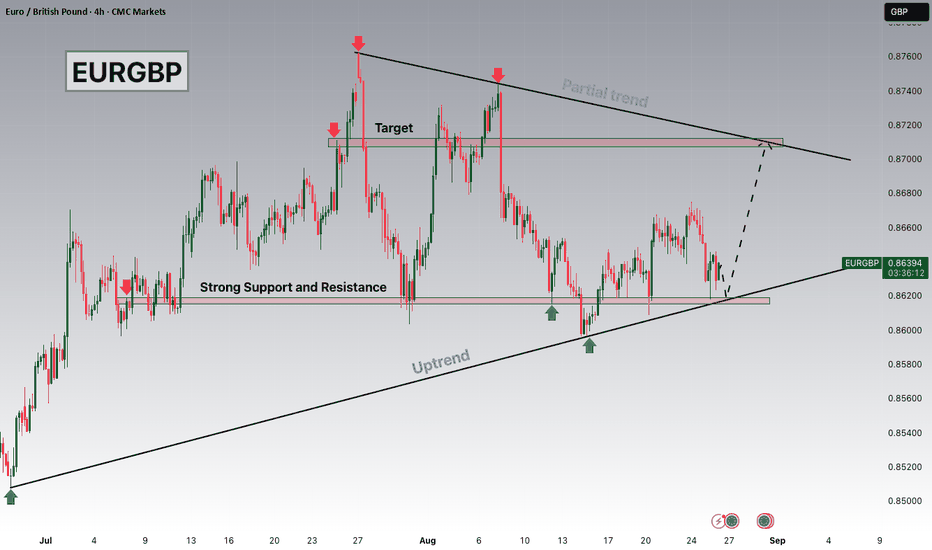

EURGBP Watching 0.86200 Support with 0.87100 in FocusIn today's session, EURGBP is trading within a broader uptrend, but price action is currently undergoing a correction phase. The pair is approaching the 0.86200 support zone, which aligns with the ascending trend structure that has been respected over recent weeks. This level has previously acted as both support and resistance, making it an area worth close attention.

Should price stabilize around 0.86200, the 0.87100 region becomes a logical area of interest. This zone is notable because it coincides with both a horizontal resistance level and the partial trend intersection, which often acts as a technical magnet for price.

Trade safe, Joe.

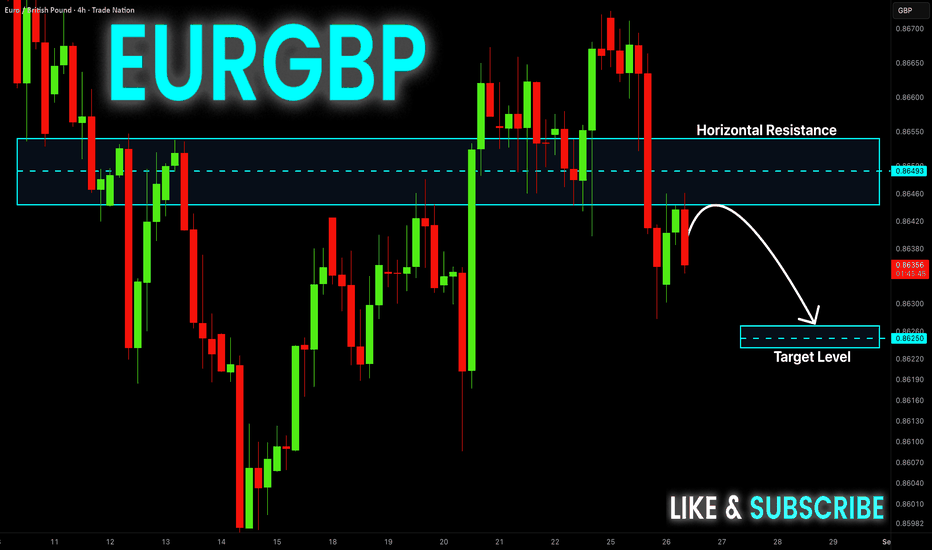

EUR-GBP Local Short! Sell!

Hello,Traders!

EUR-GBP made a retest

Of the horizontal resistance

Of 0.8651 from where

We are already seeing a

Local pullback and we will

Be expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

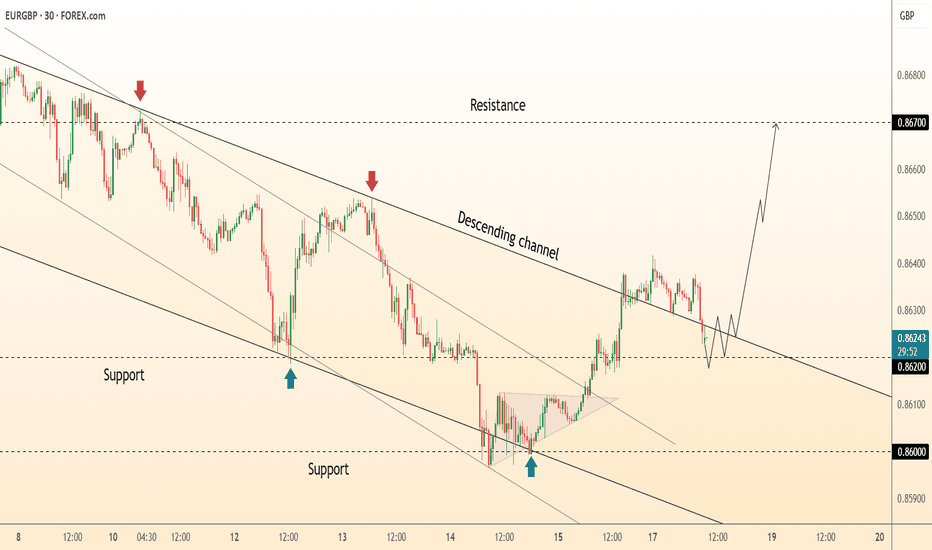

EUR/GBP Analysis – 4H Chart | Possible Trend Reversal Ahead?The EUR/GBP pair is currently trading around 0.8642 after a recent downtrend from the 0.8750 region. On the chart, we can see...

✔ Zig Zag Pattern: A clear series of lower highs and lower lows indicate a short-term bearish structure.

✔ Trendline Resistance: The blue descending trendline is acting as a dynamic resistance, and price has recently tested this level.

✔ Support Zone: Strong support is visible near 0.8638 – 0.8620, which has held multiple times in the past.

📉 RSI Analysis

The RSI (14) on the 4H timeframe is hovering near the 50 level, suggesting neutral momentum after recovering from an oversold area in early August. This signals potential consolidation before the next big move.

Key Observations

Price is currently consolidating around the 0.8640 area after rejecting lower levels.

A break above the trendline could signal a shift towards bullish momentum.

If rejected again, expect further downside toward 0.8600 or even 0.8550 in the medium term.

📈 Possible Scenarios

Bullish Case:

If price breaks and closes above 0.8670, we may see a move toward 0.8720 and 0.8750.

Bearish Case:

If price fails to break the trendline and drops below 0.8638, expect continuation to 0.8600 and 0.8550.

Strategy

Aggressive Buyers: Watch for a breakout retest above 0.8670.

Sellers: Look for rejection near trendline resistance for short entries with tight stops.

What do you think? Will EUR/GBP break the trendline or continue the downtrend? Drop your analysis in the comments!

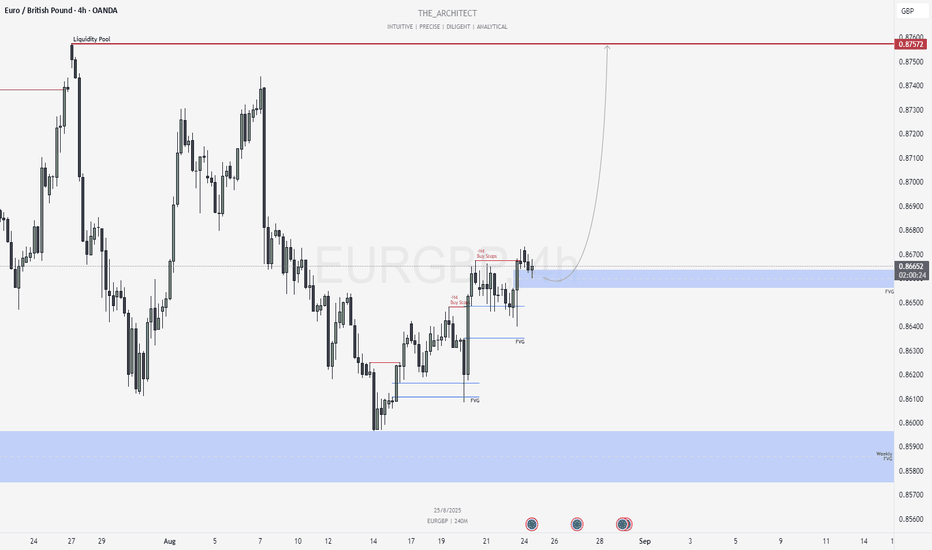

EURGBP: Bullish Continuation Setup from H4 Fair Value GapGreetings Traders,

In today’s analysis of EURGBP, we observe that the prevailing institutional order flow has shifted firmly bullish on the H4 timeframe. This directional bias positions us to focus on high-probability buying opportunities aligned with upside liquidity objectives.

Key Observations on H4:

Weekly FVG Rebalancing: Price recently rebalanced a weekly fair value gap (FVG), which acted as a higher timeframe inefficiency. Following this, we saw a market structure shift (MSS) on H4, confirming the transition from bearish to bullish order flow.

Liquidity Dynamics: After external range liquidity (buy stops) was taken, price began gravitating towards internal range liquidity (FVGs), reflecting the market’s natural movement from external to internal liquidity and vice versa.

H4 FVG Support: Price is currently trading within an H4 FVG, which we anticipate will act as a firm institutional support zone, offering a favorable area to seek long setups.

Trading Plan:

Entry Strategy: Look for confirmation-based entries on lower timeframes (M15 and below) within the H4 FVG to refine risk and validate bullish continuation.

Target Objective: Aim for upside liquidity pools, in alignment with institutional objectives to draw price higher and capture resting buy-side liquidity.

Remain patient, let the market confirm your bias, and execute with disciplined risk management.

Kind regards,

The Architect 🏛️📈

EURGBP bullish bounce back supported at 0.8590The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.8590 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.8590 would confirm ongoing upside momentum, with potential targets at:

0.8680 – initial resistance

0.8713 – psychological and structural level

0.8745 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.8590 would weaken the bullish outlook and suggest deeper downside risk toward:

0.8567 – minor support

0.8532 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURGBP holds above 0.8590 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DeGRAM | EURGBP will test the support level📊 Technical Analysis

● EUR/GBP has bounced off the lower boundary of its descending channel around 0.8600, forming a short-term higher-low signal.

● A rally above the sloping resistance (former mid-channel line near 0.8620) would validate the bounce and likely extend gains toward 0.8670 resistance.

💡 Fundamental Analysis

● UK GDP growth of 0.3% in Q2 exceeded forecasts and boosted sterling resilience, tempering rate-cut expectations from the Bank of England. Market sentiment sees fewer BoE cuts ahead.

● Mixed UK labor data—slower hiring but sustained wage growth—reinforces the BoE’s cautious stance, supporting GBP rather than encouraging dovish easing.

● Meanwhile, investors expect ECB rates to stay "higher for longer," reducing pressure for euro weakening despite prior policy divergence.

✨ Summary

Long above 0.8620; target ~0.8670. Setup invalidated if price closes below 0.8600.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

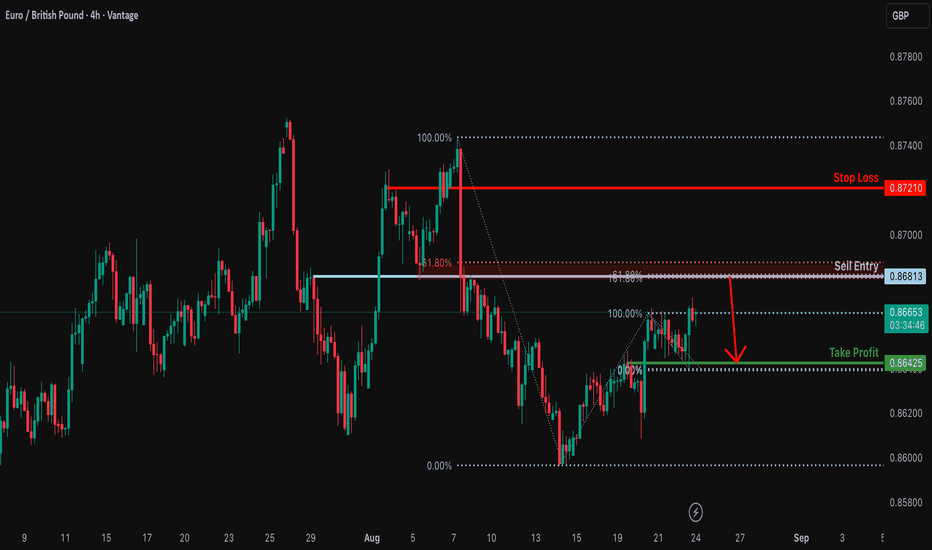

Rising towards Fibonacci confluence?EUR/GBP is rising towards the resistance level, which is an overlap resistance that lines up with the 161.8% Fibonacci extension, 61.8% Fibonacci projection and also slightly below the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 0.8681

Why we like it:

There is an overlap resistance that lines up with the 161.8% Fibonacci extension, 61.8% Fibonacci projection and slightly below the 61.8% Fibonacci retracement.

Stop loss: 0.8721

Why we like it:

There is a pullback resistance.

Take profit: 0.8642

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EURGBP Weekly Forecast – Q3 | W35 | Y25

📊 EURGBP – WEEKLY FORECAST

📈 EURGBP Weekly Forecast – Q3 | W35 | Y25

A very straightforward outlook this week — let’s get stuck in!

Price is currently trending above the weekly 50 EMA, which means higher-probability trades will be to the long side.

As I always say:

This doesn’t mean buy, buy, buy — it means buy smart ✅

Look for confluence, not impulse.

📌 The Plan:

We’re waiting for a pullback into key areas — order blocks and imbalances marked out on the chart.

Once price taps those zones, we’ll look for a lower time frame break of structure as confirmation before executing long positions.

Keep it simple. Stick to the process. Let the market show its hand. ♟️

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

— FRGNT

FX:EURGBP

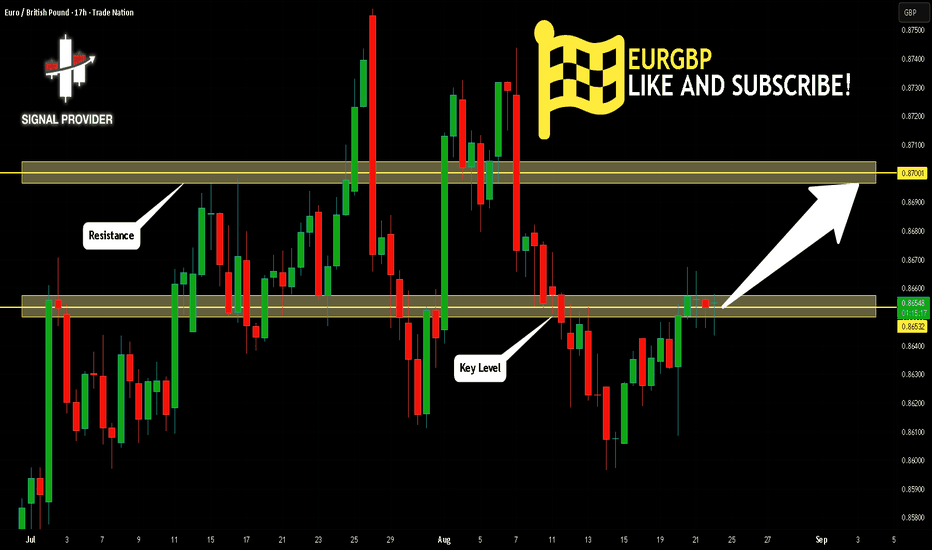

EURGBP Will Go Up! Buy!

Take a look at our analysis for EURGBP.

Time Frame: 17h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 0.865.

Considering the today's price action, probabilities will be high to see a movement to 0.870.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURGBP - LongEURGBP Analysis - LONG 👆

In this Chart EURGBP H4 Timeframe: By Nii_Billions.

❤️This Chart is for EURGBP market analysis.

❤️Entry, SL, and Target is based off our Strategy.

This chart analysis uses multiple timeframes to analyze the market and to help see the bigger picture on the charts.

The strategy uses technical and fundamental factors, and market sentiment to predict a BULLISH trend in EURGBP, with well-defined entry, stop loss, and take profit levels for risk management.

🟢This idea is purely for educational purposes.🟢

❤️Please, support our work with like & comment!❤️

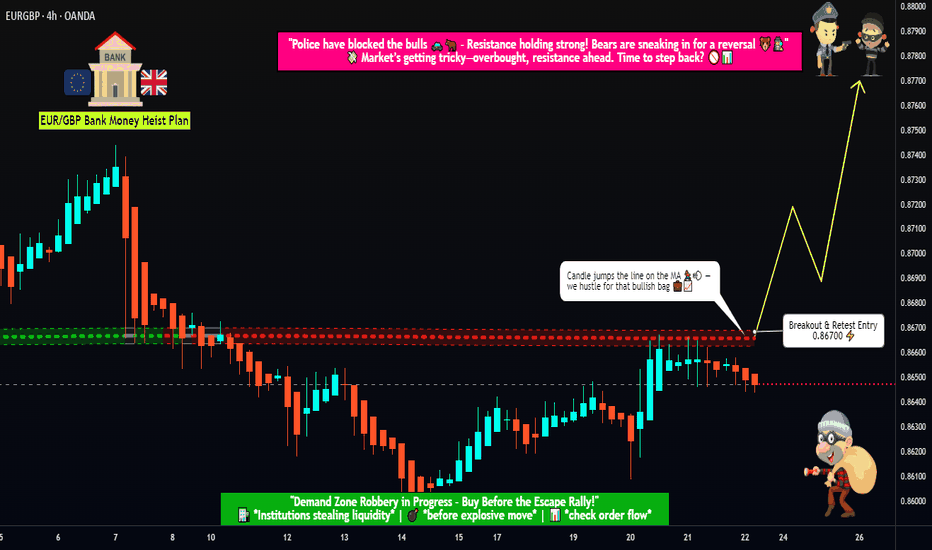

EUR/GBP "The Chunnel" Breakout Heist Plan – Ready to Rob?🚨💷 EUR/GBP "The Chunnel" Forex Bank Heist Plan 🎭💰

Dear Ladies & Gentlemen (Thief OG’s) 🕵️♂️💎,

We are setting up a Bullish Pending Order Robbery at the Forex Bank! 🔥

The “Chunnel” is about to break wide open – and we thieves are waiting with bags wide open. 💼💵

🎯 Master Heist Plan (Swing Trade)

Entry (Breakout Trigger) ⚡:

📍 Main Breakout at 0.86700

💡 Set alarm in TradingView so you won’t miss the break-in moment! ⏰

Thief Layered Entries (Layer Strategy) 💎:

Buy Layer 1: 0.86700

Buy Layer 2: 0.86600

Buy Layer 3: 0.86500

Buy Layer 4: 0.86400

(You can add more layers if you want to stack up the robbery 📊💰)

Stop Loss (Thief SL) 🛑:

Hide the escape tunnel at 0.86200 🚪💨

(Place SL only after breakout confirmation. Adjust based on your own risk + thief strategy ⚖️)

Target 🎯 (Escape Before Police Arrives 🚔):

💎 Profit Exit: 0.87800

Don’t get greedy – police barricades are waiting ahead 🚨, escape clean with stolen profits! 💵

🕵️ Thief Strategy Notes

Pending breakout confirmation is the key 🔑

Layer entries = stacking multiple buy orders 🧱

Always confirm breakout before locking in positions 🔒

Adjust SL & TP to your own robbery style + risk appetite 📊

💰📈 This is not just trading, it’s a planned forex bank heist.

Every entry, every layer, every stop loss = another step to escape with full bags of stolen pips 💼💵.

🔥 If you like this heist plan, smash the BOOST button and join the Thief Gang 🚀🐱👤

Together, we rob the market – and escape before the cops even show up 🚨💸

EURGBP – DAILY FORECAST Q3 | W34 | D22 | Y25📊 EURGBP – DAILY FORECAST

Q3 | W34 | D22 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURGBP