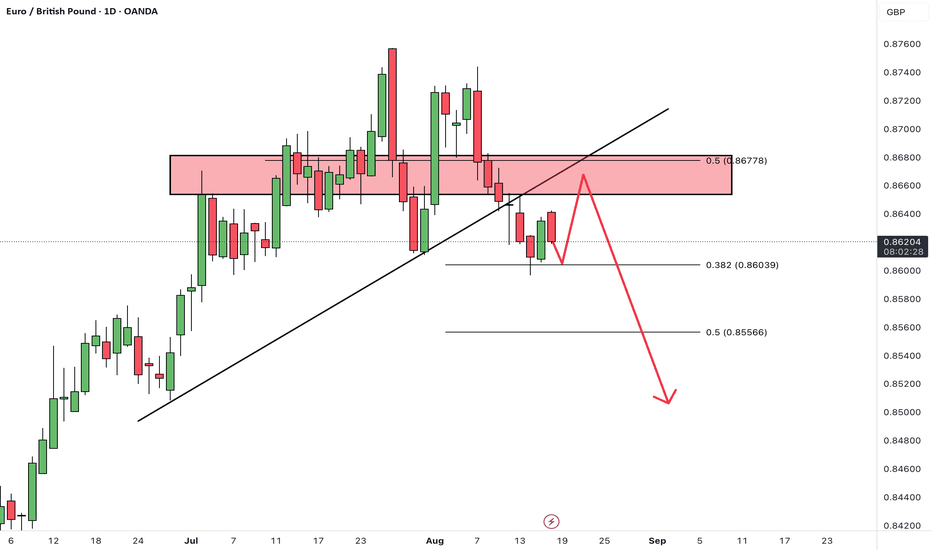

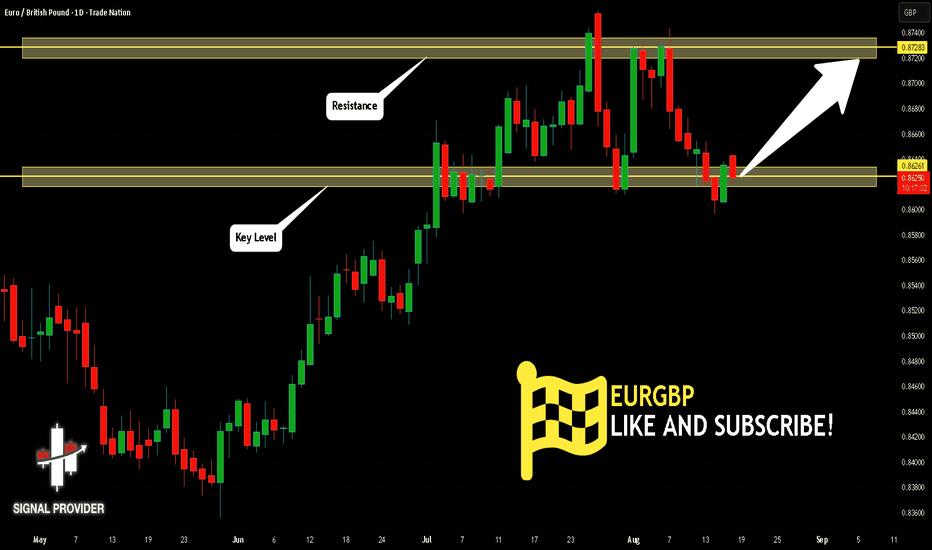

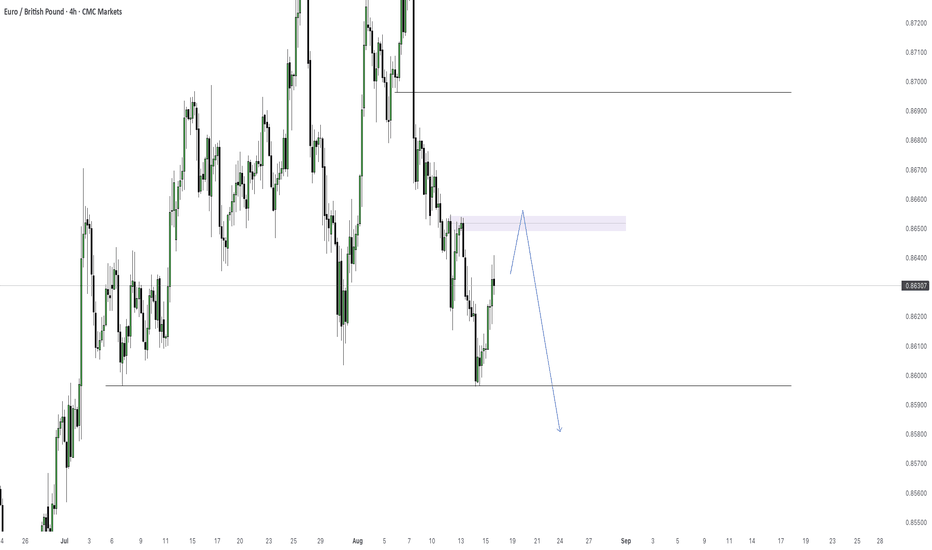

EURGBP short due to weak Euro area PMI and Strong UK PMI DataThe most recent Euro Area Services PMI data available is for August 2025, showing a value of 50.7, down from 51.2 in July 2025, and slightly below the forecast of 50.8. This indicates a slight slowdown in the services sector's expansion, as a reading above 50 still denotes growth, but the drop suggests a loss of momentum.

The most recent data for the UK Services PMI, specifically the S&P Global/CIPS Services PMI for August 2025, is 53.6, surpassing the forecast of 51.8 and improving from the previous reading of 51.8 in July 2025. This indicates a stronger expansion in the UK services sector, reflecting robust business activity.

Due to the above economic data result, we expect the Euro to weaken against the Pound.

This is a classic example of trading strong data vs weak data.

Eurgbp!

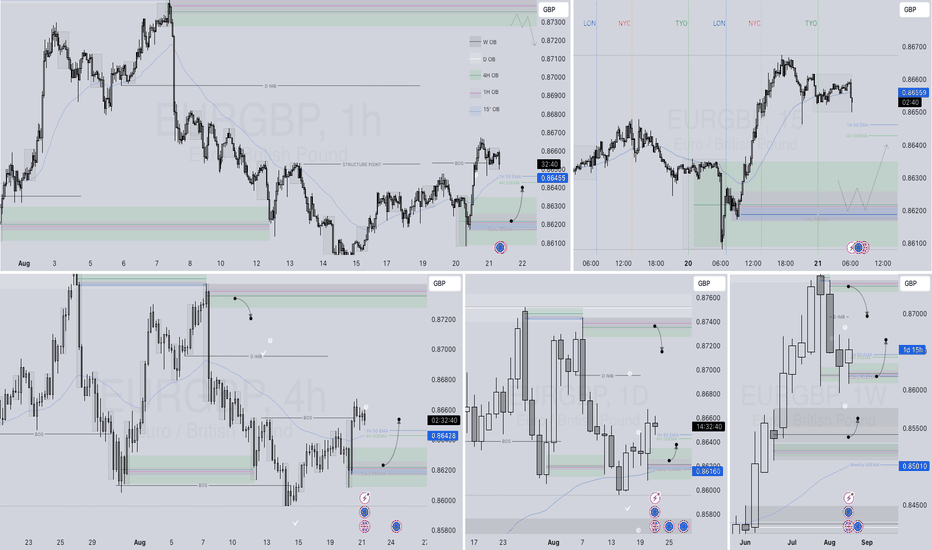

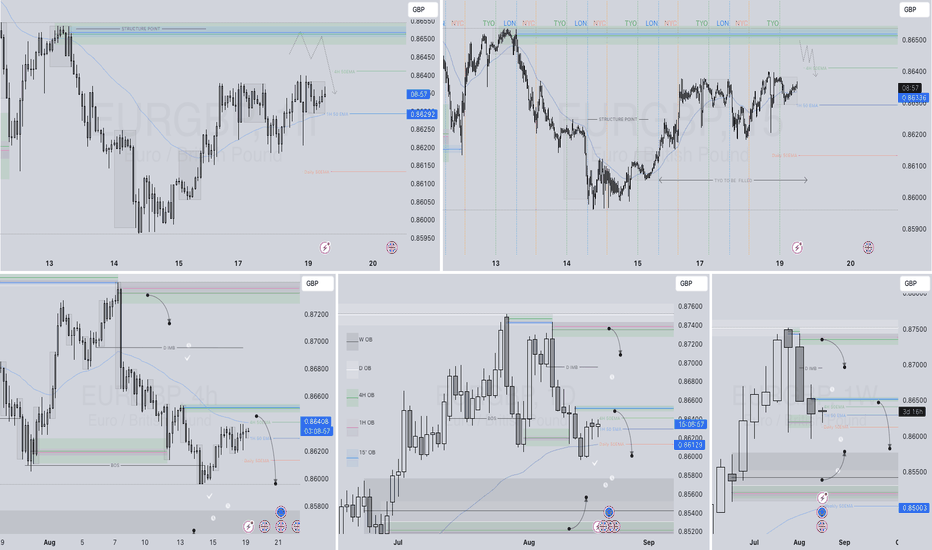

EURGBP – DAILY FORECAST Q3 | W34 | D21 | Y25📊 EURGBP – DAILY FORECAST

Q3 | W34 | D21 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURGBP

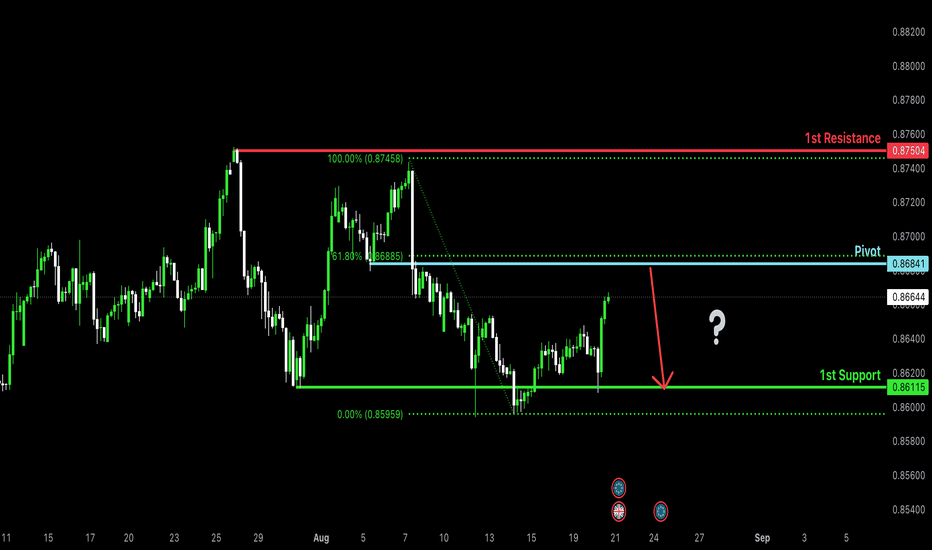

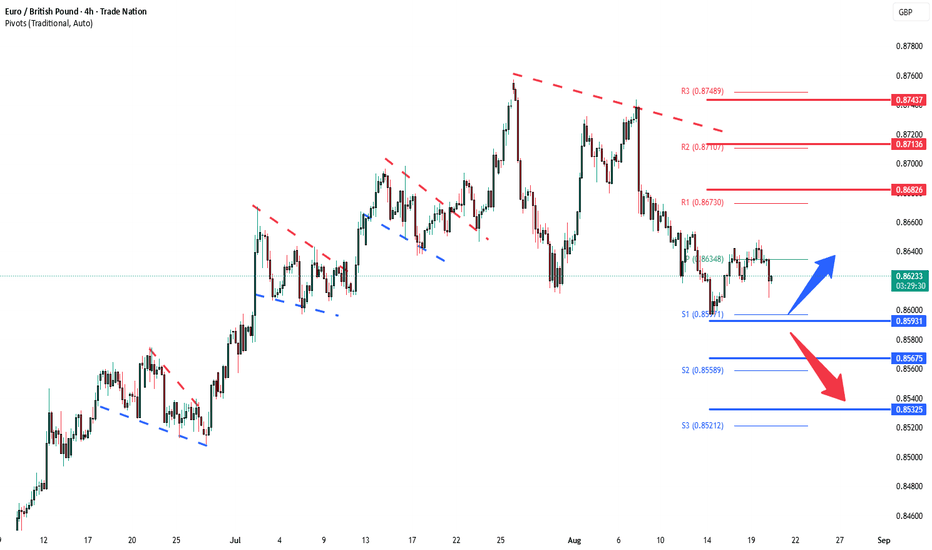

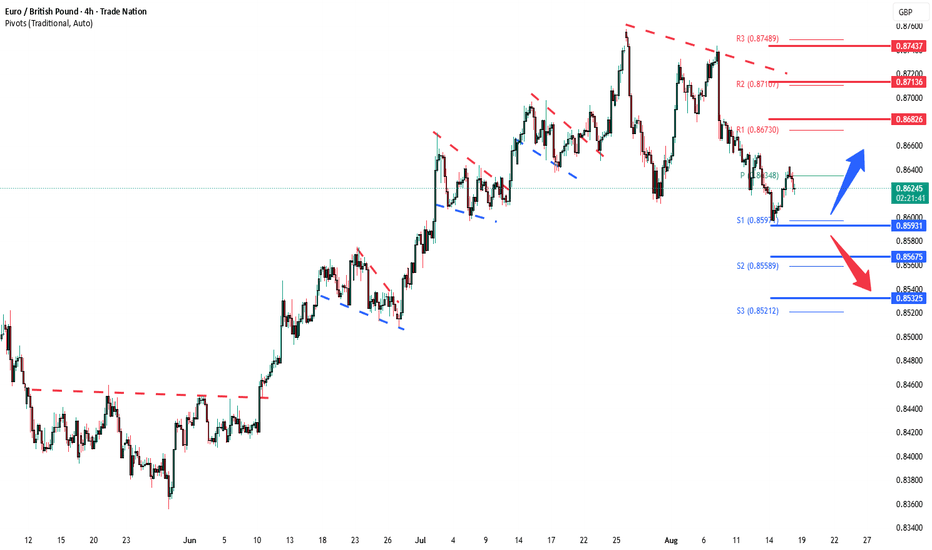

Bearish reversal off 61.8% Fibonacci resistance?EUR/GBP is rising towards the pivot, which acts as a pullback resistance that lines up with the 61.8% Fibonacci retracement and could reverse to the 1st support.

Pivot: 0.8684

1st Support: 0.8611

1st Resistance: 0.8750

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

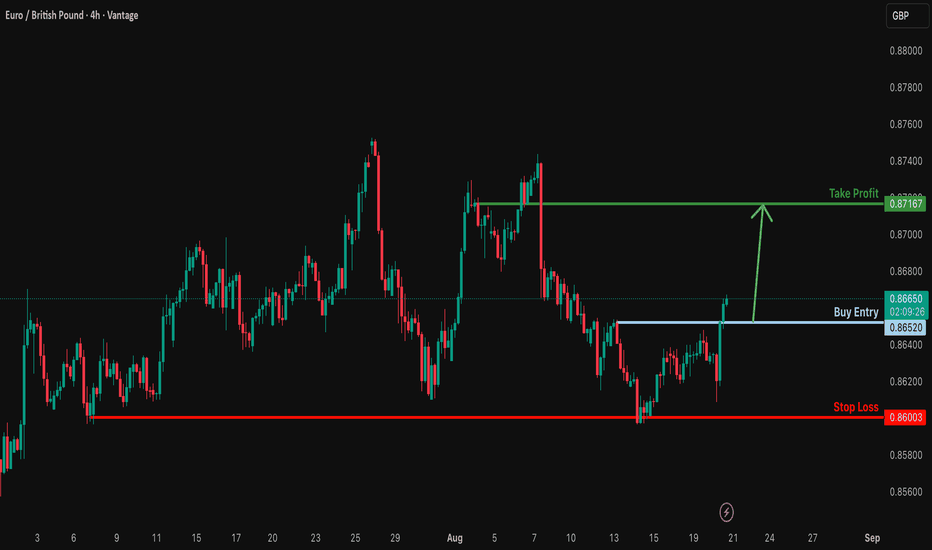

Bullish bounce off?EUR/GBP is falling towards the support level which is a pullback support and could bounce from this level to our take profit.

Entry: 0.8652

Why we like it:

There is a pullback support level.

Stop loss: 0.8600

Why we lilk eit:

There is a multi swing low support.

Take profit: 0.8716

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

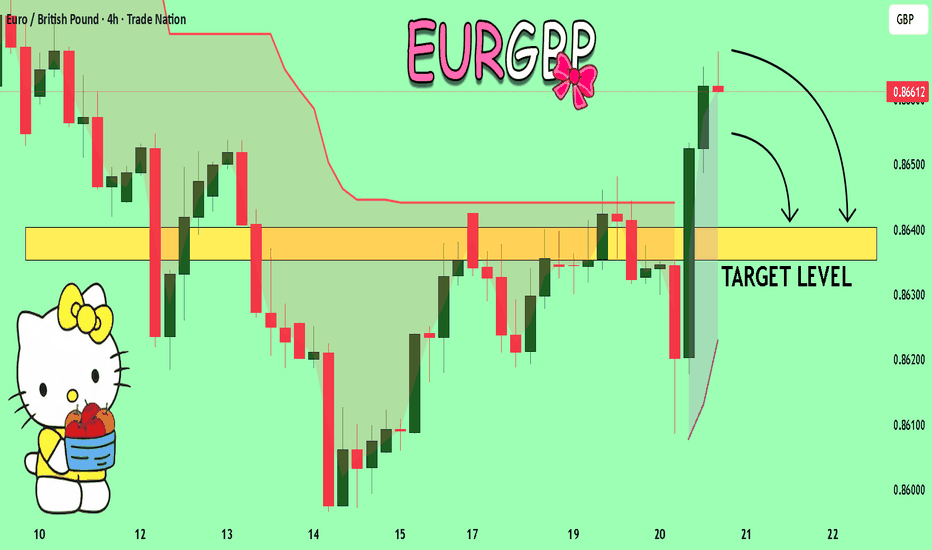

EURGBP Trading Opportunity! SELL!

My dear followers,

I analysed this chart on EURGBP and concluded the following:

The market is trading on 0.8661 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.8640

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

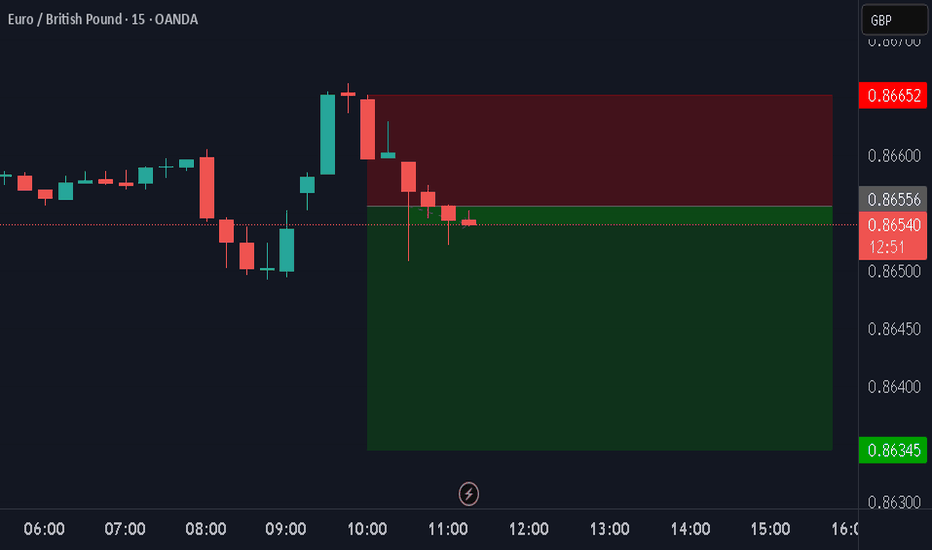

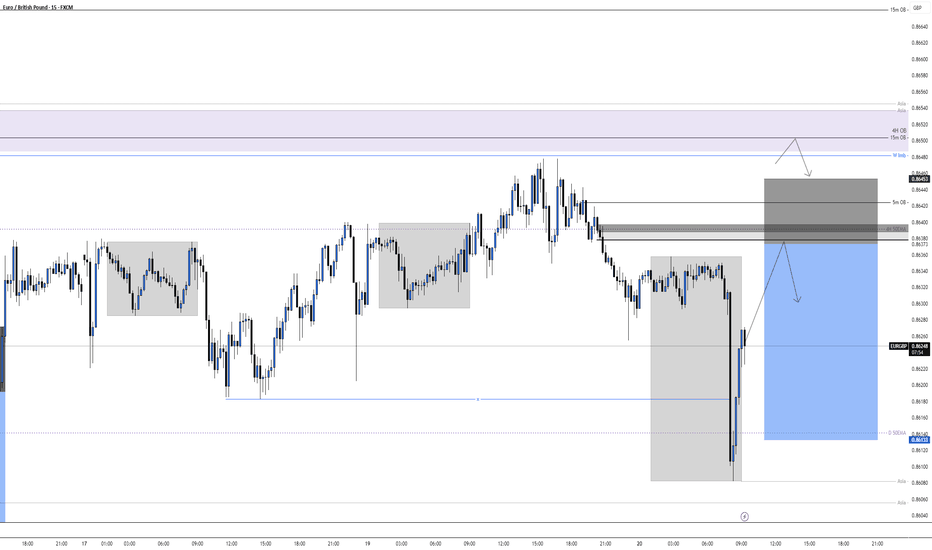

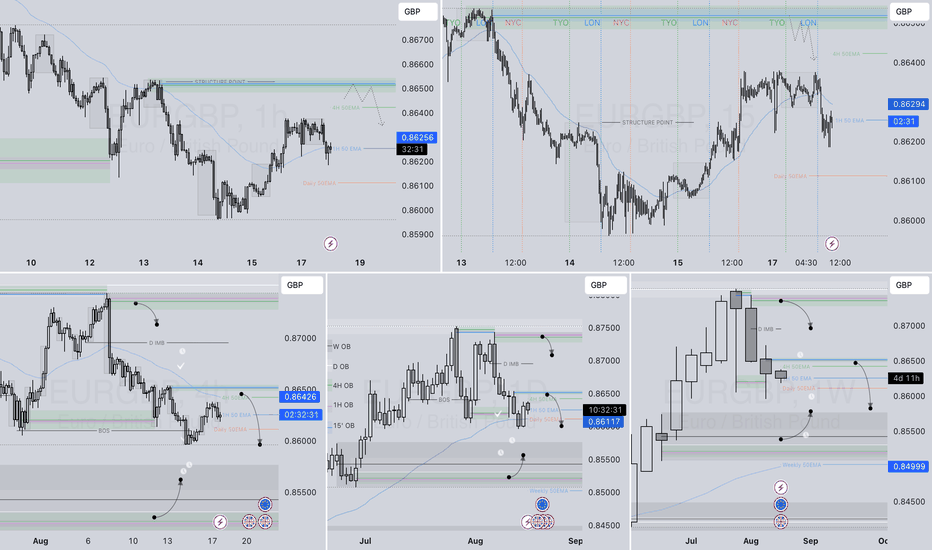

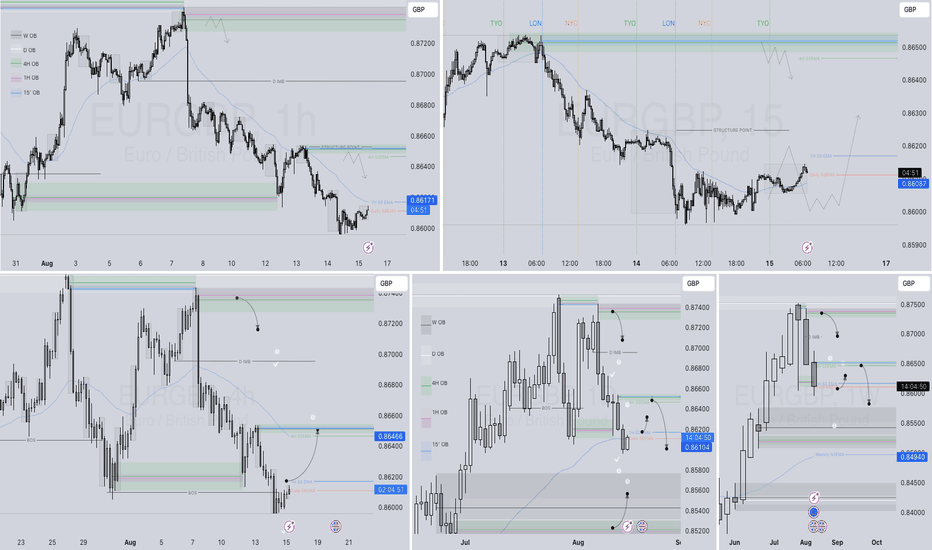

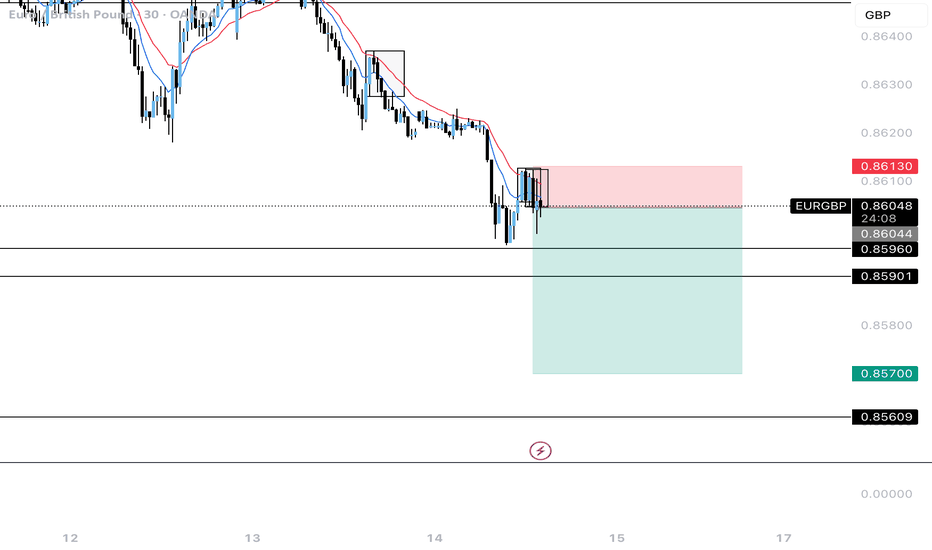

EURGBP Short, 20 AugustBearish Trend with EMA + OB Confluence

HTF bias stays bearish – price rejects from Daily EMA buy-side just to fuel HTF continuation down. 4H EMA is aligned bearish, with a clean 4H OB above as an alternative POI.

📈 HTF Confluence:

⬇️ 4H + Daily trend remain bearish

📍 4H EMA + 4H OB in play

⚡ Rejecting bullish Daily EMA → likely liquidity grab before continuation

📉 LTF Context:

💤 Asia range formed

📉 15m trend bearish with fresh BOS

🎯 Two possible POIs: current 15m OB near 4H EMA or higher 4H OB → chose current zone for entry

⚠️ Accepting risk that price may reach higher POI and take SL before continuation

🎯 Entry Plan:

✅ 50% risk placed on tap entry at 15m Decisional OB (volume-rich, possible immediate drop)

⏳ Remaining 50% reserved for LTF confirmation (1m BOS) or higher OB setup

🎯 TP: aiming asia low aligned with 1:3 RR

🛡 SL: Above 5m OB (risking sweep)

📌 TP: Targeting Asia lows / continuation into bearish HTF leg

EURGBP pullback to pivotal support zone. The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.8590 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.8590 would confirm ongoing upside momentum, with potential targets at:

0.8680 – initial resistance

0.8713 – psychological and structural level

0.8745 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.8590 would weaken the bullish outlook and suggest deeper downside risk toward:

0.8567 – minor support

0.8532 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURGBP holds above 0.8590 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

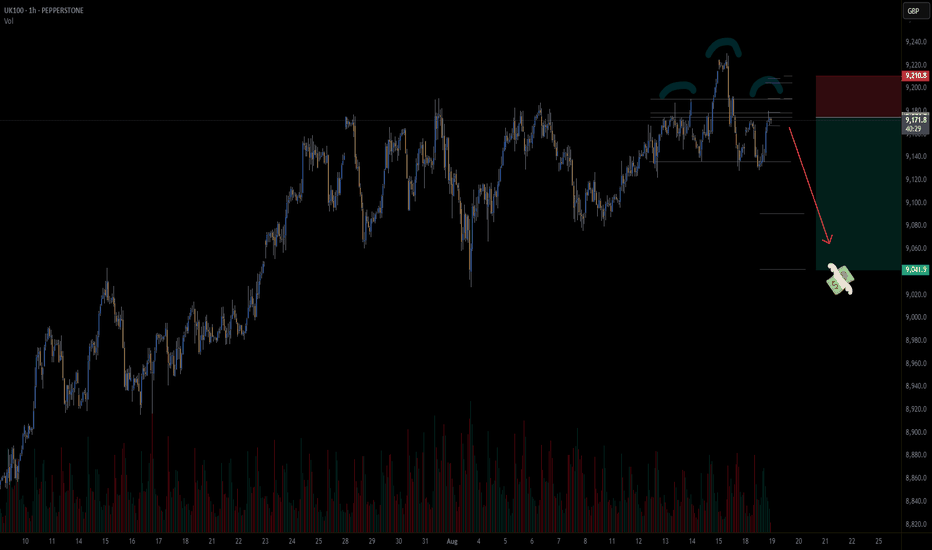

UK100 - potential head and shoulders on 1 hour chartWatching the UK100 for a potential short entry.

A head and shoulders pattern appears to be forming on the 1-hour chart. All my entry variables are currently met, but I’m holding off for now.

The UK100 will close in the next hour or two, and I prefer not to open a large position overnight due to potential slippage from market gaps. I’ll wait until tomorrow to see if my conditions are still valid before entering.

Trade Details:

📊 Risk/Reward: 3.5

🎯 Entry: 9 174.7

🛑 Stop Loss: 9 204.9

💰 Take Profit 1 (50%): 9 090.8

💰 Take Profit 2 (50%): 9 042.2

#GTradingMethod Tip: Always consider market timing and overnight risk when entering trades.

Thanks for checking out my post! Make sure to follow me to catch the next update. If you found this helpful, give it a like 👍 and share your thoughts 💬 — I’d love to hear what you think!

Please note: This is not financial advice. This content is to track my trading journey and for educational purposes only.

EURGBPHello Traders! 👋

What are your thoughts on EURGBP?

The EUR/GBP pair has broken both its support zone and the ascending trendline.

After a pullback toward the broken zone, price is likely to extend its decline toward the next key downside targets.

Bias: Bearish as long as price remains below the broken support/trendline.

Don’t forget to like and share your thoughts in the comments! ❤️

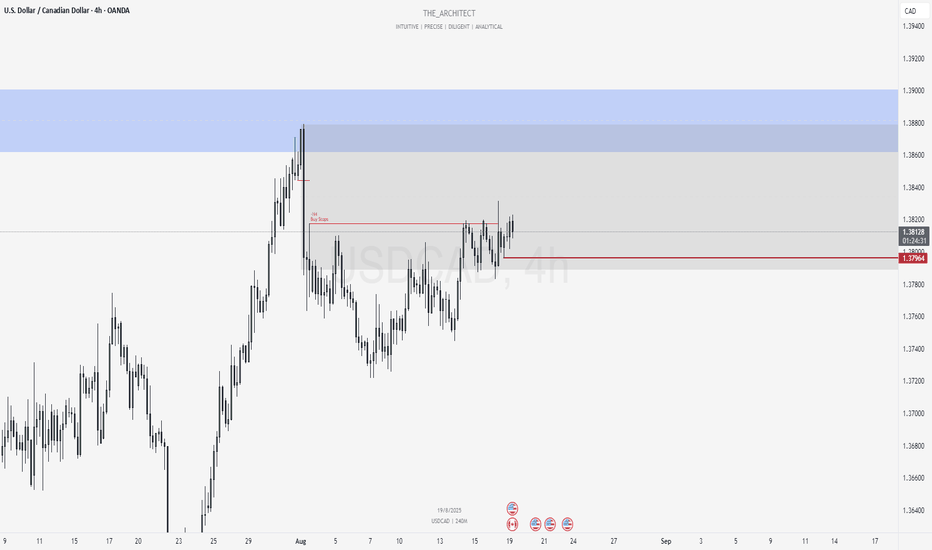

August 11, Forex Outlook: Key Market Expectations for the Week!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

USDCAD

EURGBP

EURJPY

GBPCHF

USDCHF

NZDCHF

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

EURGBP – DAILY FORECAST Q3 | W34 | D19 | Y25📊 EURGBP – DAILY FORECAST

Q3 | W34 | D19 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURGBP

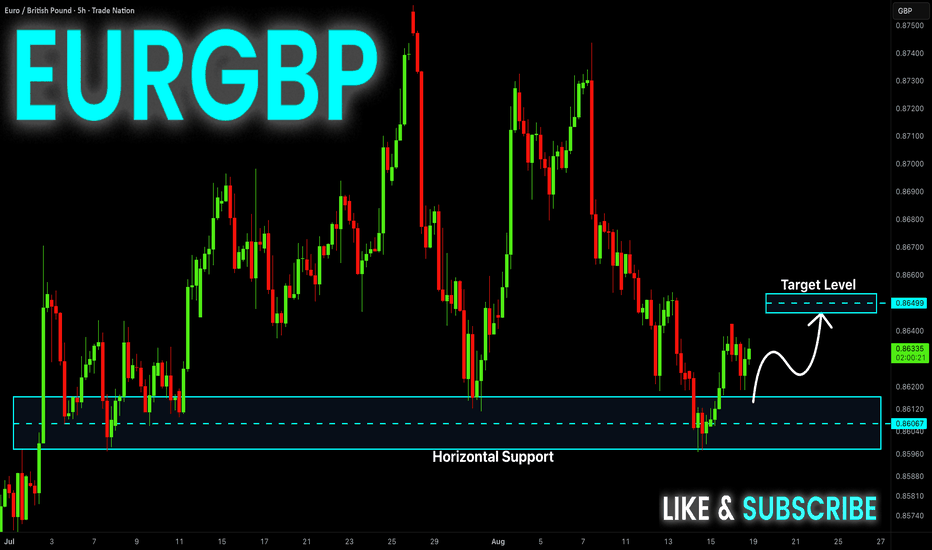

EUR-GBP Will Grow! Buy!

Hello,Traders!

EUR-GBP made a retest

Of the horizontal support

Of 0.8604 from where

We are already seeing a

Bullish rebound and we

Will be expecting a

Further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

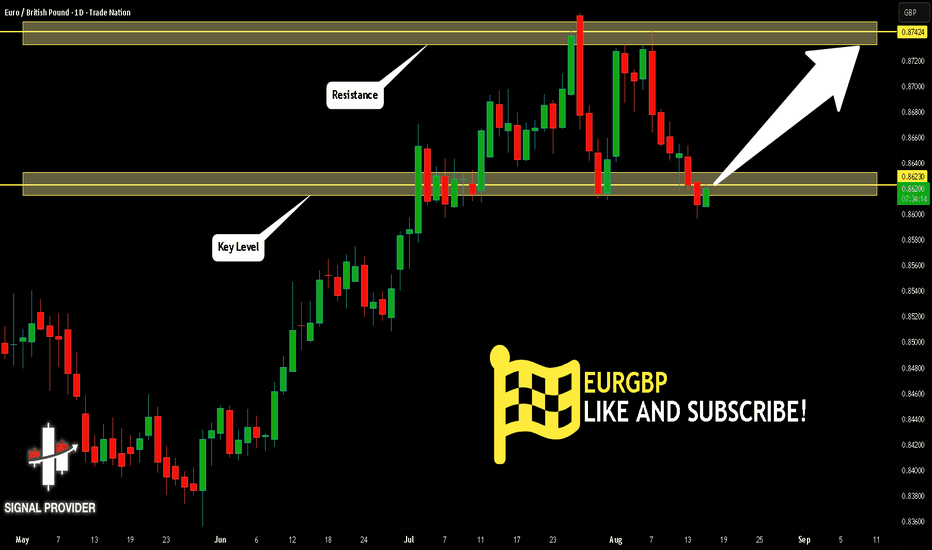

EURGBP Will Go Up From Support! Buy!

Please, check our technical outlook for EURGBP.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 0.862.

The above observations make me that the market will inevitably achieve 0.872 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURGBP at pivotal support at 0.8590The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.8590 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.8590 would confirm ongoing upside momentum, with potential targets at:

0.8680 – initial resistance

0.8713 – psychological and structural level

0.8745 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.8590 would weaken the bullish outlook and suggest deeper downside risk toward:

0.8567 – minor support

0.8532 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURGBP holds above 0.8590 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURGBP – DAILY FORECAST Q3 | W34 | D18 | Y25📊 EURGBP – DAILY FORECAST

Q3 | W34 | D18 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURGBP

Market Analysis: EUR/GBP Attempts to Find SupportMarket Analysis: EUR/GBP Attempts to Find Support

EUR/GBP declined and is now consolidating losses above 0.8600.

Important Takeaways for EUR/GBP Analysis Today

- The British Pound is attempting a fresh increase above 1.3500.

- There is a key bullish trend line forming with support near 1.3550 on the hourly chart of GBP/USD.

EUR/GBP Technical Analysis

On the hourly chart of EUR/GBP, the pair started a steady decline from well above 0.8700. The Euro traded below 0.8650 against the British Pound.

The EUR/GBP chart shows that the pair even declined below 0.8620 and the 50-hour simple moving average. A low was formed at 0.8596 and the pair is now consolidating losses. There was a move above 0.8620 and the 23.6% Fib retracement level of the downward move from the 0.8743 swing high to the 0.8596 low.

The pair is now facing resistance near a connecting bearish trend line at 0.8635. The next major barrier for the bulls could be the 50% Fib retracement at 0.8670.

A close above 0.8670 might accelerate gains. In the stated case, the bulls may perhaps aim for a test of 0.8685. Any more gains might send the pair toward the 0.8740 pivot.

Immediate support sits near 0.8620. The first key zone sits at 0.8595. A downside break below 0.8595 might call for more downsides. In the stated case, the pair could drop toward 0.8550.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

DeGRAM | EURGBP reached the lower boundary of the channel📊 Technical Analysis

● EURGBP rebounded from the lower boundary of its descending channel, signaling a potential short-term trend reversal.

● A break above 0.8634 resistance could trigger a rally toward 0.8694, while holding above 0.8607 keeps the bullish scenario intact.

💡 Fundamental Analysis

● Euro support is emerging as ECB officials hint at delaying further easing, while UK growth data underperformed expectations, softening GBP demand.

✨ Summary

Bullish above 0.8607; targets 0.8634 → 0.8694. Invalidation below 0.8607.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

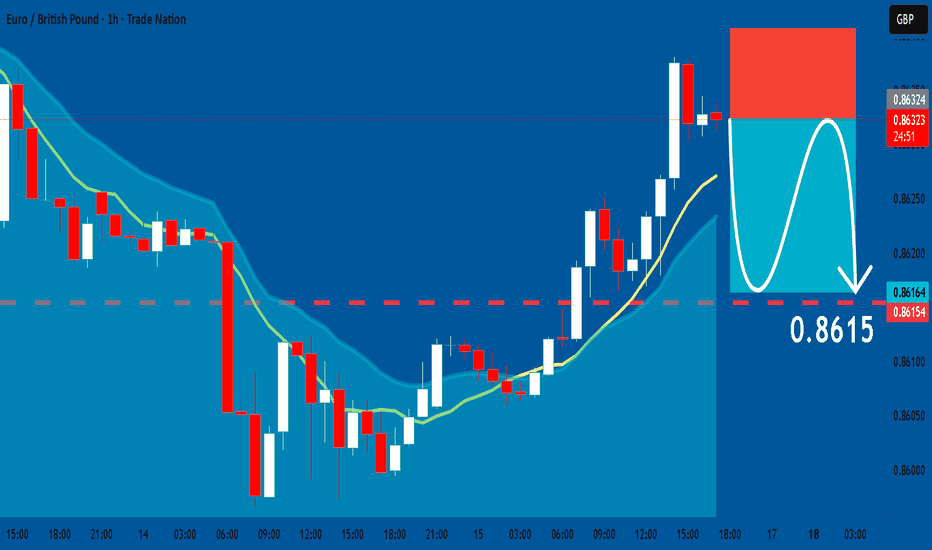

EURGBP: Trading Signal From Our Team

EURGBP

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short EURGBP

Entry Point - 0.8632

Stop Loss - 0.8640

Take Profit - 0.8615

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURGBP Will Go Up From Support! Buy!

Please, check our technical outlook for EURGBP.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 0.862.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 0.874 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURGBP – DAILY FORECAST Q3 | W33 | D15 | Y25📊 EURGBP – DAILY FORECAST

Q3 | W33 | D15 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURGBP

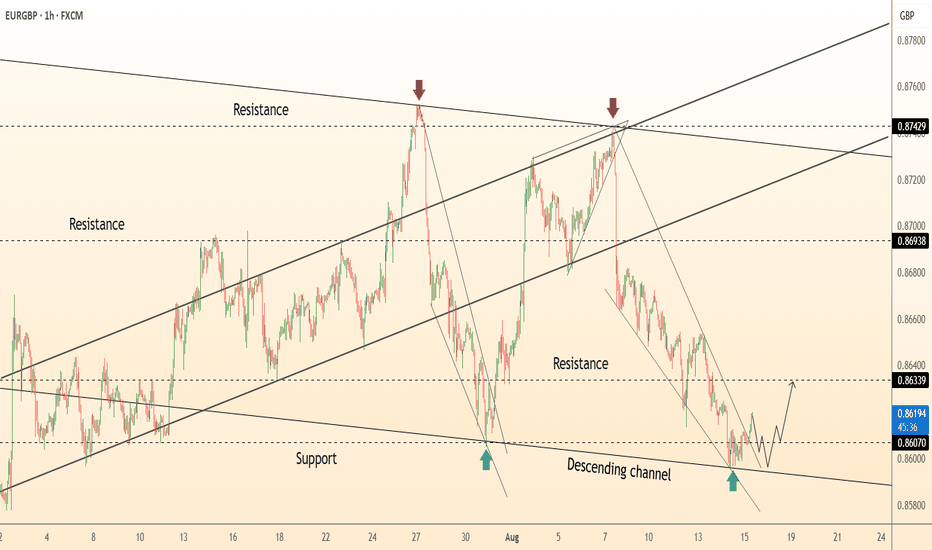

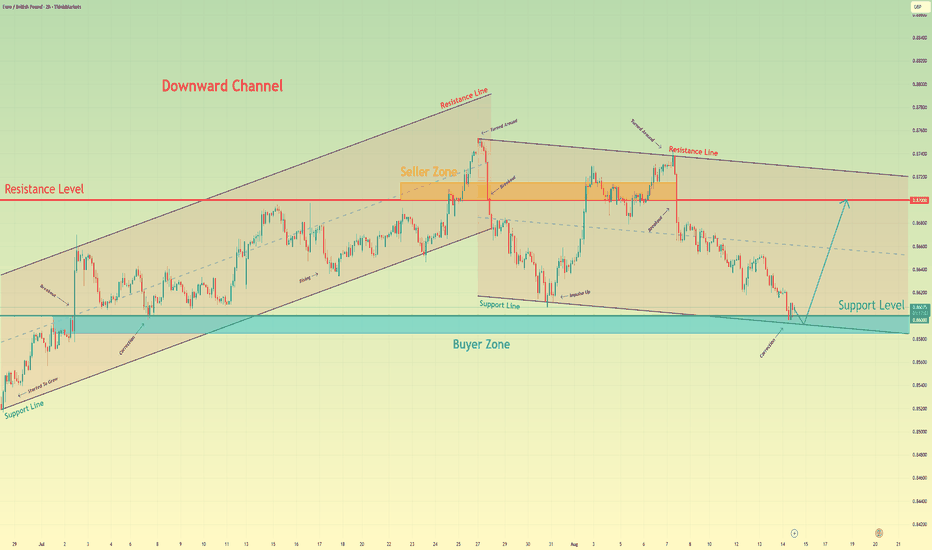

British Pound will bounce up from support line of channelHello traders, I want share with you my opinion about British Pound. The market structure has undergone a notable transition from a bullish to a bearish phase, with the breakdown from a prior upward channel leading to the formation of a new, well-defined downward channel. This has shifted the market's momentum, with price action now being governed by the descending boundaries of this new formation, respecting the seller zone near the top and finding temporary footing at the bottom. The price has recently completed a significant downward impulse within this structure, arriving at a critical confluence of support around the 0.8600 level. This area is highly significant as it represents the intersection of the channel's lower support line and a strong horizontal buyer zone that has previously provided a floor for the price. The primary working hypothesis is a long, rotational scenario, based on the high probability of a bullish reaction from this key support cluster. A confirmed bounce from the buyer zone would signal that a corrective upward rebound is underway, offering an opportunity for a move back towards the upper boundary of the channel. Therefore, the TP for this long idea is logically placed at the 0.8700 resistance level. This target aligns perfectly with the major seller zone and the channel's upper resistance line, representing the most probable destination for a counter-trend rally of this nature. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.