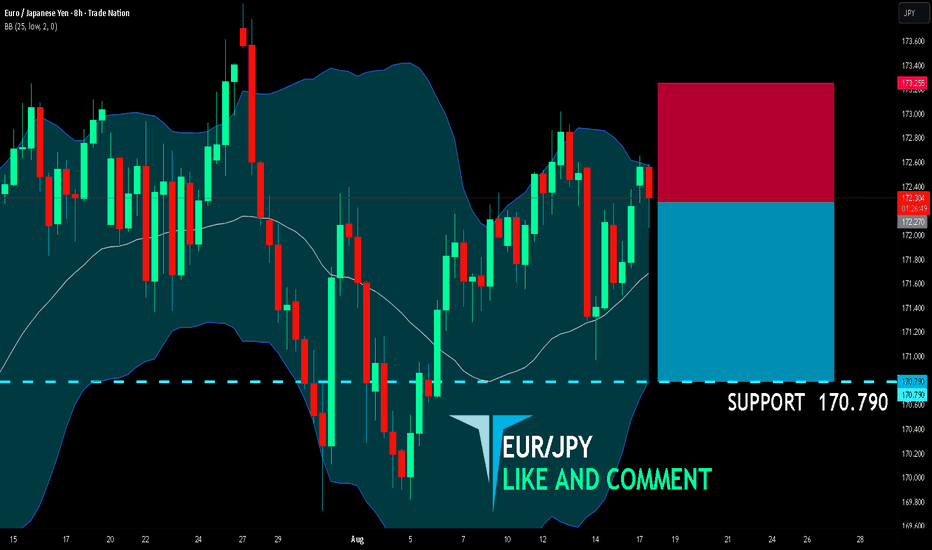

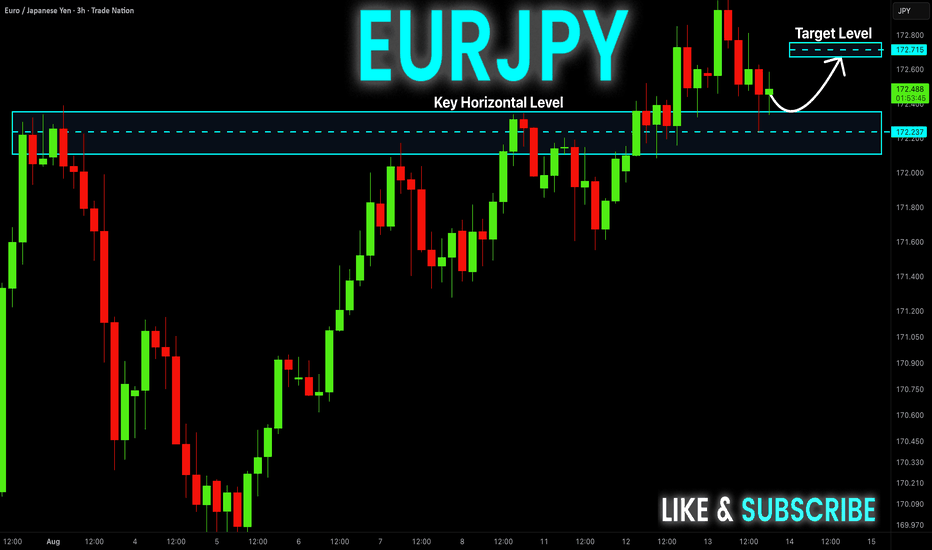

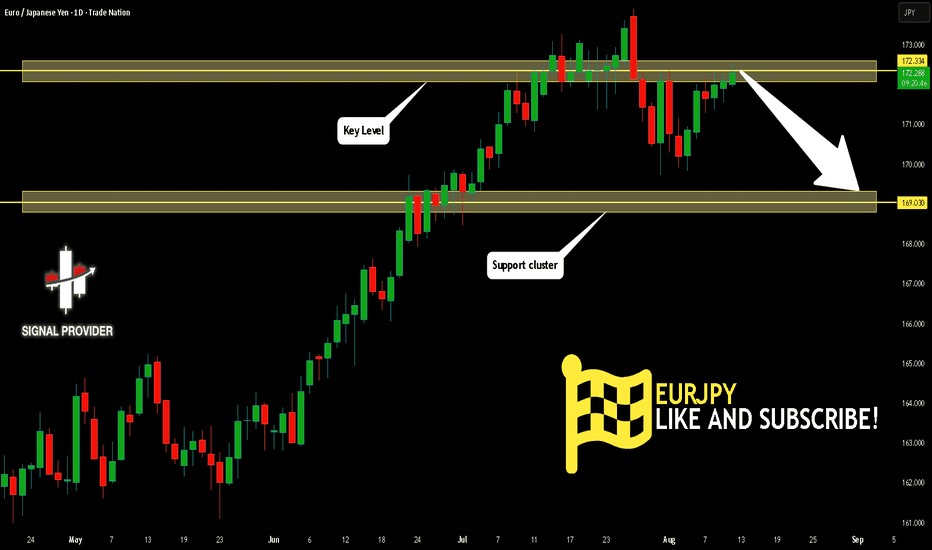

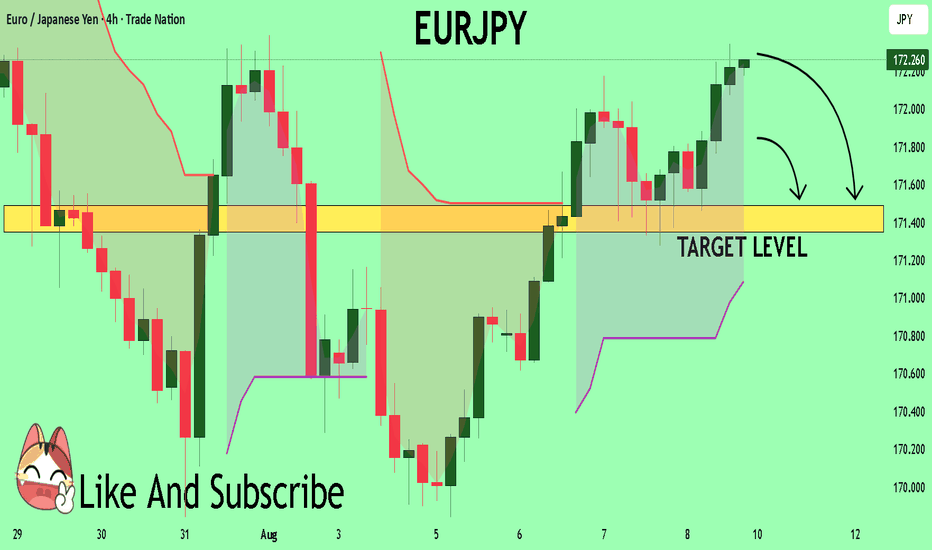

EUR/JPY SHORT FROM RESISTANCE

EUR/JPY SIGNAL

Trade Direction: short

Entry Level: 172.270

Target Level: 170.790

Stop Loss: 173.255

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 8h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Eurjpy!

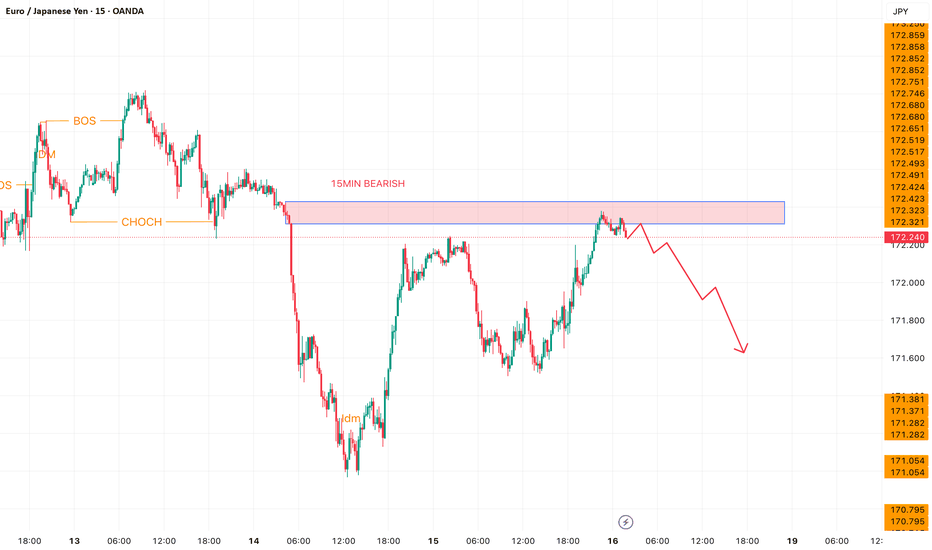

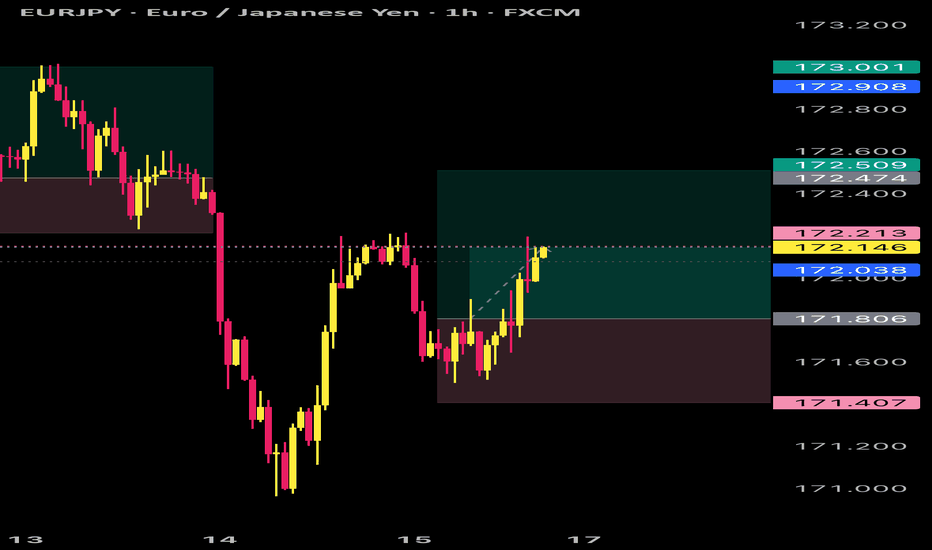

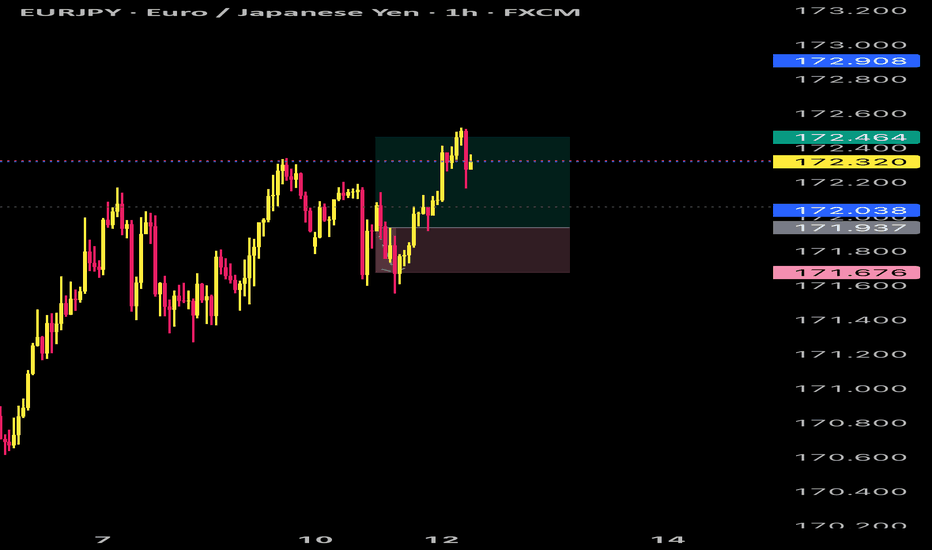

EURJPY 15MIN Timeframe Sell tradeAt the current exchange rate of 172.240, the EURJPY pair appears to be in a bearish setup according to the SMC analysis. This assessment is supported by both divergence and candlestick confirmation. Based on these indicators, I anticipate that a sell trade could yield a profitable outcome.

SL: 172.455

TP: 171.645

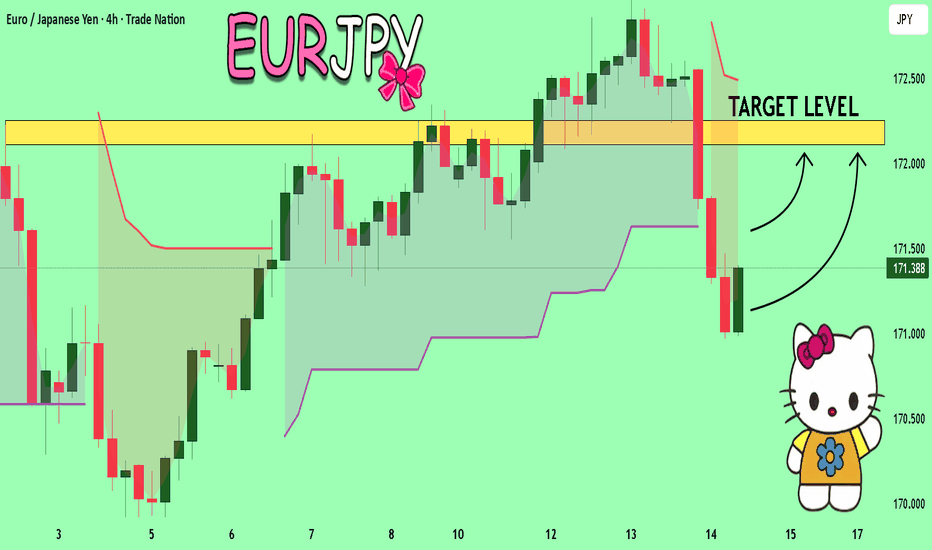

EURJPY Massive Long! BUY!

My dear friends,

Please, find my technical outlook for EURJPY below:

The price is coiling around a solid key level - 171.15

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 172.11

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

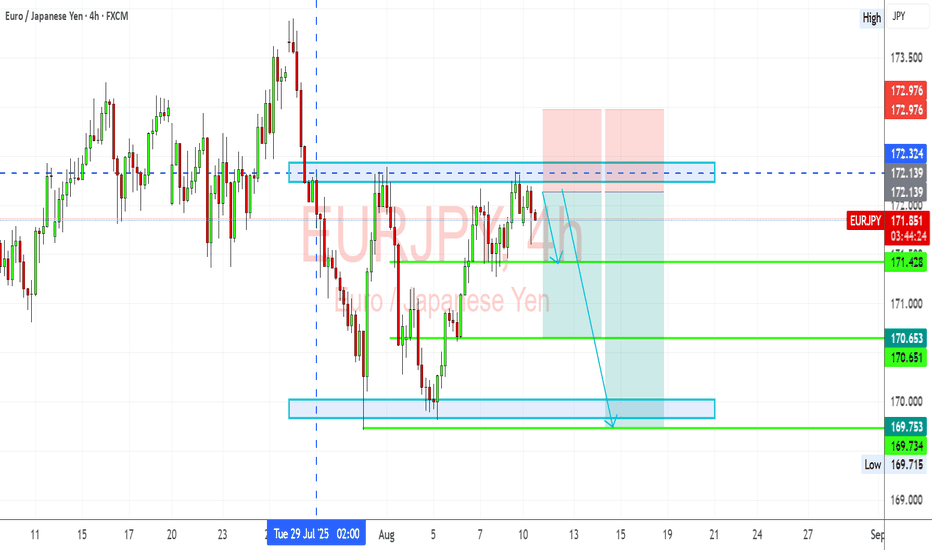

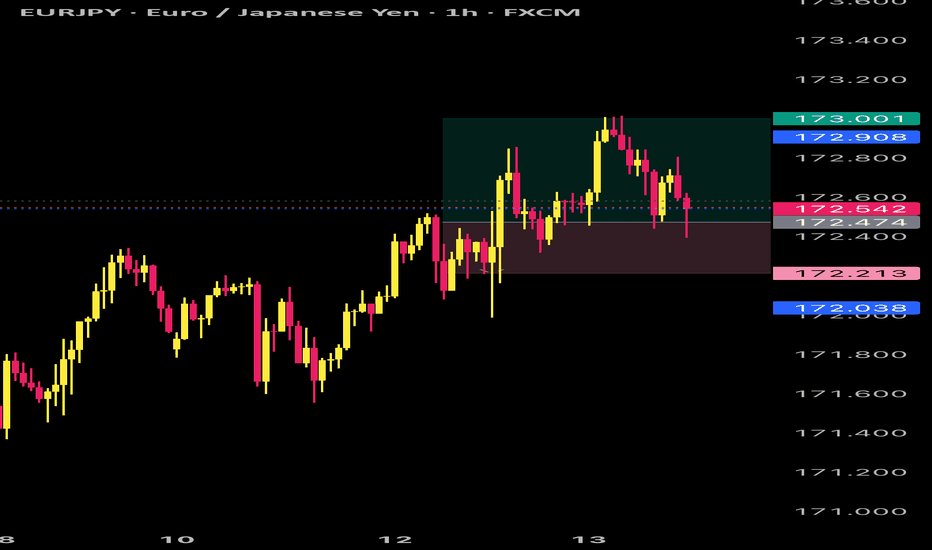

EURJPY – Bearish Reversal Looming from Key Resistance ZoneAfter a strong recovery rally, EURJPY has once again hit the 172.30 resistance zone a level that has repeatedly acted as a ceiling for price action. This latest retest comes with signs of momentum fading, and I’m eyeing a potential reversal that could send the pair back toward key support zones. With broader yen strength creeping in on safe-haven flows and the euro’s upside capped by a cautious ECB, this setup is looking primed for sellers to step in.

Current Bias

Bearish – The pair is struggling to break and hold above the 172.30 resistance zone. Price action is showing rejection wicks on the H4 chart, indicating potential distribution before a move lower.

Key Fundamental Drivers

Euro Side: The ECB remains cautious on further tightening, with growth concerns in the eurozone limiting the upside for EUR. Recent industrial production softness and muted inflation expectations cap bullish momentum.

Yen Side: The BoJ’s shift toward a slightly less accommodative stance, combined with safe-haven demand amid global trade tensions and Trump’s tariff rhetoric, supports JPY strength.

Risk Sentiment: Ongoing uncertainty around global growth and trade flows benefits JPY as a defensive asset, putting downside pressure on EURJPY.

Primary Risk to the Trend

A surprise hawkish tilt from the ECB or strong eurozone economic data could fuel renewed buying pressure, forcing a breakout above 172.98.

A sudden drop in risk-off sentiment or a rebound in global equities could weaken JPY demand and negate the bearish bias.

Most Critical Upcoming News/Event

Eurozone GDP and Industrial Production data – Any significant beat could temporarily lift EUR.

Japan CPI and BoJ commentary – Inflation beats or hawkish language could accelerate JPY gains.

Geopolitical headlines – Trade tensions between the US and China remain a key driver for yen demand.

Leader/Lagger Dynamics

EURJPY is acting as a lagger in the current yen move, with USDJPY leading the direction for JPY crosses. Any decisive move in USDJPY—especially a break lower—would likely spill over into EURJPY. The pair also tends to mirror risk sentiment shifts seen in equity indices like US500, making global sentiment a secondary driver.

Summary: Bias and Watchpoints

I’m maintaining a bearish bias on EURJPY as long as price stays below the 172.30 resistance zone. My stop-loss is placed just above the 172.98 swing high to protect against a bullish breakout. First targets sit at 171.43, then 170.65, with an extended downside target near 169.73 if momentum builds. A clean break below 170.65 would open the path for deeper declines, while any sustained break above 172.98 would invalidate this setup. In short, I’m watching for rejection confirmation from resistance and will be tracking USDJPY closely as the leader for yen sentiment.

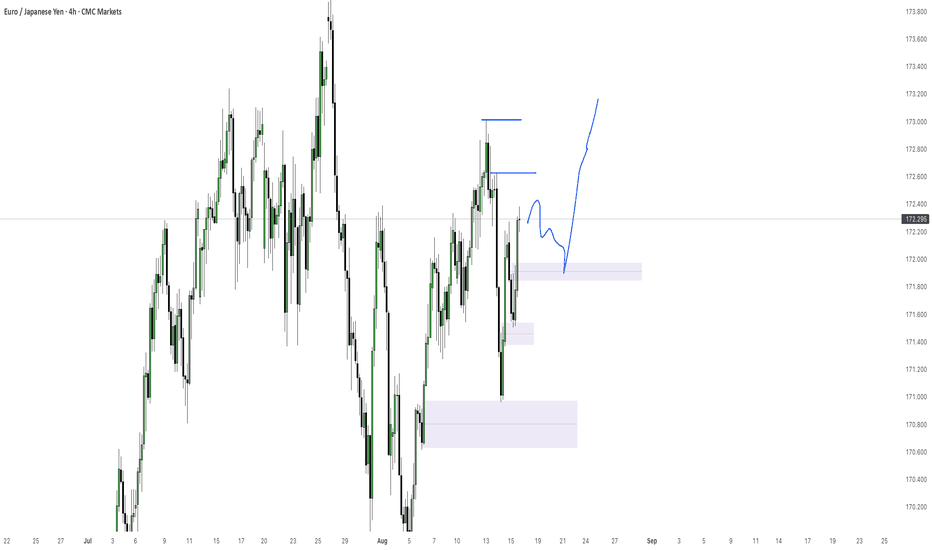

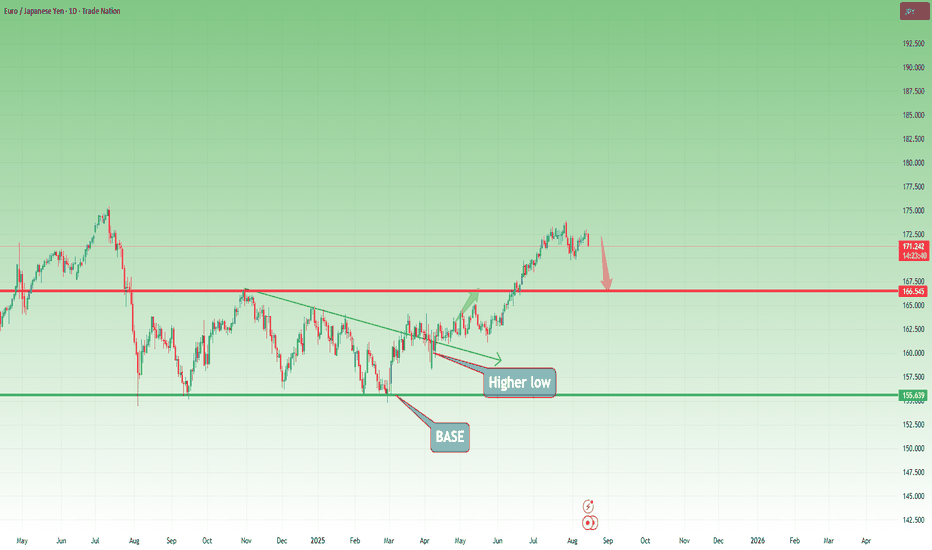

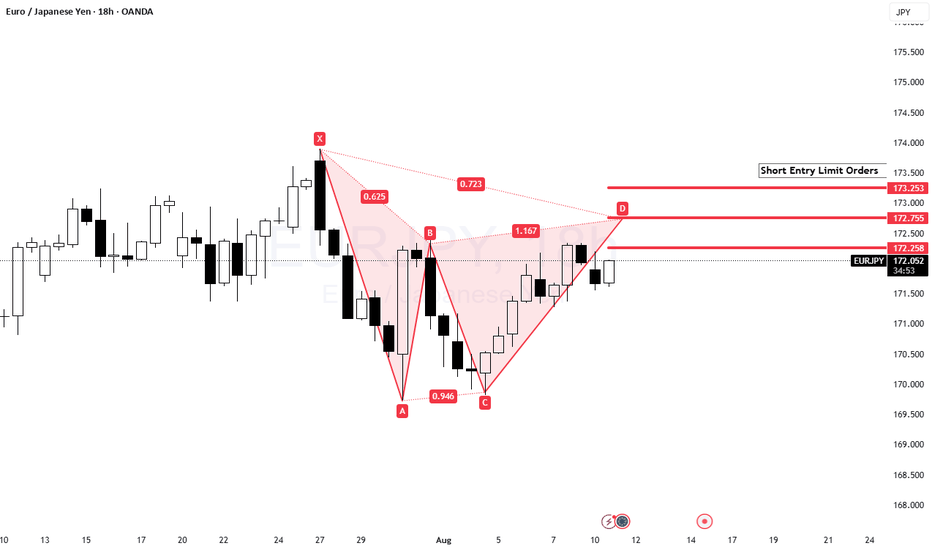

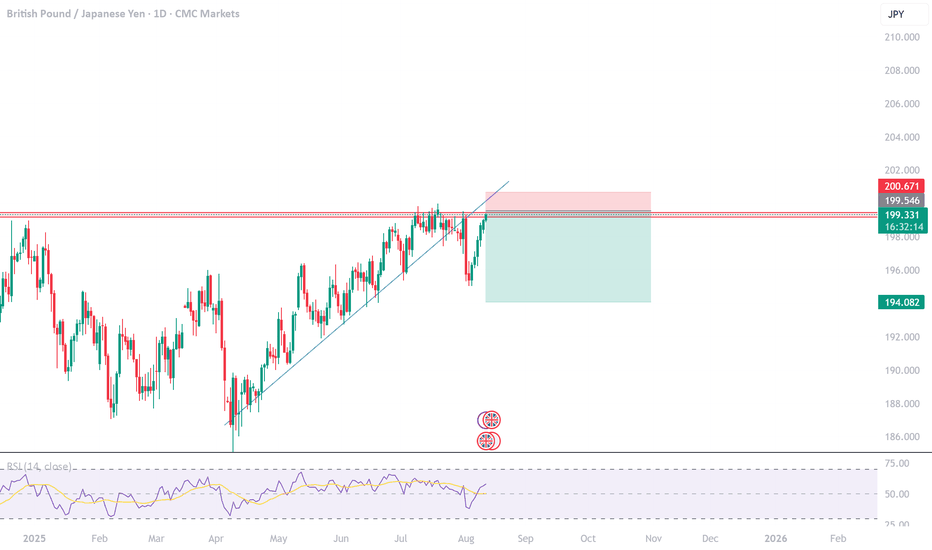

EUR/JPY – Lower High in the Making?As explained in my JPY Index analysis , alongside GBP/JPY, EUR/JPY is another strong candidate for a meaningful drop.

From the chart: after reaching a high near 174 — close to the 2024 ATH — the pair had its first leg down. When price dipped to the 170 psychological level, bulls stepped in, attempting a push to new highs.

However, at 173, it was the bears’ turn. The pair reversed again, potentially forming a lower high.

I believe we are in the early stage of a stronger drop, and in my view, rallies around 172 should be sold. The downside target is around 166.50, with this scenario negated on a break above the recent high. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

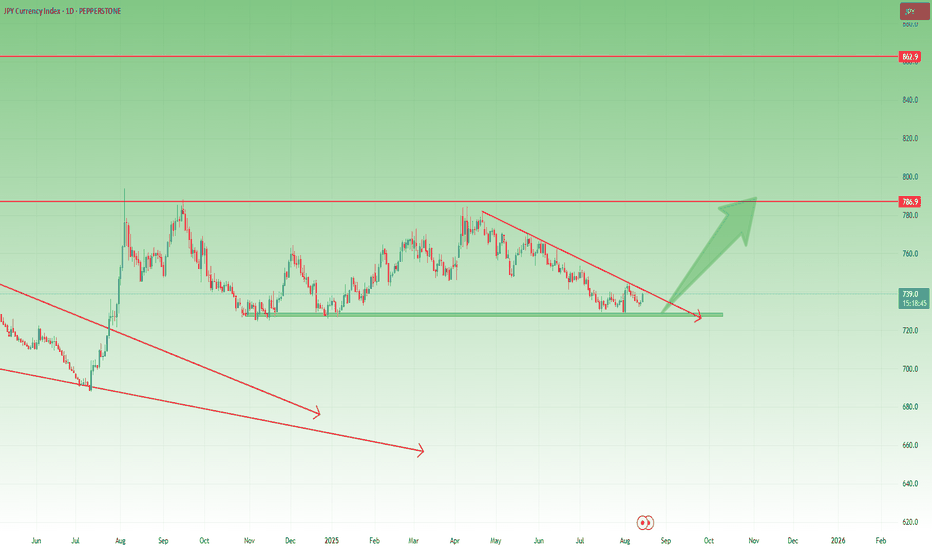

JPY Index – At a Critical JunctureLast month, I pointed out that the JPY Index was sitting in a very important support zone, making pairs like GBP/JPY and EUR/JPY worth keeping on traders’ radar.

Indeed, the index rebounded, which translated into a drop for both EUR/JPY and GBP/JPY. After the initial bounce, the index returned to test that zone once more.

What’s interesting now is that if the index continues higher, it will also break above the falling trendline. This could trigger an acceleration — and for GBP/JPY and EUR/JPY, that could mean a 500-pip drop.

JPY pairs should definitely be closely monitored from this point on. 🚀

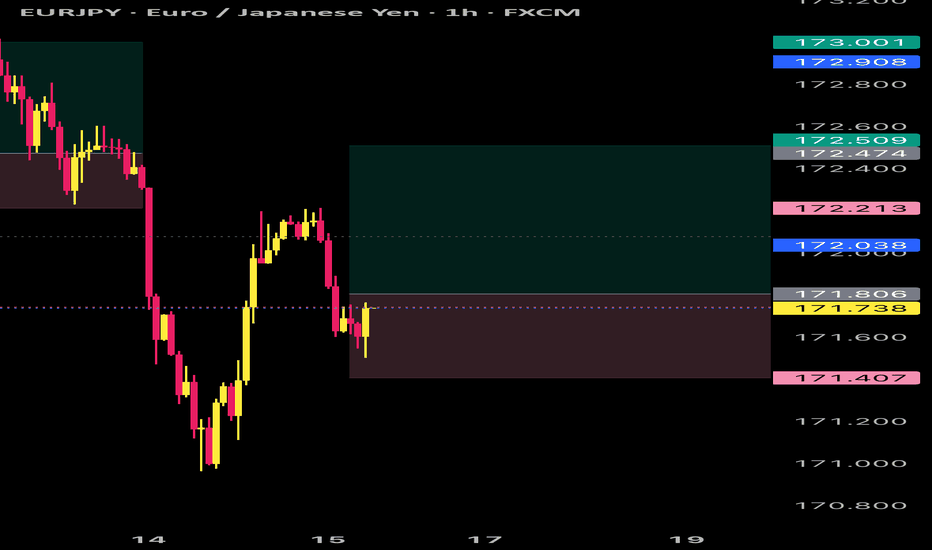

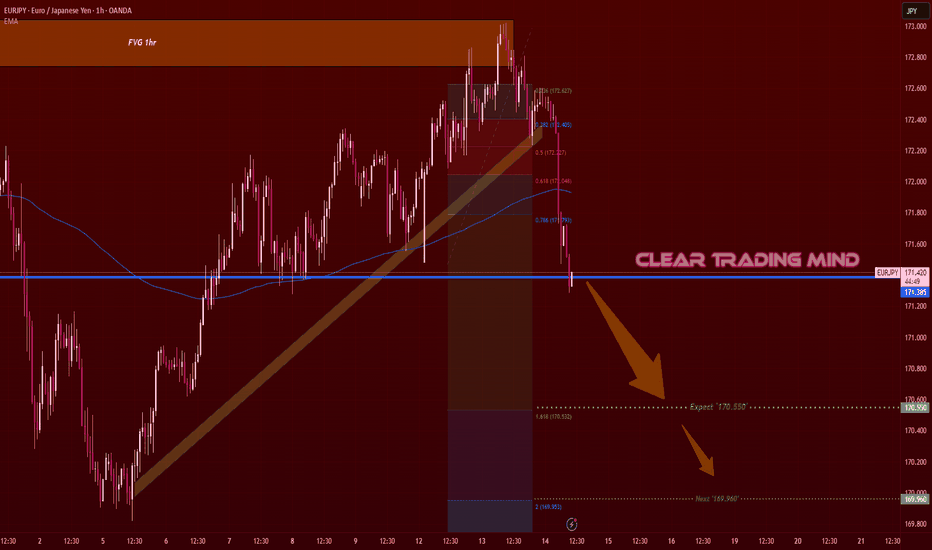

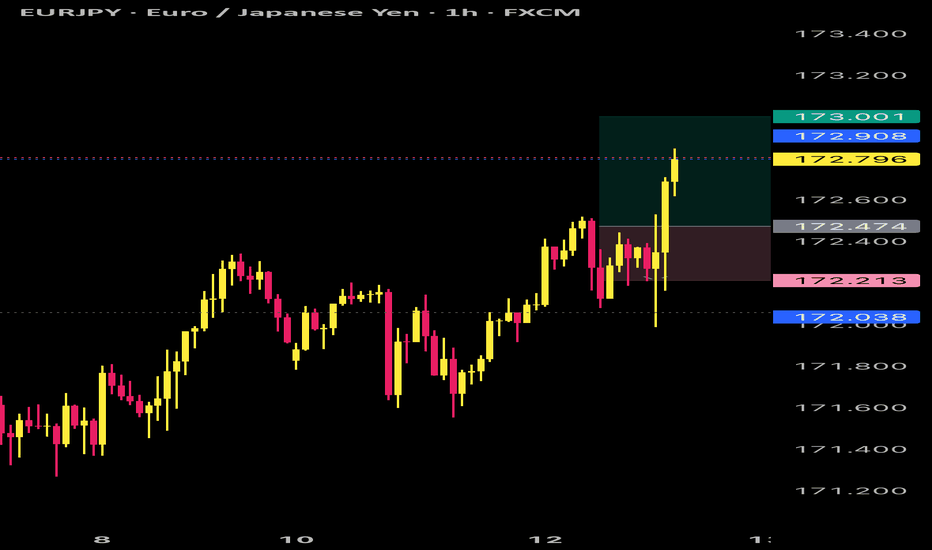

EURJPY – Bearish Break Targets 170.55 & 169.96On the 1H chart, EURJPY has broken below both the trendline support and the 200 EMA, signaling a clear shift in market sentiment toward the bears. The recent drop confirms sellers are in control after price failed to sustain near the FVG zone.

Fib extensions suggest the next downside targets are 170.55 (1.618 Fib) and 169.96 (Fib 2.0). A clean break below these could accelerate momentum toward deeper lows.

📉 Bias – Bearish

📍 Key Resistance – 200 EMA & 172.62 zone

🎯 Target Levels – 170.55 → 169.96

EUR-JPY Bullish Bias! Buy!

Hello,Traders!

EUR-JPY is trading in an

Uptrend and the pair is

Making a retest of the

Horizontal support level

Of 172.300 and we are

Bullish biased and we will

Be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

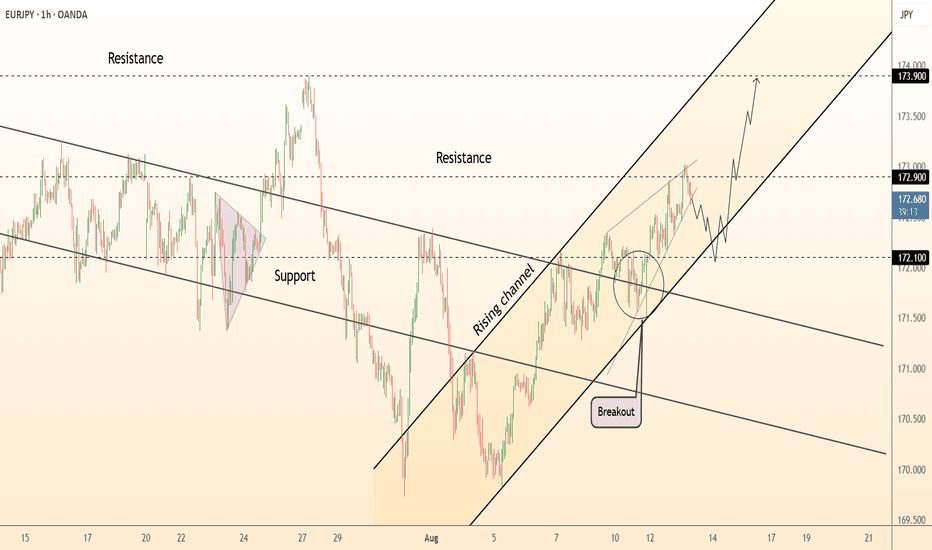

DeGRAM | EURJPY is moving in an ascending channel📊 Technical Analysis

● Price is climbing within a rising channel after confirming a breakout retest at 172.10, turning former resistance into support.

● Structure favors continuation toward 172.90 and channel top at 173.90, with minor pullbacks likely staying above the breakout base.

💡 Fundamental Analysis

● Improved eurozone PMI data and firm ECB stance reinforce euro strength, while BoJ’s unchanged ultra-loose policy keeps the yen under pressure.

✨ Summary

Long above 172.10; targets 172.90 → 173.90. Invalidation below 172.00.

-------------------

Share your opinion in the comments, and support the idea with a like. Thanks for your support!

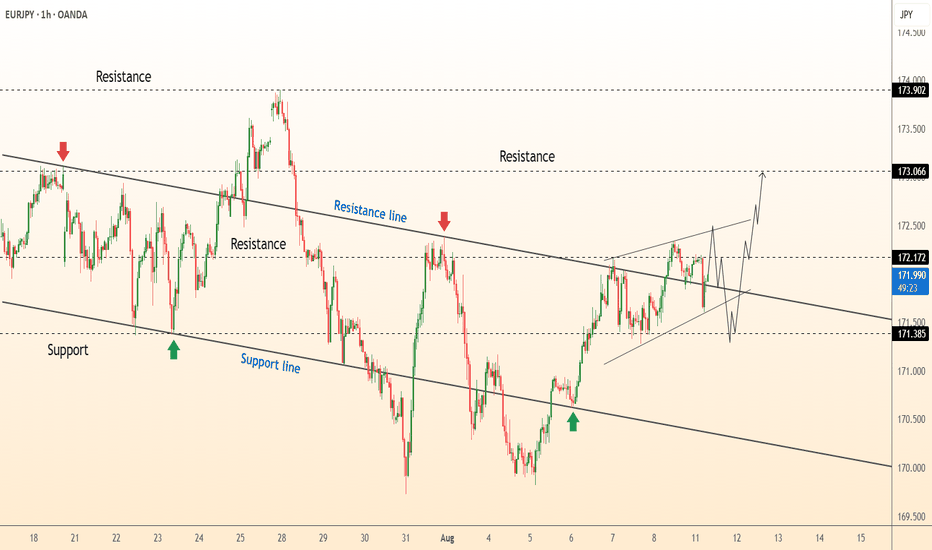

DeGRAM | EURJPY exited from the channel📊 Technical Analysis

● EURJPY broke above the descending channel’s resistance line near 171.38, holding within an ascending wedge that favors bullish continuation.

● A sustained move above 172.17 opens the way toward 173.06, with intraday pullbacks likely retesting the breakout area for support.

💡 Fundamental Analysis

● The euro gained as ECB officials signaled no immediate rate cuts, while the yen remains pressured by Bank of Japan’s commitment to ultra-loose policy despite rising inflation expectations.

✨ Summary

Buy above 171.38; target 173.06. Setup remains valid while price stays above 171.00.

-------------------

Share your opinion in the comments, and support the idea with a like. Thanks for your support!

EURJPY Is Very Bearish! Short!

Here is our detailed technical review for EURJPY.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 172.334.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 169.030 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

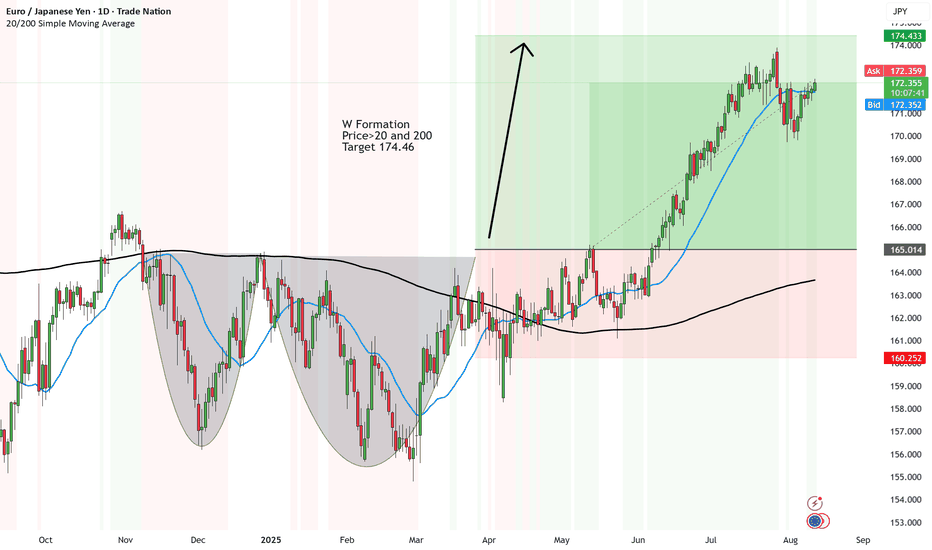

EUR/JPY - target almost reached at 174.46 - But is it worth it?W Formation formed tick.

Price>20 and 200 - Tick

Target 174.46

Stop loss - not hit - TICK

All easy and said and done.

BUt the analysis was done in April. It is August.

We take on daily interest charges.

Opportunity costs.

So are these LONG term trades good in the long run? Maybe with LARGE portfolios then it's all relative and the costs are the price to pay.

But for smaller portfolios that most people have - it's not worth it.

Prioritise with your trading risk management and profile. And if need be, implement a TIME STOP LOSS to avoid long winded holding trades that turn into unnecessary marriages.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURJPY Buyers In Panic! SELL!

My dear subscribers,

EURJPY looks like it will make a good move, and here are the details:

The market is trading on 172.25 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 171.49

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

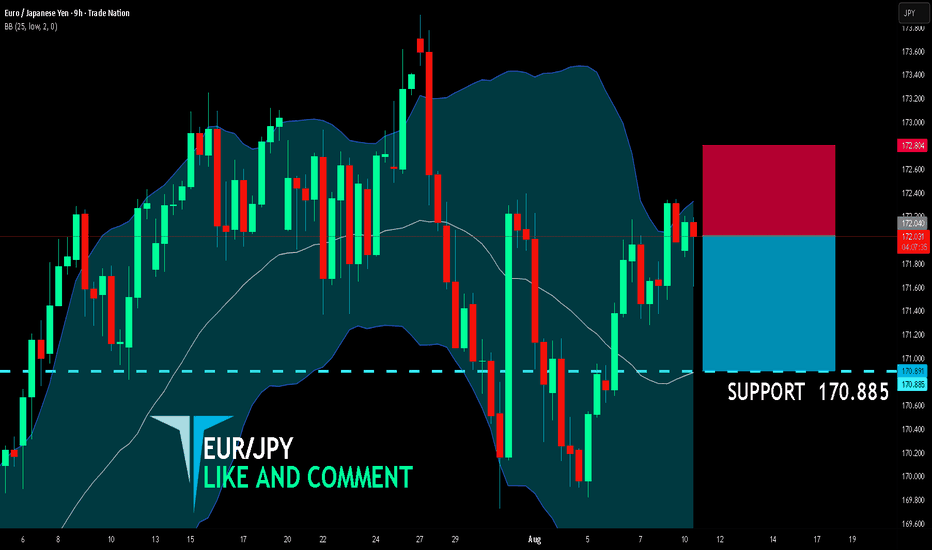

EUR/JPY BEARS WILL DOMINATE THE MARKET|SHORT

EUR/JPY SIGNAL

Trade Direction: short

Entry Level: 172.040

Target Level: 170.885

Stop Loss: 172.804

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅