Eurjpybreakout

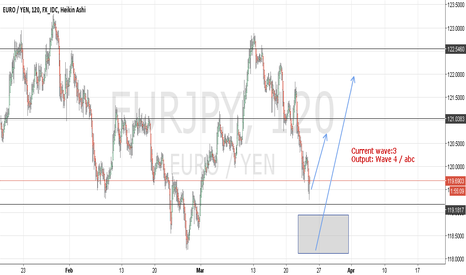

EURJPYOur preference: position bought above 127.00 with targets at 128.25 & 129.05 in extension.

Alternative scenario: in break of 127,00, a continuation of the decrease will be envisageable with 126,35 & 125,65 in line of sight.

Comment: a support base on the 127.00 formed and allowed temporary stabilization.

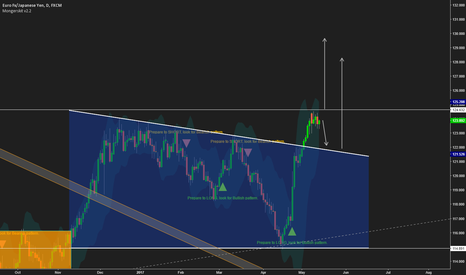

What lies for Euro-Japanese Yen's future?For quite some days, the Euro-Japanese Yen has been solely consolidating within this range despite the further decline of other Euro Forex pair. That being said, this may be qualified to be an NR7 trade; it is also called as Narrow Range 7 day bar.

With the NR7-qualified trade, we can also see a possible formation of a triple-top-double-bottom... or a possible formation of a head & shoulder... and the consolidation is just sitting at the neckline!

With a tight range running, a high risk-reward ratio setup may be placed upon this! With such consolidation, I am expecting a huge move!

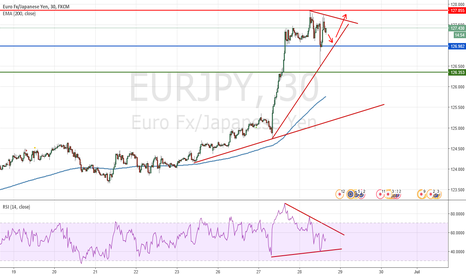

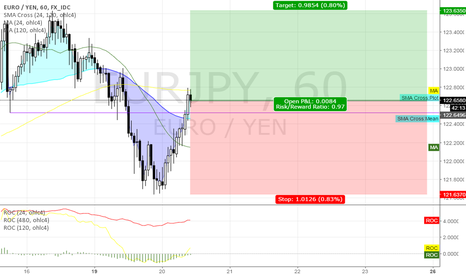

Short EURJPY Short Term based on 30M + 1H Charts H&S Pattern I have a longter term Short setup for the EURJPY but here we see a shorter term H&S pattern setup forming for anyone interested in a shorter, possible intraday trade. Wait for a break of the neckline before entering and a more conservative approach would be to wait for a pullback and re-test, however, from experience we know this does not always happen.

If you are interested in a more longer term trade, check out my related idea for a longterm short on the EURJPY with potential of around 200pips.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Please comment below and Like if you agree with my analysis.

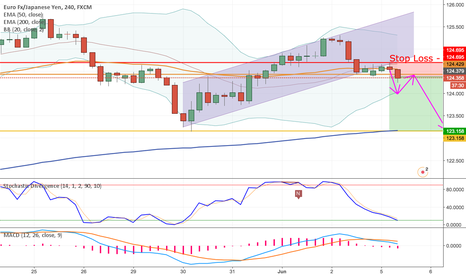

Short EURJPY Longterm Based on 30M + 4H ChartsWe saw a bullish EMA crossover (Golden Cross) occur on the 26th of April 2017 on the 4H chart and price has respected this crossover and has been riding above it, making higher highs. However, in recent weeks we've seen progression slow down and we have made our first Lower High as the uptrend begins to curve round to the downside.

Price has also fallen below the EMA50 and is heading towards our first price target of 123.158 which would make it's first Lower Low.

On the 30M chart we can see the EMA50 has now crossed below the EMA200 (Death Cross) and with strong divergence to the downside, this would support our decision to short the EURJPY pair.

Place your stop at 124.695 and price targets of 123.158 but we're not setting a TP, we will let this run and adjust our stop accordingly to secure profits.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Please comment below and Like if you agree with my analysis.