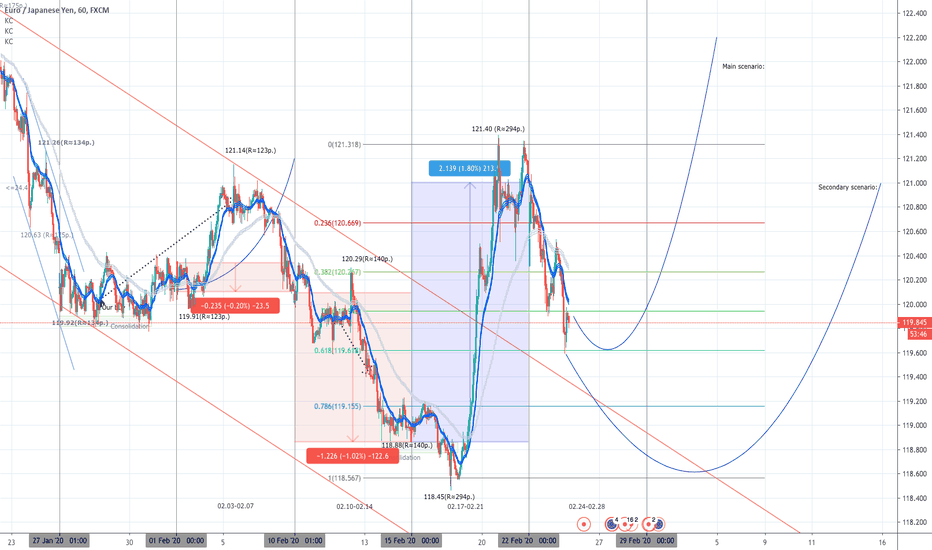

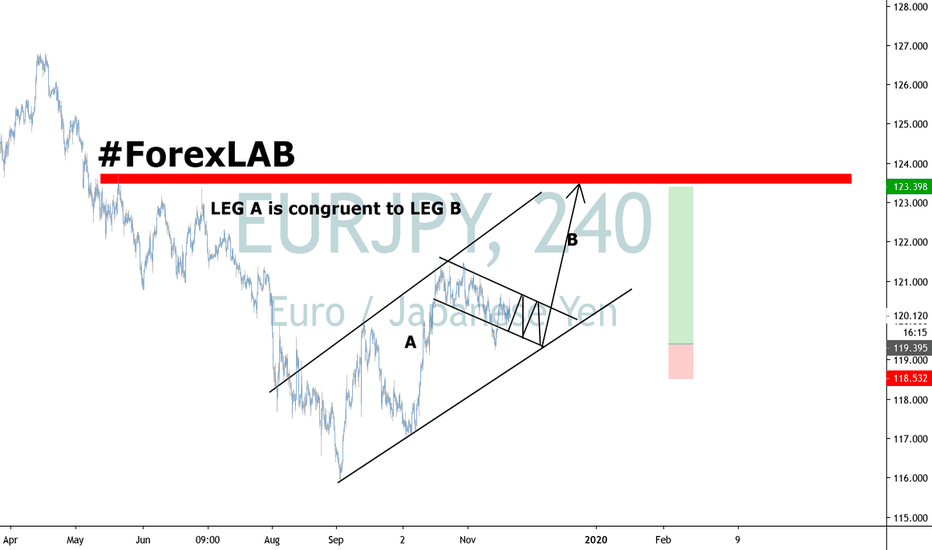

EURJPY#1--->Waiting Buy:Good day, dear #investors and colleagues #traders!

Your attention a technical analysis of the currency pair #Eurjpy:

#Comment_to_past_week:

The #yen received a crushing blow to the entire spectrum of the market after market participants digested data on #GDP of #Japan:

-6.4% per annum and -1.6 per quarter.

Given the unprecedented scale of monetary incentives from the Bank of Japan (#BankofJapan), this is completely disappointing data and what market participants actually drew attention to, the data came before the destructive # coronavirus. Therefore, most likely the first quarter will also have negative data, and negative GDP data for 2 consecutive quarters indicate the beginning of a recession in the country.

Naturally, the currency of the land of the rising sun began to lose ground. This week, on Thursday there will be a meeting of the Bank of Japan and it will be for him that special attention will be paid by bidders. To some extent, the correction of positions that we observe on Monday-Tuesday potentially tells us that large investors want to refrain from serious actions before they understand what the Central Bank of Japan will do.

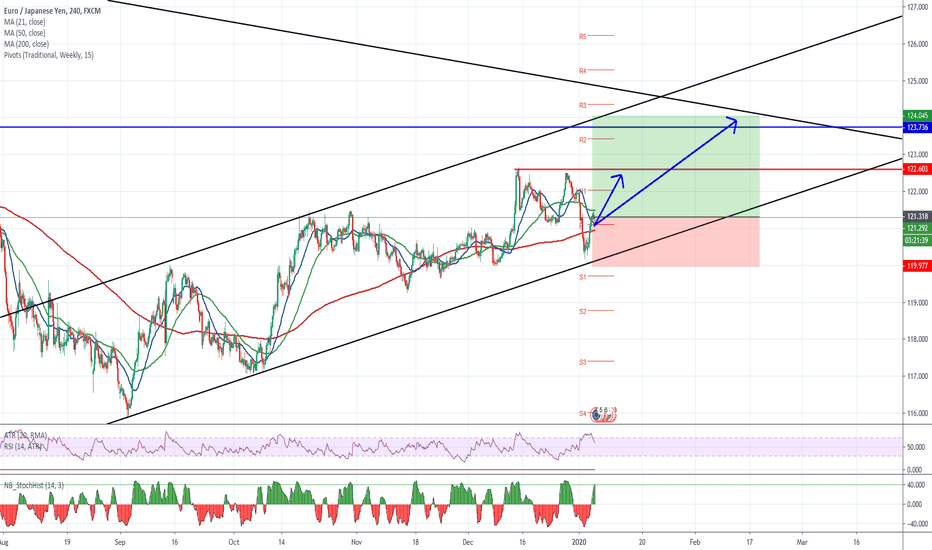

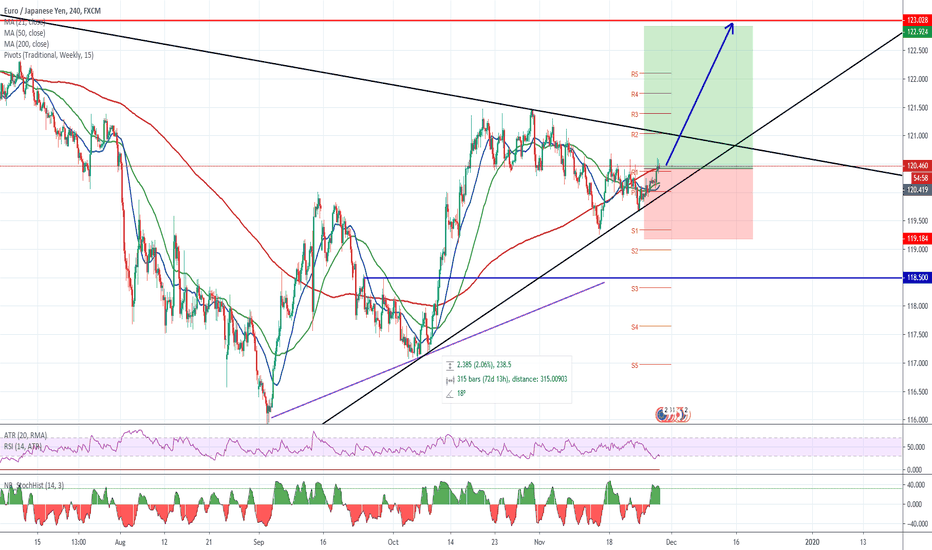

#Technical analysis:

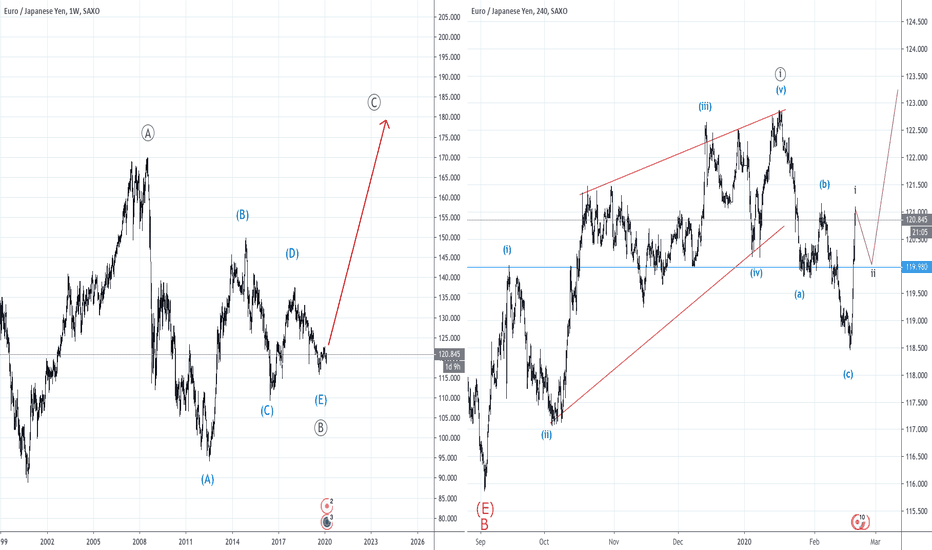

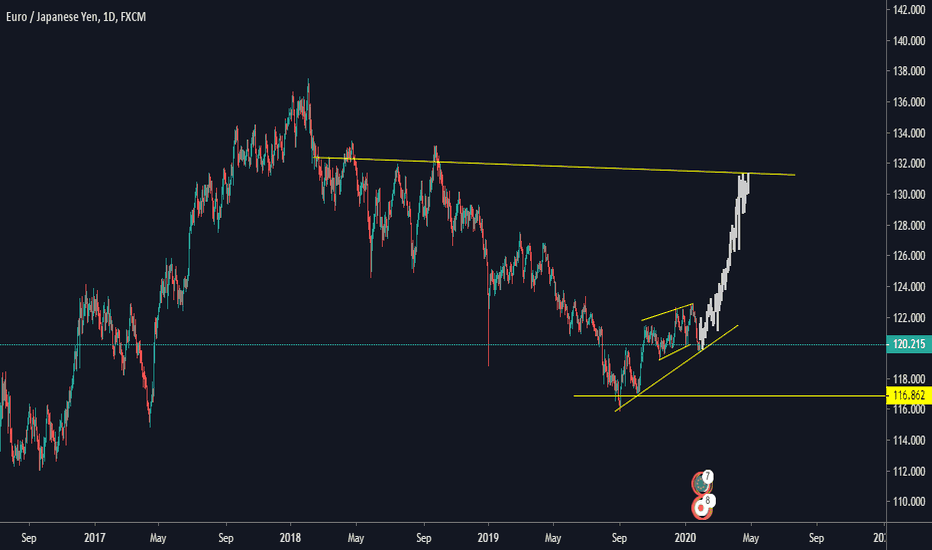

Globally:

The currency pair jumped from zone 118.60, thus creating an upward channel from October 4. This formation will receive particular stability if the pair manages to gain a foothold above 122.27.

Locally:

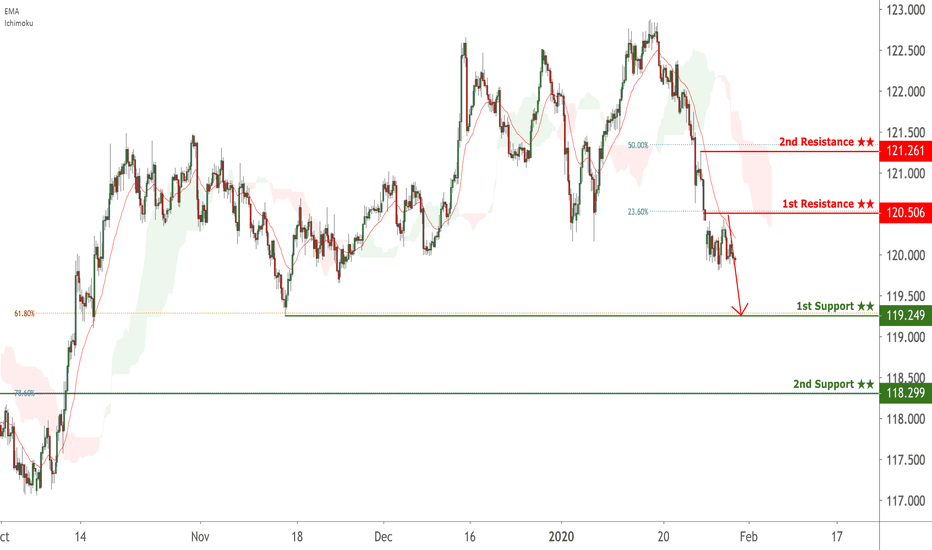

The current pricing allows 2 events and they directly depend on the Central Bank of Japan:

1. The currency pair will begin to consolidate 119.60 - 119.00, and from there the impetus will be given to it by the Bank of Japan and the Government of Japan and the currency pair will continue to grow to 121.20 and possibly to 122.27.

(More likely scenario)

2. The currency pair will begin to decline and break through the mark of 119.00 if # the Central Bank refrains from premature actions and preemptive strikes on the economic crisis. In this case, #investors will be disappointed and the Japanese currency will rush to new highs. A special strengthening will be waiting for the yen in case of correction in the US stock market. Since in this case, the Japanese investor will begin to fix positions, close the volumes for American dollars, and return the yen home.

(Less likely scenario)

By tradition, we call the weekly support and resistance zones:

A) #Support: 119.20 and 117.35.

B) #Resistance: 122.12 and 123.22.

#Orders_and_Positions:

The currency pair worked out our recommendation perfectly and we took 221 points out of 294 possible. Last week, this week, we did not manage to publish a forecast on the adjustment of the exchange rate.

At present, our system demonstrates the need for a deeper correction to open new long positions.

We will wait for consolidation around the resistance and support levels to open positions.

(! Attention, these are preliminary price levels and we reserve the right to change them in our trading).

Regards to subscribers,

Ltd ”Wermelgion and Partners Investment”

!Attention: Trading financial instruments and (or) cryptocurrencies is fraught with high risks, including the risk of losing part or all of the investment, therefore it is not suitable for all investors. Cryptocurrency prices are extremely volatile and can change due to external factors such as financial news, legislative decisions or political events. Margin trading leads to increased financial risks.

Ltd ”Wermelgion and Partners Investment” and any provider of the data contained on this website disclaim liability for any loss or loss incurred as a result of trading transactions made with reference to the information provided.

Eurjpybuy

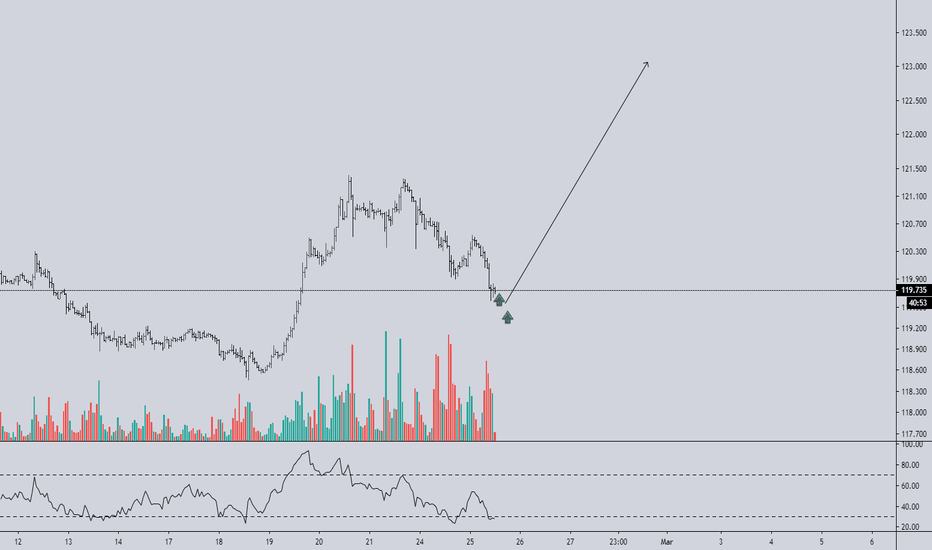

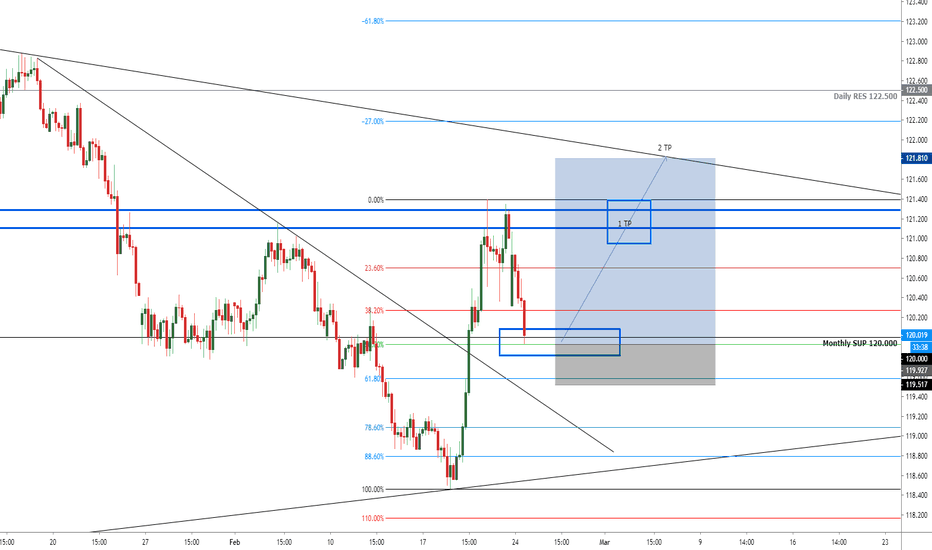

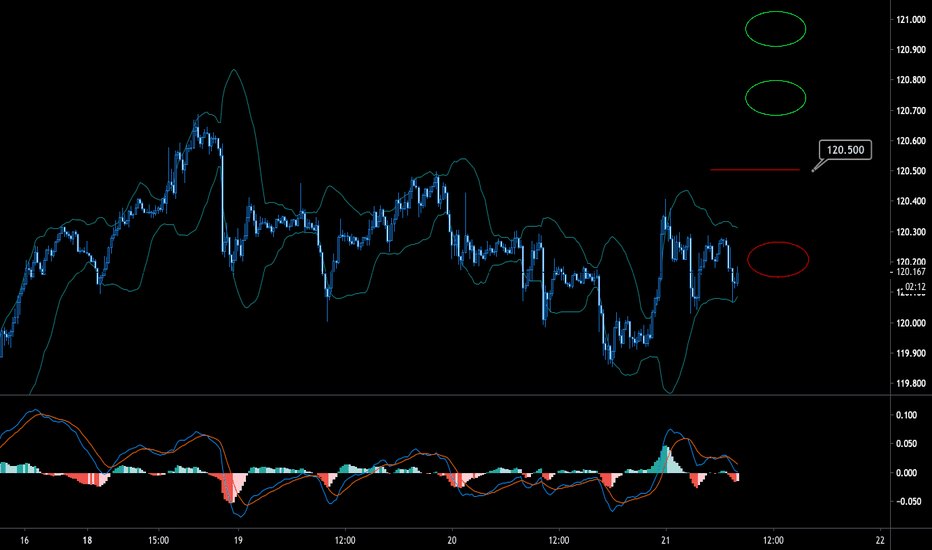

EURJPY is positioning to our LONG ENTRYAs we said yesterday, the value is now accumulating in our Key Level before the long entry in the value, we can also see a big zone of demand under our KL, a 50% of fibo that has been retested 2 times, so we have now 3 confluences to the long entry in the value. We will now wait a confirmation before the entry.

Could EURJPY give us a LONG ENTRY?EURJPY is now in a Key Level, so we need some accumulation before the entry on the value, we can see that the value is also in a 50% of fibo, comes from a strong zone (supply) that the value can't pass, now EURPY is trying to retest the KL to rise up and breake this strong zone.

There is a possibility that the value falls to the 61% to retest the downtrend so becareful and wait the confirmation of the value before the entry.

FOLLOW ME for more analysis and updates of the same and give a LIKE if you are agree with my analysis.

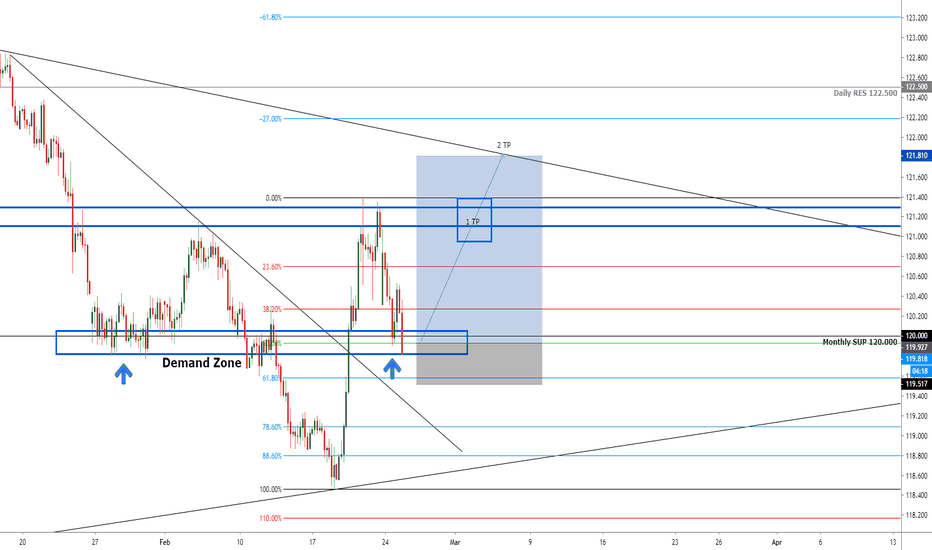

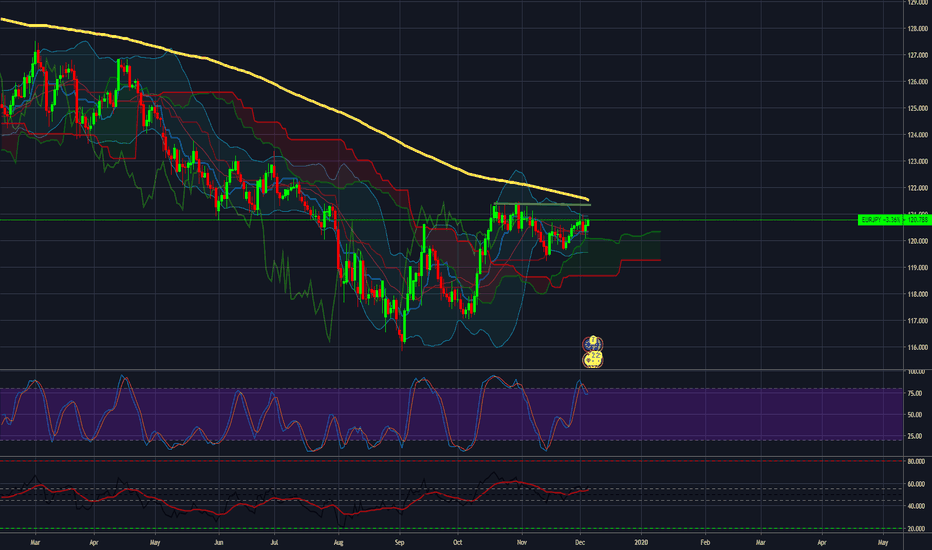

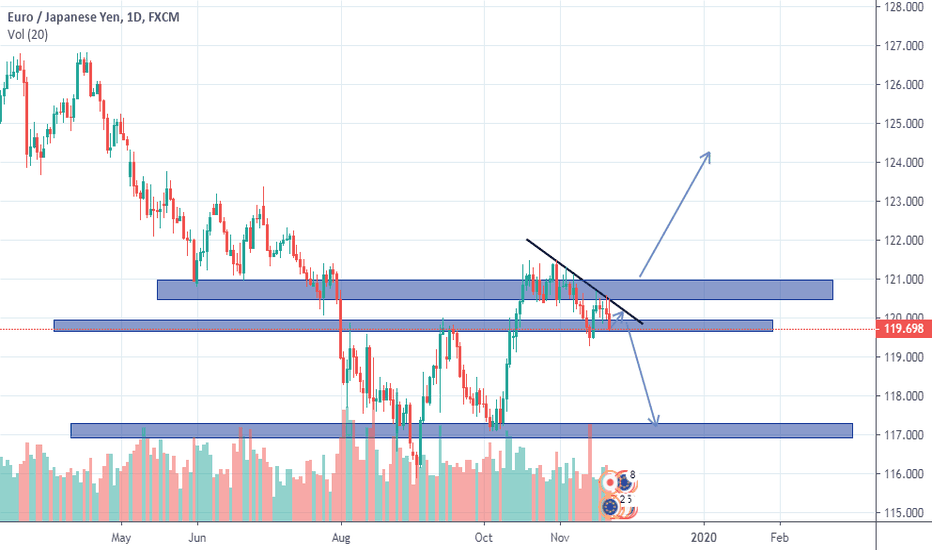

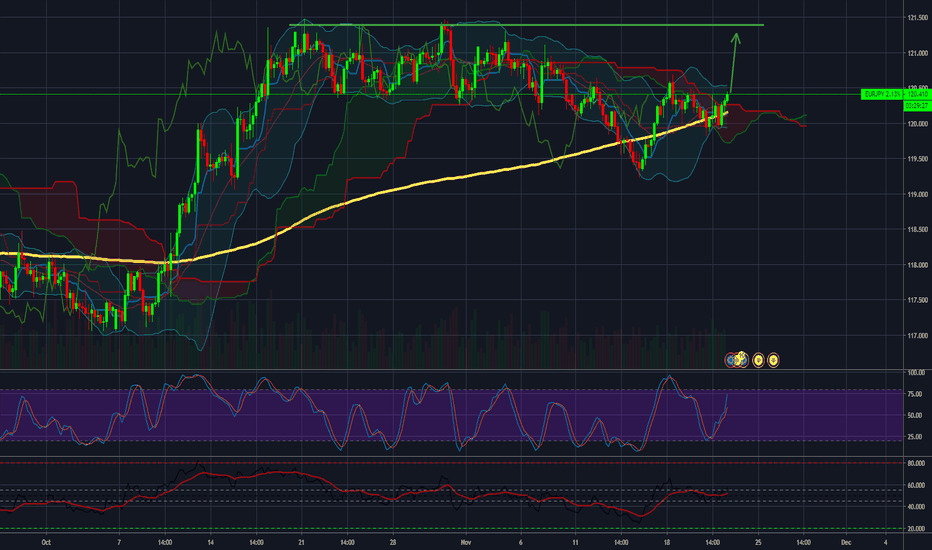

EURJPY ---> Think about buy:Good day, dear investors and colleagues traders!

Your attention a technical analysis of the currency pair #Eurjpy:

* Commentary last week:

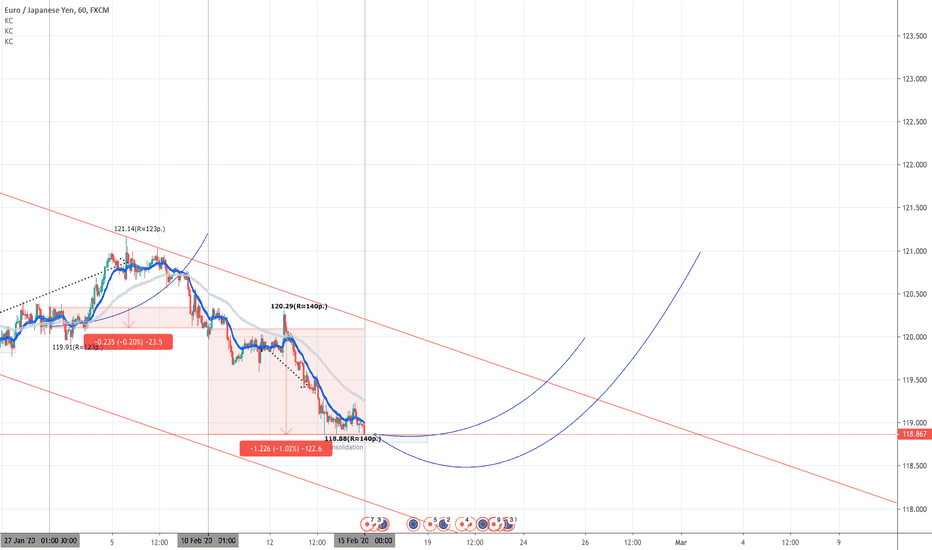

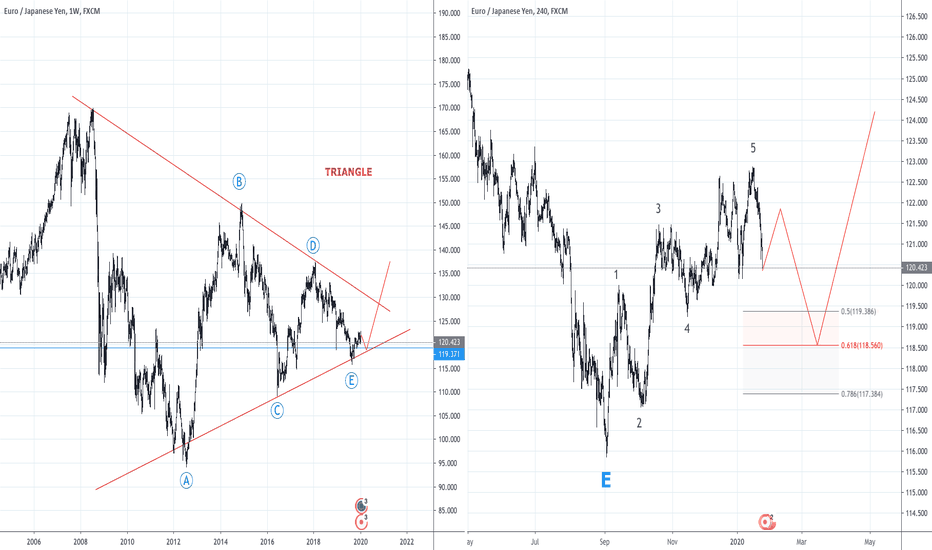

The currency pair could not stay afloat, as it was the year before last, taking advantage of the weakness of the yen. The nervousness of investors regarding a rapidly growing epidemic is likely to lead to the growth of the Japanese currency in the medium term. But the current global sale of the euro looks excessive and should end soon.

The currency pair this week decreased by 122 points (-1.02%).

* Technical comment:

Almost identical picture as in the euro / dollar. Oversold is also located on all senior time frames (H4, H8, D1). The only difference is the increase in amplitude, the coefficient R.

Support and resistance levels for the current week:

Resistances:

Supports:

* Orders and positions:

Our valuation system demonstrates that the currency is in the potential buying zone, it also begins the consolidation period at current levels and, like the euro / dollar, Monday will be important for the formation of the rebound zone.

Thus, our potential deal is as follows:

Buying from current levels to 118.50 with #stoploss 118.40-118.00 and #takeprofit: 120, 121, and possibly 122.

Best regards

Ltd ”Wermelgion and Partners Investment”

!Attention: Trading financial instruments and (or) cryptocurrencies is fraught with high risks, including the risk of losing part or all of the investment, therefore it is not suitable for all investors. Cryptocurrency prices are extremely volatile and can change due to external factors such as financial news, legislative decisions or political events. Margin trading leads to increased financial risks.

Ltd ”Wermelgion and Partners Investment” and any provider of the data contained on this website disclaim liability for any loss or loss incurred as a result of trading transactions made with reference to the information provided.

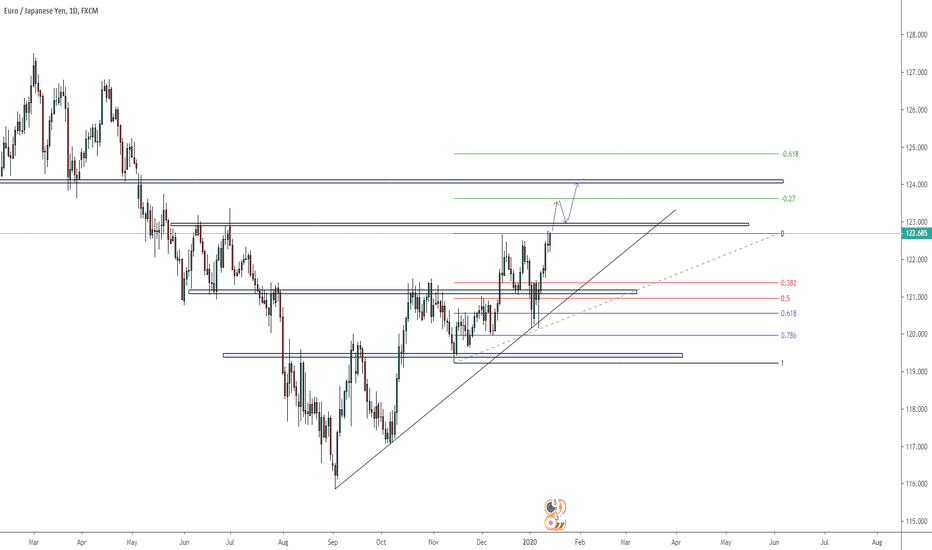

EURJPY GOOD LONG OPPORTUNITY AT DAILY TIMEFRAME

EURJPY is showing a good bullish trend for a good amount of time now, and as we see it is now ready to break a resistant level at 122.933, and after retesting it we might consider on entering this trade.Also we need to wait for 2 extra candles to confirm our bullish plan.Our target here hits at almost 140+ pips.

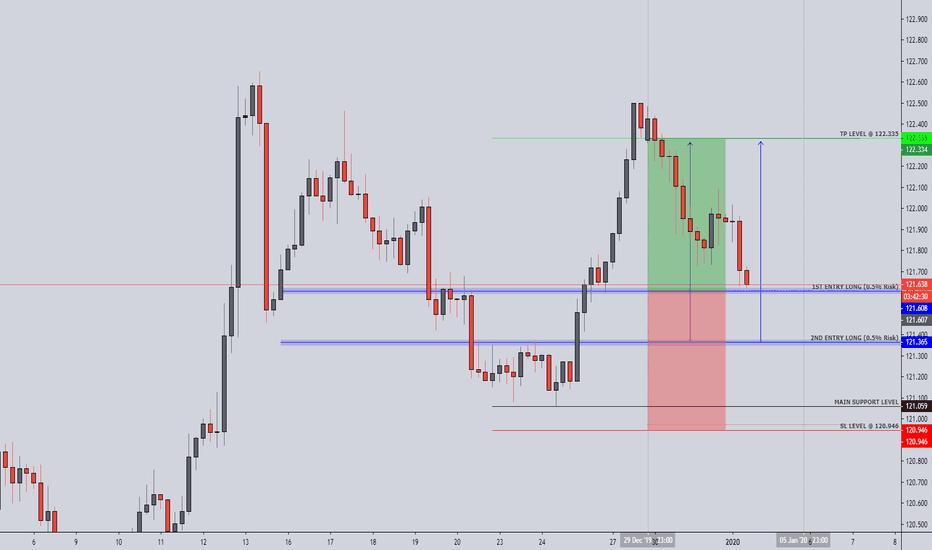

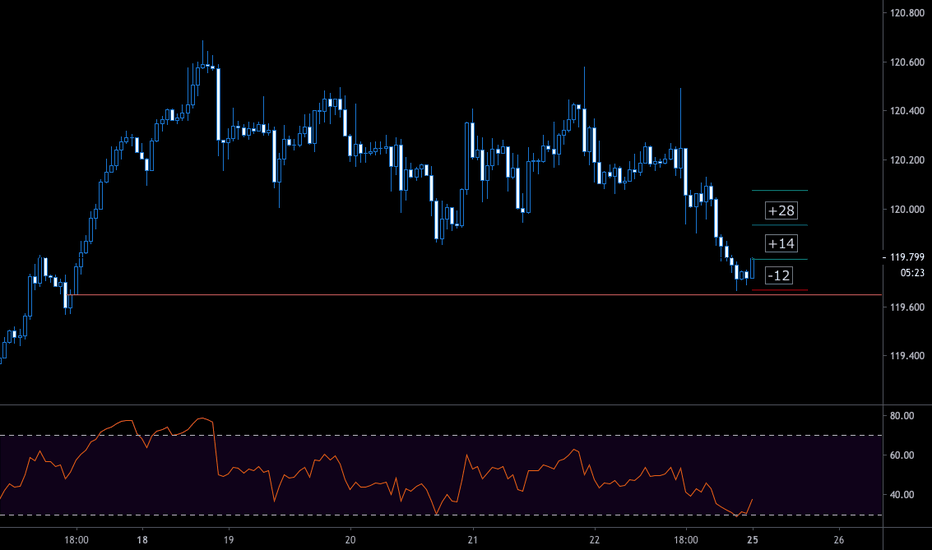

EURJPY - FOREX - 02. JAN. 2020Welcome to our weekly trade setup ( EURJPY )!

-

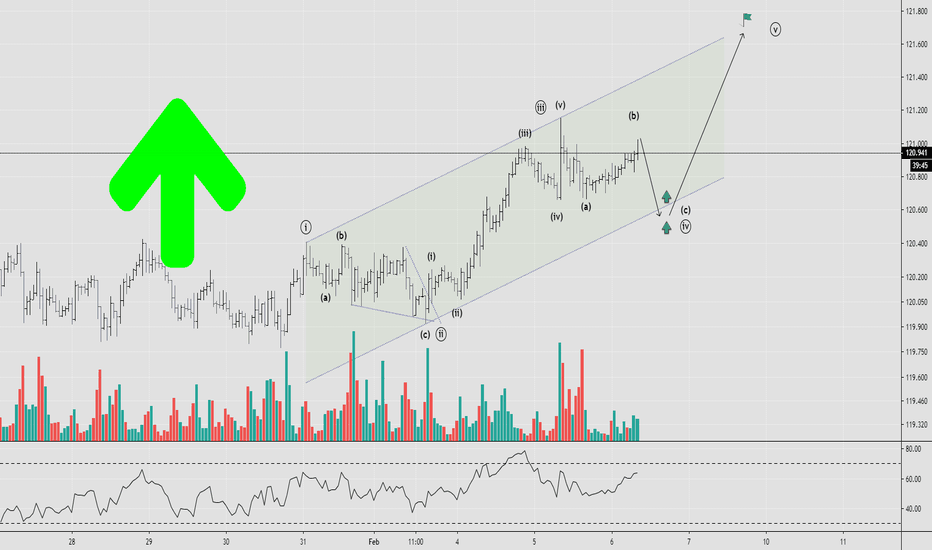

1 HOUR

Strong waves and bearish pullback.

4 HOUR

Prices at previous support level and turn area.

DAILY

Overall bullish market at its low, we need a pullback to the upside!

-

FOREX SETUP

BUY EURJPY

1ST ENTRY @ 121.610

2ND ENTRY @ 121.370 (wait for trigger)

SL @ 120.940

TP @ 122.330

RR: 1.1 / 2.35

Use 0.5% risk per Entry!

(Remember to add a few pips to all levels - different Brokers!)

Leave us a comment or like to keep our content for free and alive.

Have a great week everyone!

ALAN

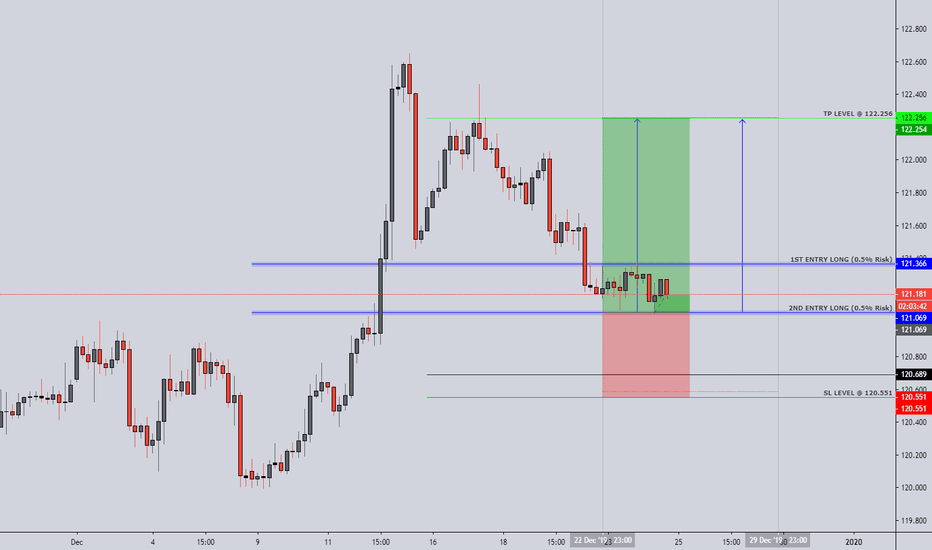

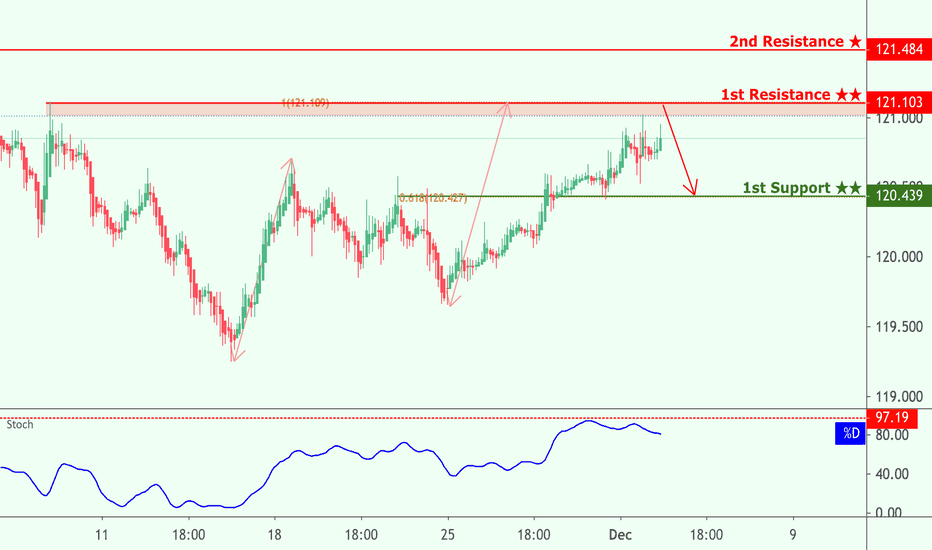

EURJPY - FOREX - 24. DECE. 2019Welcome to our weekly trade setup ( EURJPY )!

-

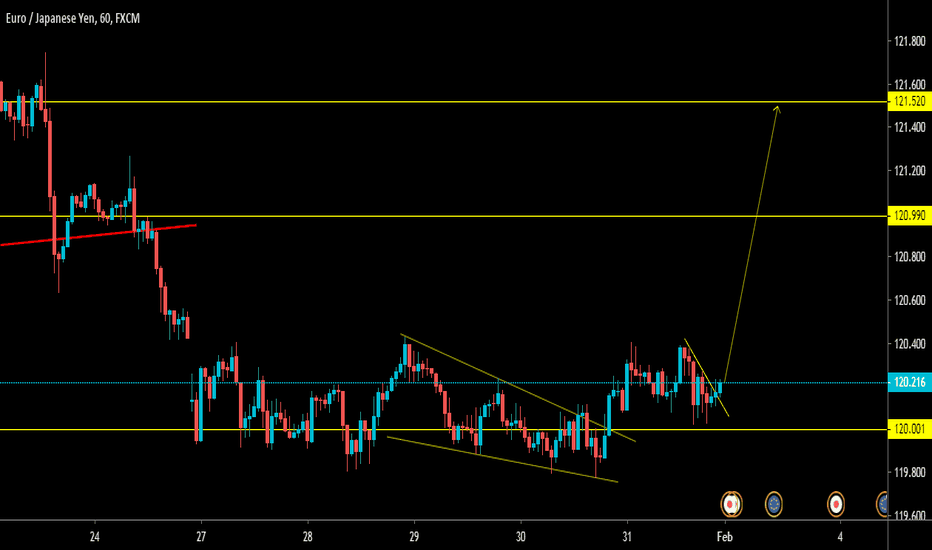

1 HOUR

Bearish push towards our support zone.

4 HOUR

Bearish pressure but overall bullish direction.

DAILY

Price action need to increase or change direction shortly, be patient and keep holding!

-

FOREX SETUP

BUY EURJPY

1ST ENTRY @ 121.360 (wait for trigger)

2ND ENTRY @ 121.070

SL @ 120.550

TP @ 122.250

RR: 1.1 / 2.35

Use 0.5% risk per Entry!

(Remember to add a few pips to all levels - different Brokers!)

Leave us a comment or like to keep our content for free and alive.

Have a great week everyone!

ALAN

EURJPY approaching resistance, look out for potential reversal!

EURJPY is approaching its resistance at 121.1026 where it is could reverse down to its support at 120.4392.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully

understand the risks.

EURJPY D1 OutlookEURJPY D1 Outlook

**Disclaimer**

the content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

_________________________________________________________________________________________________________________________________________

Thank you for your support!

Tradewithsam