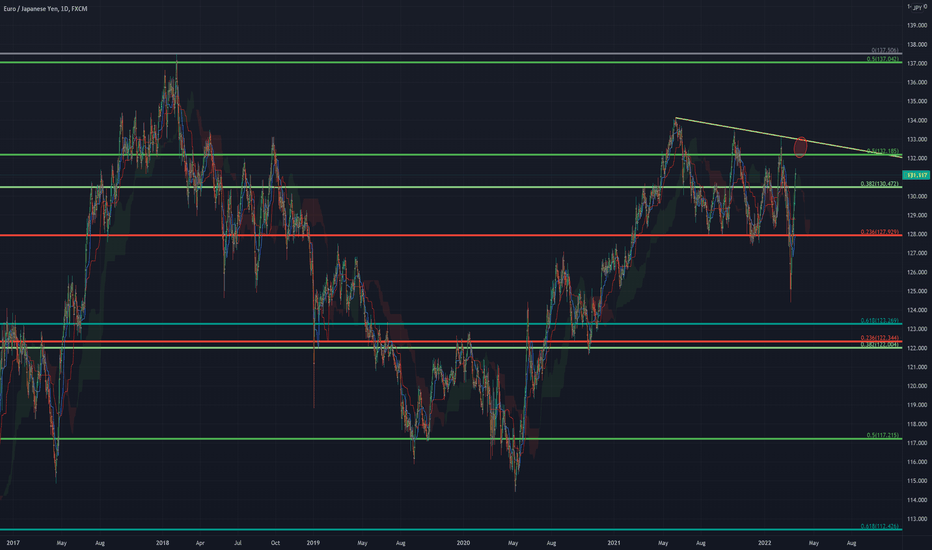

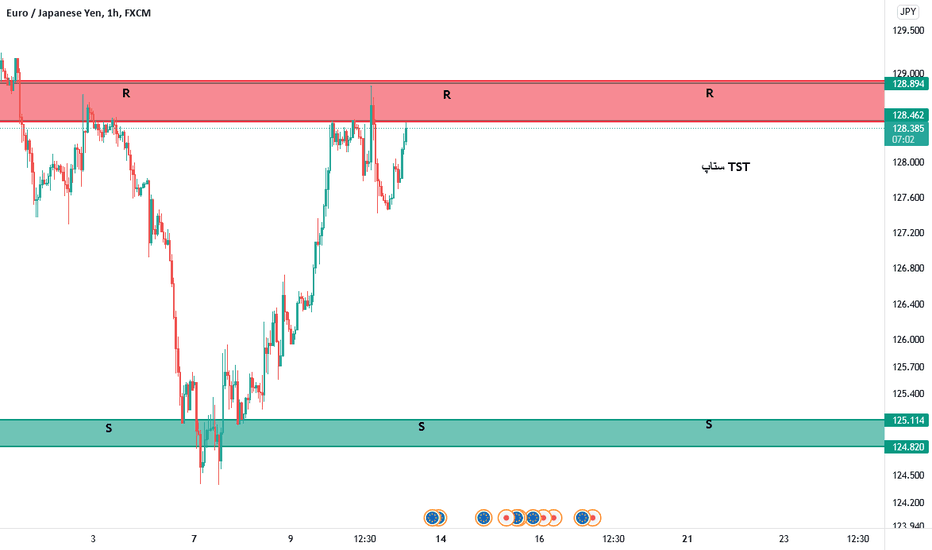

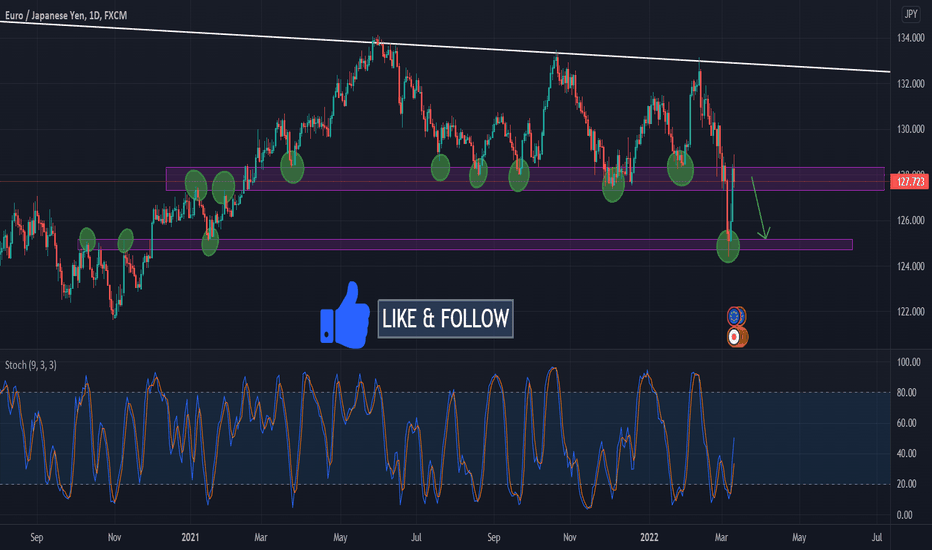

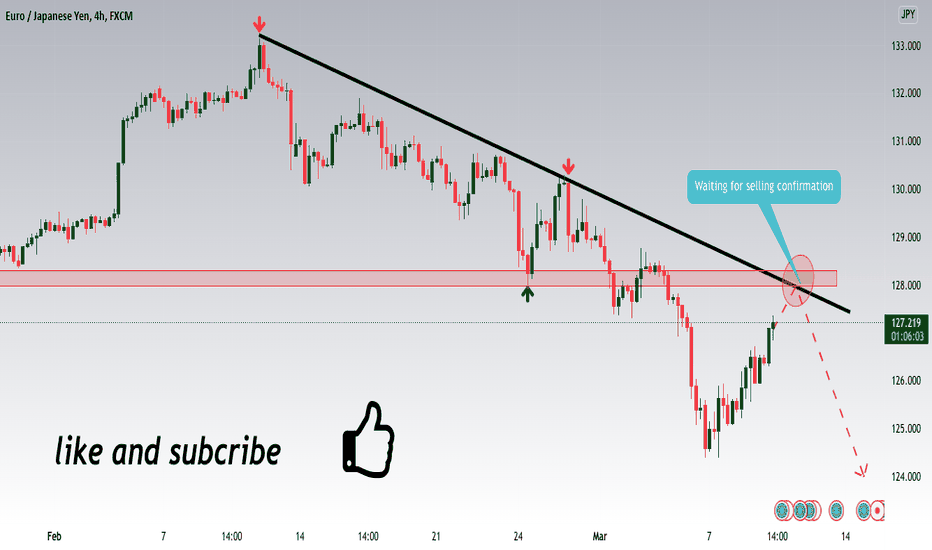

EURJPY Short - Risk/Reward 1:2.5 - mid-termShort setup for EurJPY :

With the money flow index and RSI decreasing on the 1W weekly frame, and after a strong reversal from 7th March lows (124.4), EurJpy is expected to see a selling pressure in price levels between 132 and 133. These price levels lie between a strong 1W Finbonacci level and the trendline joining the highs from june 2021.

We look for taking short positions between 132.2 and 133.

SL = 1D close above 134.3 which signifies further bullish continuation towards 137.

TPs and proposed %s for closing the position:

TP1 = 130.5 (20%)

TP2 = 128.9 (30%)

TP3 = 128 (20%)

TP4 = 127 (20%)

TP5 = 126.5 (5%)

TP6= 125.3 (5%)

with an effective closing position around 128.3 (+400pips) this short opportunity represents a Risk/Reward ratio of 1:2.5

Good luck

samurai

Eurjpyshort

EUR/JPY Short Trade UpdateHey Guys! Just a quick update!

As you guys know the current weekly bias on the Eur/Jpy is short. Or in other words, price is likely to reach 114.40 before reaching 133.68.

In this video, I explain the short position I'm currently holding and the reasons why I took the entry, as well as how I plan to trade this set up in the coming weeks.

That's it! I'll keep you guys updated!

Have a great day!

Ken

Disclaimer: This is not Personal Financial Advice.

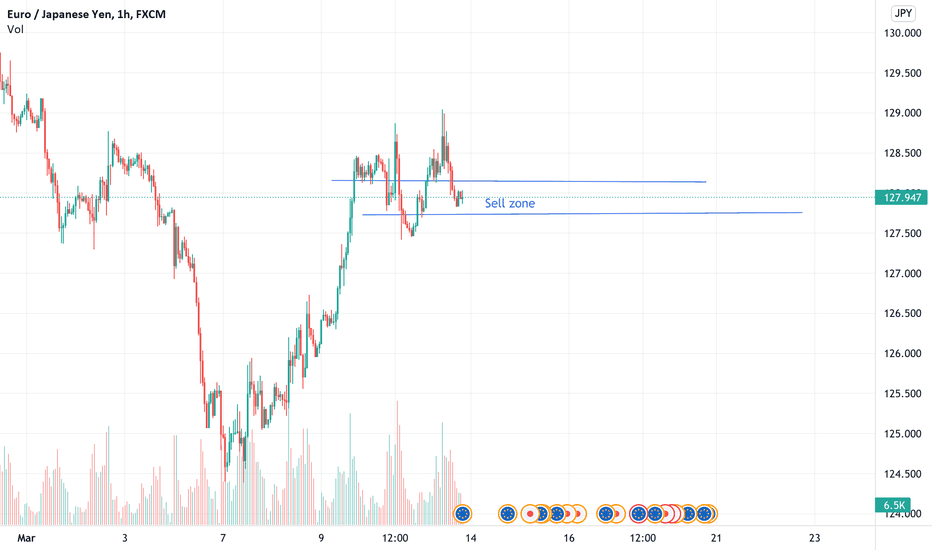

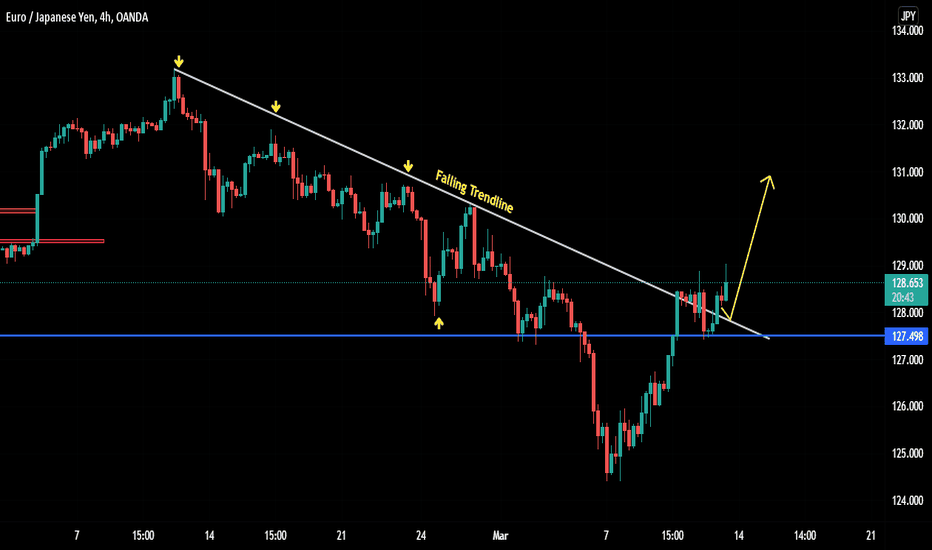

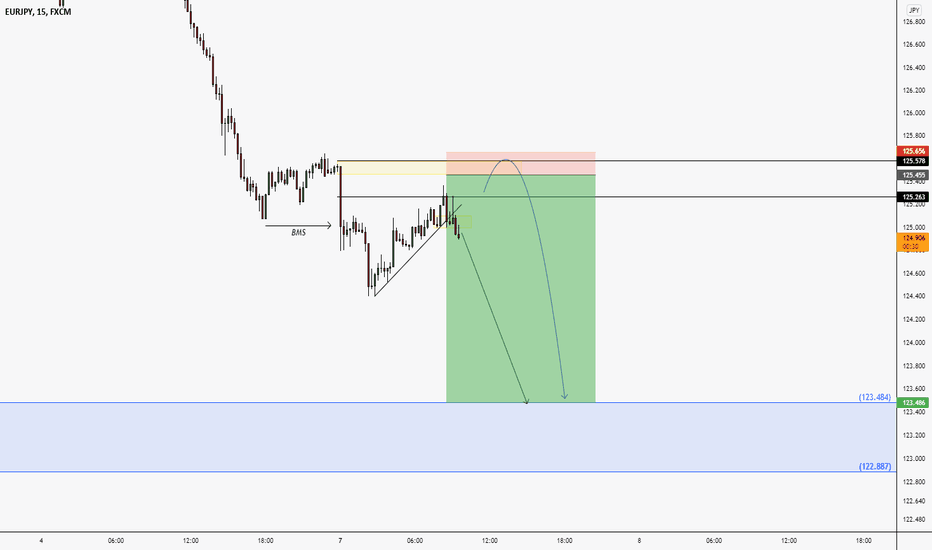

EURJPY | Breaking TrendlineEURJPY has given a bullish reversal on daily timeframe and since then the pair has been in excellent bullish momentum. Recently price has broken down the falling trendline as well. We are expecting bulls will carry this momentum and push the price to 131 area in near term.

To negate, the bears should push the price lower to 127.500.

Trade your levels accordingly.

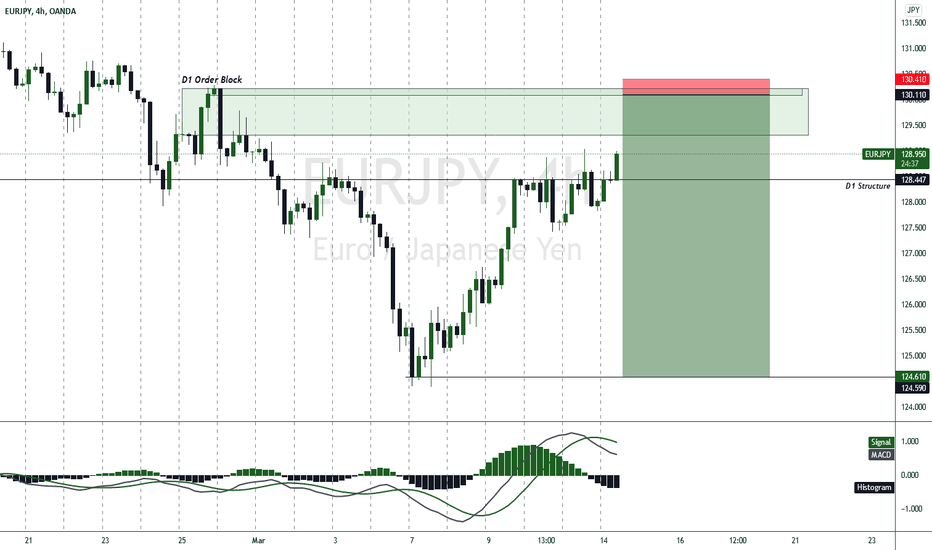

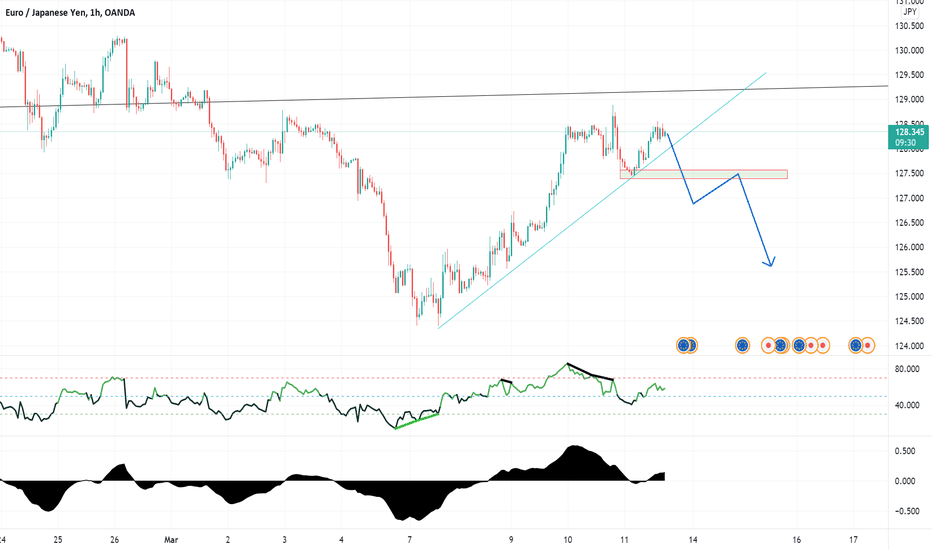

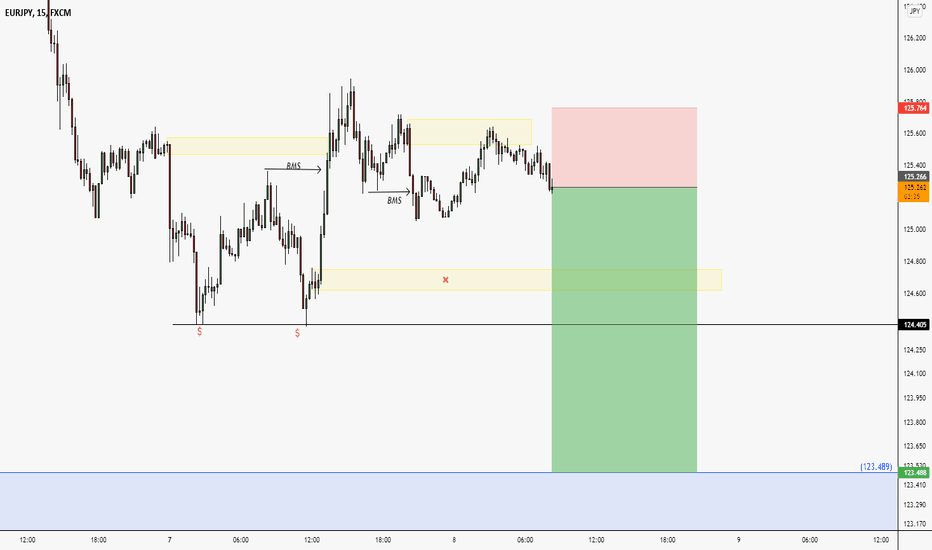

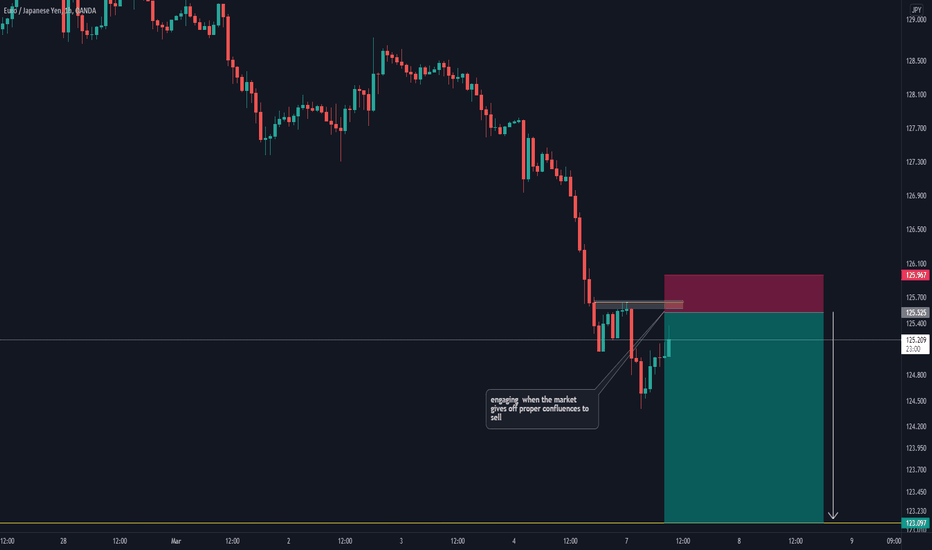

EURJPY PLANNING AHEAD FOR TRADESFor More Daily Detailed Analysis Videos, go ahead and Click on the Follow Button. If you do have any questions, please ask them in the comments section below!

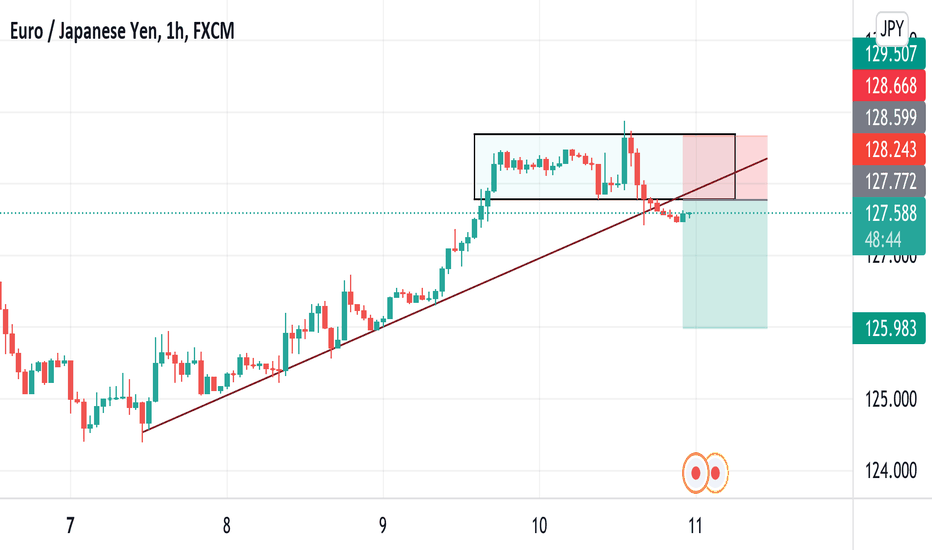

As we Start the London Trading Session we can have a look at the EURJPY.

Today we will see ECB meetings commence and it is important to plan the assets we are trading before hand..

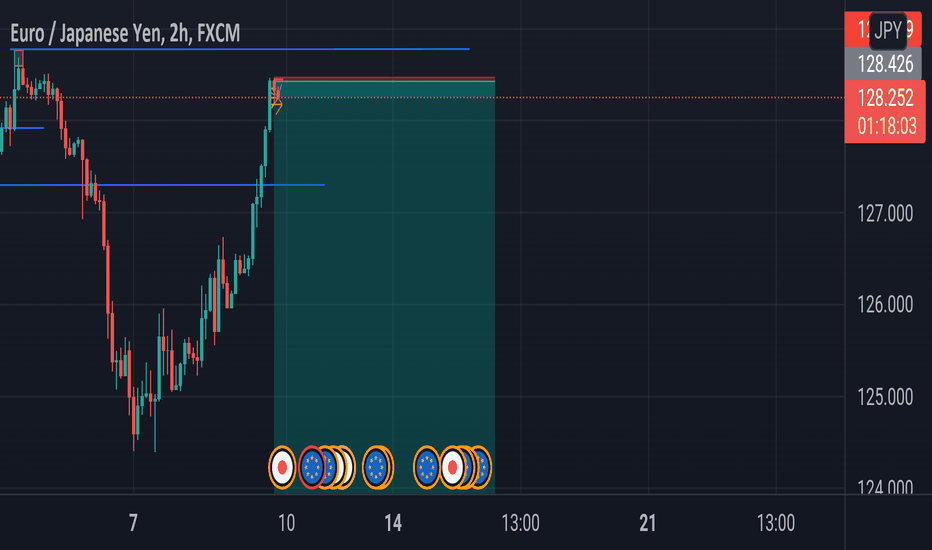

After the strong move up on better market sentiment we are arriving at key short zones for intraday Trading. We are looking to enter the market at key market memory zones.

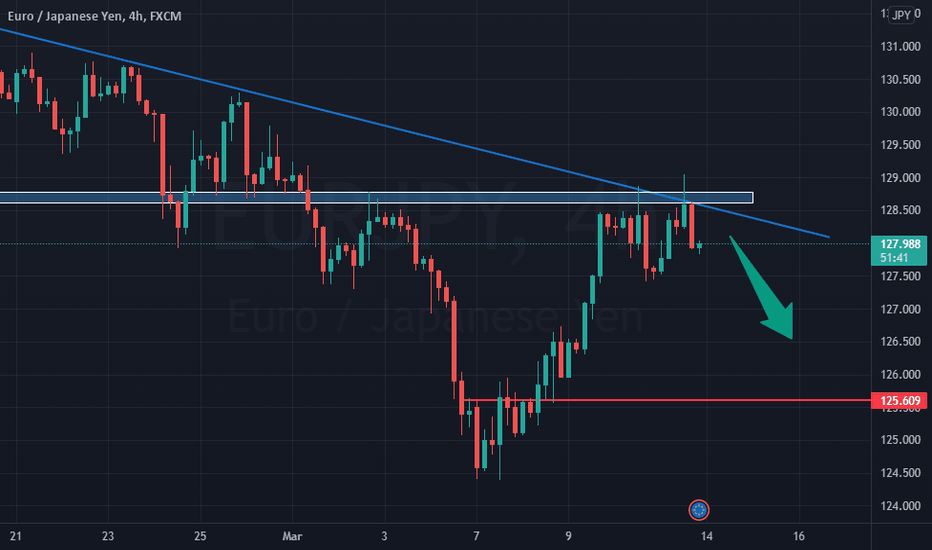

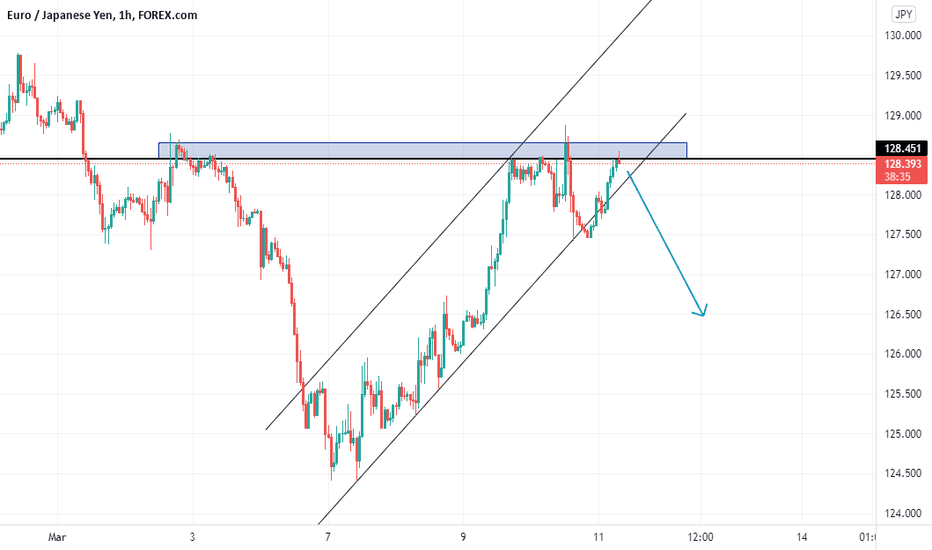

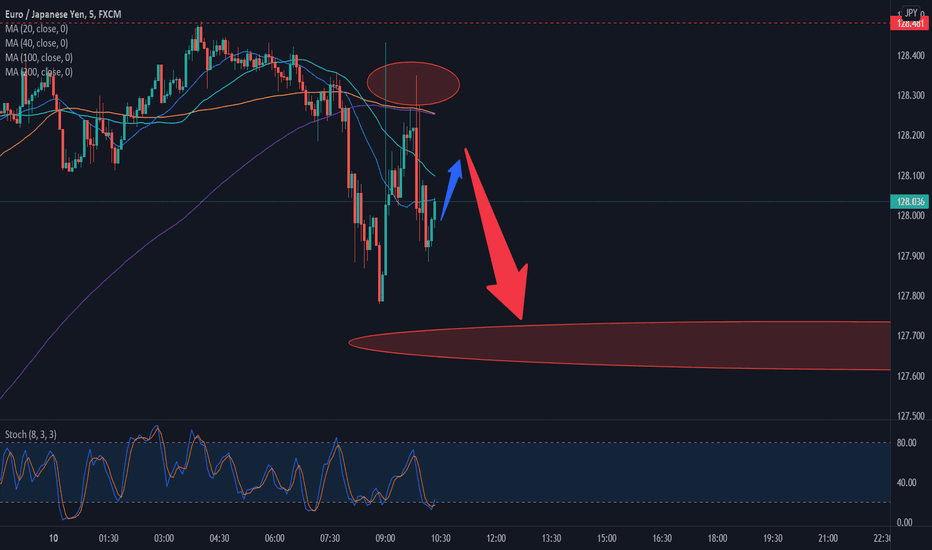

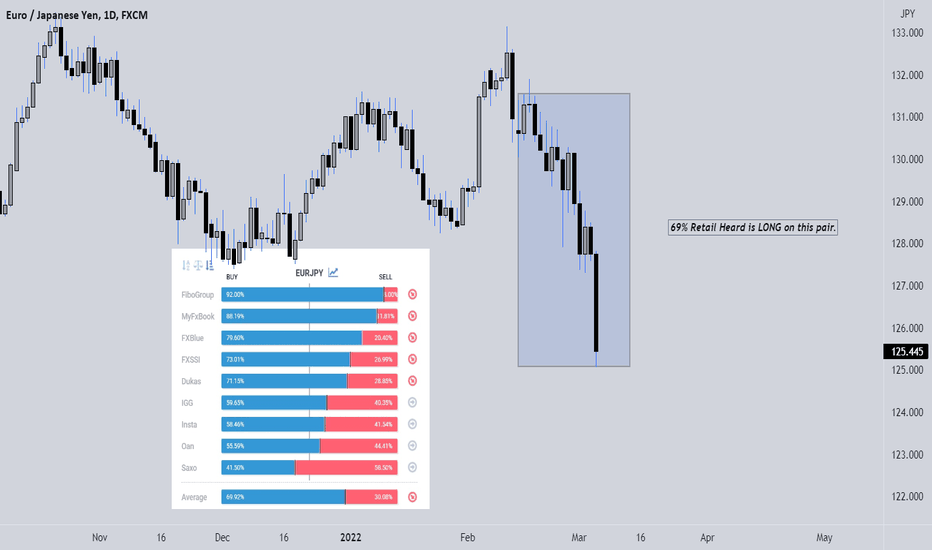

EURJPY RETAIL HEARD 📉📉📉I tried to provide you in this example how not to trade and how to find high probability entries.

In this example EURJPY was longed by retail traders for two weeks for around 69% heard positions.

The lesson is very simple if the heard is LONG and tries to catch the bottom on EURJPY for example you will look only for shorts as the longs are not high probability due huge retail positions on long

What do you think ? Comment below..

EUR/JPY Short Trade UpdateHey Guys! Just a quick update!

As you guys know the current weekly bias on the Eur/Jpy is short. Or in other words, price is likely to reach 133.68 before reaching 114. 40 .

In this video, I explain the short position I'm currently holding and the reasons why I took the entry, as well as how I plan to trade this set up in the coming weeks.

That's it! I'll keep you guys updated!

Have a great day!

Ken

Disclaimer: This is not Personal Financial Advice.

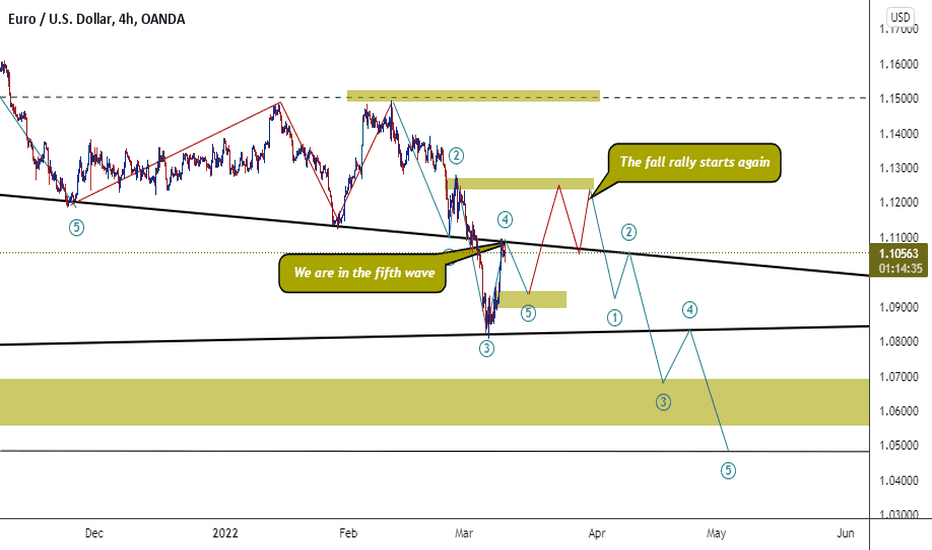

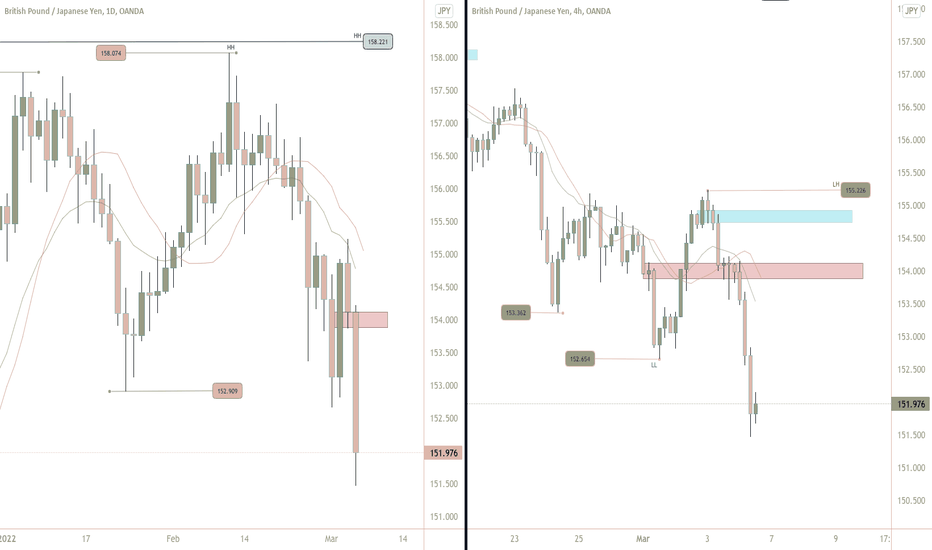

EURJPY The Big ShortSo I decided to close my 300 pip trade on EURJPY because I saw a bullish pattern form visually.. not actually. Which was a good call anyway. I saw the pullback happening and will re-enter my short trade after it passes the pullback reversal price or Get in on the pullback at the Ichimoku cloud resistance area... Sell Limit and Sell Stop.