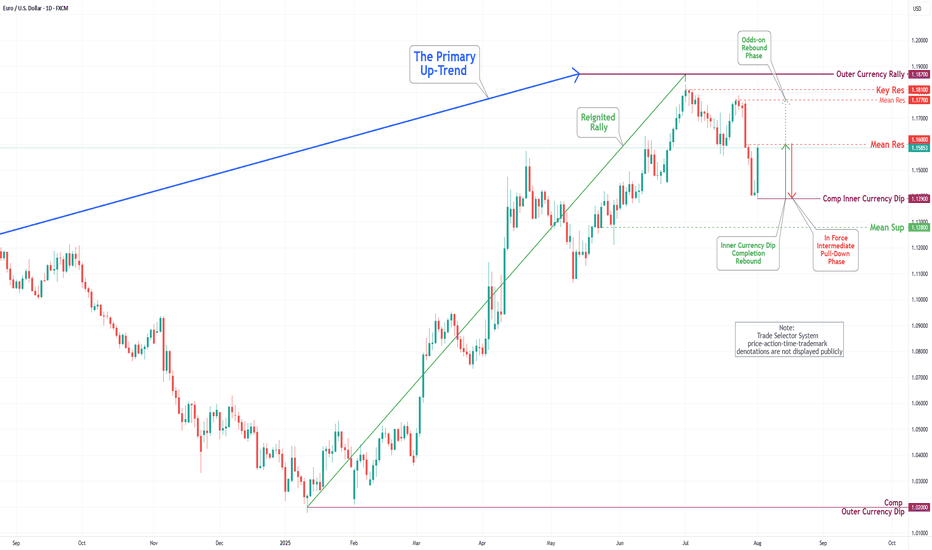

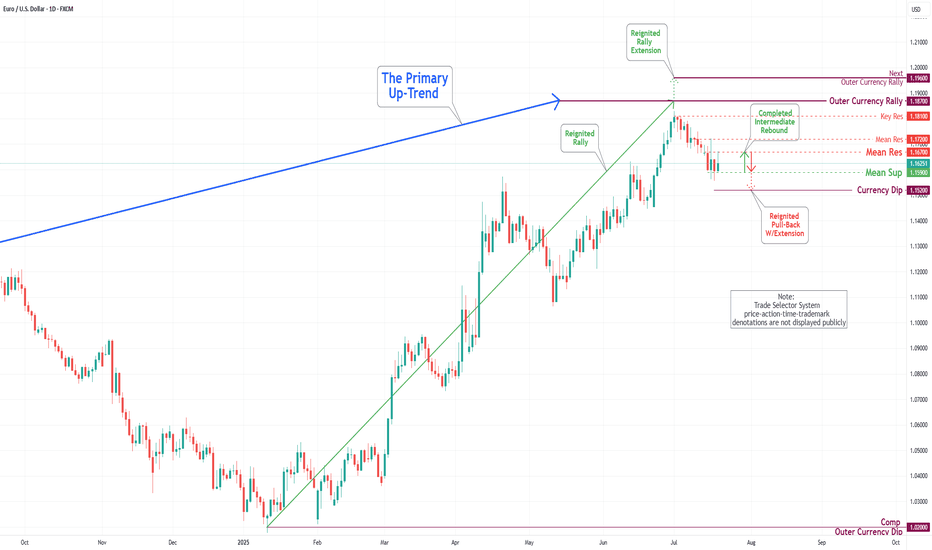

EUR/USD Daily Chart Analysis For Week of August 1, 2025Technical Analysis and Outlook:

In this week's trading session, the Euro experienced a significant drop, reaching the 1.139 level, and completing what is referred to as the Inner Currency Dip. As a result of the completion, the currency reversed direction and made a strong rebound, hitting the Mean Resistance level at 1.160. Recent analyses suggest that the Euro is likely to enter a sustained downward move after retesting the Mean Resistance at 1.160, with the target set to revisit the completed Inner Currency Dip at 1.139. However, it is essential to consider the possibility of continued upward momentum towards the Mean Resistance level of 1.177. Such a movement could trigger a significant rebound and lead to the completion of the Outer Currency Rally at 1.187.

Eurodollar

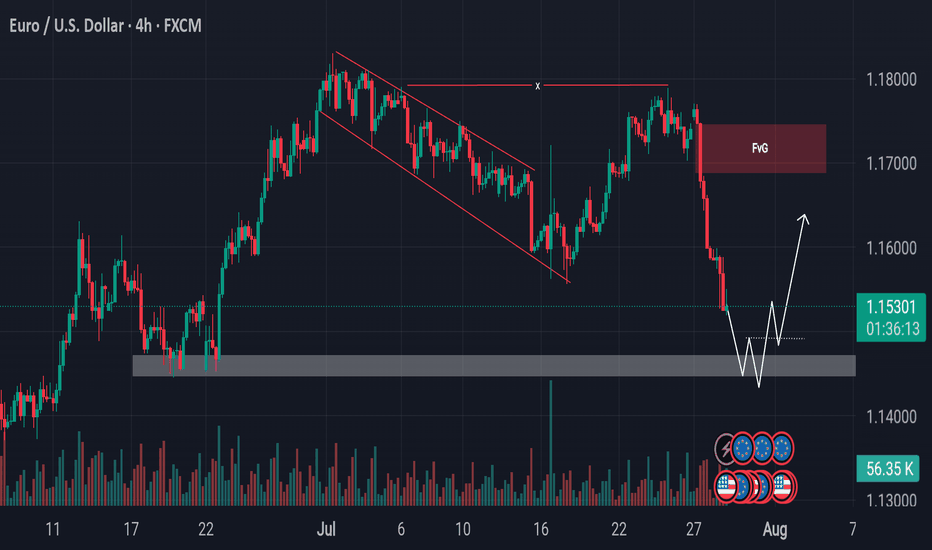

EUR/USD Hits Lowest Level Since Early JulyEUR/USD Hits Lowest Level Since Early July

As the EUR/USD chart indicates today, the euro has fallen below the 1.1550 mark against the US dollar, reaching the lows of June 2025. As a result, July may become the first month in 2025 to record a decline in the currency pair.

Why Is EUR/USD Declining?

There are two key factors driving the euro’s weakness relative to the US dollar:

→ Anticipation of the Federal Reserve Meeting. At 21:00 GMT+3 today, the Fed’s interest rate decision will be released. According to Forex Factory, analysts expect the Federal Funds Rate to remain unchanged at 4.25%-4.50%.

→ Market Reaction to the US-EU Trade Agreement. The trade deal signed last weekend between the United States and Europe is being critically assessed by market participants.

As noted in our Monday analysis, signs of a bearish takeover emerged on the chart following the agreement’s signing. Since then, EUR/USD has declined by approximately 1.3%. The question now is whether the downtrend will continue.

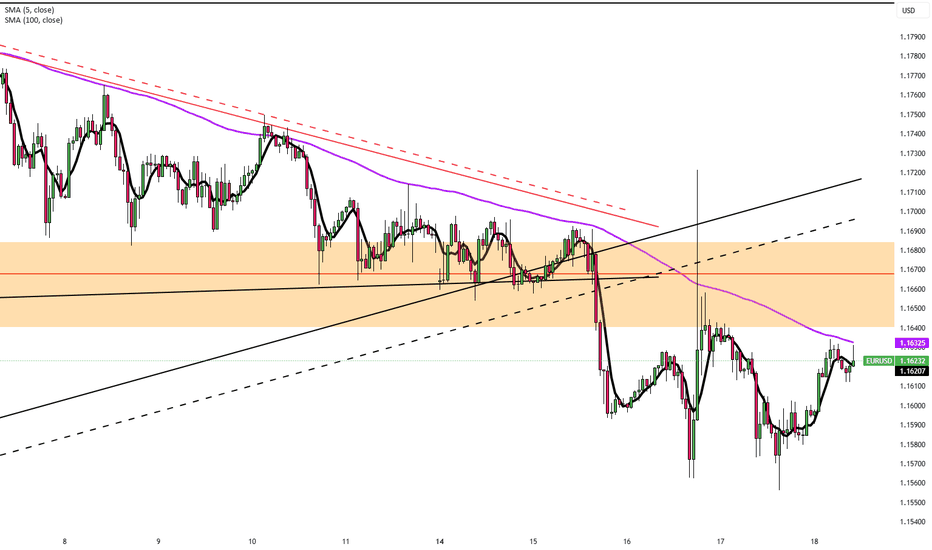

Technical Analysis of the EUR/USD Chart

The upward channel that had remained valid since mid-May was decisively broken by bears this week. The nature of the breakout (highlighted by the red arrow) was particularly aggressive, with the price dropping from the 1.1710 level to the D point low without any meaningful interim recoveries.

Key observations include:

→ The drop has resulted in a classic bearish A-B-C-D market structure, characterised by lower highs and lower lows.

→ On the 4-hour timeframe, the RSI indicator has fallen into oversold territory, reaching its lowest point of 2025 so far.

→ Notably (as highlighted by the blue arrow), there was a strong rebound from the 1.1455 support level earlier. Bulls demonstrated significant strength at that time, breaking through the R resistance line.

Given these factors, we could assume that after this week’s sharp decline, EUR/USD may attempt a short-term recovery from the support zone (highlighted in purple). Should this scenario unfold, potential resistance may emerge near the 1.1630 level, as this area aligns with:

→ The 50% Fibonacci retracement of the C→D decline;

→ The breakout point of the lower boundary of the previous ascending channel, indicating a shift in market balance in favour of the bears.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Analysis: EUR/USD Dips FurtherMarket Analysis: EUR/USD Dips Further

EUR/USD extended losses and traded below the 1.1600 support.

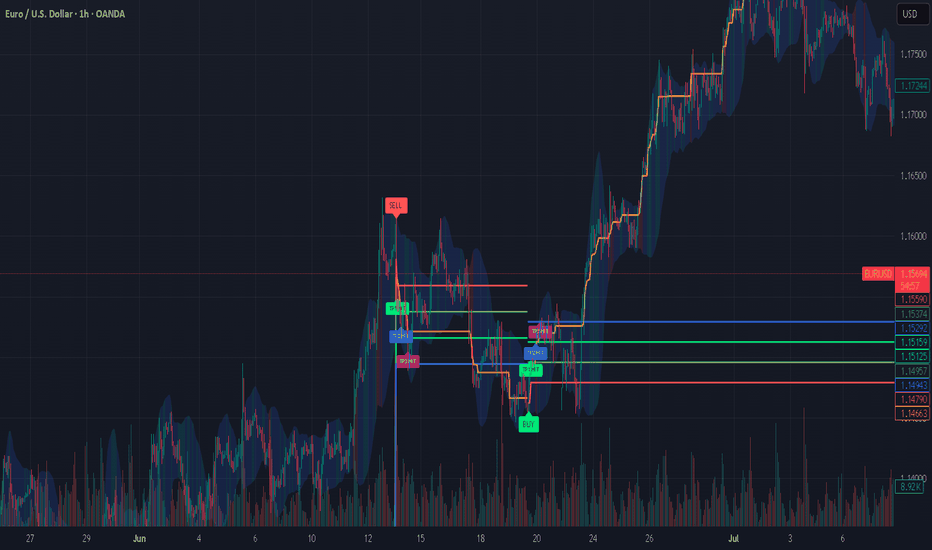

Important Takeaways for EUR/USD Analysis Today

- The Euro struggled to clear the 1.1800 resistance and declined against the US Dollar.

- There is a key downward channel forming with resistance at 1.1575 on the hourly chart of EUR/USD.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair failed to clear the 1.1800 resistance. The Euro started a fresh decline below the 1.1720 support against the US Dollar.

The pair declined below the 1.1660 support and the 50-hour simple moving average. Finally, it tested the 1.1520 level. A low was formed at 1.1519 and the pair is now consolidating losses. The market is showing bearish signs, and the upsides might remain capped.

There was a minor increase toward the 23.6% Fib retracement level of the downward move from the 1.1770 swing high to the 1.1519 low. Immediate resistance on the upside is near the 1.1575 level.

There is also a key downward channel forming with resistance at 1.1575. The next major resistance is near the 1.1665 zone and the 50-hour simple moving average or the 50% Fib retracement level.

The main resistance sits near the 1.1770 level. An upside break above the 1.1770 level might send the pair towards 1.1800. Any more gains might open the doors for a move towards 1.1850.

On the downside, immediate support on the EUR/USD chart is seen near 1.1520. The next major support is near the 1.1465 level. A downside break below 1.1465 could send the pair towards 1.1350.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Trendline Liquidity Taken Watching for MSS at Support in EUR/USDEUR/USD has taken liquidity above the previous trendline resistance during the New York session and is now declining. The pair is approaching a key support zone. If it reaches this level and shows a market structure shift (MSS) or any other bullish confirmation, there is potential for a reversal from this zone. In that case, price could move upward toward the marked bearish Fair Value Gap (FVG). Always conduct your own research (DYOR) before making any trading decisions.

Should You Still Sell Your USD for EUR? A 2025 PerspectiveWith currency markets in constant flux, the decision to hold USD or convert to EUR carries major financial implications for investors, expatriates, businesses, and frequent travelers. As of July 29, 2025, the USD/EUR exchange rate is around 0.86–0.87, with $1 buying roughly €0.86. Is now the right time to sell your US dollars for euros? Here’s a balanced look at the latest data and forecasts.

Current Market Context: Dollar Weakness and Euro Stabilization

USD Slide in 2025: The US dollar has experienced its steepest decline in over three years, falling nearly 10% year-to-date. This sustained weakness is attributed to policy volatility, capital flowing out of the US, and narrowing interest rate differentials.

Key Exchange Rate: Recent rates hover between 0.85 and 0.87, representing moderate stability following a period of volatility.

Euro’s Resilience: While the euro has had its own struggles, from slower economic growth to political uncertainty in Germany and France, analysts forecast no major sustained fall for the euro through 2025.

2025 Forecasts: USD/EUR Direction—What Do the Experts Say?

Year-End 2025 Outlook: Major banks and forecasting firms expect the EUR/USD rate could climb even higher by year-end, meaning the euro could gain modestly versus the dollar if current trends continue.

Factors to Watch:

Fed Rate Cuts: Potential US rate cuts in Q3–Q4 remain a key driver for further USD weakness.

Trade & Tariff Uncertainty: Ongoing US tariff announcements and global trade tensions add volatility but also support safe haven flows to the dollar.

Eurozone Politics: Any resolution of political uncertainty in Europe could buoy the euro.

Most Important One: Fed's Money Printer...

Strategic Considerations: Should You Sell Now?

Locking in Current Rates: If you need euros to make payments, pay salaries, or make investments in the short term, converting a portion now could reduce your exposure to further USD downside.

If You Can Wait: Analysts see some chance for USD recovery in late Q3 or early 2026, but this is contingent on US policy stability and Fed decisions.

Averaging In: For larger transfers, consider splitting your transaction over time (also called dollar-cost averaging), which can help mitigate volatility.

Bottom Line

If you have an immediate need for euros, current rates present a reasonable opportunity. The dollar’s weakness throughout 2025 is well documented, but much of the pessimism may already be priced in. If you’re flexible with timing, monitor central bank policy signals throughout Q3/Q4, a more dovish Fed or unexpected eurozone stability could push rates further in your favor, but event risks remain elevated. Ultimately, a phased or hedged approach may offer both protection and potential upside

*not investment advice*

#forex #fx #dollar #usd #euro #eur #economy #trade #tariff #trading #indicator

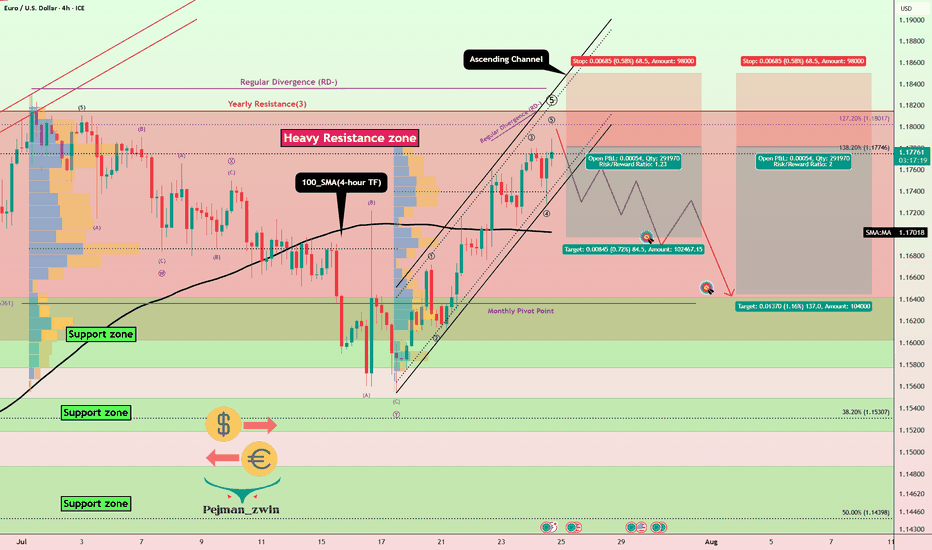

EURUSD at Make-or-Break Zone: Time to Short?EURUSD – Key Data Out Today, Short Setup Confirmed?

Today, several important economic indexes were released for both the Euro(EUR) and the Dollar(USD) . Let’s break them down in a simple way:

Eurozone PMI Data: Mixed to Weak

France:

Manufacturing PMI: 48.4 (slightly lower than forecast)

Services PMI : 49.7 (flat, but below 50 = contraction)

Germany:

Manufacturing PMI: 49.2 (weaker than expected)

Services PMI : 50.1(slightly expansionary)

Eurozone Overall:

Manufacturing PMI: 49.8 (still below 50)

Services PMI : 51.2 (slightly stronger than forecast)

ECB left the Main Refinancing Rate unchanged at 2.15% , which was widely expected.

U.S. Data( TVC:DXY ): Strong and Surprising

Unemployment Claims: 217K (better than expected 227K)

Manufacturing PMI: 49.5 (below forecast of 52.7 – a negative surprise)

Services PMI: 55.2 (well above forecast and previous – bullish for USD)

Interpretation :

The Eurozone's growth remains sluggish, especially in France and Germany.

Despite a drop in U.S. manufacturing, the services sector remains strong, and unemployment data confirms labor market resilience.

This mixed picture slightly tilts the balance in favor of the U.S. dollar, especially as the ECB remains on hold while the Fed may still consider being restrictive.

Bias: Short EURUSD ( FX:EURUSD )

Fundamentals support a Short position in EURUSD, in line with the current technical setup.

---------------------------------

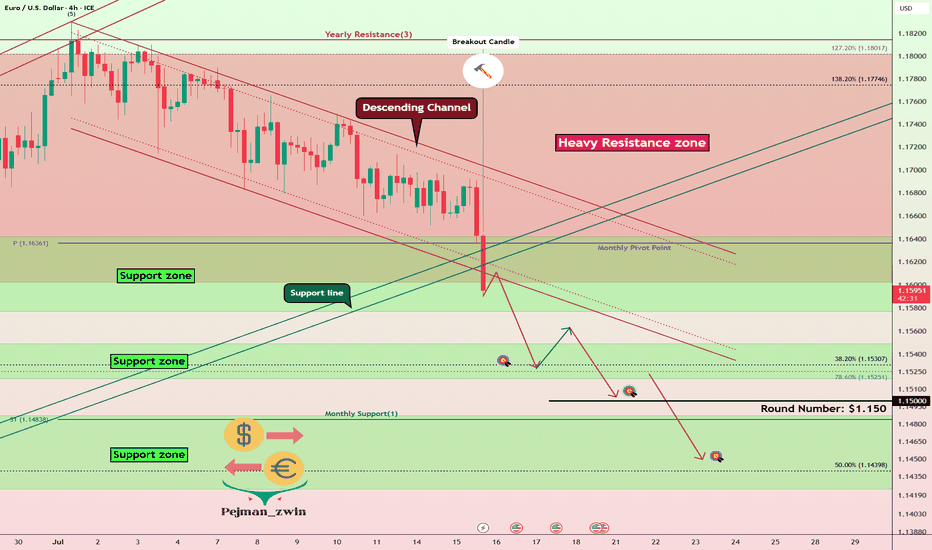

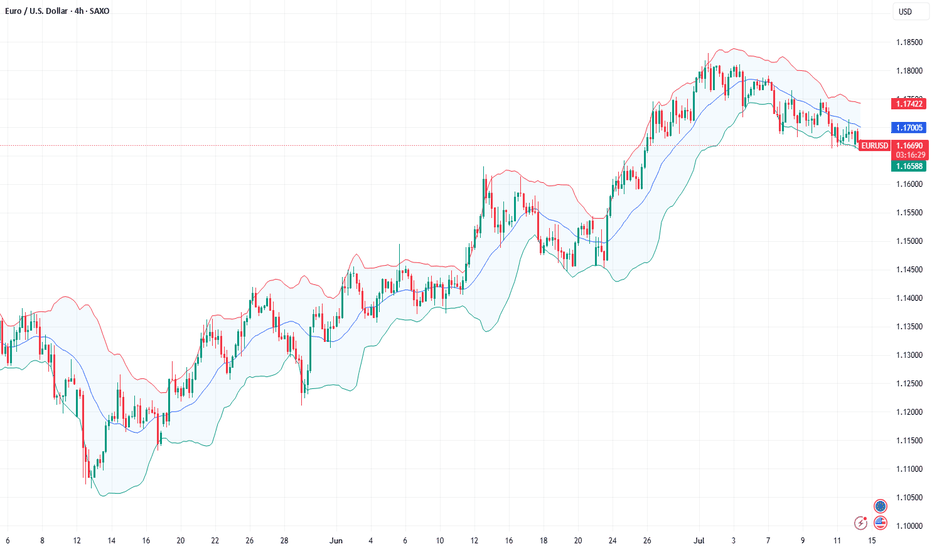

Now let's take a look at the EURUSD chart on the 4-hour time frame to find the best Short position .

EURUSD is currently trading in an Ascending Channel and at a Heavy Resistance zone($1.1845-$1.1602) .

Also, in terms of Elliott wave theory , it seems that EURUSD is completing a microwave 5 of the main wave 5 .

One of the most important supports ahead for EURUSD could be the 100_SMA(4-hour TF) .

If the currently 4-hour candlestick forms a Shooting Star Candlestick Pattern , it is a better sign for EURUSD to fall .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks .

I expect EURUSD to decline to at least $1.169 AFTER breaking the lower line of the ascending channel .

Second Target: Support zone($1.1642-$1.158) and Monthly Pivot Point.

Note: Stop Loss(SL)= $1.1850

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S. Dollar Analyze (EURUSD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Europe and the US Sign Trade Agreement, EUR/USD DeclinesEurope and the US Sign Trade Agreement, EUR/USD Declines

The past weekend was marked by the official signing of a trade agreement between the United States and Europe, as announced by US President Donald Trump and President of the European Commission Ursula von der Leyen following their meeting in Scotland.

According to reports, the agreement is based on a 15% baseline tariff on goods exported from Europe to the United States, with certain exemptions. As previously reported, a trade agreement with a 15% baseline tariff had earlier been concluded between the US and Japan.

According to President Trump:

→ under no circumstances did he allow the baseline tariff for Europe to fall below 15%;

→ the European Union committed to investing in the US economy, purchasing weapons, and importing energy resources.

The financial markets’ reaction to this news is noteworthy:

→ European stock indices opened the week with a bullish gap, reflecting relief that previously feared tariffs of up to 30% did not materialise;

→ the EUR/USD pair is exhibiting bearish momentum this morning.

Technical Analysis of the EUR/USD Chart

As indicated by the black arrow, bearish sentiment intensified on Monday morning, pushing the pair towards the 1.1700 level, which had previously acted as resistance in mid-July.

From the perspective of the ascending channel (shown in blue), its median line is currently acting as a resistance level – following contact with it, a short-term rally was broken (highlighted in purple). This reinforces the notion that bears are currently in control.

Given the above, we could suggest that, should bearish sentiment persist on the EUR/USD chart, we may soon witness an attempt to break through the 1.1700 support level. A successful breach could open the path for further downside movement of the euro against the dollar, towards the lower boundary of the channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

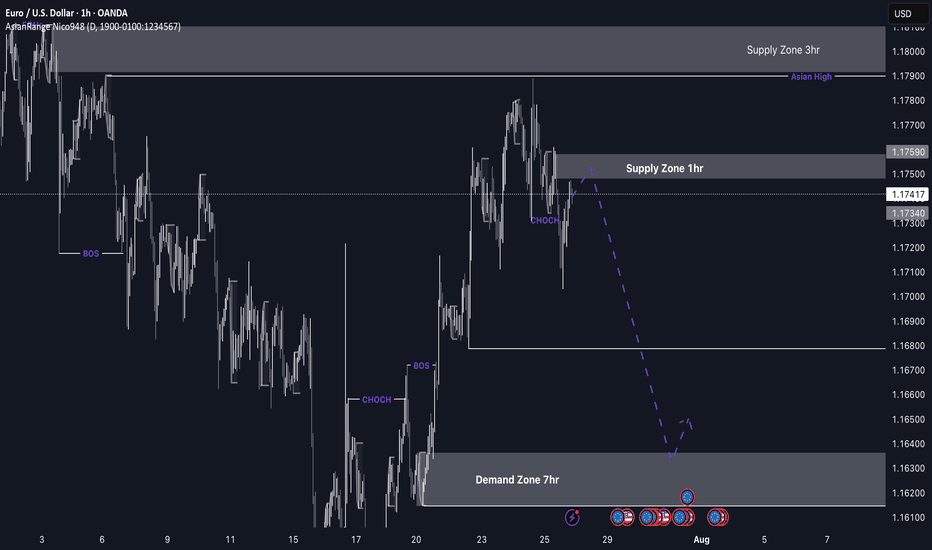

EUR/USD Short from the nearby 1hrI’m currently more confident in EU’s bearish setup compared to GU, as price is nearing a clear point of interest (POI) that aligns well with the developing downtrend. The 2hr supply zone has already caused a CHoCH (Change of Character), and price has been approaching it slowly and with reduced momentum — often a strong indication of an upcoming reaction.

While price isn’t near a demand zone yet, I’ll be keeping an eye on the 7hr demand zone below. If price reaches that area, I’ll be looking for a high-probability buy setup in line with the broader market context.

Confluences for EU Sells:

Price has tapped into a 2hr supply zone that caused a CHoCH to the downside

Bearish pressure remains strong, supported by DXY strength

Clean liquidity to the downside that needs to be swept

Slowing momentum and signs of distribution as price approaches supply

P.S. If price continues lower from this point, I anticipate another break of structure, which could form a new supply zone to work with later this week.

Let’s stay patient, follow the flow, and execute smart. 🔥📉💼

EUR/USD Robbery Blueprint Bear Strike Activated!💣🎯Operation Fiber Down: EUR/USD Robbery Blueprint (Day Trade Edition) 💰🔫

🚨 Thieves, Hustlers & Chart Bandits Assemble! 🚨

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

Welcome back to another Thief Trading Operation, where the money never sleeps—and neither do we. Let’s break into the vault of EUR/USD “The Fiber” with surgical precision. 🧠💼🕶️

🧨 THE MASTER ROBBERY PLAN: EUR/USD SHORT STRIKE 🔍💸

💀 Market Bias: Bearish – Trend Reversal + Supply Trap Setup

🎯 Target: 1.15800

🛑 Stop-Loss: Near Swing High (around 1.17400 – 3H chart view)

🕓 Timeframe Focus: 15m / 30m / 3H

🧭 ENTRY ZONE:

👣 Plan your entry from recent high retests—that’s where the big money bulls get trapped.

🎯 Use Sell Limit Orders (DCA style / Layered Limit Orders) like a true thief setting up tripwires.

💼 RISK STRATEGY:

💡 SL should match your lot size and order count—not one-size-fits-all!

📌 Place above key structure or swing level (e.g. 1.17400) based on timeframe.

🔍 BEHIND THE SCENES – THE WHY:

The EUR/USD "Fiber" pair is showing all the classic signs of a trend shift and bear raid setup, including:

📰 Fundamentals weakening the Euro

💣 COT Report reveals institutional exits

🍂 Seasonal Bias points to downward trend

📉 Intermarket Pressure from bond yields & USD strength

📊 Sentiment turning overly bullish = trap zone

⛽ Storage & Inventory imbalances adding fuel

📌 Reminder: Before any robbery, study the layout—Macro, Fundamentals, Sentiment, and Intermarket are your blueprint.

🚨 HEIST ALERT – PROTECT THE LOOT:

🕰️ High-Impact News Events? Tighten up!

💼 Don’t take fresh entries during releases.

🔐 Use Trailing SLs to lock in profits.

🎯 Exit with grace before the sirens start.

⚡🔥JOIN THE CREW, BOOST THE LOOT🔥⚡

💥 Smash the Boost Button 💥 if you're vibing with the Thief Trading Movement.

We ain’t just trading—we’re executing strategic robberies on the market’s weaknesses.

🧠💪 Every like = more power to the crew. Every comment = a new map to a vault.

We rob, retreat, and repeat. Let’s make money with skill, not luck. 🕶️💰🚁

⚠️ LEGAL COVER (For the Lawyers 😏):

This plan is not investment advice, just an organized heist blueprint by chart robbers.

Always manage your own risk and update your plan as the market evolves.

🕶️ Stay ready for the next master plan... Until then, keep your charts clean and your stops tight. 🕶️💣📉

– Thief Trader Out 🐱👤🚀

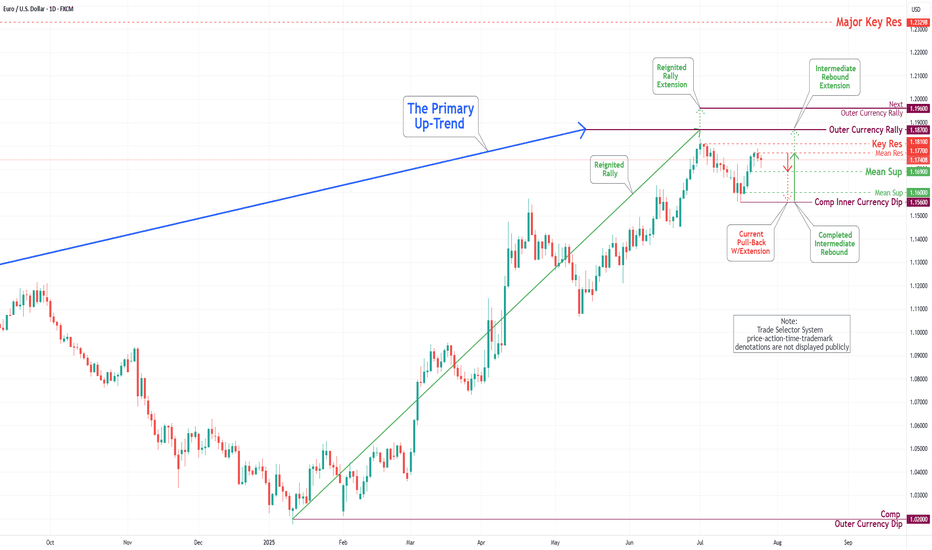

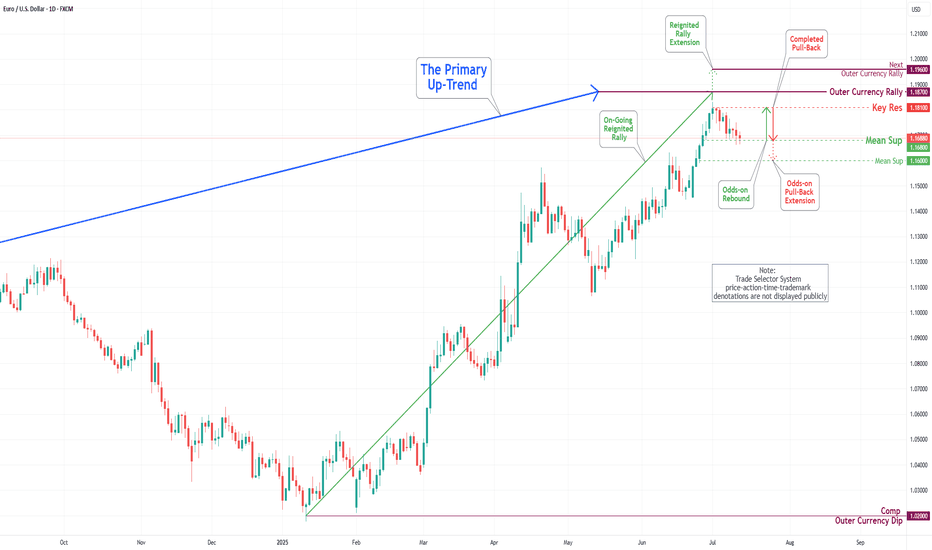

EUR/USD Daily Chart Analysis For Week of July 25, 2025Technical Analysis and Outlook:

During the previous week's trading session, the Euro experienced an increase following the completion of the Inner Currency Dip at the 1.156 level. It subsequently surpassed two significant Mean Resistance levels, namely 1.167 and 1.172; however, it reversed direction by the conclusion of the trading week. Recent analyses indicate that the Euro is likely to undergo a sustained downward trend, with a projected target set at the Mean Support level of 1.169 and a potential further decline to retest the previously completed Currency Dip at 1.156. Nonetheless, it remains essential to consider the possibility of renewed upward momentum towards the Mean Resistance level of 1.177, which could initiate a preeminent rebound and facilitate the completion of the critical Outer Currency Rally at 1.187.

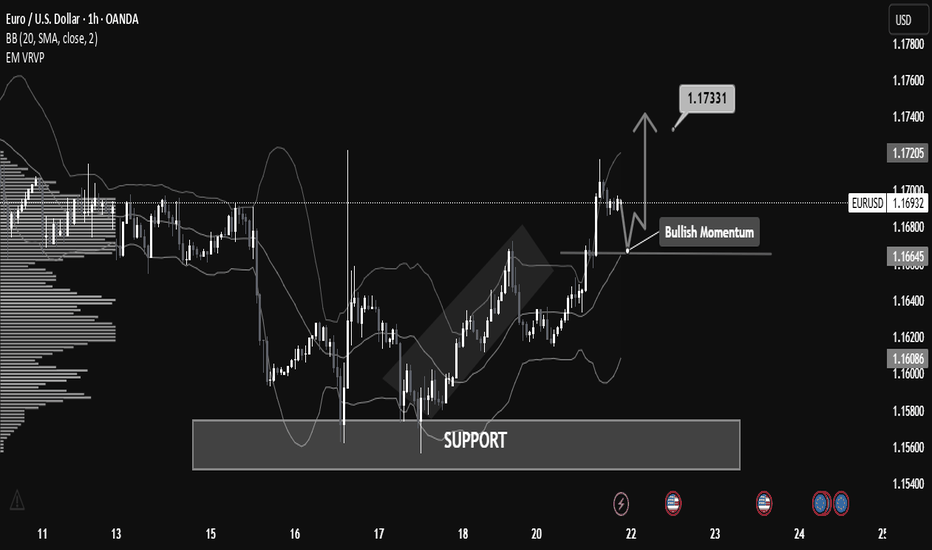

"EUR/USD Technical Blueprint: Bullish Continuation EUR/USD Technical Blueprint: Bullish Continuation Patterns and Strategic Price Zones Explained

🔹 Market Structure & Trend

The chart shows a clear shift from a ranging phase into a bullish breakout:

Price previously consolidated in a broad horizontal channel, with a strong demand zone (support) established between 1.16000 – 1.16600.

Following a deep liquidity grab on July 17-18, the price bounced sharply from support, creating higher highs and higher lows – a classic bullish structure.

Current momentum shows bullish continuation, as the price broke above local resistance around 1.16645 and is now forming a potential bull flag or bullish pennant pattern.

🟢 Bullish Momentum Confirmation

Price is currently retesting the broken resistance (now acting as support at 1.16645).

If the support holds and bullish momentum continues, the measured move target projects a price move toward 1.17331, the next significant resistance level.

This is also supported by increased volume activity in the breakout zone, as seen on the VPVR.

📊 Key Technical Levels

Level Type Description

1.16000 Major Support Historical demand zone + liquidity grab

1.16645 Support Zone Previous resistance, now retest area

1.16926 Current Price Bullish consolidation forming

1.17331 Resistance Bullish target based on breakout projection

1.17700+ Extension Potential continuation level if momentum persists

🧠 Volume & Volatility Insight

Bollinger Bands are expanding post-breakout, indicating increasing volatility and a potential trend continuation.

VPVR shows a high-volume node around 1.166, confirming it as a strong demand zone.

🔎 Outlook & Strategy

✅ Bullish Bias

As long as the price remains above 1.16645, buying dips could be a favorable strategy.

A break above 1.17000 with strong volume could open a path toward 1.1733 and higher.

❌ Invalidation Level

A strong close below 1.16600 would invalidate the bullish setup and could return price to the lower support around 1.16000.

📌 Conclusion

EUR/USD is displaying strong bullish momentum after breaking a key resistance level and forming a solid support base. A breakout above 1.17000 may lead to a continuation toward 1.17331 and potentially higher. This setup favors bullish positioning with tight risk management.

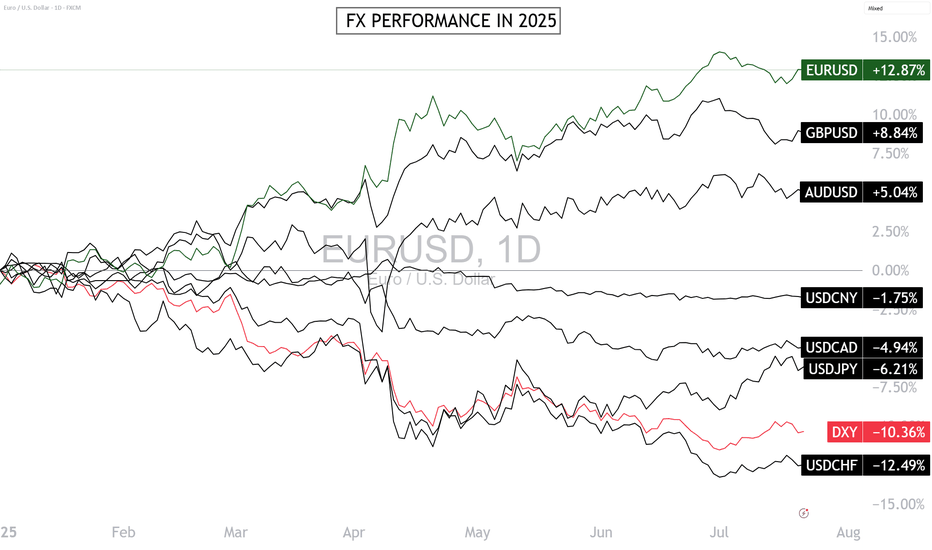

Can the Euro-Dollar Maintain Its Leadership in the FX Market?The Euro-Dollar is the best-performing major FX pair in 2025, and a short-term consolidation phase has begun below $1.18. This strength of the euro-dollar is surprising given the divergence in monetary policies. Can the euro-dollar go higher this year? How can this strength be explained fundamentally? In this week of ECB monetary policy decision (Thursday, July 24), let’s take a technical and fundamental look at the euro-dollar, which is stalling after reaching the technical resistance at $1.18.

1) Euro-Dollar’s Leadership in 2025 Defies the Logic of Monetary Policy Divergence

2025 is proving surprising in the FX market: the euro-dollar (EUR/USD) is the top-performing pair, with a gain of over 12% since the beginning of the year. This outperformance is puzzling if we rely on classic monetary fundamentals. The divergence between the Federal Reserve (Fed) and the European Central Bank (ECB) should favor the dollar.

The Fed maintains a prolonged monetary status quo with high rates due to persistent inflation and labor market tensions. In contrast, the ECB continued its rate-cutting cycle, reflecting a weaker European economy and better-contained inflation. Theoretically, this monetary asymmetry should have strengthened the dollar — yet the euro leads. This paradox is explained by a combination of fundamental factors.

2) Unexpected Fundamentals Are Driving the Euro-Dollar’s Strength in 2025

The euro-dollar’s bullish trend this year ignores the interest rate differential between the Fed and the ECB, both current and projected for the end of 2025.

Here’s a summary of the bullish fundamentals that allowed the euro-dollar to overlook monetary divergence:

• Trump administration’s fiscal policy raises concerns over U.S. debt sustainability (see long-term bond yields)

• Trade war initiated by the Trump administration creates economic slowdown risks for U.S. companies heavily reliant on international trade

• U.S. administration’s political will to improve currency competitiveness for exporters

• European stocks catching up to U.S. stocks in valuation

• Emerging markets’ will to diversify their public debt issuance

• Euro catching up as a global reserve currency as diversification away from the U.S. dollar

• Germany’s structural shift in fiscal and debt policy with massive investments in defense and industry

• EU stimulus spending and the ECB’s perceived monetary policy coherence

3) Is $1.18 the Final High for the Euro-Dollar in 2025? Probably Not.

The euro-dollar has been consolidating since early July after hitting $1.18. Is this the peak for the year? The answer is no — unless EUR/USD breaks below the $1.13/$1.15 support and unless institutional net positions reverse from their upward trend (see yellow line in CFTC COT data).

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

EUR/USD Daily Chart Analysis For Week of July 18, 2025Technical Analysis and Outlook:

In the current trading session, the Euro has continued its decline, completing our Mean Support level of 1.160. Recent analyses indicate that the Euro is likely to experience a sustained downward trend, with an anticipated retest at the Mean Support level of 1.159 and a possible further decline to reach a Currency Dip of 1.152. Nevertheless, it is crucial to consider the potential for a dead-cat bounce toward the Mean Resistance level of 1.167, which could trigger a significant reversal of the downtrend and target a Currency Dip of 1.152.

EUR/USD Drops to $1.16 Amid Strong U.S. DataThe euro declined to $1.16 on Thursday, reaching its lowest level in almost a month as the U.S. dollar regained strength. The dollar’s rise followed solid U.S. inflation data and President Trump’s comments suggesting he will keep Fed Chair Jerome Powell in place, reducing expectations for near-term Fed rate cuts. Meanwhile, markets continued to monitor U.S.-EU trade negotiations ahead of the August 1 deadline.

Resistance for the pair is at 1.1670, while support is at 1.1580.

Fundamental Market Analysis for July 17, 2025 EURUSDThe euro is edging back toward the 1.16 – 1.17 range highs after headlines suggesting former U.S. president Donald Trump might try to dismiss Fed Chair Jerome Powell and a softer-than-expected U.S. Producer Price Index (PPI) print pressured the dollar. Political noise around the Fed’s independence, coupled with a cooling inflation pulse, has pushed market pricing toward a longer policy pause; the pair is hovering near 1.16250 at the time of writing.

Fundamental support also stems from the upcoming 24 July ECB meeting. Governing-Council commentary reveals a split between hawks and would-be doves, yet consensus that euro-area inflation remains above target makes an aggressive rate cut unlikely for now. Meanwhile, subdued U.S. Treasury yields—futures price a 95 % probability of no change this month and only 50 bp of total easing over 12 months—help narrow the U.S.–German 10-year spread to about 150 bp.

Against a backdrop of ongoing U.S. trade tensions and steady inflows into euro-area assets, that narrower spread leaves room for EURUSD to grind toward the 1.1680 target if sentiment stays risk-positive.

Trading recommendation: BUY 1.16250, SL 1.15950, TP 1.16800

EURUSD Under Pressure After Hot CPI – More Downside Ahead?Today, the US released key inflation figures :

Core CPI m/m: 0.2% (vs 0.3% forecast)

CPI m/m: 0.3% (as expected)

CPI y/y: 2.7% (vs 2.6% forecast, up from 2.4%)

Fundamental Analysis ( EURUSD ):

The slightly lower Core CPI suggests some easing in underlying inflation pressures. However, the headline CPI y/y came in hotter than expected at 2.7%, reinforcing the idea that the Fed is not yet ready to ease policy aggressively.

This combination supports the US dollar, as sticky inflation could delay rate cuts.

EURUSD is likely to remain under pressure in the short term unless the ECB signals a more hawkish stance or US data starts showing broader weakness.

Now let's move on to the technical analysis of EURUSD ( FX:EURUSD ) on the 4-hour timeframe .

EURUSD is trading in a Heavy Resistance zone($1.1802-$1.1602) , having simultaneously managed to break the Support lines and the lower line of the Descending Channel , and is also trying to break the Support zone($1.1642-$1.1578) .

I expect EURUSD to continue its downtrend and decline to the Support zone($1.1549-$1.1520) at the first target .

Second target : $1.15043

Third target : $1.1464

Note: Stop Loss(SL)= $1.1660

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S. Dollar Analyze (EURUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

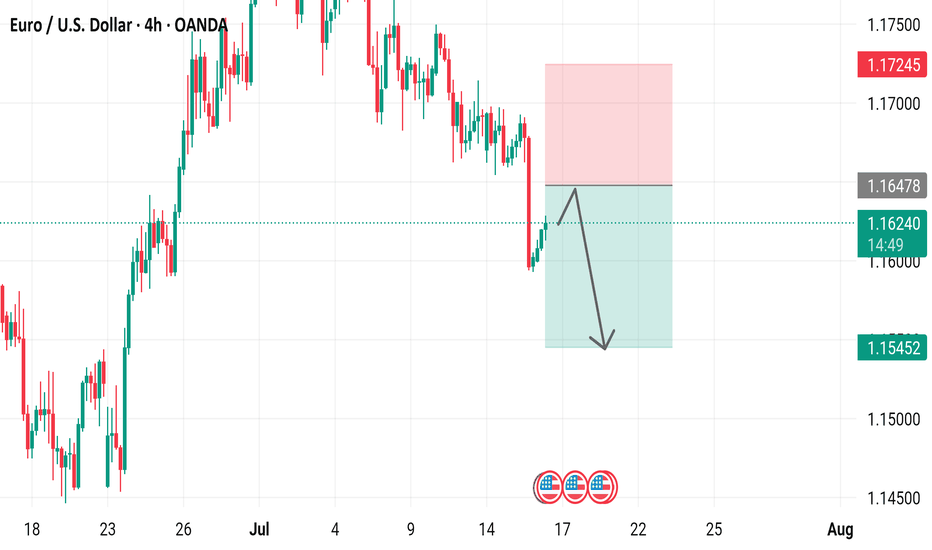

Euro/U.S. Dollar (EUR/USD) 4-Hour Chart - OANDA4-hour performance of the EUR/USD currency pair. The chart shows a recent upward trend peaking around 1.16241, followed by a sharp decline to approximately 1.15452. Key levels include a high of 1.17245 and a support level around 1.16478, with a highlighted area indicating a potential consolidation or reversal zone.

Fundamental Market Analysis for July 14, 2025 EURUSDThe euro remains under pressure: on Monday the pair slipped to 1.16750 after the European Commission extended its pause on retaliatory tariffs against the United States until 1 August. With no resolution in sight, the trade dispute keeps European exporters on edge and turns the dollar into a safe-haven choice for investors looking to limit risk.

Additional support for the greenback comes from rising real yields. The 10-year U.S. Treasury rate is holding above 4.40 %, locking in a wide spread over German Bunds. That has led futures traders to price in just one 25 bp Federal Reserve rate cut for the rest of the year, reducing the euro’s relative appeal.

Macro data from the euro area offer little relief. German industrial production rose only 0.2 % m/m in May, while the July ZEW expectations index slid back into negative territory. With the ECB having already delivered a June cut and projecting lower inflation ahead, inward capital flows to the eurozone remain subdued.

Trading recommendation: SELL 1.16750, SL 1.17050, TP 1.16200

EUR/USD Sells from 1.17200 back downWeekly Outlook: EUR/USD (EU)

This week, my bias on EUR/USD is similar to GBP/USD, as both pairs have been following a consistent bearish trend. Based on this structure, I’ll be watching to see if price begins a retracement back into an area of supply.

I’ve marked out the 8-hour supply zone, which sits at a premium level and was responsible for the last break of structure to the downside. If price retraces into this zone, I’ll look for potential sell confirmations on the lower time frames.

If price doesn’t tap into the supply zone first, I’ll then shift my focus to the 8-hour demand zone below. In that case, I’ll watch closely for signs of accumulation and a bullish reaction from this level, which could signal the start of a rally.

Confluences for EUR/USD Sells:

✅ Bearish trend has been consistent for the past few weeks.

✅ Breaks of structure have formed new supply zones to trade from.

✅ Liquidity exists below current price, which may be targeted first.

✅ The lower demand zone remains unmitigated, suggesting further downside movement.

📌 On the way down toward demand, I expect price to form another break of structure to the downside. The plan is to ride the sells down into demand, then look for potential buy opportunities if price begins to accumulate and react.

Let’s stay sharp and disciplined — have a solid trading week, everyone! 📊

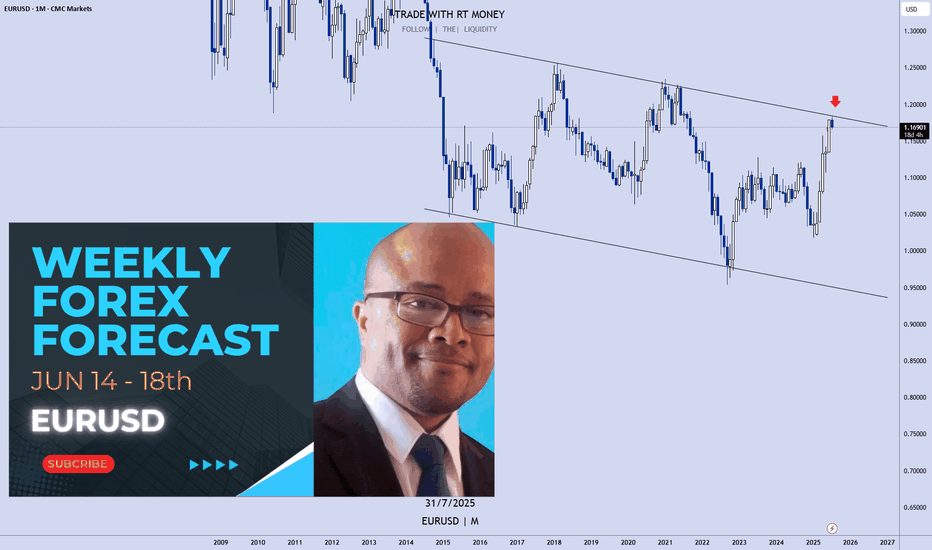

EURUSD Weakened By New Tariff Tensions With US This is the Weekly FOREX Forecast for the week of July 14 - 18th.

In this video, we will analyze the following FX market: EURSUD

The latest headlines tell the story. The tariffs are triggering a slow run to the USD safe haven. The previous week showed the USD Index closed pretty strong. There's a good chance we'll see more of the same this coming week.

Look for the strength in USD to continue to be supported by fundamental news, and outperform the other major currencies, including the EURO.

Buy USD/xxx

Sell xxx/USD

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

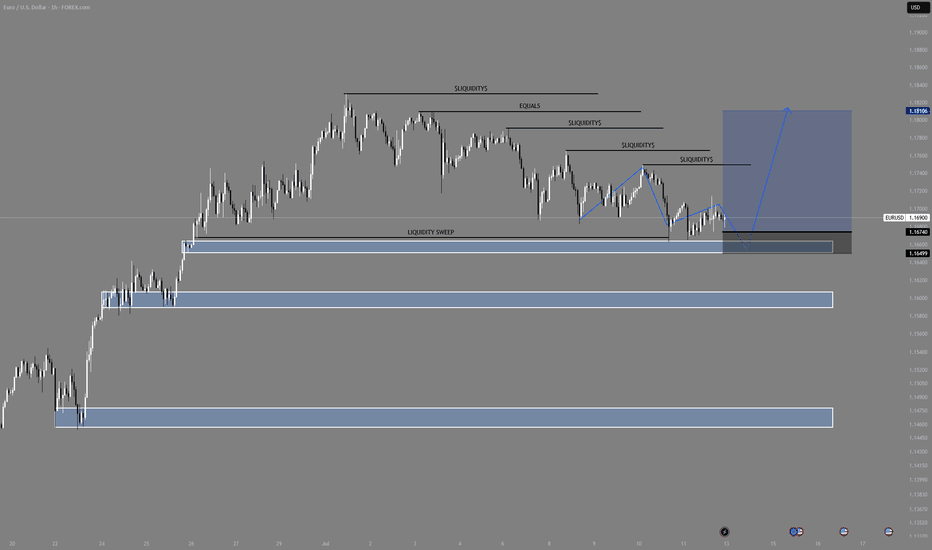

EUR/USD Bullish Continuation SetupMarket Structure Overview:

The market remains in a clear higher timeframe bullish trend, consistently forming higher highs and higher lows. Recently, price has entered a descending channel, resembling a bull flag formation — a classic continuation pattern that typically precedes a strong bullish breakout.

Key Observations:

✅ Descending Channel (Bull Flag): Price is respecting a downward-sloping channel while remaining above key demand zones.

💧 Liquidity Pools: Multiple liquidity highs have been left untouched above — suggesting fuel for a potential impulsive move upward.

🧹 Liquidity Sweep: On both H4 and H1, we see a clear sweep of previous equal lows, tapping into a significant demand zone.

📈 Reaction from Demand: Strong reaction from the demand zone suggests institutional buying interest.

🔵 Projection: A bullish breakout from the flag could target the liquidity above 1.1800, with immediate resistance near 1.1740–1.1760.

Bias:

🔼 Bullish — as long as price holds above the most recent demand zone (~1.1649), the bias remains bullish with expectations of a breakout and continuation toward previous highs.

Note: We must see how the market opens on Sunday night going into Monday. Based on the initial price action, we can determine the best trading opportunities and direction for the upcoming week.

EUR/USD Daily Chart Analysis For Week of July 11, 2025Technical Analysis and Outlook:

In this week's trading session, as expected, the Euro continued its decline, reaching our Mean Support level of 1.168. Recent analyses suggest that the Euro is likely to experience a further downward trend, with the next target set at the Mean Support level of 1.160. However, it's essential to consider the possibility of a rebound toward the Key Resistance level of 1.181, which could lead to the completion of an Outer Currency Rally reaching 1.187.