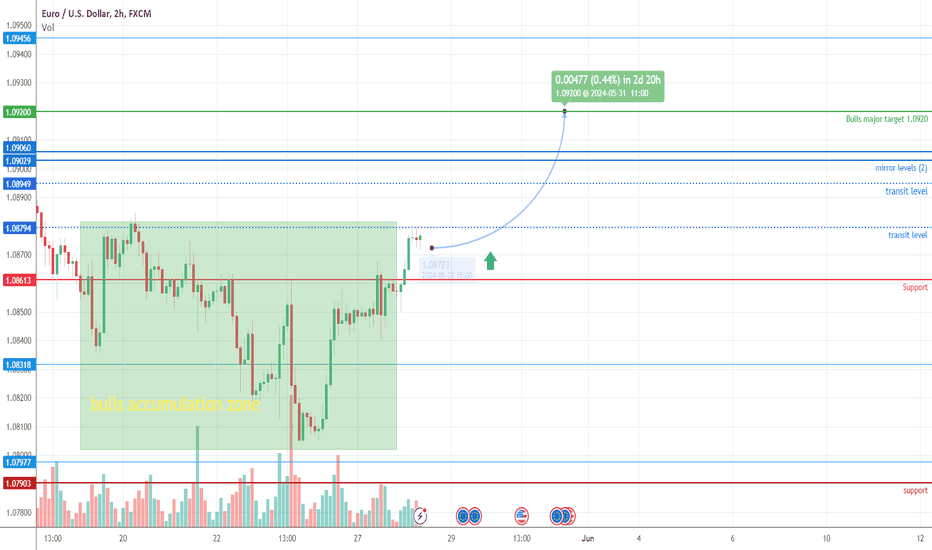

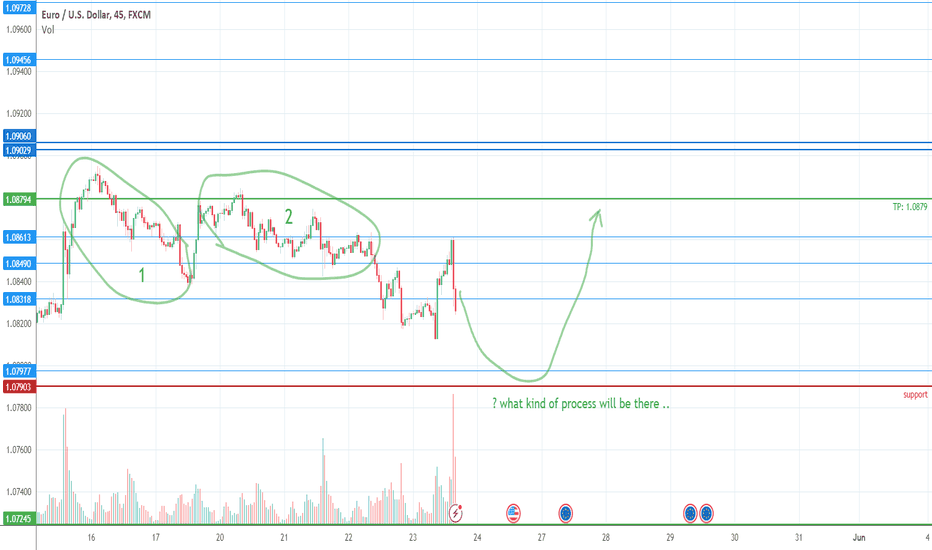

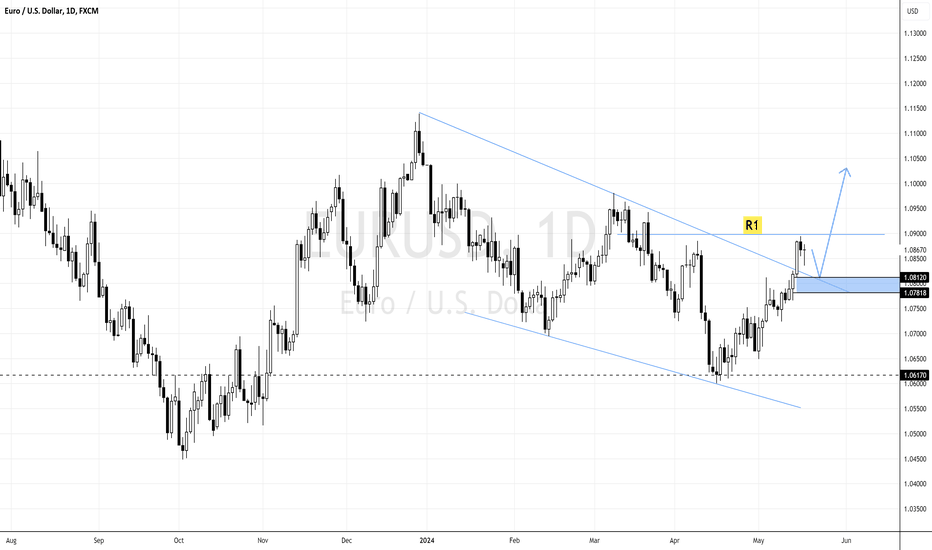

EURUSD, growth continue. Powerful tendention.Hi friend. Euro show stable upward tendention based on big accumulation zone. I specially take a 2H timeframe to show it mass. We have 2 transit levels (1.0879 and 1.0894) also there is mirror levels - 1.0902, 1.0906 (pivot). And finally we have on chart bulls target level and strong resistance - 1.0920.

Follow me. And i`ll be pleasure to know your opinion.

Eurodollar

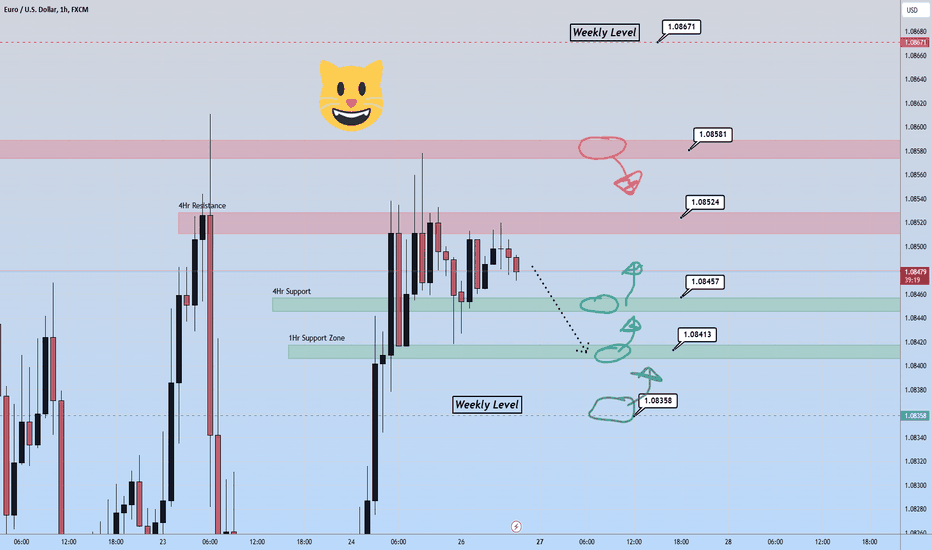

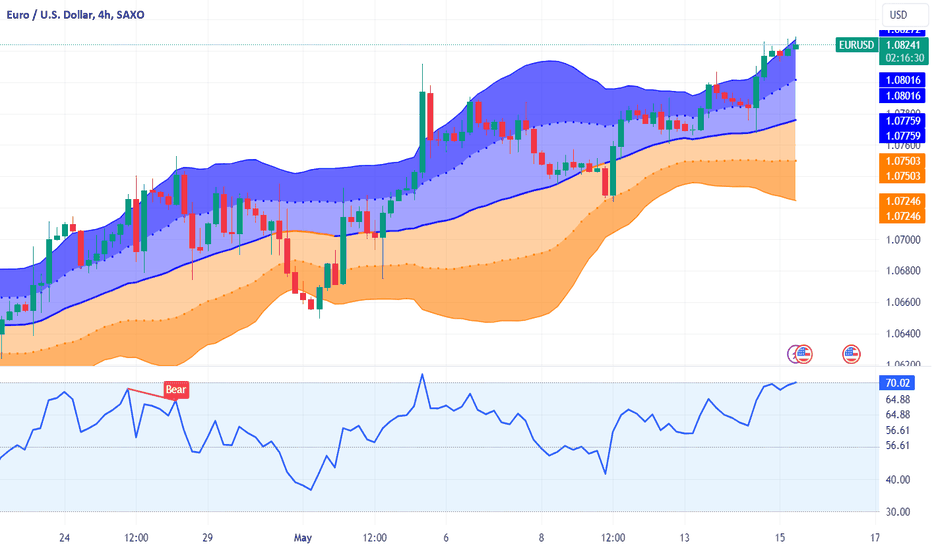

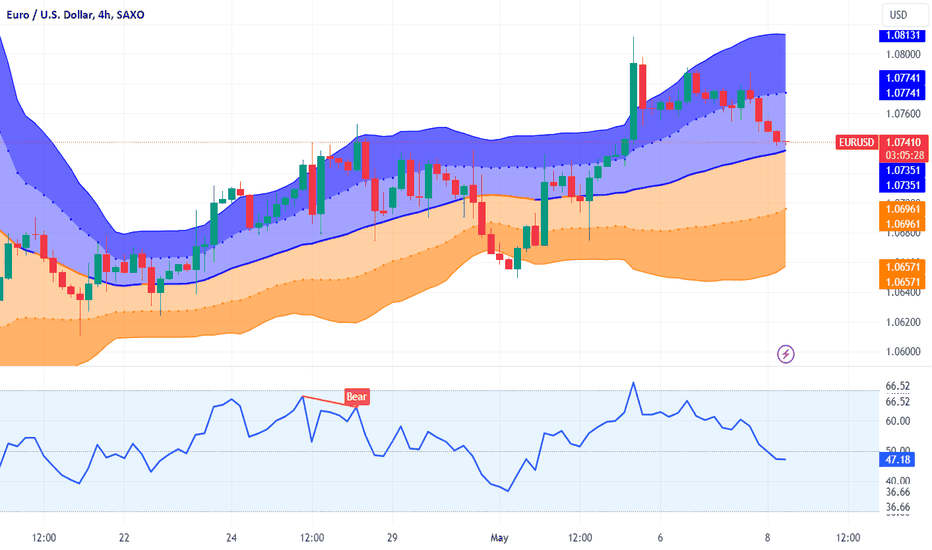

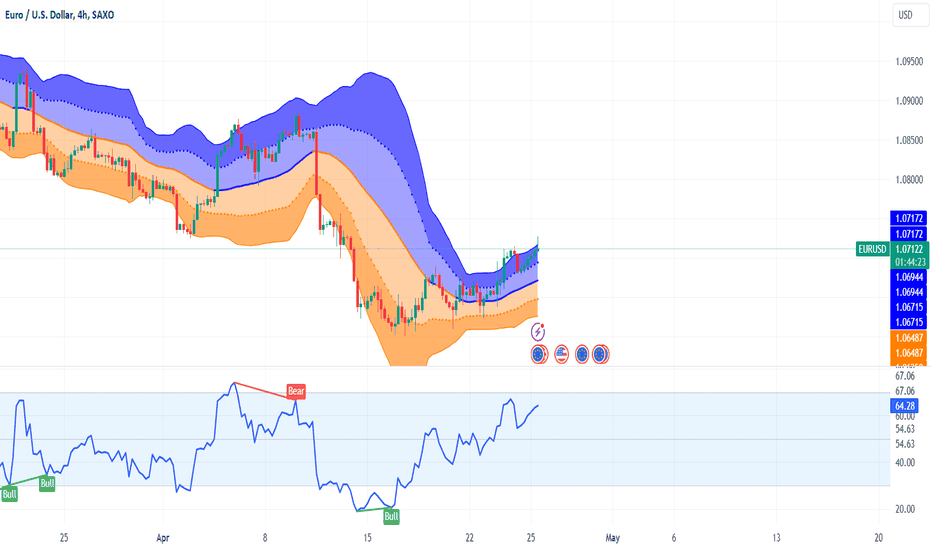

Friday Optimism carries into Monday's trading? ♦️Hello Traders. Welcome back to another Analysis. Last Weekly candle closed down 20 Pips on EurUsd.. which was quite a different picture from the previous 5 weeks. Through the second half of April and throughout most of May we observed alot of optimism and observed a decent rise in EurUsd. This sentiment came to a halt last week as EurUsd pulled down during most of the week as the USD made some gains.. that was until Friday when most of the gains were given up to the Eur as price climbed it's way back up. The 50 pip move down on Thursday, with better than expected PMI numbers for the USD, was corrected in it's entirety on Friday. Now What? Price is in a tight range to begin the week between 1.08524 4hr zone and 1.0845 4hr zone. Well the monthly candle on EurUsd is still quite bullish. It is the End of the month and this last week could see some hectic volatility, so we must be cautious. Either the Monthly candle will keep pushing up or it will pull back and create a larger top wick. We do have a very nice clean traffic area on EurUsd if we can get below 1.0835. We can decrease underneath there for 20 pips at the least down to the 1.08147 Daily Level. Ranges to trade within look quite messy to me to the upside. My Bias to begin this week will be short and we have the weekly candle closure last week to back us up. This doesn't mean that a solid 1hr candle closure off 1.08413 couldn't suggest decent buy scalp opportunities. My bias to begin Monday's trading is a decrease to the Weekly support level 1.08358. Safe trading. Not Financial Advice but purely for General Informational and Educational purposes only.

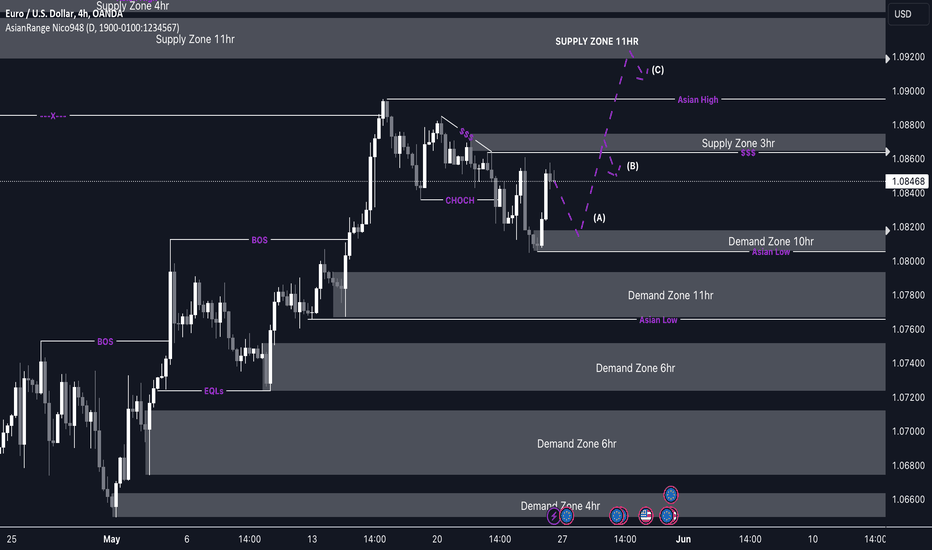

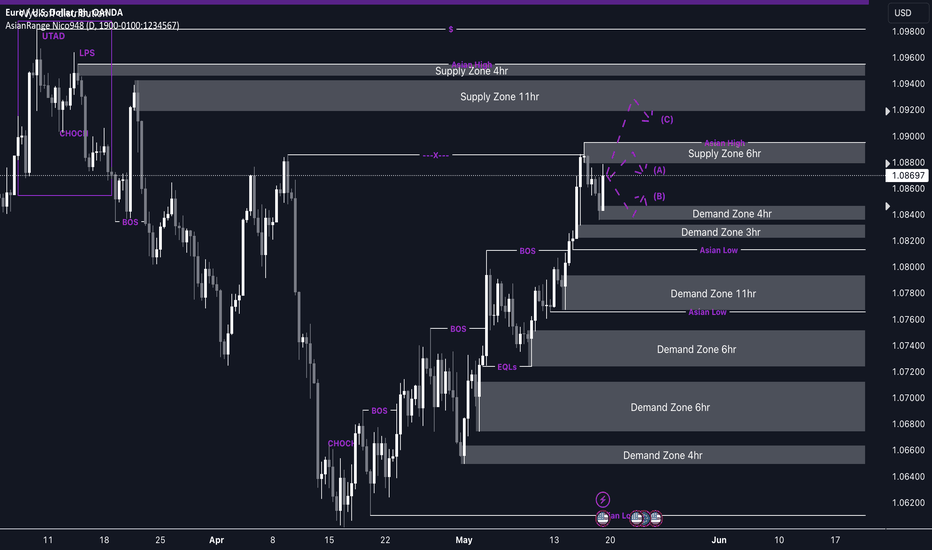

EUR/USDMy plan for EU this week is similar to GU, but with a focus on the nearby supply zone. I will look for a temporary sell-to-buy setup, especially interested in the 3-hour supply zone. However, I will proceed with caution and wait for a distribution to occur within the POI before considering any sells.

There is trendline liquidity above the supply, so I expect the zone might get breached to sweep the Asian high. Once price reaches the 11-hour supply zone, it will present a more favorable sell opportunity. If the price drops early, I will wait for it to reach the 10-hour demand.

Confluences for EU Sells are as follows:

- Price has changed character to the downside.

- Price has left a clean 3hr supply that is sitting ontop of some liquidity.

- Price left an imbalance below that needs to get filled.

- Price has been very bullish and can do with a retracement back down.

P.S. If the price reacts to the 3-hour supply, I will look to sell down to fill in some of the imbalance just above the 10-hour demand. At that area, I will shift my bias to buying, following a day trader approach.

Have a great trading week ahead guys!

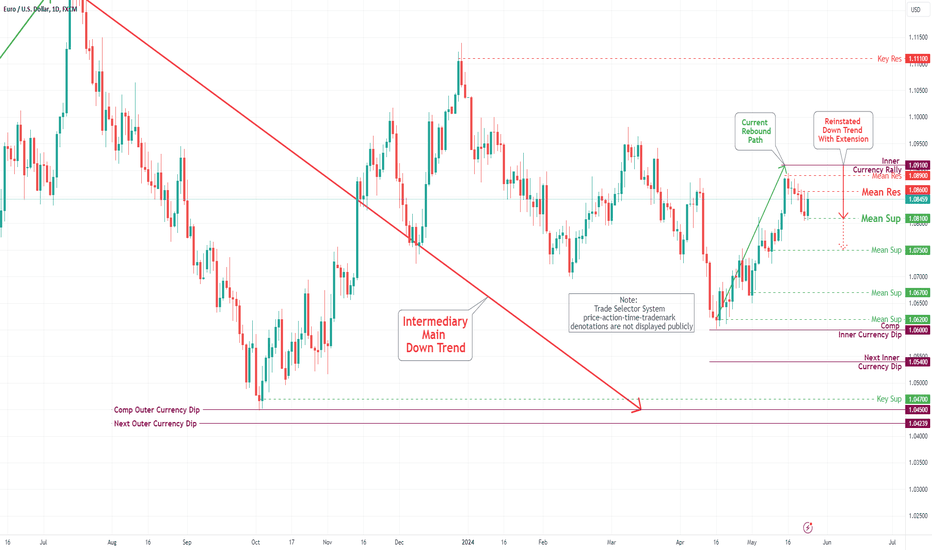

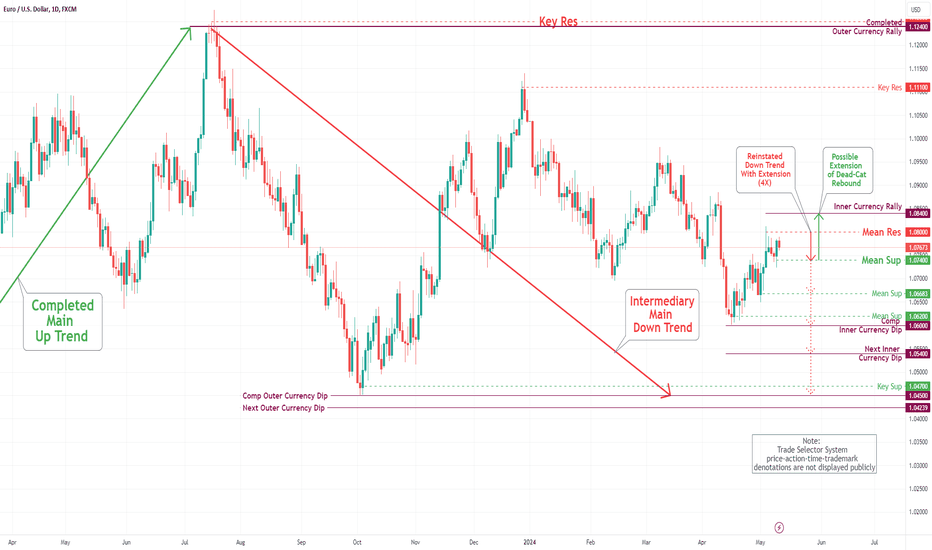

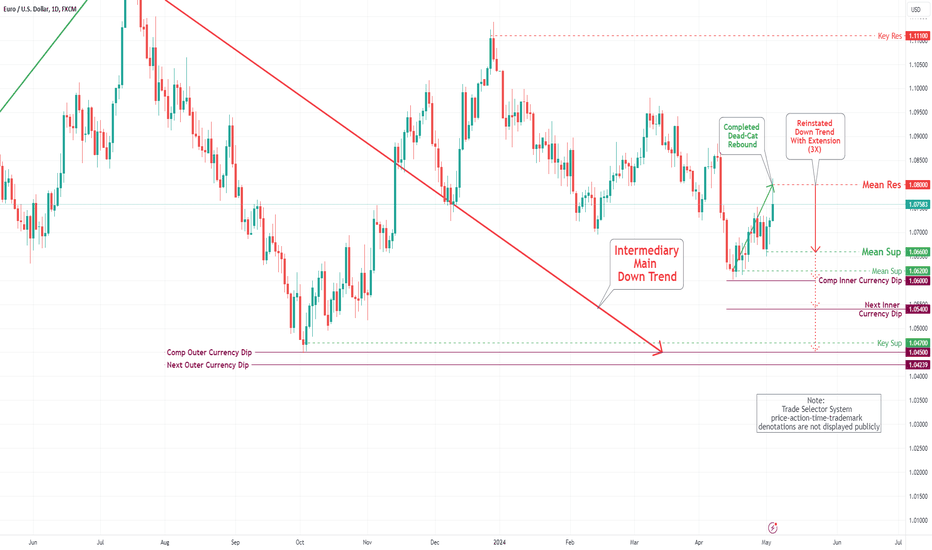

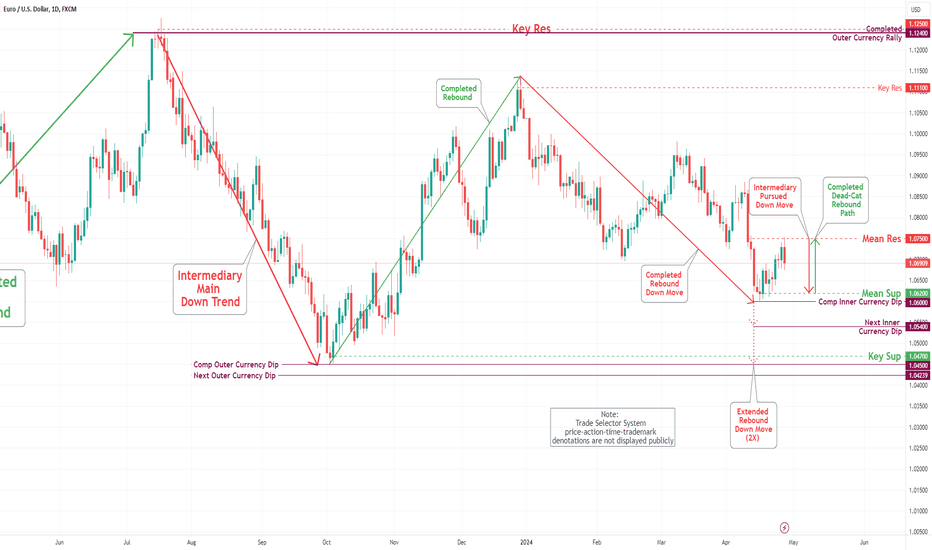

EUR/USD Daily Chart Analysis For Week of May 24, 2024Technical Analysis and Outlook:

The Eurodollar bounced off last week's established Mean Resistance level of 1.089 and reached our specified lower target of the Mean Support level of 1.082. The likelihood of revisiting the Mean Resistance level of 1.089 and reaching the Inner Currency Rally level of 1.091 is slim. On the downside, the currency is prone to hit the Mean Support level of 1.081 and target a well-established price level of 1.075.

EURUSD, growth after falling. Bears target 1.0790Hi friends. Lets look at EURUSD market. We see a big bullish accumulation "1" and trend break after. But there is no accumulation on downward now. Its just a kind of distribution process "2". And after price touch 1.0790 (support level) growth will continue to 1.0879 after that. Follow me.

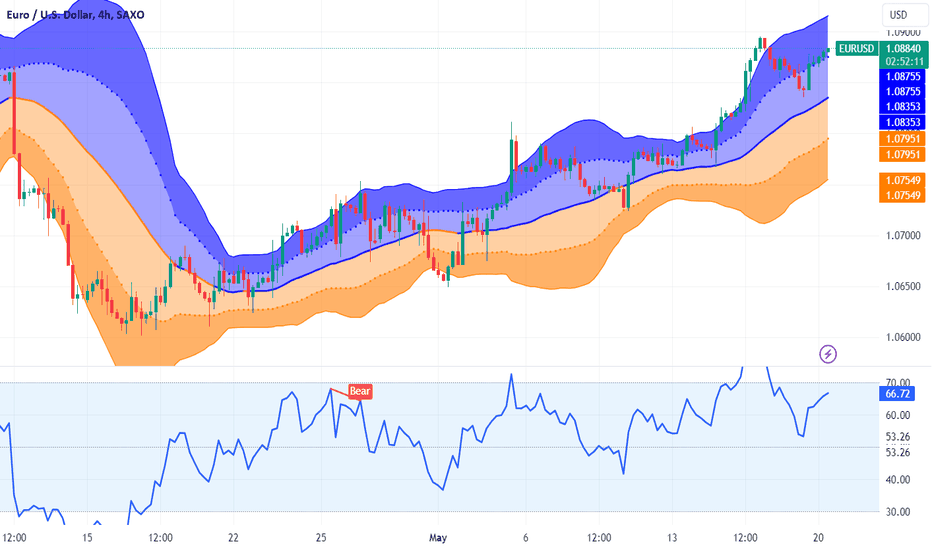

Fundamental Market Analysis for May 23, 2024 EURUSDThe Euro-dollar pair is trying to halt its three-day losing streak, hovering around the 1.08200 mark during the Asian session on Thursday. The strengthening of the Euro against the US Dollar (USD) can be attributed to the latter's corrective movement. Investors are likely to await the Purchasing Managers' Index (PMI) data from the eurozone and Germany before turning their attention to the US PMI, which will be released later in the North American session on Thursday.

The eurozone manufacturing PMI is forecast to rise to 46.2 from 45.7 in May, while the services PMI is expected to show a slight increase to 53.5 from 53.3. Meanwhile, in the US, the manufacturing and services PMIs are expected to remain unchanged at 50.0 and 51.3 respectively.

The Euro could face challenges as the European Central Bank (ECB) is expected to consider lowering borrowing costs at its June meeting. This expectation is due to the current inflation rate in the Eurozone, which stands at 2.4%, very close to the ECB's target of 2.0%. President Christine Lagarde recently stated that such action in June is highly likely if data continues to support confidence that inflation will eventually align with the ECB's target over the medium term.

The US Dollar (USD) strengthened on Wednesday as the minutes of the latest Federal Open Market Committee (FOMC) meeting indicated hawkish sentiment towards Federal Reserve (Fed) policy. Fed policymakers expressed concern over the lack of progress on inflation, which has been more persistent than expected in early 2024. As a result, the Fed is hesitant to start cutting interest rates.

Trading recommendation: Trade mainly with Sell orders from the current price level.

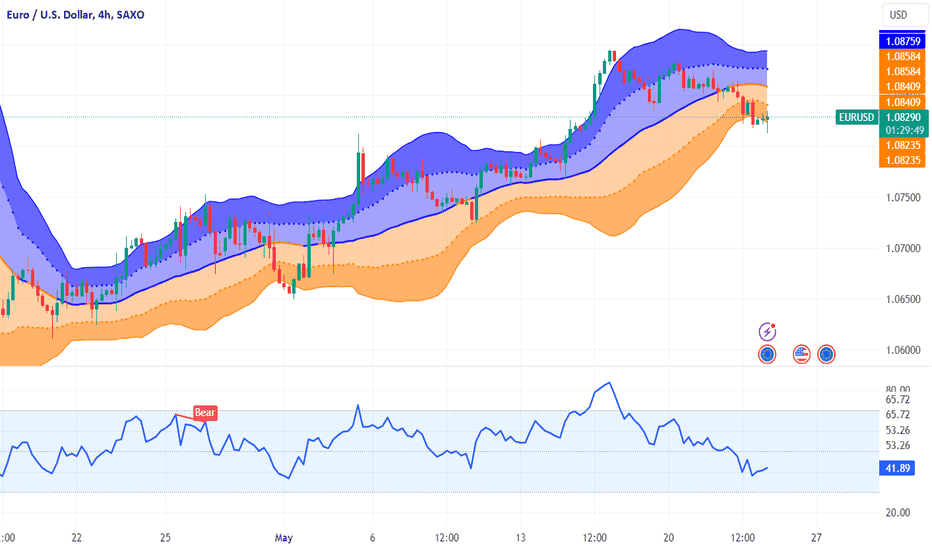

Fundamental Market Analysis for May 20, 2024 EURUSDThe Euro-dollar pair is trading on a stronger note near 1.08800 on Monday in the early hours of Asian trading. The growth of the major pair is supported by the weakening of the US dollar. Federal Reserve (Fed) officials Bostic, Barr, Waller, Jefferson and Mester are scheduled to speak on Monday. The main event in the Eurozone will be the preliminary PMI for May on Thursday.

Inflationary pressures eased in April, but this progress is unlikely to prompt the Fed to cut interest rates anytime soon. Fed Chairman Jerome Powell said he believes the U.S. central bank will need more data to gain confidence that inflation is steadily falling toward the 2% level. In addition, several Fed officials have emphasized their cautious stance on holding rates longer.

Last week, Atlanta Fed President Raphael Bostic said he sees signs of cooling inflation in the recent CPI report, but prefers to keep an eye on May and June data to make sure inflation doesn't turn the other way. FRB Cleveland President Loretta Mester said policy is in a good place and it is premature to say that progress on inflation has stalled. Richmond FRB President Tom Barkin said the central bank needs to keep borrowing costs high for longer to ensure that the inflation target is met.

Trading recommendation: Trade predominantly on Buy from the current price level.

EUR/USD Shorts to Longs ideaMy EU analysis this week focuses on shorting opportunities. I will look for sells either from the 6-hour supply zone near the current price or, ideally, from the 11-hour supply zone if the price breaches the Asian high and continues upward.

If the price opens lower, I will look for buying opportunities at the 4-hour or 3-hour demand zones. Once the price reaches these demand zones, I plan to buy up toward the supply zone, as we are still in a short-term bullish trend indicated by the recent break of structure to the upside.

Confluences for EU Sells are as follows:

- 11hr supply zone has caused a break of structure to the downside and nearby 6hr supply.

- The overall trend on the higher time frame is bearish and the dollar is also overall bullish.

- Price has already mitigated 4hr supply might be a start of a bearish trend.

- Bullish pressure is getting exhausted after the bullish rallies we saw last week.

- Clean 11hr supply that has an imbalance that we could see a clean reaction from

P.S. Since the price is between liquidity zones, I will approach these nearby areas with caution and may lower my risk until the price reaches more favourable extreme zones where trades will be more worthwhile.

Have a great trading week!

EURUSD IN HIGHER-HIGH & HIGHER-LOW MAY TARGET ABOVE 1.09500The pair has recently rallied above the bullish wedge and has been creating higher-high and higher-low for the past few days. IF fibre can rally above resistance at 1.09000, then the next target will be above 1.09500.

N.B!

- EURUSD price might not follow the drawn lines . Actual price movements may likely differ from the forecast.

- Let emotions and sentiments work for you

- ALWAYS Use Proper Risk Management In Your Trades

#eurusd

#fibre

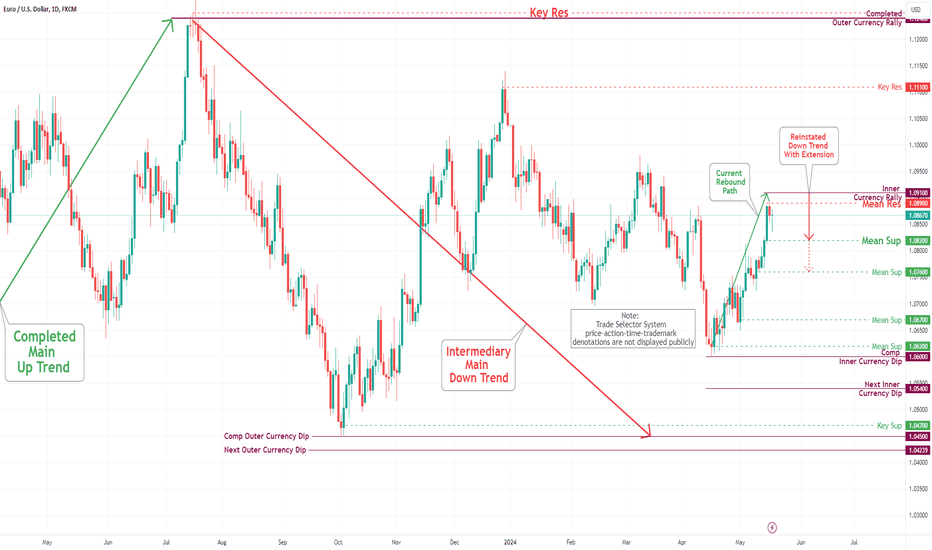

EUR/USD Daily Chart Analysis For Week of May 17, 2024Technical Analysis and Outlook:

During this week's trading session, the Eurodollar made a spectacular surge on the upside to our Inner Currency Rally 1.084 and a lot more. Current market conditions suggest that the Eurodollar may continue upward momentum to complete our Inner Currency Rally 1.091 via the newly created Mean Res 1.089. On the downside, the currency is prone to go down to Mean Sup 1.082 and possibly Mean Sup 1.076.

Fundamental Market Analysis for May 15, 2024 EURUSDThe Euro-dollar pair is trading with a bullish bias around 1.08150 in the early hours of Asian trading on Wednesday. Later, markets may shift to cautious sentiment ahead of key economic data releases from the Eurozone and the US. Wednesday's highlights will be the first reading of the Eurozone's first quarter gross domestic product (GDP) and the April US consumer price index (CPI).

On Tuesday, Federal Reserve (Fed) Chairman Jerome Powell said inflation is falling more slowly than expected and the CPI data gave more reason to keep rates higher. Powell added that he believes it is unlikely that the central bank will need to raise interest rates further, even if there is less chance of a rate cut. In addition, Kansas City Fed President Jeffrey Schmid said inflation remains too high and the U.S. central bank still has a lot of work to do. These hawkish comments could boost the US Dollar (USD) and put pressure on the major pair in the near term.

However, later in the day, US CPI data is due to be released, which could influence the Fed's interest rate decision at the next meeting. Annual core CPI inflation is expected to fall to 3.4% in April from 3.5% in the previous reading. Core CPI inflation is projected to fall to 3.6% in April from 3.8% previously. If the upcoming CPI data meets expectations, it could lead to the prospect of a rate cut. This, in turn, could lead to a decline in the dollar and serve as a tailwind for EUR/USD.

Trading recommendation: Trade predominantly on Buy from the current price level.

EUR/USD Daily Chart Analysis For Week of May 10, 2024Technical Analysis and Outlook:

During this week's trading session, the Eurodollar fluctuated around our significant Mean resistance level of 1.080. There are projections that the currency may experience an upward surge and complete the Inner Currency Rally of 1.084 before undergoing a downward transition to the Mean Support level mark of 1.074 and possibly further down to designated targets. However, it is also possible that the Eurodollar might go down to hit the Mean Support level of 1.074 from its current position.

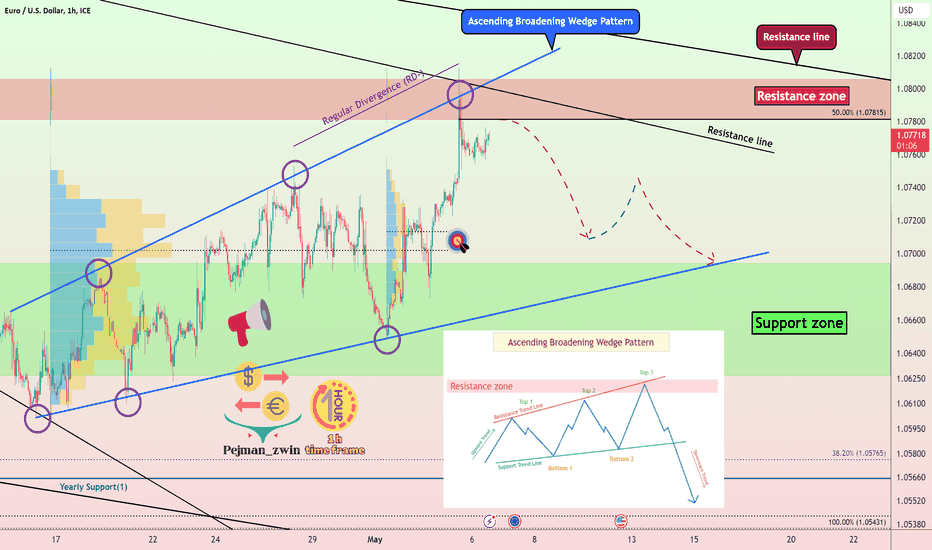

🚨EURUSD will Go Down by Ascending Broadening Wedge Pattern🚨🏃♂️ EURUSD is moving near the 🔴 Resistance zone($1.0806-$1.0781) 🔴.

📈According to Classical Technical Analysis , EURUSD seems to have succeeded in forming an Ascending Broadening Wedge Pattern .

💡Also, we can see Regular Divergence(RD-) between two Consecutive Peaks .

🔔I expect EURUSD to at least decline to the 🎯Target🎯 I have marked on the chart.

Euro/U.S.Dollar Analyze ( EURUSD), 1-hour Time frame ⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Fundamental Market Analysis for May 08, 2024 EURUSDThe Euro-dollar pair extended its losses for the second consecutive session, trading near 1.07400 during the Asian session on Wednesday. The US dollar (USD) is strengthening on expectations that the Federal Reserve (Fed) will extend interest rate hikes. However, weaker US jobs data over the past week has revived hopes of a possible interest rate cut by the Federal Reserve (Fed) in 2024.

On Tuesday, comments from Minneapolis Fed President Neel Kashkari strengthened the US dollar, which led to weaker EUR/USD. Kashkari said that the most likely scenario is for rates to remain unchanged for an extended period of time. However, if disinflation returns or there is a significant weakening of the labor market, a rate cut could be considered.

In the Eurozone, retail sales (m/m) rose 0.8% in March, recovering from an upwardly revised 0.3% decline in February. This exceeded the expected 0.6% increase. This is the strongest increase in retail activity since September 2022, indicating a strengthening European consumer sector. In addition, retail sales (y/y) rose 0.7% compared to a revised 0.5% fall in February. This marks the first increase in retail sales since September 2022, signaling a positive change in consumer spending trends.

The European Central Bank (ECB) is expected to start reducing borrowing costs in June. According to Business Standard, ECB chief economist Philip Lane said that the latest data has bolstered his confidence that inflation is approaching the 2% target. While many ECB officials appear to favor easing measures next month, President Christine Lagarde has not yet proposed further cuts.

Trading recommendation: Trade predominantly with Sell orders from the current price level.

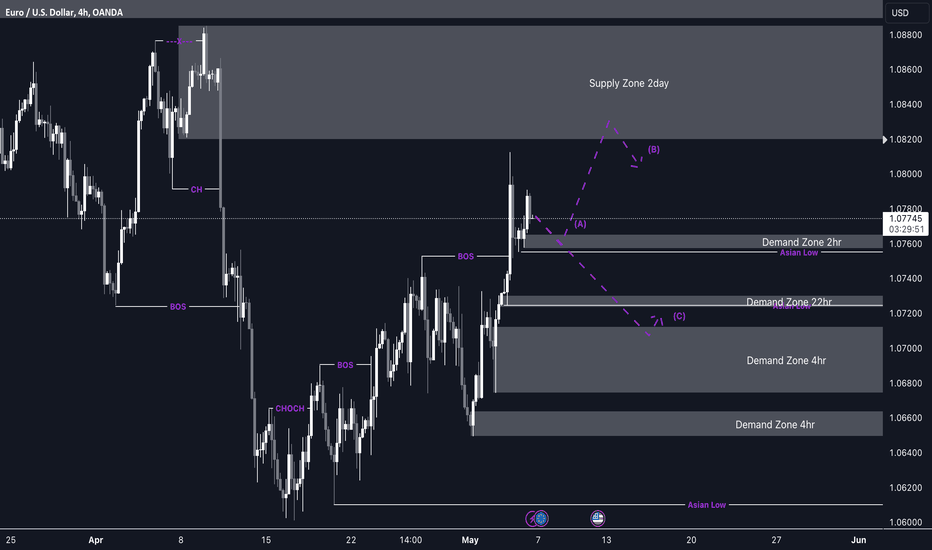

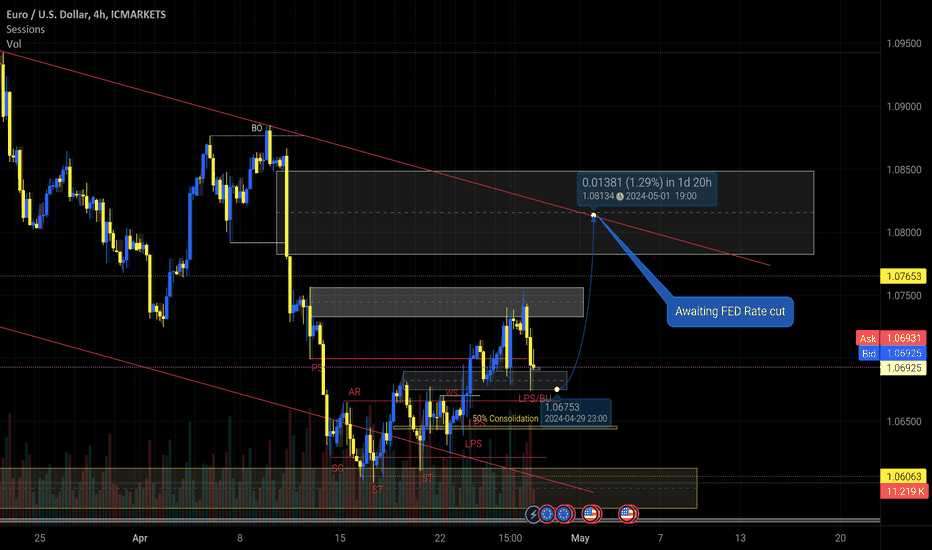

EUR/USD SHORT TO LONG idea (towards 1.08200)My analysis for EU aligns with that of GU in terms of directional bias. I expect price to turn bullish from either of my demand points of interest (POIs), aiming to eventually mitigate the major supply zone within two days. This anticipation stems from the expected substantial reaction at the supply zone. While pursuing the buys aligns with a pro-trend approach, I plan to switch strategies once price reaches the significant supply zone.

Currently, the market remains bullish, prompting me to prioritize seeking buying opportunities near demand zones to drive price upward. The most intriguing opportunities for me lie within the demand zones on the 2-hourly, the 22-hourly below, and the two 4-hourly zones at the bottom.

Confluences for EU buys are as follows:

- Price has recently been in an uptrend, forming higher highs and higher lows.

- 2-day supply zone that needs to get mitigated eventually.

- Good demand zones left that price might pick up another bullish rally from.

- Liquidity to the upside as well as substantial imbalances that need mitigation.

- price has also recently broken structure to the upside once again to confirm the trend.

P.S. If the price maintains its upward trajectory, I will wait for it to decelerate and consolidate within my designated area. Upon closer examination, I've identified several refined zones, such as the 4-hour supply zone. In such a scenario, I won't rush but will instead wait for a thorough and significant mitigation before taking action.

Have a great trading week guys!

EUR/USD Daily Chart Analysis For Week of May 3, 2024Technical Analysis and Outlook:

The Eurodollar experienced significant volatility during this week's trading session, with an upward movement that surpassed our Mean Resistance level at 1.075. As a result, a new resistance mark has been established at 1.080. However, it is projected that the currency will experience a downward transition to the Mean Support level mark of 1.066. It will dip further to retest the previously completed Inner Currency Dip at 1.060. Furthermore, the currency is anticipated to continue its downward trajectory, reaching our next Inner Currency Dip level at 1.054.

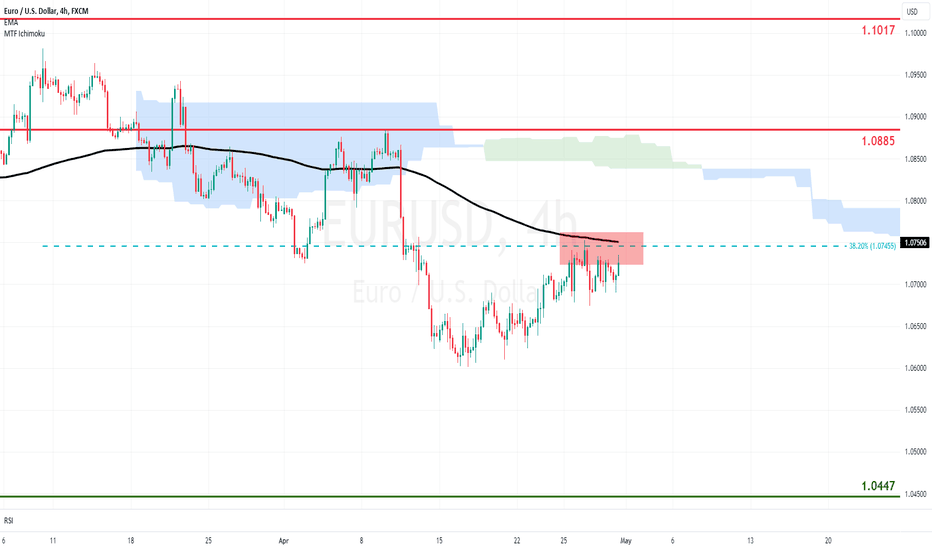

EURUSD Struggles at Key Resistance Ahead of the FedThe pair has managed to stage a rebound from its 2024 lows and reacts positively to today’s preliminary data from Eurozone, which showed Q1 GDP expansion and persistence in headline inflation. As such, the common currency continues its effort to surpass the pivotal resistance confluence, provided by the EMA200 and the 38.2% Fibonacci of the March-April slump. Successful outcome would negate the downside bias and bring 1.0885 in the spotlight.

However, we are cautious around the ascending prospects. The path of least resistance is down, technically and fundamentally. A rejection of the aforementioned critical region would reaffirm the bearish bias and open the door to lower lows (1.0600).

The monetary policy differential is unfavorable and EZ core CPI continued to decelerate. The European Central Bank is looking to change tack and slash rates as early as June, dictated by weak growth and progress on inflation. Its US counterpart on the other hand, has adopted a conservative approach due to strong economy, resilient labor market and persistent price pressures that raise the bar for a pivot.

The next leg of the move will likely be determined by Wednesday’s policy decision from Fed officials and since no move is projected, investors will be looking for any updates around their rate intentions.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (trading as “FXCM” or “FXCM EU”), previously FXCM EU Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763). Please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this video are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed via FXCM`s website:

Stratos Markets Limited clients please see: www.fxcm.com

Stratos Europe Ltd clients please see: www.fxcm.com

Stratos Trading Pty. Limited clients please see: www.fxcm.com

Stratos Global LLC clients please see: www.fxcm.com

Past Performance is not an indicator of future results.

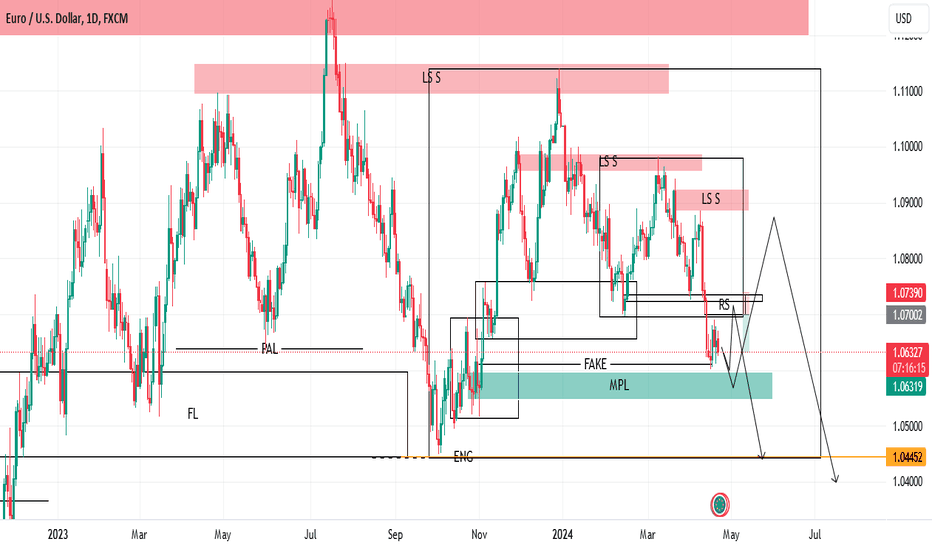

EUR/USD Daily Chart Analysis For Week of April 25, 2024Technical Analysis and Outlook:

The Eurodollar has reached a crucial point in its trajectory, having just encountered its Mean Resistance level of 1.072. This has triggered a sharp downward move, with the currency now seeking its vital Mean Support level at 1.062. This suggests a probable continuation of the downward trend, which traders and investors should take note of.

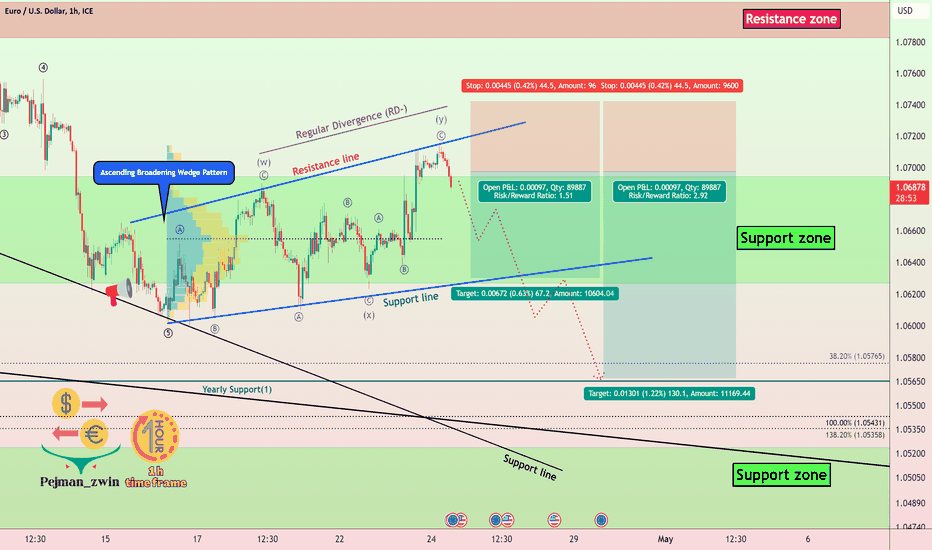

EURUSD will Attack to Support zone⚔️===>>(➡️RR=2.92)🏃♂️ EURUSD is moving in the 🟢 Support zone($1.0695-$1.0626) 🟢, but I expect it to be broken based on the explanation below 👇.

🌊According to the theory of Elliot waves , EURUSD seems to have completed the Double Three Correction(WXY ) in the 🟢 Support zone($1.0695-$1.0626) 🟢.

📈Regarding Classic Technical Analysis , EURUSD has successfully formed an Ascending Broadening Wedge Pattern Reversal Pattern .

💡Also, we can see Regular Divergence(RD-) between two Consecutive Peaks.

🔔I expect EURUSD to go DOWN at least to the lower line of the Ascending Broadening Wedge Pattern , and EURUSD will probably break the 🟢 Support zone($1.0695-$1.0626) 🟢.

--------------------------------------------------------------------------

EURUSD

🔴Position: Short

✅Entry Point: 1.06975 USD (Limit Order)

⛔️Stop Loss: 1.07420 USD

💰Take Profit:

💰Take Profit:

🎯1.06303 USD👉Risk-To-Reward: 1.51

🎯1.05674 USD👉Risk-To-Reward: 2.92

⚠️Please don't forget to follow capital management.

⚠️Please pay attention to the style of opening the position.

--------------------------------------------------------------------------

Euro/U.S.Dollar Analyze ( EURUSD), 1-hour Time frame ⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Fundamental Market Analysis for April 25, 2024 EURUSDThe Euro-dollar pair is holding near the psychological 1.07000 level on Thursday during the early Asian session. The moderate rise in the major pair is supported by the weakening US dollar (USD). Later in the day, the preliminary US gross domestic product (GDP) growth figure will be released.

On Wednesday, the U.S. Commerce Department reported that orders for durable goods in the U.S. rose 2.6% in March from the previous reading of 0.7%, beating the estimate of 2.5%. Core goods, excluding transportation, rose 0.2% for the month, falling short of the 0.3% forecast.

The release of US GDP for the first quarter could provide an indication of how strongly the economy is growing and point to the Fed's next move. If the report shows stronger-than-expected data, it could spark speculation that the Fed will postpone the rate-cutting cycle and strengthen the US dollar. Markets have estimated a nearly 70% chance that the U.S. Federal Reserve (Fed) will cut the benchmark rate in September.

On the other hand, European Central Bank (ECB) policymakers are sticking to their plans to cut interest rates this year, even though elevated U.S. inflation could delay the Fed's move to looser policy. ECB President Christine Lagarde suggested that the central bank may cut the deposit rate from a record high of 4% in June, but is keeping options open on how to proceed.

Trading recommendation: Watch the level of 1.07000. If it bounces back, take Buy positions, if it stays below - Sell.

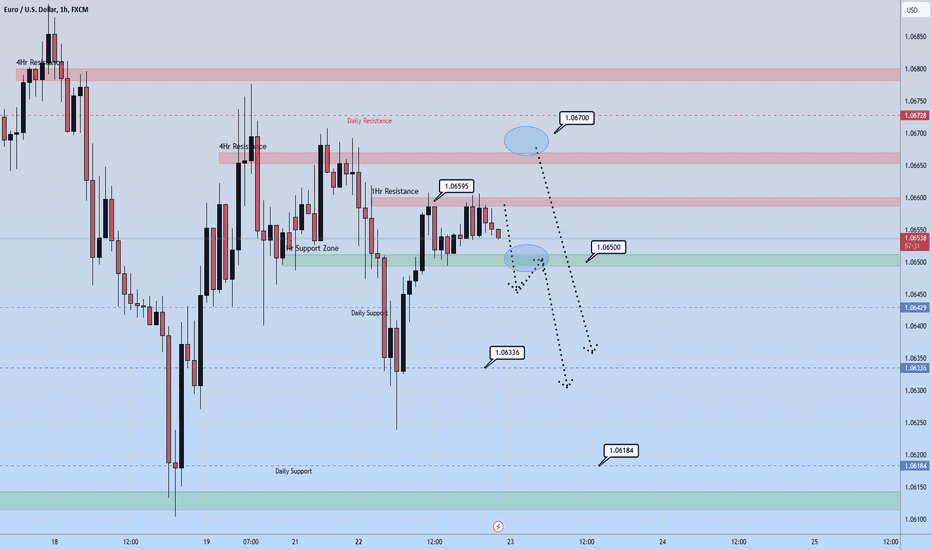

Beginning of Tuesday's trading.. Forex markets 😼Hello traders.. EurUsd is about 87 pips from our monthly support level at 1.057.. not too far. The closest we've come was last Tuesday during the hawkish fed speech. Protecting against higher inflation is indeed important and slowing down economic growth as a result may be the only way. The weekly candle is back to being at Break even. The Daily candle today closed slighty bearish, a doji candle really. We went down during London and retraced the move back p during NY session. TheLow of the day was 4 minutes after New York stock exchange open. We saw a nice continuation of momentum with the new NY 4hr candle, to follow London bearish momentum. However, this was short lived as 1hr candles never quite managed to dig below the 1.06336 weekly support level. It's safe to say at this point that we are ranging and the volatility this week has been low.. but I suppose it's only Monday. End of Monday and around Asian session to begin Tuesday's trading has a tendency to be a turning point in the market for a good run.. How far? not sure.. maybe we can see 30-40 pips down to structural lows and around the weekly level 1.06336 and the Daily level 1.06184. If price pulls up higher, 1.067 could bbe a good entry point for either a small scalp or longer hold back to structural lows as we jsut mentioned. Pay attention to how candles interact with 1.065.. this will give us hints about further direction.