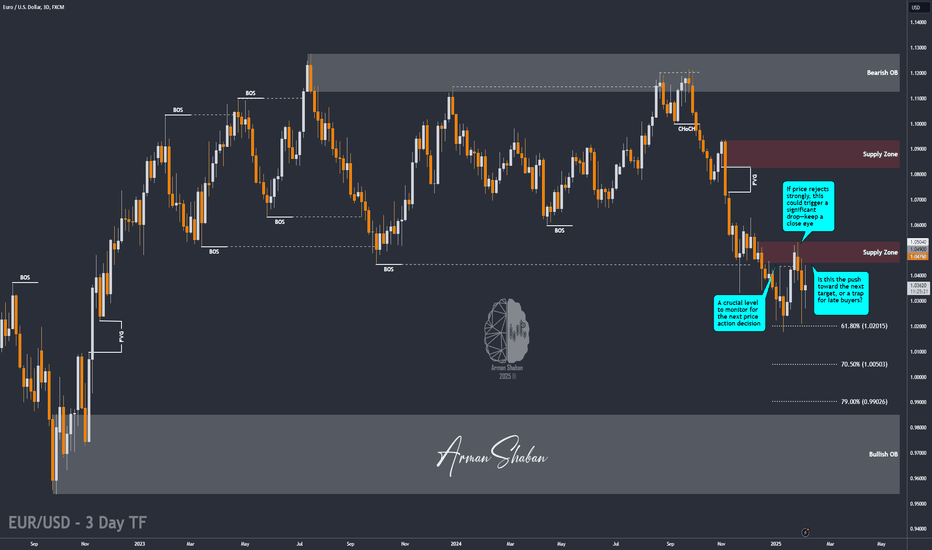

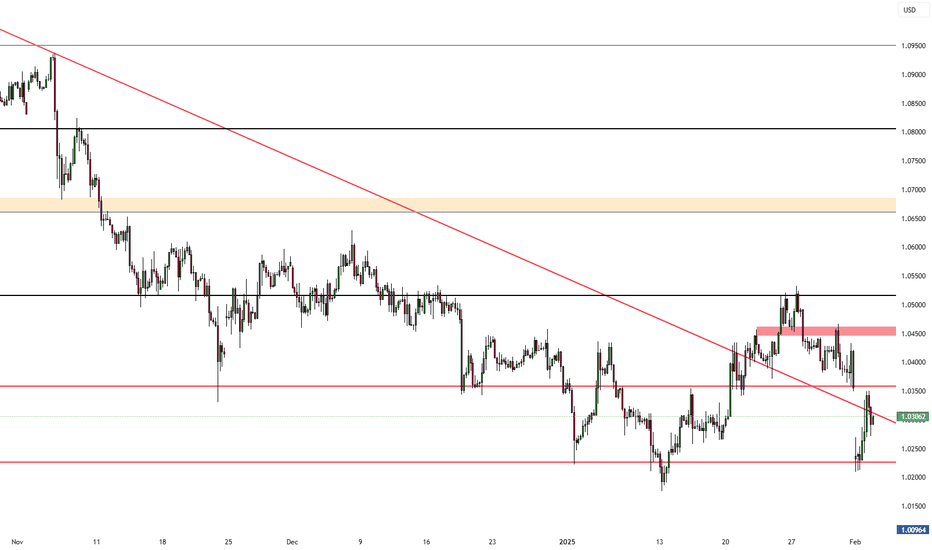

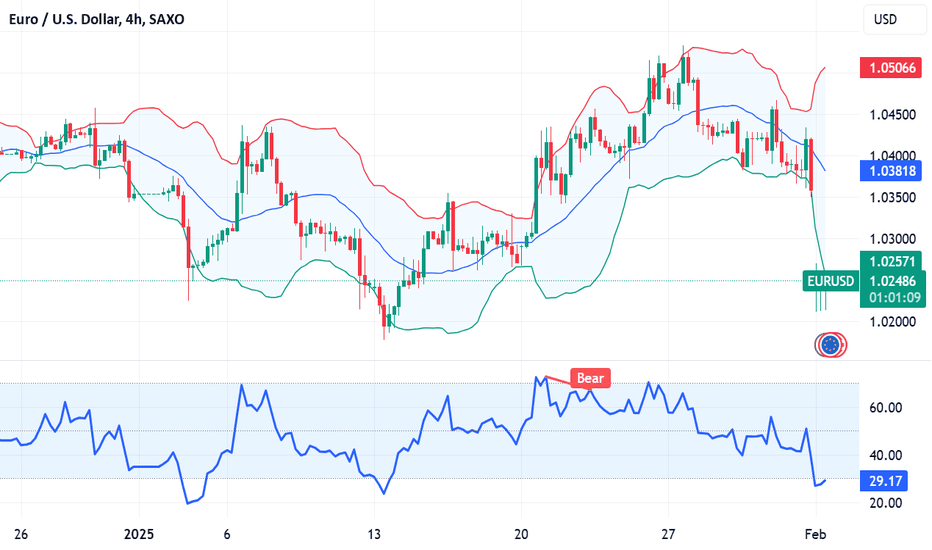

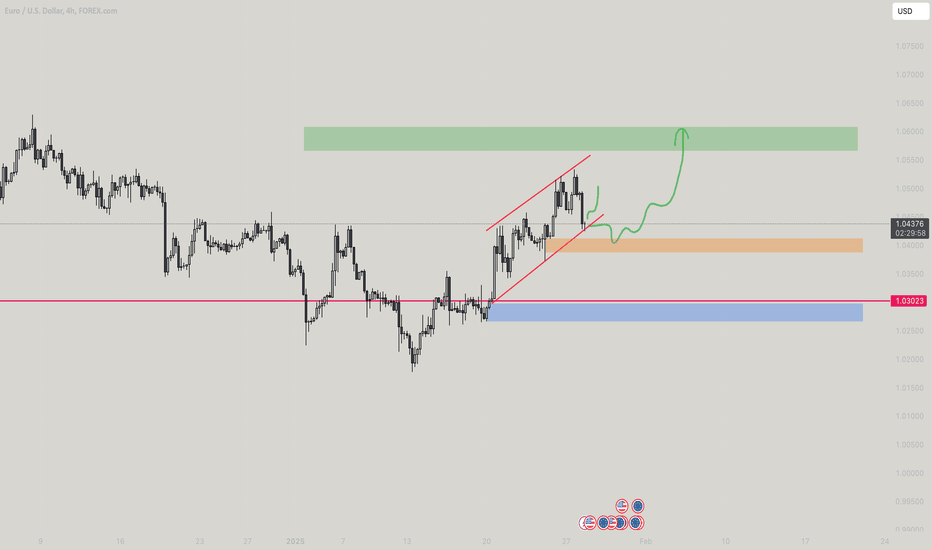

EUR/USD : More Fall Ahead? Let's See! (READ THE CAPTION)By analyzing the EUR/USD chart on the three-day timeframe, we can see that the price was rejected from the 1.053 level, as per our main analysis, leading to a decline of over 300 pips down to 1.021.

Currently, EUR/USD is trading around 1.036, and if the price stabilizes below 1.042, we can expect further downside movement. Keep an eye on the price reaction to the key levels marked on the chart!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Eurodollar

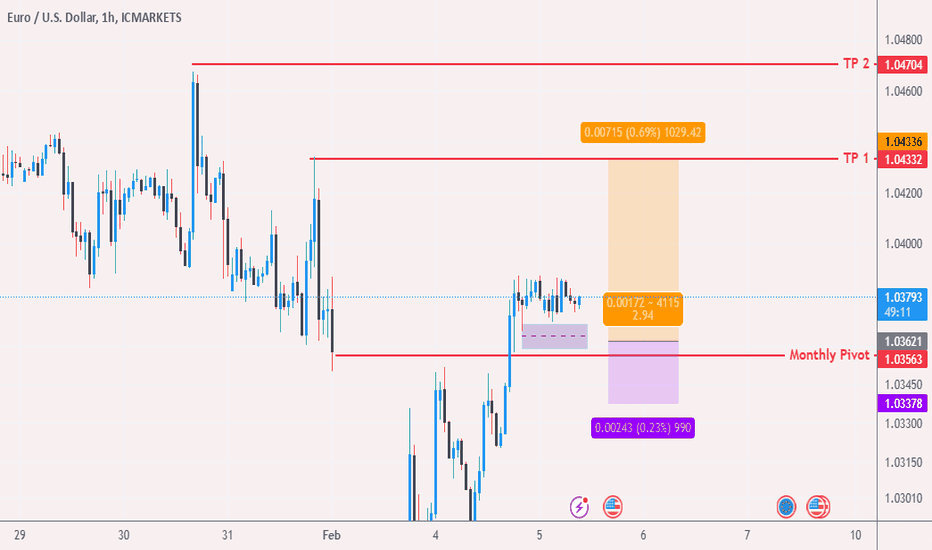

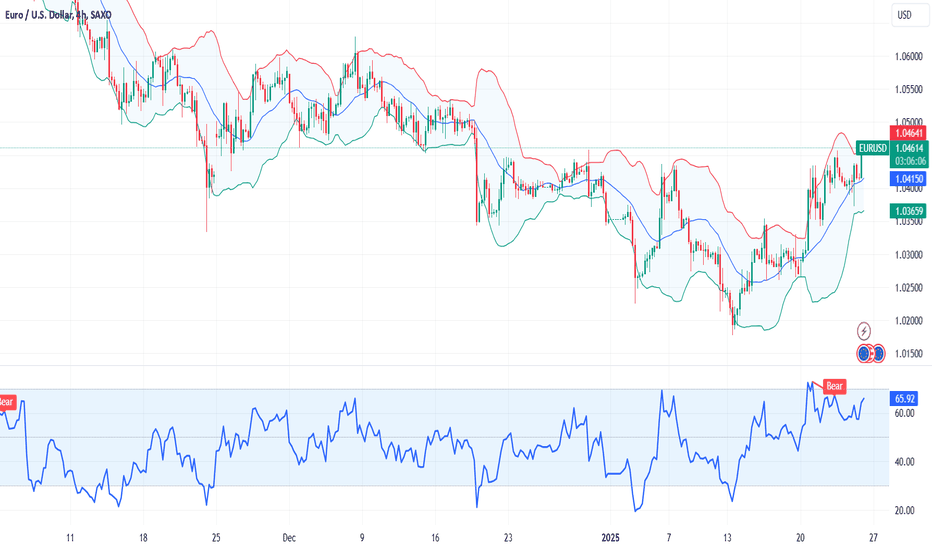

Fundamental Market Analysis for February 6, 2025 EURUSDThe euro is trying to consolidate after breaking a six-day losing streak, with EUR/USD still holding at 1.0400.

US employment change data from ADP showed stronger-than-expected results for January, with a net increase in the number of people employed coming in at 183k, beating the expected decline to 150k from December's revised 176k. While the ADP jobs data unreliably predicts the US Non-Farm Payrolls (NFP) data expected later in the week, the increase bolsters investor confidence that the US economy remains on solid ground.

Early Thursday will see the release of pan-European retail sales data for December. Median forecasts expect the figure to rise to 1.9% y/y, up from 1.2% in the previous period. However, the month-on-month figure is expected to fall to -0.1% from 0.1%.

The most important release this week will be the US Non-Farm Payrolls (NFP) report on Friday. Investors expect the January NFP to fall to 170k from December's 256k. Traders will also be watching for revisions to previous months' data. Those expecting a rate cut are becoming increasingly frustrated with the sustained strength of the US economy as labour statistics are often revised upwards.

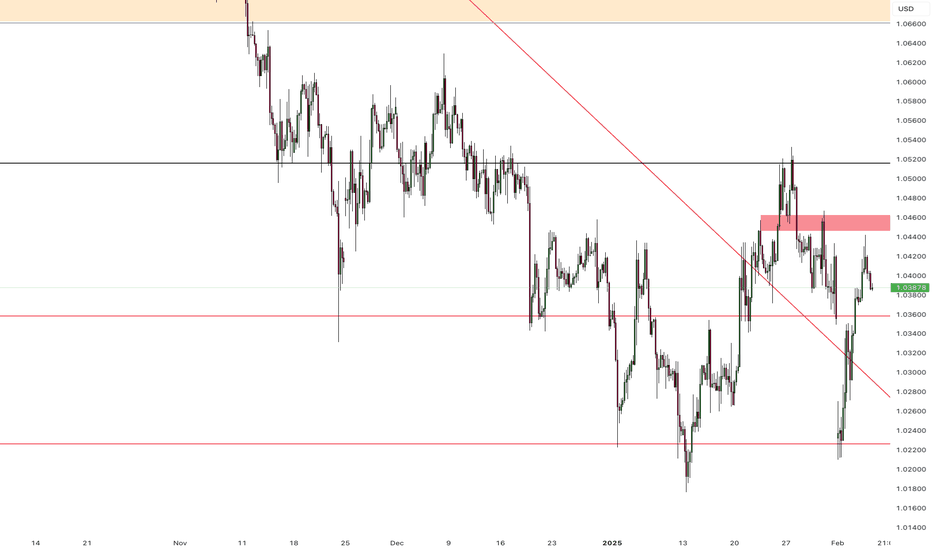

Trade recommendation: Watch the level of 1.0370, when fixing below consider Sell positions, when rebounding consider Buy positions.

EUR/USD Rises as Dollar Weakens Amid Trade War ConcernsThe euro climbed above $1.04 as a weaker dollar and Trump’s tariffs fueled economic concerns. China retaliated with its own levies, escalating trade tensions. Meanwhile, Eurozone business activity rebounded after two months of decline. The ECB cut rates and hinted at more easing in March, with US tariffs potentially pressuring it to loosen policy further. Investors now expect the ECB’s deposit rate to fall to 1.87% by December.

From a technical perspective, the first resistance level is at 1.0400, with further resistance levels at 1.0460 and 1.0515 if the price breaks above. On the downside, the initial support is at 1.0350, followed by additional support levels at 1.0220 and 1.0180.

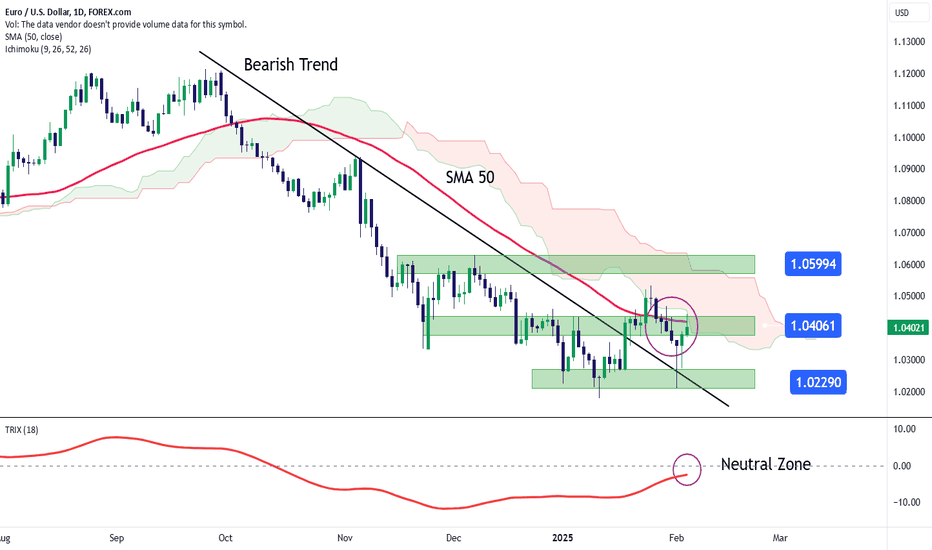

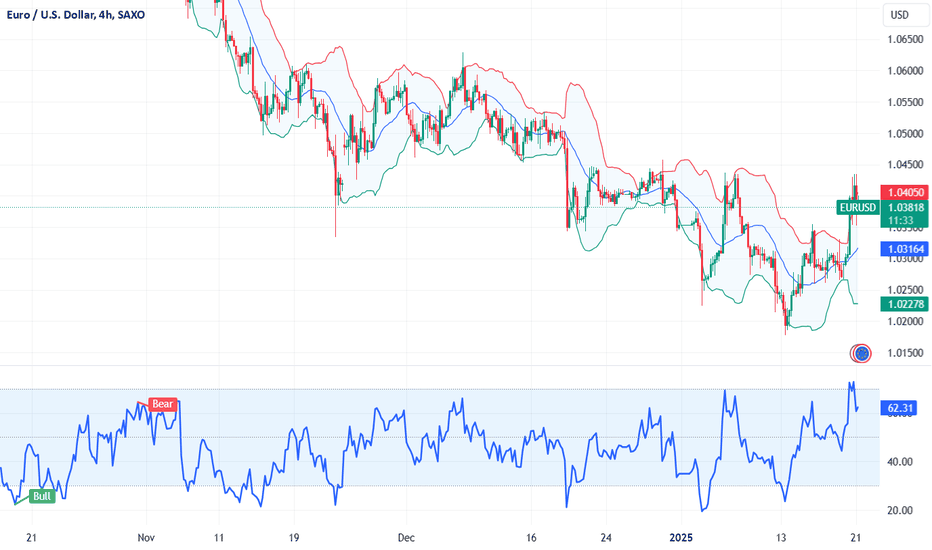

EUR/USD Faces a New Neutral MovementThe latest movements in the EUR/USD pair have been highly indecisive in the short term, with strength constantly shifting between the U.S. dollar and the euro. This is due to the increasingly neutral stance of both currencies, fueled by the ongoing tariff-related turmoil from the White House. Initially, these policies significantly strengthened the U.S. dollar, but confidence in the euro has gradually returned as the market begins to view Trump’s approach as a negotiation tactic rather than a policy with long-term economic consequences.

As a result, short-term dollar weakness has become evident, and the DXY index, which tracks dollar strength, has already accumulated a decline of over 2% in the past three trading sessions.

Neutrality Increases

At the moment, EUR/USD has been testing the key barrier at 1.04061 , which aligns with the 50-period moving average and the Ichimoku cloud resistance in the short term.

Additionally, the TRIX indicator line has oscillated toward the neutral 0 level , reflecting a state of equilibrium in the average of recent market movements.

This key barrier and the neutrality observed in the TRIX suggest that the pair remains firmly in a neutral stance in the short term. As long as the price does not break away from the 1.04061 zone , it is unlikely that a clear trend will emerge in EUR/USD.

Key Levels:

1.05994: The most important resistance level in the short term, coinciding with the previous December highs. A breakout above this level would strengthen bullish momentum and increase the probability of a larger uptrend formation.

1.02290: A critical support level, marking the lowest point reached by the pair in the last two months. A bearish break below this level could restart the downtrend that had been in place since September 2024.

As a reminder, if price movements continue hovering around the 1.04061 barrier, the current sideways range may still have room to extend further.

By Julian Pineda, CFA - Market Analyst

EUR/USD Consolidates, Upside LimitedThe EUR/USD pair is struggling to sustain its recovery from the 1.0200 area, the lowest since January 13, and is fluctuating near Wednesday’s weekly high around 1.0375-1.0380, showing little change amid mixed economic signals.

Tuesday’s JOLTS report signaled a US labor market slowdown, reinforcing expectations of two Fed rate cuts this year. A risk-on mood keeps the USD near its weekly low, supporting EUR/USD, but concerns over potential US tariffs on EU goods and the ECB’s dovish stance, despite a 2.5% YoY rise in Eurozone HICP for January, limit upside potential.

Traders await the final Eurozone Services PMI, while the US calendar features the ADP private-sector employment report, ISM Services PMI, and Fed speeches, influencing USD demand. However, Friday’s US NFP report remains the key focus.

Technically, resistance levels are at 1.0410, 1.0460, and 1.0515, while support stands at 1.0350, 1.0220, and 1.0180.

EUR/USD Struggles as Tariff Risks, ECB Rate Cut Prospects WeighThe euro edged up but stayed pressured around $1.03 amid uncertainty over Trump’s tariff policies. Over the weekend, Trump confirmed a 25% tariff on Mexican and Canadian imports, a 10% duty on Chinese goods, and threatened EU tariffs, citing the U.S. trade deficit. However, Mexico secured a one-month delay by agreeing to deploy 10,000 troops to curb fentanyl trafficking. The euro also faced pressure from the ECB’s dovish stance and prospects of further rate cuts after last week’s expected 25bps reduction. Meanwhile, Euro Area inflation rose to 2.5% in January, above the 2.4% forecast, while core inflation held at 2.7%, defying expectations of a slight dip.

From a technical perspective, the first resistance level is at 1.0305, with further resistance levels at 1.0360 and 1.0460 if the price breaks above. On the downside, the initial support is at 1.0220, followed by additional support levels at 1.0180 and 1.0120.

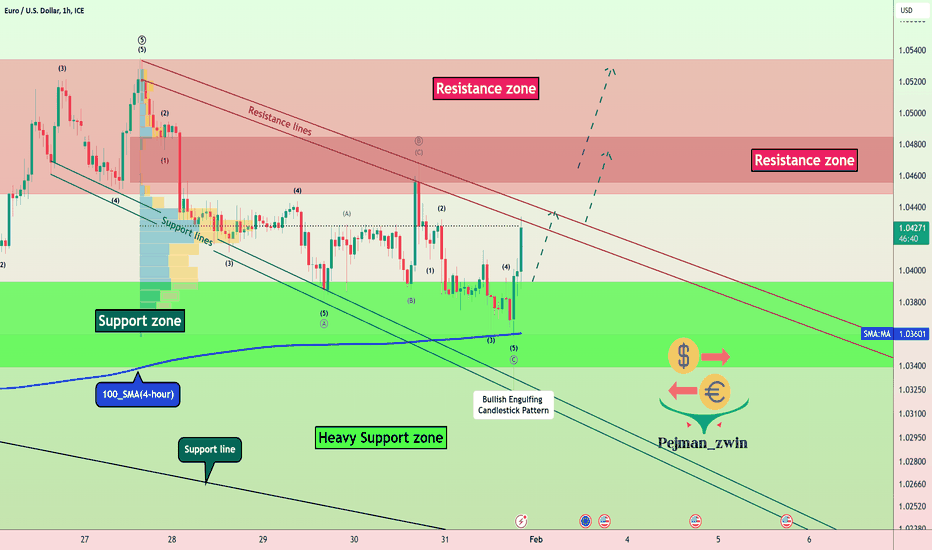

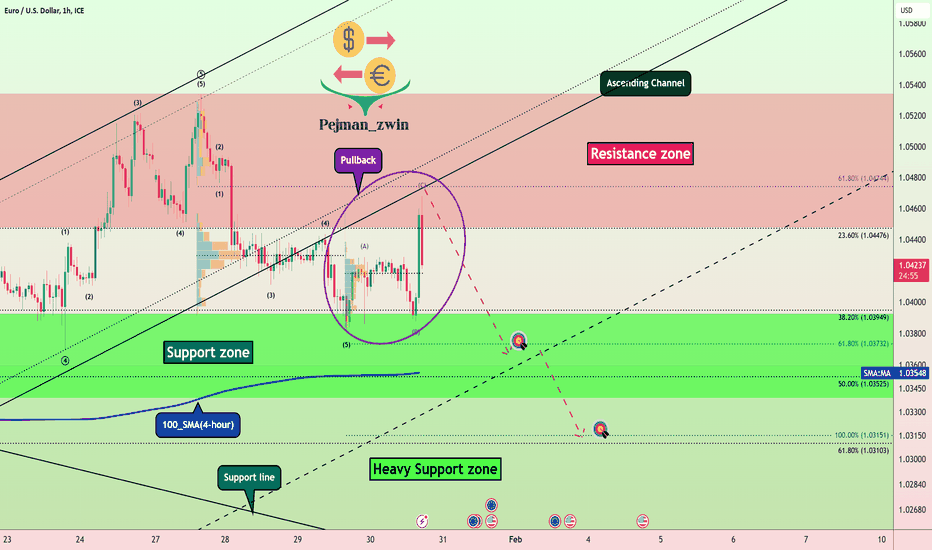

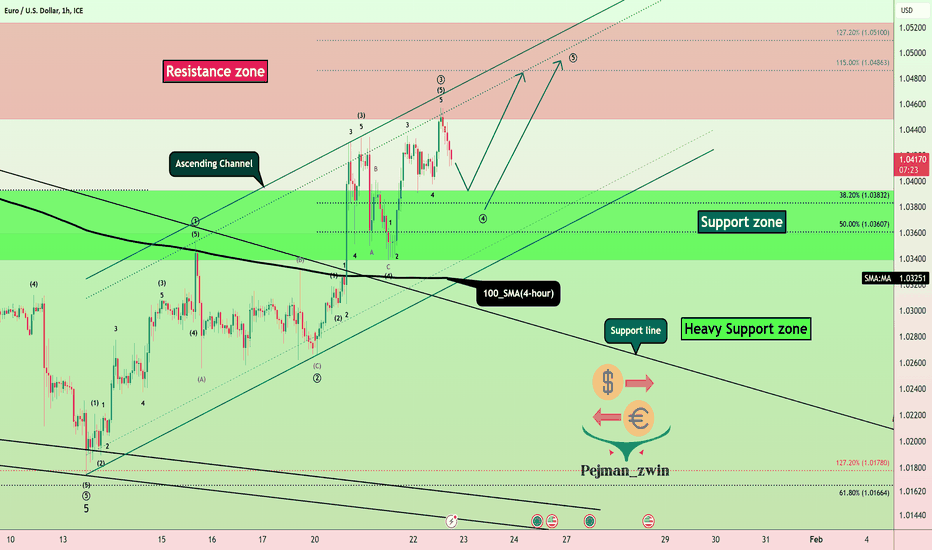

EURUSD Hits Support Zone—Is a Bullish Reversal Coming!!!As I expected , the EURUSD ( FX:EURUSD ) fell to the target I set yesterday.

EURUSD is moving near Support zone($1.039-$1.033) and 100_SMA(4-hour) .

According to the theory of Elliott waves , it seems that the EURUSD has succeeded in completing the corrective Zigzag(ABC/5-3-5) , and we should wait for the EURUSD to rise again. One of the signs of completion can be a Bullish Engulfing Candlestick Pattern with a suitable volume .

I expect EURUSD to rise to Resistance zone($1.0534-$1.0448) after breaking the Resistance lines .

Note: If EURUSD goes below $1.0333, we can expect more dumps .

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S.Dollar Analyze (EURUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

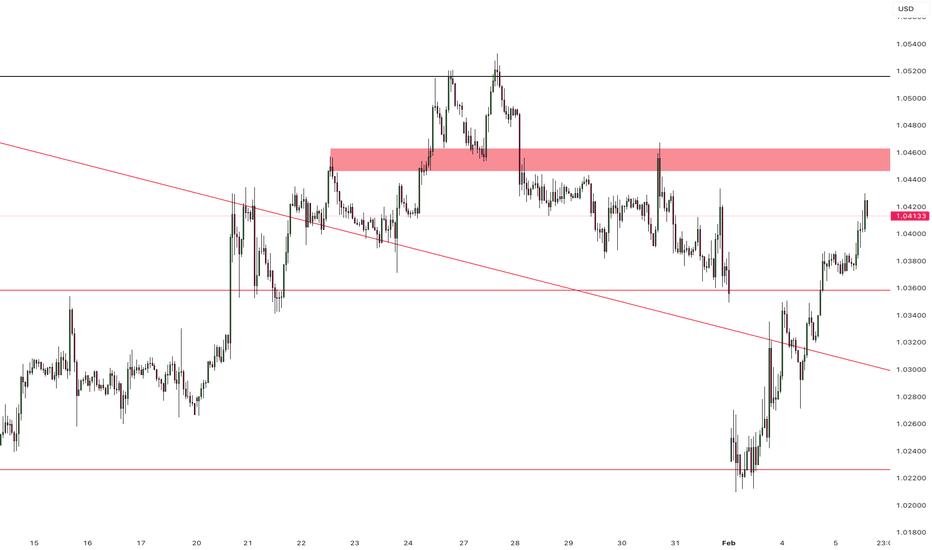

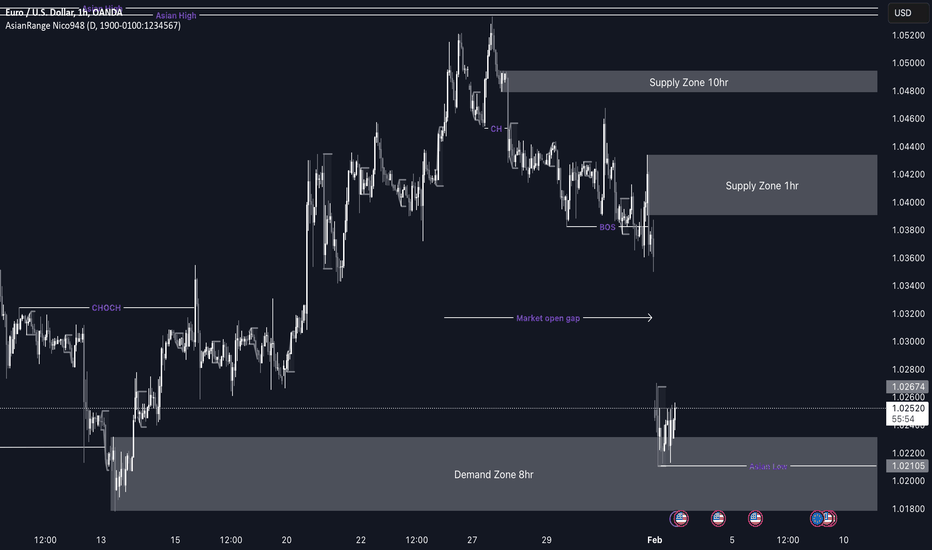

EUR/USD Outlook to recover the imbalance My EU outlook for this week is similar to GU as the dollar index gapped to the upside which made pairs like GU and EU to drop down heavy. once price did so it did breach a lot of my previous demands so we have to now adapt and re adjust our analysis and forecast.

So i have this demand zone that as you can see is getting reacted off of which what i drew out a. while ago which is the 8hr demand zone. I feel like this zone will hold as there is of validity. If price reacts well and manages to cover that gap i will then look to short inside the 1hr supply zone but after finding of course LTF confirmation.

COnfluences for EU Buys are as follows:

- The price gap has left a significant imbalance that needs to be filled.

- Price is currently in a 8-hour demand zone that previously caused a Break of Structure (BOS),

making it a valid POI.

- There is a large pool of liquidity to the upside that needs to be taken.

- The setup aligns well with the DXY correlation.

- For price to carry on going down it must form a correction to the upside regardless.

P.S. If price decides to go lower then we might be in a bearish trend temporarily and will have to look for a new near by supply to capitilise on a shift of trend to the downside. Thats if this 8hr demand doesn't hold.

Fundamental Market Analysis for february 3, 2025 EURUSDEUR/USD was subjected to heavy selling on Monday and fell towards 1.0200 early in the Asian session. Spot prices have returned to more than two-year lows reached in January and look set to continue their multi-month downtrend.

The US Dollar (USD) is rising across the board in response to US President Donald Trump's decision over the weekend to impose 25 per cent duties against Canada and Mexico, as well as an additional 10 per cent against China. This marks the start of a new global trade war and has curbed investor appetite for risky assets. The flow of anti-risk sentiment is putting good pressure on the safe-haven quid, which is becoming a key factor putting downward pressure on EUR/USD.

Meanwhile, on Friday evening, Trump announced that he will impose tariffs on goods from the European Union. This comes amid the European Central Bank's (ECB) stance, which continues to undermine the common currency. As expected, the ECB cut borrowing costs by 25 basis points (bps) last Thursday and left the door open for further rate cuts before the end of this year.

This is a significant divergence from the Federal Reserve's (Fed) pause, which favours dollar bulls and supports the prospects for further EUR/USD declines. Meanwhile, the recent sharp pullback in US Treasury yields acts as a headwind for the quid and may provide some support to spot prices. Nevertheless, the fundamental backdrop suggests that the path of least resistance for spot prices is to the downside.

Trade recommendation: Trading mainly with Sell orders from the current price level.

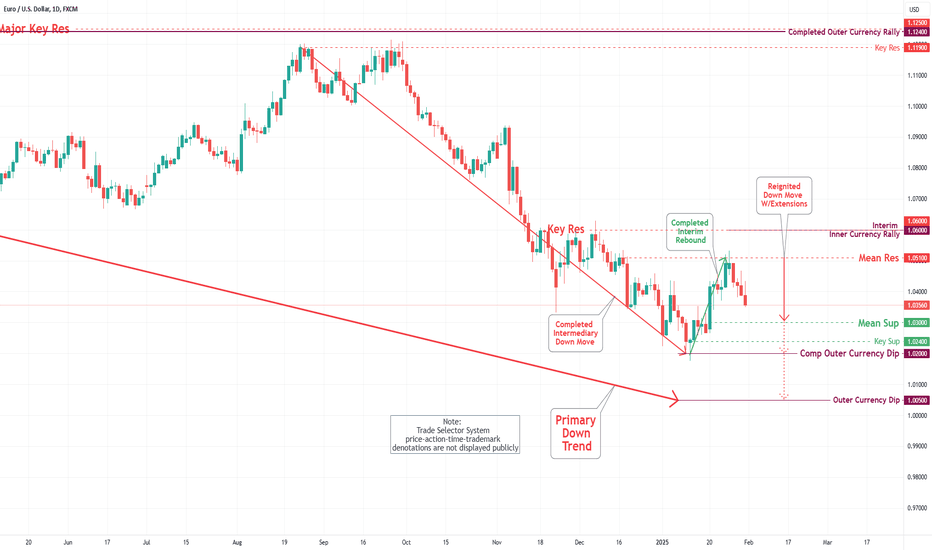

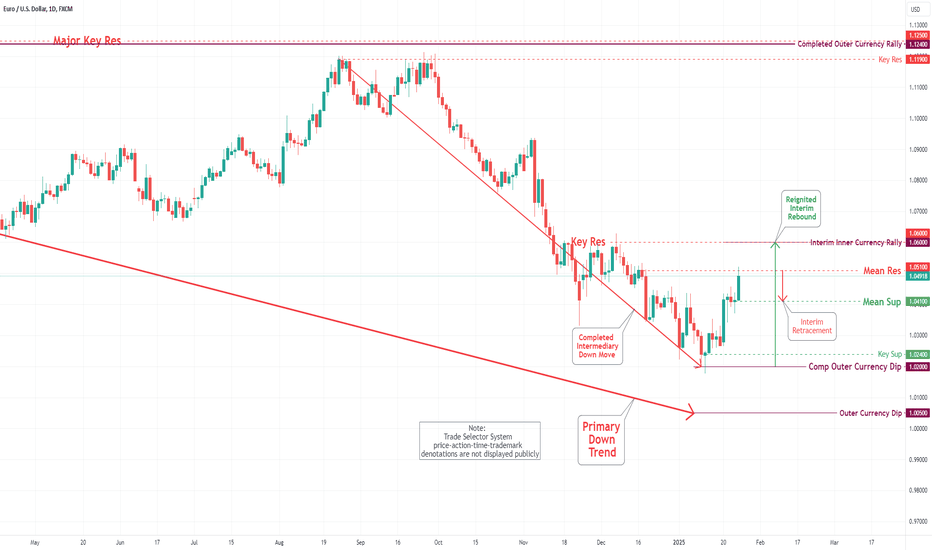

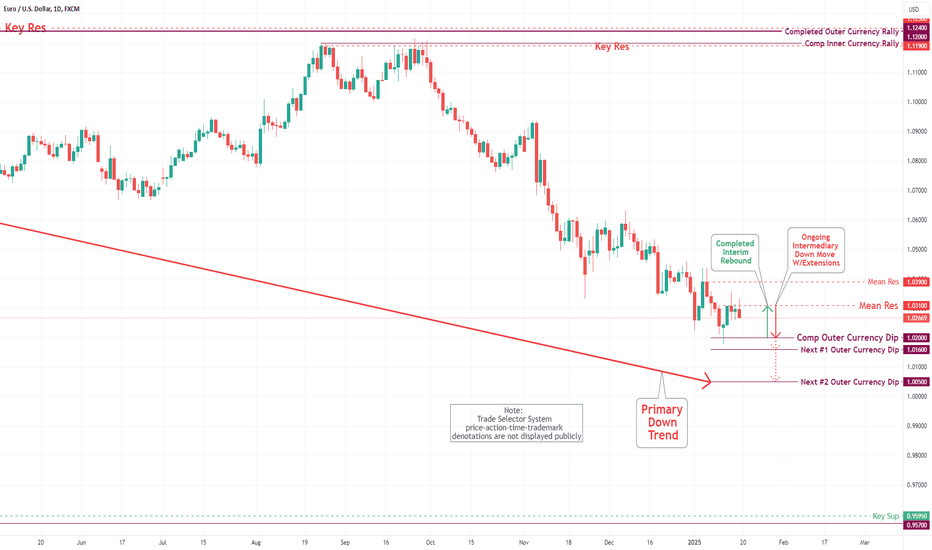

EUR/USD Daily Chart Analysis For Week of Jan 31, 2025Technical Analysis and Outlook:

Following a successful retest of our Mean Resistance at 1.051, the Eurodollar has undergone a significant retracement to our Mean Support at 1.041. It is now positioned to approach the newly established Mean Support at 1.024. We anticipate that this downtrend will persist as it seeks to retest the Interim Inner Currency Dip, set at 1.020, in conjunction with Key Support at 1.024. However, this downward movement may also result in a temporary "dead-cat bounce," allowing the price action to prepare for the subsequent decline.

US Economic Data Impact: Will EURUSD Test Support zone Again?Today, key U.S. economic data was released , including GDP , Unemployment Claims , and the GDP Price Index . These data points had a direct impact on the U.S. dollar, resulting in volatility in the EURUSD pair . The weaker-than-expected GDP and lower inflation caused a temporary weakening of the USD, but the strong labor market data still supports the dollar, potentially limiting further downside for EURUSD.

This was an analysis of the US economic data that was released today.

------------------------------------

EURUSD ( FX:EURUSD ) entered the Resistance zone($1.054-$1.044) again, and it seems that this move is a Pullback to the ascending channel (broken) .

According to Elliott's wave theory , pullback appears to be a Zigzag corrective wave(ABC/5-3-5) .

I expect EURUSD to attack the Support zone($1.039-$1.033) again, 100_SMA(4-hour) , and decline to at least the width of the broken ascending channel .

Was the bullish candle the previous hour in the role of a pullback or the start of another upward trend for EURUSD?

Note: If EURUSD goes over $1.049, we can expect more pumps.

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S.Dollar Analyze (EURUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

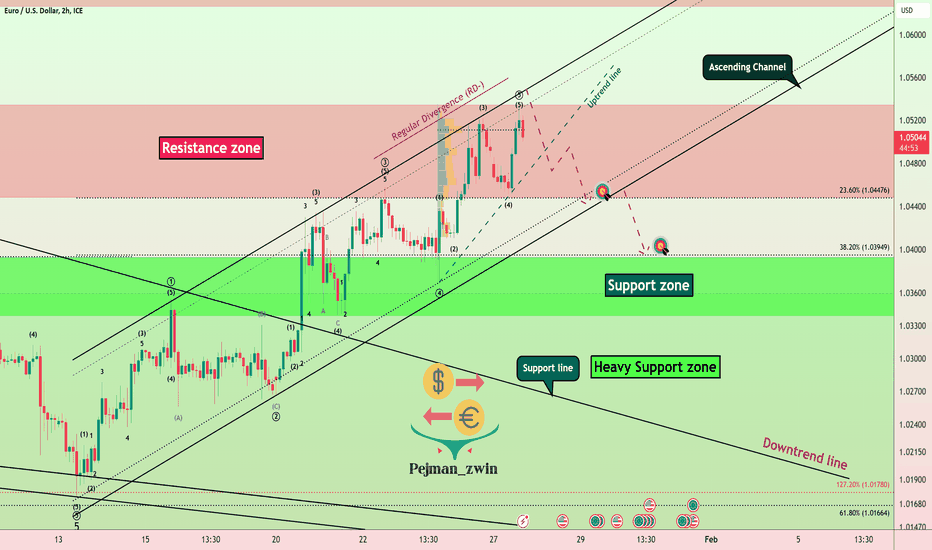

EURUSD Near Ascending Channel’s Peak: Will It Reverse?EURUSD ( FX:EURUSD ) rose to the Resistance zone($1.054-$1.044), as I expected in the previous idea .

EURUSD is moving in the Resistance zone($1.054-$1.044) and near the upper line of the Ascending Channel ( the role of resistance ).

According to the theory of Elliott waves , it seems that EURUSD has completed 5 impulsive waves , and we should wait for corrective waves .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

I expect EURUSD to fall at least to the Targets I have marked on the chart .

What do you think? Will EURUSD break the Resistance zone($1.054-$1.044) or back to test the Support zone($1.039-$1.033)?

Note: If EURUSD breaks the Resistance zone($1.054-$1.044), we can expect more pumps.

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S.Dollar Analyze (EURUSD), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

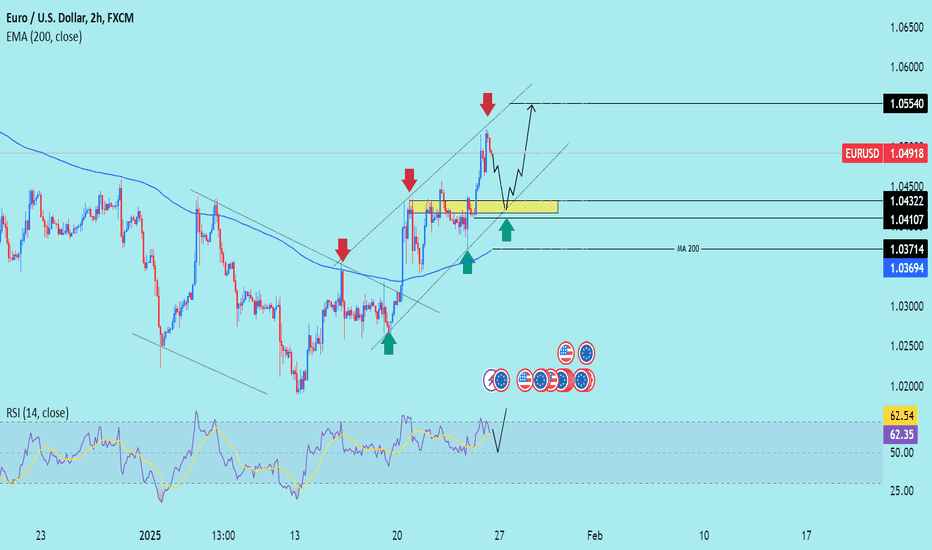

EUROUSD TRADING POINT UPDATE> READ THE CHAPTIN Buddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺️ Euro USD Traders SMC-Trading Point update you on New technical analysis setup Euro USD breakout of MA 200 ) Now 👍 Looking start with bullish trend 📈 🚀 analysis setup update fisrt I look short 1.04918- 1.04322). That' is good buying zone ☺️) target point 1.5540)

Key resistance level 1.05215 +1.05540

Key support level 1.4500 1.043222. .104107

Mr SMC Trading point

Support 💫 My hard analysis setup like And Following 🤝 me that star ✨ game 🎮

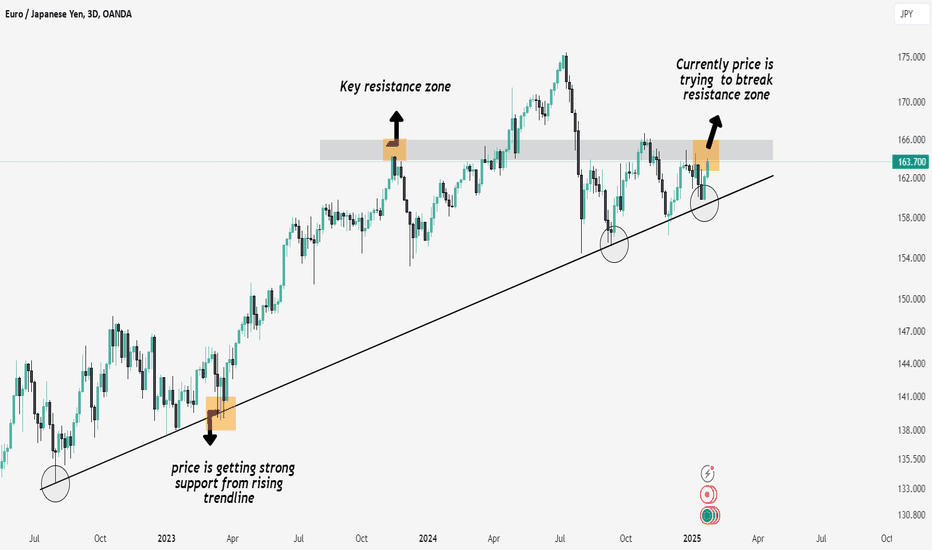

EUR/JPY Tests Key Resistance: Breakout or Pullback?EUR/JPY Analysis

Key Resistance Zone:

The price is currently testing a key resistance zone near the 164 level, which has previously acted as a strong barrier. A successful breakout above this zone could signal further bullish momentum.

Rising Trendline Support:

The price has consistently found strong support from the ascending trendline, confirming the overall bullish structure of the market.

EUR/USD Daily Chart Analysis For Week of Jan 24, 2025Technical Analysis and Outlook:

The Eurodollar saw a significant increase during this week's trading session after successfully breaking through our resistance levels at 1.031 and 1.039 and is now resting at the previous weekly chart analysis charts identified as a resistance level of 1.051. We expect a rally towards the next key target, the Interim Inner Currency Rally, set at 1.060. However, this upward movement could lead to a temporary retracement towards the support level at 1.041 and may challenge the next significant support level at 1.024.

EURUSD Roadmap==>>Short-term!!!EURUSD ( FX:EURUSD ) is moving near the Support zone($1.039-$1.033) and inside the Ascending Channel .

According to the theory of Elliott waves , it seems that EURUSD has succeeded in completing the main wave 3 above the ascending channel and is currently completing the main wave 4 .

I expect EURUSD to attack the Resistance zone($1.052-$1.044) again soon, and the main wave 5 could end in this zone.

What do you think? Will EURUSD break the support zone or bounce back to test the resistance zone?

Note: If EURUSD can break the Support zone($1.039-$1.033), the lower line of the ascending channel, and 100_SMA(4-hour) , we should expect a further decline of this pair.

Note: Donald Trump's speech and the announcement of the Unemployment Claims index can affect the EURUSD trend(Tomorrow).

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S.Dollar Analyze (EURUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Fundamental Market Analysis for January 24, 2025 EURUSDEUR/USD is attracting buyers towards 1.04500 in the early Asian session on Friday, fuelled by a weaker US Dollar (USD). Later on Friday, preliminary Purchasing Managers' Index (PMI) data for January in the Eurozone and Germany will be released. In the US, the flash S&P PMI for January will take centre stage.

U.S. President Donald Trump's remarks at the World Economic Forum in Davos led to a decline in the U.S. dollar against a basket of major currencies. Late on Thursday, Trump said he wants to see interest rates cut immediately and accordingly they should fall across the board.

‘The markets seem to be more concerned about lower rates and any indication that they're going to be cut’, said David Eng, an investment adviser at Sonora Wealth Group in Vancouver.

Meanwhile, ECB President Christine Lagarde emphasised on Wednesday that the central bank is ‘not too concerned’ about the risk of inflation from abroad and will continue to cut interest rates at a gradual pace. Markets have priced in a nearly 96% probability that the ECB will cut rates at its upcoming meeting.

Trading recommendation: Trade predominantly with Buy orders from the current price level.

EURUSD Macro Chart The macroeconomic situation forms a favorable background for assets valued in US dollars, with a tendency of their growth There comes a moment of domination of foreign currencies and displacement of the dollar. Shares of European companies will also show strong growth. The euro may have a noticeable impact on economic activity in the region and the structure of expenditures of the population.

Fundamental Market Analysis for January 21, 2025 EURUSDThe Euro-Dollar pair remains in negative territory after cutting its recent losses, trading around 1.03800 during Asian hours on Tuesday. The Euro (EUR) remains under pressure amid prevailing expectations for the European Central Bank (ECB). Markets expect a 25 basis points (bps) rate cut at each of the ECB's next four meetings, driven by concerns over the eurozone's economic outlook and the belief that inflationary pressures will remain subdued.

The U.S. Dollar Index (DXY), which tracks the performance of the U.S. dollar against six major currencies, rose to 108.30 at the time of writing. The US Dollar recovered from recent losses in the previous session, helped by news that President Donald Trump intends to direct federal agencies to review tariff policy and assess the United States' trade relations with Canada, Mexico and China.

However, the dollar faced headwinds after Bloomberg reported that President Donald Trump will not immediately announce new tariffs after his inauguration on Monday. The U.S. Federal Reserve (Fed) is expected to keep the benchmark overnight rate in a range of 4.25 percent to 4.50 percent at its January meeting. However, investors believe that Trump's policies could lead to rising inflationary pressures, which could limit the Fed to another rate cut.

Trading recommendation: Watch the level of 1.04000, if consolidated above consider Buy positions, if rebounded consider Sell positions.

EUR/USD Daily Chart Analysis For Week of Jan 17, 2025Technical Analysis and Outlook:

The Eurodollar has seen a notable increase in volatility during this week's trading session after completing our significant Outer Currency Dip at 1.020. The interim rebound reached our target of the Mean Resistance at 1.030, as outlined in last week's chart analysis. We are now anticipating a retest of the completed Outer Currency Dip at 1.020, with additional extension levels at Outer Currency Dips of 1.016 and 1.005, respectively.