Is EURUSD Set for a Reversal? Watch the Potential Reversal ZonesThe recent release of Core PPI and PPI m/m published in lower than expected , signaling a potential decrease in inflationary pressures in the U.S. This could lead to speculation about a more dovish stance from the Federal Reserve, which might weaken the U.S. Dollar and provide support for other currencies, including the Euro.

Let’s analyze how this data could influence the EURUSD ( FX:EURUSD ) chart.

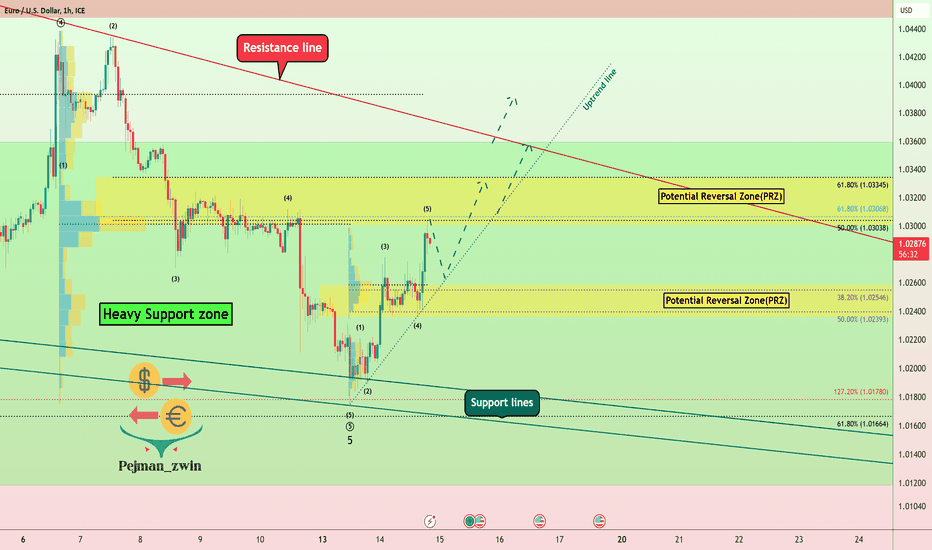

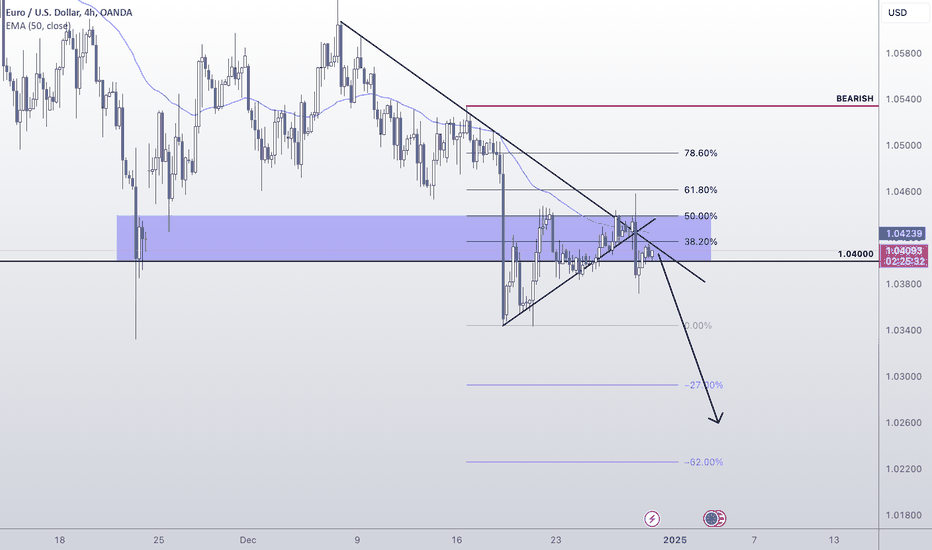

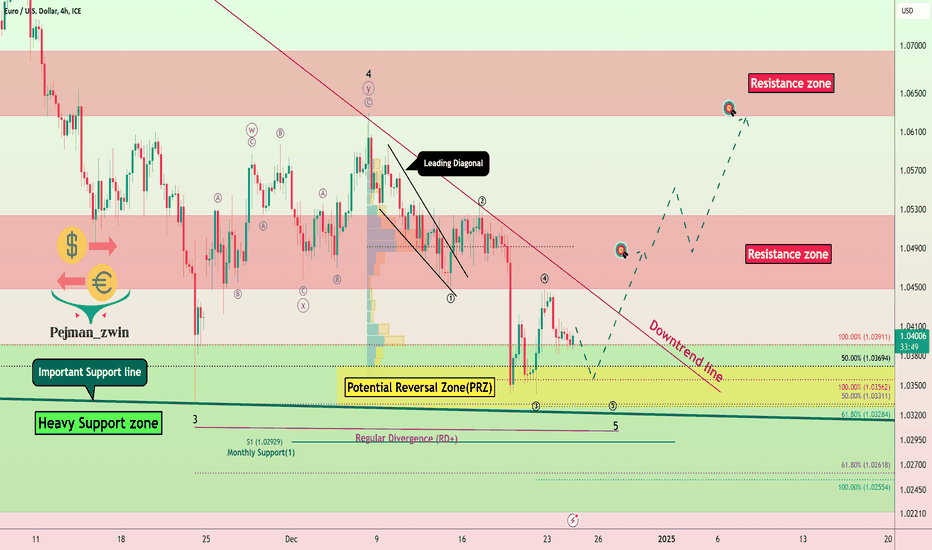

The EURUSD is moving through a Heavy Support zone($1.036-$1.011) .

According to the theory of Elliott waves , it seems that EURUSD has completed the main five waves (downward) , and we can expect upward waves .

I expect EURUSD to start rising again from the lower Potential Reversal Zone(PRZ) and Uptrend line and then attack the upper Potential Reversal Zone(PRZ) . If this zone is broken, we should wait for the EURUSD to attack the Resistance line .

🙏Please respect each other's ideas and express them politely if you agree or disagree.

⚠️Note: If the EURUSD goes below the lower Potential Reversal Zone(PRZ), EURUSD may fall further.

Euro/U.S.Dollar Analyze (EURUSD), 1-hour time frame⏰.

🔔Be sure to follow the updated ideas.🔔

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Eurodollar

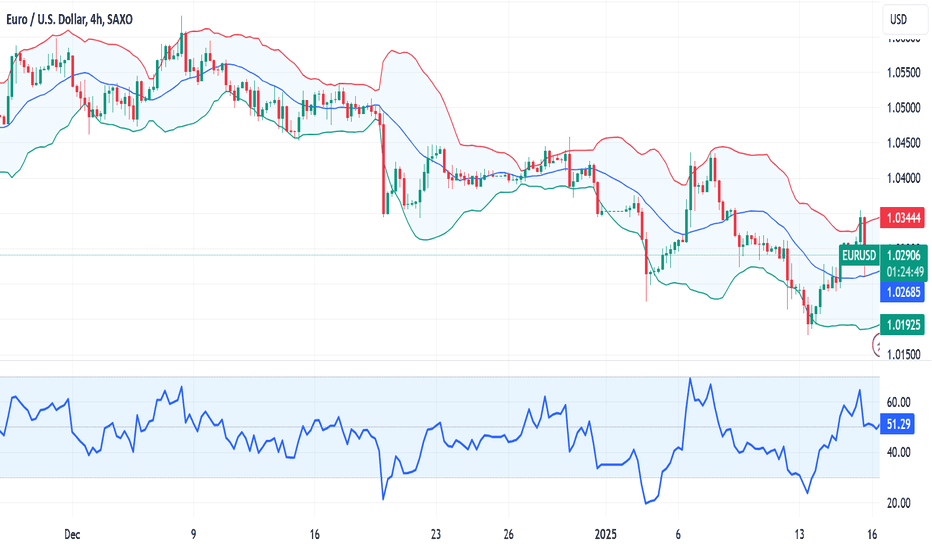

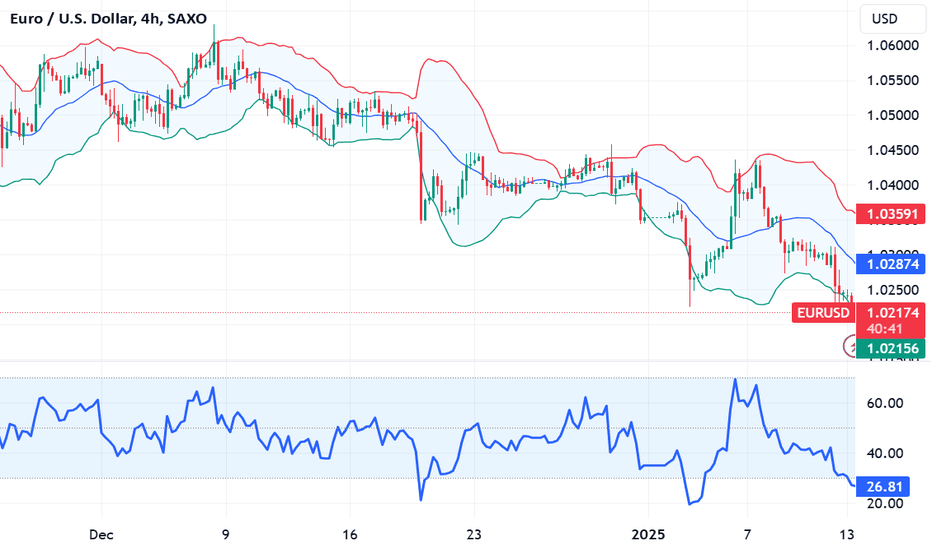

Fundamental Market Analysis for January 16, 2025 EURUSDEUR/USD is holding near 1.0295 in the early Asian session on Thursday. Lower than expected US Consumer Price Index (CPI) data for December raises the possibility that the US Federal Reserve (Fed) may cut interest rates twice this year, putting pressure on the US Dollar. However, growing concerns over Eurozone economic growth could limit the major pair's gains.

The US Dollar (USD) declined after weaker than expected US core CPI data, fuelling expectations that the Fed's easing cycle is not yet over. Markets now expect the US central bank to cut rates by 40 basis points (bps) before the end of the year, compared to around 31 bps before the inflation data was released.

Across the ocean, the European Central Bank (ECB) cut rates four times last year and traders expect three or four changes this year due to concerns about the Eurozone's weak economic outlook. Rising bets on further ECB interest rate cuts could undermine the euro (EUR) against the U.S. dollar in the near term.

Later on Thursday, investors will be watching Germany's Harmonised Index of Consumer Prices (HICP) for December and the ECB monetary policy meeting report. In the US, the main events will be retail sales data for December and weekly initial jobless claims.

Trade recommendation: Watch the level of 1.0260, when fixing below consider Sell positions, when rebounding consider Buy positions.

Fundamental Market Analysis for January 13, 2025 EURUSDData from the US Bureau of Labour Statistics (BLS) released on Friday reported that non-farm payroll employment (NFP) rose by 256k in December, exceeding market expectations of 160k and beating the revised November figure of 212k (previously reported at 227k).

The unemployment rate fell to 4.1% in December from 4.2% in November. Annual wage inflation, as measured by the change in average hourly earnings, fell slightly to 3.9% from 4%.

US labour market data for December is likely to reinforce the US Federal Reserve's (Fed) stance on keeping interest rates unchanged in January, which will support the dollar against other currencies. Markets expect the Fed to keep the benchmark overnight interest rate in the range of 4.25%-4.50% at its 28-29 January meeting.

In addition, traders expect four interest rate cuts by the European Central Bank (ECB), which are expected to occur at each meeting through the summer. ECB policymakers seem to be comfortable with these expectations as inflationary pressures in the Eurozone remain largely under control.

The head of the ECB and the Bank of France said that interest rates will continue to move towards a neutral rate ‘without slowing down by the summer’ if upcoming data confirm that ‘the pullback in price pressures does not remain in place’.

Trade recommendation: Trading mainly with Sell orders from the current price level.

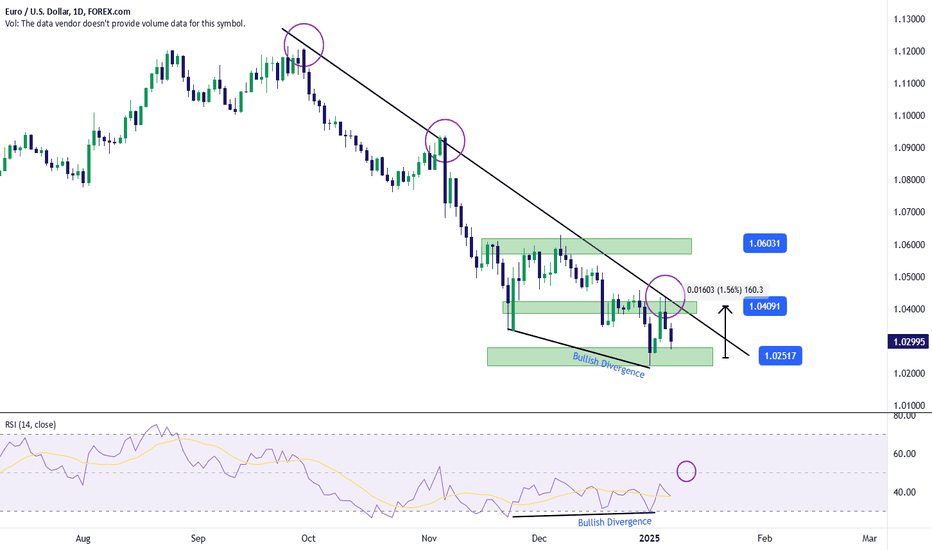

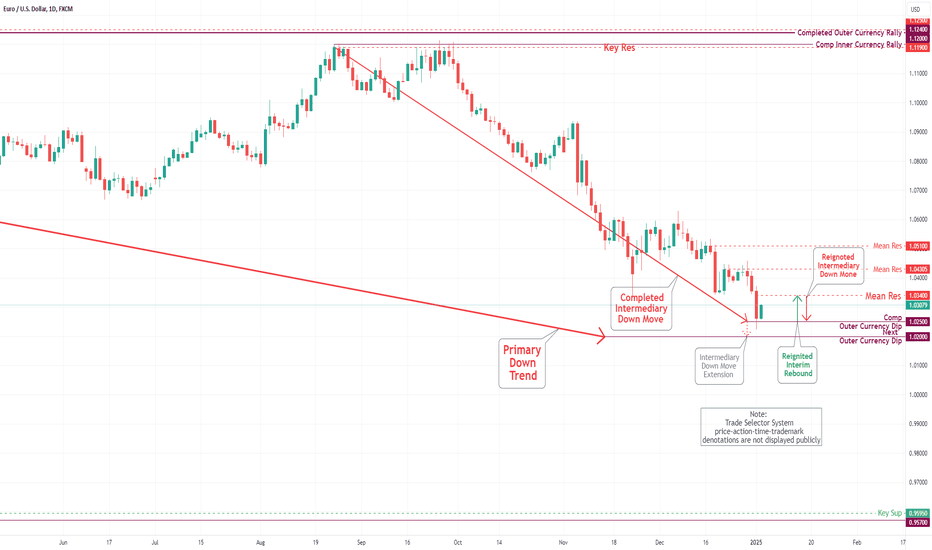

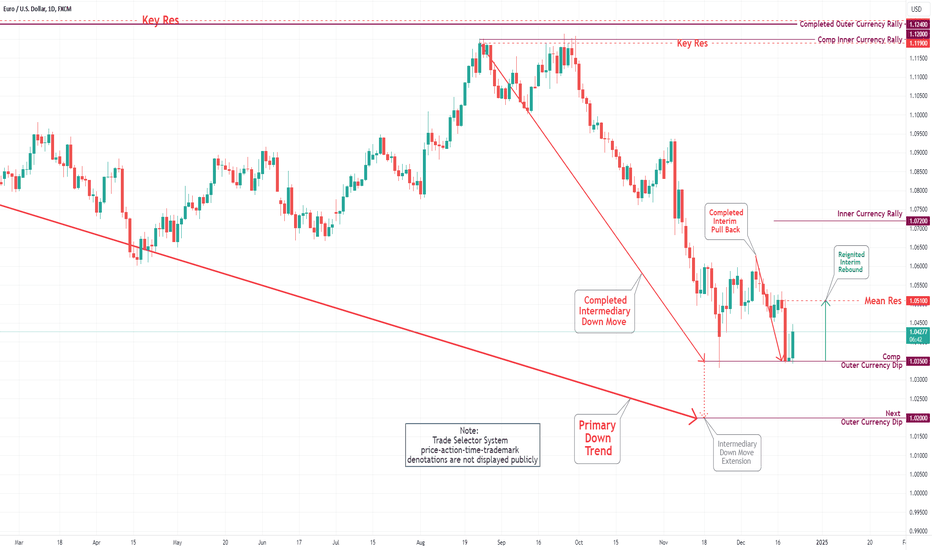

EUR/USD Daily Chart Analysis For Week of Jan 10, 2025Technical Analysis and Outlook:

The Eurodollar has experienced a significant increase during this week's trading session, surpassing our initial target of Mean Resistance at 1.034. It then encountered strong resistance at a Mean Resistance of 1.043, leading to a notable pullback that brought it down to an Outer Currency Dip of 1.025 and lower. We are now looking at the next target at Outer Currency Dip 1.020, with additional extension levels at Outer Currency Dip 1.016 and 1.005, respectively. Reaching our first target, Outer Currency Dip 1.025, will likely trigger an interim rebound toward the designated level at Mean Resistance 1.030.

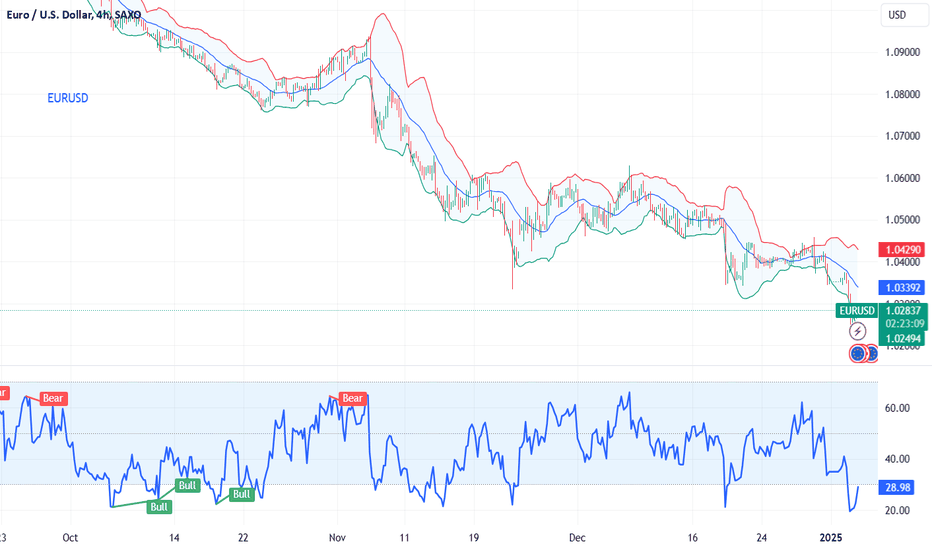

EUR/USD: Neutrality Dominates Movements Around the 1.0250 ZoneThe U.S. dollar continues to gain ground as the Fed remains firm in slowing down rate cuts. The interest rate differential of 4.5% from the Fed versus 3.15% from the ECB remains a key reason for the market's preference for the U.S. dollar in the short term.

Bearish Trend:

The trend in favor of the U.S. dollar remains intact since late September 2024. So far, there are no significant breaks above 1.04091 that would threaten the current bearish formation.

RSI Divergence : Lower lows in price and higher lows in the RSI indicate a bullish divergence in the short term. This suggests an imbalance in selling pressure and the potential for upward corrections. Monitoring the nearby resistance at 1.0491 is critical for these upcoming oscillations.

Key Levels:

1.04091: Nearby resistance that coincides with the bearish trendline. Potential upward corrections may stall at this level.

1.02517: Main short-term support, the lowest level seen in recent months. Breaks below this price could accelerate selling pressure.

1.06031: Key resistance, the December high. Oscillations around this level could jeopardize the current bearish trend.

-JP

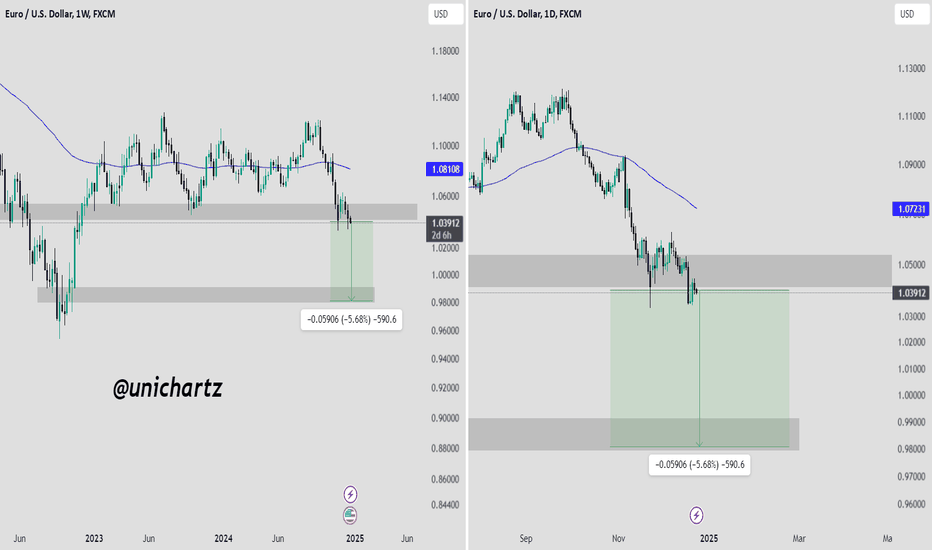

Will History Repeat as Major Currencies Dance Toward Parity?In a dramatic shift that has captured the attention of global financial markets, the euro-dollar relationship stands at a historic crossroads, with leading institutions forecasting potential parity by 2025. This seismic development, triggered by Donald Trump's November election victory and amplified by mounting geopolitical tensions, signals more than just a currency fluctuation—it represents a fundamental realignment of global financial power dynamics.

The confluence of diverging monetary policies between the U.S. and Europe and persistent economic challenges in Germany's industrial heartland has created a perfect storm in currency markets. European policymakers face the delicate task of maintaining supportive measures. At the same time, their American counterparts adopt a more cautious stance, setting the stage for what could become a defining moment in modern financial history.

This potential currency convergence carries implications far beyond trading desks. It challenges traditional assumptions about economic power structures and reevaluates global investment strategies. As geopolitical tensions escalate and economic indicators paint an increasingly complex picture, market participants must navigate a landscape where historical precedents offer limited guidance. The journey toward potential parity serves as a compelling reminder that in today's interconnected financial world, currency movements reflect not just economic fundamentals but the broader forces reshaping our global order.

Conclusion

The current landscape presents unprecedented challenges for the EUR/USD pair, driven by economic fundamentals and geopolitical tensions. One significant concern is the potential release of sensitive footage from Israel (by the Israeli National Security Agency (NSA) from Hamas body cameras, containing graphic atrocities from the October 7th incident.), which could threaten European stability. These developments go beyond simple market dynamics and have the potential to reshape the social and political fabric of Europe.

Market professionals emphasize the importance of adaptable strategies and the vigilant monitoring of key indicators. Investors must prepare for increased volatility while maintaining strong risk management frameworks. The pressure on the euro-dollar relationship is likely to persist, making strategic positioning and careful market analysis more crucial than ever in navigating these turbulent waters.

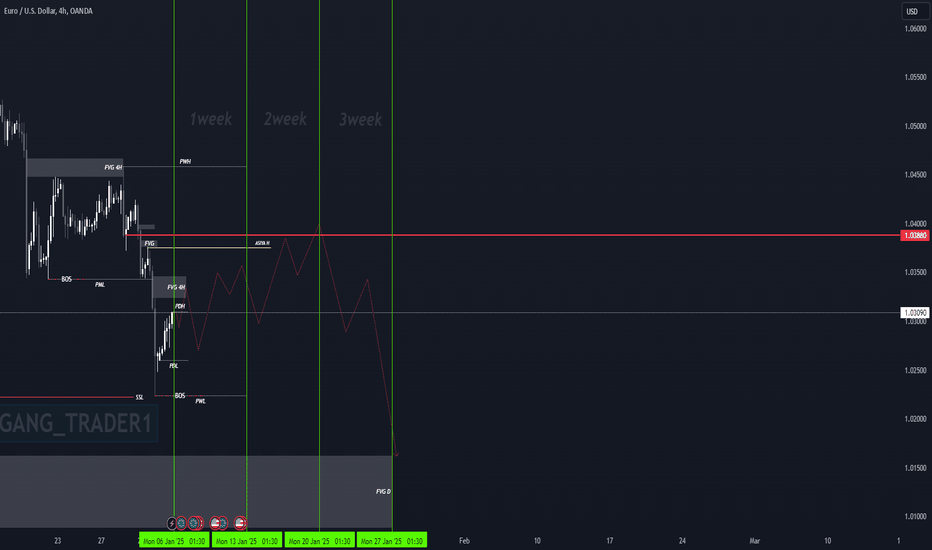

Be sure to check out the Euro Dollar AnalysisGreetings to our dear followers💎

The main trend of the above timeframes, like the weekly and daily timeframes, is bearish, so we expect a decline in the Euro-Dollar.🎯

We have predicted the trend of the Euro-Dollar for the next three weeks🚀

Please take a position with your personal trading setup along with the trend.

If I see any changes, I will update the post with new analysis. Thank you for your support❤✔

Market Analysis: EUR/USD TumblesMarket Analysis: EUR/USD Tumbles

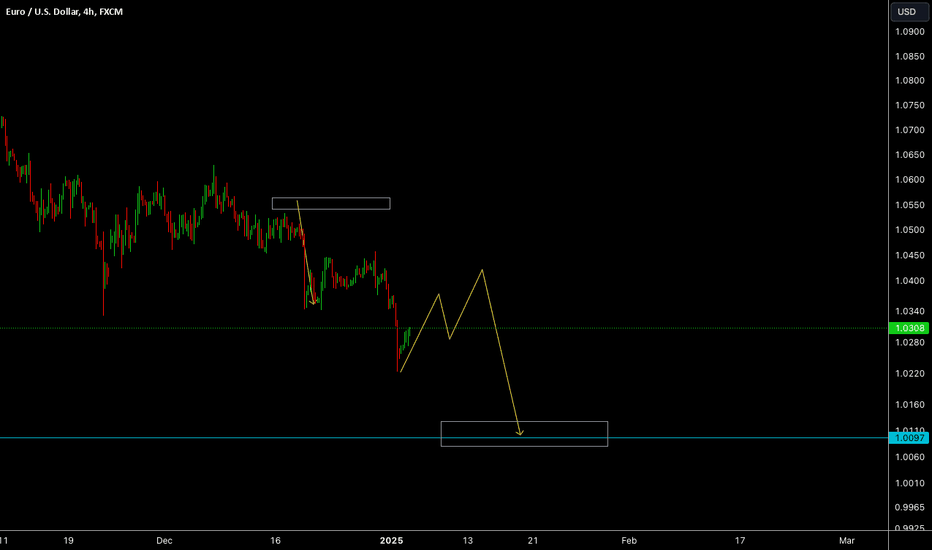

EUR/USD declined from the 1.0450 resistance and traded below 1.0300.

Important Takeaways for EUR/USD Analysis Today

- The Euro started a fresh decline below the 1.0350 support zone.

- There is a key bearish trend line forming with resistance at 1.0320 on the hourly chart of EUR/USD at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair struggled to clear the 1.0450 resistance zone. The Euro started a fresh decline and traded below the 1.0350 support zone against the US Dollar.

The pair declined below 1.0300 and tested the 1.0225 zone. A low was formed near 1.0224 and the pair recently attempted a recovery wave. There was a minor recovery wave above the 1.0280 level. The pair climbed above the 23.6% Fib retracement level of the downward move from the 1.0458 swing high to the 1.0224 low.

The pair is now trading above 1.0285 and the 50-hour simple moving average. On the upside, the pair is now facing resistance near the 1.0320 level. There is also a key bearish trend line forming with resistance at 1.0320.

The next key resistance is at 1.0340. The main resistance is near the 1.0365 level or the 61.8% Fib retracement level of the downward move from the 1.0458 swing high to the 1.0224 low.

A clear move above the 1.0365 level could send the pair toward the 1.0460 resistance. An upside break above 1.0460 could set the pace for another increase. In the stated case, the pair might rise toward 1.0500.

If not, the pair might resume its decline. The first major support on the EUR/USD chart is near 1.0280. The next key support is at 1.0225. If there is a downside break below 1.0225, the pair could drop toward 1.0200. The next support is near 1.0150, below which the pair could start a major decline.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

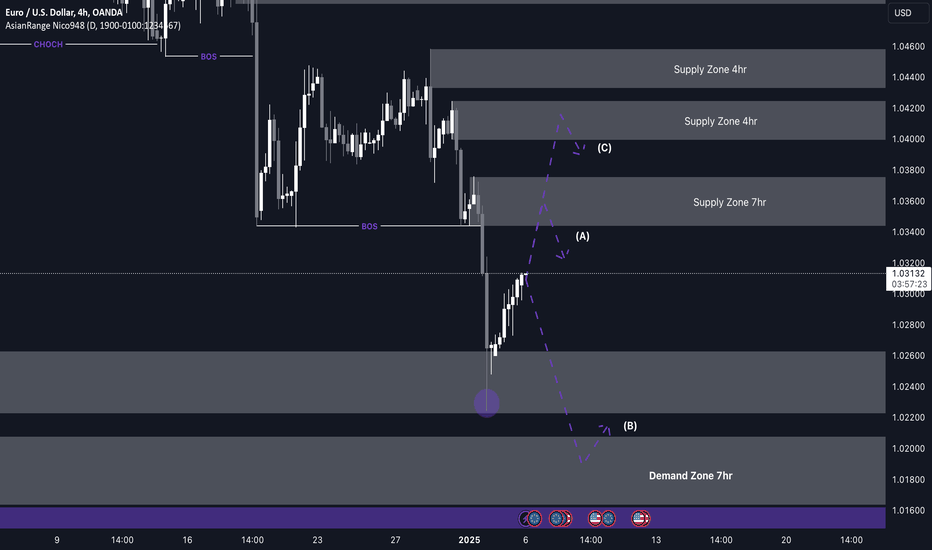

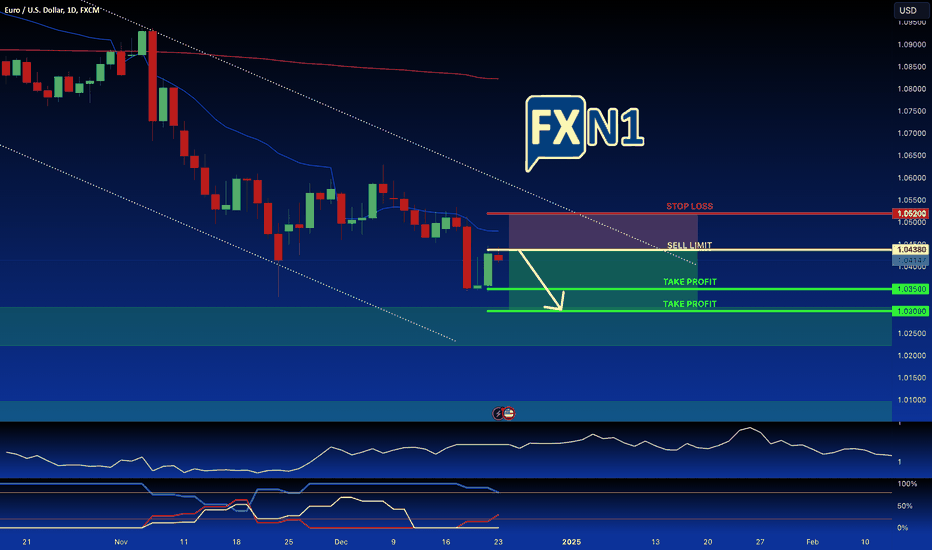

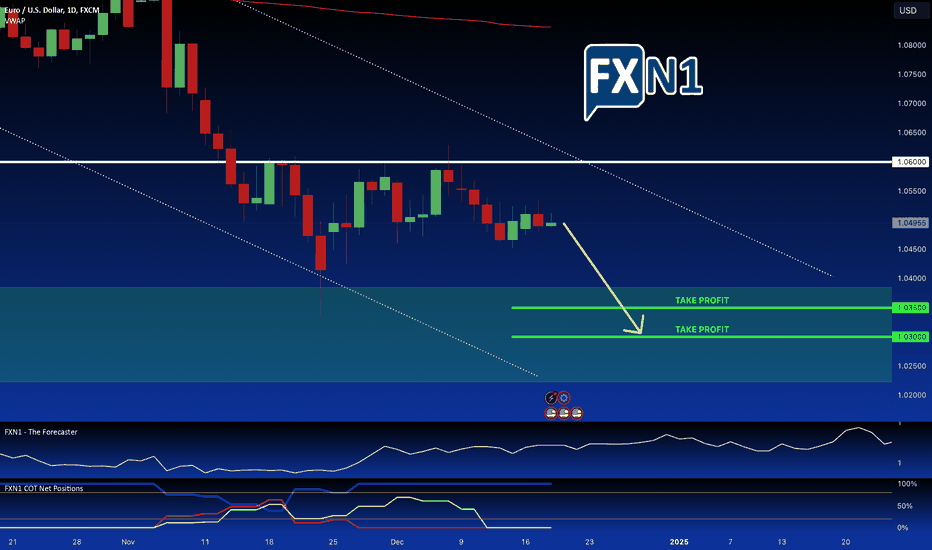

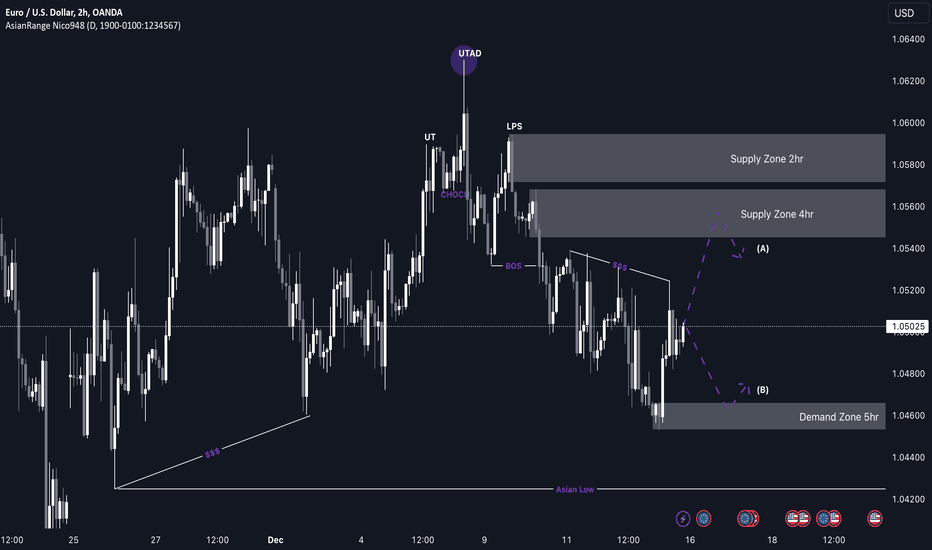

EUR/USD Shorts from 1.03600 back down?My analysis for EUR/USD (EU) this week closely mirrors my expectations for GBP/USD (GU), as both pairs share similar points of interest (POIs). I’ll be focusing on capitalizing on the bearish trend evident in the formation of lower lows and lower highs.

With the recent break of structure to the downside, new supply zones have been created. I’ll be waiting for a retest of these zones to catch sell opportunities in alignment with the overall trend. Once the price sweeps liquidity and forms a clear schematic, I’ll enter sell trades targeting the demand zone below.

Confluences for EU Sells:

- The price has shown a Change of Character (CHOCH) and multiple Breaks of Structure (BOS) to the downside.

- A few unmitigated supply zones remain, which are likely to be tapped.

- Lots of liquidity below, alongside imbalances that need to be filled.

- The Dollar Index (DXY) is bullish, strengthening the bearish case for EU through correlation.

Note: If the price continues dropping, I’ll wait for a new supply zone to form or look for counter-trend buy opportunities from a valid demand zone.

EUR/USD Daily Chart Analysis For Week of Jan 3, 2025Technical Analysis and Outlook:

The Eurodollar has significantly declined in this week's abbreviated trading session, reaching the Outer Currency Dip level of 1.025. Consequently, the currency has rebounded robustly and is heading toward the Mean Resistance level of 1.034. Current analyses suggest that the Euro is positioned to continue its upward trajectory. Nevertheless, it is anticipated that a revitalized pullback will occur from this resistance level.

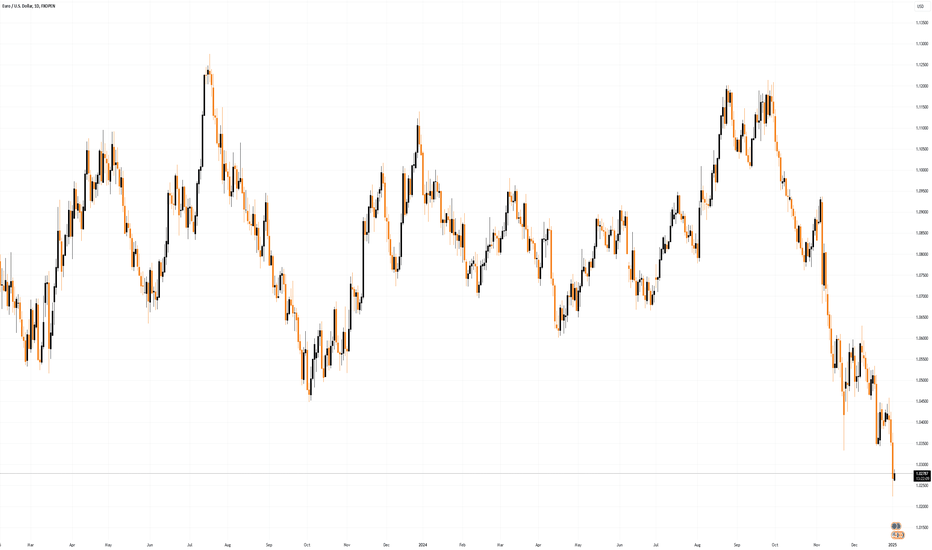

EUR/USD Started 2025 at Its Lowest Point in 25 MonthsEUR/USD Started 2025 at Its Lowest Point in 25 Months

According to the EUR/USD chart, on 2nd January, the first trading day of the year, the EUR/USD pair fell below the psychological level of 1.025, the lowest mark since November 2022.

There are few news events, and the EUR/USD rate decline may be attributed to:

→ The holiday period still affecting financial markets, reducing liquidity and creating vulnerabilities for volatility spikes;

→ Market participants potentially rebalancing their portfolios for the new calendar year;

→ Reassessing the strength of the dollar amid uncertainty about the actual steps of President-elect Trump, whose inauguration is scheduled for this month.

Meanwhile, technical analysis of the EUR/USD chart reveals that:

→ In 2024, price fluctuations formed a downward channel, with key pivot points marked by red circles. Notably, the previous holiday period led to the formation of the first of these points.

→ The bullish "Cup and Handle" pattern, which we discussed on 30th December, resulted in a false bullish breakout (indicated by an arrow). Seizing the bulls' failure, the bears pushed the price to the lower boundary of the mentioned channel.

The area where the lower boundary of the channel intersects the psychological level of 1.025 could serve as strong support. The recovery observed on the morning of 3rd January may confirm this.

The holiday period may lead to the formation of a new key pivot point on the EUR/USD chart, as has happened before.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice

Fundamental Market Analysis for January 3, 2025 EURUSDEUR/USD paused its four-day losing streak, trading near 1.02700 during the Asian session on Friday. European Manufacturing Purchasing Managers' Index (PMI) data on Thursday fell short of expectations, which only added to Euro traders' concerns following a soft speech from European Central Bank (ECB) Governor Yannis Stournaras later in the day.

According to ECB Governing Council member Yannis Stournaras, the ECB intends to smoothly cut interest rates until 2025. According to Stournaras, the ECB rate is expected to be somewhere in the neighborhood of 2% at the end of this year. As the Federal Reserve (Fed) will cut interest rates much more slowly than previously expected in 2025, the EUR interest rate differential will widen significantly by the end of the year, putting downward pressure on EUR/USD in the long term. This is in line with the expectations of some analysts who are calling for the euro to reach parity with the US dollar as early as this year.

Pan-European PMI results for December fell slightly to 45.1 against expectations of holding at 45.2. While the data itself had relatively little impact, it helped underscore the growing likelihood that the European Central Bank (ECB) will accelerate rate cuts to support the European economy, even as gasoline prices hit their two-year highs, further confounding Europe's economic outlook.

The only significant data on Friday's economic calendar is the results of the ISM US manufacturing PMI, which is expected to remain at the declining 48.4 reading for December.

Trading recommendation: Watch the level of 1.02500, if it is fixed below consider Sell positions, if it bounces back consider Buy positions.

EUR/USD Market Dynamics: Analyzing Recent Price MovementsFollowing our previous analysis, we anticipated the market's response to last week's robust U.S. economic indicators, particularly regarding the USD's strength against the EUR. After experiencing a notable bearish trend, the euro managed to recoup some losses, specifically retesting our pending order at 1.04380. As I write this article on December 23, 2024, the currency pair trades around 1.04130, providing a rejection of our entry point.

On Monday, the U.S. Dollar (USD) stabilized after a significant drop on Friday. This sell-off was prompted by weaker-than-expected growth in the U.S. Personal Consumption Expenditure Price Index (PCE). Specifically, the core PCE—a key inflation metric favored by the Federal Reserve—rose by 2.8%, falling short of the projected 2.9%. On a month-to-month basis, both headline and core PCE inflation inched up by only 0.1%, leading to speculation about the Federal Reserve's trajectory concerning interest rate adjustments in 2025.

Federal Reserve officials are beginning to signal expectations of fewer rate cuts in the coming year, as the disinflation process appears to be slowing and uncertainties loom over how President-elect Donald Trump’s upcoming immigration, trade, and taxation policies could affect the economy.

Given the current outlook, we are anticipating a continuation of bearish trends in the market.

Previous Idea:

✅ Please share your thoughts about EUR/USD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Euro softens as Russia rejects Ukraine peaceThe EUR/USD pair has slipped below 1.0400, reflecting a bearish outlook as recent macroeconomic and geopolitical developments weigh on the euro. The European Central Bank (ECB) has implemented a series of rate cuts, with more expected in 2025, contrasting sharply with the US Federal Reserve's decision to reduce its rate cut projections, thereby strengthening the dollar. The euro's challenges are compounded by geopolitical uncertainties, particularly Russia's rejection of Donald Trump's Ukraine peace plan, which has heightened tensions in European financial markets due to the EU's involvement in proposed peacekeeping efforts. Additionally, the potential expiration of the Russia-Ukraine gas transit deal could lead to increased energy costs and inflationary pressures in the Eurozone, challenging the ECB's monetary policy efforts and potentially leading to increased euro volatility. Traders should watch for any ECB strategies to manage these inflationary and trade impacts, which could stabilize the euro amidst these challenges.

EUR/USD Daily Chart Analysis For Week of Dec 27, 2024Technical Analysis and Outlook:

During the current abbreviated trading week, the Eurodollar is exhibiting a narrow trading range above the Outer Currency Dip level of 1.035. Current analysis suggests that the Euro is poised to resume its upward trajectory, with anticipated targets of Mean Resistance 1.051 and a potential extension to Mean Resistance marked at 1.060. It is important to note that a pull-down movement may occur towards Mean Support at 1.039; with a possible retest of the completed Outer Currency Dip level of 1.035, before resuming the upside movement.

EURUSD Analysis==>>Pumping Soon!?EURUSD ( FX:EURUSD ) is currently moving near the Heavy Support zone($1.040-$1.022) , Potential Reversal Zone(PRZ) , and an Important Support line .

According to Elliott's wave theory , EURUSD is completing microwave 5 of the main wave 5 , so we should expect bullish waves soon .

Also, Regular Divergence (RD+) between Consecutive Valleys .

I expect EURUSD to rise to at least $1.049 AFTER the Downtrend line is broken , and if the Resistance zone($1.040-$1.022) is broken, we have to wait for further increases .

⚠️Note: If EURUSD breaks the Important Support line, we can also expect the break of the Heavy Support zone($1.040-$1.022).⚠️

Euro/U.S.Dollar Analyze (EURUSD), 4-hour Time frame ⏰.

🔔Be sure to follow the updated ideas.🔔

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

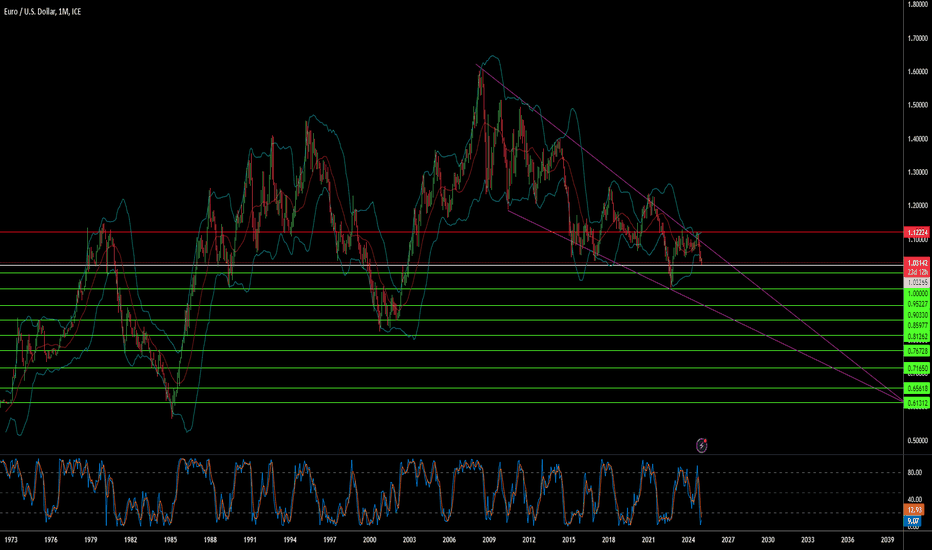

EUR/USD Break-and-Retest: Next Stop 0.97?Weekly Timeframe:

Clear downtrend with a rejection at the 50 MA and a break below key support. Next target lies around 0.97-0.98, a major demand zone.

Daily Timeframe:

Confirms the bearish bias with a retest of the broken support, now acting as resistance. Price remains below the 50 MA, signaling continued downside.

Correlation:

Both timeframes align in a bearish trend. Weekly sets the direction, while daily refines entry opportunities with break-and-retest setups.

EUR/USD Daily Chart Analysis For Week of Dec 20, 2024Technical Analysis and Outlook:

The Eurodollar exhibited a bearish trend during the initial part of the week; however, it subsequently demonstrated a significant recovery by retesting the completed Outer Currency Dip at 1.035. This renewed interim rebound is poised to drive the Eurodollar toward the Mean Resistance level of 1.051. However, it is crucial to recognize that a retest of the completed Outer Currency Dip at 1.035 remains plausible.

EUR/USD Stagnates Near 1.0500: All Eyes on the Federal ReserveThe EUR/USD currency pair is currently consolidating within a narrow range, lingering around the 1.0500 to 1.0490 levels. As investors turn their attention to the upcoming Federal Reserve policy meeting, market sentiment remains cautious yet focused. Today's scheduled announcement regarding the US Federal Funds Rate, along with the subsequent FOMC statement and press conference, could further bolster the US dollar.

Expectations are leaning toward a 25 basis point reduction in interest rates by the Fed. However, it is anticipated that the central bank will accompany this cut with somewhat hawkish commentary regarding future policy guidance. Such remarks could indicate that despite the rate cut, the Fed remains vigilant about economic conditions and inflation pressures.

This meeting represents a crucial moment for market participants, as it could usher in significant volatility, particularly ahead of tomorrow's Unemployment Claims report. As traders assess these economic indicators, they are likely to position themselves accordingly, especially if the data reflects a robust labor market.

Given the current landscape, our outlook for the euro remains bearish as the dollar shows a tendency to strengthen. The pressure on the eurozone continues to mount amid various economic challenges, making it difficult for the euro to gain traction against its US counterpart.

As we navigate this period of uncertainty, traders are advised to keep a close eye on the developments from the Federal Reserve, as well as any shifting dynamics in the broader economic context. The next few sessions could prove pivotal for both currencies, influencing the short-term trading strategies of many market participants. We expect the dollar to maintain its upward trajectory, while the euro may struggle to hold its ground.

✅ Please share your thoughts about EUR/USD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Fundamental Market Analysis for December 16, 2024 EURUSDThe Euro-dollar pair starts the week with continued gains, trading around 1.05200 during the Asian session on Monday. This rise can be attributed to the decline in the US Dollar (USD) amid lower US Treasury bond yields ahead of the Federal Reserve's (Fed) interest rate decision scheduled for Wednesday.

The Fed is widely expected to announce a 25 basis point rate cut at its final monetary policy meeting in 2024. Market analysts predict the U.S. central bank will cut rates but prepare the market for a pause given the strong U.S. economy and inflation stalled above 2%. According to CME's FedWatch tool, markets have already all but priced in the possibility of a quarter basis point rate cut at the Fed's December meeting.

In addition, Fed Chairman Jerome Powell's press conference and dot plots will be closely watched. Earlier this month, Powell struck a cautious tone, saying, “We can afford to be a little more cautious in trying to find a neutral stance.” He indicated he was in no rush to cut rates.

The euro gained support after President Emmanuel Macron appointed centrist ally Francois Bayrou as France's prime minister, raising hopes for political stability. Macron promised to quickly select a new candidate for the job after Michel Barnier was forced to resign following a confidence vote in parliament.

Trading Recommendation: Watch the level of 1.05000, if consolidated below consider Sell positions, if rebounded consider Buy positions.

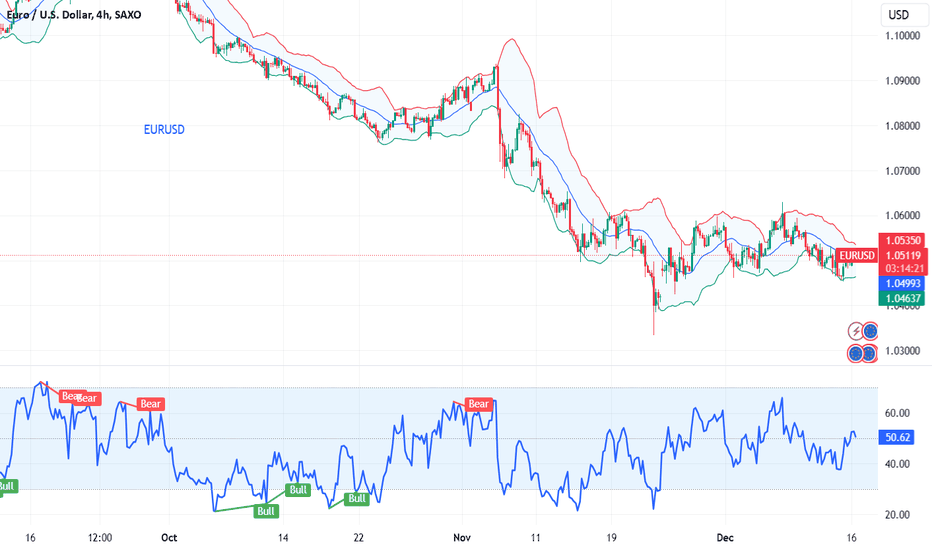

EUR/USD Shorts from 1.05600 back downThis week, my analysis for EUR/USD aligns closely with GBP/USD, as both pairs have exhibited bearish momentum. However, there are subtle differences in price action as we approach the final month of the year. A key focus is the 4-hour supply zone around 1.05600, which initiated a break of structure to the downside.

Once price reaches this area, I’ll look for redistribution on the lower timeframes to confirm a potential sell. If the price moves higher, the 2-hour supply zone just above offers an even better opportunity for shorts.

Confluences for EUR/USD Sells:

- Liquidity Below: Significant downside liquidity remains untapped.

- Bearish Momentum: The pair has been bearish for the past two weeks.

- Break of Structure: Key levels have broken to the downside on the higher timeframe.

- DXY Correlation: The dollar index (DXY) supports this bearish setup.

- Key Supply Zone: The 4-hour supply zone caused the initial bearish move.

Note: If price mitigates the 5-hour demand zone, I may consider a counter-trend buy to take price back up toward the supply zone. However, if this demand zone fails, it will trigger another break of structure (BOS), prompting me to identify a new supply zone for potential shorts.

Stay disciplined and have a strong trading week—let’s close Q4 on a high note!