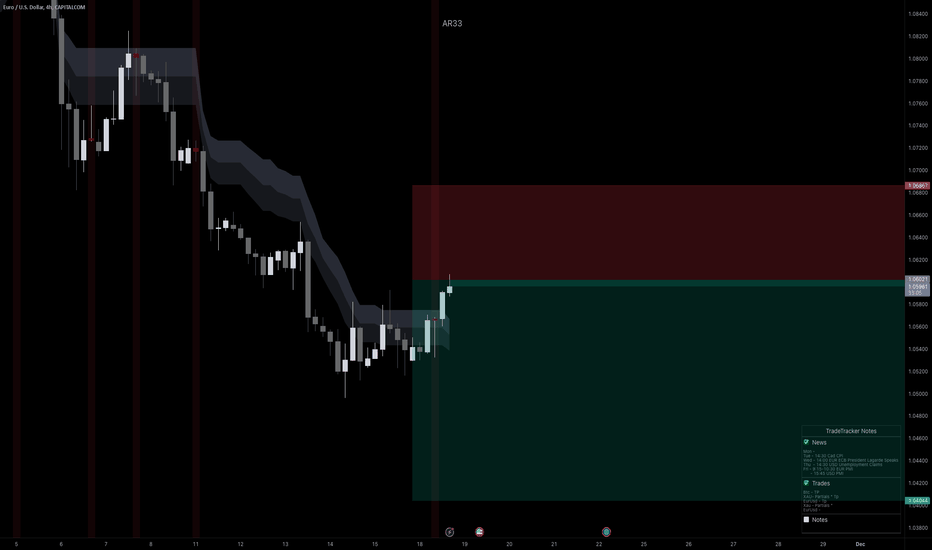

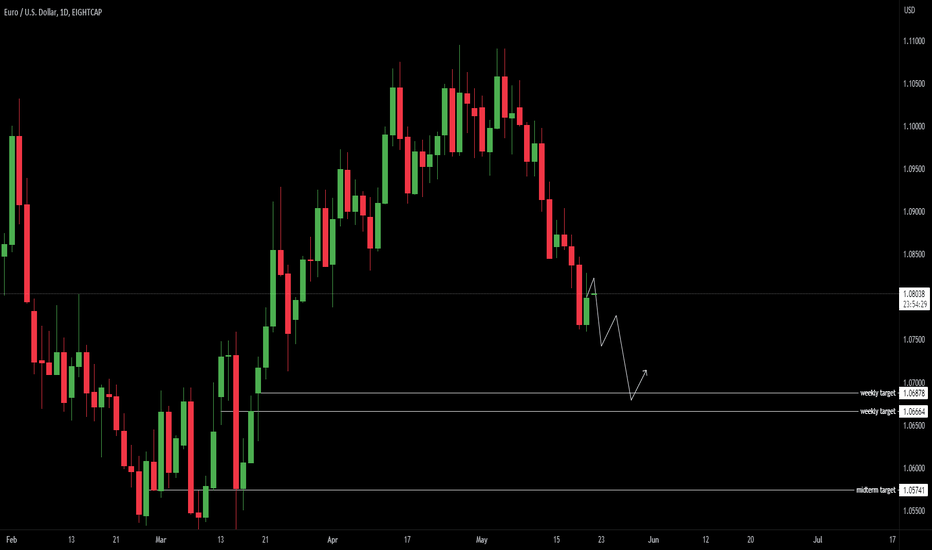

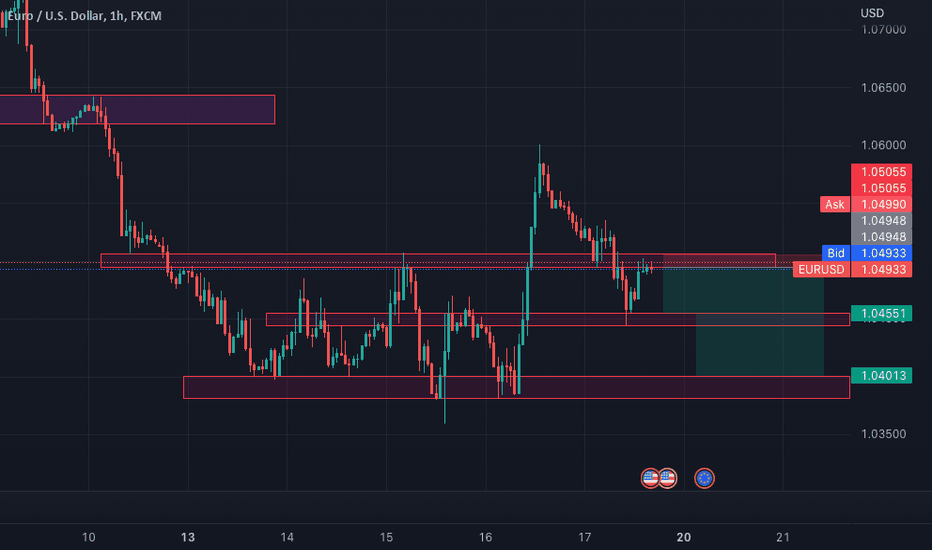

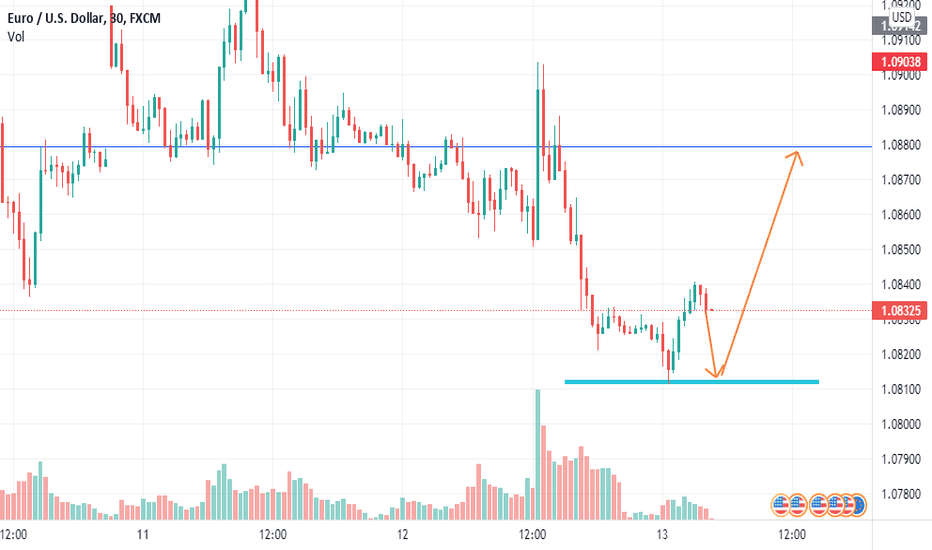

EUR/USD Short Setup: Leveraging the Retrace for a Downtrend PlayEUR/USD has retraced slightly, offering a good entry point for a short trade. The pair remains bearish, trading below the 200-day MA, with strong resistance near 1.062 holding firm. Targeting the 1.0400 price area, this trade aligns with the broader downtrend, supported by both technical and fundamental factors.

Technical Overview:

The current trend is bearish, with the pair respecting lower highs and significant resistance at the 200-day MA. The initial target is set around 1.0495, with the long-term aim at 1.0400. Price action confirms a sell opportunity as the retrace reaches resistance areas.

Fundamental Context:

The U.S. Dollar has regained strength, driven by optimism around pro-growth policies and a solid DXY rally. Meanwhile, the Fed remains cautious on rate cuts, signaling slower changes ahead. In the Eurozone, the ECB continues a dovish approach, focusing on inflation concerns while speculative short positions on the Euro rise. This reinforces the bearish outlook for EUR/USD. Upcoming speeches and economic data, including Lagarde’s address and U.S. TIC flows, could further influence the pair’s movement.

This short trade aims to capitalize on the retrace within a bearish structure. With clear resistance levels and supportive fundamentals, the setup targets a move toward 1.0400. Risk management remains key as market conditions evolve.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

Eurousdshort

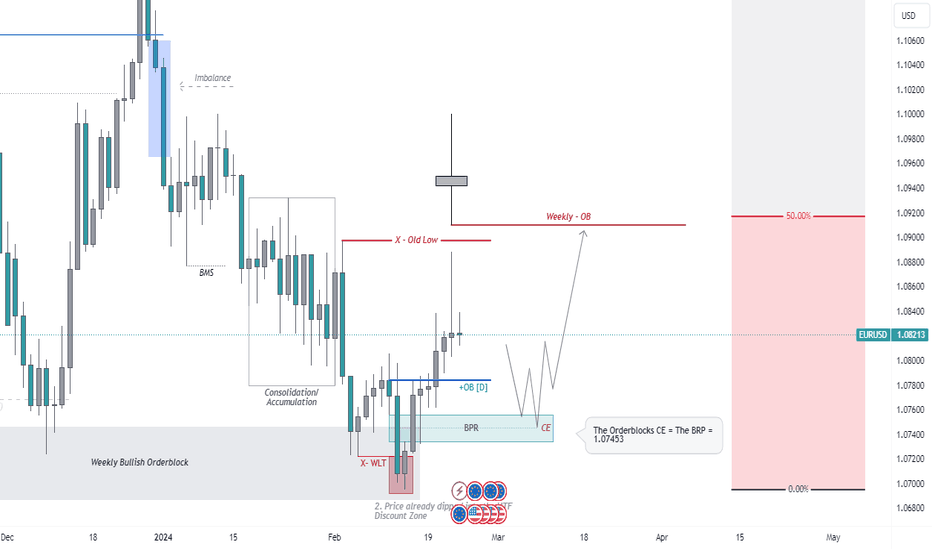

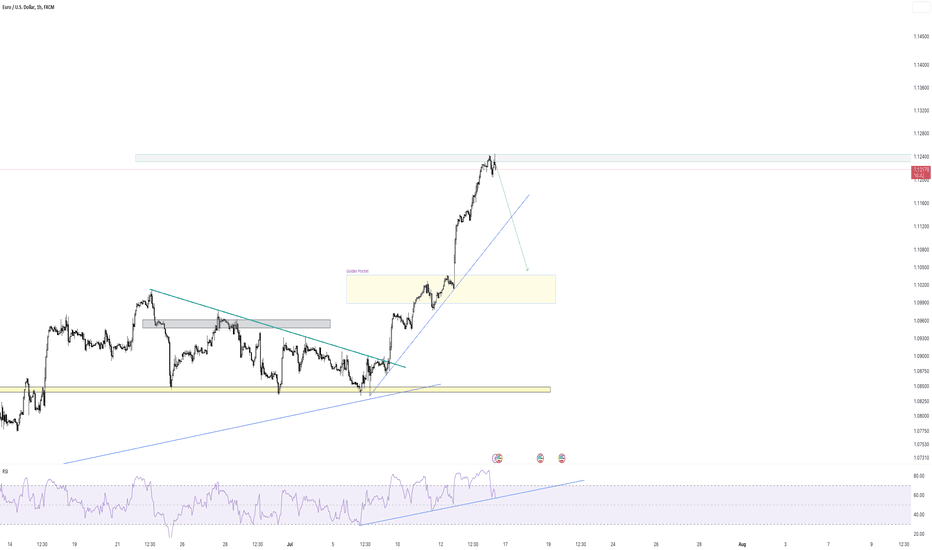

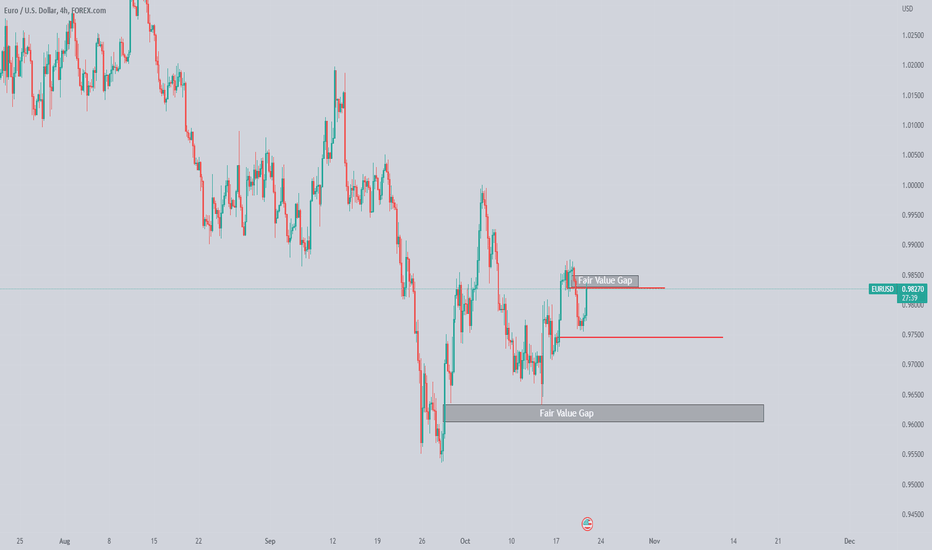

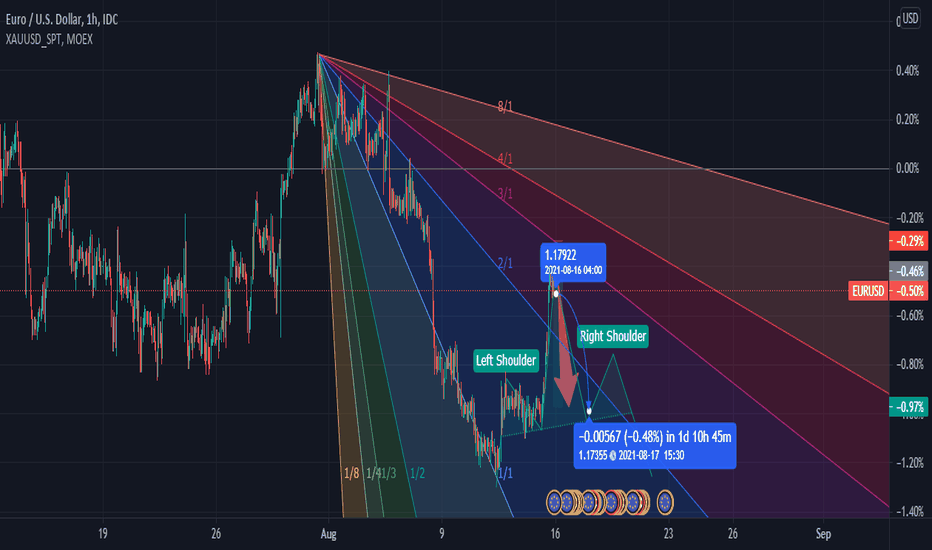

EURUSD, DOLLAR FALLING??This is a EURO / DOLLAR chart, We are currently neutral in-terms direction bias for this week. Non-Farm Payroll definitely will be the influential factor to our setup.

Setup Breakdown :

WEEKLY

Price is in the Discount in terms of the weekly range and we have seen the first bullish candlestick in the last 5-6 months.

Note : The Premium - Discount zones further left.

Price in the weekly has traded into the Bullish Orderblock and the 2 weeks ago low has been taken out, hence the bullish candlestick for last week's trading.

DAILY

We have a Swing Low After or during a Turtle Soup.

Accumulation and price trading down to a weekly PD Array + taking out stops, makes it more possible to see a AMD Trade .

two large down candles = Orderblock from the weekly, we measured half of the two last down candles and we identified a CE. Below that we have a Balanced Priced Range/ Bullish FVG.

Price inefficiency (notice the latest continuous up candles, well they have created a price inefficiency, Price needs balance. [Hence our speculation of the EU shorting towards our Bullish/ Daily Discount Arrays

We looking to trade towards the Balanced Price Range (BRP) which is inside the Orderblock

SETUP Expectations

Bullish conditions

Price seeks a PD Array to take out the Buy side liquidity laying above, trading to the Weekly Bearish Orderblock .

Thus confirming our AMD

The BRP / +OB / +FVG are our Points of interest, we look to initiate the longs there, just switch to a 15 Minutes or and look for a valid entry between London Killzone / New York Killzone.

There's a high possibility that this is a NFP Setup

We now operating as Proff_InvestsZA, which is actively throughout our social media incase you have questions you wanna ask.

DISCLAIMER :

Before using this Tradingview account setups, please make sure that you note the following important information:

Do Your Own Research (DYOR)

Our content is intended to be used and must be used for information and education purposes only.

It is very important to do your own analysis before making any investment based on your own personal circumstances.

You should take independent financial advice from a professional in connection with, or independently research and verify,

any information that you find on our Website and wish to rely upon, whether for the purpose of making an investment decision or otherwise.

No Investment Advice

Our Tradingview account is a financial data and news portal, discussion forum and content aggregator.

Circle Forex Institution (Proff InvestsZA) is not a broker/dealer, we are not an investment advisor,

we have no access to non-public information about publicly traded companies,

and this is not a place for the giving or receiving of financial advice, advice concerning investment decisions or tax or legal advice.

We are not regulated by the Financial Services Authority.

We are an educational forum for analysing, learning & discussing general and generic information related to stocks, investments and strategies.

No content on the site constitutes - or should be understood as constituting - a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in our site content.

We do not provide personalised recommendations or views as to whether a stock or investment approach is suited to the financial needs of a specific individual.

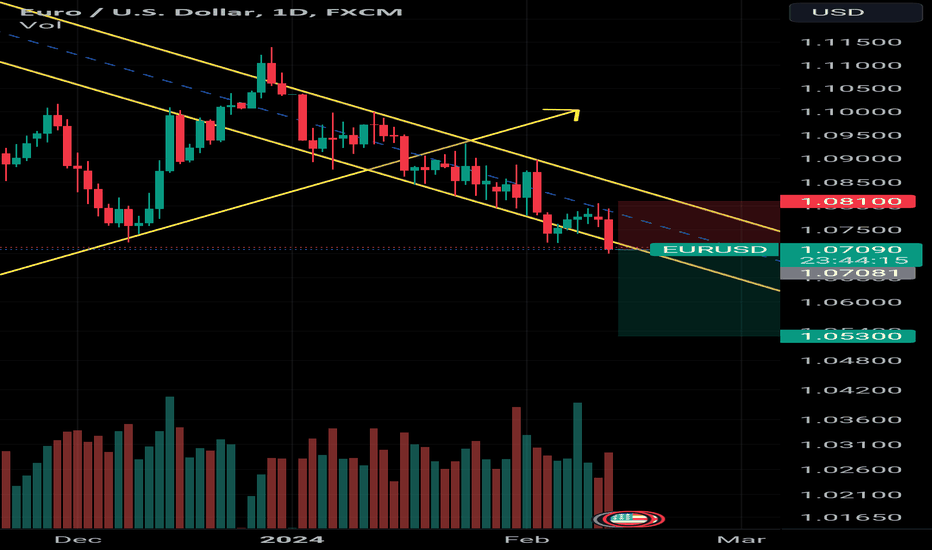

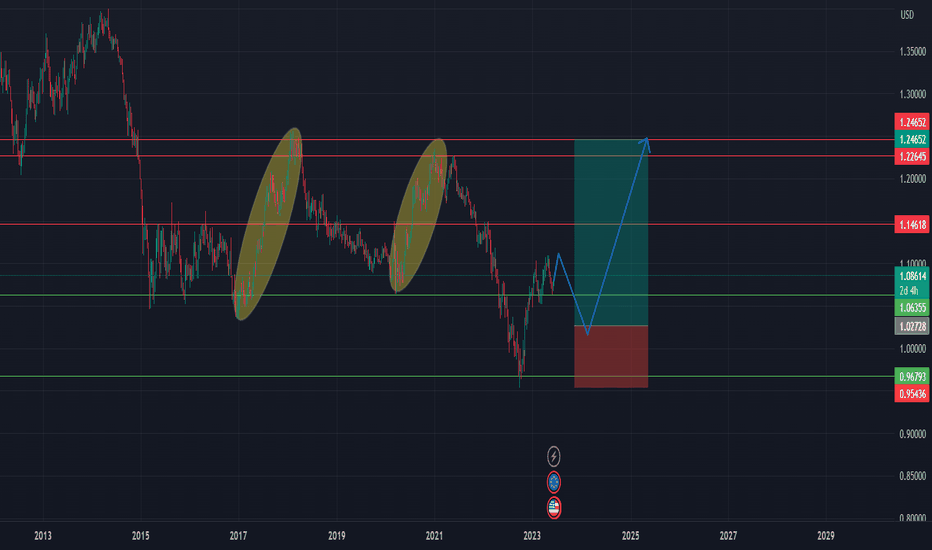

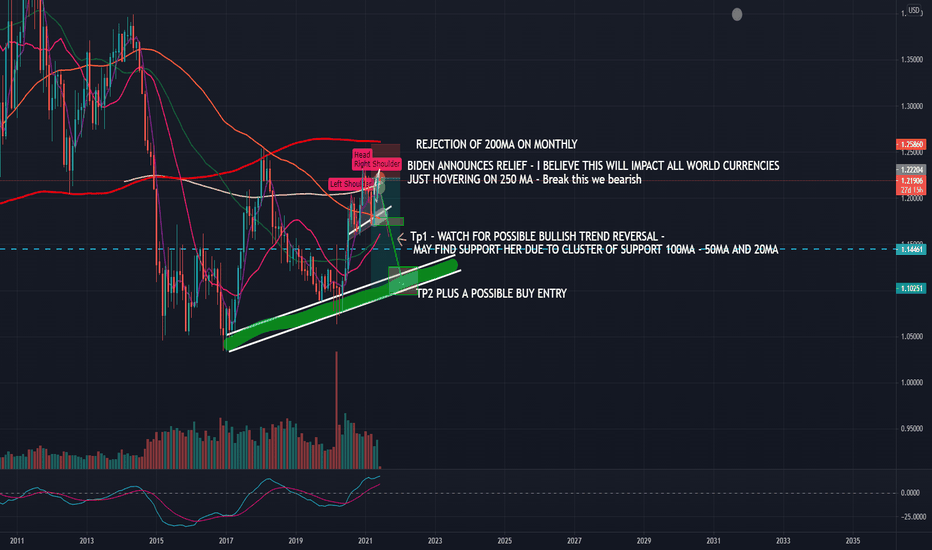

[EN] EURUSD long term trend // GaliortiTradingAfter a pullback to its 200 sessions average, the FX:EURUSD is still dominated by its long term bearish trend line (since 2008). The loss of 1.04 would open the door to test new lows projected on the long term upward trend line ( range 0.86-0.90 ). Above the latter prices, the stock could restructure to the upside in a shoulder, head, shoulder reversal figure.

The loss of 0.86 would be very bearish .

Pablo G.

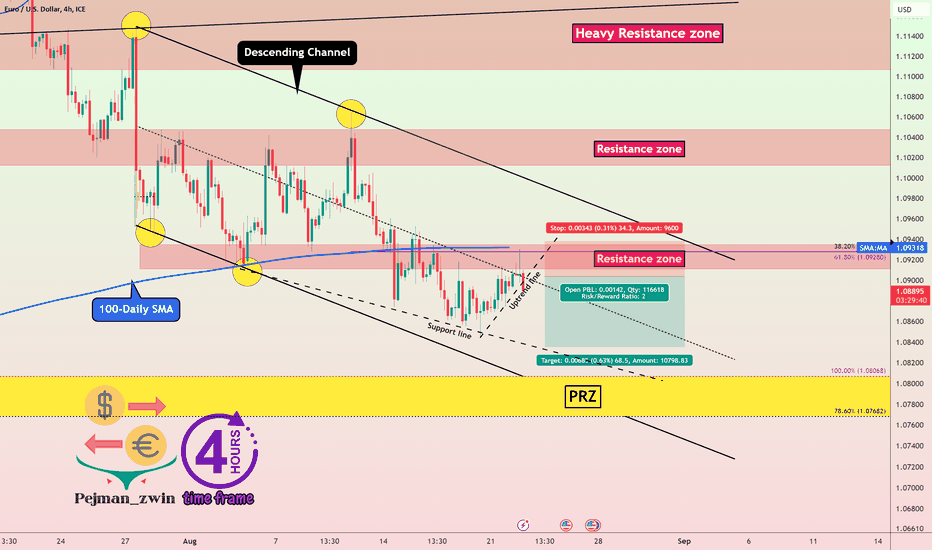

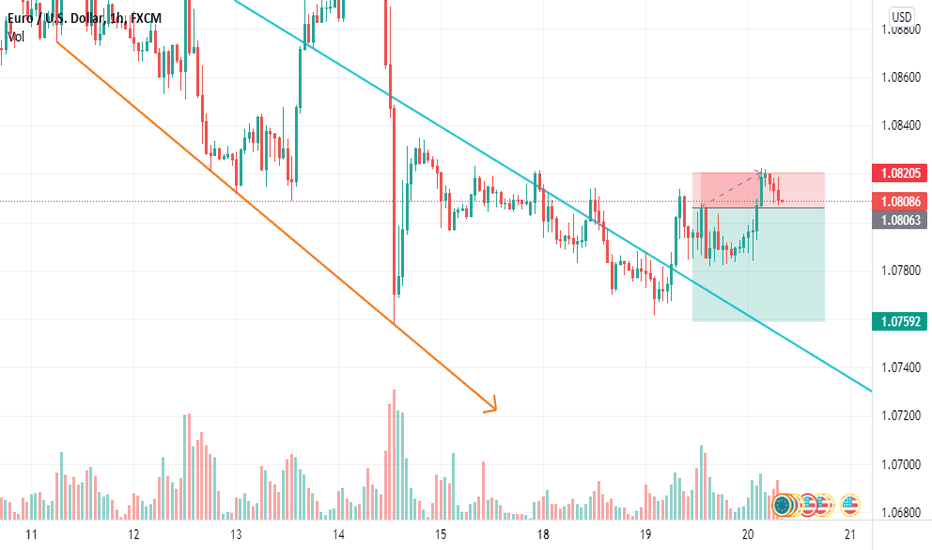

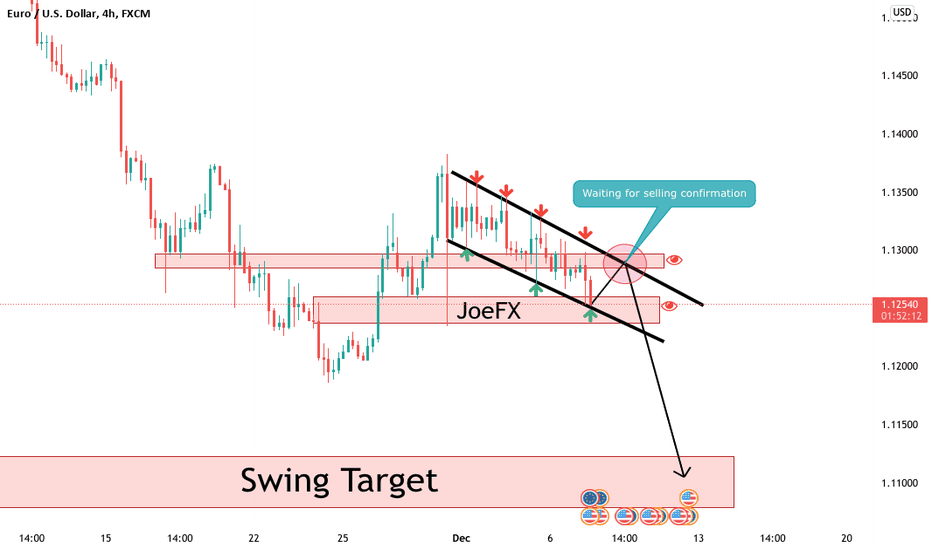

🚨EURUSD will FALL to Support Line🚨EURUSD is moving in the middle of the descending channel (the middle line of the channel), and the 🔴 resistance zone 🔴 and near 100_SMA(Daily) .

Also, EURUSD managed to break the Uptrend line .

🔔I expect EURUSD will fall at least to support line .

Euro/U.S.Dollar Analyze ( EURUSD), 4-hour time frame ⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy, this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

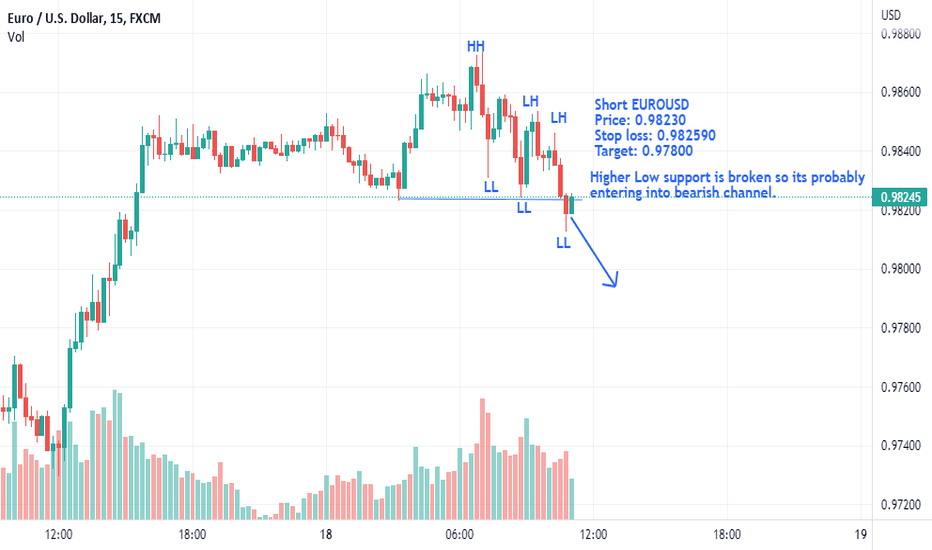

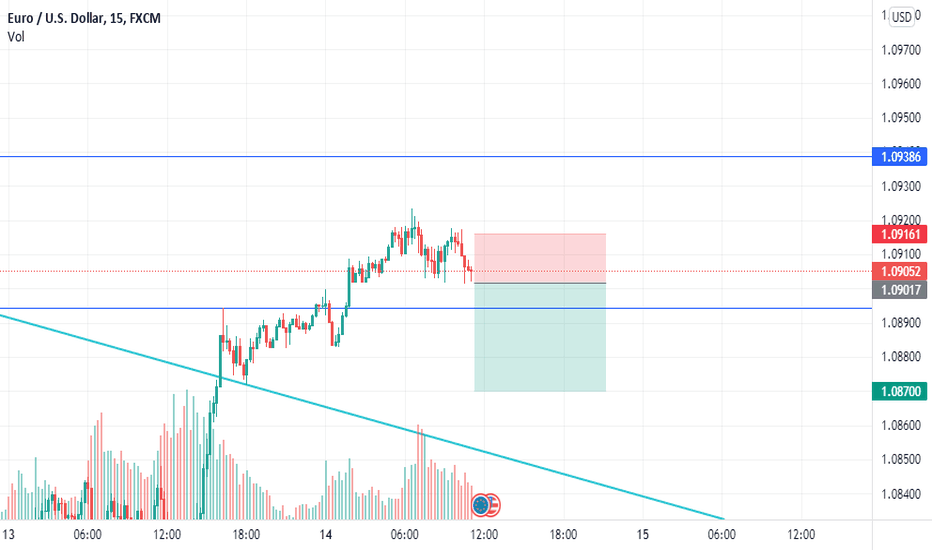

Euro/USDprice has been moving upward for several days now, and it's the last days of this week .. also by looking at DXY, it did test the support zone, and now it's moving upward (by the time I'm writing ) So USD pairs will go down somehow (Dollar gets strong)

price needs to correct itself .. we have a pin bar also retest .. so now you can open the short position and follow the price to the GP zone

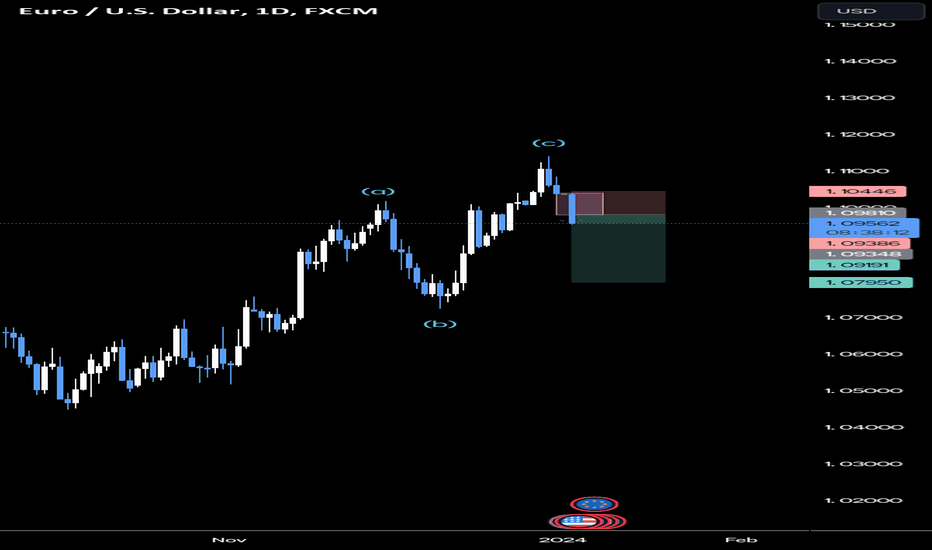

EURUSD analysis (1W time frame)On the chart, we can see that the price is in the middle of the range, but is retesting the key support now.

We expect that the price will breakdown to grab the liquidity and do the false breakout. After that we expect the price to come back up and move higher towards the horizontal resistance

Target, stop loss and entry are shown on the chart

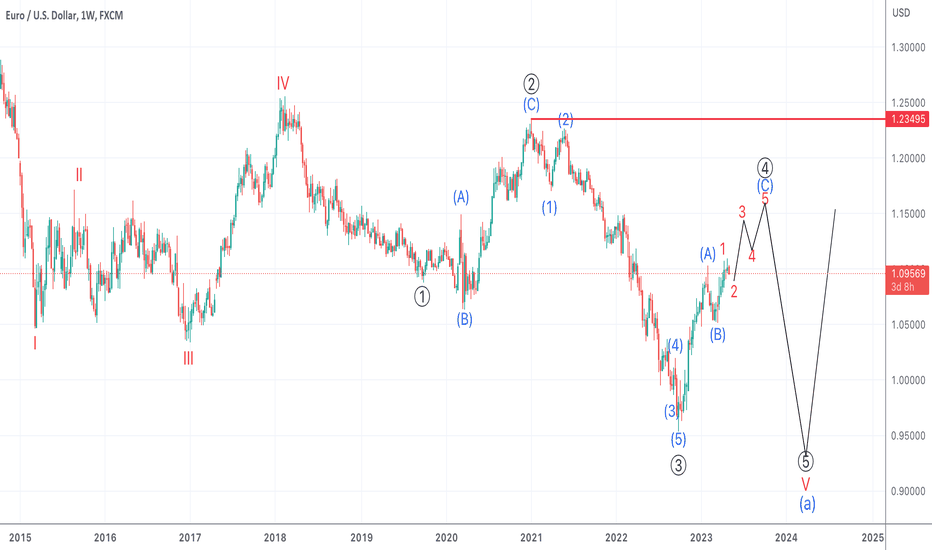

Prepare to sell EUR within next 2 monthsTechnical Analysis:

- In weekly, EURUSD is doing wave ((4)) in black

- In short term, EURUSD is doing wave 2 in red

- H1 right side is turning down

- H4 right side is up

- Weekly right side is down

Technical Information:

- If you're a Swing Trader, you can sell wave ((4)) in red around 1.16

- If you're a Position Trader, you must wait for wave ((5)) in black around 0.93 to buy

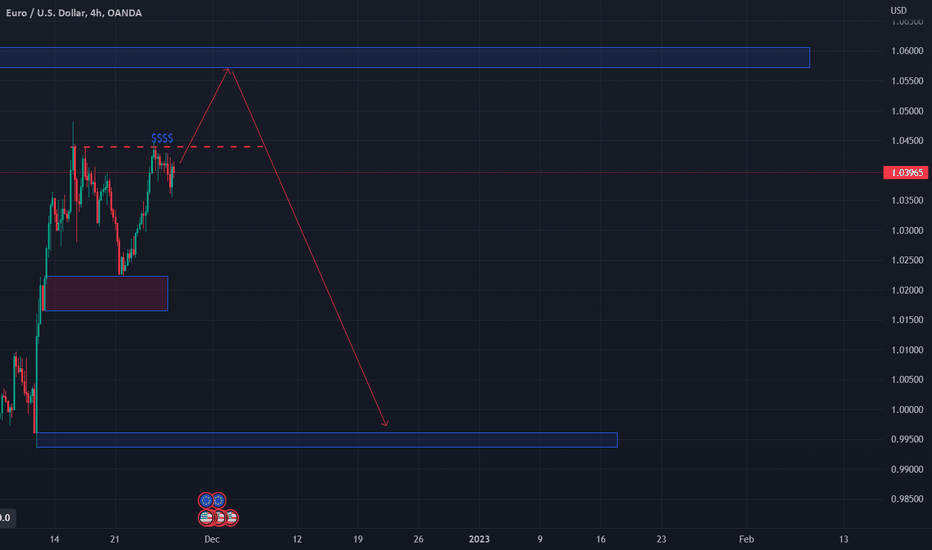

A MASSIVE 200 PIP MOVE SET TO OCCUR ON EURUSD? The 200 Pip move towards €1 or €0.96? I reckon the latter will occur first. Below are my confluences (reasons) as to why I see EURUSD reaching €0.96 in the coming days/ weeks.

Confluences

- The DXY is very bullish with Commercial banks (Smart Money) being Net Long on the U.S Dollar Index (see ). Which results in XXXUSD pairs being Bearish.

- EURUSD has been in a Bearish Orderflow on the Higher Timeframe (HTF), so it would make sense to follow the order flow until a key Discount array has been reached before a Break in Market structure to become bullish.

- EURUSD is currently at a 4 Hour Bearish OB (Which is at premium array of the current 4 hour range price is trading within).

- Institutional Price level (IPL) €0.98500 is a strong sell entry point as the institutions will be looking to sell their EURO for USD during the NY Session (which is a great time to get good entries during a volatile time of the Market day).

- €0.98500 is also the close of the Fair Value Gap above current Price which is also within the 4 hour Bearish OB mentioned in the 2nd confluence above.

- €0.96000 is a great Take Profit area for the Swing position since there is a Fair Value Gap that has not been closed fully. That is also the Discount Array of the price Range EURUSD is trading within.

If you are confused with which broker to use to trade Forex pairs, I got you covered as i am recommending you to try out FBS which is a regulated broker that has been in operation for 12+ years running. There are pretty cool incentives (e.g. Rebates on trades) you shall receive using this link: fbs.partners

Feel free to do more research on them before opening an account.

With this said, Happy Trading Pals

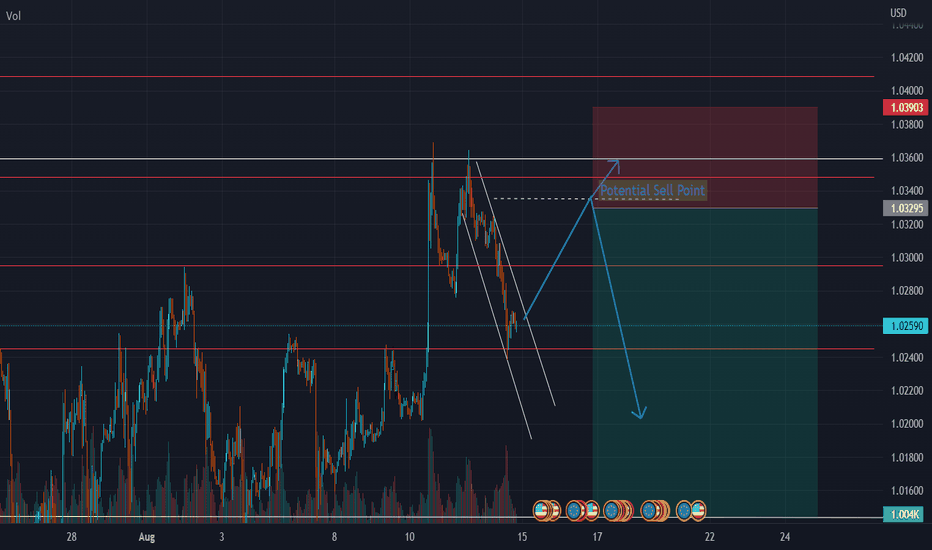

Likely Bearish War win ! The Overall trend of eurousd in the day view is showing a downtrend. I believe the market will come rumbling down and continue to sink. I'm predicting another retest around 1.03590. After that Let See if this bad boy drops like crazy! Patience is key! Comment your opinions and theories. LOVE FAMILY!

EURO/USD LONG TERM BEARISH OUTLOOK Jumping back in to currencies trading looking for some nice LT Trade opportunities to set and forget.

Stumbled across the EUR/USD Pair -

Looking over bought on the RSI -

Multiple rejections on Multiple time frames-

Analysis explained on chart as to why I'm in this position

I Placed my Short order @ 1.22175 - An nice heavy dump followed placement which put me in the green.

Price since came back but struggled to even hit my entry for a rests but failed.

So far so good am

THIS IS NOT FINANCIAL ADVICE AND I AM NOT A FINANCIAL ADVISOR-

DO YOUROWN RESEARCH AND MAKE YOUR OWNTRADE DECISIONS-

Look at the longer time frames identify tops and bottoms for best possible trade opportunities.

Place your order hold your nerve