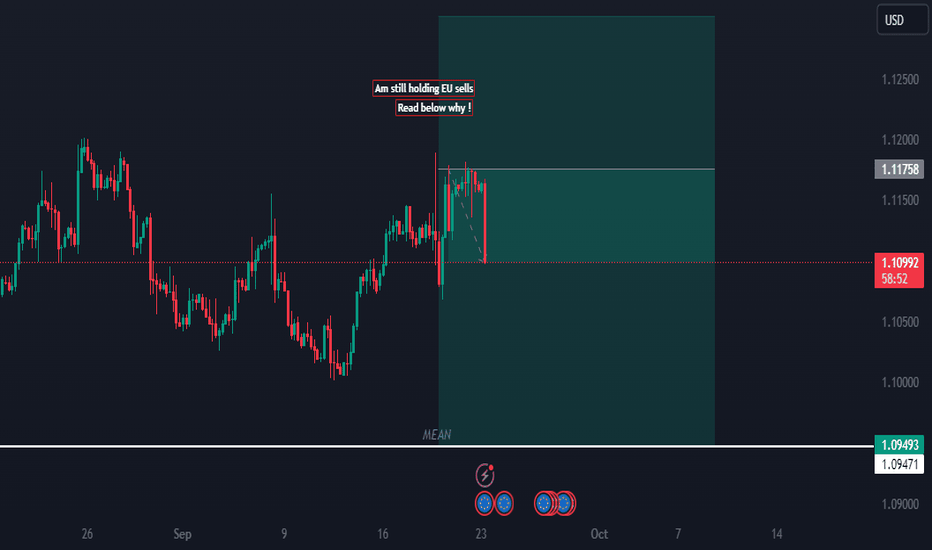

Who taked my EURUSD sells calls ?? - In Dr.Aziz we trust !!EURUSD Weekly Analysis: Slight Bearish Bias Expected for 23/09/2024

As we enter the week of September 23, 2024, the EURUSD currency pair presents a slightly bearish outlook based on the latest fundamental drivers and current market conditions. Traders and investors should pay close attention to several key factors shaping this potential downturn. This article outlines the crucial economic and geopolitical elements that are expected to weigh on the Euro, resulting in a bearish bias against the US Dollar.

1. Diverging Central Bank Policies

The European Central Bank (ECB) recently raised interest rates in a bid to control inflation, but their latest forward guidance has softened. ECB President Christine Lagarde signaled that the bank may adopt a more cautious approach to further rate hikes due to concerns over slowing economic growth across the Eurozone. In contrast, the US Federal Reserve remains hawkish, with markets anticipating at least one more rate hike by the end of 2024 to combat persistent inflationary pressures in the US. This divergence between ECB’s potential pause and Fed's hawkish stance gives the USD an edge.

2. Economic Slowdown in the Eurozone

Recent data releases indicate that the Eurozone economy is facing significant headwinds. The PMI (Purchasing Managers' Index) numbers have shown contraction in key economies such as Germany and France, signaling weakness in the manufacturing and services sectors. These weak economic indicators, coupled with subdued consumer spending, are likely to add downward pressure on the Euro.

3. US Economic Strength

The US economy continues to show resilience, with strong job market data and higher-than-expected retail sales reported in the latest figures. This strength supports the Federal Reserve’s case for maintaining its tight monetary policy, which in turn strengthens the US Dollar. Additionally, the demand for safe-haven assets like the USD is growing amid global economic uncertainties, further pressuring EURUSD to the downside.

4. Geopolitical Tensions

Geopolitical tensions, particularly in Eastern Europe and uncertainties surrounding Russia’s conflict with Ukraine, continue to dampen investor confidence in the Euro. The ongoing energy crisis and the risk of a harsh winter in Europe are contributing to economic challenges, making the Euro less attractive to global investors compared to the USD.

5. Technical Indicators

From a technical analysis perspective, the EURUSD chart displays key resistance around the 1.0700 level, which has held strong in recent sessions. A failure to break above this resistance indicates that the pair could face downward momentum, potentially retesting the 1.0600 level in the near term. The Relative Strength Index (RSI) remains below 50, reflecting a lack of bullish momentum, further supporting the bearish bias.

Conclusion

In conclusion, EURUSD is poised for a slight bearish bias this week, driven by diverging central bank policies, weaker Eurozone economic data, and the continued strength of the US economy. With geopolitical tensions and technical factors adding additional downward pressure, traders should be cautious of potential downside risks. Monitoring key levels and upcoming economic data releases, such as Eurozone inflation and US consumer confidence, will be essential for navigating the pair in the coming days.

Keywords for SEO:

- EURUSD analysis 23/09/2024

- EURUSD bearish bias

- EURUSD weekly forecast

- Euro weakness

- US Dollar strength

- Forex trading EURUSD

- ECB vs Fed monetary policy

- EURUSD technical analysis September 2024

- Eurozone economic slowdown

- EURUSD trading strategy

Eurozoneeconomicslowdown

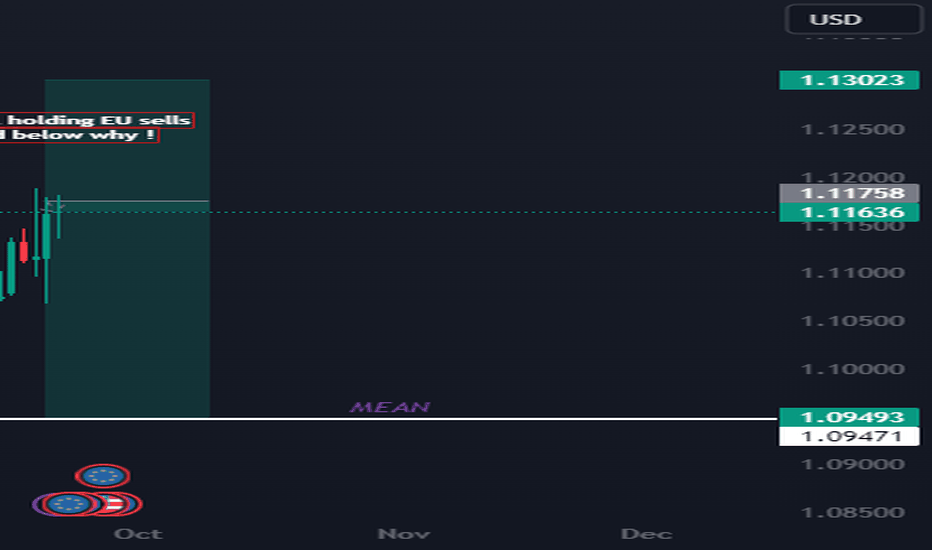

EURUSD: Bearish Bias Anticipated for the Week of 25/09/2024The EURUSD pair has displayed significant volatility in recent weeks, with fundamental factors and macroeconomic data driving price action. As we look ahead to the week starting 25/09/2024, the prevailing market conditions suggest a slight bearish bias for EURUSD. Here's a brief analysis of the key drivers influencing this outlook:

1. Diverging Central Bank Policies

The Federal Reserve has maintained a relatively hawkish stance, signaling potential interest rate hikes later in 2024. The ECB (European Central Bank), however, has been cautious, reflecting concerns about slowing growth in the Eurozone, especially after recent data indicating sluggish economic performance in major European economies like Germany and France. This policy divergence is expected to exert downward pressure on EURUSD as the dollar remains supported by higher yields, while the euro faces headwinds due to weaker growth prospects.

2. Slowing Economic Growth in the Eurozone

Recent data from the Eurozone, particularly the German ZEW Economic Sentiment index and PMI reports, have shown a marked slowdown in industrial activity and business confidence. This has raised concerns about a potential recession, which could further weigh on the euro. In contrast, the U.S. economy continues to outperform, with robust retail sales and stable job growth supporting a stronger USD.

3. Inflationary Pressures and Monetary Policy Uncertainty

The ECB has also been grappling with persistent inflation, but the likelihood of further rate hikes appears to be diminishing. With inflation still elevated, but growth faltering, the ECB may choose to adopt a more dovish stance moving forward. Meanwhile, the Fed remains committed to controlling inflation, with Chair Jerome Powell signaling that rates could stay elevated for longer. This contrast in inflation management strategies continues to favor the U.S. dollar over the euro.

4. Geopolitical Risks in Europe

Ongoing geopolitical tensions, particularly related to the conflict in Ukraine, continue to cast a shadow over the Eurozone economy. Rising energy prices, uncertainty in supply chains, and potential disruptions to trade all contribute to the euro's vulnerability. These factors, while less impactful on daily price movements, play a significant role in the long-term bearish sentiment surrounding the EURUSD pair.

Technical Outlook

From a technical standpoint, EURUSD has been trading near key support levels around 1.0650. If this level is breached, the pair could see further declines toward 1.0550. The 50-day moving average is pointing downward, signaling continued bearish momentum. However, the pair could find temporary support if market sentiment shifts or if the ECB surprises with a more hawkish stance than expected.

Conclusion: Slight Bearish Bias Expected for EURUSD

Based on the current market conditions and fundamental factors, it appears that the EURUSD is likely to experience a slightly bearish bias heading into next week. The combination of diverging monetary policies between the Fed and ECB, slowing Eurozone growth, inflationary pressures, and ongoing geopolitical risks all suggest downward pressure on the pair. Traders should closely monitor key support levels and any updates from central bank policymakers, as these could influence the direction of EURUSD in the near term.

---

Keywords for SEO:

EURUSD outlook, EURUSD forecast, EURUSD next week, bearish EURUSD, Euro to Dollar analysis, EURUSD trading analysis, EURUSD technical analysis, EURUSD fundamental factors, ECB monetary policy, Federal Reserve impact on EURUSD, Eurozone economic slowdown, Forex trading EURUSD, EURUSD price action analysis, Forex weekly forecast, EURUSD key support levels, EURUSD technical indicators.