EUR TRY

Euro's Resilience: Weathering Market VolatilityAmidst market volatility, the Euro has demonstrated resilience, maintaining its position against major currencies. Despite challenges posed by geopolitical tensions and economic uncertainties, the Eurozone economy has shown signs of stability and gradual recovery. The European Central Bank's accommodative monetary policy and fiscal stimulus measures have supported the Euro, bolstering investor confidence. As global economic conditions evolve, the Euro's performance remains closely monitored, with analysts cautiously optimistic about its resilience in the face of ongoing challenges.

Euro Holds Steady Amidst Global Economic UncertaintyThe Euro (EUR) has maintained a relatively stable position in the forex markets this week, as global economic uncertainty continues to weigh on investor sentiment. Let's take a closer look at the factors influencing the performance of the Euro in the current market landscape.

Throughout the week, the Euro has shown resilience in the face of several geopolitical and economic challenges. One of the key factors contributing to the stability of the Euro is the cautious stance of the European Central Bank (ECB). Despite mounting inflationary pressures and concerns over the economic recovery in the Eurozone, the ECB has remained committed to its accommodative monetary policy stance, providing support for the Euro.

Moreover, the recent developments surrounding the conflict between Russia and Ukraine have added an element of uncertainty to the global markets. The Euro, being one of the major reserve currencies, has benefited from its status as a safe-haven asset amidst geopolitical tensions. Investors seeking refuge from volatility in other markets have turned to the Euro, contributing to its steady performance.

On the economic front, the Eurozone has seen mixed data releases this week. While economic indicators such as manufacturing and services PMI have shown signs of improvement, concerns linger over the impact of rising energy prices and supply chain disruptions on the region's recovery prospects. Despite these challenges, the Euro has managed to hold its ground against other major currencies.

Looking ahead, the outlook for the Euro remains subject to various factors, including monetary policy decisions, economic data releases, and geopolitical developments. Traders and investors will closely monitor upcoming events such as the ECB's policy meeting and key economic reports for further insights into the direction of the Euro in the coming weeks.

In conclusion, the Euro has demonstrated resilience amid global economic uncertainty, maintaining a steady position in the forex markets this week. While challenges persist, the Euro's status as a safe-haven asset and the cautious stance of the ECB have supported its performance. Moving forward, market participants will continue to assess evolving factors to gauge the trajectory of the Euro in the dynamic forex landscape.

EUR: Assessing the Euro's Current PositionAs global economic conditions evolve, the Euro (EUR) remains a focal point for investors and analysts alike. Recent developments, including shifts in monetary policy and geopolitical tensions, have influenced the EUR's performance. Despite challenges, the Eurozone's resilience and strong economic fundamentals continue to support the EUR's stability. Investors are closely monitoring key indicators and market trends to gauge the EUR's current position and its potential trajectory in the near term. Join us as we delve into the current landscape of the EUR and its implications for the broader financial markets.

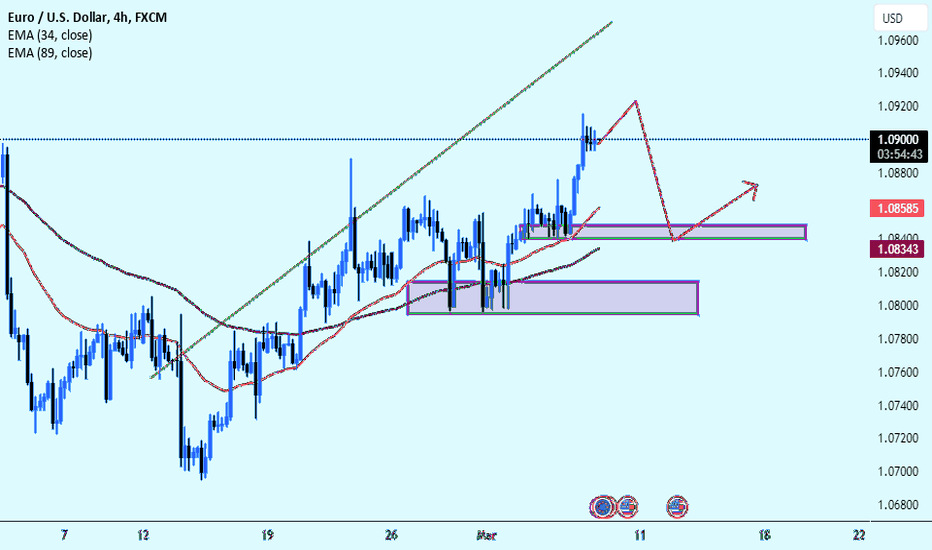

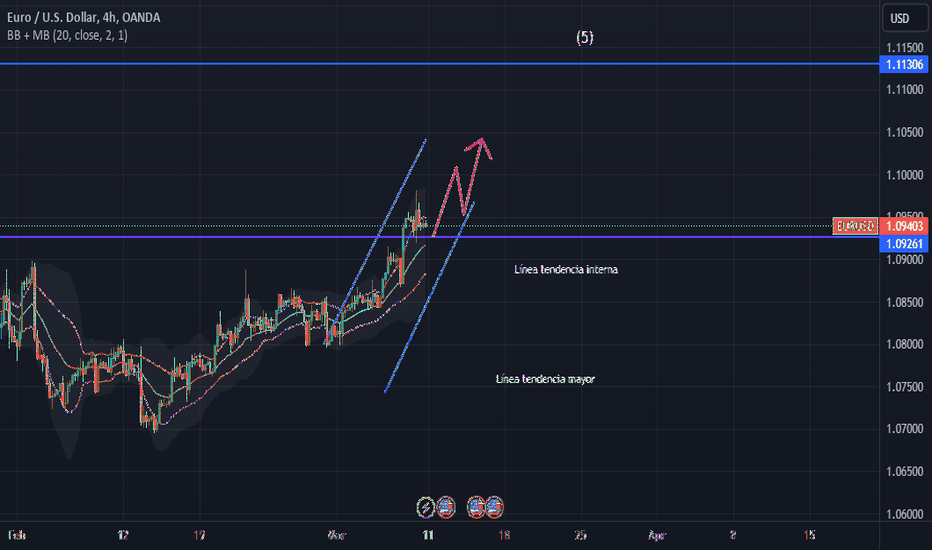

EUR: Charting the Euro's Path Amidst Market VolatilityThe Euro (EUR) faces a dynamic landscape as it navigates through periods of market volatility. Despite challenges such as economic uncertainties and geopolitical tensions, the EUR demonstrates resilience backed by strong fundamentals within the Eurozone. Investors closely monitor key economic indicators and policy decisions, assessing the EUR's performance against other major currencies. As the EUR charts its course amidst evolving market conditions, analysts anticipate shifts in investor sentiment and trading patterns. Join us as we explore the Euro's trajectory in the face of market volatility and its implications for global financial markets.

EUR depreciatedIn an era marked by economic uncertainties and geopolitical tensions, the Euro (EUR) stands as a symbol of stability and resilience. As one of the world's most powerful currencies, the Euro plays a pivotal role in shaping international trade and financial markets. Despite facing headwinds such as Brexit, inflationary pressures, and geopolitical risks, the Euro continues to demonstrate its strength, supported by robust monetary policies and a cohesive economic bloc. Join us as we explore the dynamics shaping the Euro's trajectory and its significance in a rapidly changing global landscape.

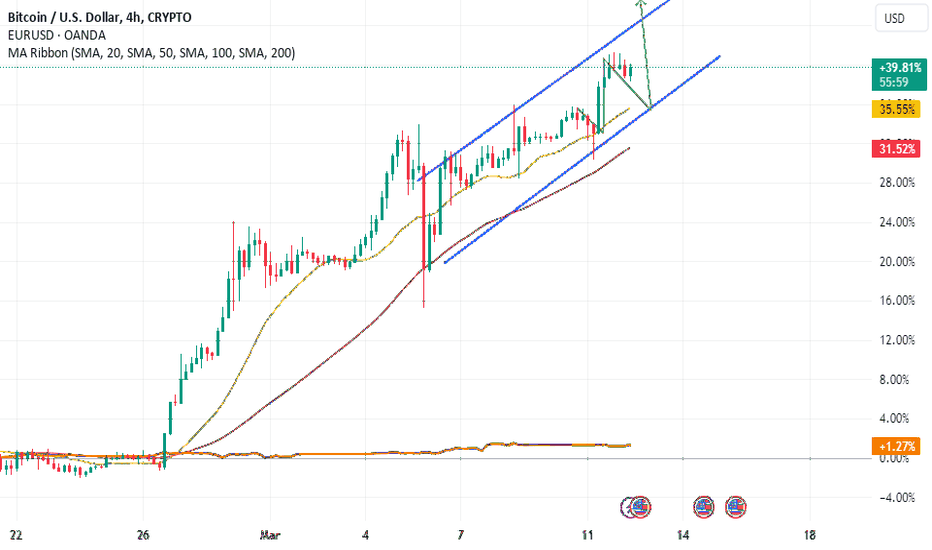

Euro Strengthens Amidst Economic RecoveryThe euro has surged in strength as the global economy undergoes a robust recovery. Buoyed by improving economic indicators and vaccination efforts across the Eurozone, the euro has seen a notable uptick in value against major currencies.

Investor confidence in the euro has been bolstered by the European Central Bank's commitment to supportive monetary policies and stimulus measures, aimed at fostering economic growth and stability. This proactive stance has contributed to the euro's resilience in the face of ongoing challenges.

While uncertainties surrounding inflation and geopolitical tensions persist, the euro's current trajectory reflects optimism about the region's economic outlook. As Eurozone countries continue to progress towards recovery, the euro is poised to play a pivotal role in facilitating trade and investment within the region and beyond.

Eurozone's Economic Resilience Amidst Global UncertaintyDespite global economic headwinds, the Eurozone stands resilient, navigating challenges with adaptability and innovation. With a steadfast commitment to fiscal stability and structural reforms, the region continues to forge ahead, driving growth and prosperity.

Amidst geopolitical tensions and market volatilities, the Euro remains a beacon of stability, bolstering investor confidence and fostering trade within the bloc and beyond. Its status as a reserve currency and its widespread adoption in international transactions underscore its enduring strength.

As the Eurozone charts its course through uncertain waters, proactive measures and collaborative efforts among member states are imperative. Embracing digitalization, promoting sustainable practices, and fostering a cohesive economic agenda will be pivotal in ensuring long-term resilience and prosperity for the Eurozone.

Euro's Resilience Amidst Economic HeadwindsDespite recent economic challenges, the Euro has shown resilience in the face of market turbulence. Factors such as improved vaccination rates, fiscal stimulus measures, and a gradual economic recovery have bolstered confidence in the Eurozone. As investors navigate uncertainties, the Euro's stability and resilience stand as a testament to the region's economic strength and potential for growth.

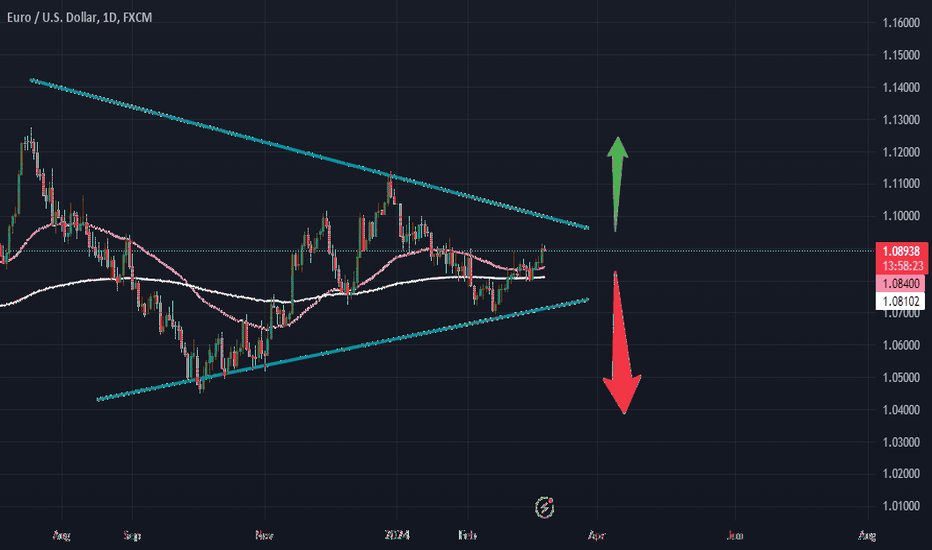

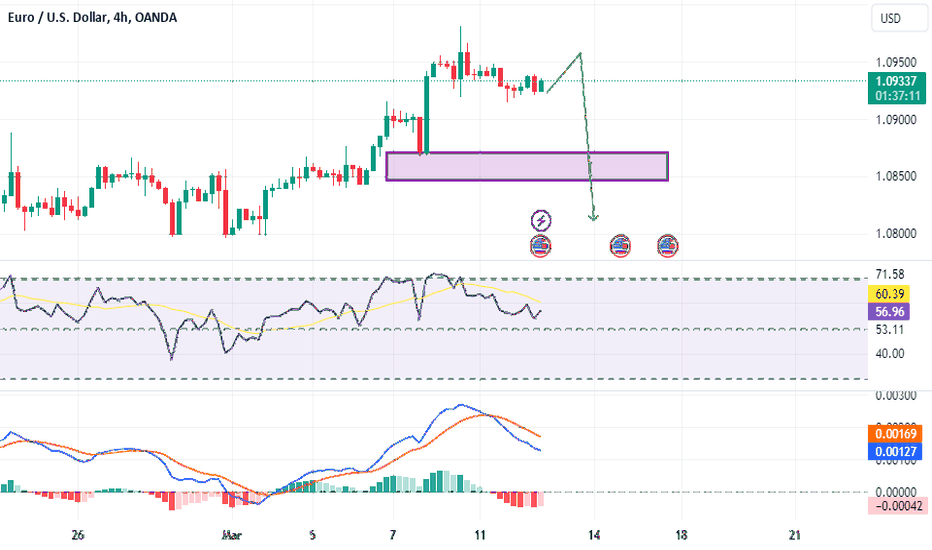

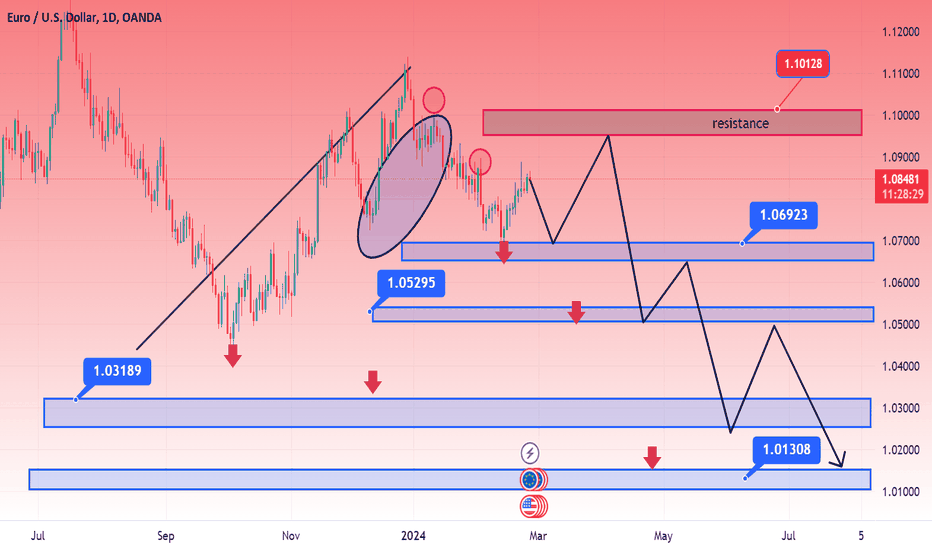

Euro's Downward Spiral: Recent Market TrendsIn recent market activity, the Euro has been on a downward trajectory against major currencies, reflecting a shift in investor sentiment. Factors contributing to this decline include concerns over the Eurozone's economic recovery, geopolitical tensions, and monetary policy uncertainties. As market participants assess the landscape, the Euro's performance remains closely monitored amidst evolving global economic dynamics.

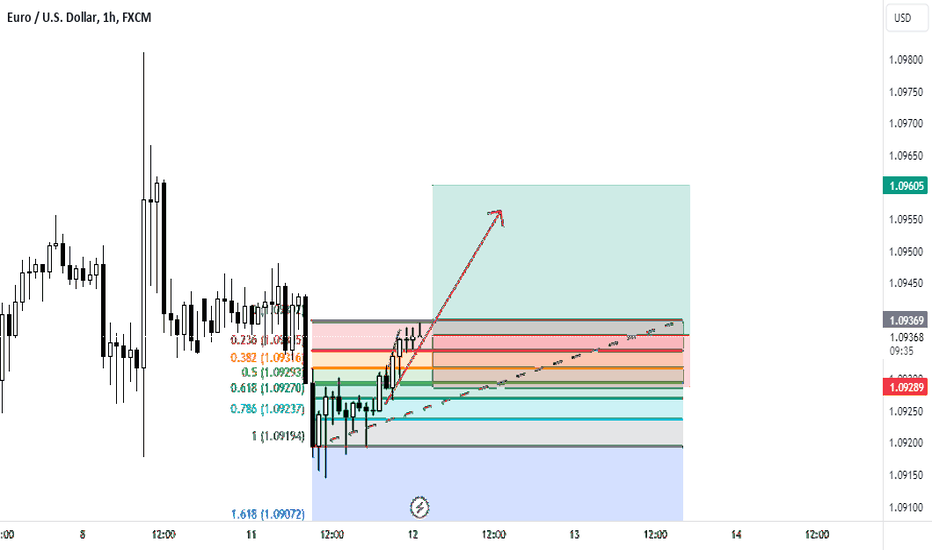

Euro Insights: Unraveling Currency TrendsIn the realm of global finance, the Euro remains a pivotal currency subject to constant scrutiny and analysis. Recent fluctuations in currency markets have placed the Euro under the spotlight, prompting investors and analysts to delve deeper into its dynamics. From economic indicators to geopolitical events, various factors contribute to the Euro's movements against other major currencies. As policymakers navigate through challenges such as inflation and monetary policy decisions, the Eurozone's resilience and adaptability continue to shape its performance in the international arena. Observers keenly monitor these developments, seeking insights into the intricate trends and forces influencing the Euro's trajectory.

Euro Update: Unraveling Currency TrendsIn the realm of global finance, the Euro remains a focal point of analysis and speculation. Recent movements in currency markets have drawn attention to the Euro's performance, prompting investors and analysts to closely monitor its fluctuations. From economic data releases to geopolitical developments, various factors contribute to shaping the Euro's trajectory against other major currencies. As policymakers navigate challenges such as inflation and monetary policy decisions, the Eurozone's resilience and adaptability continue to influence its performance on the international stage. Observers closely track these developments, seeking insights into the ever-evolving trends and forces driving the Euro's movements.

Euro Update: Unraveling Currency TrendsIn the realm of global finance, the Euro remains a focal point of analysis and speculation. Recent movements in currency markets have drawn attention to the Euro's performance, prompting investors and analysts to closely monitor its fluctuations. From economic data releases to geopolitical developments, various factors contribute to shaping the Euro's trajectory against other major currencies. As policymakers navigate challenges such as inflation and monetary policy decisions, the Eurozone's resilience and adaptability continue to influence its performance on the international stage. Observers closely track these developments, seeking insights into the ever-evolving trends and forces driving the Euro's movements.

Euro Insights: Navigating Currency TrendsIn the realm of global finance, the Euro remains a focal point of analysis and speculation. Recent movements in currency markets have drawn attention to the Euro's performance, prompting investors and analysts to closely monitor its fluctuations. From economic data releases to geopolitical developments, various factors contribute to shaping the Euro's trajectory against other major currencies. As policymakers navigate challenges such as inflation and monetary policy decisions, the Eurozone's resilience and adaptability continue to influence its performance on the international stage. Observers closely track these developments, seeking insights into the ever-evolving trends and forces driving the Euro's movements.

Euro's Resilience Amid Global Economic HeadwindsThe euro, Europe's common currency, has showcased remarkable resilience amidst the prevailing headwinds of the global economy. Despite challenges stemming from geopolitical tensions and inflationary pressures, the euro has remained steadfast, bolstered by the European Central Bank's monetary policies and the region's strong economic fundamentals.

Recent fluctuations in currency markets have underscored the euro's stability, with investors turning to it as a safe haven in times of uncertainty. Its status as the second most traded currency in the world further solidifies its importance on the global stage, providing a reliable anchor for international trade and investment.

However, the euro faces ongoing challenges, including divergent economic performance among Eurozone countries and the specter of Brexit lingering over the European Union. Moreover, the resurgence of COVID-19 variants and supply chain disruptions pose additional risks to the euro's outlook.

Despite these obstacles, the euro's resilience remains a testament to the Eurozone's commitment to economic integration and stability. As policymakers navigate the complexities of a rapidly evolving global landscape, the euro stands poised to weather the storm and emerge stronger, reaffirming its position as a cornerstone of the global financial system.

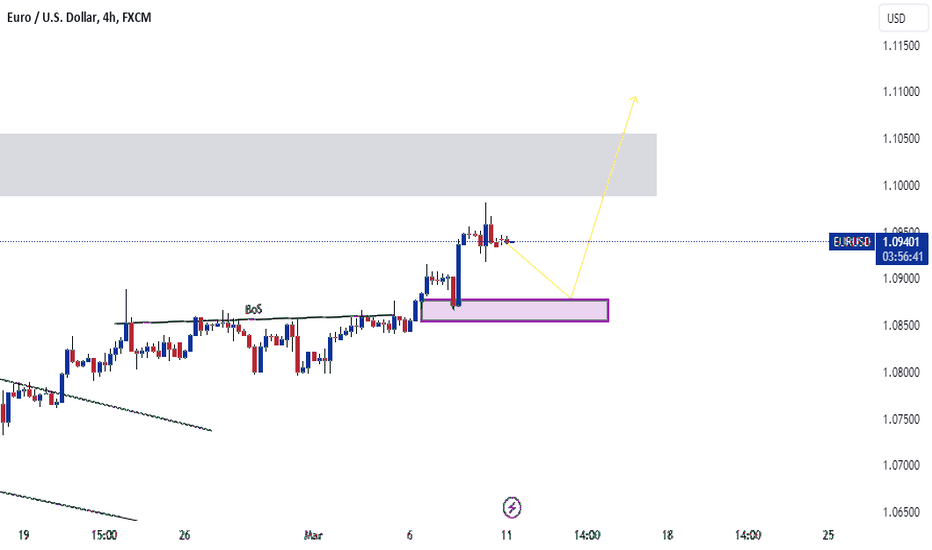

Euro's Steady Climb: Navigating Economic RecoveryThe euro has steadily climbed amidst signs of economic recovery, reflecting confidence in the Eurozone's resilience and stability. Buoyed by proactive measures from the European Central Bank and improving economic indicators, the euro has strengthened against major currencies.

Investor sentiment towards the euro has been bolstered by progress in vaccination efforts and positive economic data, signaling a gradual return to pre-pandemic levels. This upward trajectory reaffirms the euro's status as a reliable currency and a key player in the global financial system.

While challenges remain, including divergent economic performances among Eurozone countries and lingering uncertainties surrounding the pandemic, the euro's steady climb reflects optimism about the region's economic prospects. As the Eurozone continues on its path to recovery, the euro is poised to play a pivotal role in driving growth and stability in the months ahead.

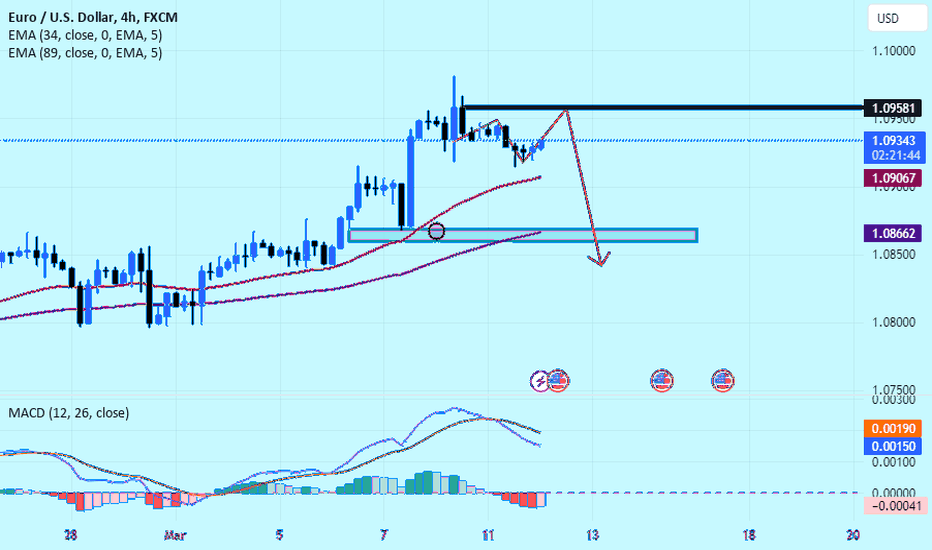

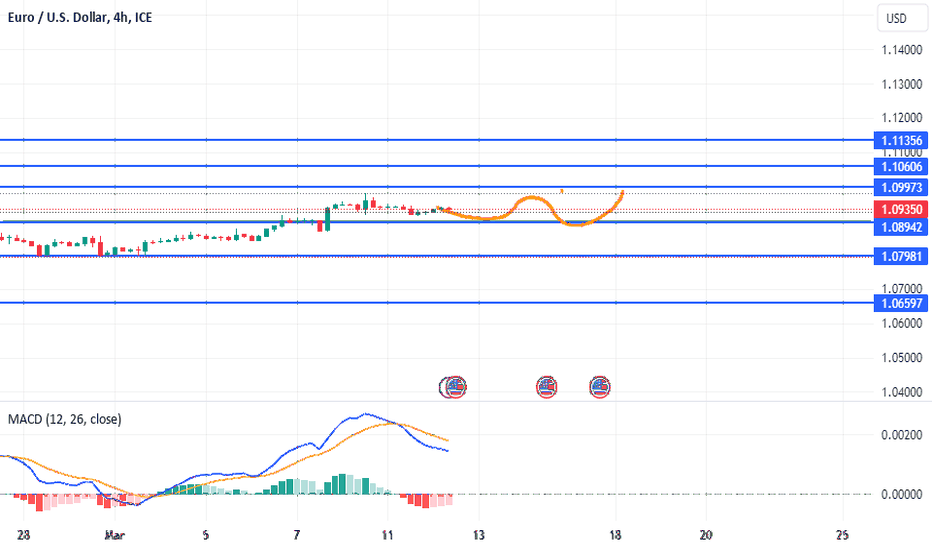

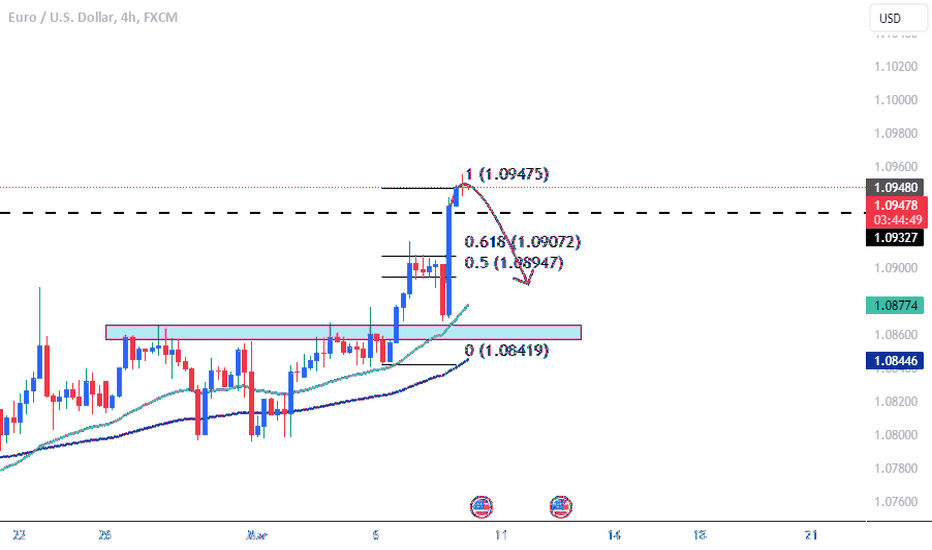

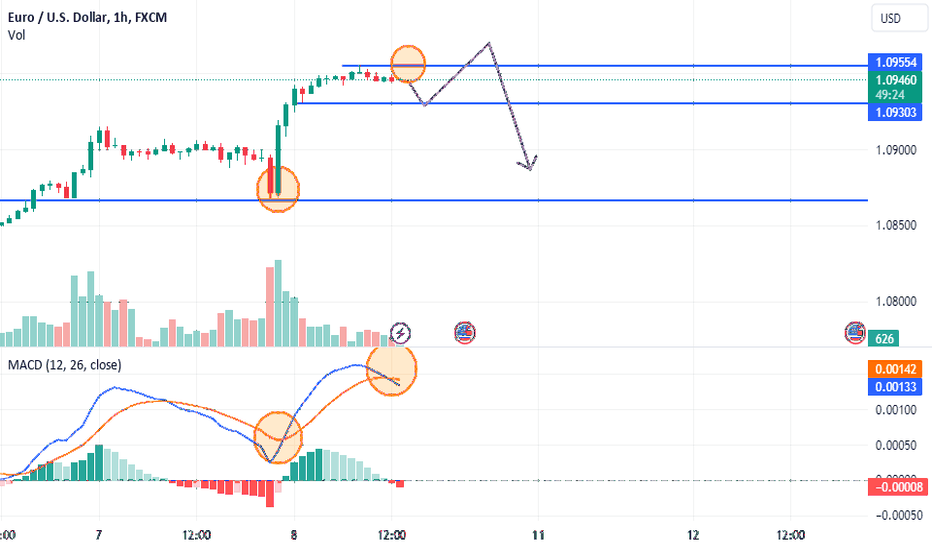

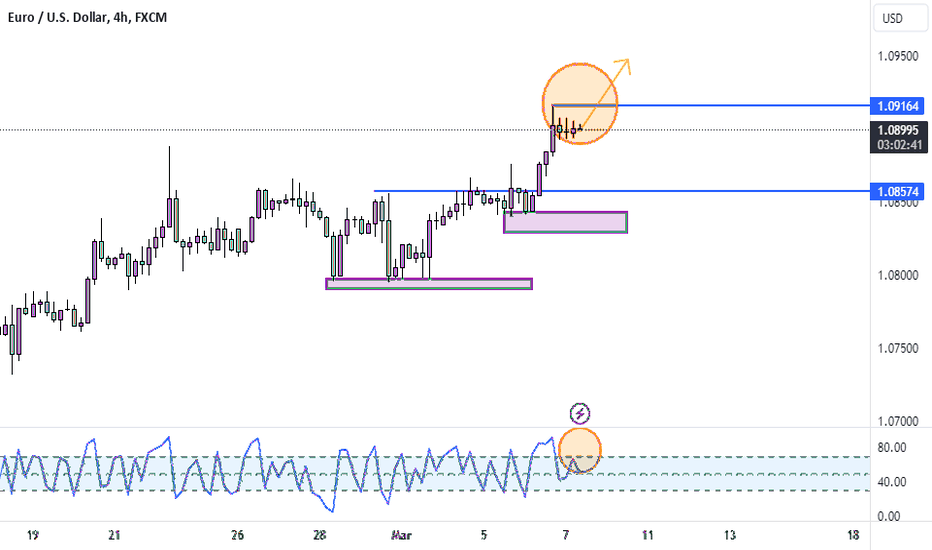

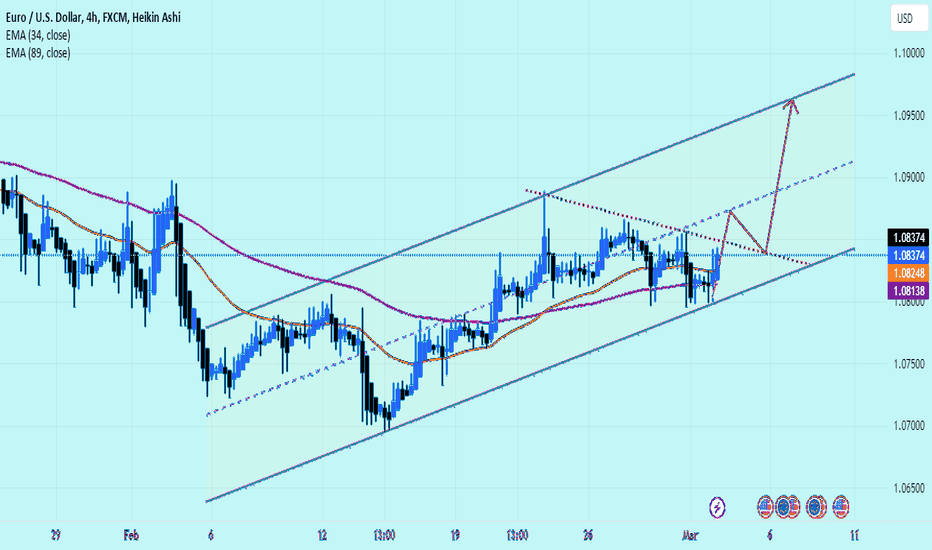

eurusd sell EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles. The U.S. dollar, as measured by the DXY index, was subdued, and displayed restraint on Monday despite a modest uptick in U.S. Treasury yields. Market participants appear to be leaning toward a cautious stance at the start of the new week ahead of a high-impact event on Thursday: the release of the core personal consumption expenditures deflator, the Federal Reserve’s preferred inflation gauge. confirm signal EUR/USD is ranging at around 1.0850 in the European session on Tuesday. The pair stays supported amid a broadly subdued US Dollar and hawkish comments from ECB President Lagarde. The focus now shifts to the high-impact US economic data.