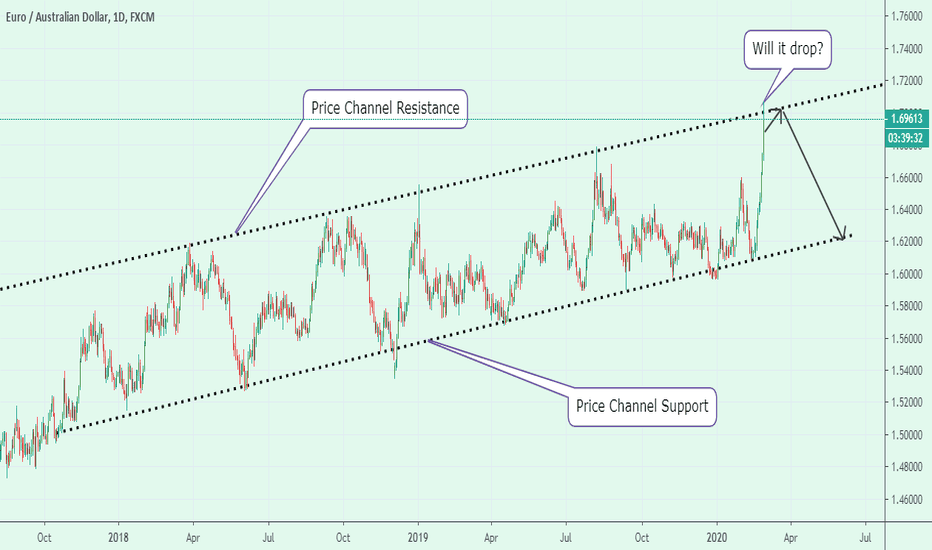

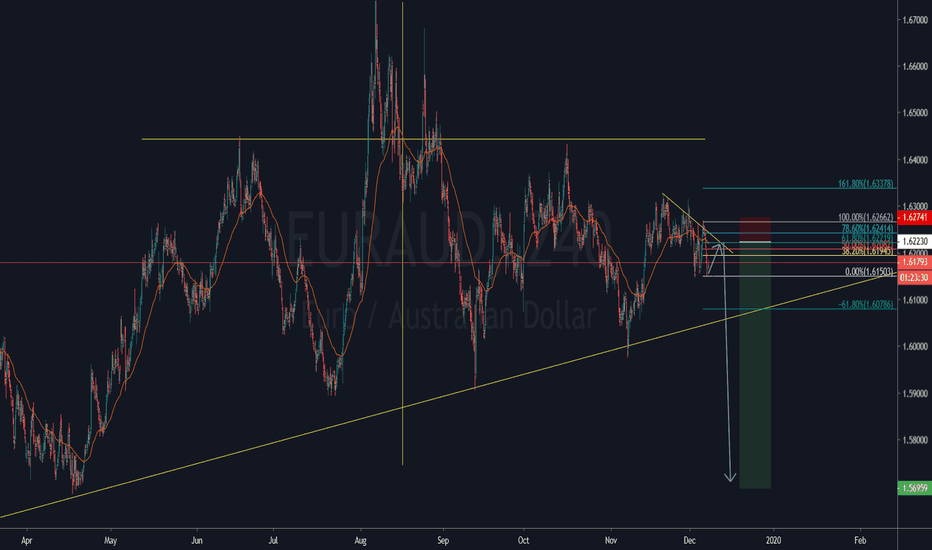

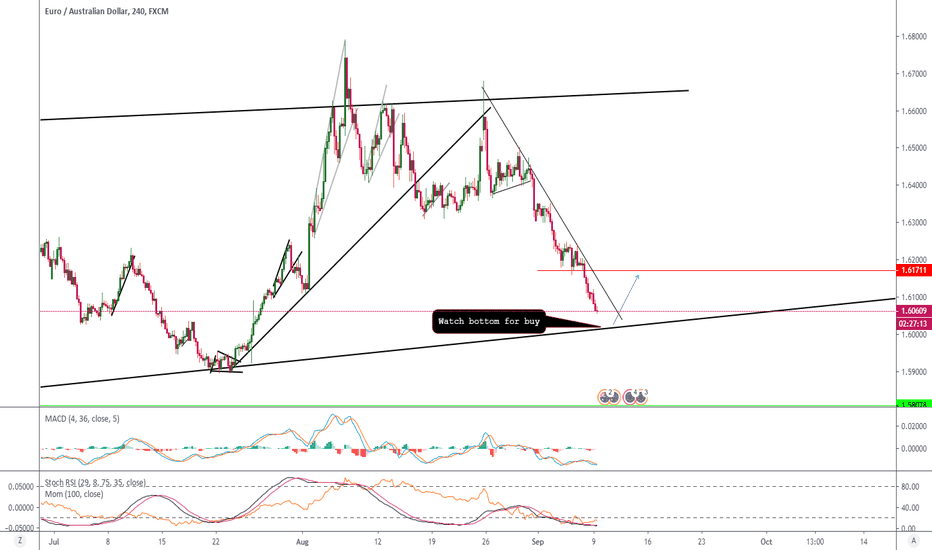

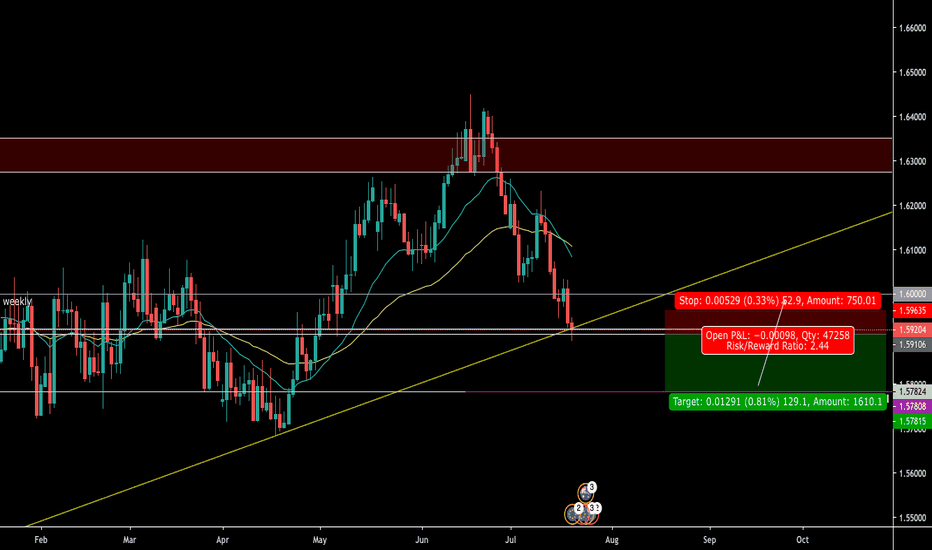

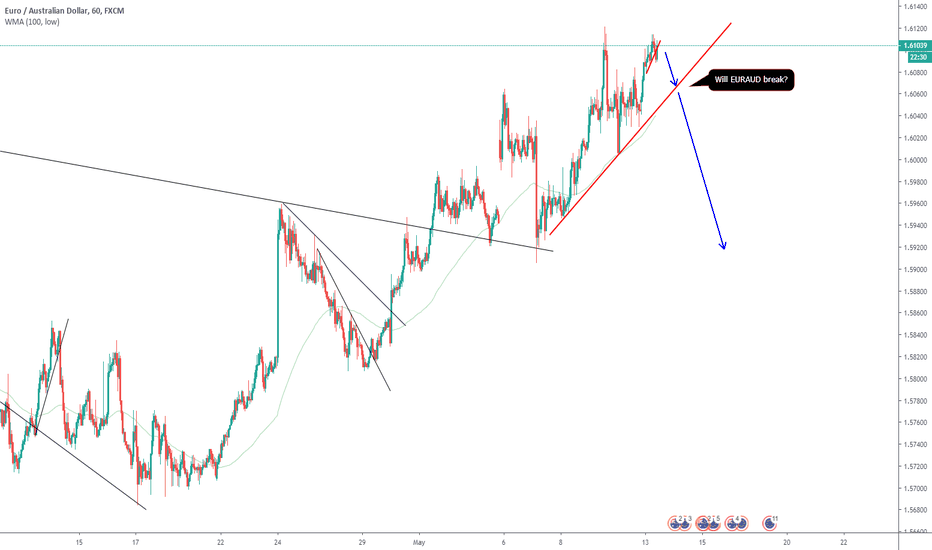

EURAUD reaches the Channel TOP once again, SELL?EURAUD has rallied to the channel top driven by the dramatic sell-off in risk assets like AUD.

Now, is it possible that we can get a sell entry here?

As you can see in the chart, on all the previous occasions, the price dropped after hitting the channel top.

So, yes, there is a possibility of a drop. But, for that to happen we need to see improvement in risk appetitive and a healthy correction in the stock markets. If that happens then EURAUD is going to drop.

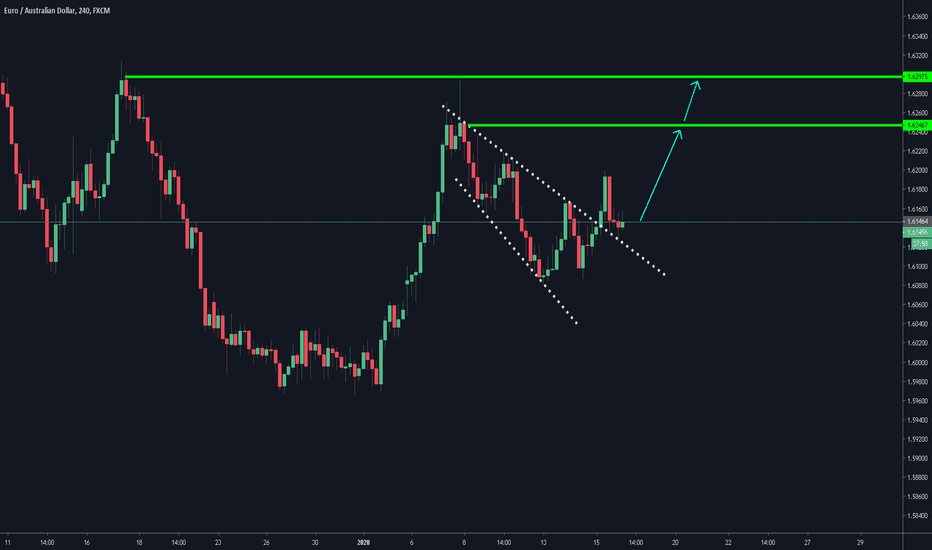

Euruad

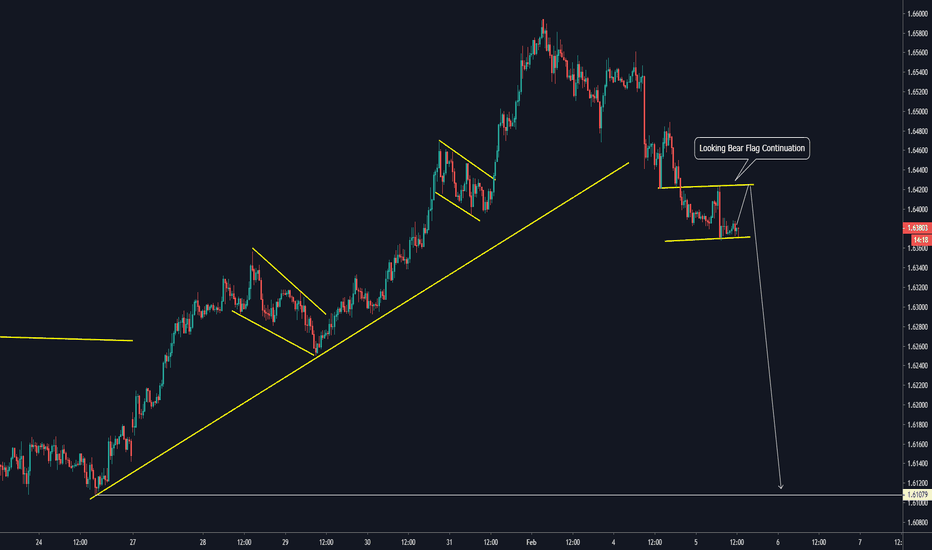

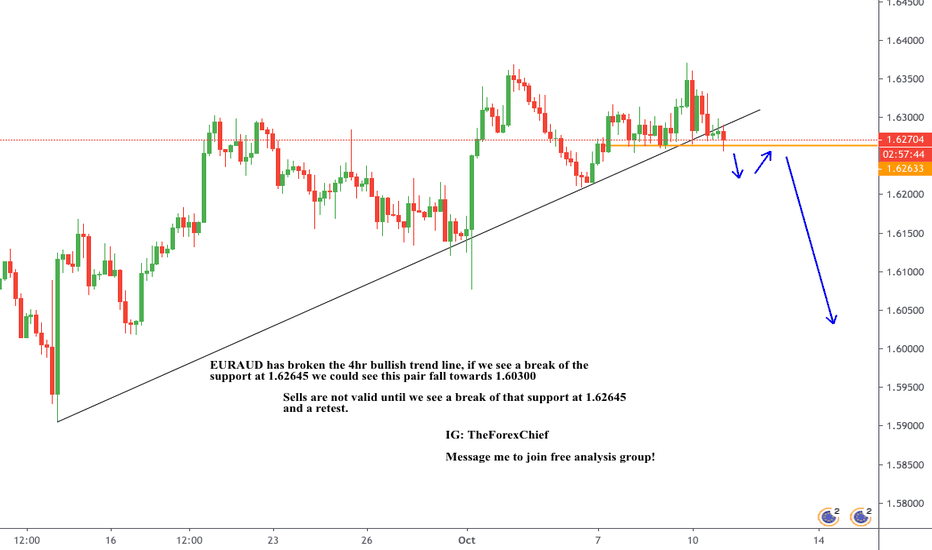

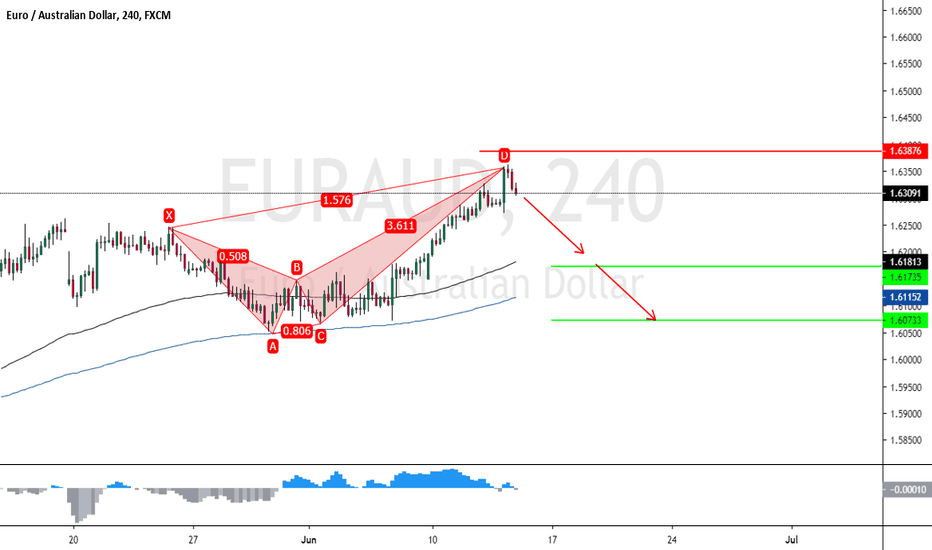

EurAud Waiting for retracement to go long towards the fib retracement 61.8 inline with the trendline that I have in place.

so im expecting a short around that area depends on price action, once it goes short im expecting a breakout.

as you can see I have a cross there which shows that the market is repeating itself, creating the same pattern but towards the downside.

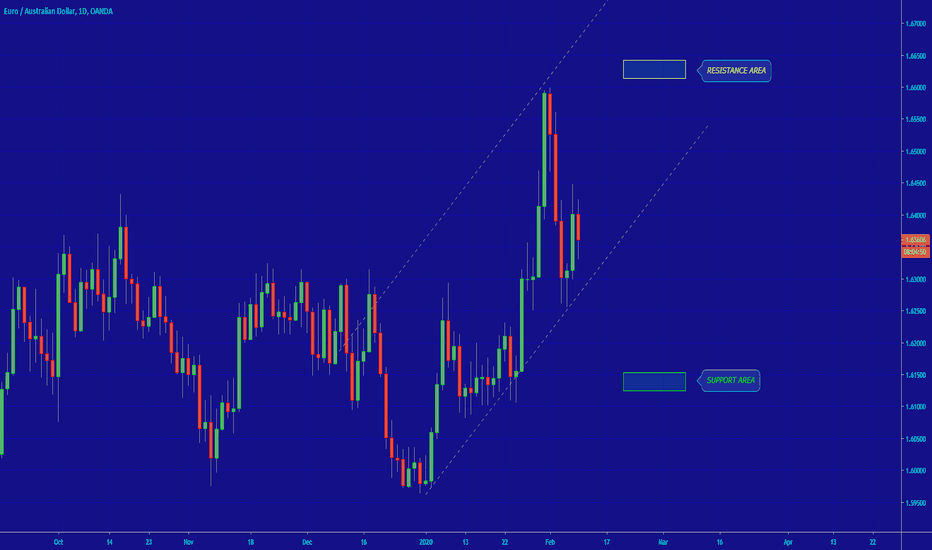

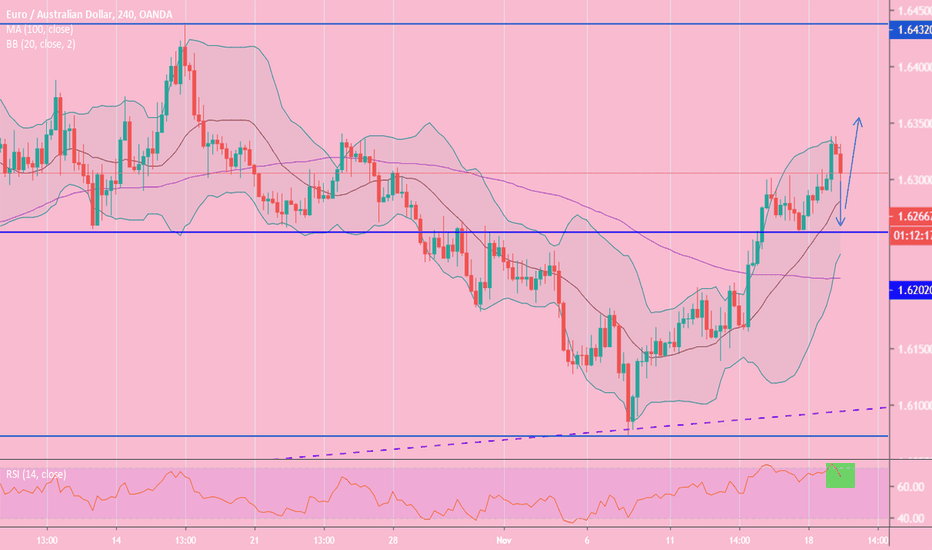

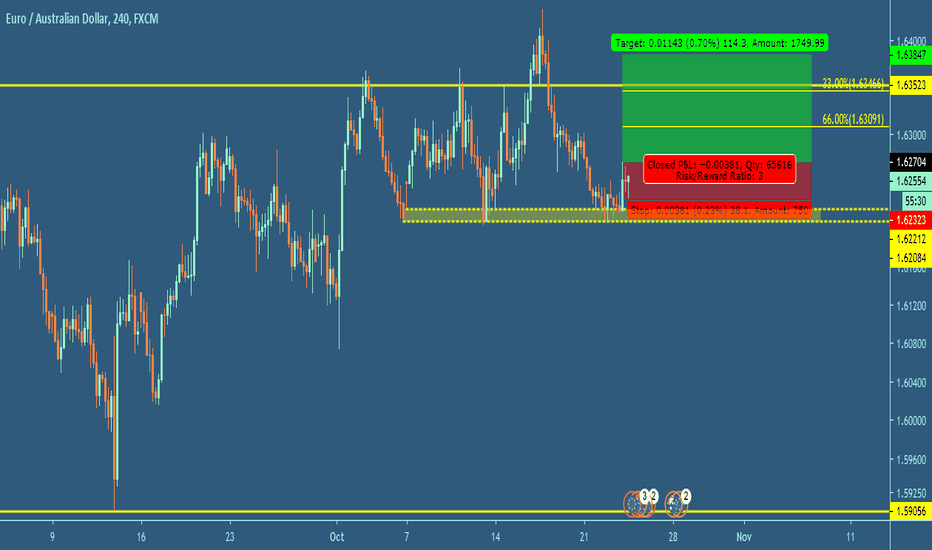

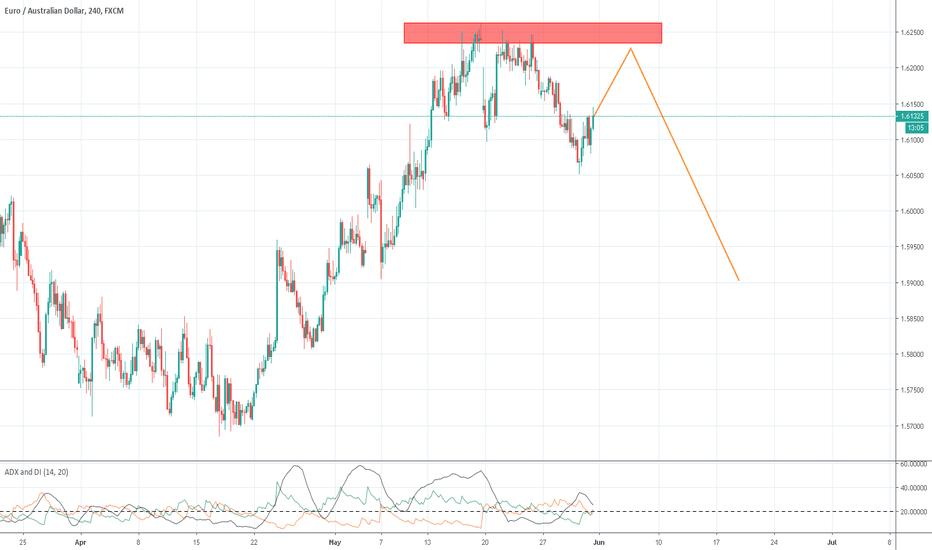

Is it EUR/AUD getting ready for more bullish moves?After brief consolidation the EUR/AUD’s rise from 1.5976 resumed and intraday bias is back on the upside. Friday’s daily candle came out as a bullish Marubozu candle, which indicates that the buyers are in control. Additionally, the today breakout on daily chart above Friday’s high may push the price upside with good bullish momentum.

But the H4 chart shows that after being very bullish, the price retreated a little bit. The pair may find resistance at the level of 1.6310 (24th October's high). Further rally should be seen to 1.6432 resistance first. Sustained move above this level will pave the way to retest 1.6787 high.

If the downward correction keeps, it may come up to 1.6202 to find its support. A clear breakout below 1.6202 minor support will turn bias back to the downside for testing 1.6150 (100-day SMA on H4), followed by 1.5976 key support zone. The H4 RSI was in overbought area which is indicative that the underlying momentum is positive for the AUD relative to the EUR.

In the bigger picture, as long as 1.5895 support (the triple bottom since July) holds, outlook remains bullish.

We prefer upside momentum and buying opportunities on the declines. So, in short-term look for Sell at the current level with TP at 1.6205 and Stop Loss around 1.6305. On daily chart waiting the long positions to hit the target 1.6435.

What's your strategy for that pair?

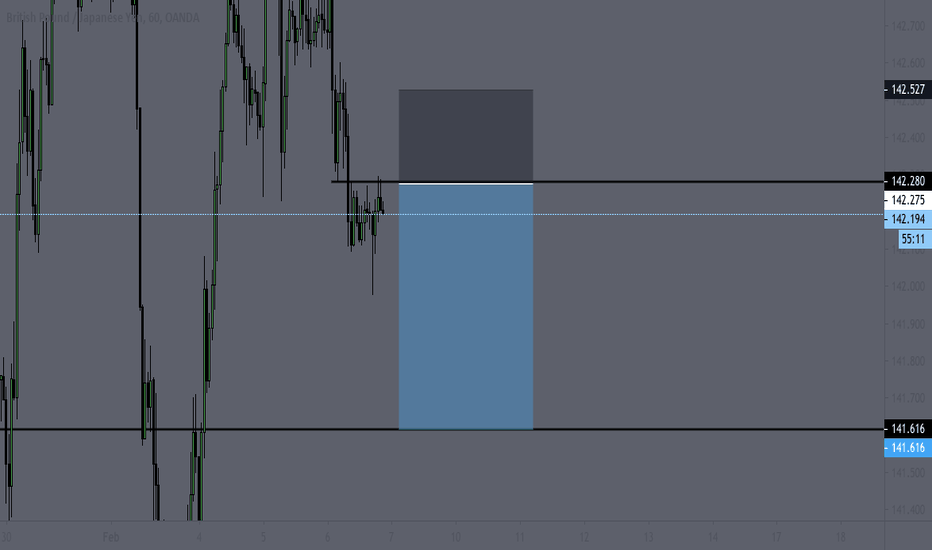

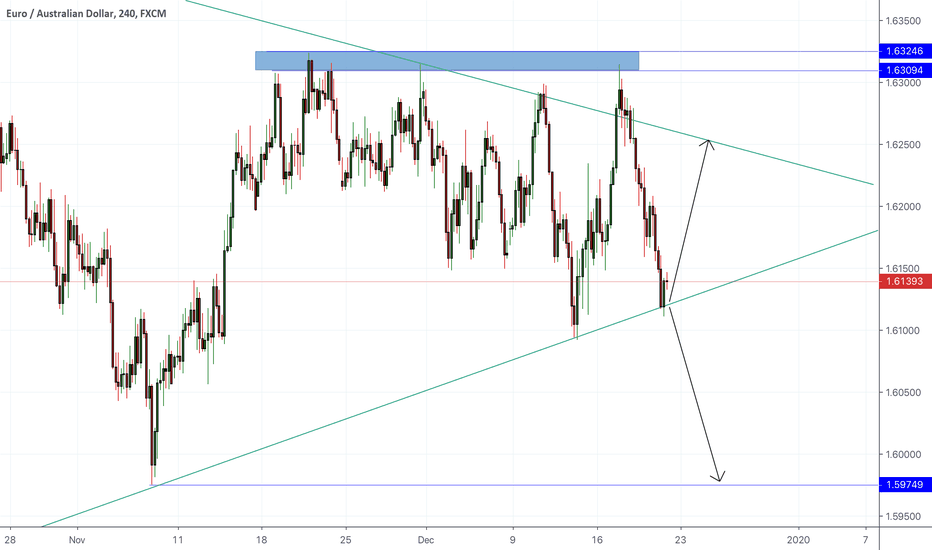

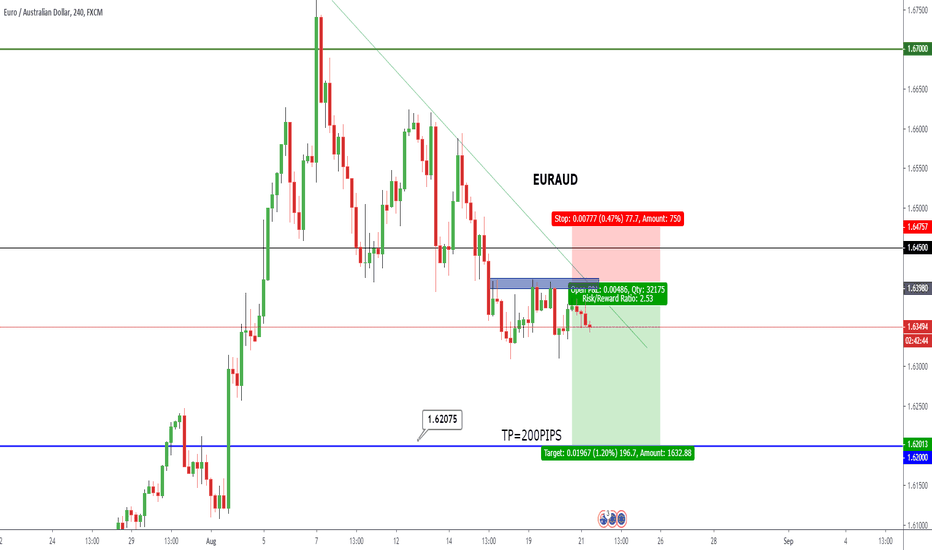

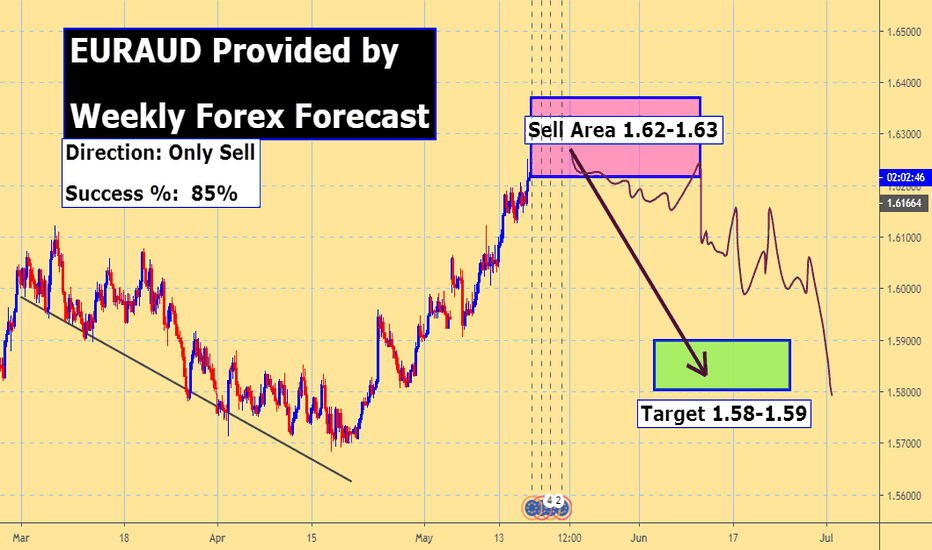

EURAUD shortI will be waiting for a break and retest of my boxed zone and a 4H confirmation candle before entering short to around 1.5800.

II must wait for a break and retest as price is currently at 1.27 fib extension so price could still reverse from here. However confluence for EURAUD start with a strong bearish close on weekly showing momentum for the bears swell as price breaking through both EMAS. On daily both my 20ema and 50ema have crossed showing potential for more bearish movement. My target being the 1.618 fib extension where I will be looking for longs on corrective wave 4 up to around 1.600.

My trade should look something like this:

SELL EURAUD ~@ 1.5910

SL @ 1.5955 (-45)

TP @ 1.5780 (130)

R:R = 2.9

After this move I will be looking for longs but I will post this when the time comes, and if price plays out how I hope it does...