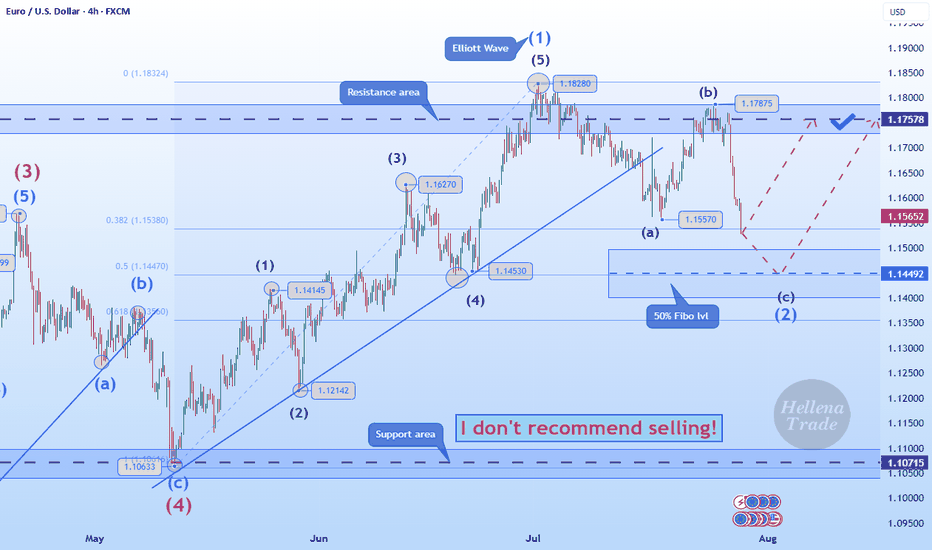

Hellena | EUR/USD (4H): LONG to the resistance area 1.17578.Colleagues, the price has made a strong downward movement, which can only mean one thing: the correction is not complete.

This means that the latest upward movement is wave “1” of medium order.

Therefore, I now expect the correction to end in wave “2” at the 50% Fibonacci level and thean upward movement to continue to at least the resistance level of 1.17578.

It is quite possible that after updating the level of 1.15570, the price will immediately begin an upward movement — this is a more risky option for entering a position.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Eurusd-3

EURUSD consider on support and resistance zone togetherEURUSD now on resistance area i expect the price will break and form head and shoulder

on the other hand, may this area is strong and the price make down trend ,but we should wait candle pattern on this area to take sell

you must wait price action to take good trade with risk to reward 1:3

good luck

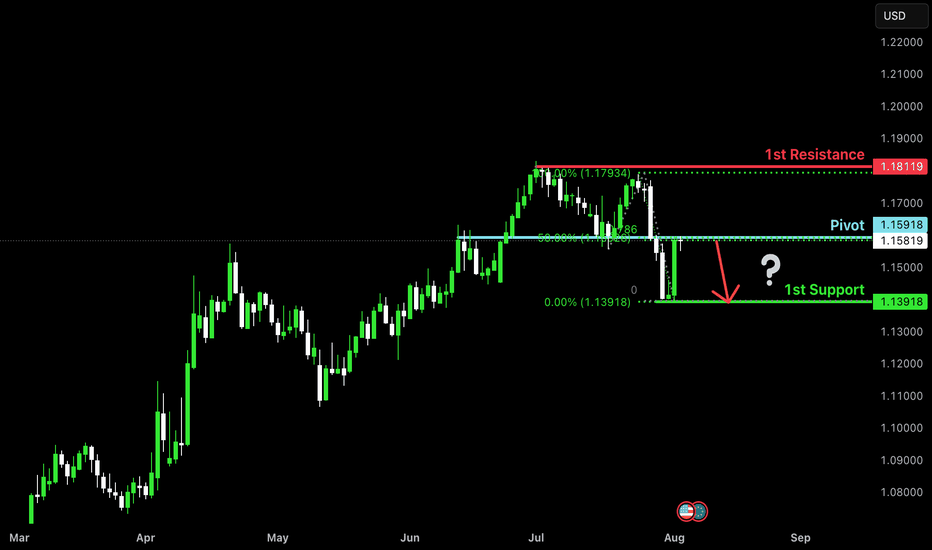

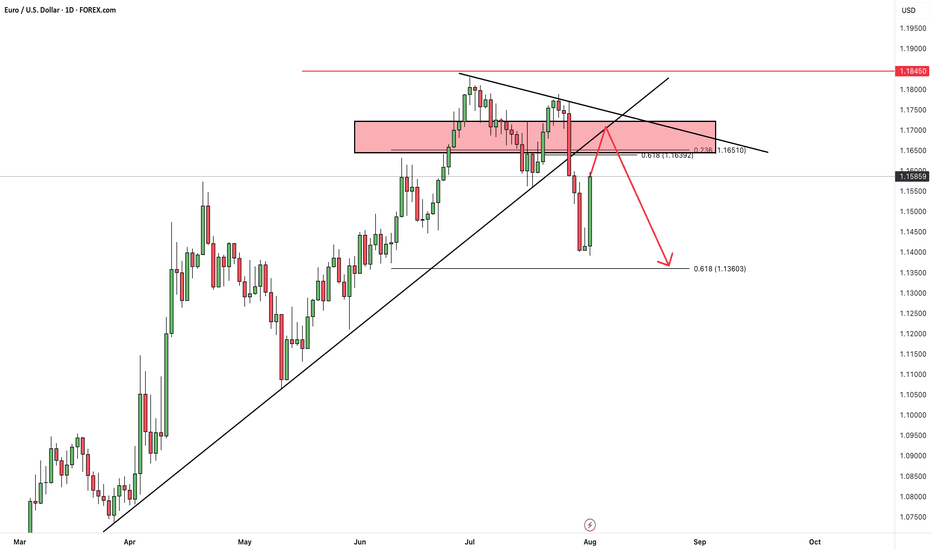

Bearish reversal off 50% Fibonacci resistance?The Fiber is reacting off the pivot, which acts as an overlap resistance that lines up with the 50% Fibonacci retracement and could reverse to the 1st support.

Pivot: 1.1691

1st Support: 1.1391

1st Resistance: 1.1811

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

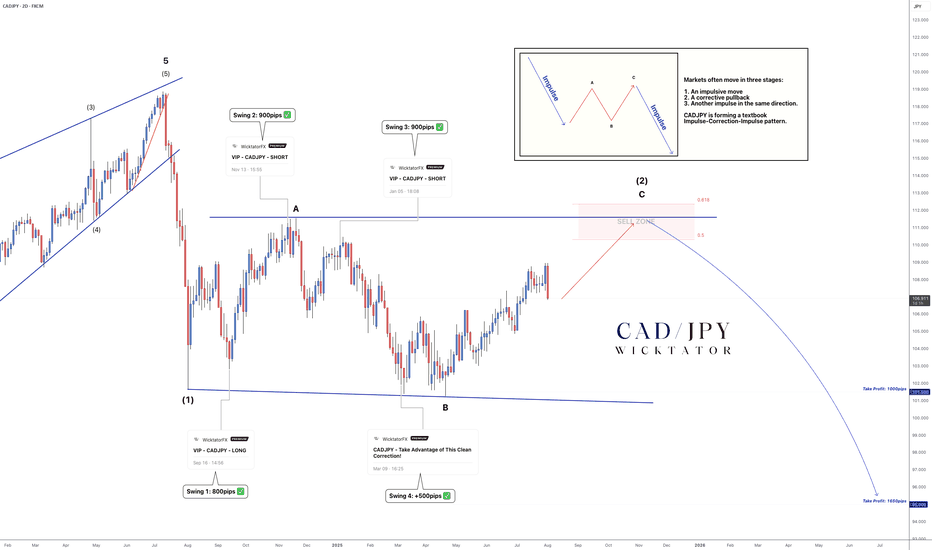

CADJPY - Wave C Near Completion: Big Drop Coming!We’ve been tracking CADJPY for years, and price has followed Elliott Wave structure almost perfectly.

In mid‑2024, an ending diagonal signalled the top and kicked off a major bearish impulse. That drop formed wave A of the current ABC correction. Wave B completed in late 2024, and price is now in wave C -pushing toward the 50–61.8 % Fibonacci retracement, which marks our sell zone.

We’ll be watching for a trendline to form into this zone. A clean break of that trendline will be our trigger to enter shorts.

Trade Idea:

- Watch for rejection in the 50–61.8 % sell zone

- Aggressive entry: Inside sell zone with stops above rejection

- Conservative entry: On break of trendline, stops above the break candle

Targets:

TP1: 101.5 (1000pips)

TP2: 95 ( 1650pips)

Optional: Leave a runner for a long-term swing

See below for our previous CADJPY setups:

Swing 1:

Swing 2:

Swing 3:

Swing 4:

Goodluck and as always, trade safe!

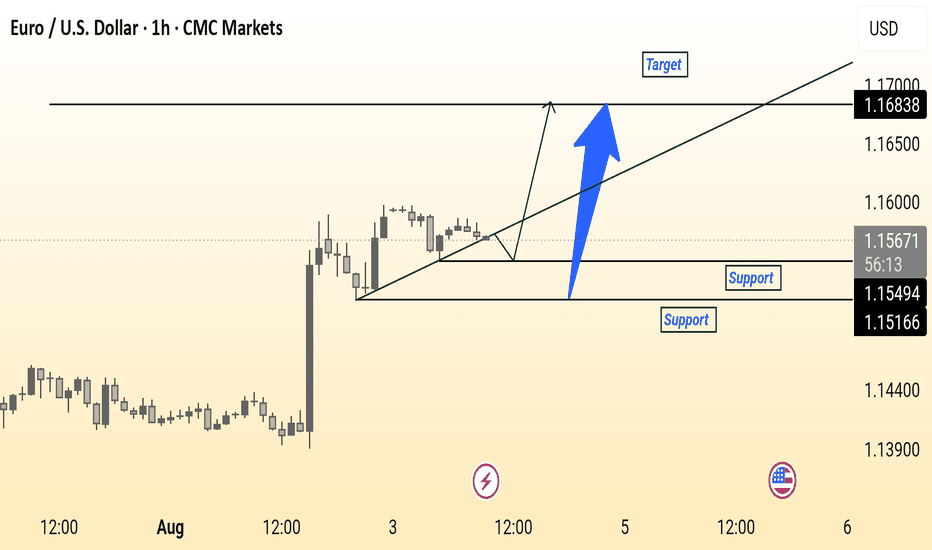

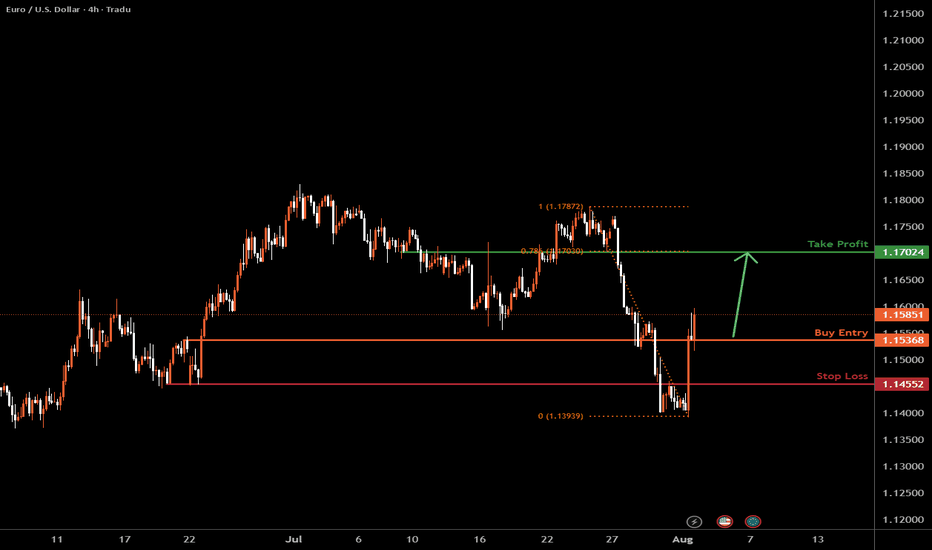

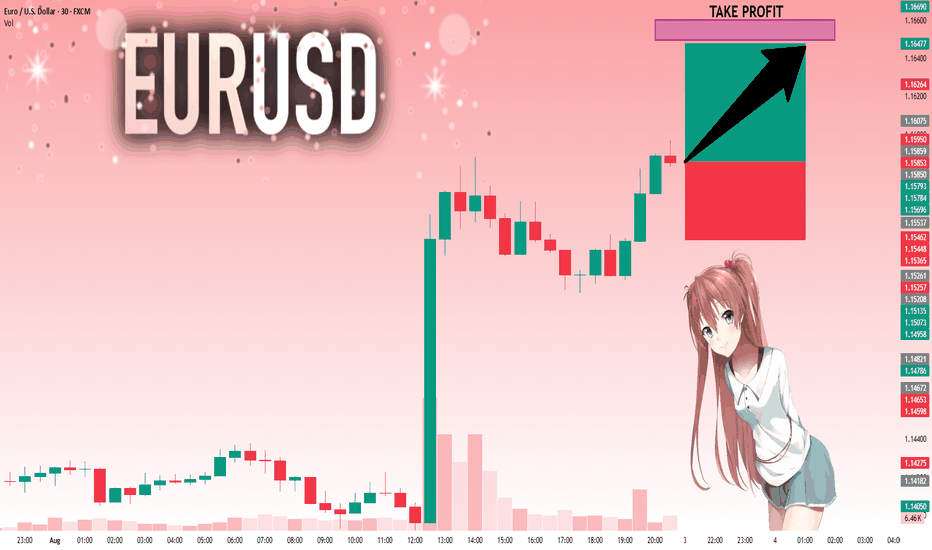

The Fiber H4 | Bullish riseEUR/USD has bounced off the support level, which serves as a pullback support and could potentially rise from this level to our take-profit target.

Buy entry is at 1.1585, which is a pullback support.

Stop loss is at 1.1455, which is a pullback support.

Take profit is at 1.1702, which is a pullback resistance that aligns with the 78.6% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

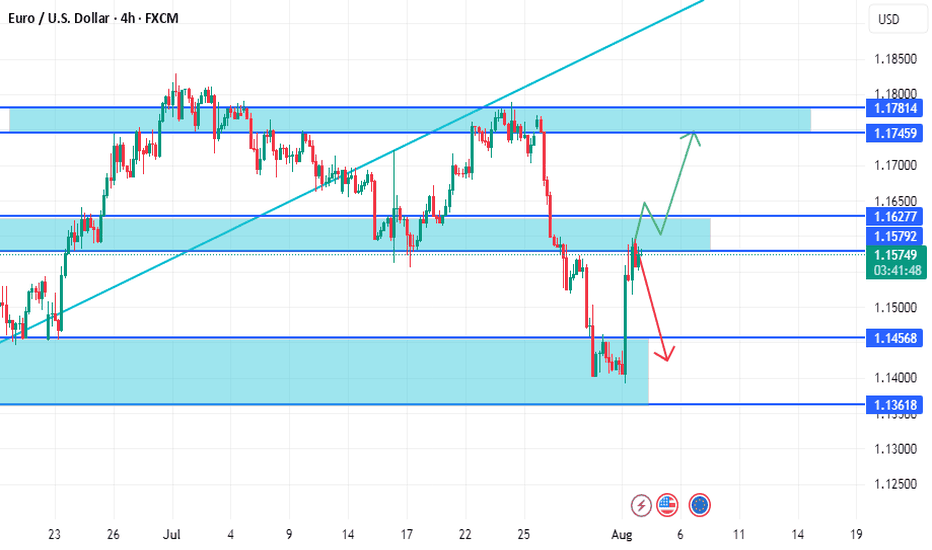

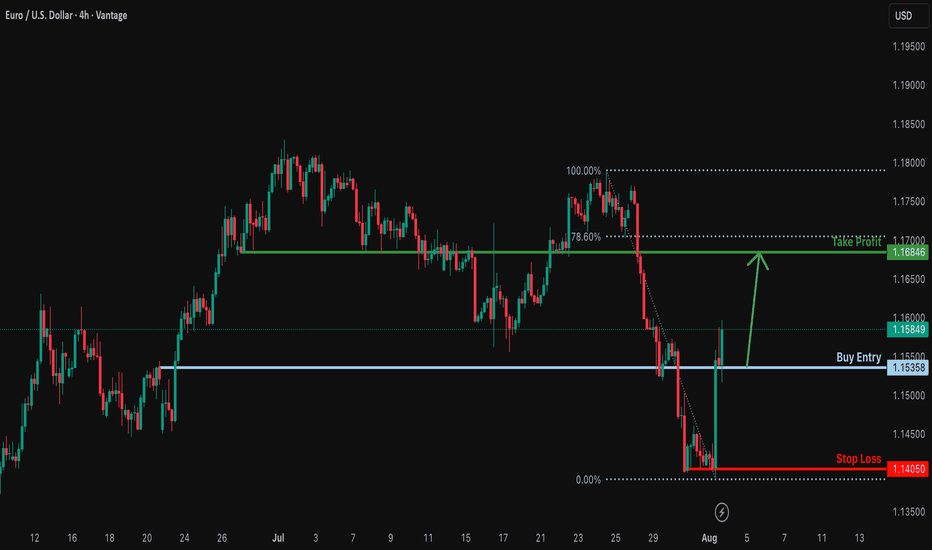

Bullish rise?EUR/USD has reacted off the support level and could potentially rise from this level to our takeprofit.

Entry: 1.1535

Why we like it:

There is a pullback support.

Stop loss: 1.1405

Why we like it:

There is a swing low support.

Take profit: 1.1684

Why we like it:

There is a pullback resistance that is slightly below the 78.6% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

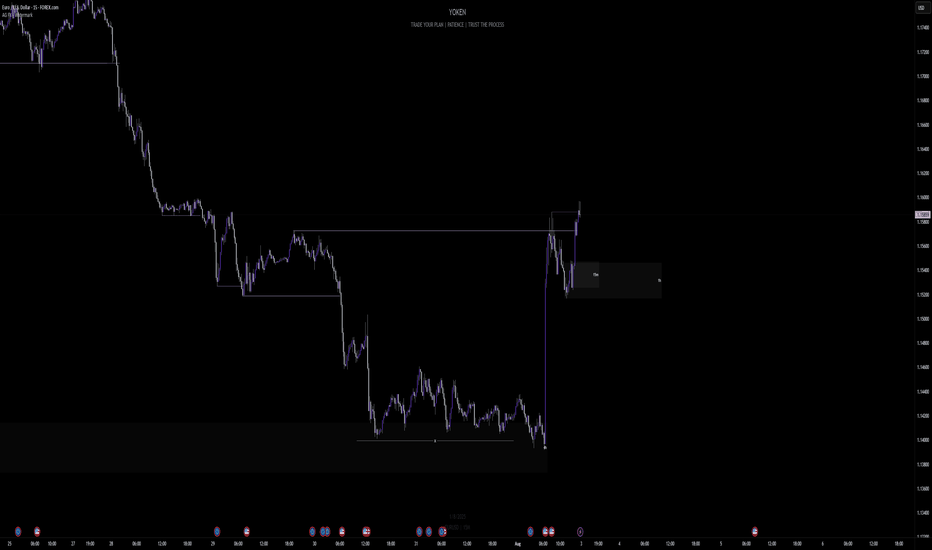

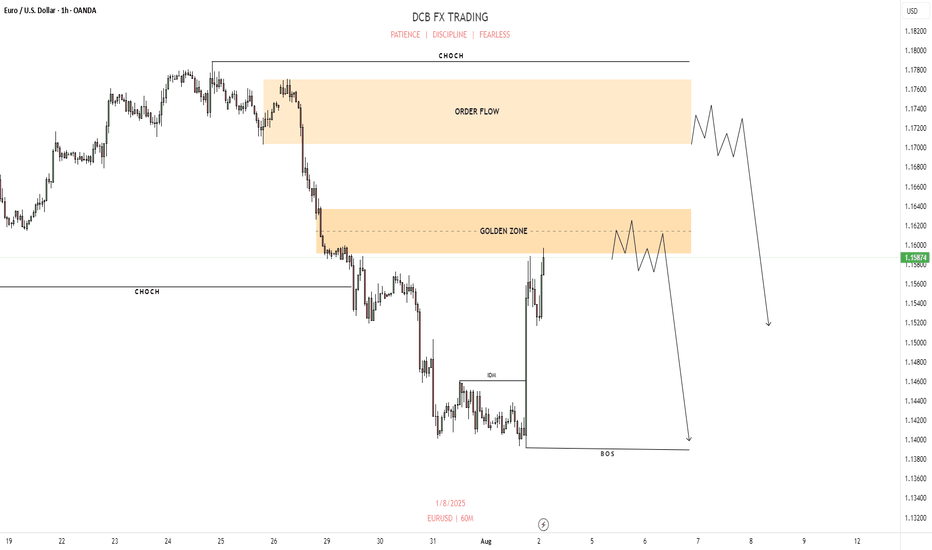

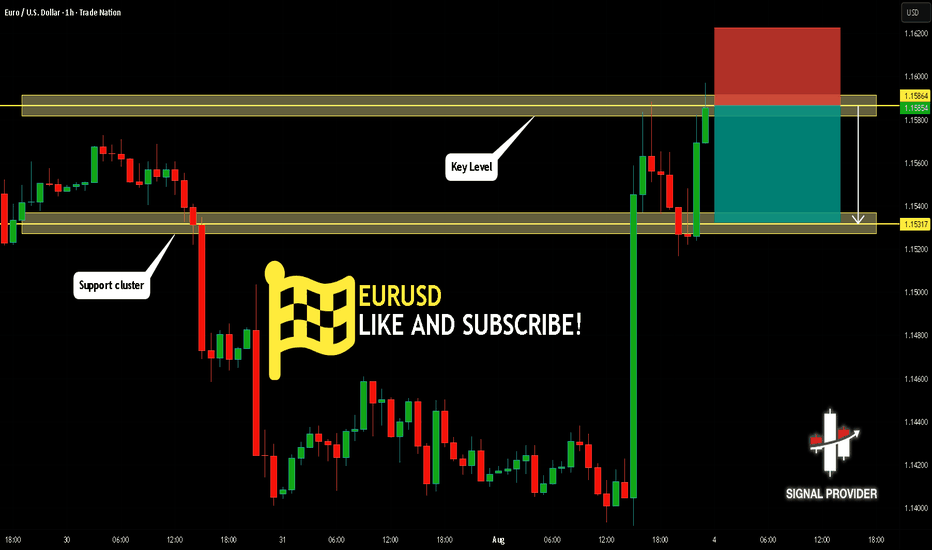

Week of 8/3/25: EURUSD AnalysisPrice was bearish all of last week until NFP, resulting in a shift in 4h and 1h market structure to be bullish.

Focus this week is being bullish and following 1h order flow until it reaches the extreme of the daily bearish structure to then be cautious and seeing where price wants to go from there.

Major News:

Tuesday: PMI

Thursday: Unemployment Claims

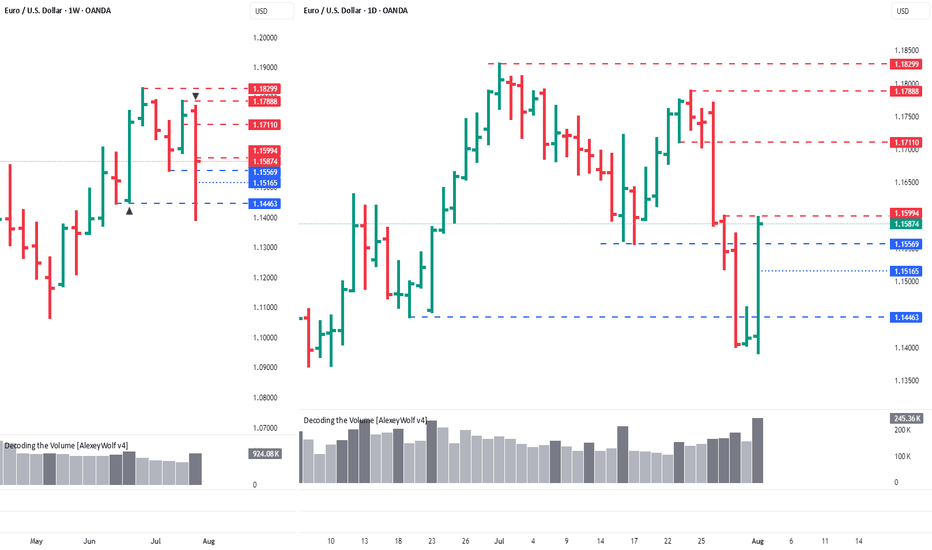

EURUSD. Weekly and Daily AnalysisHi traders and investors!

This analysis is based on the Initiative Analysis concept (IA).

Weekly TF

Price has tapped the 50 % level of the last buyer initiative at 1.14477 and run a manipulation around 1.15569.

Daily TF

We’ve seen a manipulation of the lower boundary of the buyer initiative, and an IKC candle has printed.

Buyer targets on the daily chart: 1.17110, 1.17888, 1.18299.

Before aiming for those, buyers first need to clear the potential sell zones at 1.15994 and 1.16108.

Conservative long setup:

Wait for buyers to defend 1.15994 (or a higher level).

Alternatively, watch the 1-hour support at 1.15165; if buyers hold it, there’s scope for a move toward 1.15994 — and potentially higher after that.

Wishing you profitable trades!

EURUSD SMC ANALYSIS H1 TIME FRAME📉 EURUSD 1H SMC CHART – SHORT BIAS ZONE ACTIVE!

🔶 GOLDEN ZONE REACHED

📍 Zone: 1.15912 – 1.16369

– Previous CHoCH + Clean OB + Premium zone

– Likely area for Smart Money to initiate sell positions

– Price reacting aggressively upon entry

📌 Trade Idea:

– Look for 15M / 5M CHoCH or bearish FVG inside the golden zone

– Ideal sniper entry setup forming soon

– SL above 1.17043 or OB high 1.17692

– TP: Break of structure low and imbalance fill near 1.1450–1.1400

🧠 Bias:

– Order Flow is Bearish

– Strong IDM structure already mitigated

– We anticipate price will grab liquidity and reverse from premium zone

⛔️ Avoid early entries – let Smart Money give the signal. Precision = Power 🎯

#EURUSD #SMC #SniperEntry #SmartMoneyConcept #OrderBlock #GoldenZone #DCBFXTRADING

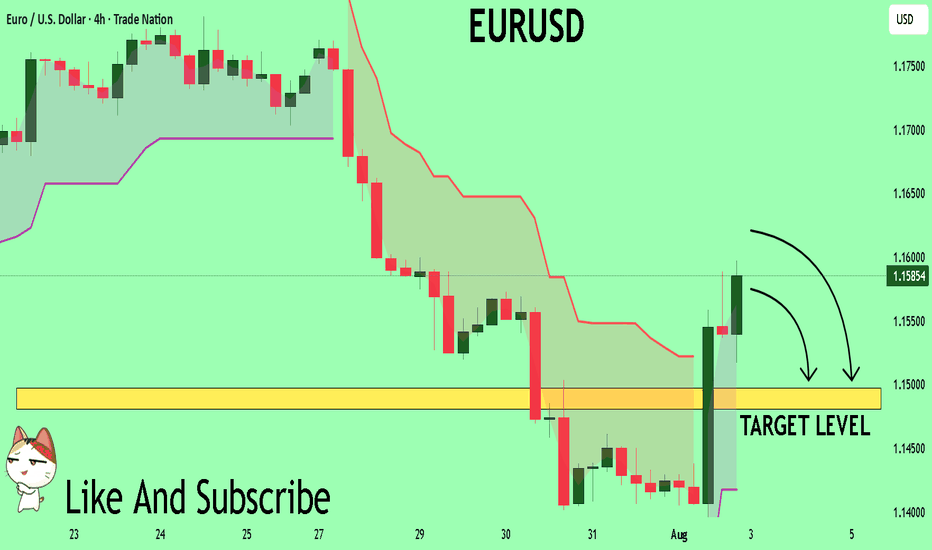

EURUSD Trading Opportunity! SELL!

My dear followers,

This is my opinion on the EURUSD next move:

The asset is approaching an important pivot point 1.1585

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 1.1497

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD - Scaling into Confluence ZoneTaking a look at EURUSD on the daily timeframe we had quite the rebound in EURUSD last Friday following the NFP report. However price action is now heading towards a cluster of resistance levels which is why I'm implement my scaling in technique using a specially designed and programmed EA that i use for MT5.

== TRADE PLAN ==

Scale-in with short positions and target a 0.5% growth on the account. In other words, once the basket arrives in profit by 0.5% CLOSE ALL.

Trade Safe - Trade Well

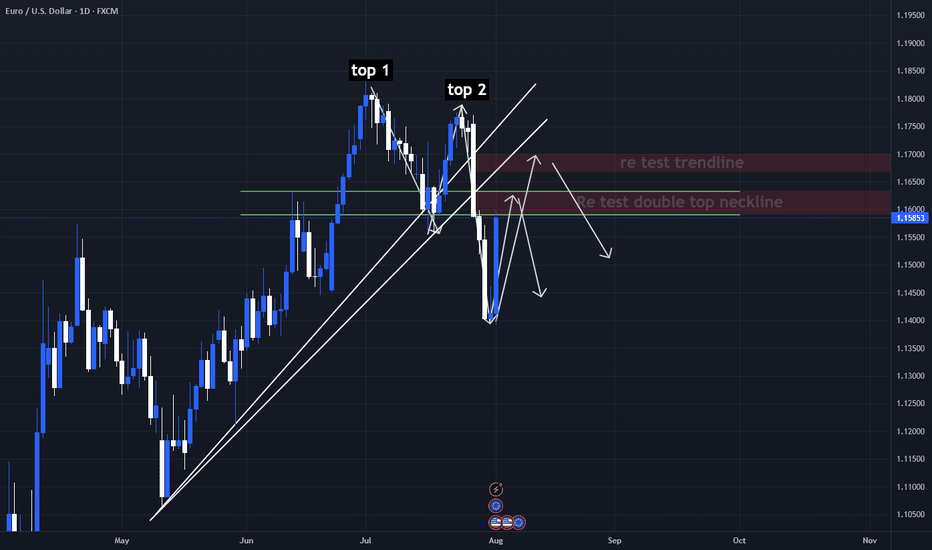

EURUSD Current Market Situation Technical Analysis Current Market Situation

The chart displays a Double Top pattern, a strong bearish reversal signal that often indicates the start of a downward move.

The price has already broken the neckline, and it is now approaching a retest of both the neckline and the broken trendline, which serves as a critical resistance area for potential bearish continuation.

Key Zones

Neckline Retest Zone: Around 1.1600, acting as immediate resistance.

Trendline Retest Zone: Between 1.1670 – 1.1700, serving as an additional resistance level to confirm the bearish bias.

Potential Scenarios

✅ Bearish Scenario (Preferred):

If price respects the retest zones and fails to break higher, we may see a decline toward:

Target 1: 1.1500

Target 2: 1.1400

Target 3: 1.1300

⚠ Bullish Scenario (Alternative):

A clear breakout and daily close above 1.1700 would invalidate the bearish outlook and could lead to a bullish reversal.

Conclusion

The market structure currently favors the bears.

Rejection from the neckline or trendline retest zones will provide a strong confirmation for sell positions.

⚠️ Trade at your own risk – We are not responsible for any losses.

EURUSD Will Go Lower! Sell!

Here is our detailed technical review for EURUSD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 1.158.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 1.153 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

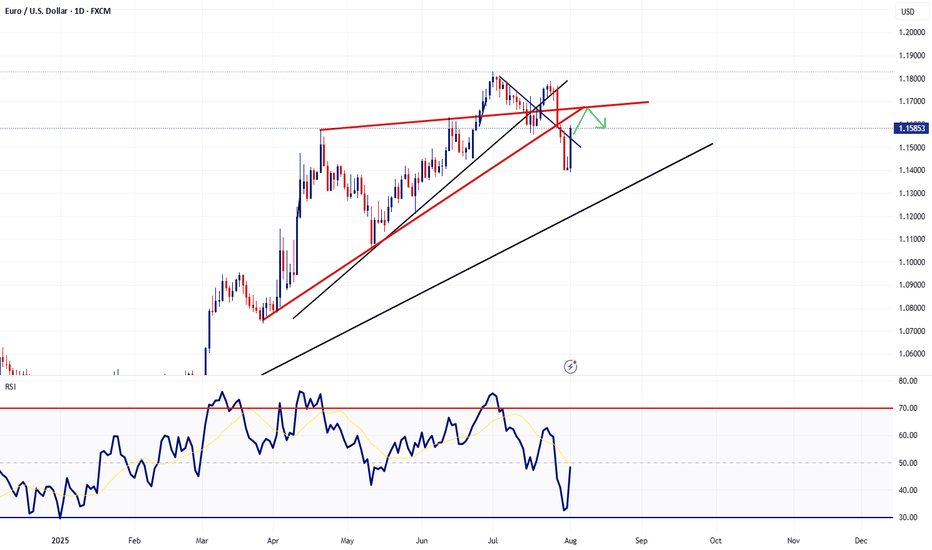

EURUSDHello Traders! 👋

What are your thoughts on EURUSD?

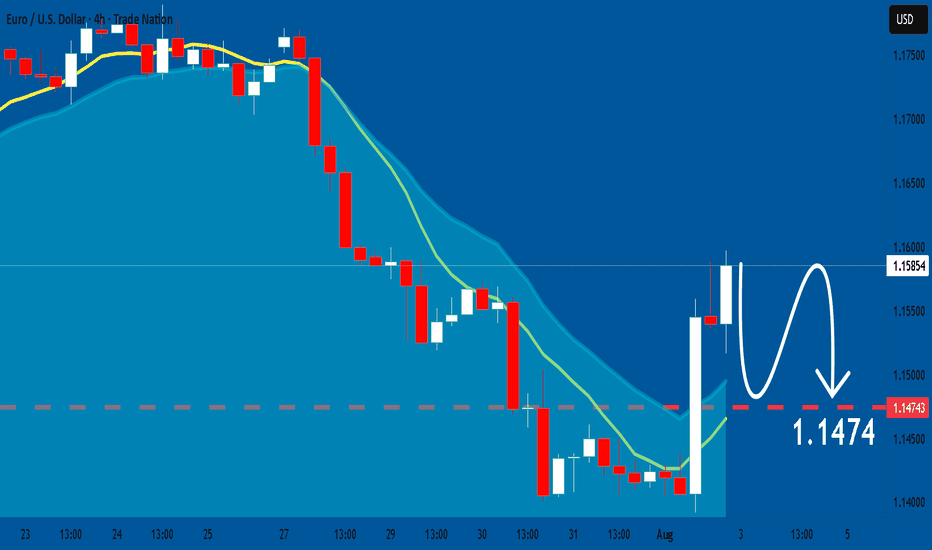

After last week's sharp decline, EUR/USD rebounded slightly on Friday, initiating a corrective move to the upside.

We anticipate this retracement to extend over the next few days, likely reaching the broken trendline and former support zone, which now acts as resistance.

As long as the pair remains below this resistance area, the bearish outlook remains valid.

Once the pullback is complete, we expect renewed downside pressure toward the next support levels.

💬 Is this just a corrective move before another leg down? Let us know your thoughts below! 👇

Don’t forget to like and share your thoughts in the comments! ❤️

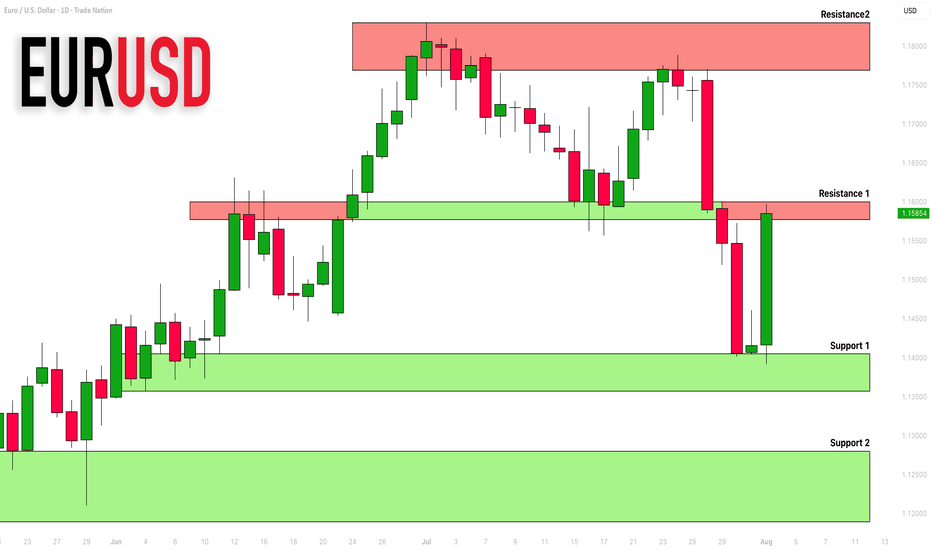

EURUSD: Support & Resistance Analysis For Next Week 🇪🇺🇺🇸

Here is my latest structure analysis and important

supports & resistances for EURUSD for next week.

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

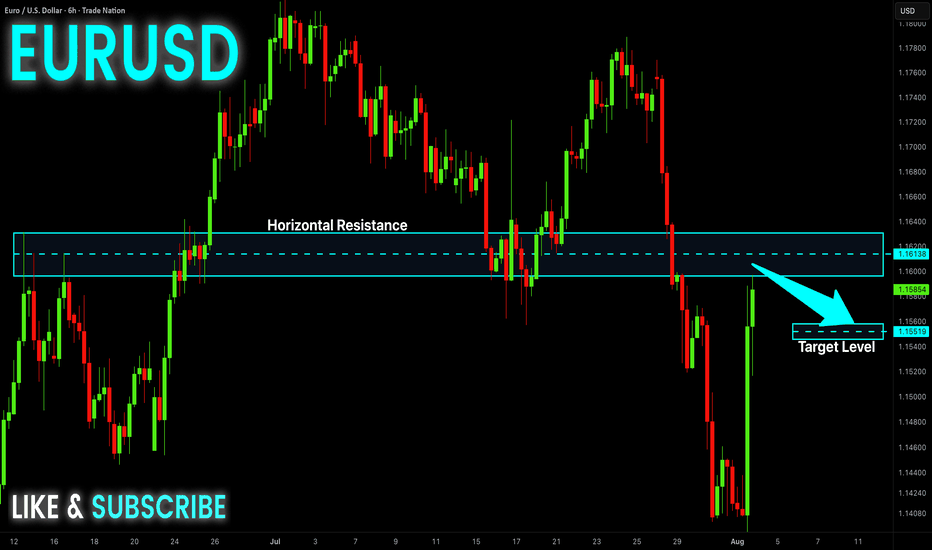

EUR-USD Will Fall! Sell!

Hello,Traders!

EUR-USD will hit the

Horizontal resistance of 1.1620

On Monday after making a

Powerful move up on Friday

And as the pair is locally

Overbought a local bearish

Correction is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD: Eu Looking to Make Gains Vs Weakened USDWelcome back to the Weekly Forex Forecast for the week of Aug 4 - 8th.

In this video, we will analyze the following FX market:

EURUSD

The USD pushed higher on keeping it's interest rate unchanged, but gave back those gains on weak job numbers. This allowed the EU to recover some of the previous weeks losses and show some resiliency.

Now analyst are betting there is a 66% chance for rate cuts in Sept by the Fed. This is negative for the USD, allowing the EURO to move higher.

It is worth mentioning, the EU inked a highly criticized tariff deal with the US, which was not at all positive for the currency.

The market is at a pivotal area that could go either way. Wait for a definitive break of structure before committing to a bias.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

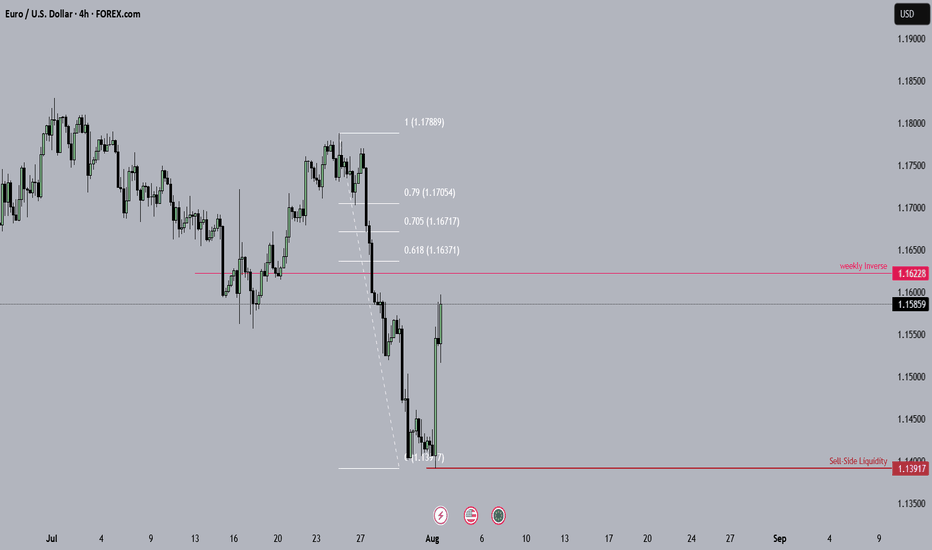

Fiber (EurUsd) Short Idea. Aug 4-8 This Idea wont be precise as my Last Euro Analysis, You can check that out on my Profile.

Now the what do i mean by it not being precise? it means that there is room for upside Movement But it should break that high (Fib high) and the target is Sell-Side Liquidity for this week Key Things in this charts are Liquidity gap, Breaker block IFVG weekly Inverse rejection block.

EURUSD: Strong Bullish Sentiment! Long!

My dear friends,

Today we will analyse EURUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1.15859 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 1.16494.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

EURUSD: Bears Will Push Lower

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the EURUSD pair which is likely to be pushed down by the bears so we will sell!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

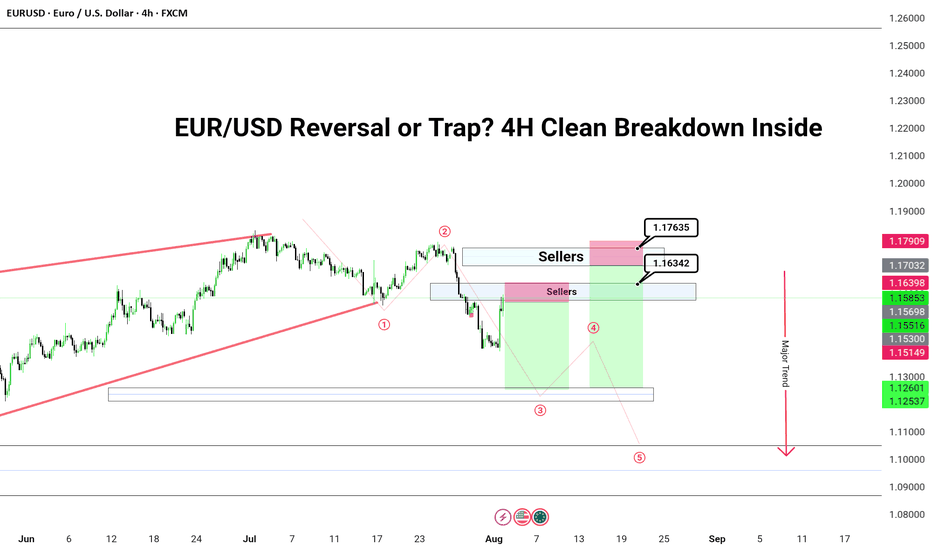

EUR/USD Reversal or Trap? 4H Clean Breakdown InsidePrice just tapped into a high-probability sell zone after a corrective Wave 2 structure. With sellers already active at 1.16342 and 1.17635, this setup is not just textbook—but a potential goldmine for swing traders.

🔻 Is this Wave 3 continuation about to begin?

🔍 Liquidity swept. Zones respected. Structure still bearish.

⚠️ Many traders will miss the bigger picture here—will you?

👇 Drop your thoughts:

Are we about to break 1.13000?

Do you agree with the Elliott Wave count?

What’s your bias on DXY?

💬 I personally reply to every comment—let’s build this chart together.

🔥 If you caught the entry, show your entry point and reasoning—let’s level up as a team.

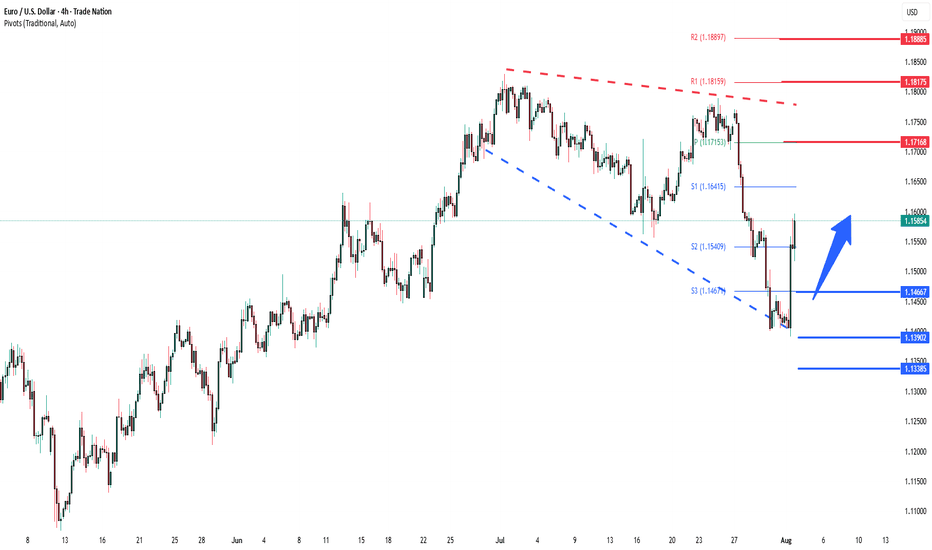

EURUSD The Week AheadKey Support and Resistance Levels

Resistance Level 1: 1.1716

Resistance Level 2: 1.1817

Resistance Level 3: 1.1885

Support Level 1: 1.1466

Support Level 2: 1.1390

Support Level 3: 1.1338

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.