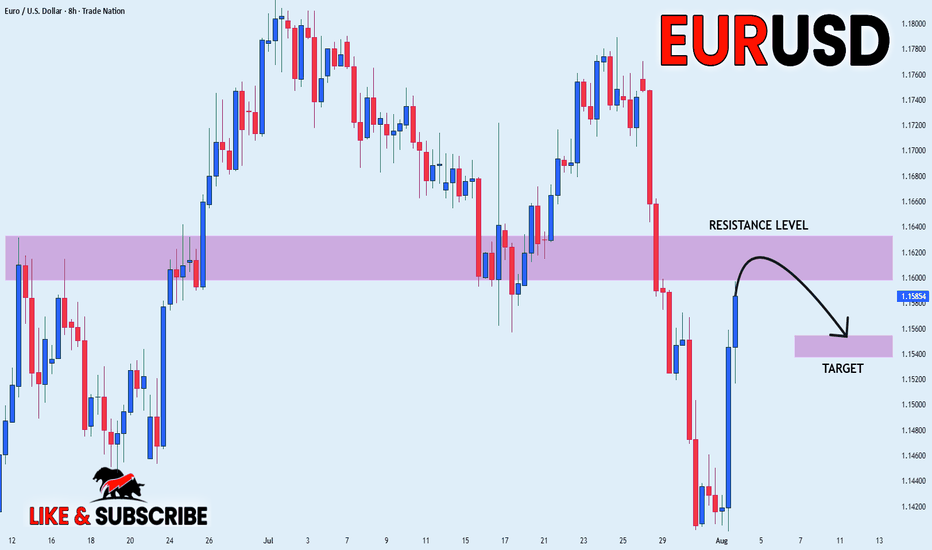

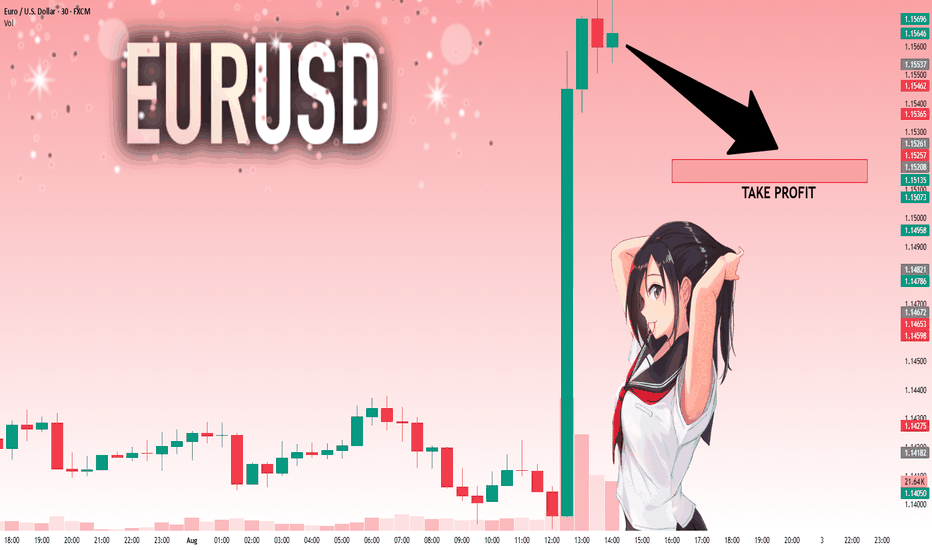

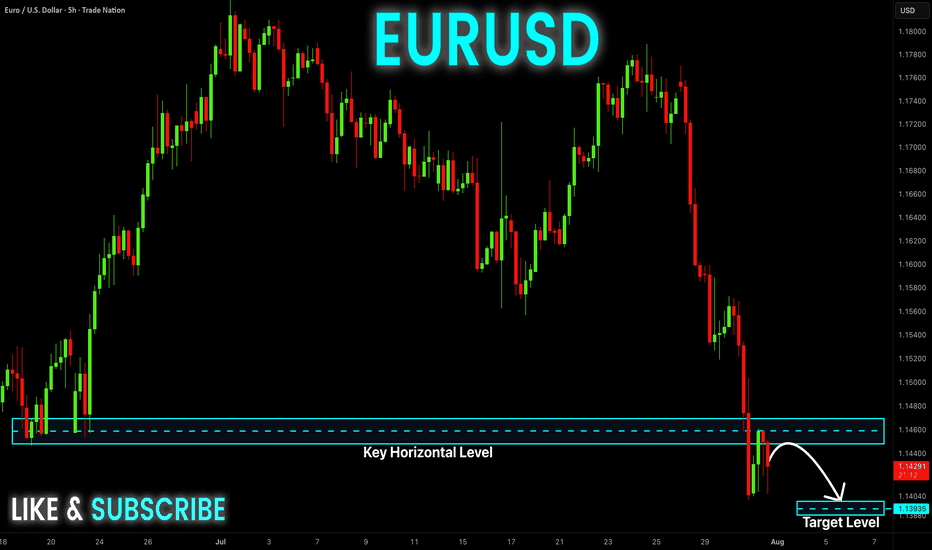

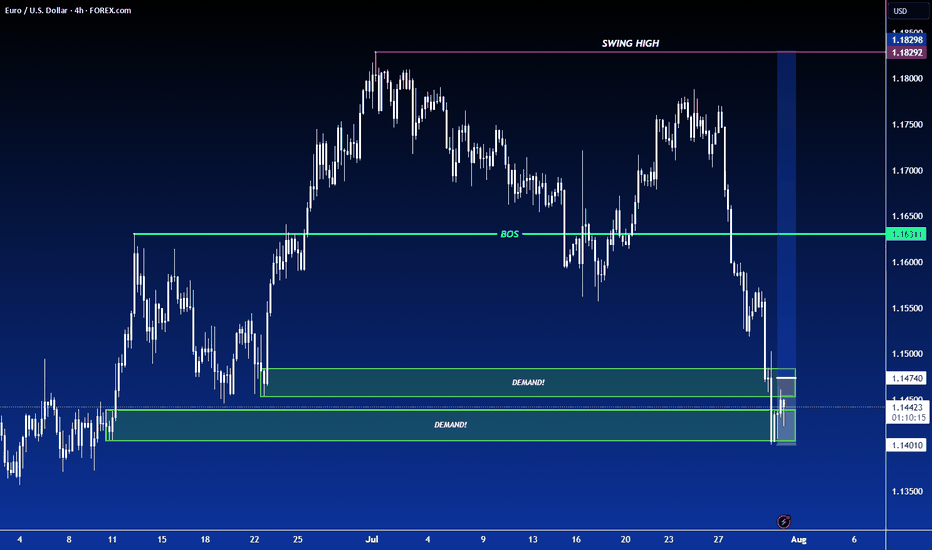

EUR_USD POTENTIAL SHORT|

✅EUR_USD has been growing recently

And the pair seems locally overbought

So as the pair is approaching

A horizontal resistance of 1.1632

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Eurusd-3

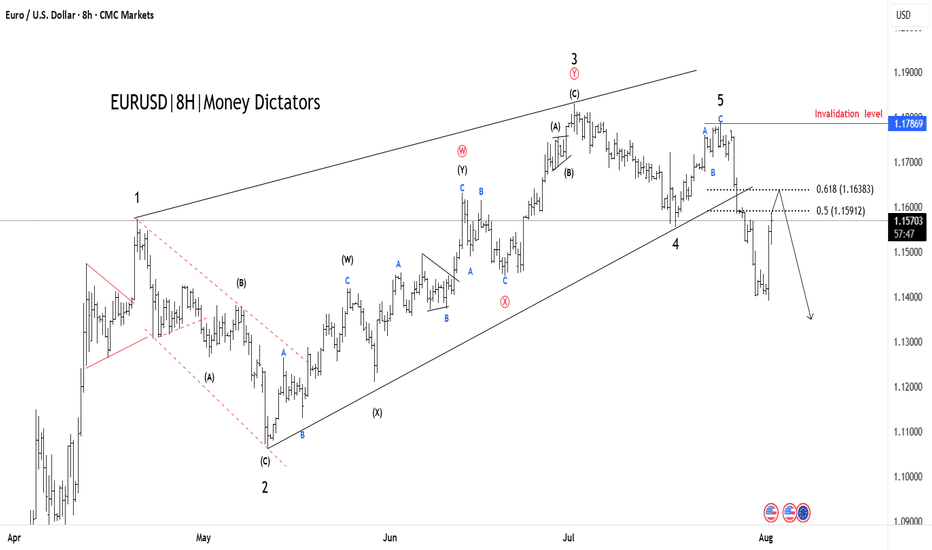

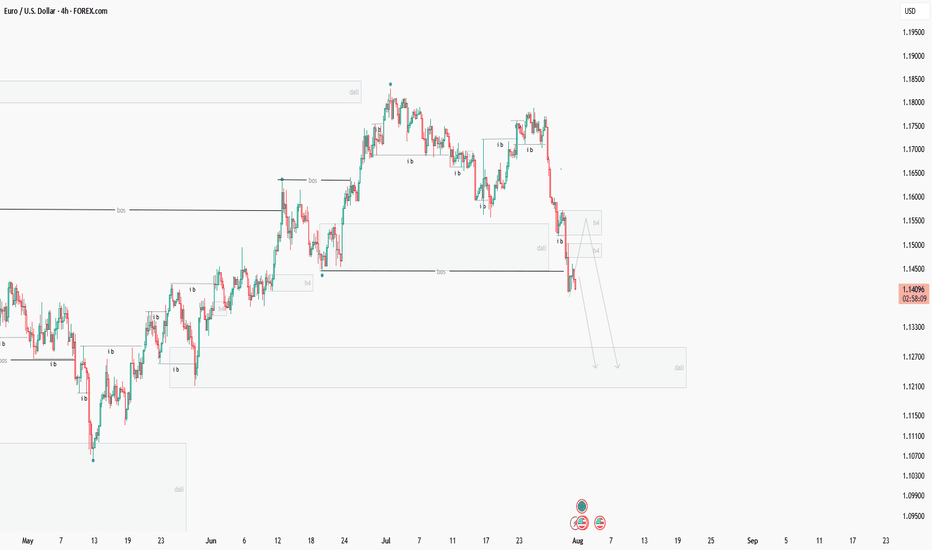

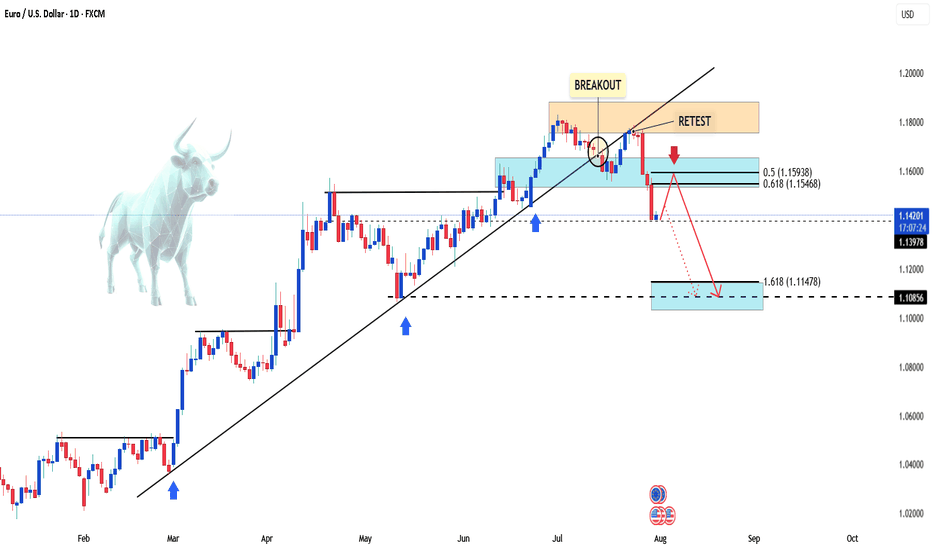

EUR/USD Elliott Wave Count Signals Downside TargetsThe EUR/USD chart is displaying a completed 5-wave Elliott impulse structure, suggesting the potential start of a larger corrective move to the downside. Wave 5 appears to have finished after a classic ending diagonal pattern, with price now breaking below the wave 4 support trendline — a strong confirmation of trend exhaustion.

Currently, price is retracing upward towards the 0.5–0.618 Fibonacci retracement zone of the last impulsive leg, around 1.15912–1.16383, which may serve as the final rejection zone for bears to re-enter. This area aligns perfectly with prior support-turned-resistance and is considered the potential reversal pocket.

If price holds below the 1.17869 invalidation level, the structure supports the beginning of an ABC correction or a larger bearish impulse.

Target 1 (T1): 1.14800

Target 2 (T2): 1.13915

Stop Loss (SL): 1.17869

This scenario remains valid as long as the price does not break above 1.17869. A clean break and close above this level would invalidate the bearish setup and suggest a possible wave extension.

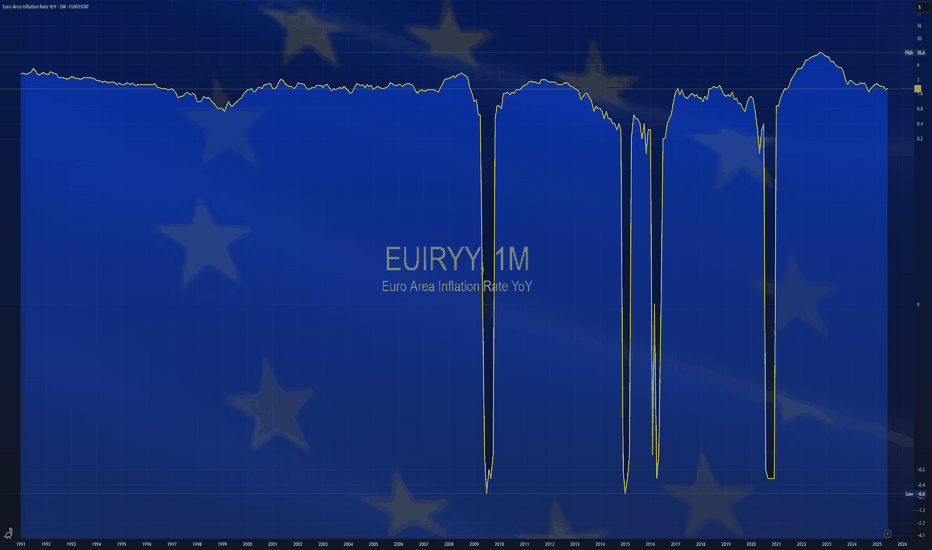

$EUIRYY -Europe CPI (July/2025)ECONOMICS:EUIRYY

July/2025

source: EUROSTAT

- Eurozone consumer price inflation held steady at 2.0% year-on-year in July 2025, unchanged from June but slightly above market expectations of 1.9%, according to preliminary estimates.

This marks the second consecutive month that inflation has aligned with the European Central Bank’s official target.

A slowdown in services inflation (3.1% vs 3.3% in June) helped offset faster price increases in food, alcohol & tobacco (3.3% vs 3.1%) and non-energy industrial goods (0.8% vs 0.5%).

Energy prices continued to decline, falling by 2.5% following a 2.6% drop in June.

Meanwhile, core inflation—which excludes energy, food, alcohol, and tobacco—remained unchanged at 2.3%, its lowest level since January 2022.

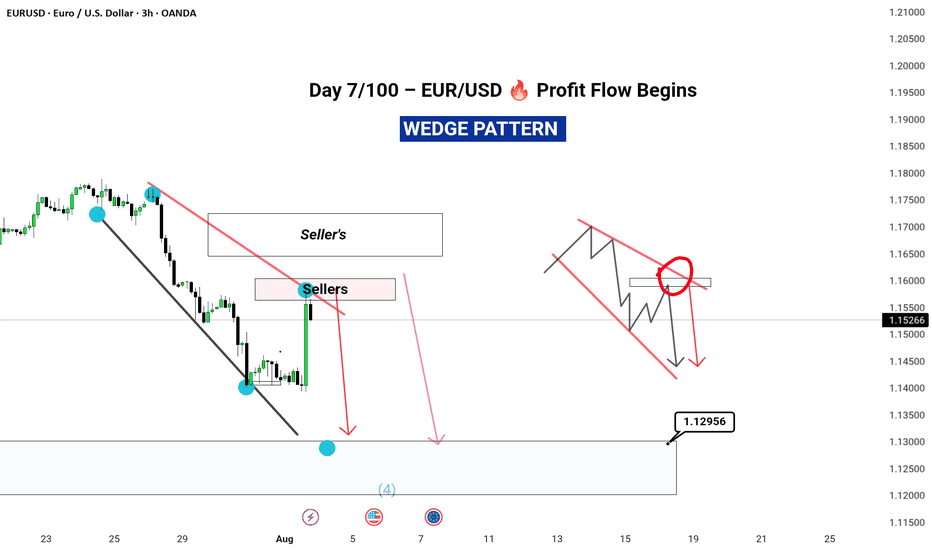

“Exactly What I Saw” promises value and transparency.

In today's analysis, I’ve identified a clear completion of Wave D, securing a 3% ROI across just two trades – all before the move unfolded.

🔍 What’s inside this breakdown?

• Multi-timeframe analysis: Weekly ➝ Daily ➝ 4H ➝ 1H

• Elliott Wave structure with confluence zones

• Trade psychology at key turning points

• Exact entry & exit insights explained

• Risk management for consistent returns

---

⚡ Highlights:

Precise reversal spotted before it was obvious

No indicator clutter – just clean, confident price action

Part of my 100-day breakdown series: real, raw, and repeatable setups

---

👣 Day 7 of 100 is just the beginning.

Tap Follow to stay ahead of the market – one wave at a time.

#EURUSD #ForexAnalysis #ElliottWave #Forex #TradingViewUK #SwingTrading #PriceAction #RiskReward #FXMindset #ForexTradersIndia #ForexEducation

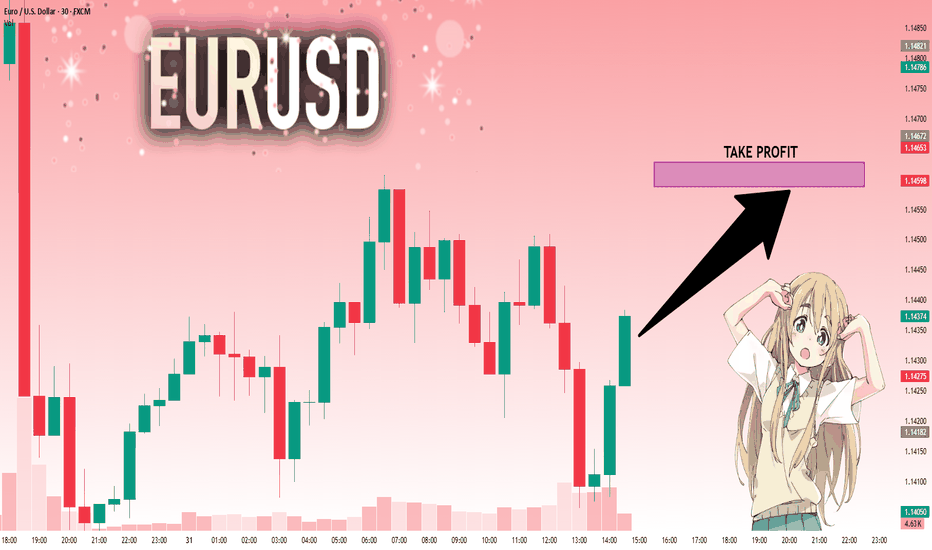

EURUSD: Move Down Expected! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1.15337 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 1.15208.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

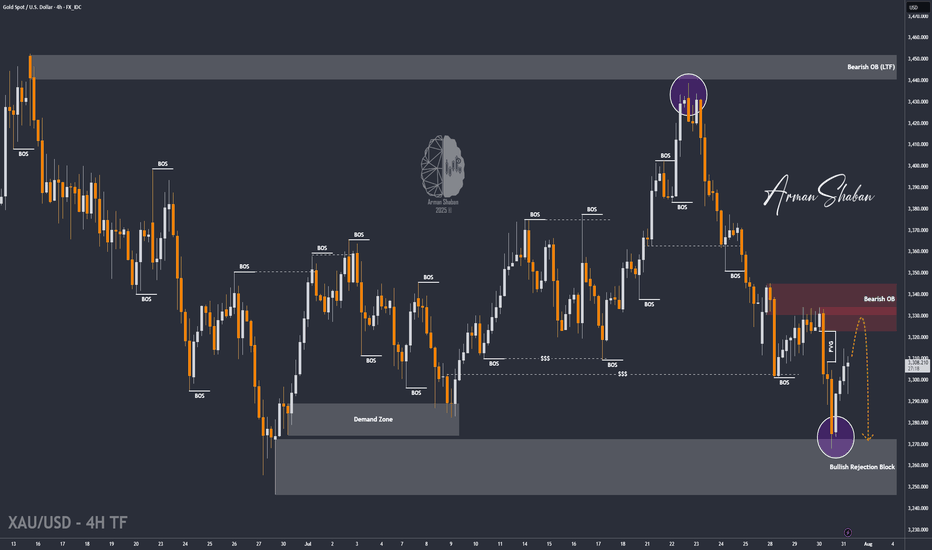

XAU/USD | Next Key Zone: Watch for Rejection at $3334! (READ)By analyzing the gold chart on the 4-hour timeframe, we can see that, just as expected, the price dropped from $3310 to $3288 in the first leg, where it hit a demand zone and bounced up to $3305, delivering a 170-pip rally. The main bearish move from $3333 to $3288 yielded 450 pips, bringing the total return on this analysis to over 620 pips!

In the second phase, gold dropped sharply again to $3268, and once more found demand, currently trading around $3307. If the price holds above $3294, we could expect further upside toward the $3322–$3334 zone. Once gold reaches this area, a strong bearish rejection is likely, with a potential return of 250 to 400 pips.

All key supply and demand levels are marked on the chart — make sure to monitor them closely and study the chart in detail. Hope you’ve made the most of this powerful analysis!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

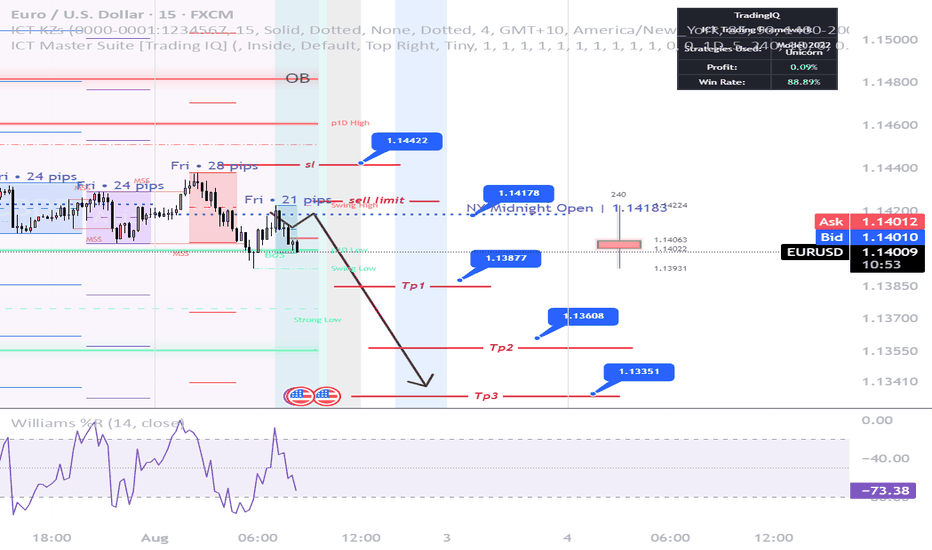

EURUSD – Smart Money Short Setup During NFP Friday | ICT Concept

EURUSD is trading inside a well-defined bearish structure after multiple internal liquidity sweeps during the London and Asia sessions.

As we enter the New York Killzone, price has returned to a bearish OB near the NY Midnight Open, with clear signs of exhaustion.

The pair failed to break above the Thursday OB zone, and the 15M chart shows consecutive MSS and BOS patterns, indicating supply is in control.

🧠 Trade Idea (Execution Plan):

Sell Limit: 1.14183

SL: 1.14422

TP1: 1.13877

TP2: 1.13608

TP3: 1.13351

📌 Confluence:

Bearish OB

NY Midnight Open rejection

MSS on LTF

RSI/Williams %R Overbought

📉 Structure: Bearish

🕒 Session: New York (NFP Volatility Expected)

💡 Context: USD is likely to strengthen after deep retracement into DXY OB, targeting 100.5–100.7

If price invalidates 1.14422 with bullish displacement, setup becomes void.

Patience is key during high-impact news – let Smart Money show their hand.

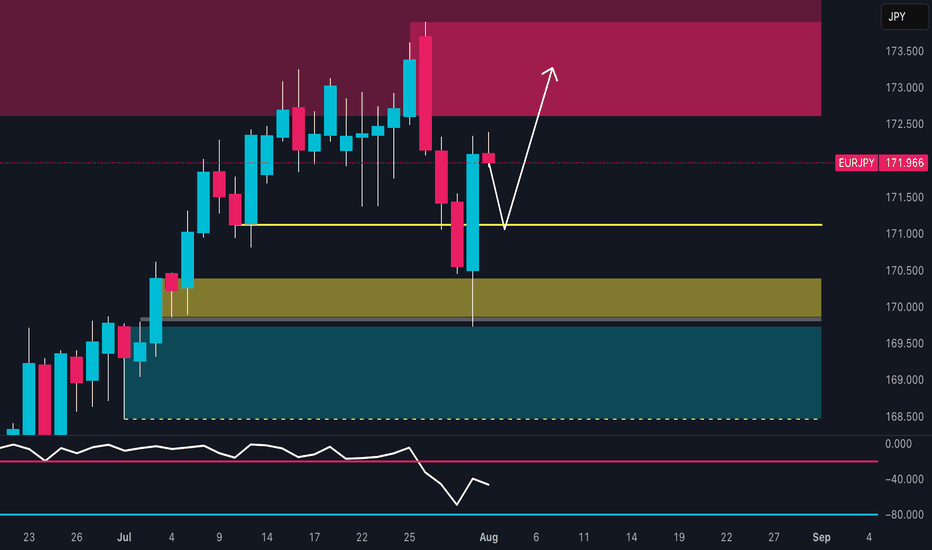

EUR/JPY Setup: Retail is 82% Short – Squeeze First, Drop After?🔹 Technical Context

Price reacted with a strong bullish wick in the 169.50–170.30 demand zone, signaling clear buyer defense. The RSI bounced from weakness but remains subdued, showing limited momentum.

📍 Current price action suggests a potential retest of the 172.50–173.30 area, which aligns with a supply zone, before a possible directional decision is made.

🗓️ Seasonality

Historically, August tends to be bearish for EUR/JPY:

5Y average: -0.48%

10Y average: -0.12%

15Y/20Y averages: -1.3% and -1.2%

📉 Seasonality indicates potential weakness, especially in the second half of the month.

🪙 COT Report (EURO & YEN) – July 22

EURO: Strong long accumulation by non-commercials (+6,284) and commercials (+17,575)

JPY: Net decline in both longs (-1,033) and shorts (-4,096), with a drop in total open interest

🧠 The market is heavily positioned on the Euro, while Yen positioning is fading. This creates a divergence between the two currencies, favoring a short-term technical bounce on EUR/JPY, though downside risks remain in the mid-term.

📉 Sentiment

82% of retail traders are short EUR/JPY

Volume: 1,564 lots short vs 352 lots long

📣 This extreme sentiment imbalance suggests a potential short-term squeeze against retail traders.

📊 Market Mood & DPO

Overall mood: Neutral

DPO at -9.0, Wyckoff score below 50

Momentum remains weak, but not showing a clear divergence.

🧩 Operational Summary

Retest of the 172.50–173.30 supply zone

Likely exhaustion in that area

Ideal setup: rejection + bearish confirmation

→ Targets: 170.30, then 169.00

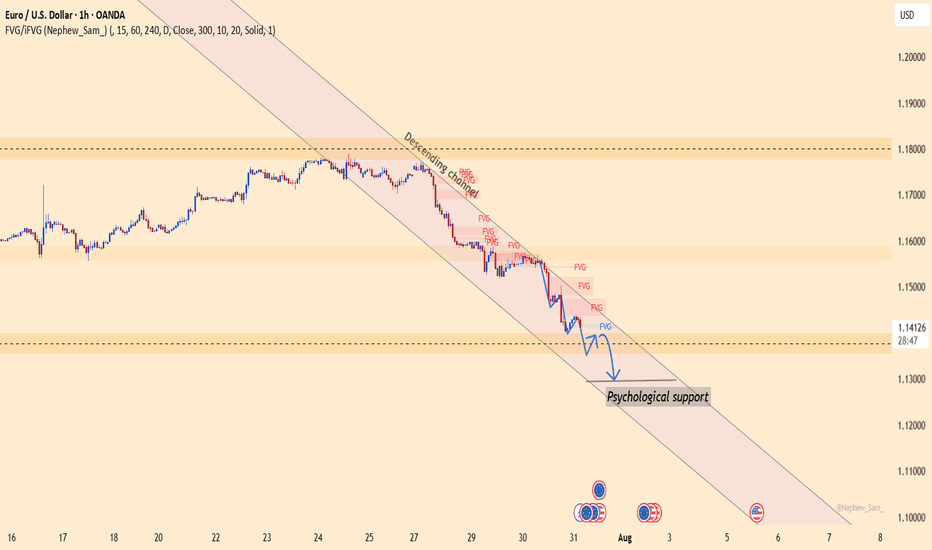

EURUSD plunges without brakes – The bears take full control!EURUSD continues its steep decline as both macroeconomic and technical pressures mount. A trade deal unfavorable to the EU, combined with the Fed’s hawkish stance, has fueled USD strength and dragged the euro sharply lower. At the same time, strong U.S. labor data and rising employment costs further reinforce the bearish outlook.

On the H1 chart, EURUSD is clearly moving within a descending channel. Key price zones have been broken with no significant bullish reaction, indicating that sellers remain firmly in control. The market is heading toward a psychological support area, with no signs of reversal as RSI stays weak.

I remain biased toward SELL setups on any short-term pullbacks, avoiding countertrend trades in this environment. If downside momentum continues, deeper targets may still be ahead.

In a market dominated by bearish sentiment, trading with the trend remains the smartest and safest approach.

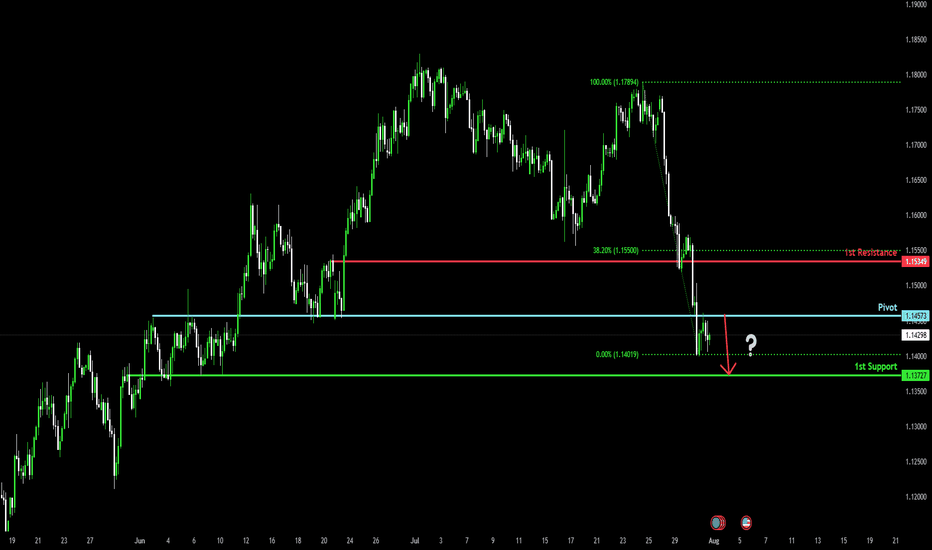

Bearish drop?The Fiber (EUR/USD) has rejected off the pivot and could potentially drop to the 1st support, which acts as an overlap support.

Pivot: 1.1457

1st Support: 1.1372

1st Resistance: 1.1534

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

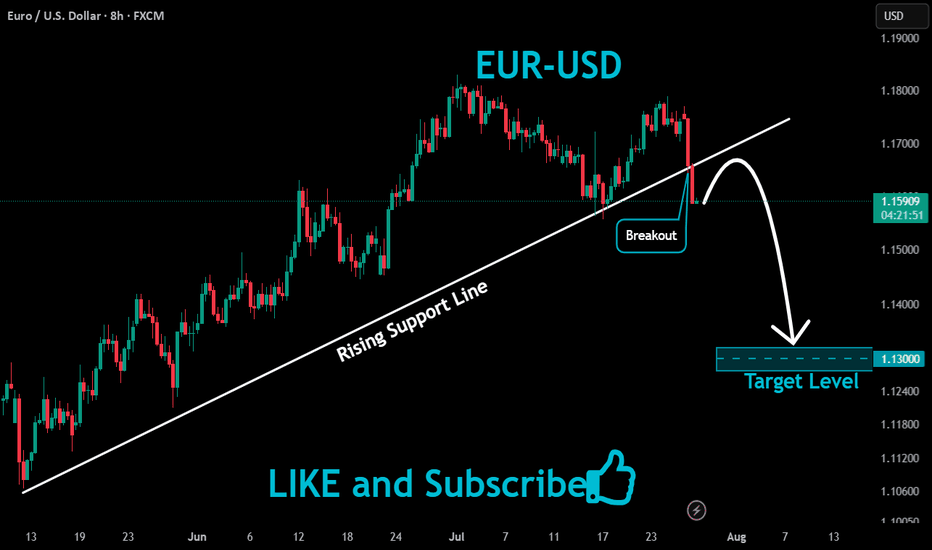

EUR-USD Bearish Breakout! Sell!

Hello,Traders!

EUR-USD made a bearish

Breakout of the key horizontal

Level of 1.1460 then made

A retest and a pullback so

We are bearish biased and

We will be expecting a

Further bearish continuation

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD: The Market Is Looking Up! Long!

My dear friends,

Today we will analyse EURUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1.14350 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 1.14588.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

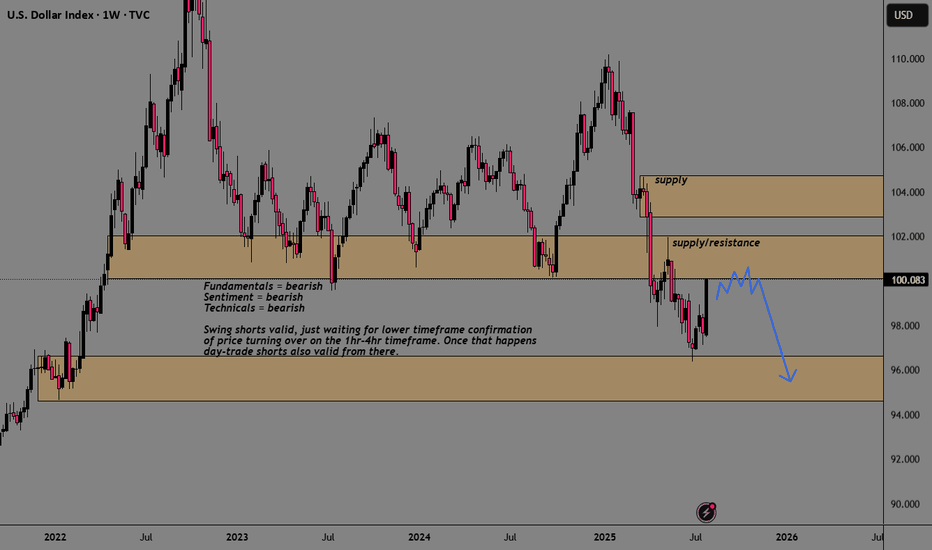

DXY USDOLLAR CRASH Incoming!Long-term fundamentals are bearish

Long-term sentiment = bearish

Long-term technicals = bearish

Trump wants a weaker dollar + FED injecting endless amounts of cash into the markets

driving stocks/ gold up, and the dollar down, losing purchasing power.

My plan is to look for shorts on the 1hr-4hr timeframe with lower timeframe confirmation.

Once price starts turning over, day-traders can join in.

Agree or disagree?

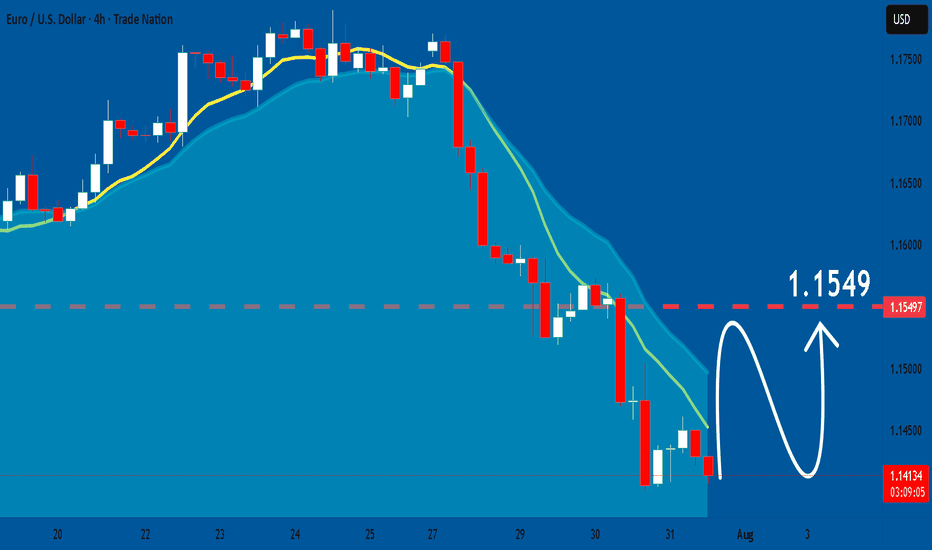

EURUSD: Will Start Growing! Here is Why:

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current EURUSD chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

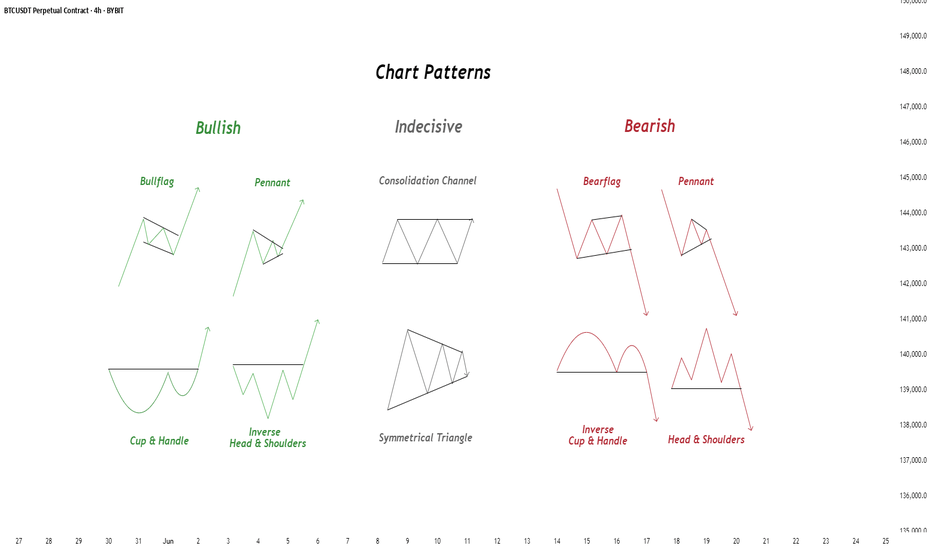

Chart Patterns - How to read them like a ProChart patterns are visual formations on price charts that help traders anticipate potential market movements.

These patterns fall into three main categories: bullish , bearish , and indecisive .

---

1. Bullish Chart Patterns

Bullish patterns often signal that price is likely to move upward.

1.1 Bull Flag

* What it looks like: A sharp upward move followed by a small downward-sloping rectangle (the flag).

* Meaning: After a strong rally, the price consolidates briefly before continuing higher.

* Key insight: A breakout above the flag typically signals a continuation of the trend.

1.2 Pennant (Bullish)

* What it looks like: A strong upward move followed by a small symmetrical triangle.

* Meaning: Similar to the bull flag, but the consolidation takes a triangular form.

* Key insight: Once price breaks above the pennant, the uptrend often resumes.

1.3 Cup & Handle

* What it looks like: A “U”-shaped curve (the cup) followed by a small downward drift (the handle).

* Meaning: This pattern suggests a period of accumulation before price breaks higher.

* Key insight: A breakout above the handle signals the beginning of a new bullish leg.

1.4 Inverse Head & Shoulders

* What it looks like: Three low points, with the middle low being the deepest.

* Meaning: This reversal pattern appears after a downtrend and signals a potential change to an uptrend.

* Key insight: A breakout above the “neckline” confirms the reversal.

---

2. Indecisive Chart Patterns

These patterns show market hesitation, where neither bulls nor bears are clearly in control.

2.1 Consolidation Channel

* What it looks like: Price moves within a horizontal channel.

* Meaning: Market is moving sideways with no strong trend.

* Key insight: A breakout in either direction often leads to a significant move.

2.2 Symmetrical Triangle

* What it looks like: Two converging trend lines forming a triangle.

* Meaning: This is a neutral pattern that can break out in either direction.

* Key insight: Traders wait for a breakout before taking a position.

---

3. Bearish Chart Patterns

Bearish patterns signal a high probability of downward price movement.

3.1 Bear Flag

* What it looks like: A sharp decline followed by a small upward-sloping rectangle.

* Meaning: After a strong drop, price consolidates before continuing lower.

* Key insight: A breakout below the flag suggests a continuation of the downtrend.

3.2 Pennant (Bearish)

* What it looks like: A sharp downward move followed by a small symmetrical triangle.

* Meaning: Similar to the bear flag, but the consolidation takes a triangular form.

* Key insight: A breakout downward typically resumes the bearish trend.

3.3 Inverse Cup & Handle

* What it looks like: An upside-down cup with a small upward drift forming the handle.

* Meaning: Indicates weakness after an uptrend, often followed by a drop.

* Key insight: A break below the handle usually signals a strong bearish move.

3.4 Head & Shoulders

* What it looks like: Three peaks, with the middle one being the highest.

* Meaning: A classic reversal pattern that indicates a potential shift from an uptrend to a downtrend.

* Key insight: A break below the “neckline” confirms the bearish reversal.

---

How to Use These Patterns

* Combine pattern recognition with support/resistance, volume, and indicators for stronger confirmation.

* Always wait for breakouts and avoid acting too early.

* Manage risk with stop-loss orders.

LONG ON EUR/USDEUR/USD is currently at a major demand level after sweeping sell side liquidity.

The Dxy (Dollar) is overall bearish. I expect the dollar to fall and EUR/USD to rise to the previous high / supply level for over 200-300 pips.

News most likely will affect this pair in terms of volatility.

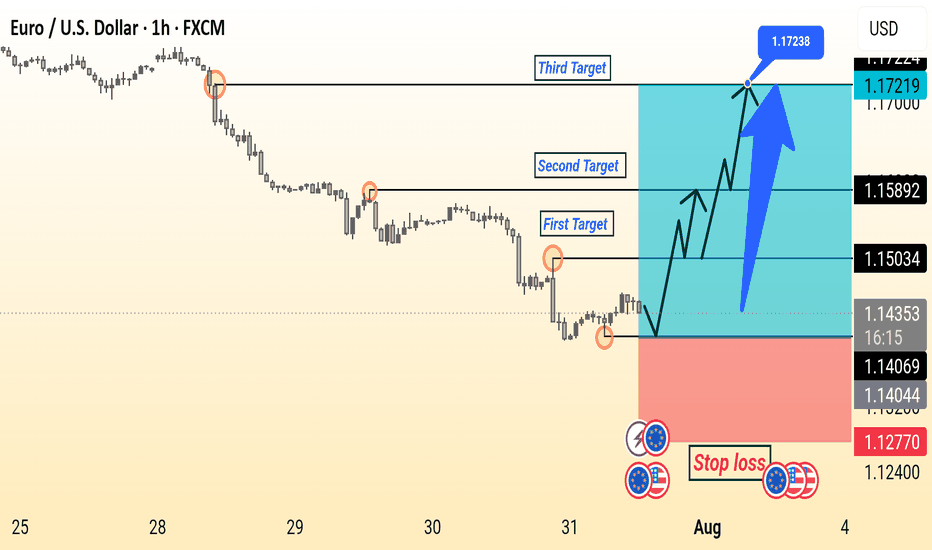

EUR/USD Setup Is Ready This is a bullish EUR/USD (Euro/US Dollar) 1-hour chart analysis. The setup indicates a potential upward reversal after a downtrend, supported by a series of higher lows.

Key elements:

Entry Point: Around 1.14044–1.14376.

Stop Loss: Placed below the recent low at 1.12770 to manage risk.

Targets:

First Target: 1.15034

Second Target: 1.15892

Third Target: 1.17238

The chart suggests a buy setup with a risk-reward strategy, aiming for a breakout and continuation towards higher resistance levels. The large upward arrow emphasizes bullish momentum expectations.

EURUSD – Retest Failed, Bearish Pressure RemainsHello, what’s your take on FX:EURUSD ?

After breaking the trendline, EURUSD attempted a retest but failed. The price is now hovering around 1.142, with selling pressure still evident.

This setup targets the 1.618 Fibonacci extension zone around 1.114. In the short term, a correction based on Dow Theory may unfold — the marked area could offer a perfect selling opportunity.

💡 Priority: SELL on RETEST – strict risk management with clear TP and SL.

Now it’s your turn — what’s your view? Share it in the comments below.

Good luck!

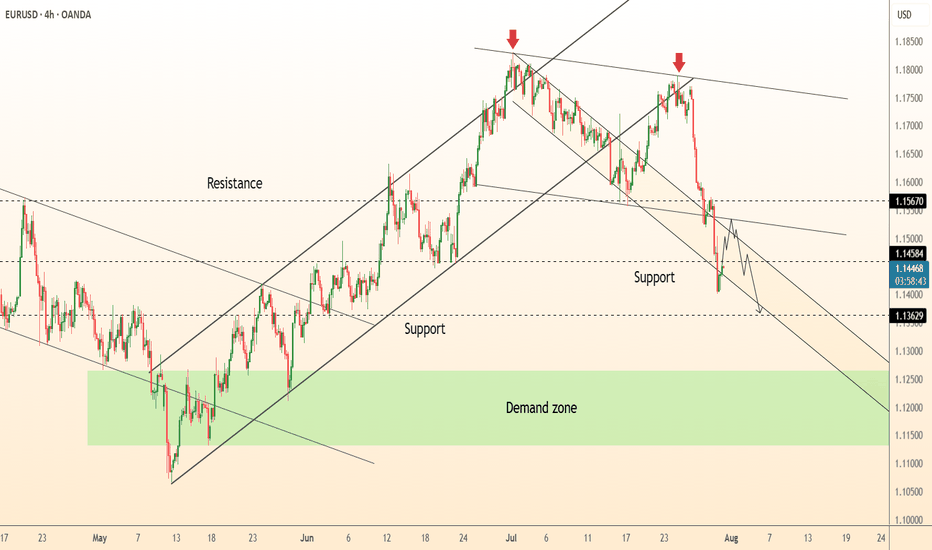

DeGRAM | EURUSD dropped below the support level📊 Technical Analysis

● EURUSD confirmed a double rejection below long-term resistance with two lower highs and broke channel support at 1.1567.

● Price is now trending within a descending channel toward 1.1363, with lower targets pointing into the 1.12–1.11 demand zone.

💡 Fundamental Analysis

● US Q2 GDP surprised to the upside, reinforcing the Fed’s hawkish tone, while Eurozone CPI inflation cooled below forecast.

● Diverging central bank trajectories continue to widen yield differentials in favor of the dollar, sustaining bearish euro flows.

✨ Summary

Short bias confirmed below 1.1567. Break of 1.1450 opens path to 1.1363 ➜ 1.1200 zone. Watch for rallies to fade below trendline.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

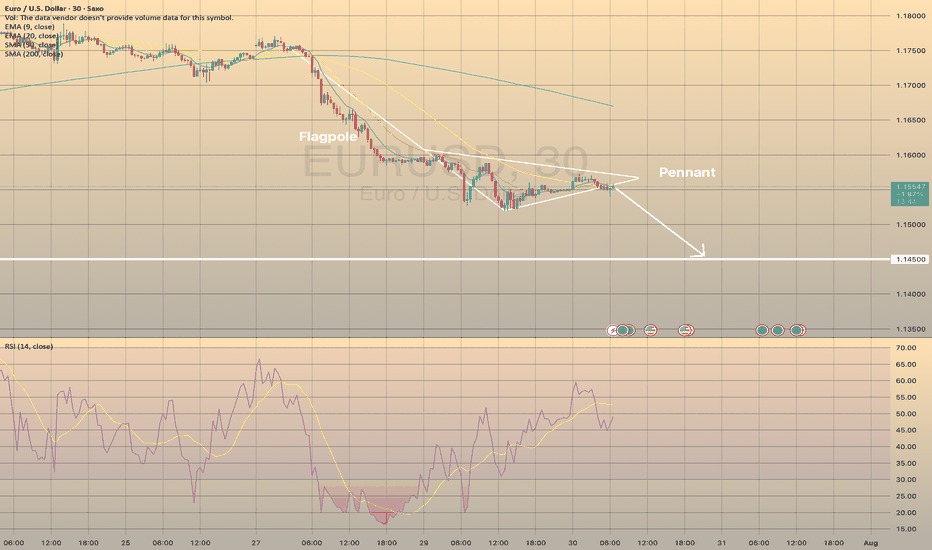

EURUSD FORMED BEARISH PENNANT. THE PRICE IS READY TO DROP.EURUSD FORMED BEARISH PENNANT. THE PRICE IS READY TO DROP.

EURUSD has been trading sideways within the last day, showing lower highs and higher lows. Eventually, the price has formed the pennant chart pattern.

What is a pennant?

A pennant chart pattern is a short-term continuation pattern in technical analysis, resembling a small symmetrical triangle, formed after a strong price movement (flagpole). It consists of converging trendlines, indicating a brief consolidation before the trend resumes. Bullish pennants form after an uptrend, bearish pennants after a downtrend.

The price is expected to decline towards 1.14500 support level