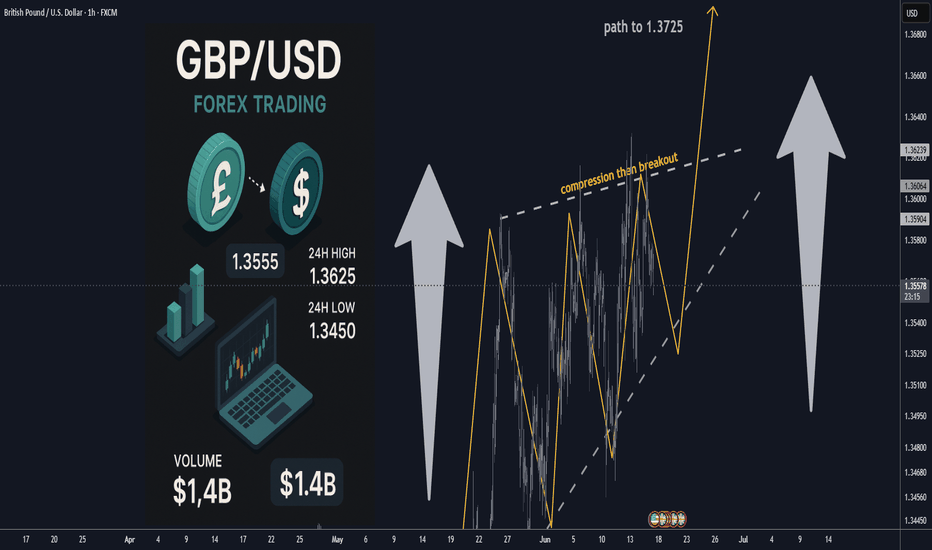

GBPUSD H1 compression BUY/HOLD TP1 +100 TP2 +200 pips low risk🏆 GBPUSD Market Update

📊 Technical Outlook

Short-term: BULLS active; resistance forming mid‑1.3600s, consolidation below 1.3600s

Mid-term: Neutral to slight bullish bias; bulls seek 1.3600–1.3700/1.3730 zone

Status: Narrow trading range (tight band) ahead of key UK CPI, Fed & BoE meetings

🔥 Latest Forex Updates

GBP/USD is consolidating in a narrow range around the mid‑1.3500s ahead of this week’s UK CPI and central bank meetings.

The pair holds defensive below 1.3600, with dovish BoE bets capping gains while the Fed is expected to stand pat.

GBP/USD sits near a 40‑month high (~1.3600), boosted by geopolitical risk tone, but lacking momentum to break much higher.

GBP/USD hit ~1.3600 after rebounding from 1.3515 amid renewed Middle East tensions and a weaker US dollar.

Live charts show a mild bullish tilt, awaiting central bank outcomes.

💡 Trade Recommendation

Buy GBPUSD at 1.3530 (recommended entry near 1.3530)

Take Profit at 1.3730 → +200 pips profit target

Stop Loss: 50 pips (around 1.3480)

This trade aligns with the current structure: shallow dip followed by rebound, positioning ahead of central bank catalysts. Momentum above resistance could propel GBP/USD toward 1.3730.

📌 Market Overview

Metric Details

Current Price ~1.3565–1.3600

24H Range 1.3515–1.3600

Central Event Risks UK CPI (Wed), US Retail Sales & Fed (Wed), BoE (Thu)

Geopolitical Middle East tension supports USD weakness, aiding GBP

📈 Forecast Highlights

Support Levels: ~1.3530 (100‑period SMA), ~1.3460, ~1.3425

Resistance Levels: 1.3600, 1.3630 static ceiling, followed by ~1.3700–1.3730 for bulls

🧭 Final Take

GBP/USD sits in a tight range, awaiting central bank clarity. The recommended long trade at 1.3530 aims to capitalize on upside momentum toward 1.3730, supported by technical confluence and a softer USD. Manage risk with a 50‑pip stop loss.

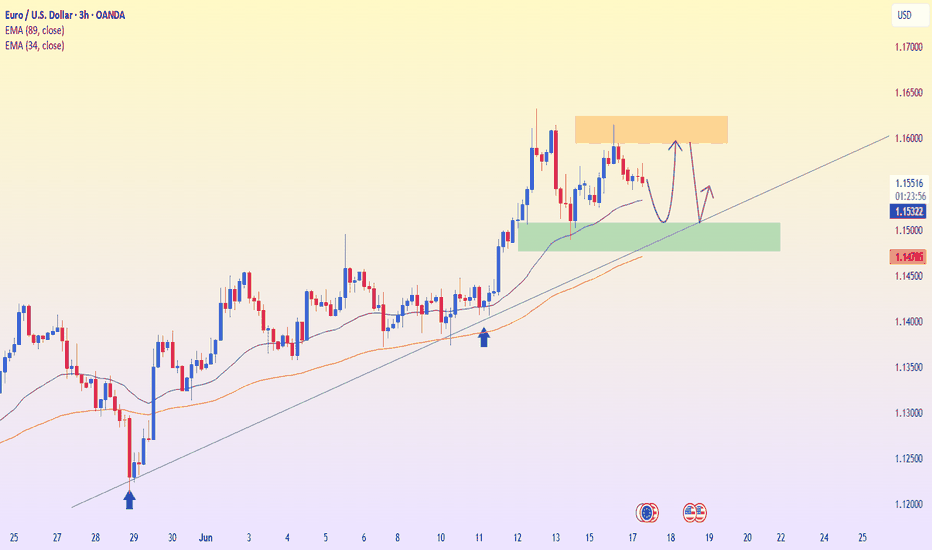

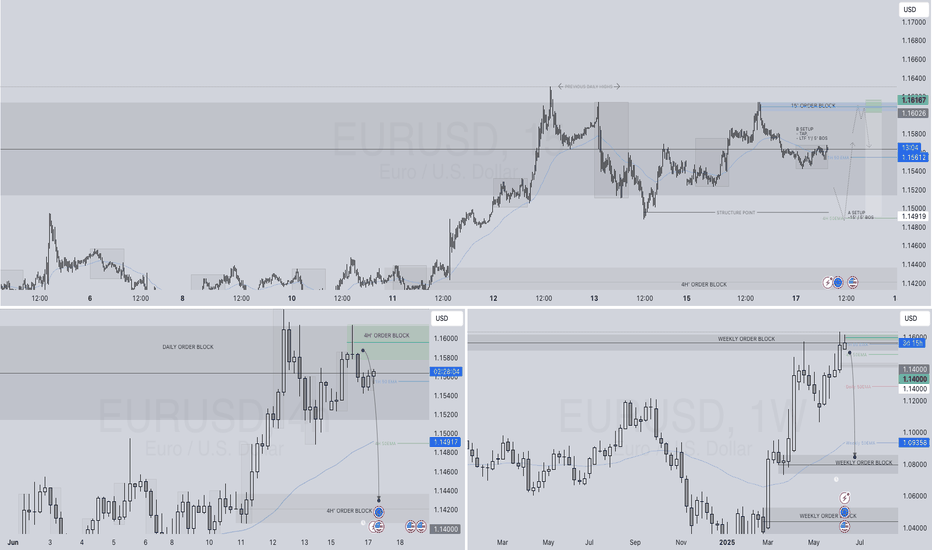

Eurusd-4

EURUSD – Healthy pullback within a strong uptrendEURUSD is undergoing a temporary correction after a strong bullish move, but the pair remains above key technical support levels such as the EMA34 and the ascending trendline. The 1.15070 zone now acts as a potential buy area—where demand may return if confirmation signals appear.

Market sentiment is leaning toward the expectation that the Fed may cut interest rates soon due to weaker-than-expected U.S. retail sales data, which has weighed on the USD and indirectly supported the euro. Meanwhile, the ECB continues to maintain a stable policy stance, further reinforcing the current bullish trend.

If the price holds above the green support zone, the next target could be around 1.15940. If this support breaks, traders should watch price behavior at the trendline before making the next trading decision.

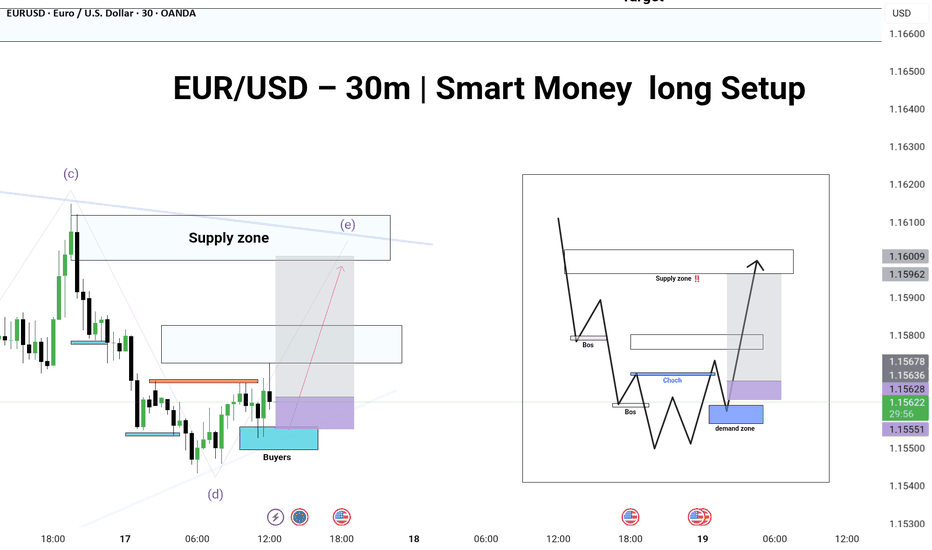

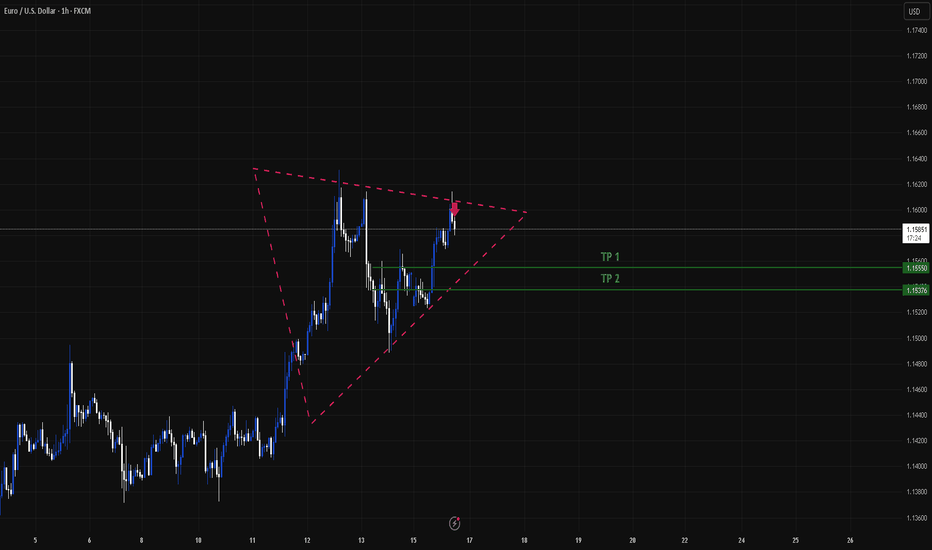

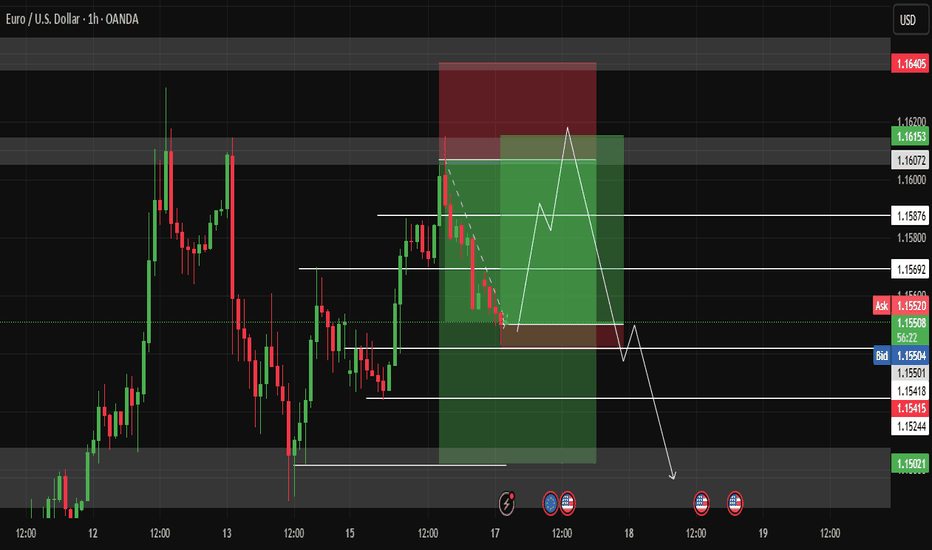

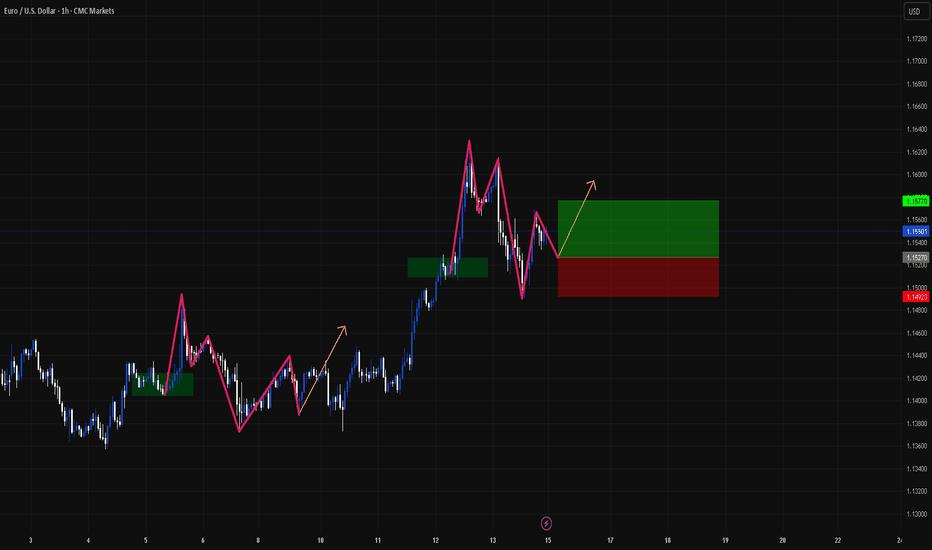

EUR/USD – 30m | Smart Money long SetupPair: EUR/USD

🔹 Timeframe: 30-Minutes

🔹 Confluence Strategy: Elliott Wave + Smart Money Concepts (SMC)

🔹 Pattern: Ending Triangle (Wave e) + CHoCH + BOS

🔹 Published on: June 17, 2025

---

🧠 Analysis Summary:

1. Wave (e) of triangle nearly complete — signs of liquidity grab at the low.

2. CHoCH formed after internal structure break – a bullish signal.

3. Demand zone successfully mitigated, showing buyer reaction.

4. BOS confirms intent to shift bullish structure.

5. Clear imbalance/fair value gap filled before move.

---

🎯 Next Move Projection:

Entry Zone: 1.1562–1.1565 (Demand Area)

Target: 1.1596–1.1600 (Supply Zone Resistance)

Invalidation: Clean break below 1.1555 low (demand fails)

---

📌 Trade Bias:

✔️ Bullish — Expecting price to tap into supply zone and potentially reverse.

⚠️ Monitor lower timeframes (5m–15m) for rejection signs near 1.1600.

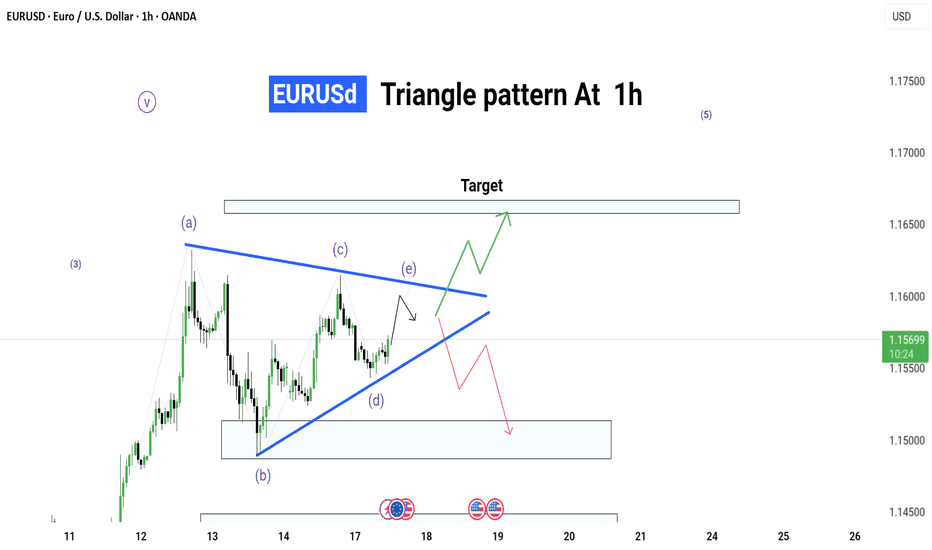

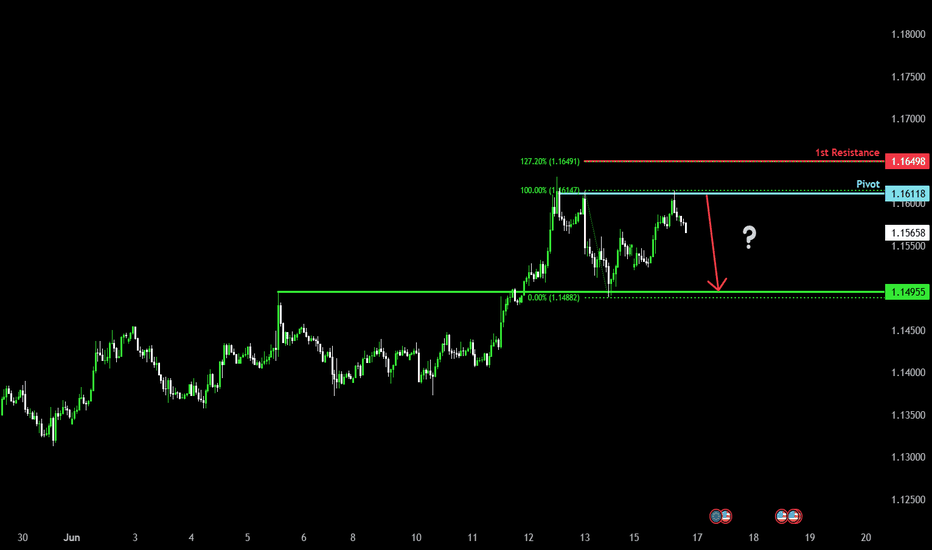

EUR/USD Triangle Pattern – 1H Timeframe

📊 EUR/USD Triangle Pattern – 1H Timeframe

🕐 Date: 17 June 2025

📌 Chart by: GreenfireForex

🔷 Pattern: Contracting Triangle (ABCDE)

🔍 Context: Forming inside Wave (4) – possible breakout before Wave (5)

📈 Upside Potential: Break above triangle → target near 1.16500+

📉 Downside Risk: If fails to break up → revisit demand zone around 1.15000

---

🔮 Possible Scenarios:

✅ Bullish Breakout:

Breaks above wave (e)

Clean rally toward target zone

Ideal for a long setup with tight SL

❌ Bearish Fakeout:

Rejection from triangle resistance

Falls back into demand zone

Look for reversal or retest opportunities

---

🎯 Strategy Tips:

Wait for a breakout candle

Use SL outside triangle zone

Entry based on confirmation – avoid early trades

💬 Let’s discuss live market reaction as price nears triangle edge. Stay ready .

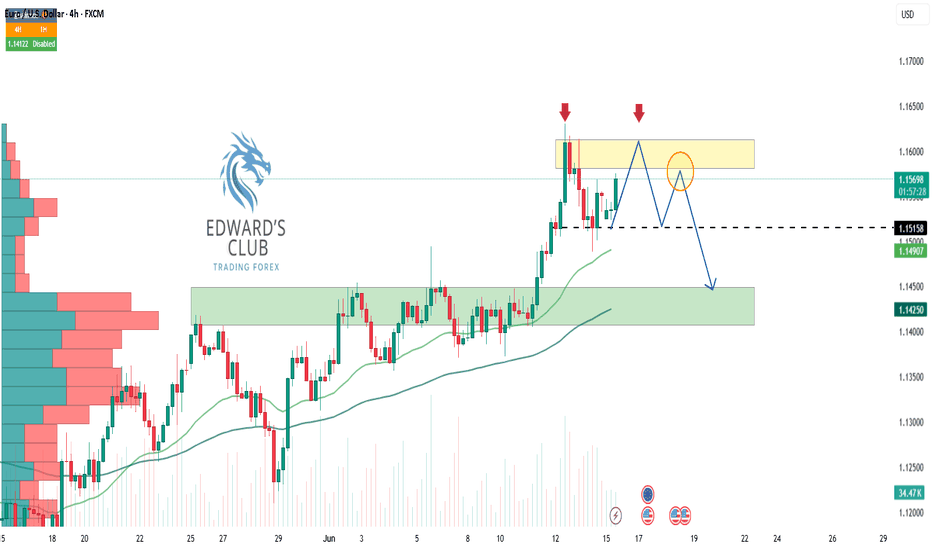

EURUSD SHORT FORECAST Q2 W25 D17 Y25EURUSD SHORT FORECAST Q2 W25 D17 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅15' order block

✅4 hour order block identified

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

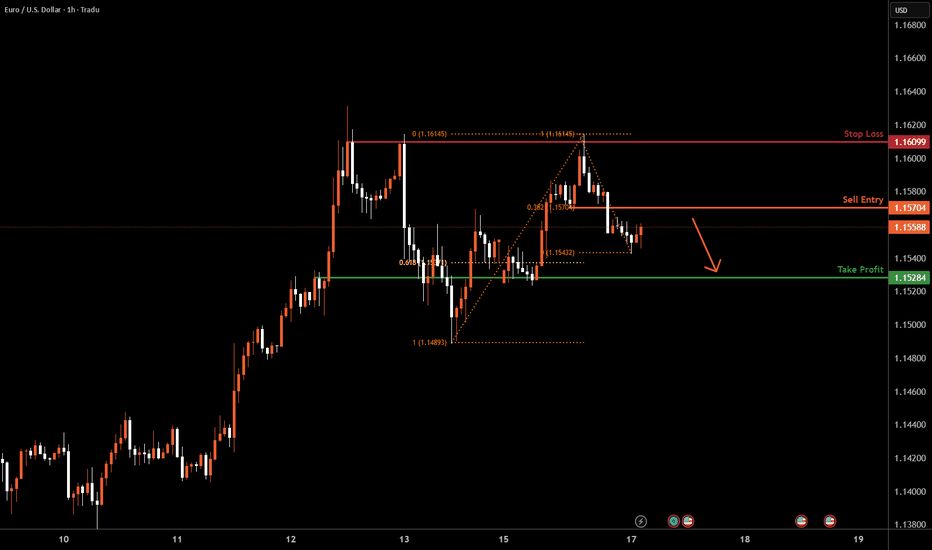

EURUSD H1 I Bearish Reversal Based on the H1 chart analysis, we can see that the price is rising toward our sell entry at 1.1570, which is a pullback resistance aligning with a 38.2% Fib retracement.

Our take profit will be at 1.1528, an overlap support level.

The stop loss will be placed at 1.1609, a multi-swing high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

EUR/USD Slips — Setup or Selloff?EUR/USD kicked off the week under pressure, hovering near 1.1540 during the Asian session. The drop comes as the U.S. dollar regains strength, driven by safe-haven demand amid rising geopolitical tensions in the Middle East.

In times like these, the greenback shines — and riskier currencies like the euro naturally take a hit. If the situation escalates further, the pair could extend its decline in the near term.

But let’s flip the perspective: while some see risk, others see opportunity. This dip might just be the pullback that buyers have been waiting for — especially if the fundamentals shift or tensions ease. Timing, as always, is everything.

EURUSD Long Setup – Bullish Rejection from Demand ZoneEURUSD remains supported by strong eurozone fundamentals and broad USD softness. The pair has retraced into a key demand zone around 1.1490 and is showing signs of bullish rejection. With the Fed likely to pause further rate hikes and the ECB maintaining a steady tone, the bias favors further upside toward recent highs.

⚠️ Geopolitical tensions in the Middle East (Israel-Iran conflict) have introduced mild safe haven demand, but so far the USD has underperformed versus the euro, suggesting EUR remains relatively insulated.

Watch for confirmation and entries within the blue demand box.

🔍 Technical Analysis:

Structure: Clear uptrend with higher highs and higher lows. Price retraced to a well-defined 1H demand zone between 1.1490–1.1500.

Setup: Anticipating a bounce from the demand zone targeting the recent high near 1.1620–1.1630.

Entry Zone: 1.1490–1.1500 (bullish reaction area)

Target: 1.1620–1.1630 (previous supply zone)

Stop Loss: Below 1.1439 (recent swing low)

Risk-Reward Ratio: Approximately 1:2.5

🧠 Fundamental Context (as of June 16):

EUR Bias: Bullish – ECB has paused cuts; euro is resilient despite geopolitical headwinds.

USD Bias: Bearish – Fed is on pause; soft inflation data and geopolitical risks weigh on dollar strength.

Key Drivers:

Fed dovish tone (FOMC pause, lower CPI)

Strong EU resilience despite global tensions

CHF and JPY attracting safe haven flows over USD

📅 Key Events to Watch:

US Core PCE (next major inflation readout)

FOMC commentary and Fed speakers

Eurozone CPI and sentiment data

Bearish drop?The Fiber (EUR/USD) has rejected off the pivot and could drop to the 1st support.

Pivot: 1.1611

1st Support: 1.1495

1st Resistance: 1.1649

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

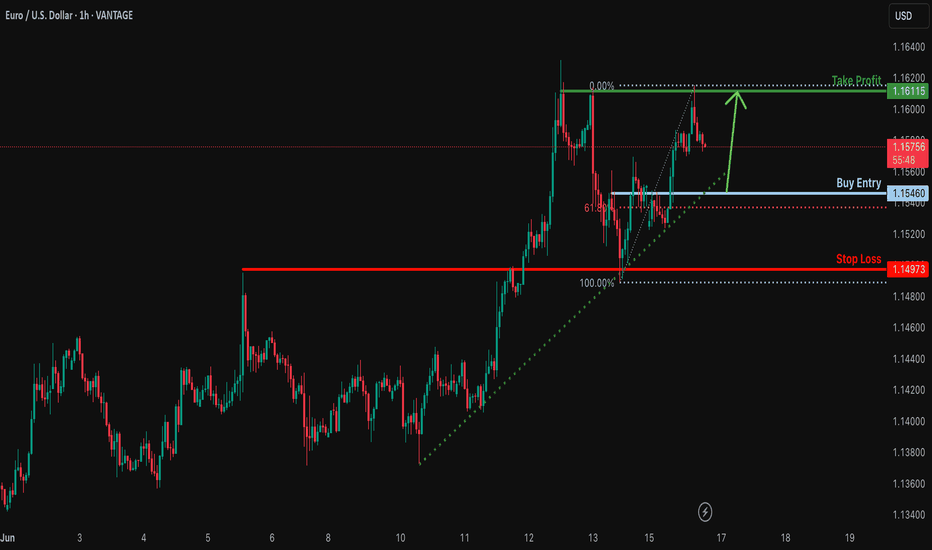

Bullish bounce?EUR/USD is falling towards the support level which is a pullback support that is slightly above the 61.8% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.1546

Why we like it:

There is a pullback support level that is slightly above the 61.8% Fibonacci retracement.

Stop loss: 1.1497

Why we like it:

There is an overlap support level.

Take profit: 1.1611

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

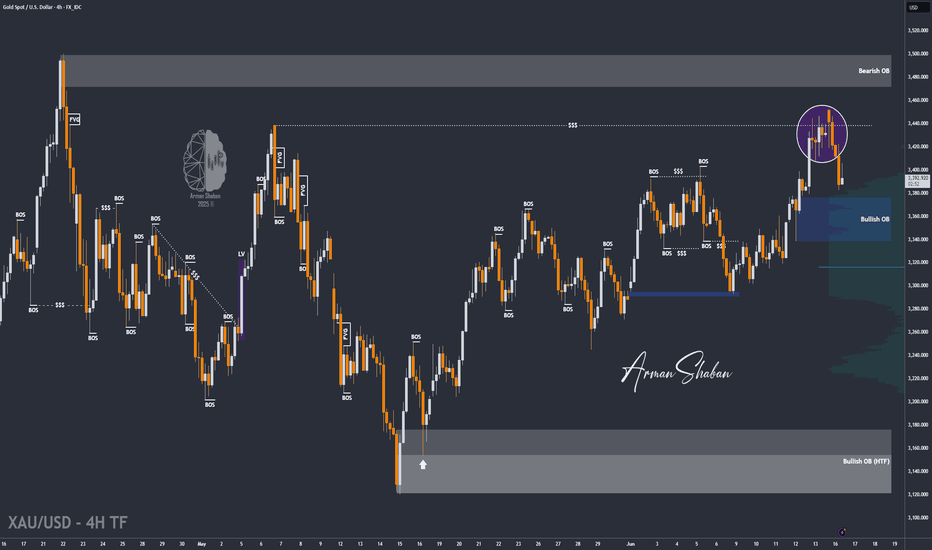

Gold Cooling After Spike – $3375 Key Level to WatchBy analyzing the gold chart on the 4-hour timeframe, we can see that after surging to $3450 amid the Iran–Israel conflict, gold faced a pullback following a liquidity sweep above that level.

Currently, gold is trading around $3392, and after a potential correction down to $3375, I expect to see further upside movement.

⚠️ Stay cautious — gold remains highly volatile and sudden moves are likely!

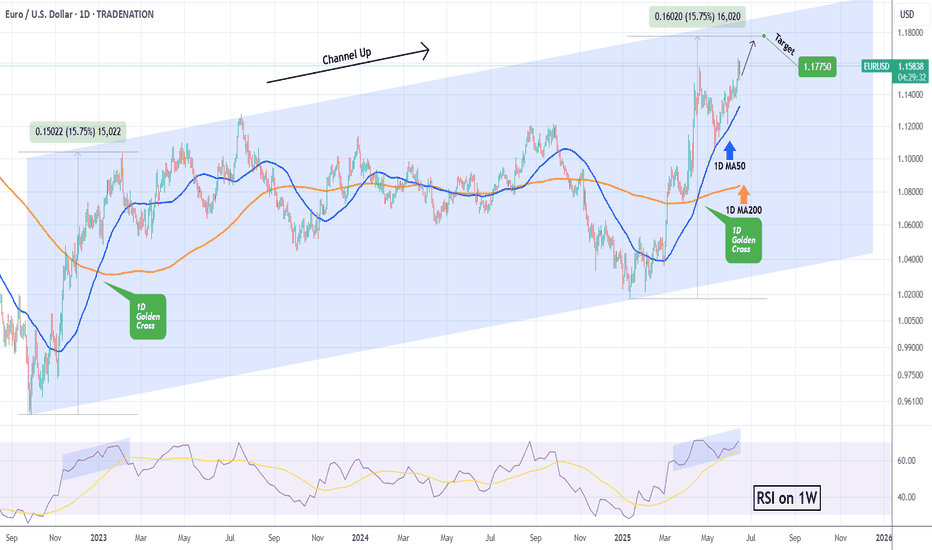

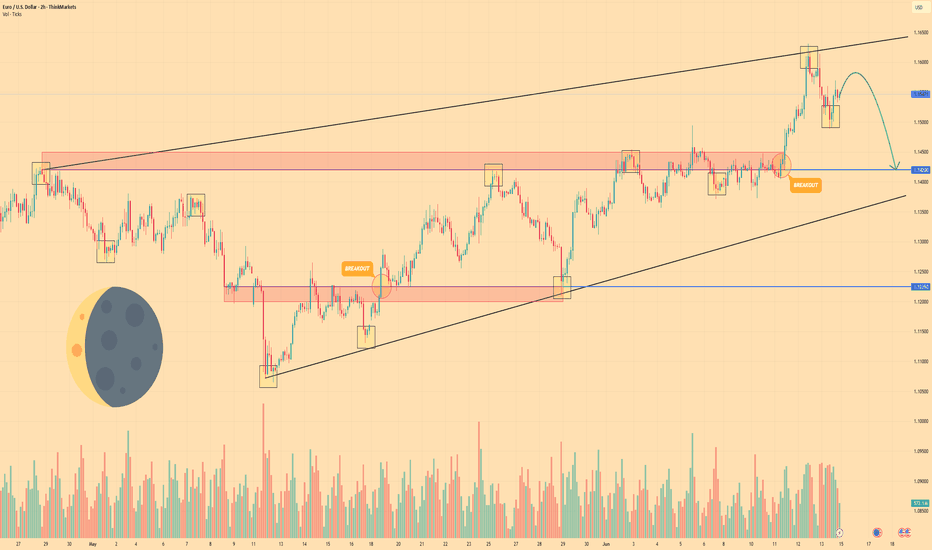

EURUSD Last push before correction.The EURUSD pair made a new High by breaking above the 1.15725 Resistance and is extending the rally since the January 13 2025 Low. That Low was the Higher Low of the multi-year Channel Up, so the current uptrend is technically its latest Bullish Leg.

The first Bullish Leg of that pattern peaked after a +15.75% rise. We expect a similar peak for the current rally, thus targeting 1.17750, before a new pull-back below the 1D MA50 (blue trend-line).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

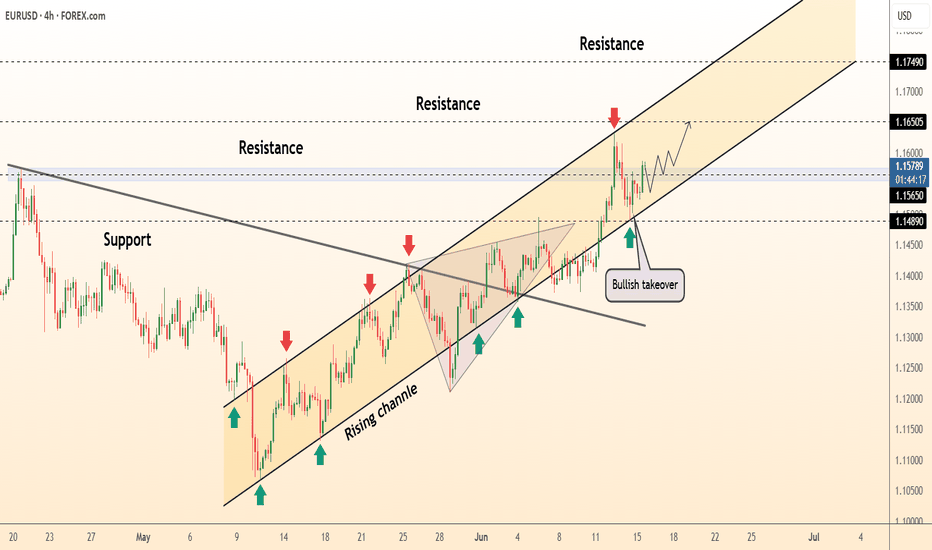

Testing Upper Channel Line || Eyes on 1.16 and Previous High📌 EURUSD 4H – Testing Upper Channel | Eyes on 1.1600-1.1666

🕓 June 12, 2025

👤 By: MJTrading

🔍 Technical Overview:

EURUSD continues its upward trajectory within a clean ascending channel, respecting both dynamic structure and EMA support zones. We're now retesting a key confluence area:

==============================================================

🔻 Bearish Setup Idea:

Entry Zone: 1.1570–1.1600

Stop Loss: Above 1.16666 (round number & psychological resistance)

Target: Channel midline (~1.1450) or lower band (~1.1380)

🧠 Why This Zone Matters:

🔺 Previous Swing Highs: Price is revisiting the April peak zone (~1.1570)

🧱 Round Number Confluence: 1.1600 & 1.1666

📉 Rising Channel Resistance: Upper boundary hit after extended leg

🔄 Potential Mean Reversion: EMAs are lagging behind price

⚠️ Invalidation:

A clean break and close above 1.1700 with follow-through may invalidate short bias and signal continuation toward 1.1800+

💬 Patience is power. Let the levels do the talking.

📎 #EURUSD #ForexAnalysis #TechnicalTrading #SmartMoney #PriceAction #RoundNumberLevels #MJTRADING

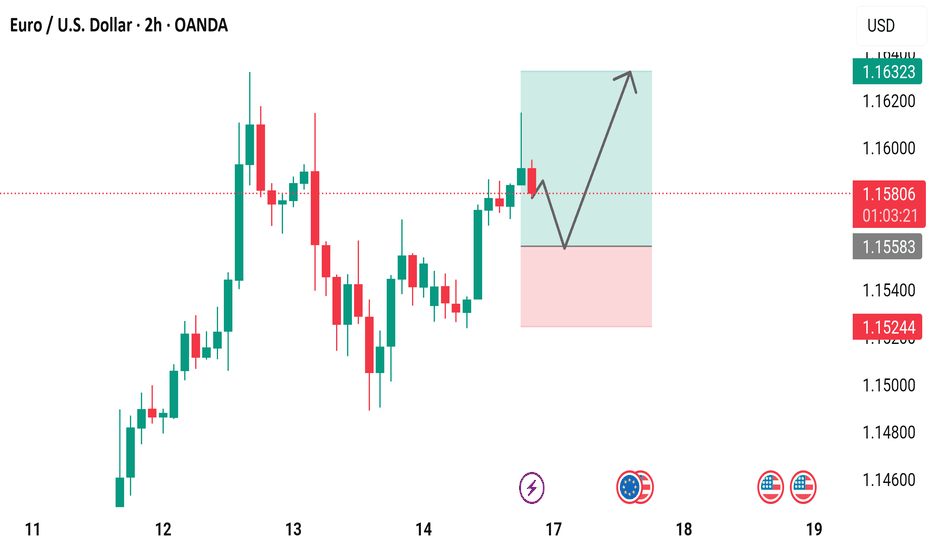

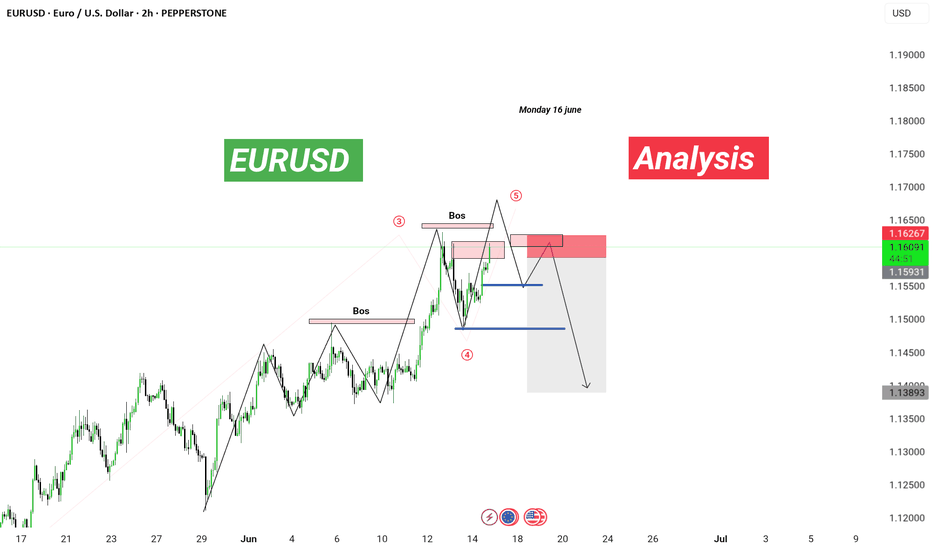

EURUSd a big move down

📉 EUR/USD Analysis | 2H Timeframe

Wave 5 in play! 🚨

Structure shift confirmed with BOS at key supply zone. Expecting liquidity sweep and a bearish reversal 📉

🧠 Smart Money + Elliott Wave Combo:

🔹 BOS at Wave 3 ✅

🔹 Wave 4 retracement held

🔹 Anticipating Wave 5 top-out and reversal

🔹 Targeting major demand zones (blue lines)

🔻 Potential Sell Setup Loading…

📆 Monday, 16 June | 2H Chart

🔍 PEPPERSTONE: EUR/USD

💬 Drop your thoughts below or DM “WAVE” to learn this strategy!

—

🔖 #eurusd #forexanalysis #elliottwave #smartmoneyconcepts #forextrader #fxsignals #technicalanalysis

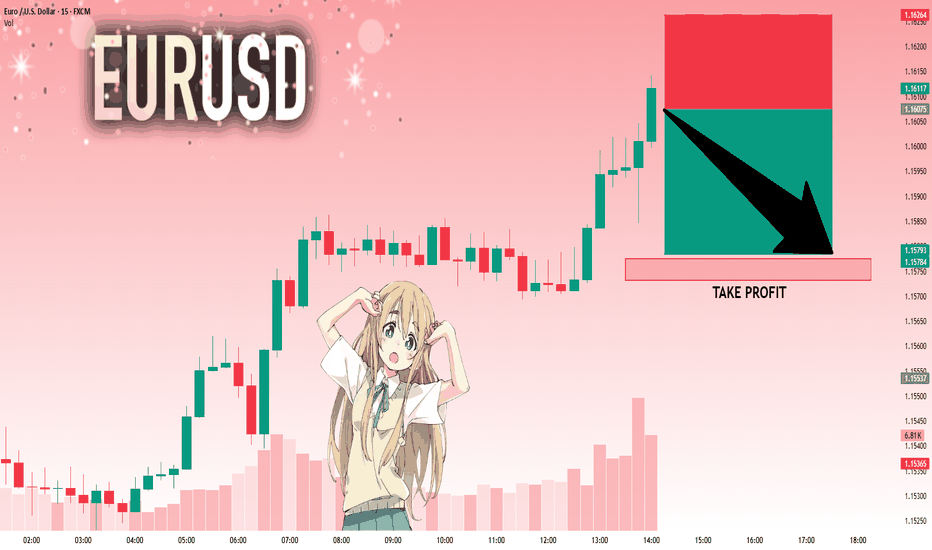

EURUSD: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The market is at an inflection zone and price has now reached an area around 1.16075 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 1.15775..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

EURO - Pirce can make movement up and then drop to $1.1420Hi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

After entering the wedge, Euro began to slow down, creating a tightening structure between support and resistance.

Price corrected toward the support line of the wedge, where it briefly paused and bounced with weak momentum.

The bounce triggered a breakout above local resistance, but buyers failed to hold the price at higher levels.

Soon after, the market reversed from the wedge’s upper boundary and began forming a bearish rejection pattern.

Now price trades just below the recent highs, showing fading demand and early signs of short-term reversal.

I expect Euro to move lower and reach the $1.1420 support level — my current target in this scenario.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

EURUSD 1H. for 50 pips! :)Hello dear traders, this is EURUSD with Nika.

I want to share you this idea, with buy on limit perspective.

We may see this previous and current pattern are strong in connection.

So that's my opinion, about how we may receive some price movement.

It's good trading idea only in low budget. :)

Thank you!

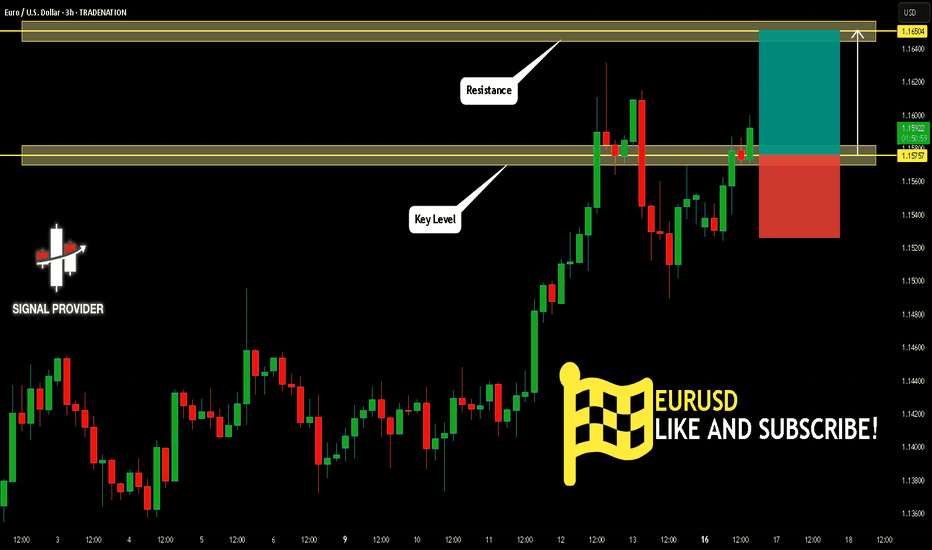

EURUSD Is Bullish! Long!

Here is our detailed technical review for EURUSD.

Time Frame: 3h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 1.157.

The above observations make me that the market will inevitably achieve 1.165 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

DeGRAM | EURUSD fixed above the lower boundary of the channel📊 Technical Analysis

● Euro keeps stair-stepping along the inner trend-line of the 2-month rising channel; each dip to the line (green arrows) is met with higher lows, confirming firm demand around 1.1485-1.1500.

● Friday’s break back above the former wedge cap turned 1.1550 into support; clearing the last swing high at 1.1605 would expose the channel median / fib cluster at 1.1650, with the upper rail near 1.1745 as an extension.

💡 Fundamental Analysis

● Softer US retail-sales and a slump in NY Fed manufacturing pulled Treasury 2-yr yields under 4.70 %, while ECB speakers warned that further cuts “are not a given,” narrowing the rate gap and reviving euro bids.

✨ Summary

Long 1.1520-1.1560; hold above 1.1550 targets 1.1650 ➜ 1.1745. Bias void on an H4 close below 1.1480.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EURUSD 16 June – Technical Rebound or Liquidity Trap? EURUSD 16 June – Technical Rebound or Liquidity Trap?

The EURUSD pair has shown sharp movements after testing key resistance near 1.1607. While the price action may appear bullish at first glance, deeper analysis suggests we might be facing either a continuation of the uptrend or a strategic liquidity hunt.

🌍 Macro & Fundamental Overview

The ECB remains hawkish with rates still high, but recent commentary hints at a more dovish tone possibly leading to rate cuts in late Q3 2025.

Meanwhile, the Federal Reserve maintains its cautious stance, holding off on rate cuts due to sticky core inflation.

This divergence in policy expectations creates a neutral to slightly USD-favorable bias, depending on upcoming economic data.

⏳ Bottom line: EURUSD remains in a choppy environment with compression–expansion cycles, and no confirmed macro-driven trend yet.

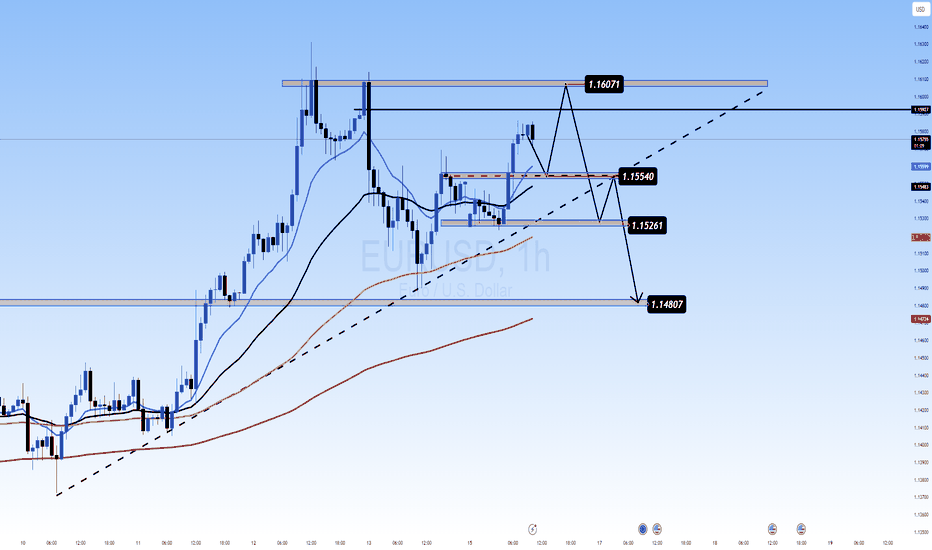

📉 Technical Outlook (H1 Chart)

Price Structure: The pair is moving within a short-term ascending channel, but current price is testing the upper boundary.

EMA Analysis (13/34/89/200): Still supports an uptrend, but flattening out — potential bearish crossover if price fails to hold.

Key Resistance:

1.1607: Major resistance and local top (double rejection zone).

Critical Support Zones:

1.15540: Minor structural support — a decisive level for intraday direction.

1.15261 & 1.14807: Unfilled FVG zones and liquidity pools that may get targeted if the price breaks lower.

🎯 Trade Setup Ideas

📘 Scenario A – BUY from 1.15540 support (bullish continuation)

Entry: 1.15540 (upon bullish candle confirmation or strong bounce)

Stop Loss: 1.15200

Take Profits: 1.15850 → 1.16070 → 1.16300+

✅ Ideal if European sentiment remains positive or if USD weakens across the board.

📕 Scenario B – SELL if price breaks and retests 1.15540

Entry: 1.15540 (after a breakdown + rejection retest)

Stop Loss: 1.15720

Take Profits: 1.15261 → 1.14807 → possibly 1.1450

✅ Best used if USD gains strength or EUR shows weakness after economic releases.

🧠 Market Psychology

The market is currently reactive to any shift in tone from ECB and Fed, causing price whipsaws near key zones.

Smart traders will avoid chasing breakouts and instead focus on reaction zones like 1.15540 for confirmation-based trades.

Watch for fakeouts, as institutional players may be hunting liquidity before choosing direction.

📌 Final Thoughts

EURUSD is in a sensitive zone, and 1.15540 is the intraday pivot. Holding above could trigger a push toward 1.1607 and higher. But failure to hold would likely attract sellers toward the 1.1480–1.1450 liquidity range.

🎯 Discipline is key. Avoid emotional entries. Let the market come to your level — and execute only with confirmation.