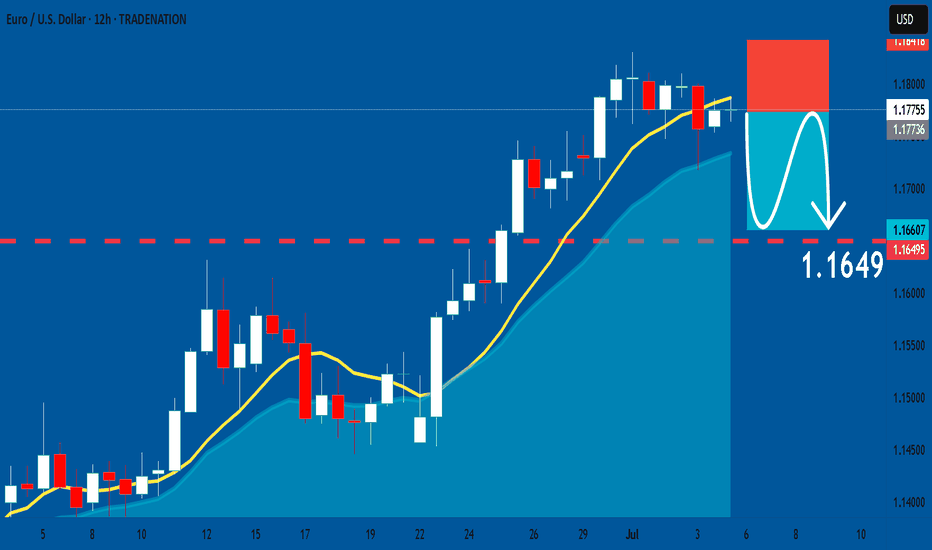

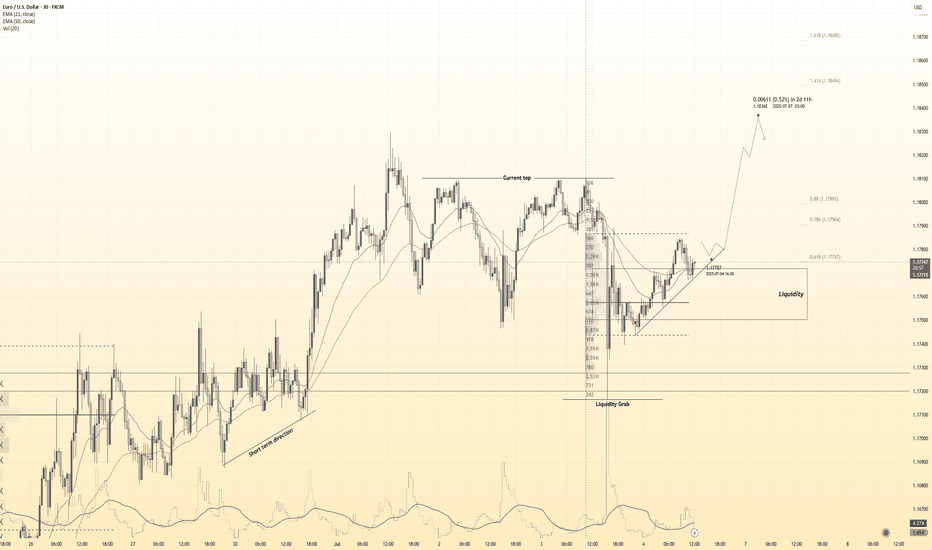

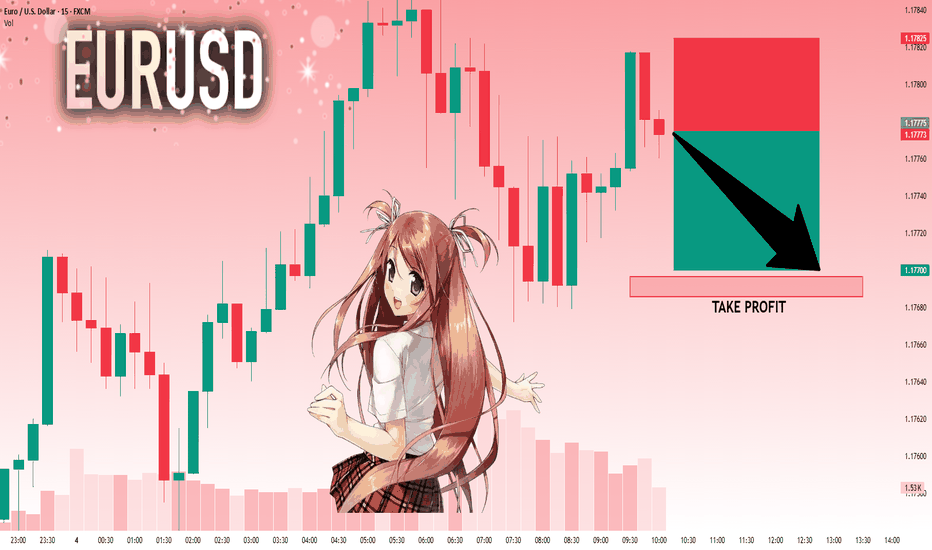

EURUSD H1 I Bearish Reversal Based on the H1 chart, the price is approaching our sell entry level at 1.1778, a pullback resistance.

Our take profit is set at 1.1758, an overlap support.

The stop loss is set at 1.180, a swing high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

EURUSD

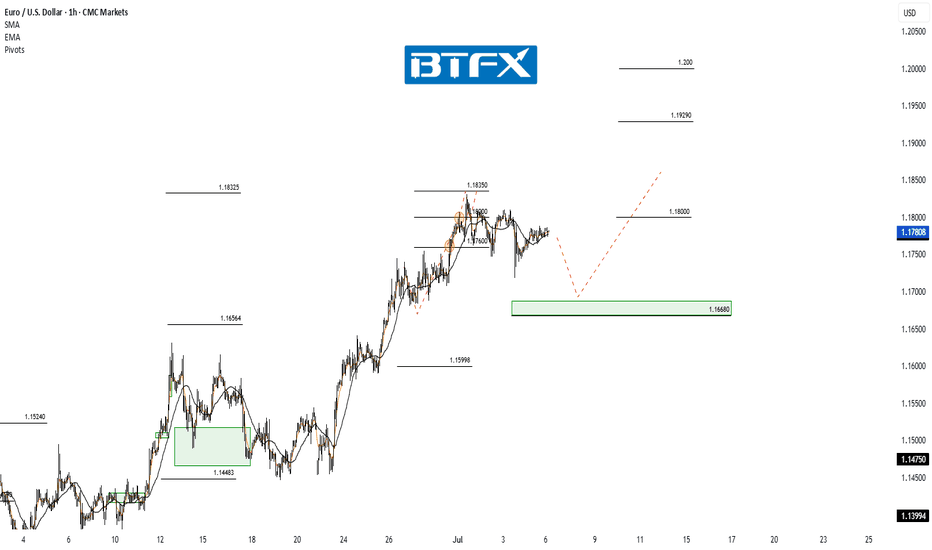

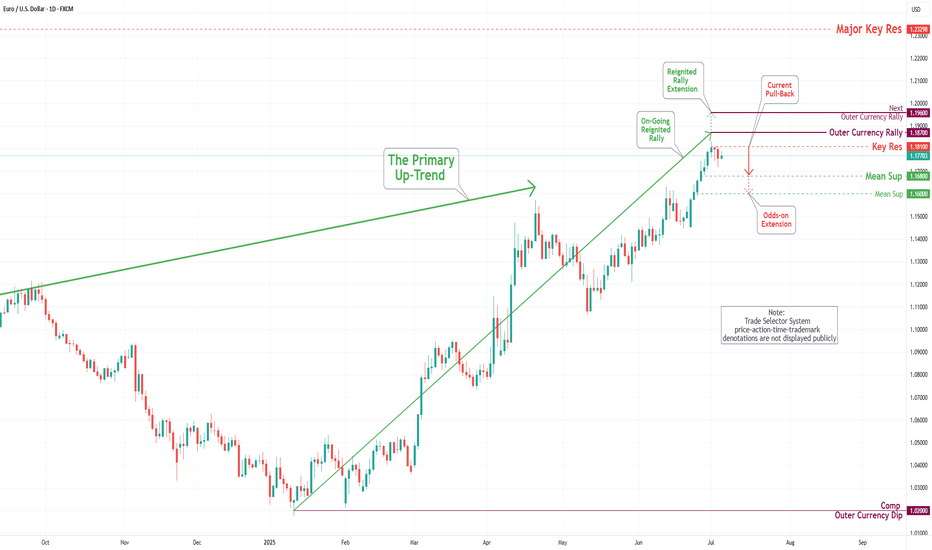

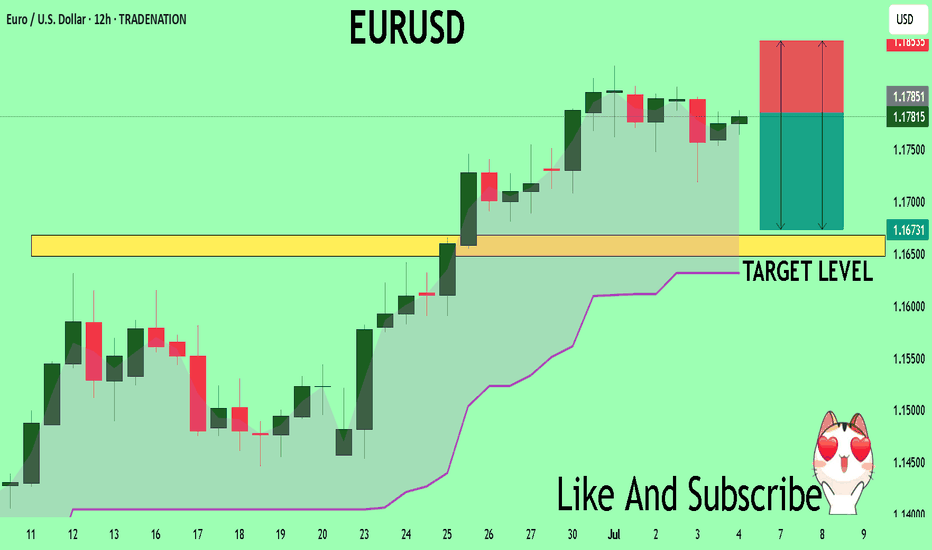

EUR/USD Rally Pauses Near 1.18000 – Higher Targets in SightHi Everyone,

Last week, price action delivered the 1.18000 level we had been calling for, and as expected, dynamic resistance around that area proved to be significant.

Looking ahead, we anticipate EUR/USD will continue to test the 1.18000 level this week while holding above the 1.16680 support zone. A strong break above last week’s high could attract further buyers, paving the way for a move towards the 1.19290 and ultimately the 1.20000 levels. We’ll share further updates on the projected path for EUR/USD if price breaks above this level.

The longer-term outlook remains bullish, with expectations for the rally to extend towards the 1.2000 level, provided the price holds above the key support at 1.10649.

We will continue to update you throughout the week with how we’re managing our active ideas and positions. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for a good end to the week. Trade safe.

BluetonaFX

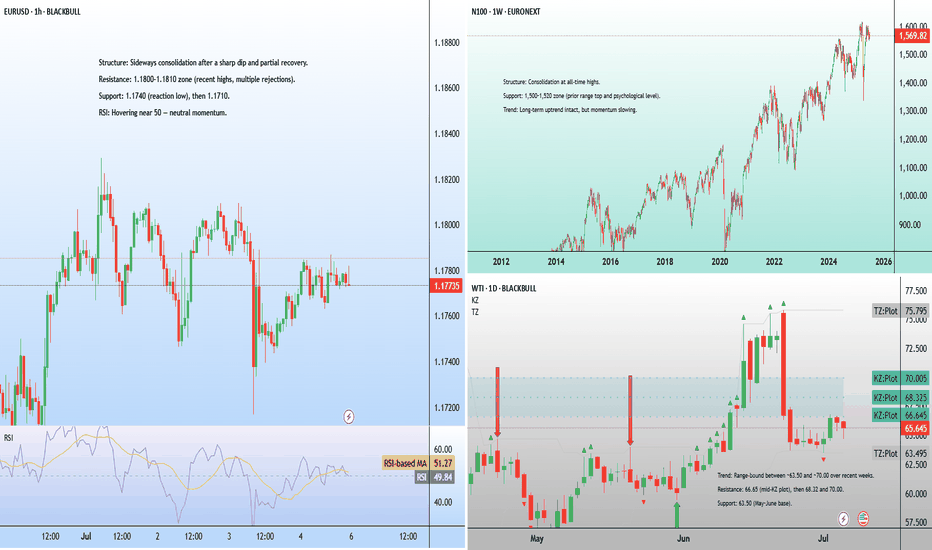

Tariff and oil volatility converge on July 9 Tuesday, July 9 marks a key deadline for two major market-moving events.

Tuesday is the official deadline for U.S.–EU trade negotiations. While a full deal is off the table, the EU hopes to secure a last-minute "agreement in principle" to avoid a threatened 50% U.S. tariff on some European exports.

President Trump’s history of moving deadlines adds uncertainty. Traders might like to watch for sharp intraday moves in EUR/USD and European equities tied to tariff risk.

OPEC’s International Seminar also kicks off on the 9th in Vienna. Energy ministers and CEOs from BP, Shell, and others will speak on oil supply, investment, and long-term strategy.

Crude has been volatile in July, and any signs of supply shifts or policy changes could drive WTI and Brent in either direction.

Gold in buyIn Day gold in side ways but we got h&d

In point stry we got low confrm also got high in day

day OB entry is Buylimit

4hrs OB entry is selllimit

If sell limit active hold buy limit

If buy limit active before sell limit delete sell limit

Tp 20,50,100,200,500&open pips

Use risky management

Note: entry will chance on Monday

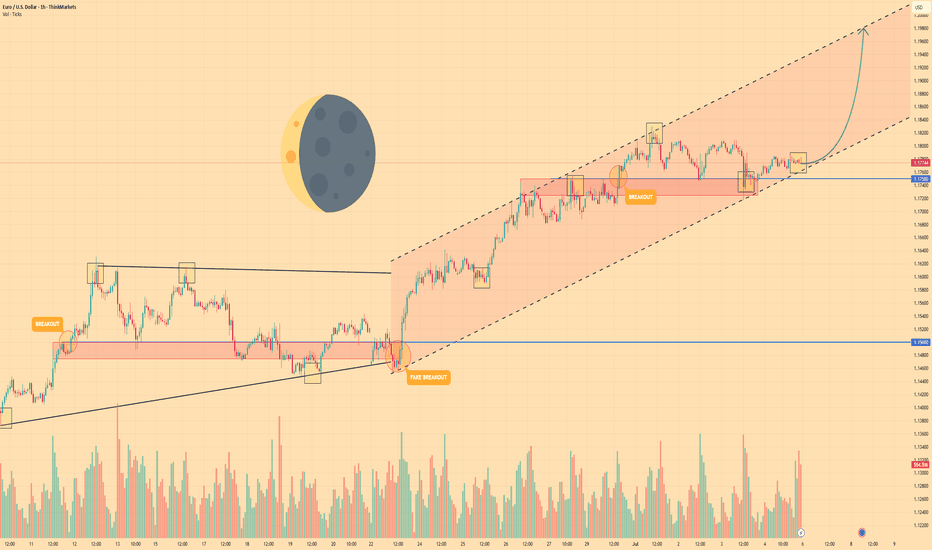

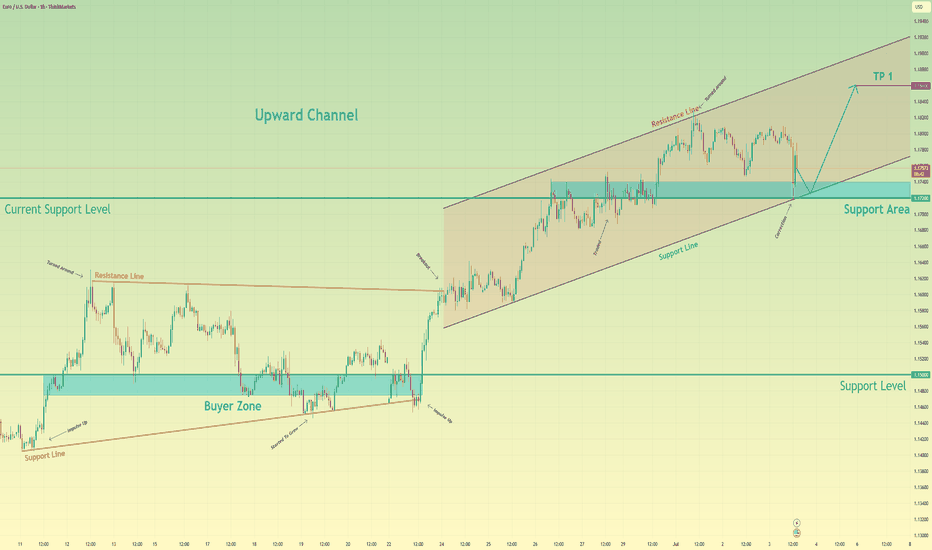

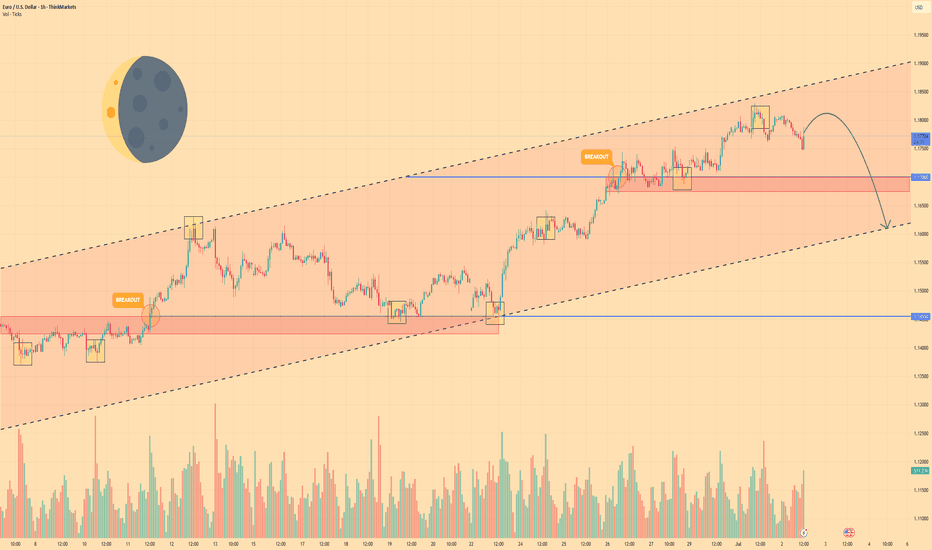

EURO - Price can continue to grow inside rising channelHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

The price traded in a flat range between $1.1500 and $1.1750 for an extended period, testing both extremes multiple times with low volatility and indecision.

A breakout above $1.1750 initially looked promising but turned into a fakeout when sellers quickly pushed the price back below $1.1725, trapping aggressive longs.

After that shakeout, buyers regained control and propelled EUR into a rising channel, marked by higher highs and higher lows since the end of June.

Price has since respected the lower boundary of this rising channel near $1.1725–$1.1750, using it as reliable support for continued gains.

With two confirmed breakouts and the channel structure intact, bullish momentum suggests the pair can extend its move higher within the channel.

I expect Euro to continue climbing toward the next key resistance at $1.1980, where the upper channel line and structural supply zone converge.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

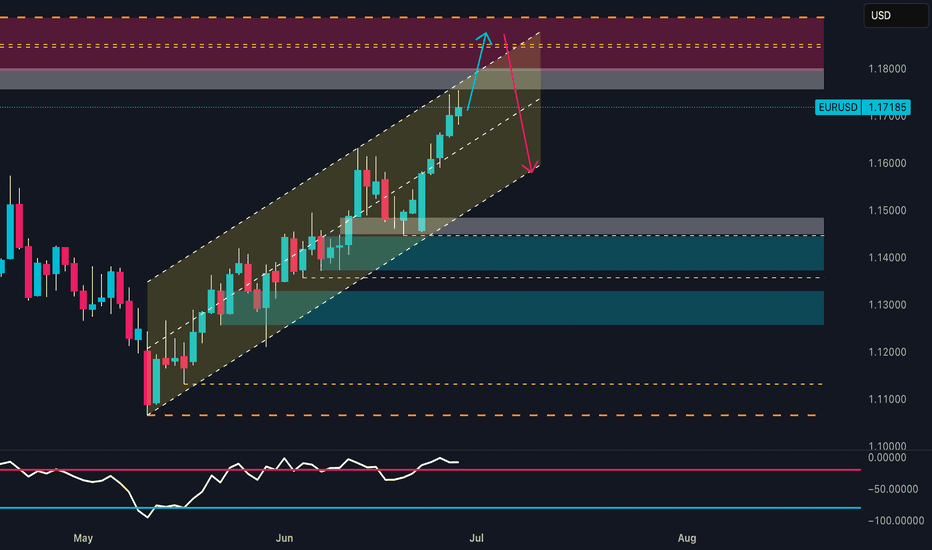

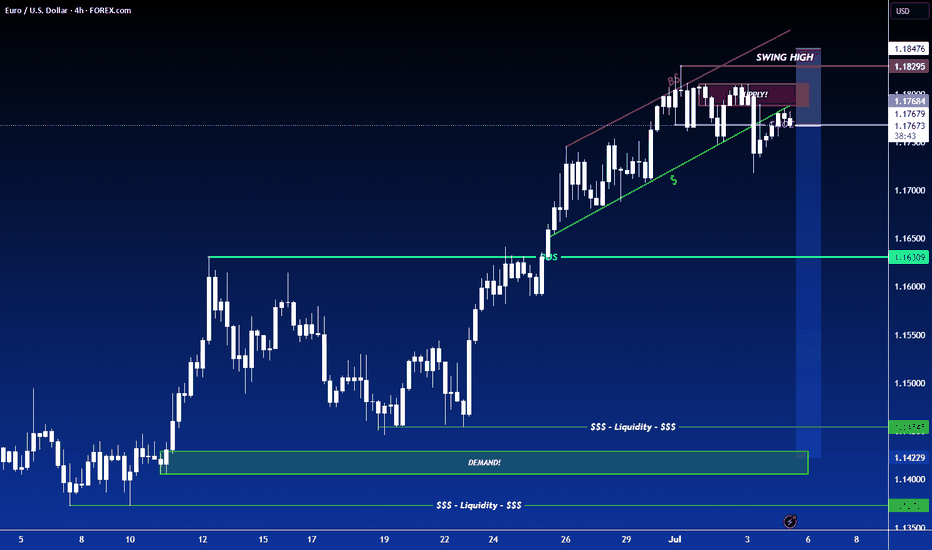

EUR/USD – Smart Money Trap at 1.18? Massive Rejection Ahead 1. Technical Context

The pair has been moving inside a well-defined bullish channel since May, forming higher highs and higher lows. Price is currently hovering around 1.1718, approaching the upper boundary of the channel and a key weekly supply zone (1.1750–1.1850).

➡️ Potential scenario:

A short bullish extension toward 1.1780–1.1820 to trigger stop hunts, followed by a bearish rejection toward 1.1500, and potentially 1.1380.

The daily RSI is overbought (>70), suggesting a likely short-term correction.

2. Retail Sentiment

80% of retail traders are short, with an average entry around 1.1318.

This signals a liquidity cluster above current highs, increasing the likelihood of a fake bullish breakout followed by a sell-off.

➡️ Contrarian insight: Retail heavily short → market may push higher first to wipe them out before reversing lower.

3. COT Report – USD Index (DXY)

Non-commercials (speculators) increased their short exposure on USD (+3,134).

Commercials cut their short positions (-1,994), indicating a potential bottoming on the dollar.

➡️ Conclusion: USD strength could return soon → bearish pressure for EUR/USD.

4. COT Report – EUR FX

Non-commercials increased longs on EUR (+2,980) and sharply reduced shorts (-6,602) → market is now heavily net long.

Commercials remain net short (581,664 vs 417,363 longs).

➡️ Over-leveraged spec longs → vulnerable to downside squeeze if macro sentiment shifts.

5. Seasonality

June tends to be mildly bullish for EUR/USD.

July historically shows even stronger upward performance over the last 5–10 years.

➡️ Shorts are high risk in the very short term, but a bearish setup is likely in the second half of July, especially if price action confirms.

6. Trading Outlook

📍 Short-Term Bias: Neutral to bullish toward 1.1780–1.1820

📍 Mid-Term Bias: Bearish on rejection from supply area and break of channel

🎯 Key Levels:

1.1780–1.1850: critical decision zone (liquidity + weekly supply)

1.1500: first key support

1.1380: next downside target (demand zone + previous POC)

📌 Final Conclusion

The most likely play is a short setup from 1.1780–1.1850 on strong rejection, supported by:

Extreme retail positioning (80% short),

COT pointing to USD recovery,

Extended technical structure,

Overbought RSI on the daily chart.

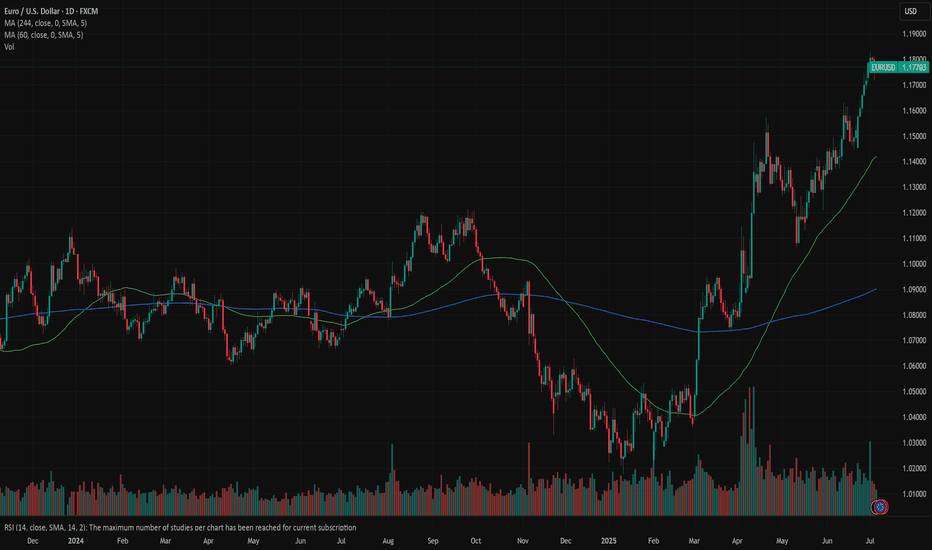

EURUSD: overboughtFriday was a non-working day in the US, as the country was celebrating Independence Day. The most important weekly macro data was related to US jobs data. At the start of the week JOLTs job openings in May were posted with a figure of 7.769M, significantly higher from market estimate of 7,3M. The next day the NFPs and Unemployment rate was published. As per data, the unemployment rate dropped by 0,1pp to the level of 4,1%, which missed market expectations of 4,2%. The Non-farm payrolls in June added 147K new jobs, again better from forecasted 110K. The average hourly earnings were higher by 0,2% in June, or 3,7% on a yearly basis, modestly below the forecasted 3,9%. Other weekly macro data including ISM Manufacturing PMI in June reached 49,0 a bit higher from estimated 48,8. The ISM Services PMI in June was standing at 50,8 in line with market estimates.

Retail Sales in Germany dropped by an additional -1,6% in May, bringing the indicator to the level of +1,6% on a yearly basis. Both figures were lower from the market estimate of +0,5% for May and +3,3% for the year. Inflation rate in Germany preliminary in June was 2% a bit lower from forecasted 2,2%. Inflation for the month was standing at 0%. Preliminary inflation data for the Euro Zone in June was 0,3% for the month and 2% for the year. EuroZone core inflation was standing at 2,3% in June, exactly in line with market estimates. The unemployment rate in the Euro Zone in May was modestly increased by 0,1pp to the level of 6,3%, while the market was expecting to remain flat at 6,2%.

The US Dollar continued its decline against the euro during the previous week. The highest weekly level was at 1,1825, but the currency pair closed the week at 1,1776. The RSI reached the level of 73, signalling a clear overbought market side, increasing the probability of a short term reversal in the coming period. The MA50 continues to diverge from MA200, indicating low probability of a potential cross in the future period.

The eurusd daily chart is showing that the currency pair had formed a sort of channel with an uptrend during the past period. If lows from end of February, mid March and end of March are connected, the indication for a next potential level of eurusd might be somewhere above the 1,16 level. The 1,1620 was the highest level achieved in mid July this year, which aligns well with the previous indication. Indicators are currently showing higher probability of a short term reversal. The week ahead is not bringing any currently significant news with respect to the US economy, in which sense, it could be expected that the market will slow down a bit during the week. Short reversal is quite possible, where the level of 1,1620 might be shortly tested. Just in case that the market decides to continue movement toward the higher grounds, then 1,18 resistance will be tested, before the market continues its road toward the 1,19 level.

Important news to watch during the week ahead are:

EUR: Industrial Production in May in Germany, Retail Sales in the Euro Zone for May, Balance of Trade in Germany in May, Inflation rate final for May in Germany,

USD: FOMC Meeting minutes.

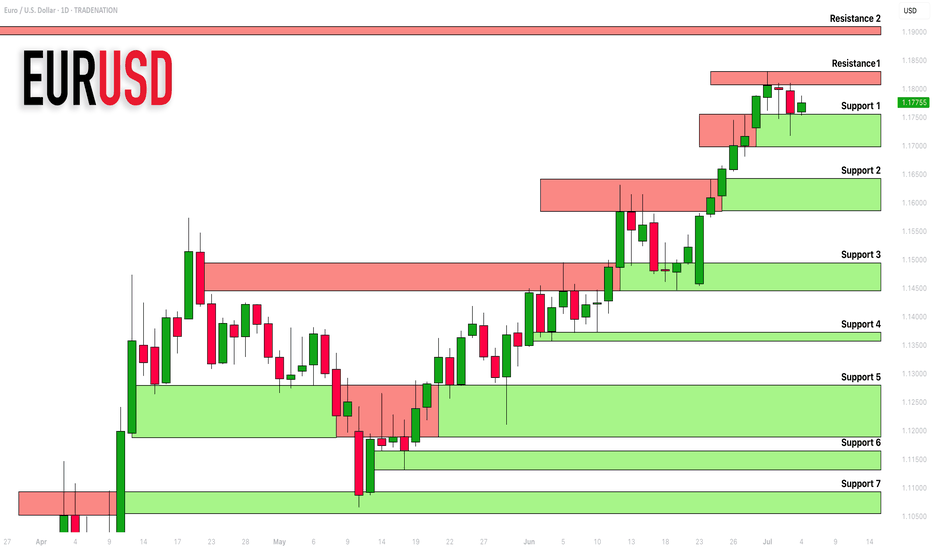

EURUSD: Support & Resistance Analysis For Next Week 🇪🇺🇺🇸

Here is my recent structure analysis and important

supports and resistances for EURUSD for next week.

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

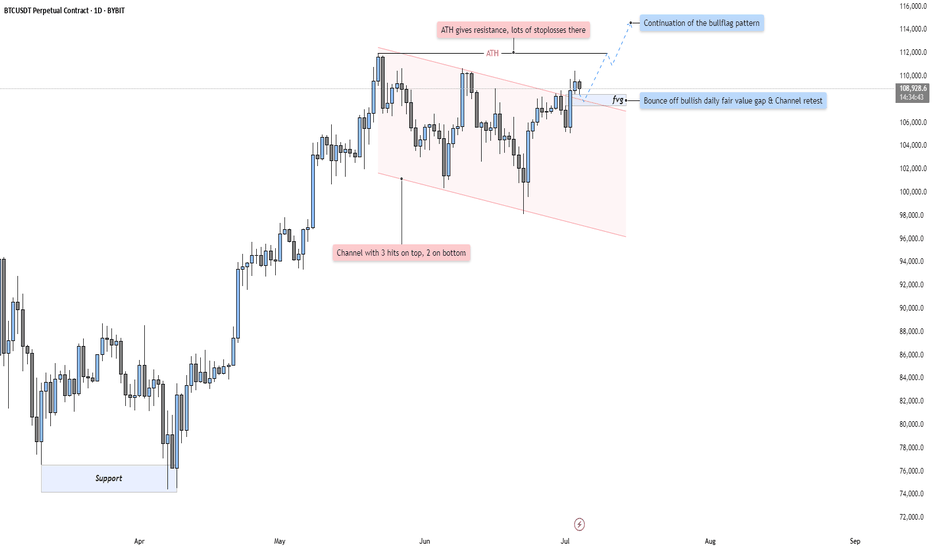

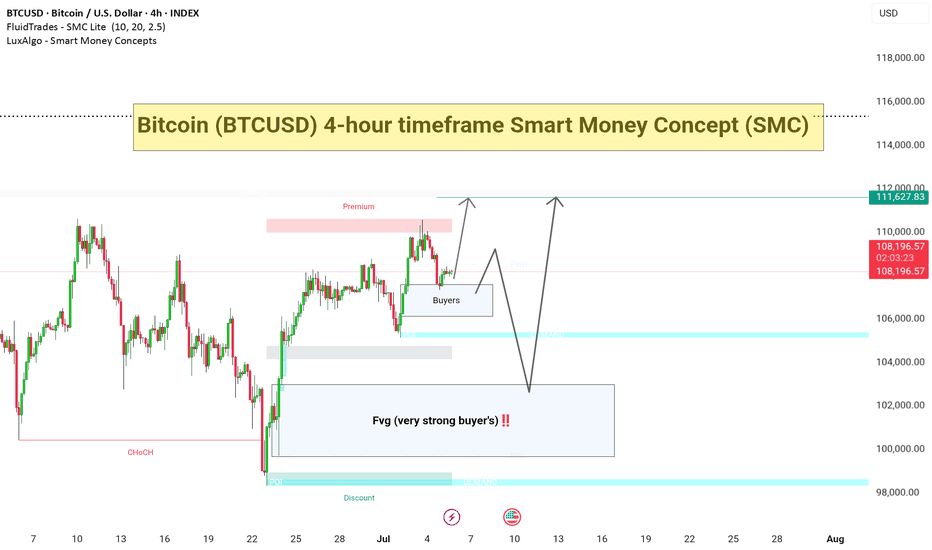

BTC - Bullflag Pattern points to new ATHMarket Context

Bitcoin has been trading within a well-defined descending channel for several weeks now, respecting both upper and lower boundaries with precision (3 touches on the top, 2 on the bottom). This structure suggests an orderly pullback after a strong impulsive leg to the upside in Q2. As price compresses within this flag-like pattern, market participants are watching closely for signs of breakout or breakdown.

Bullish Fair Value Gap Reaction

Recently, price dipped into a Daily Fair Value Gap (FVG) and bounced strongly — a key bullish signal indicating that demand stepped in at the inefficiency. The FVG also aligns with a retest of the channel’s resistance-turned-support, further validating the bounce. This confluence zone acts as a springboard for potential continuation.

Channel Breakout & Liquidity Above ATH

Price has now broken above the channel structure, shifting the market narrative from consolidation to potential expansion. The breakout zone is located just beneath the All-Time High (ATH) — an area that’s likely loaded with stop orders and breakout buys. A sweep or clean break above the ATH would not only invalidate the prior bearish structure but also trigger a fresh wave of bullish momentum.

Bull Flag Continuation Potential

Structurally, this chart presents a classic bull flag breakout. After a strong impulsive leg up and a controlled consolidation phase, we now see bullish continuation potential toward the 112,000–114,000 region. If the ATH gets breached and reclaimed, it could become strong support in the next leg higher.

Final Thoughts

This is the type of setup that blends both technical precision and market psychology — structure, liquidity, and momentum all coming together. Whether you're already long or watching for confirmation, this move could set the tone for Bitcoin’s next major rally.

If you found this analysis helpful or thought-provoking, please give it a like! And let me know in the comments — do you see this as a true breakout or a trap in disguise?

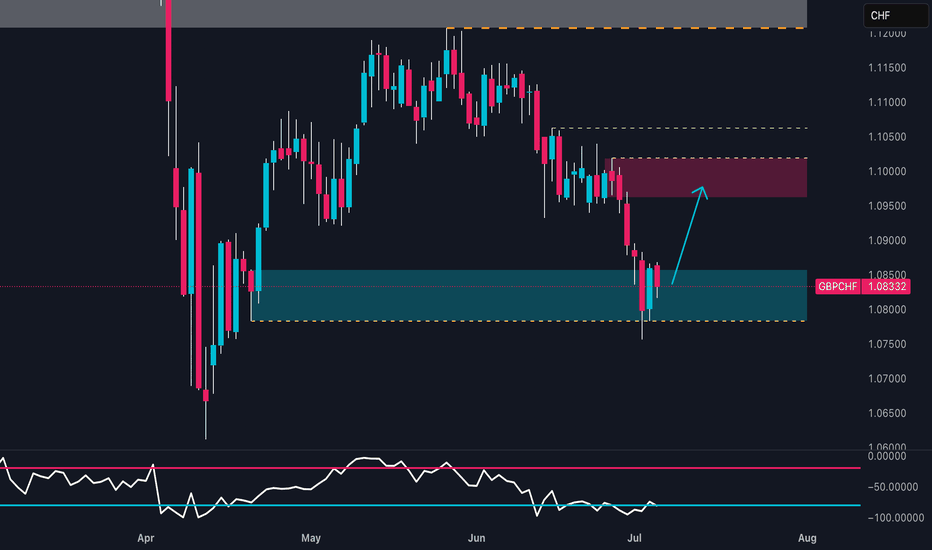

GBP/CHF Headed to 1.10 – But Bulls Might Regret It📉 1. Price Action & Technical Structure (D1)

Key demand zone tested with bullish reaction:

Price reacted strongly around the 1.0790–1.0840 structural demand area, previously the origin of a significant bullish impulse. The latest daily candle closed above the previous swing low, suggesting a potential technical rebound.

Immediate target:

The 1.0980–1.1010 zone, aligning with:

A clear supply area

RSI bouncing from oversold territory

A visible imbalance left unfilled

Technical bias: Short-term LONG to fill the imbalance before a potential institutional-driven short setup at supply.

2. Retail Sentiment

86% of traders are LONG, with an average entry of 1.0997

Only 14% are SHORT, with lower volume and better pricing

Current price: 1.0833, meaning most long traders are in drawdown

Contrarian view:

The heavy long positioning creates a liquidity pool between 1.0990–1.1010, making that zone highly attractive for institutional distribution and liquidation of retail longs, especially if accompanied by a structural shift.

🎯 Operational impact:

Supports a technical long to 1.10, but high risk of reversal once that level is reached.

3. COT Report

GBP (British Pound – CME)

Non-commercials:

Long: -6,434 → massive unwind of bullish exposure

Short: +2,028 → rising bearish bets

Net positioning is increasingly bearish

Commercials:

Long: +7,459 → increasing coverage against GBP weakness

Short: -569 → slight reduction

Positioning is mixed, but commercials are taking defensive long positions

GBP interpretation:

Bearish pressure rising from institutional speculators, despite some commercial support.

CHF (Swiss Franc – CME)

Non-commercials:

Long: +327

Short: +1,215

Net positioning still heavily short, but shorts increasing again

Commercials:

Long: +1,909

Short: +307

Commercials are accumulating long CHF positions (bullish sign)

CHF interpretation:

Divergence between commercials (bullish CHF) and speculators (still short) → shift may be underway.

4. July Seasonality

GBP:

Historically strong in July, especially the last 2 years (+3.5%)

Positive tendency across 10y/15y/20y averages

CHF:

Also seasonally positive in July, but underperforms GBP across most timeframes (except 2Y where CHF is also strong)

Operational impact:

Favors short-term bullish GBP/CHF bias, supported by seasonal momentum.

✅ Final Outlook

Current short-term bias is bullish, driven by:

Clear technical rebound

Visible imbalance toward 1.10

Seasonal divergence in favor of GBP

However, excessive retail long positioning + COT speculative pressure on GBP suggest this rally could be a distribution phase, offering an optimal short opportunity at 1.10.

EURUSD: Short Signal Explained

EURUSD

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell EURUSD

Entry Level - 1.1775

Sl - 1.1841

Tp - 1.1649

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Bitcoin (BTCUSD) 4-hour timeframe Smart Money Concept (SMC)📌 Key Zones:

Zone Type Price Area Importance

Premium ~111,000-112,000 Sell area / resistance

Buyers Box ~107,000-108,500 Current minor support

FVG Zone ~100,000–106,000 Strong buy zone with imbalance

Discount Below 102,000 High interest zone for large buyers

Resistance Target 111,627.83 Key liquidity target

---

🔔 Conclusion:

As long as buyers defend the current support, price can target the 111.6K resistance.

If rejected, deeper discount entries may be formed in the FVG zone, giving smart money a chance to reaccumulate.

Keep an eye on economic calendar/news (indicated by icons on chart) which might trigger volatility near July 10.

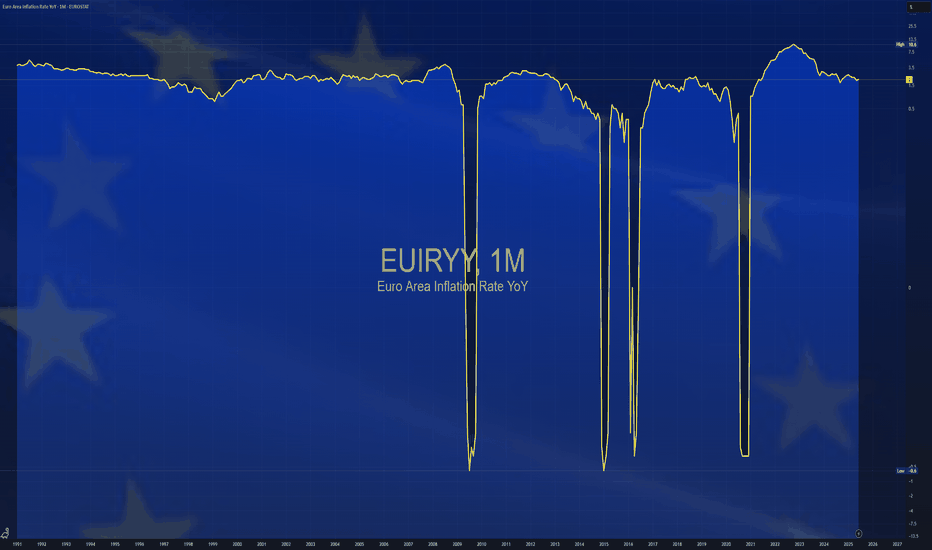

$EUIRYY - Europe CPI (June/2025)ECONOMICS:EUIRYY 2%

June/2025

source: EUROSTAT

- Eurozone consumer price inflation rose slightly to 2.0% year-on-year in June 2025, up from May’s eight-month low of 1.9% and in line with market expectations, according to a preliminary estimate.

The figure aligns with the European Central Bank’s official target.

Among major economies, inflation in Germany unexpectedly declined, while France and Spain saw modest increases and Italy’s rate held steady.

Euro can rebound up from support area to 1.1860 pointsHello traders, I want share with you my opinion about Euro. In this chart, we can see how the price has been moving confidently inside an upward channel after breaking out of a wedge formation. Previously, price consolidated within a narrowing wedge pattern above the buyer zone and broke upward, showing strong bullish momentum. That breakout initiated the current uptrend and led to the formation of a new support area. Now, price is pulling back from the resistance line of the channel and approaching this support area, which also coincides with the support line of the channel. This confluence increases the probability of a bullish reaction in this region. The structure suggests that buyers may step in around this level, preventing a deeper retracement. If the pair bounces off the support zone, I expect a continuation of the uptrend toward the upper boundary of the channel. For that reason, I set my TP at 1.1860 points, almost aligning with the resistance line of the channel. Given the current price action, the bullish structure, and strong reaction levels, I remain bullish and anticipate a rebound followed by further growth toward my target. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

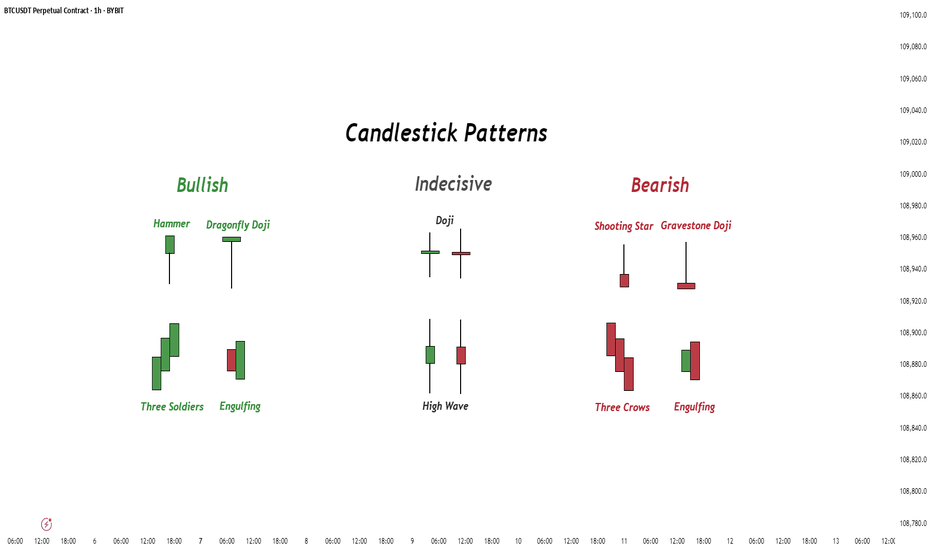

Candlestick Patterns - How to read them like a ProOverview

Candlestick charts serve as a cornerstone in technical analysis, presenting price activity in a visually digestible format. By examining how prices move over a given timeframe, traders gain key insights into potential market direction, sentiment shifts, and trend strength.

Mastering candlestick interpretation is essential for identifying bullish or bearish sentiment, as well as for spotting possible trend reversals or continuations. Still, candlesticks alone don’t paint the full picture—using them without broader context increases the risk of false signals.

---

What You'll Learn

What are candlestick charts?

Common bearish candlestick patterns

Common bullish candlestick patterns

How to apply candlestick analysis in trading

---

What is a Candlestick Chart?

A candlestick provides a snapshot of an asset’s price behavior during a specific time interval, whether it's one minute, one hour, or one day. This format allows traders to quickly assess how the price has moved within that period.

Each candle reveals four price points:

* Open – the price at the beginning of the interval

* Close – the price at the end of the interval

* High – the highest price reached

* Low – the lowest price during that time

Anatomy of a Candlestick:

* Body: The thick section between the open and close. A green (or white) body means the close was higher than the open (bullish), while red (or black) means the opposite (bearish).

* Wicks (or Shadows): Thin lines extending from the body to indicate the high and low.

* Upper wick: Marks the highest traded price

* Lower wick: Marks the lowest traded price

---

Bearish Candlestick Patterns

Understanding bearish candlestick patterns helps traders identify moments when buying momentum might be running out—setting the stage for a potential downward shift.

Evening Star

A three-candle formation that signals a shift from buying pressure to selling dominance. It starts with a strong bullish candle, followed by a small-bodied candle of indecision, and concludes with a large bearish candle that cuts deep into the first. This pattern often appears at the end of an uptrend.

Bearish Engulfing

This setup includes a small bullish candle followed by a large bearish candle that completely swallows the previous one. It indicates that sellers have seized control, potentially marking the beginning of a downward trend.

Shooting Star

With a small real body near the low and a long upper wick, this pattern reflects strong early buying that is ultimately rejected by the close—suggesting fading bullish momentum.

Gravestone Doji

This candle opens, closes, and hits its low all around the same price, leaving a long upper wick. It suggests that bulls pushed higher during the session but were overpowered by bears by the close.

Three Crows

Three consecutive bearish candles, all approximately the same size. These indicate that a sell off is coming soon.

---

Bullish Candlestick Patterns

Bullish patterns can alert traders to possible reversals after a downtrend or strengthen conviction during an uptrend.

Morning Star

This three-candle formation marks a potential turning point from bearish to bullish. It begins with a strong bearish candle, followed by a smaller candle showing indecision, and ends with a large bullish candle breaking upward—signaling buying strength is returning.

Bullish Engulfing

This two-candle pattern begins with a bearish candle, then a larger bullish candle that completely envelops the previous body. It reflects a sharp transition in sentiment, suggesting renewed buying pressure.

Dragonfly Doji

A single candle where the open, close, and high are all very close, with a long lower wick. It shows sellers pushed prices lower but buyers stepped in and brought them back up—an early sign of possible reversal.

Hammer

A classic bullish reversal signal that features a small real body near the top and a long lower shadow. It indicates a battle where sellers initially dominated, but buyers managed to close near the open price.

Three soldiers

Three consecutive bullish candles, all approximately the same size. These indicate that a big buy is coming soon.

---

Trading with Candlestick Patterns

Candlestick patterns become more meaningful when they align with major chart areas—such as previous support or resistance, trendlines, or retracement zones. A bullish signal at a support level can hint that the downward pressure is fading, while a bearish pattern at resistance may warn of an upcoming decline.

To increase the reliability of your trades, combine candlestick patterns with other forms of technical analysis:

* Support & Resistance Zones: These are price levels where the market has historically reacted. Candlestick patterns forming near these zones have stronger potential implications.

* Fibonacci Levels : These help identify likely retracement areas. When a candlestick pattern forms near a key Fibonacci level like 61.8%, it adds strength to a potential reversal setup.

* Liquidity Areas: Clusters of orders (buy or sell) tend to create strong reactions. When patterns appear in these zones, they often precede more decisive moves.

* Technical Indicators : RSI, MACD, Moving Averages, and Stochastic RSI can provide confirmation. For instance, a bullish reversal pattern that appears when RSI is oversold strengthens the signal.

💡 Tip: Don’t rush into trades based on one candlestick alone. Always wait for the next candle or price confirmation (e.g., a break of a previous high/low) to validate your signal.

---

Thanks for Reading!

✨ If you found this helpful, show some love by liking or commenting!

🔔 Don’t forget to follow for more technical breakdowns and trading insights coming soon!

EUR/USD Daily Chart Analysis For Week of July 4, 2025Technical Analysis and Outlook:

During the trading session this week, we witnessed the successful completion of the Outer Currency Rally at a level of 1.177. Recent analyses suggest that the Euro is likely to encounter a downward trend, with an initial target set at the Mean Support level of 1.168 and a potential extension to an additional Mean Support of 1.160. Nevertheless, it is crucial to acknowledge the possibility of a subsequent increase toward the next Outer Currency Rally level of 1.187 before any definitive downward movement transpires.

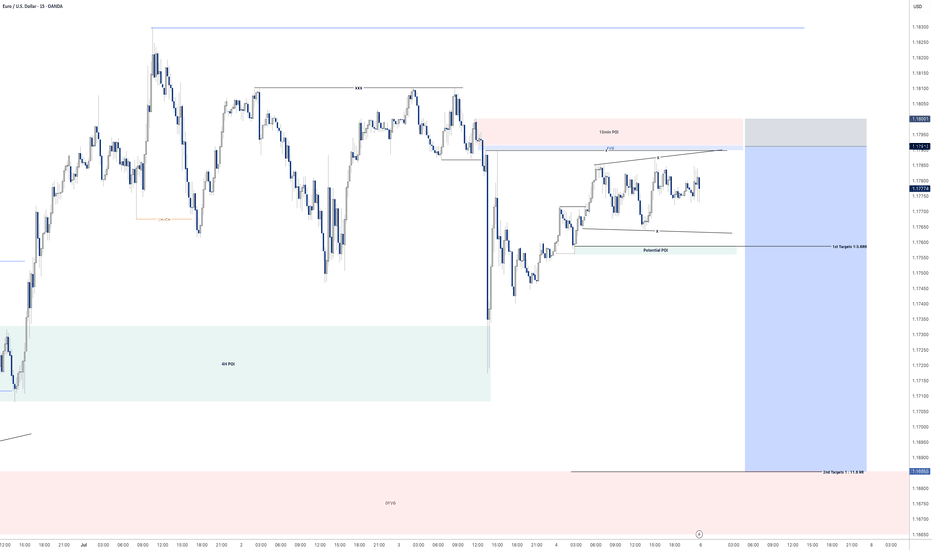

EURUSD - Where next?Looking at EURUSD

I still feel like we are due some sort of deeper retracement to the downside considering how bullish the 4H and Daily time frame have been in recent times.

Although the market does not care how I feel in all honesty haha. I will play the short term short until the 15min orderflow switches bullish once again.

The expansion that is currently happing right now is very interesting and makes a good watch to see what we will do come market open as we are engineering liquidity for both a buy and sell with both POI's looking primed for entries.

Will be keeping a close and keen eye on EURUSD when the market opens

Any questions feel free to give me a message

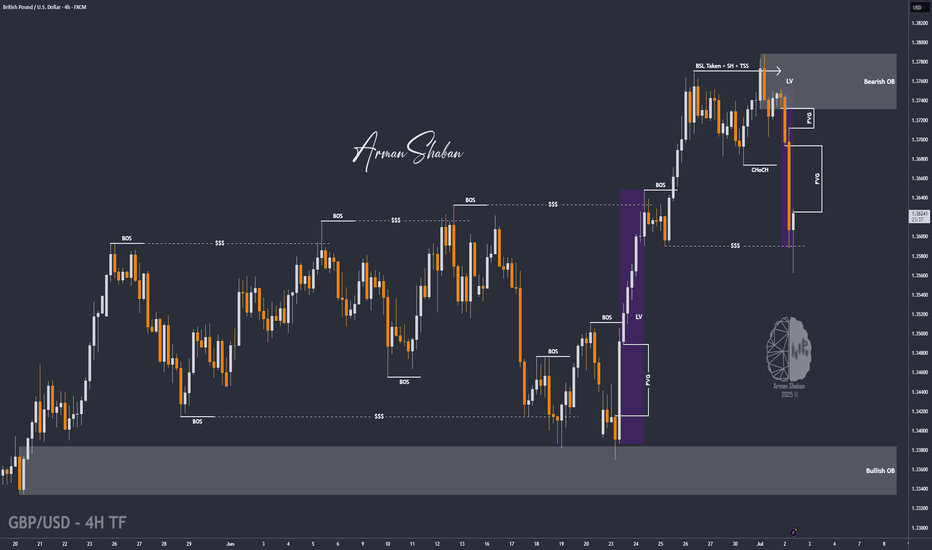

GBP/USD : First Long, Then SHORT! (READ THE CAPTION)By analyzing the GBP/USD chart on the 4-hour timeframe, we can see that the price is currently trading around 1.3625. I expect a new Fair Value Gap (FVG), formed by the recent sharp drop, to be filled soon.

The first target for this potential move is 1.3650, with the next bullish zone between 1.3670 and 1.3730.

Supply and demand zones are marked on the chart — keep a close eye on how the price reacts to these key levels!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

EURUSD 30Min Engaged ( Bullish Entry Detected )➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bullish Wave Coming From : 1.17400

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

EURUSD 30Min Engaged ( Bullish Entry Detected )

EURUSD A Fall Expected! SELL!

My dear subscribers,

My technical analysis for EURUSD is below:

The price is coiling around a solid key level - 1.1784

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.1667

My Stop Loss - 1.1853

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURO - After movement up, price will drop to support lineHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

Recently price started to grow inside a rising channel, where it some time traded below the support area and soon bounced up.

Price broke $1.1455 level and rose to the resistance line of the channel, after which it turned around and made correction movement.

Next, price some time traded near $1.1455 level and then bounced and continued to move up inside the channel.

In a short time Euro rose to $1.1700 level, which coincided with a support area, and some time trades between this level.

Then the price broke this level and continued to move up, until it almost reached the resistance line of the channel and started to fall.

Now, I think the Euro can rise a little and then continue to fall to $1.1610 support line of the channel, breaking $1.1700 level.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

EURUSD: Strong Bearish Sentiment! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 1.17775 will confirm the new direction downwards with the target being the next key level of 1.17696.and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️