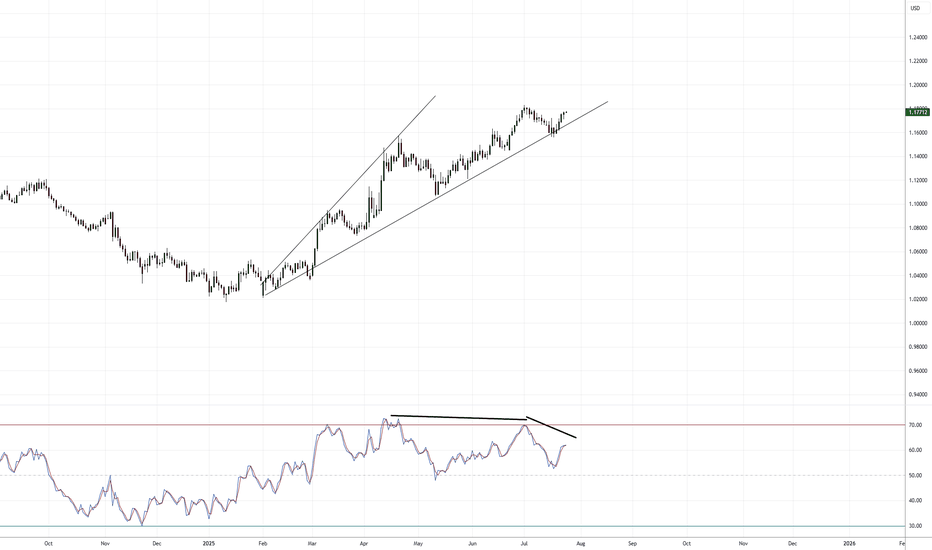

EUR/USD: The Last Bear Standing...As indicated on my previous EUR/USD idea ( that's still currently open ), I remain short EUR/USD given the technical aspect of things are still valid.

Divergences are still in play along with a rising broadening pattern and the fact that we're trading at the yearly R3 level ( which is rare ).

I suspect we will have some volatility with the ECB press conference tomorrow, so that should get things moving hopefully in the bearish direction. If we begin trading aggressively above 1.1800+, that will invalidate the short idea overall.

If we roll over, I'm still looking for 1.13000 - 1.12000 as the target range for Q3 going into Q4.

We'll see how this all develops.

As always, Good Luck & Trade Safe!

Eurusddivergence

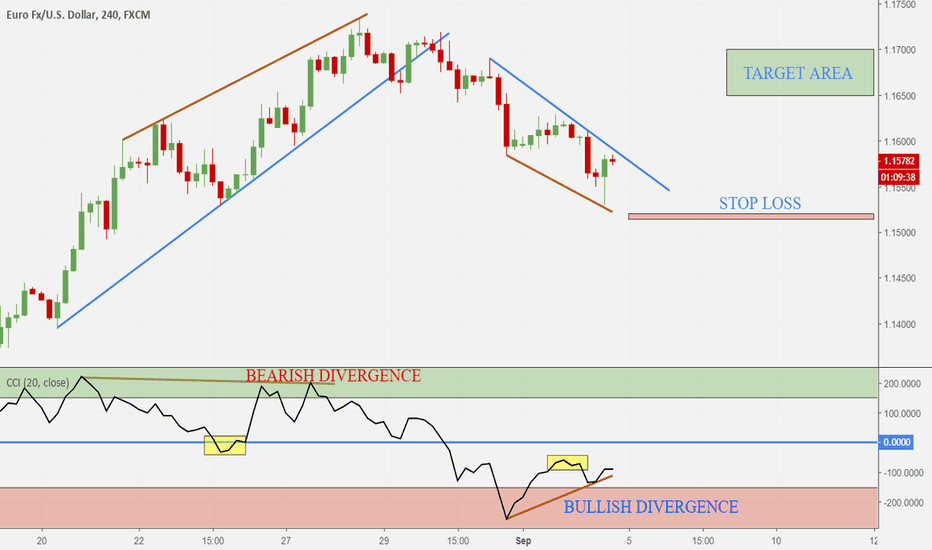

EUR-USD updatingIn my previous analysis, after a bearish divergence, I decided an ambition target in area 1.1450. This week, after a study of the options (that will expire Friday) I changed my target, and I closed today my trade at 1.1550.

Now, always on the 4-hour chart, there is another divergence, this time bullish. The breakout of the blue trendline will give the signal. Target at least at 1.1650; it could be hit within Friday. Stop loss at 1.1515/1.1520. Be careful with the macro-data, in particular, Friday (NFP, Unemployment rate, Average Hourly Earnings).