Eurusdlong

EURUSD:Sharing of the Trading Strategy for Next WeekAll the trading signals this week have resulted in profits!!! Check it!!!👉👉👉

Fundamental Analysis:

U.S. May retail sales unexpectedly declined, signaling weak consumption momentum and reinforcing expectations of Federal Reserve rate cuts, weighing on the U.S. dollar.

While the eurozone manufacturing PMI remains in contraction territory, a month-on-month improvement has supported the euro to some extent.

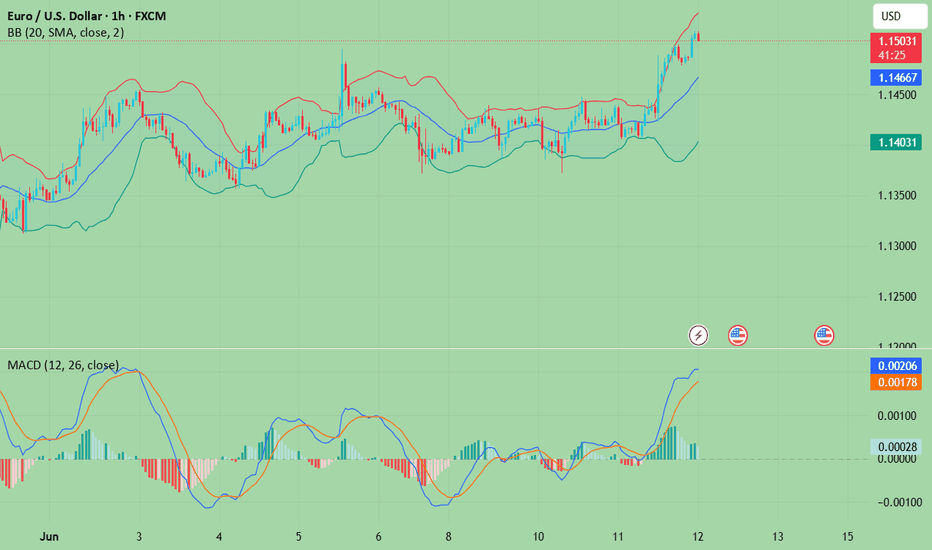

Technical Analysis :

The MACD indicator stays above the zero line with bullish histogram alignment, indicating dominant bullish momentum.Bollinger Bands are slightly widening upward, with price trading above the middle band (support near 1.1500).The RSI at 55 suggests strong bullish sentiment.Price has found support multiple times in the 1.1520–1.1530 zone, forming a key support range.

Trading Strategy:

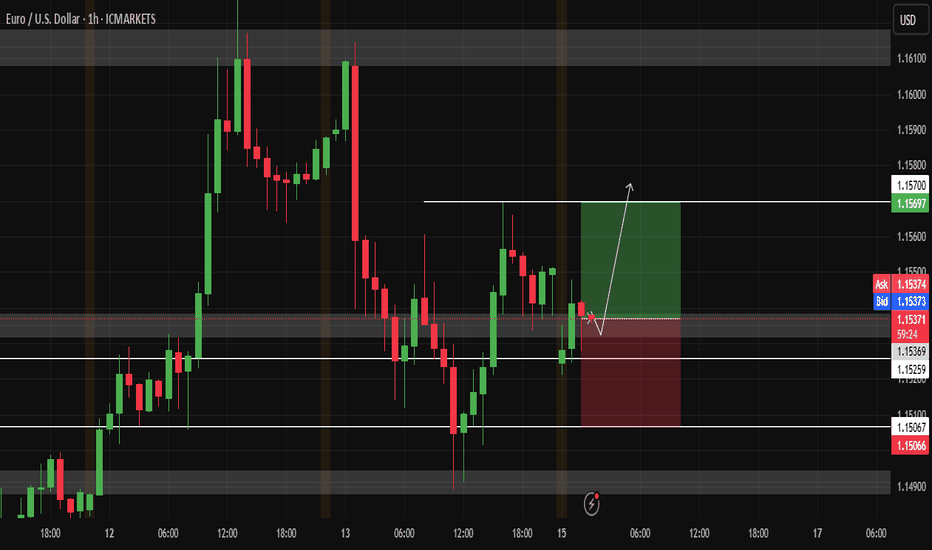

Initiate long positions after price stabilizes in the 1.1520–1.1530 zone on pullbacks.

buy@ 1.15200–1.15300

TP:1.15800-1.16000

Share accurate trading signals daily—transform your life starting now!

👇 👇 👇 Obtain signals👉👉👉

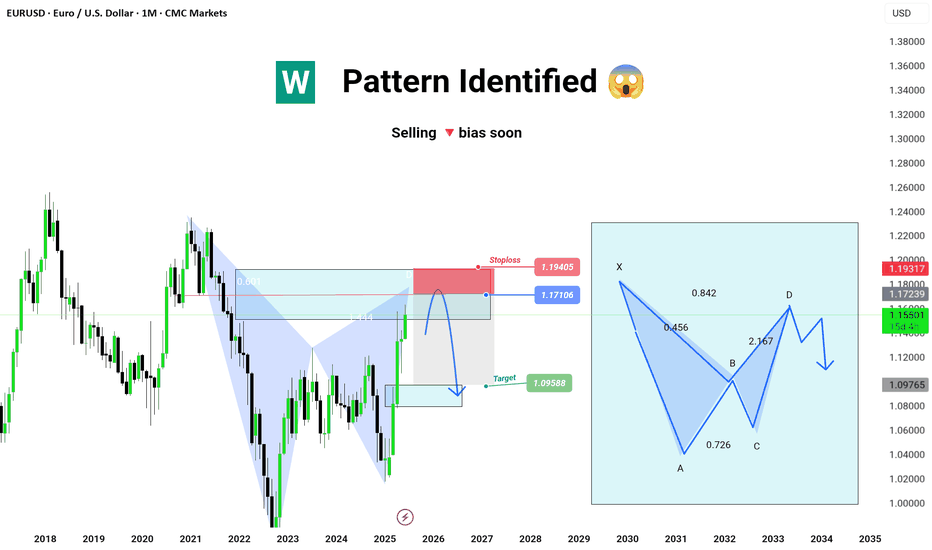

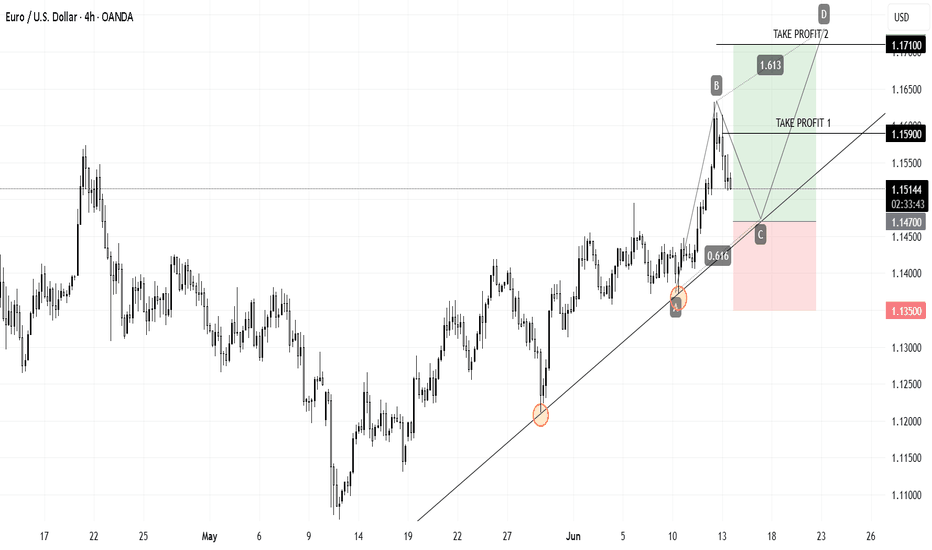

EURUSD ||| '' W '' PATTERN IDENTIFIED . ✅ Harmonic Formation (Bearish Potential)

⚠️ Selling Bias forming soon

---

🧩 Pattern Breakdown:

A Bearish Harmonic Pattern (likely Butterfly or Deep Crab) has been identified and is now nearing completion at the D point.

Current price is approaching key resistance / reversal zone, precisely around the 0.786 - 0.886 fib area (highlighted red).

The Risk-to-Reward is clearly mapped:

🔺 Stop Loss: 1.19405

✅ Entry Zone: Around 1.17106

🎯 Target: 1.09588

Potential short setup if price respects the harmonic symmetry and fails to break above resistance.

Projected Price Path (White Lines)showing technical analysis and a projected price path. Here’s a breakdown of what’s visible:

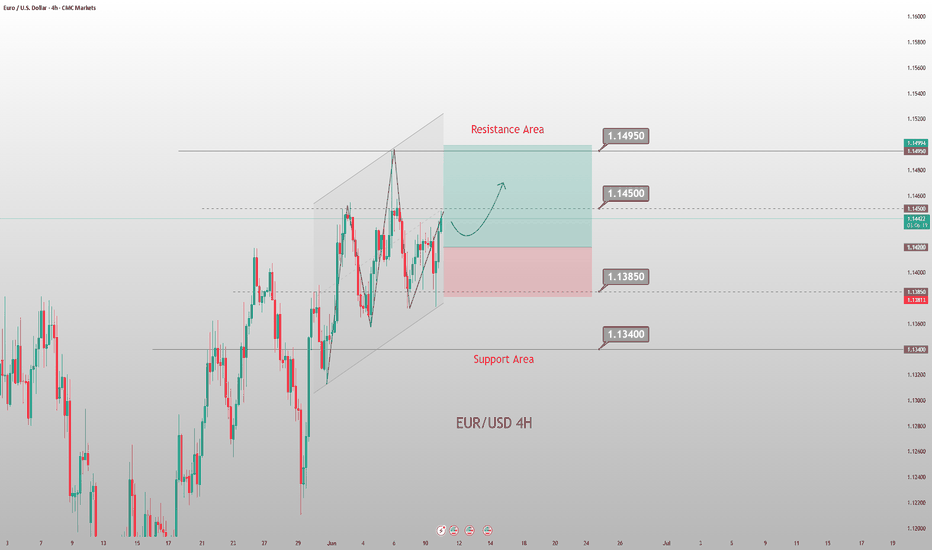

🔍 Chart Overview

Pair: EUR/USD

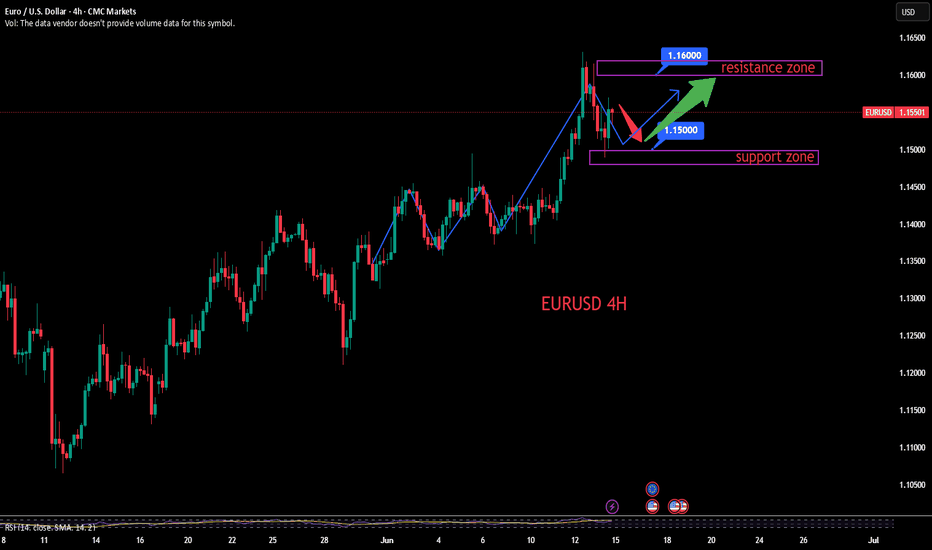

Timeframe: 4H (4-hour)

Current Price: ~1.15881

Date/Time: Around June 13, 2025, 3:47 AM (UTC+3)

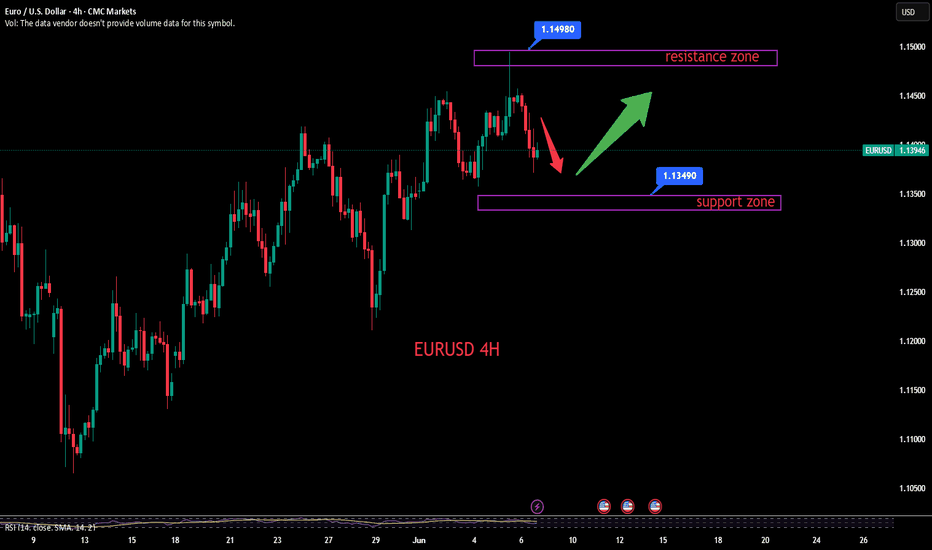

🟩 Highlighted Zones

Upper Supply Zone (resistance area):

Around 1.15150 – 1.15300

Price previously reacted and broke above this zone.

Lower Demand Zone (support area):

Between 1.13600 – 1.13900

Price bounced from this level in the past.

Intermediate Zone (recent consolidation):

Around 1.14300 – 1.14500

Possibly an area of minor structure or reaccumulation.

📈 Price Action

Price made a strong bullish move, breaking through previous resistance zones.

Bearish pin bar (rejection wick) at the top suggests potential reversal or pullback.

🔮 Projected Price Path (White Lines)

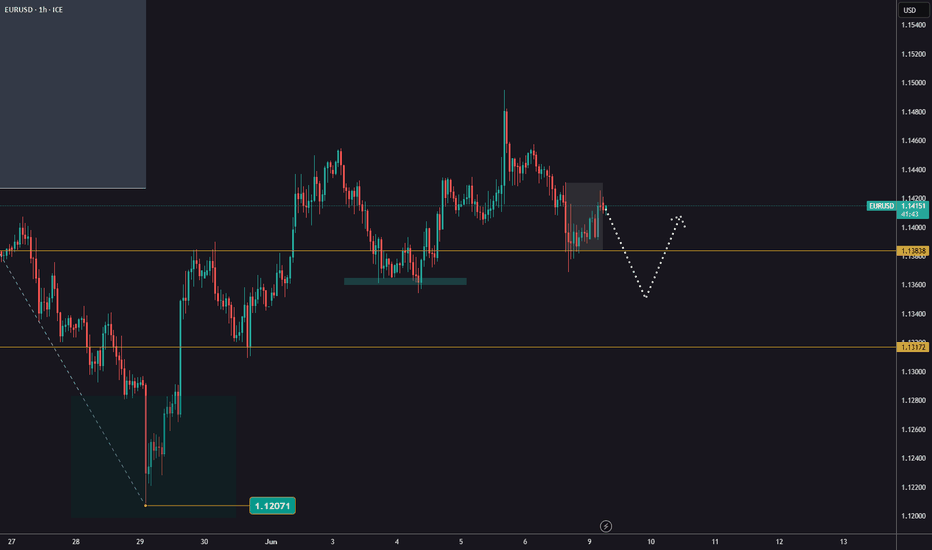

The drawn projection suggests:

Short-term pullback, possibly to retest the 1.15300–1.15150 area.

A minor lower high forms.

Deeper drop expected toward the demand zone at 1.13800 or lower.

🧠 Analysis Implication

This is likely a swing trader’s roadmap, anticipating a reversal after an overextended move.

The analysis could be based on liquidity sweep above highs and return to structure.

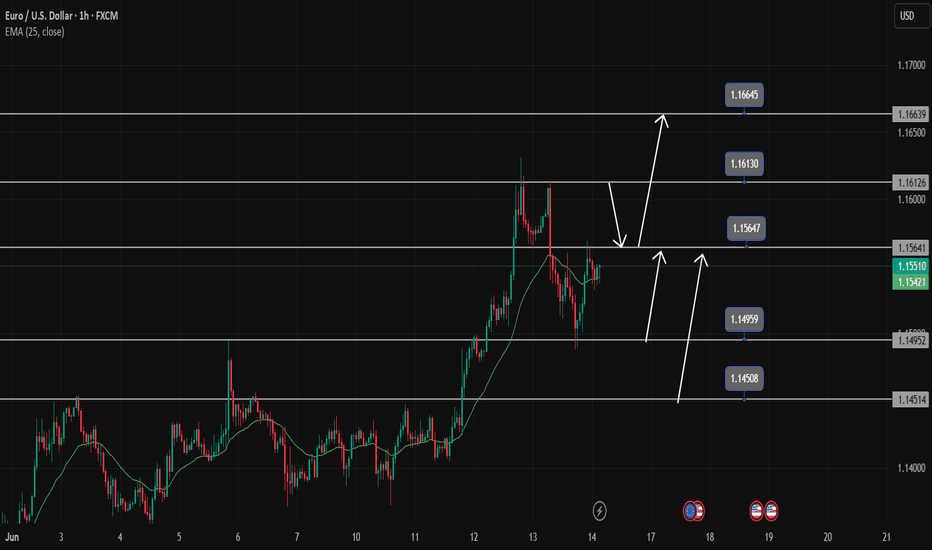

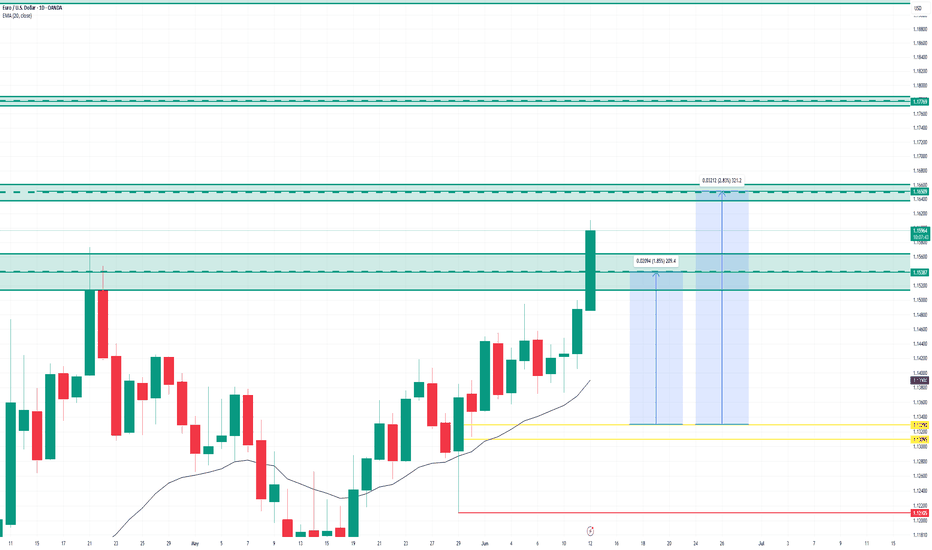

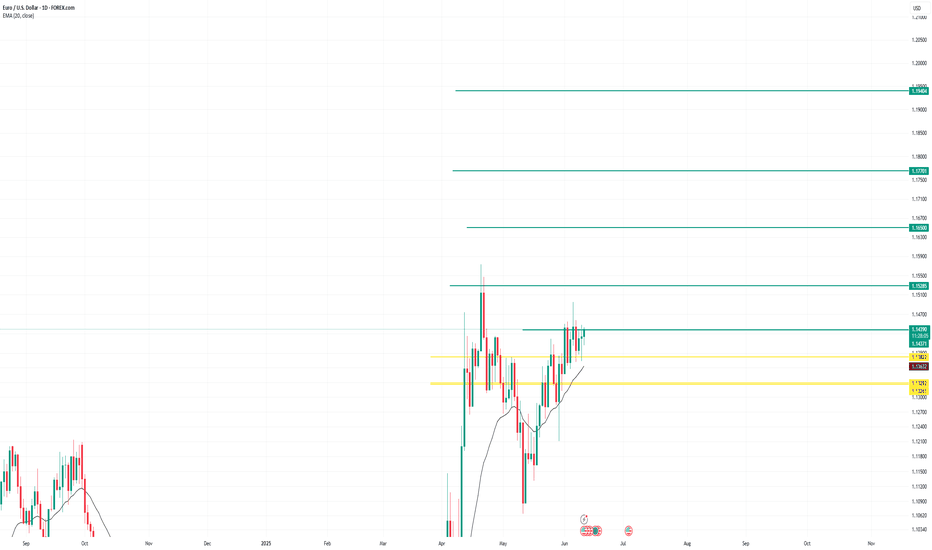

EURUSD is continuing its uptrendEURUSD is still in a strong uptrend. There was a drop in the Asian and European sessions on Friday but that was not enough to reverse the pair. The end of the US session saw the price being pushed up by the bulls from the 1.155 price zone and is stuck in this resistance zone.

The price continues to increase when breaking 1.155 will head towards the resistance of 1.161, the highest peak of last week. If there is a retest of 1.155, the price will head towards 1.166 next week to be able to use short-term SELL strategies

The BUY strategy is still prioritized as the EU is still in an uptrend. The main BUY zone of the pair is still waiting for 1.150 and lower is the breakout zone of 1.145

Resistance: 1.161, 1.166

Support: 1.150, 1.145

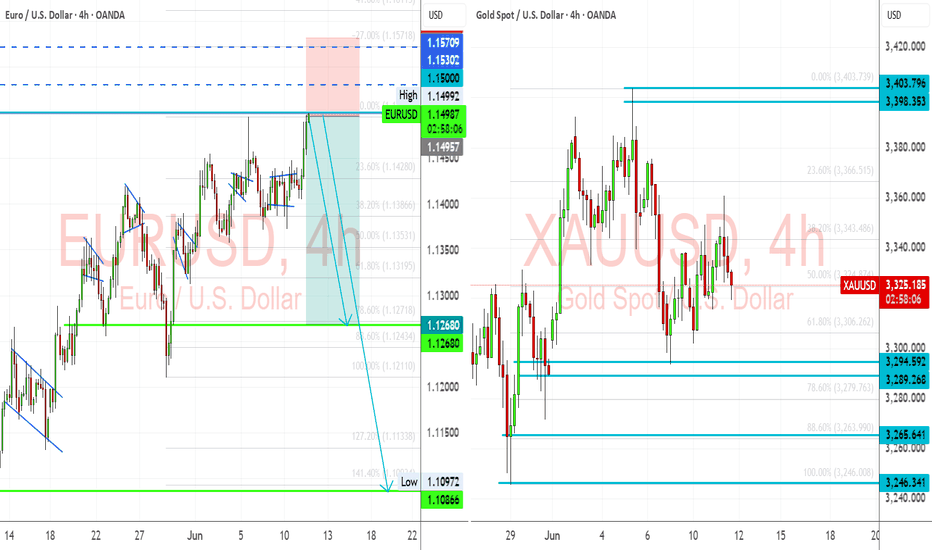

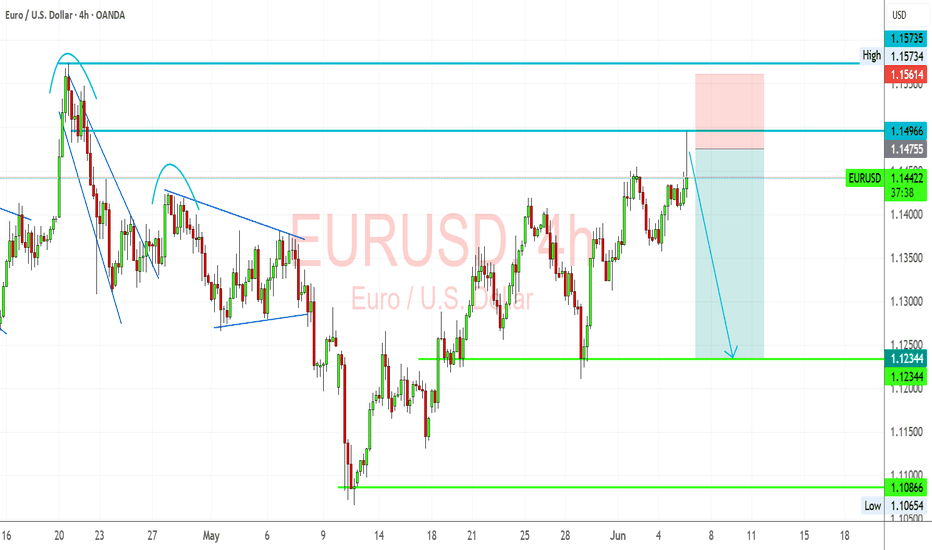

EURUSD Setup | CPI Fades, Fed Focus & Gold Leads Dollar ReboundEURUSD is showing signs of exhaustion after soft US CPI failed to extend the rally beyond 1.1495. While markets initially priced in a dovish Fed response, recent commentary and gold’s rejection from its highs suggest the dollar may be gearing up for a short-term recovery. With Gold pulling back and yields stabilizing, EURUSD could now follow suit lower into key support levels—especially if the Fed maintains a patient tone at this week’s meeting.

🔹 EURUSD (4H) Analysis

📉 Bias: Bearish

💡 Context:

EURUSD stalled just below 1.1500 after the CPI miss and now sits at a high-liquidity reversal zone. With DXY stabilizing and gold already rolling over, EURUSD may lag behind but eventually follow the same path. If the Fed leans hawkish or even neutral (ignoring political pressure), it could catalyze a drop toward 1.1268 and below.

📊 Technical Levels:

Resistance Zone: 1.1495–1.1530

Target 1: 1.1268

Target 2: 1.1086

Invalidation: Daily close above 1.1530 (or strong bullish follow-through after FOMC)

🪙 Leading Asset Clue:

Gold has already rejected major resistance (3,390–3,403) and is now pulling lower. Historically, EURUSD tends to follow when metals stall—especially if driven by real yields and Fed dynamics.

⚠️ Fundamentals to Watch:

🏦 FOMC Rate Decision & Dot Plot (June 12)

📈 US PPI + Jobless Claims (June 13)

💬 Fed Chair Powell's Press Conference

📰 Any shift in ECB or Fed rate cut timelines

🧠 Risk Factors:

Fed surprise dovish shift due to CPI softness

Market overreacts to rate cut expectations

Geopolitical risk-off flows favoring EUR

✅ Summary: Bias and Watchpoints

EURUSD

Bearish

Fed holding firm vs. ECB easing bias

Fed turning dovish post-CPI (Top Risk)

FOMC Rate Decision, PPI, Powell

📌 Final Note:

Gold is leading the turn as dollar strength resurfaces. EURUSD may lag initially but the macro context favors downside from this key resistance zone. Watch the Fed for confirmation—positioning into 1.1268 and 1.1086 looks attractive if the dollar gains traction post-FOMC.

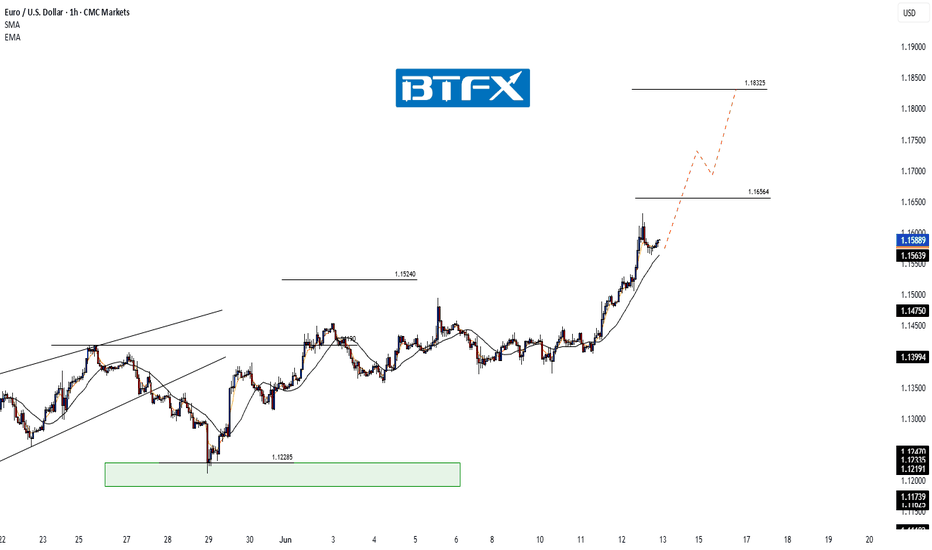

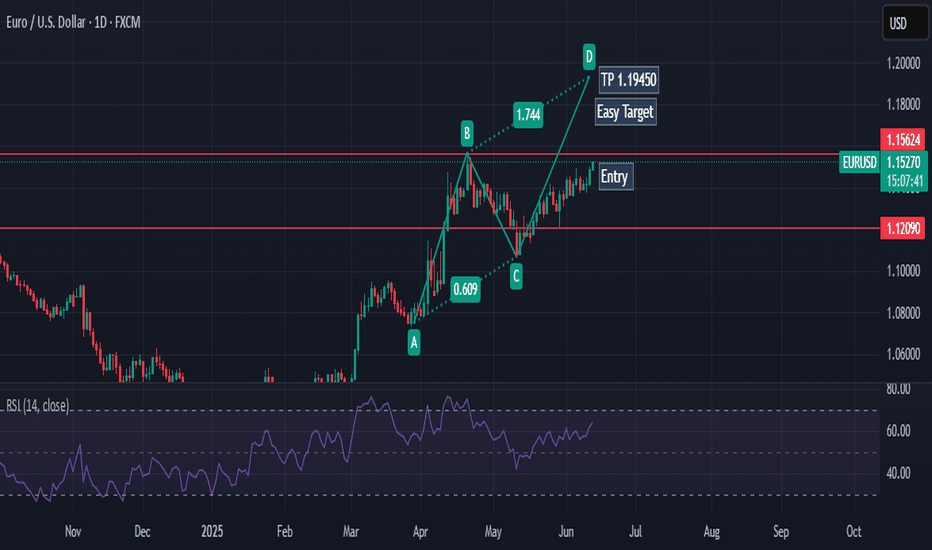

EUR/USD Rally Extends – Eyes on 1.20000 as Momentum BuildsHi Everyone,

As outlined in our analysis last week (idea linked below), EUR/USD continued to the upside and reached the 1.15240 level.

We expect price action to extend further toward the 1.16564 level, which would reinforce our long-term bullish outlook.

A confirmed break above this resistance would likely open the door for a move toward 1.18325, where we anticipate encountering dynamic resistance.

We will provide further updates on the projected path for EUR/USD should price reach this level.

The longer-term outlook remains bullish, with expectations for the rally to extend toward the 1.2000 level, provided the price holds above the key support at 1.10649.

We will continue to update you throughout the week with how we’re managing our active ideas and positions. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for a good end to the week. Trade safe.

BluetonaFX

EURUSD(20250612) Today's AnalysisMarket news:

① The EU hopes that the trade negotiations will be extended beyond the suspension period set by Trump. ② Bessant: As long as "sincerity" is shown in the negotiations, the Trump administration is willing to extend the current 90-day tariff suspension period beyond July 9. ③ Trump will hold multiple bilateral talks during the G7 summit. ④ The total customs revenue of the United States in May reached a record high of US$23 billion, an increase of nearly four times year-on-year. ⑤ Lutnick: One deal after another will be reached.

Technical analysis:

Today's buying and selling boundaries:

1.1463

Support and resistance levels:

1.1556

1.1521

1.1499

1.1427

1.1404

1.1369

Trading strategy:

If the price breaks through 1.1499, consider buying in, and the first target price is 1.1521

If the price breaks through 1.1463, consider selling in, and the first target price is 1.1427

Today's EUR/USD Trend Analysis and Trading RecommendationsThe EUR/USD is trading at the upper end of its recent range, having hit an intraday high of around 1.1440 and remaining near that level. The US Dollar strengthened in the early session due to optimism about the easing of Sino-US trade tensions, but later declined as European stocks fluctuated. Technically, the daily chart shows bulls remain in control, with the 20-day SMA rising gently at 1.1330. In the short term, the pair is range-bound around the 20-day SMA, yet to confirm a bullish breakout, while the 100-day and 200-day SMAs support the overall upward trend.

EUR/USD

buy@1.14200-1.14300

tp:1.14600-1.14900

Correction on EURUSDAfter Friday’s news, EURUSD reached 1,1368.

Make a note of the news candle and wait for a breakout.

If the retracement continues, the next key support level is 1,1317.

Important USD-related news is expected this Wednesday.

Watch for potential trend continuation setups and avoid rushing into new trades.

EURUSD:Sharing of the Trading Strategy for Next WeekAll the trading signals this week have resulted in profits!!! Check it!!!👉👉👉

Fundamental Analysis:

Easing EU-U.S. trade tensions have provided support for the euro, though the stability of the eurozone's economic recovery remains uncertain—subsequent economic data will influence EUR dynamics. Markets are closely monitoring U.S. economic indicators and Federal Reserve policy: weak data or dovish signals could weaken the USD, benefiting EUR/USD.

Technical Analysis (4-Hour Chart):

MACD: Positive histogram shrinking, indicating diminishing bullish momentum and a non-trending market environment.

Price-Volume Divergence: Rising prices accompanied by declining trading volumes signal insufficient upward momentum.

KDJ: Reading of 95 suggests overbought conditions.

Key Levels: Resistance at 1.1461 (upper Bollinger Band), support at 1.1300.

Trading Recommendation:

Consider light long positions near 1.1350 on price retracement.

Trading Strategy:

buy@1.13500-1.13550

TP:1.14500-1.15000

Share accurate trading signals daily—transform your life starting now!

👇 👇 👇 Obtain signals👉👉👉

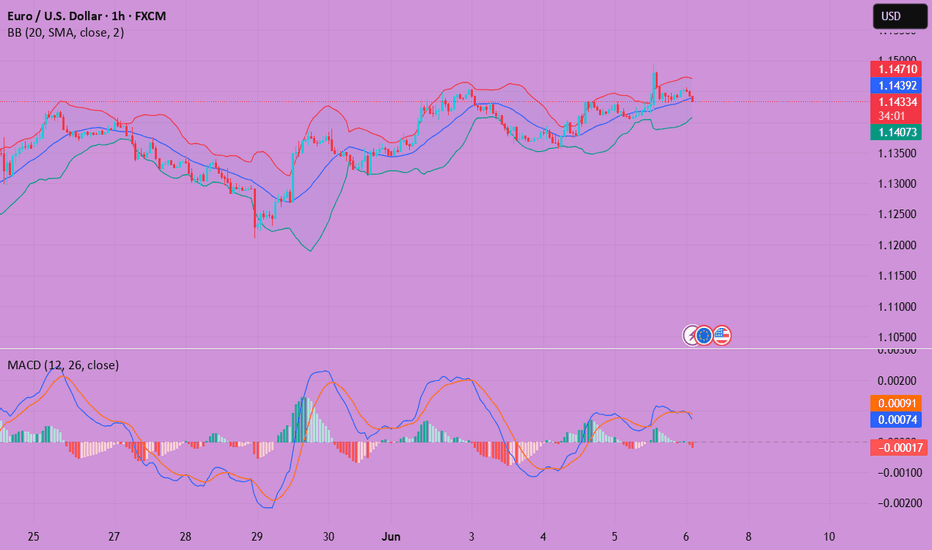

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

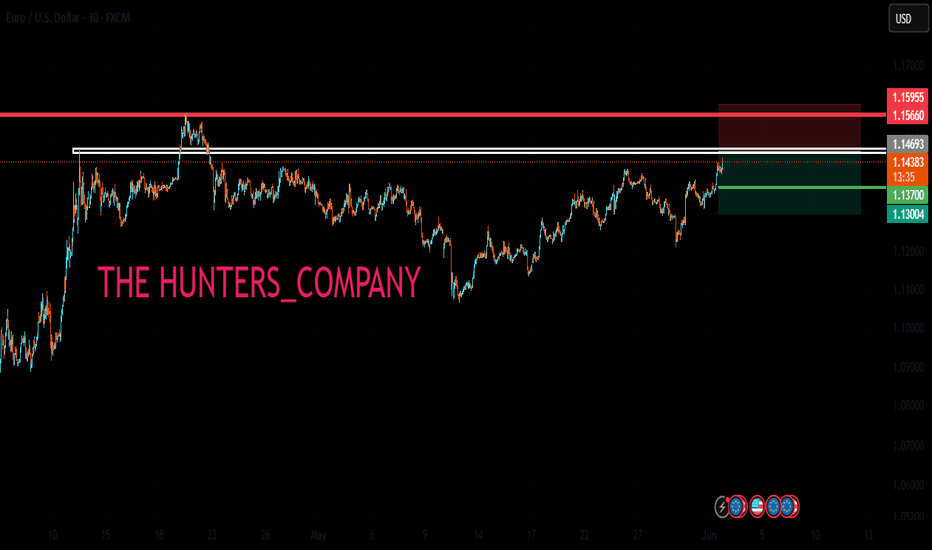

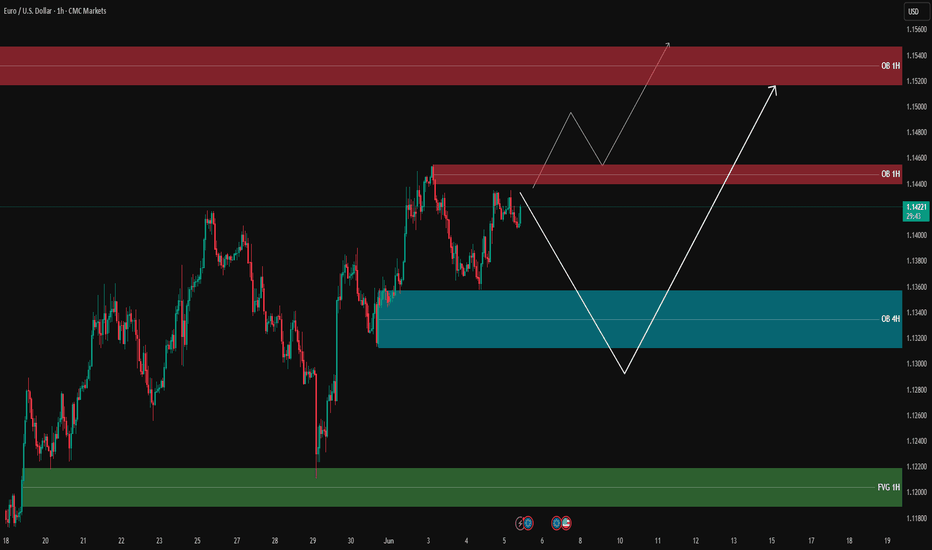

EUR/USD Analysis – Possible Scenarios🔹 Price is currently trading around 1.1421, consolidating between key supply and demand zones.

🔴 Supply Zone (Order Block 1H): 1.14360 – 1.14590

📌 Strong bearish reaction from this resistance area. First scenario: rejection from this OB and a move downward.

🔵 Demand Zone (Order Block 4H): 1.13050 – 1.13430

✅ If price fails to break the resistance, we could see a retracement to this OB. Bullish reaction here may offer long opportunities.

🟢 Fair Value Gap (FVG 1H): 1.11800 – 1.12220

📉 If OB 4H fails to hold, price could drop into this FVG area – a high-liquidity zone for potential reversal.

📊 Possible Scenarios:

1️⃣ Break and hold above OB 1H → price may extend toward next OB zone at 1.15150 – 1.15400

2️⃣ Rejection from OB 1H → pullback to OB 4H → possible long setup if confirmed

3️⃣ Break below OB 4H → deeper move into FVG 1H

‼️ Avoid premature entries – wait for valid confirmations.

🔍 Insight by ProfitaminFX

If this outlook aligns with your bias, or if you see it differently, feel free to share your perspective in the comments. Let’s grow together 📈

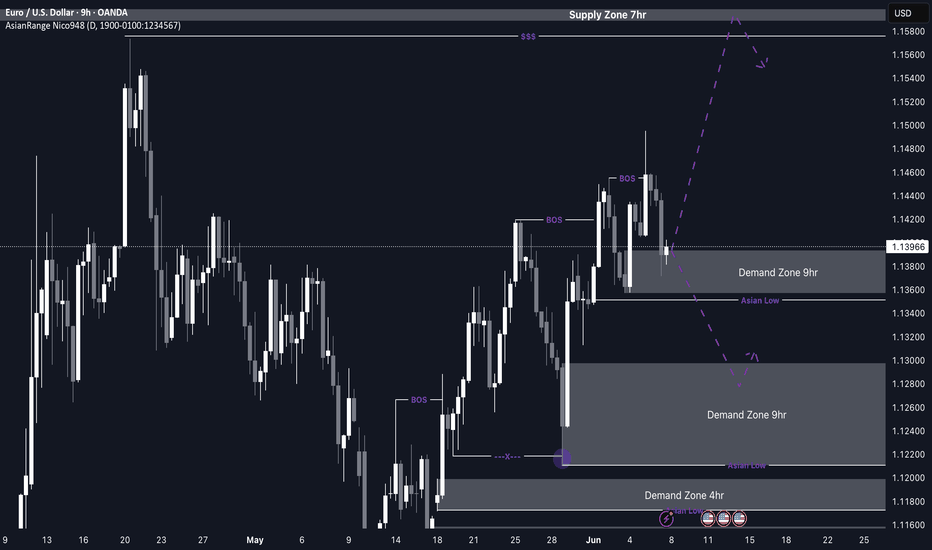

EUR/USD Potential buys from current zone or 1.12800My outlook for EU this week closely aligns with GU — both pairs are showing similar structure and direction. Price continues to form higher highs and higher lows, maintaining its bullish momentum.

Following the most recent break of structure to the upside, EU has now entered a 9H demand zone, where I’ll be watching for signs of accumulation and potential entry as the market opens on Monday.

If this current zone fails to hold, there’s a more discounted 9H demand zone just below, which could offer a cleaner long opportunity. Either way, both scenarios follow the pro trend, which adds conviction to the buy idea.

Confluences for EU Buys:

Price has broken structure to the upside and entered a clean 9H demand zone

There’s another refined 9H demand zone just below for additional confirmation

Plenty of upside liquidity remains untouched

Structure remains bullish on the higher timeframes, making this a pro trend setup

P.S. If price reacts well and continues pushing higher, I’ll be keeping an eye on the 7H supply zone above for any possible short-term bearish reaction.

Wishing everyone a successful and disciplined trading week ahead!

EURUSD Analysis – Short Bias Builds on Key Resistance RejectionEURUSD pair is currently testing a critical resistance zone around 1.1495–1.1500, with bearish rejection beginning to form on the 4H timeframe. The technical setup suggests a potential lower high forming within the context of a broader downtrend, supported by a confluence of horizontal resistance and bearish risk catalysts.

🔍 Technical Overview:

Resistance Zone: 1.1495–1.1575 (multi-timeframe key levels)

Support Levels to Watch: 1.1234 (range base) and 1.1086 (swing low)

Price Action: After a sustained rally, price is showing exhaustion near previous highs, and a rejection pattern is emerging, suggesting selling interest.

Risk Management: Stop placed above 1.1575 high, with downside targets near 1.1234 and extended toward 1.1086.

🧠 Fundamental Backdrop:

ECB Policy Outlook: Lagarde recently warned that a stronger euro and higher tariffs may hurt EU exports. This dovish tone could weigh on EUR sentiment in the medium term.

US Dollar Strengthening: The latest US labor market data (ADP, JOLTS) beat expectations, showing continued resilience in employment and wage growth. This supports the Fed's data-dependent approach, favoring a stronger USD.

Macro Tensions: Global trade concerns (Trump’s tariffs, weak China demand, Germany’s slowing job market) are adding pressure to EUR while supporting safe-haven USD flows.

ECB Consumer Expectations Survey (April): Highlights persistent inflation fears and deteriorating economic confidence.

⏳ Scenario Outlook:

✅ Bearish Bias Preferred below 1.1500 with confirmation of rejection.

🎯 Target Zone 1: 1.1234 – Strong structure & demand zone.

🎯 Target Zone 2 (Extended): 1.1086 – Major low from mid-May.

❌ Invalidation: A breakout and close above 1.1575 would neutralize the bearish outlook and open up higher targets toward 1.17.

Conclusion: The EURUSD pair presents a compelling short opportunity, with both technical resistance and macro pressure aligning for a retracement or reversal. Short setups are favored unless bulls reclaim and hold above the 1.1575 handle.

EURUSD(20250606) Today's AnalysisMarket news:

The European Central Bank cut three key interest rates by 25 basis points. Lagarde hinted that the rate cut cycle will end, and the market is no longer fully pricing in another 25 basis point rate cut this year.

Technical analysis:

Today's buying and selling boundaries:

1.1447

Support and resistance levels

1.1537

1.1503

1.1481

1.1412

1.1391

1.1357

Trading strategy:

If the price breaks through 1.1447, consider buying, and the first target price is 1.1481

If the price breaks through 1.1412, consider selling, and the first target price is 1.1391

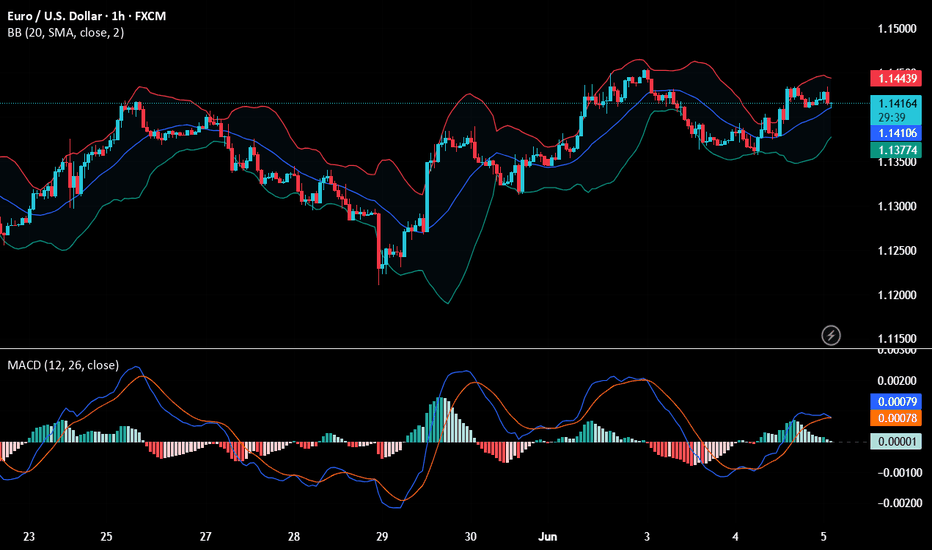

EURUSD(20250605) Today's AnalysisMarket news:

U.S. economic data-① ADP employment increased by 37,000 in May, far below the expected 110,000 and the previous value of 62,000. ② The U.S. ISM non-manufacturing index in May fell to 49.9, shrinking for the first time in nearly a year, and the expected increase was from 51.6 to 52.

Technical analysis:

Today's buying and selling boundaries:

1.1401

Support and resistance levels:

1.1478

1.1449

1.1431

1.1372

1.1353

1.1324

Trading strategy:

If the price breaks through 1.1431, consider buying, and the first target price is 1.1449

If the price breaks through 1.1401, consider selling, and the first target price is 1.1372