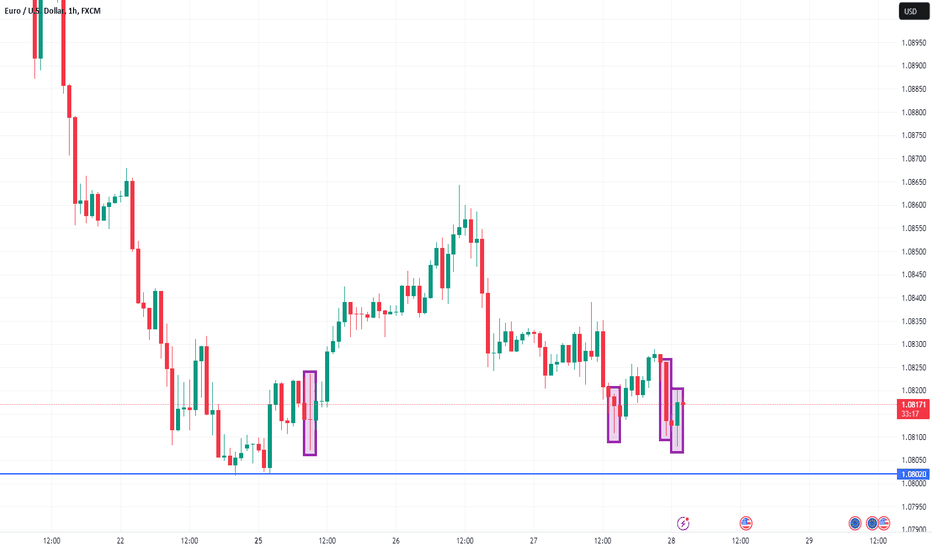

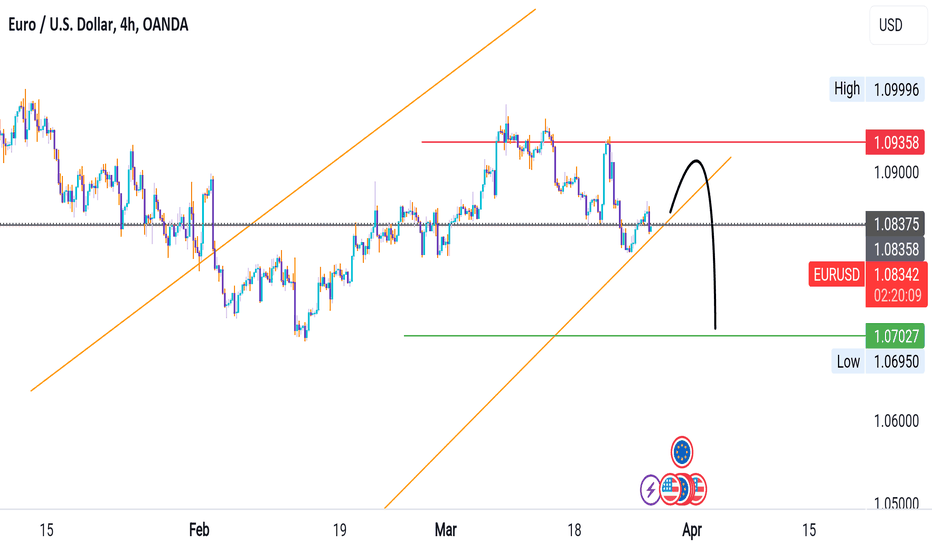

EURUSD - BUY SIGNALEUR/USD holds a very narrow range in the low 1.0800s.

Bargain hunters are still likely to look at dips to near 1.0800 as a buying opportunity for now.

Short-term trend dynamics are neutral while the daily and weekly DMIs still lean, if only moderately, EUR-bullish. That should limit downside pressure on spot in the near term at least.

Resistance is 1.0865/1.0875

Guys, what do you think? Leave a comment with your thoughts.

Eurusdlong

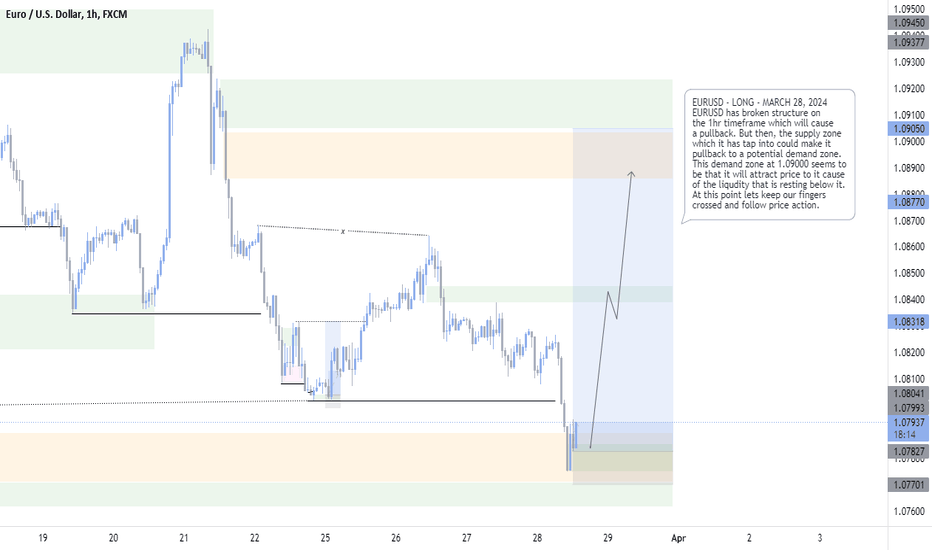

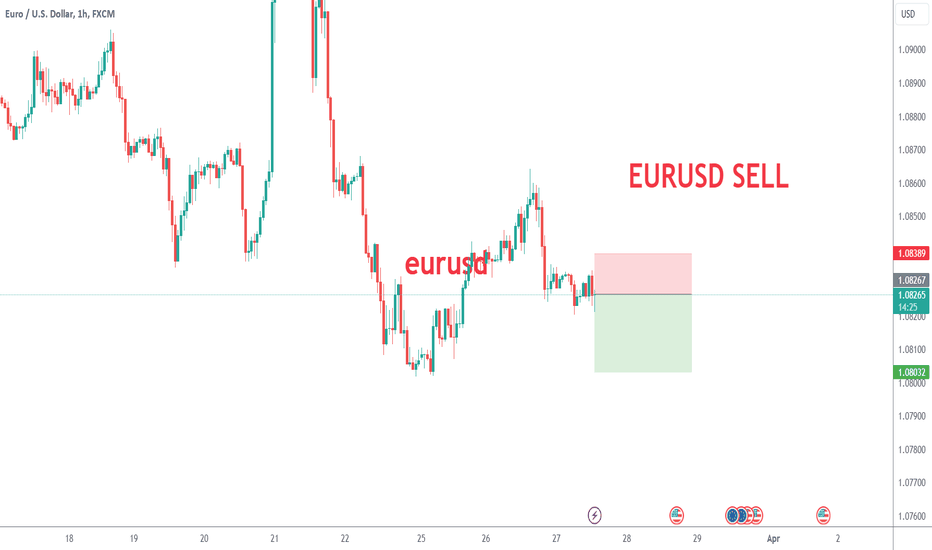

EURUSD - LONG - MARCH 28, 2024EURUSD has broken structure on the 1hr timeframe which will cause a pullback. But then, the supply zone which it has tap into could make it pullback to a potential demand zone. This demand zone at 1.09000 seems to be that it will attract price to it cause of the liquidity that is resting below it. At this point lets keep our fingers crossed and follow price action.

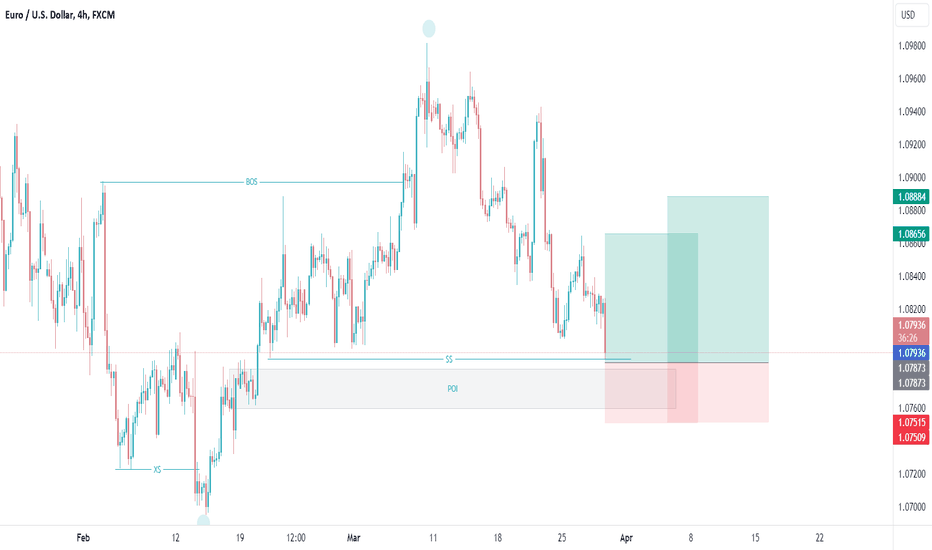

EURUSD Analysis of PreferforexAccording to the 4hour View, the pair EURUSD is in Bullish, it break the bullish structure and now it is retracing to find more liquidity and to mitigate the unmitigated POI.

It is now near to a POI, expecting the bullish continuation when the price touch and react on this POI.

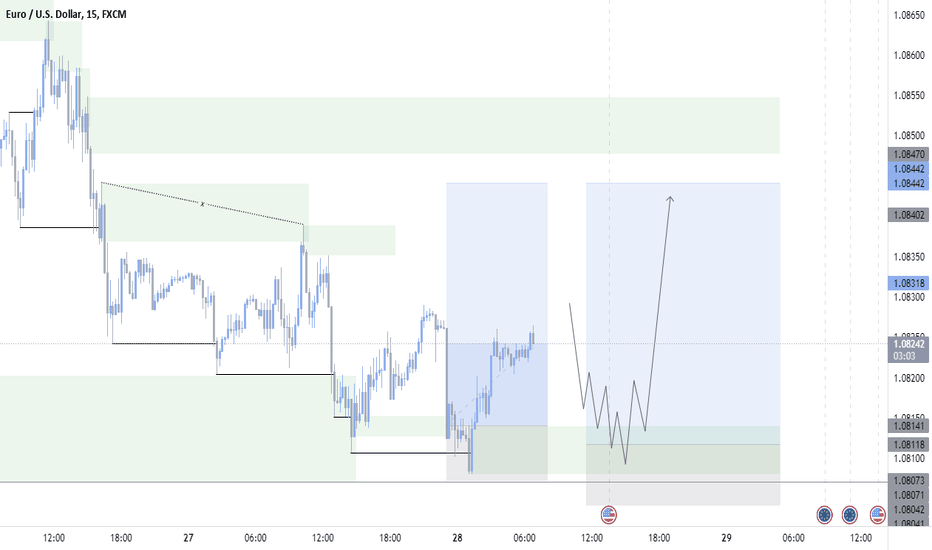

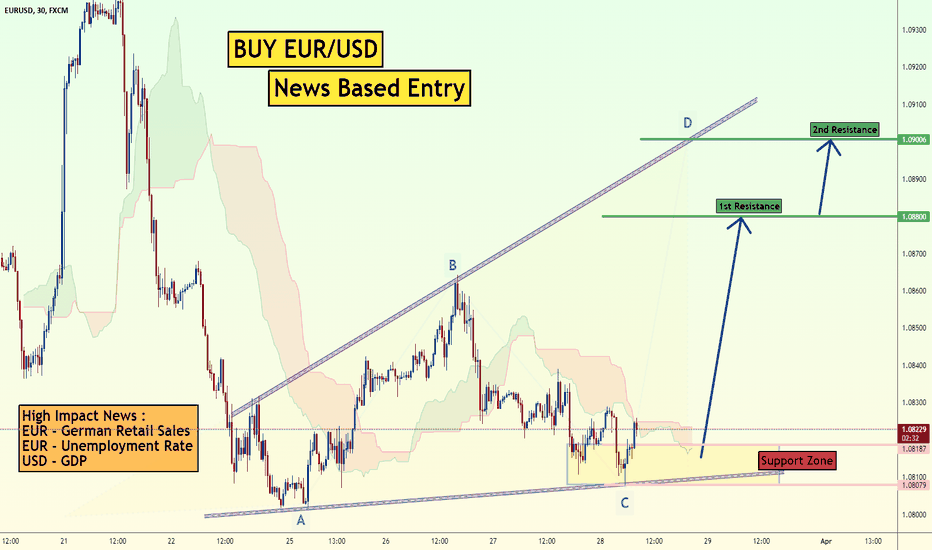

Buy EURUSD News BasedThe EUR/USD pair on the M30 timeframe presents a potentially ambiguous situation with an expanding triangle pattern. While this pattern can signal a breakout in either direction, some caution is advised before entering a long (buy) position.

Potential Long Trade :

Entry around: 1.0823 (current price)

Target Levels:

1.0880: This represents the upper trendline of the triangle, which could act as the initial upside target upon a confirmed breakout.

1.0900: This is a further extension of the upside target, based on the recent price movement.

Stop-Loss: Place a stop-loss order below the lower trendline of the triangle, ideally around 1.0807. This helps limit potential losses if the price breaks down from the triangle pattern.

Thank you.

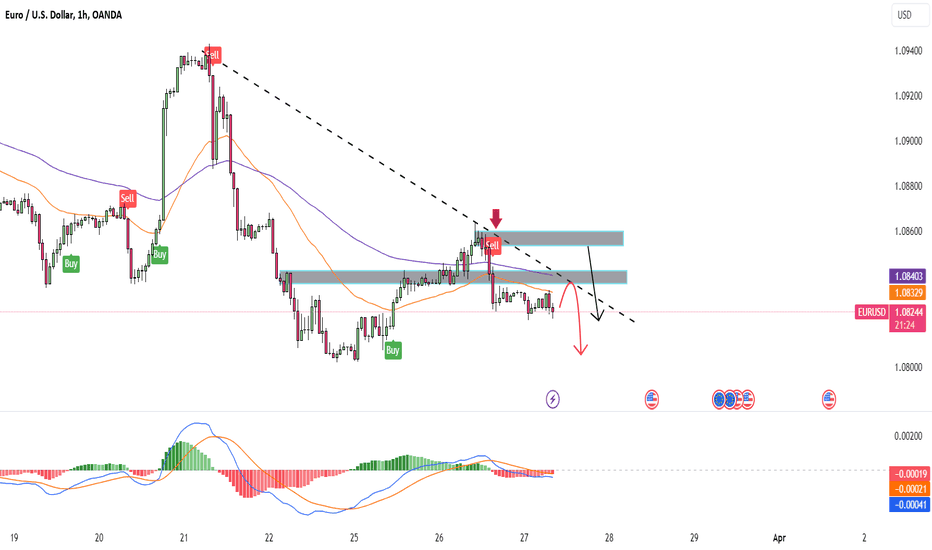

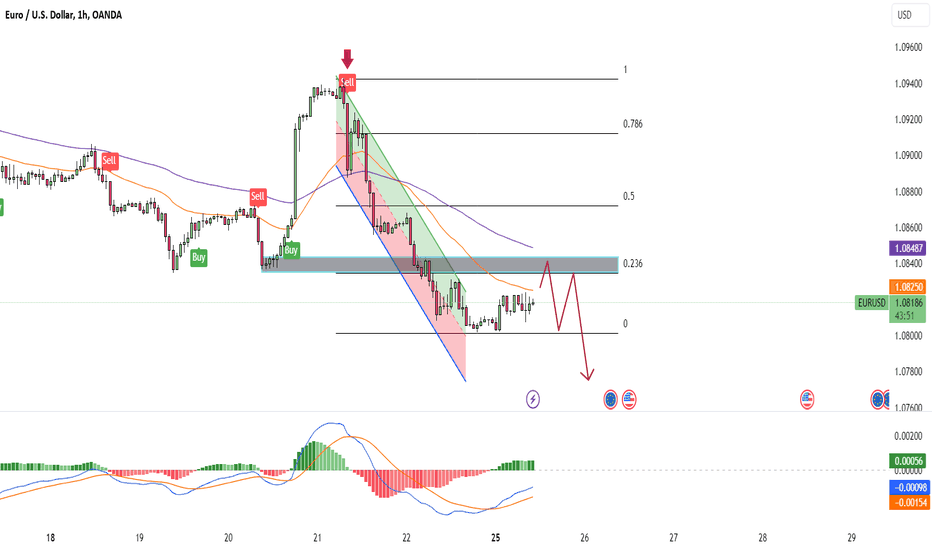

💡 EURUSD: Forecast March 27EURUSD yesterday rose to the resistance zone around 1.0855 and formed a selling pressure zone for us. You can enter a sell order with the bearish candle marked with a red arrow as shown in the chart.

Currently, the market is turning bearish. If you look at the low time frame, you can see this downward trend much more clearly. Our current trading strategy is selling. and the nearest resistance area is the supply area and is struggling around the previous peak at the price level of 1.0840. If the price can return to this resistance area, you can find a signal to sell.

EURUSD → Day Analysis | BUY SetupHello Traders, here is the full analysis.

Price reversal going up, levels for BUY . EURUSD long

! Great BUY opportunity EURUSD

I still did my best and this is the most likely count for me at the moment.

Support the idea with like and follow my profile TO SEE MORE.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

Patience is the If You Have Any Question, Feel Free To Ask 🤗

Just follow chart with idea and analysis and when you are ready come in THE GROVE | VIP GROUP, earn more and safe, wait for the signal at the right moment and make money with us💰

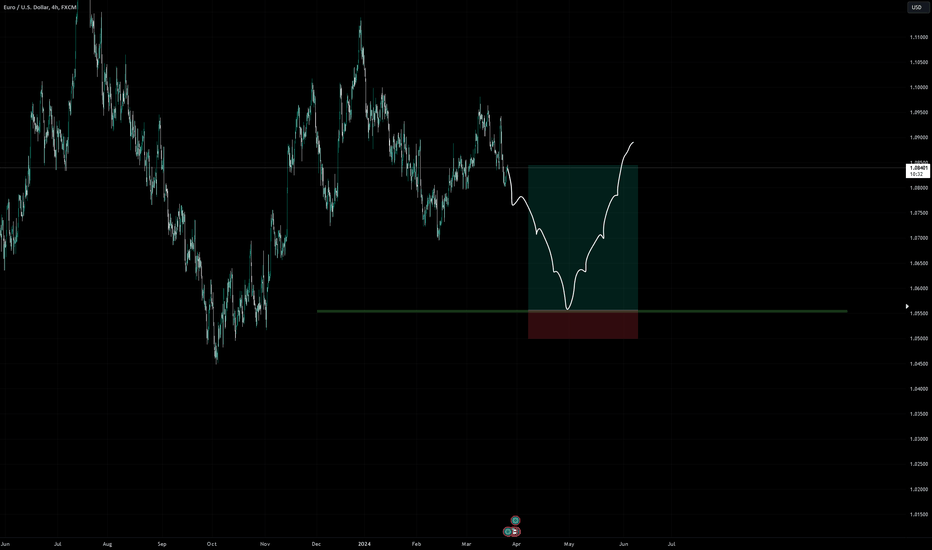

EUR/USDHello everyone, and welcome, subscribers.

Please share your personal opinions in the comments. Booster and subscription requests are appreciated.

Last week, the February inflation indicators for the United States were released, showing a higher level than expected. It indicated that contrary to market expectations, inflationary pressures are not abating. There's speculation that the Fed may adjust its dot plot at this week's FOMC meeting and concerns are rising that the rate cut may be postponed until the latter half of the year, not June.

March 18: Eurozone February Consumer Price Index will be released.

March 19: BOJ Interest Rate Decision. It's anticipated that BOJ will halt its negative interest rate policy at this meeting.

March 21: FOMC meeting is scheduled, with a rate hold expected. The dot plot will be released, and remarks on future monetary policy will be crucial.

March 22: Speech by Chairman Powell.

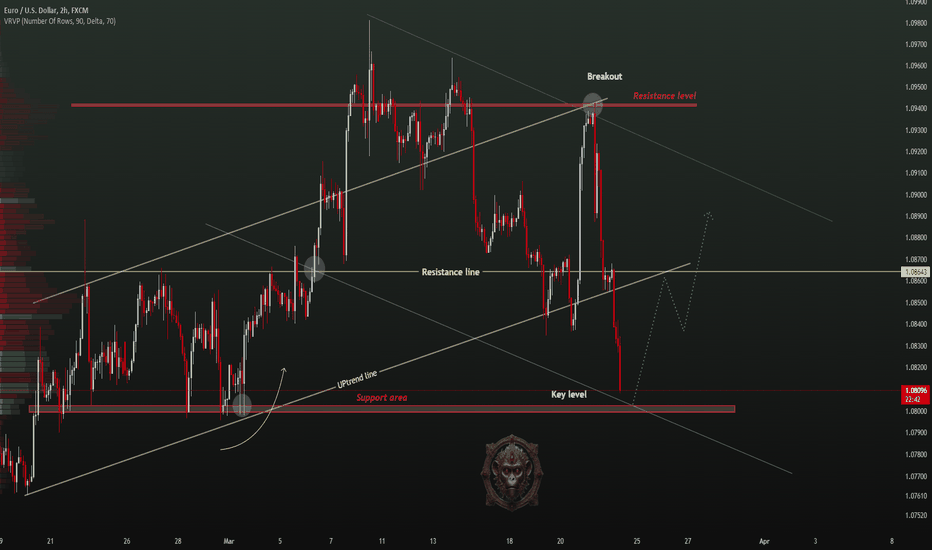

The euro has been forming a downward trend and has shown signs of rebounding after hitting the 1.07000 line recently. There's an expectation of a rise to the 1.10000 line, but there's some concern about potential abrupt changes in direction due to variables this week. Considering the upcoming releases, movement can be anticipated in two ways:

First, short-term rise followed by resistance at the 1.10000 line, leading to medium to long-term decline.

Second, breaking below the 1.07000 line, leading to short-term decline towards the 1.04500 line.

If movements deviate from expectations, we will analyze again and adjust the strategy

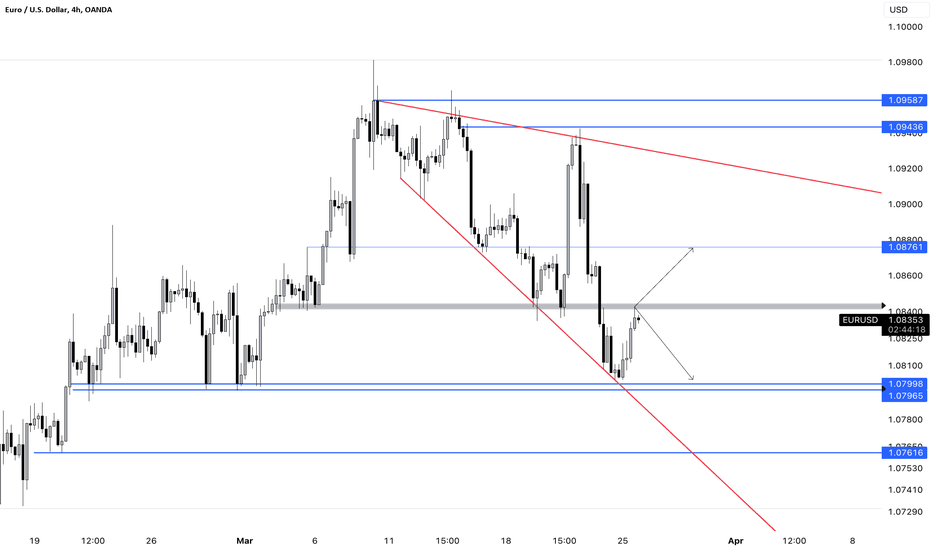

EURUSD - BUY SIGNALEurozone PMIs continued to paint a grim picture for the region’s manufacturing outlook. That is not hugely relevant for the FX market, anyway. The soft economic outlook in the Eurozone has been priced in for a while, and with markets relatively confident about a June European Central Bank cut, it’s mostly Dollar rate expectations that are set to keep moving EUR/USD.

It remains unlikely that the pair can enjoy a sustained recovery without a decline in USD rates, but Thursday’s positive Dollar reaction to US data appeared overdone considering the recent narrative by the Fed, and I don’t feel EUR/USD should fall much further before bottoming out.

Guys, what do you think? Leave a comment with your thoughts.

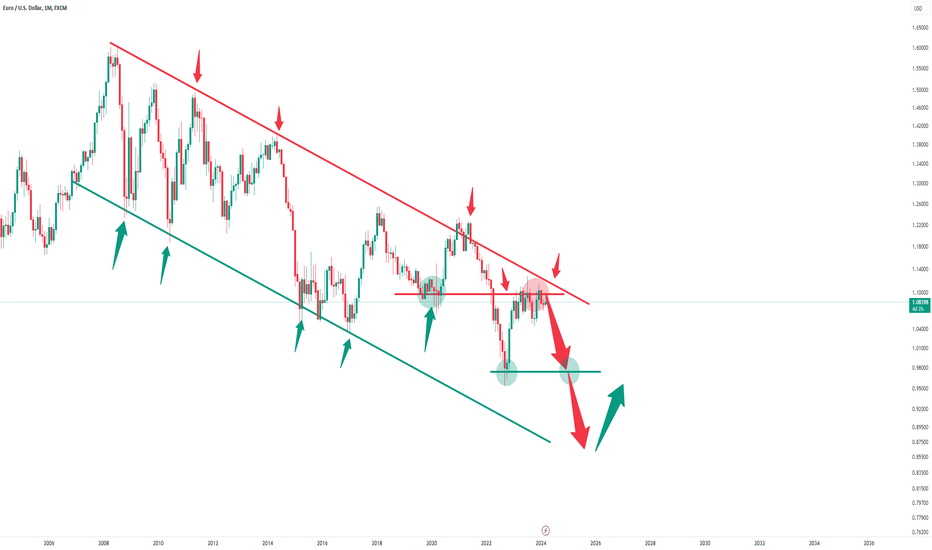

EurUsd - 1.000 Pip DropHello Traders, welcome to today's analysis of EurUsd.

--------

Explanation of my video analysis:

EurUsd has been trading in a pretty obvious descending channel for over a decade and is currently retesting the top resistance of the channel. Furthermore there is a horizontal structure level around the $1.09 level which is also acting as resistance. I am expecting more bearish pressure on EurUsd to eventually retest the lower support of the channel pattern.

--------

I will only take a trade if all the rules of my strategy are satisfied.

Let me know in the comment section below if you have any questions.

Keep your long term vision.

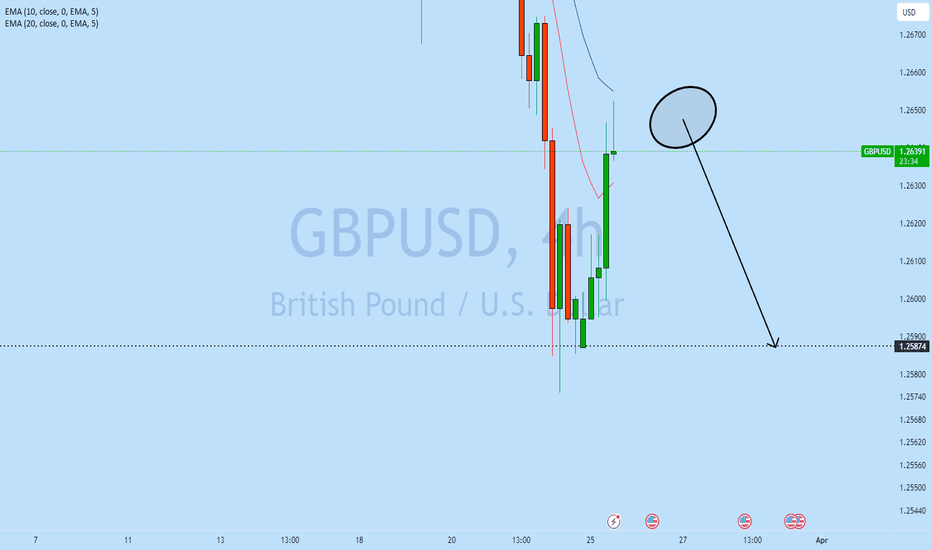

EURUSD and GBPUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

💡 EURUSD: Forecast March 25After the railroad model, EURUSD broke the previous bottom and fell sharply in the past session. It has now approached the initial target level around 1.08 and completed the head-and-shoulders reversal pattern. The sellers are showing dominance, expecting the price to continue to go down, the next target is around 1.07xx, you can already look for selling opportunities.