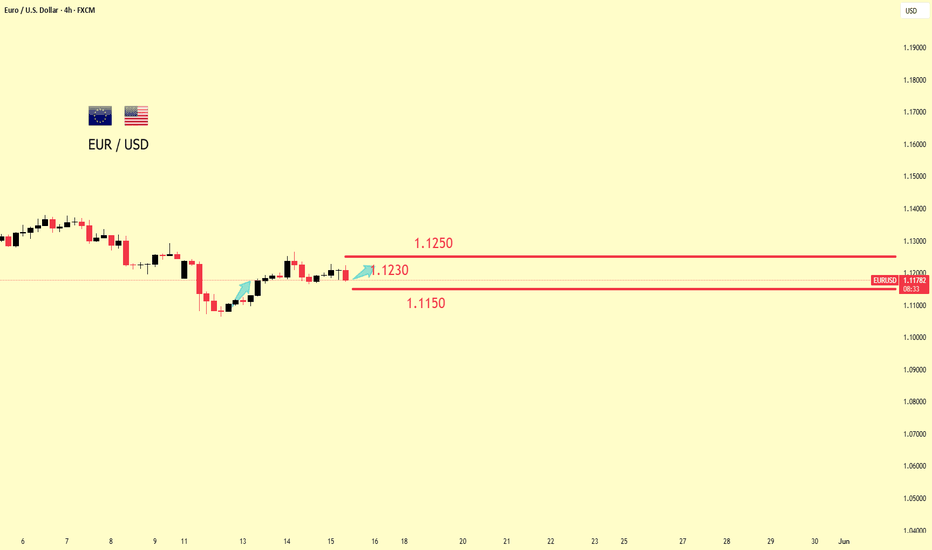

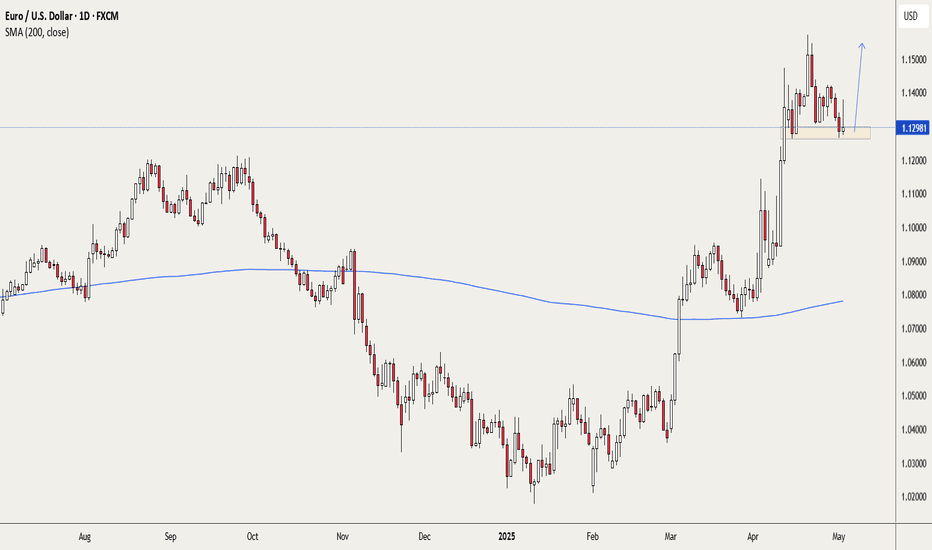

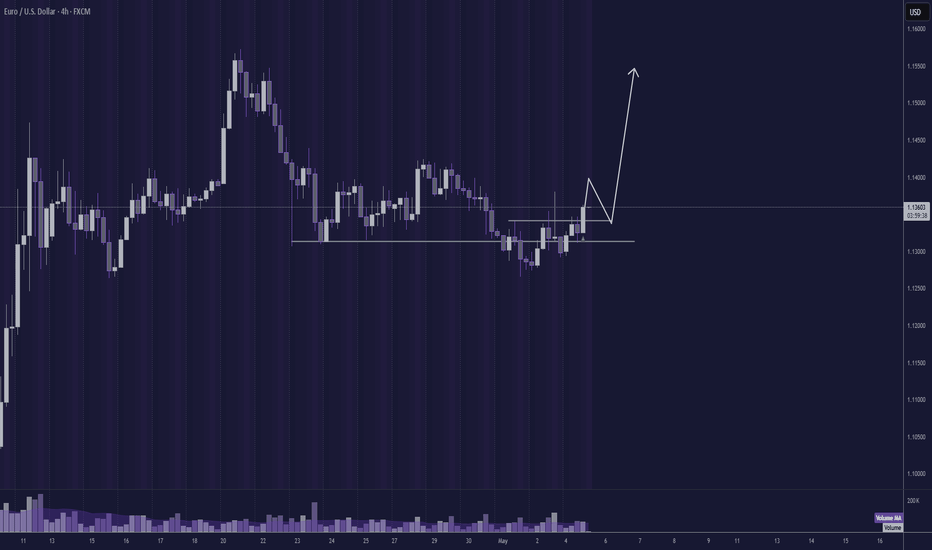

EURUSD: Growth Is Coming! Buy!Driven by the lower-than-expected U.S. Producer Price Index (PPI) data, the EUR/USD exchange rate oscillated higher and broke through the 1.1200 threshold. During the North American trading session, EUR/USD rose 0.25% and traded near 1.1200, indicating that short-term bullish momentum is gradually strengthening.

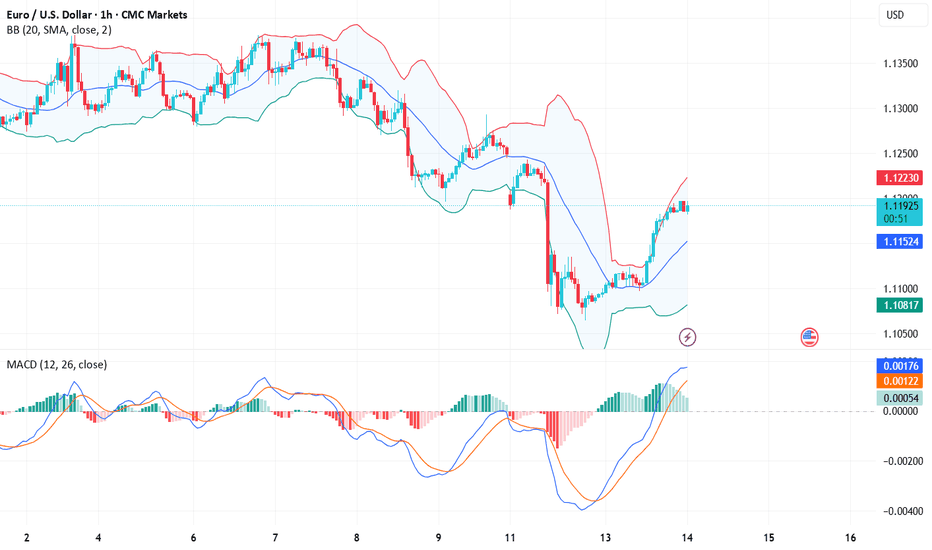

The EUR/USD has successfully broken through the psychological resistance level of 1.1200, forming a strong upward breakout pattern. The MACD indicator shows a golden cross formation, with the histogram turning from negative to positive, signaling a shift in momentum to bullish. In the short term, EUR/USD is expected to continue its upward momentum, with the primary target being the previous high of 1.1230. If this level is effectively breached, it could challenge the 1.1250–1.1275 area.

For support levels, 1.1180 serves as a key short-term support, followed by the 1.1150 zone.

you are currently struggling with losses, or are unsure which of the numerous trading strategies to follow, at this moment, you can choose to observe the operations within our channel.

Eurusdlong

USOIL UPDATEThe EUR/USD exchange rate continued its upward momentum, approaching the 1.1230 area during the North American session, extending Tuesday's gains. The major currency pair attracted significant buying interest due to the weakening U.S. dollar, with the U.S. Dollar Index retreating from around the monthly high of 102.00 to near 100.50.

This week, the key catalyst for EUR/USD will be Federal Reserve Chair Powell's speech at the Thomas Laubach Research Conference in Washington on Thursday. In terms of economic data, traders will focus on the release of U.S. April retail sales and Producer Price Index (PPI) figures on Thursday.

From a candlestick pattern perspective, the recent price action has formed a rising wedge, a technical formation often indicating a potential trend reversal. The exchange rate is currently testing the support level at 1.1220. A break below this level could trigger a further retracement to the 1.1180 zone.

you are currently struggling with losses, or are unsure which of the numerous trading strategies to follow, at this moment, you can choose to observe the operations within our channel.

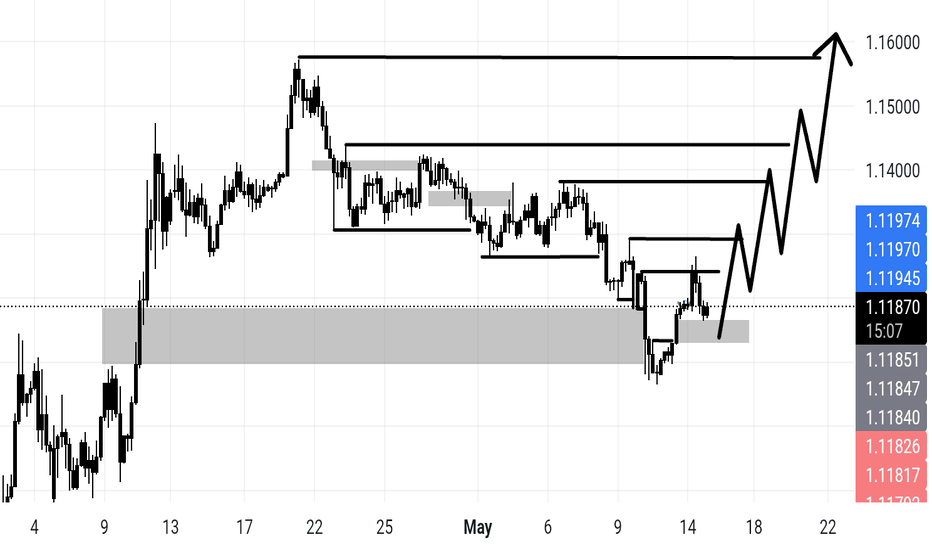

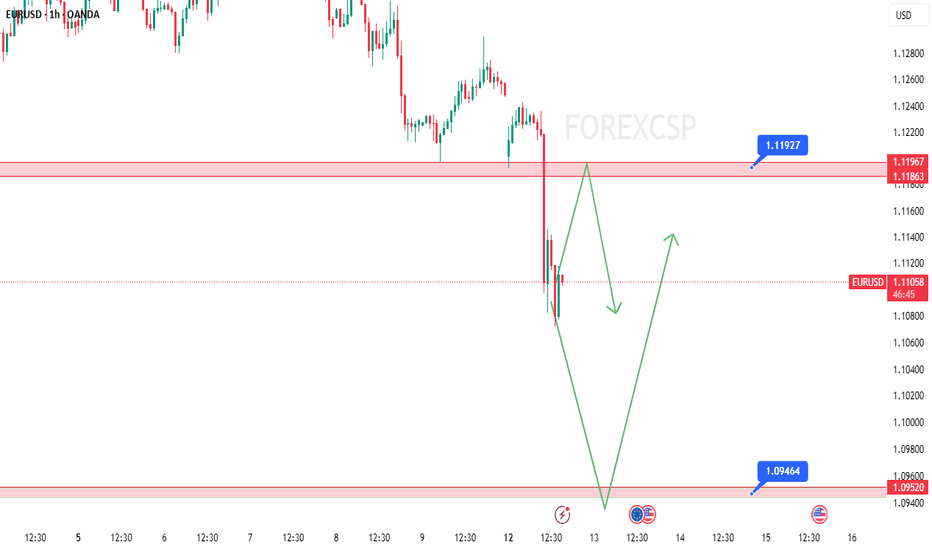

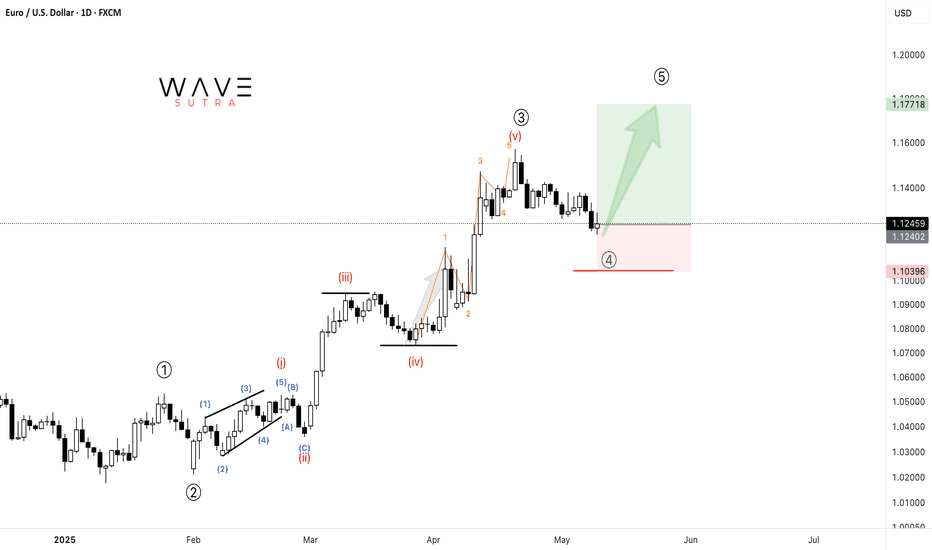

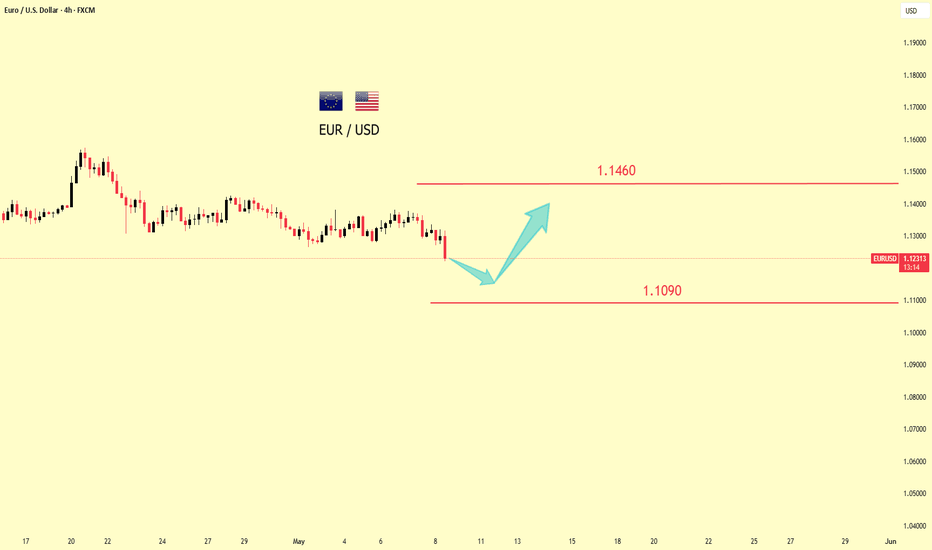

EURUSD – This Week’s SetupAs shown in the previous analysis, the key levels have been broken 🔓.

We’re now waiting for a pullback to short from the marked level 🔽.

But if price goes straight to the lower level without a pullback, we’ll look for a buy opportunity there 🔼🎯.

Exact price levels shown on the chart!

Live markets need live plans! ⚔️📈

For detailed entry points, trade management, and high-probability setups, follow the channel:

ForexCSP

EURUSD(20250514) Today's AnalysisMarket news:

The U.S. unadjusted CPI annual rate unexpectedly dropped to 2.3% in April, the lowest since February 2021.

Technical analysis:

Today's buying and selling boundaries:

1.1154

Support and resistance levels:

1.1261

1.1221

1.1195

1.1113

1.1087

1.1047

Trading strategy:

If the price breaks through 1.1195, consider buying, the first target price is 1.1221

If the price breaks through 1.1154, consider selling, the first target price is 1.1113

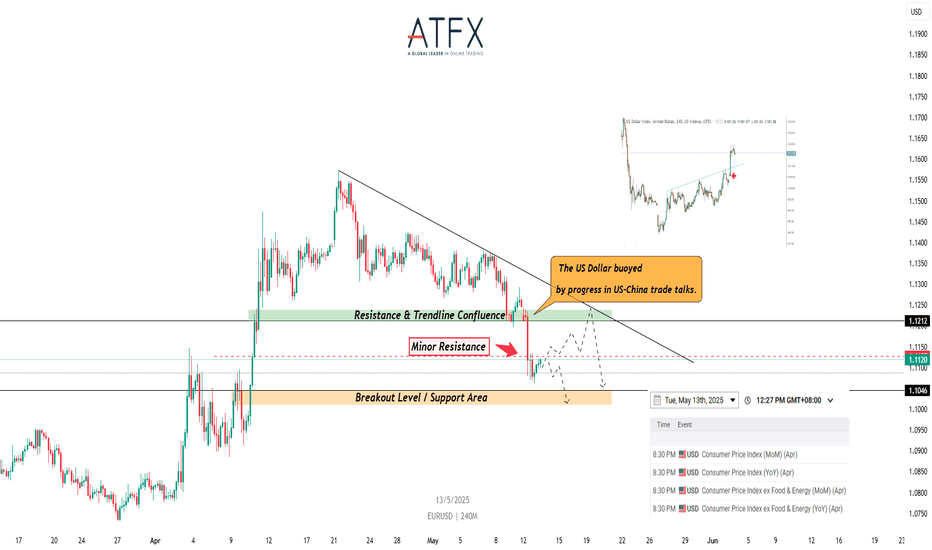

EUR/USD consolidates ahead of US CPICMCMARKETS:EURUSD EUR/USD holds above the 1.1110 area ahead of key US inflation data. The pair rebounded modestly after finding support near the breakout zone (1.1046-1.1100), but upward momentum is capped by minor resistance at 1.1127. A failure to break above this level may expose the 1.1046 support. Technically, the broader trend remains under pressure, as the pair trades below trendline resistance and recent breakdown levels. The upcoming US CPI release could trigger volatility and provide directional confirmation.

Resistance: 1.1127, 1.1212

Support: 1.1046, 1.0960

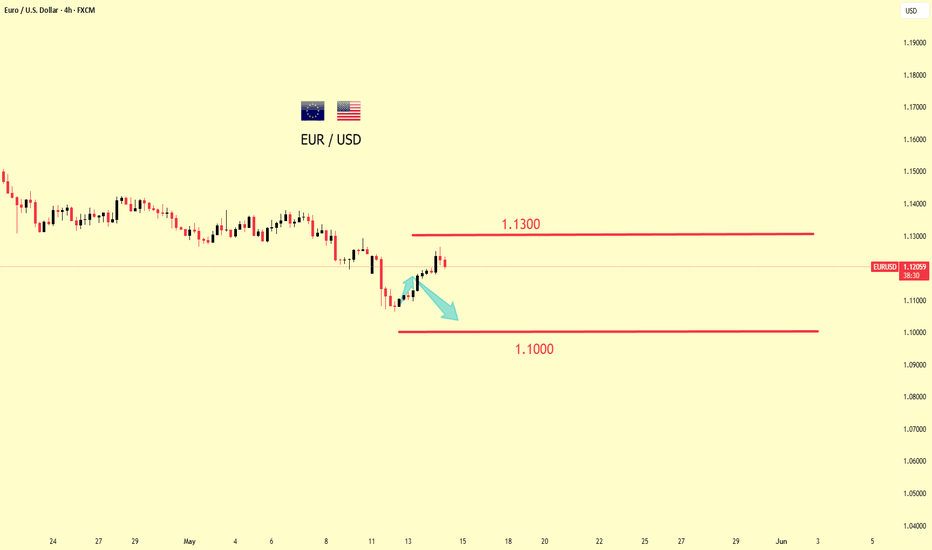

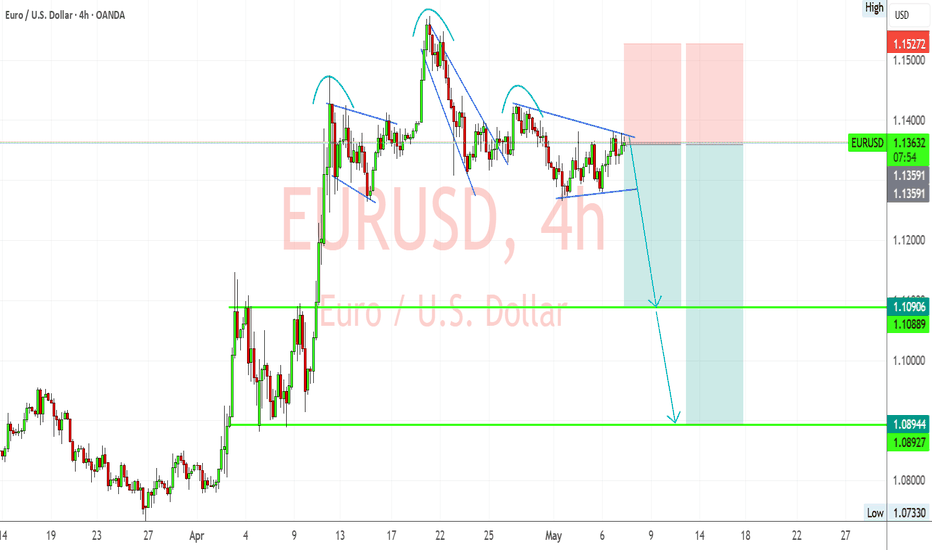

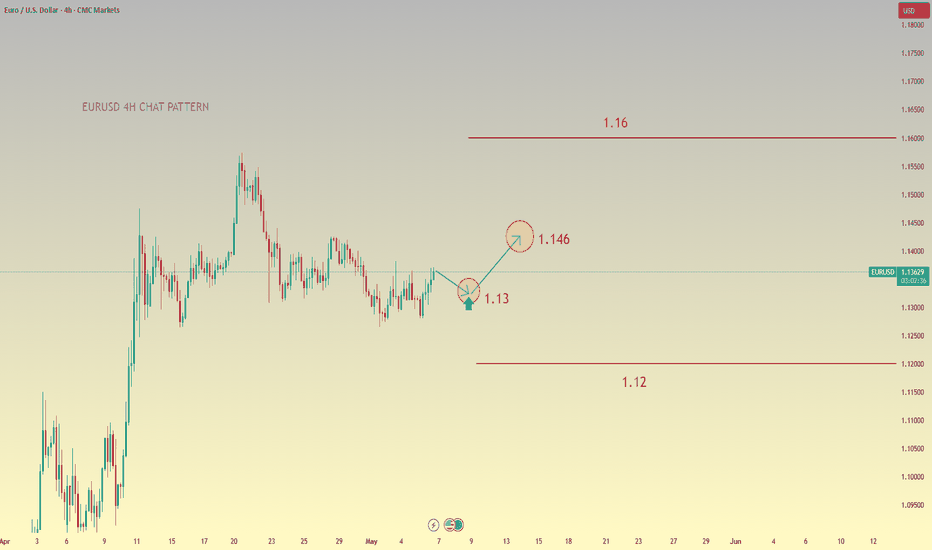

EURUSD Bearish Structure Forming Amid Dollar UncertaintyEURUSD appears to be carving out a series of lower highs, showing potential signs of distribution. With price compressing inside a symmetrical triangle following multiple failed breakout attempts, the stage could be set for a bearish breakdown. This comes as U.S. inflation and Fed policy hold the spotlight and the euro faces political and structural crosswinds.

📉 Technical Breakdown (4H Chart)

Triple Top / Head & Shoulders Variant Forming:

Price action has traced a rounded top sequence, forming a triple top or complex head and shoulders structure.

Each rally attempt has been followed by steeper declines and faster recoveries—typical of a topping process.

Triangle Contraction Zone:

Current price is consolidating into a symmetrical triangle, which is often a continuation pattern.

Bearish breakout is expected if support around 1.1330–1.1320 fails.

Key Bearish Targets:

TP1: 1.1090 – former resistance turned support.

TP2: 1.0890 – April breakout base and key structure low.

Trade Setup (as per chart):

Sell Entry Zone: Break and retest of 1.1320–1.1300.

Stop Loss: Above 1.1527 (supply zone high).

Targets:

TP1: 1.1090

TP2: 1.0890

🌐 Macro Context

USD Side:

Fed is holding rates steady amid rising inflation fears triggered by tariffs

Tariff shocks are already pushing prices up, while growth slows—a tough environment for the Fed.

Dollar could strengthen if market sentiment shifts risk-off.

Euro Side:

Former EU Commissioner Gentiloni calls for unified borrowing to boost the euro’s global role, as U.S. stability is questioned

Political uncertainty around German leadership transitions may also weigh on the euro short term.

✅ Conclusion

EURUSD is trading at the apex of a tightening triangle pattern following a distribution structure. With a clean break of 1.1320 support, expect increased volatility and bearish momentum toward 1.1090 and 1.0890.

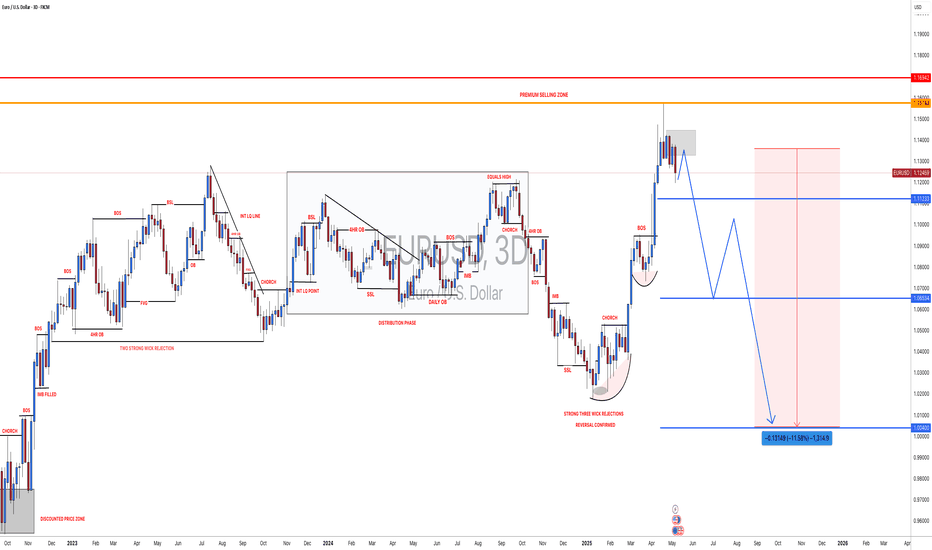

#EURUSD: At Perfect Area to Swing Sell Worth 1300+ Pips! The FX:EURUSD price is currently showing strong sell momentum, indicating a potential strong bearish trend in the coming time. We’ve already taken two swing sell positions on EURUSD. There are three targets you can set according to your own plan and strategy.

The DXY index suggests further price growth in the coming weeks. Please ensure you manage your risk while trading. This is our concept only and does not guarantee the movements we’ve shown in our analysis. Therefore, please conduct your own analysis before taking any swing entry.

Good luck and trade safely!

Wishing you good luck and safe trading!

Thank you for your support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

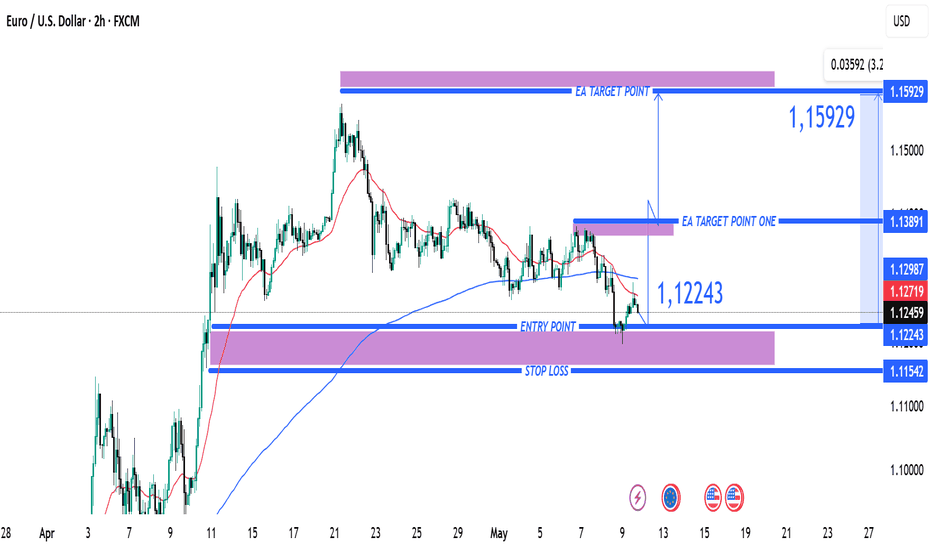

1. EUR/USD Buy Setup1. Entry Point:

Marked at: 1.12243

This is the suggested price level to enter a long (buy) trade.

2. Stop Loss:

Set at: 1.11542

Placed below a support zone, it limits the downside risk if the trade moves against the position.

3. Target Points:

EA Target Point One: 1.13891

EA Target Point (Final): 1.15929

These levels are profit-taking zones, with the first being a conservative target and the second being a more extended move.

4. Technical Indicators:

Moving Averages:

A red shorter-term moving average (possibly 20 EMA)

A blue longer-term moving average (possibly 200 EMA)

Price is currently below both, indicating bearish momentum, though the long setup is anticipating a reversal.

5. Support/Resistance Zones:

Purple Zones: Highlighted as key demand and supply areas.

The lower purple zone supports the entry and stop-loss area.

The upper purple zones mark resistance areas aligning with the target levels.

6. Current Price:

Around 1.12459, slightly above the entry zone.

Conclusion:

This setup is a bullish trade idea with a clearly defined:

Entry (1.12243),

Stop-loss (1.11542), and

Two take-profit levels (1.13891 and 1.15929).

EURUSD bulling ideaAlthough there is no single significant event directly affecting the euro-dollar exchange rate on May 8, from a macro perspective, the U.S. dollar index fluctuated on that day, having a certain impact on the euro-dollar exchange rate. The U.S. dollar index once broke the 100 mark. Generally speaking, the strength of the U.S. dollar index has an inverse relationship with the euro-dollar exchange rate. From different time cycles, on the monthly chart, the euro-dollar is supported at the 1.0800 level, and the long-term trend is regarded as bullish. At the weekly level, the price is supported in the 1.0900 area, and the medium-term outlook remains bullish

you are currently struggling with losses, or are unsure which of the numerous trading strategies to follow, at this moment, you can choose to observe the operations within our channel.

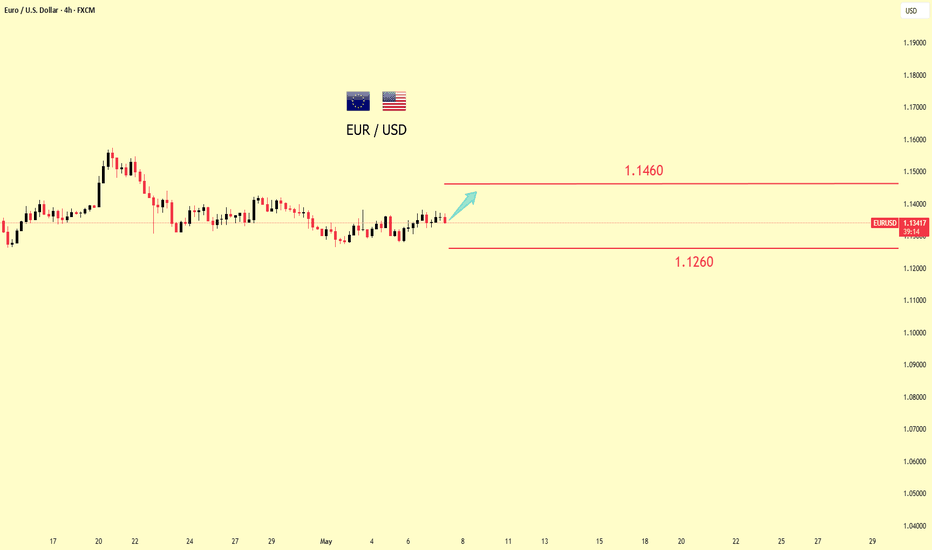

price bull interest.The annual growth rate of retail sales in the euro - zone in March was 1.5%. On the surface, it still maintained expansion. However, compared with the previous value of 1.9% and the market expectation of 1.6%, there was a slight slow - down trend. In terms of the monthly rate, the data was - 0.1%, which was a significant decline compared with the revised 0.2% in February. Although such performance did not trigger violent market fluctuations, it to some extent reflected the phenomenon of marginally weakened terminal consumption momentum in the region.

It is worth noting that the leaders of the major political parties in Germany failed to pass the parliamentary confirmation process smoothly. The market was once worried that political uncertainty would drag down the trend of the euro, and the exchange rate briefly dropped to 1.1310. However, judging from the market reaction, the euro showed relatively strong resilience and quickly recovered to the level of 1.1380, indicating that the market still holds a cautiously optimistic attitude towards the medium - term prospects.

Currently, the exchange rate is running above the middle band of the Bollinger Bands, and the overall structure remains within the oscillation range of 1.1260 - 1.1440. 1.1440 is a strong short - term resistance level. The failure of several consecutive upward attacks indicates that the selling pressure above is relatively heavy. 1.1260 is a key support level in the near term and is also in the area near the middle band of the Bollinger Bands. If it is broken, it may trigger a technical correction.

you are currently struggling with losses, or are unsure which of the numerous trading strategies to follow, at this moment, you can choose to observe the operations within our channel.

Analysis of the Latest SignalsThe market expects the Federal Reserve to keep interest rates unchanged in May, and there is uncertainty about the future path of rate cuts. In contrast, the European Central Bank's monetary policy is gradually tightening, leading the market to expect that the euro has room for appreciation in the future. This difference in monetary policy expectations has driven the rise in the euro - dollar exchange rate. Technically, it is necessary to pay attention to the resistance level of the euro - dollar exchange rate near 1.16 and the support level near 1.12. If the 1.16 resistance level can be broken through, the euro - dollar exchange rate is likely to continue to rise. Conversely, if it falls back due to resistance, the effectiveness of the 1.12 support level needs to be observed.

you are currently struggling with losses, or are unsure which of the numerous trading strategies to follow, at this moment, you can choose to observe the operations within our channel.

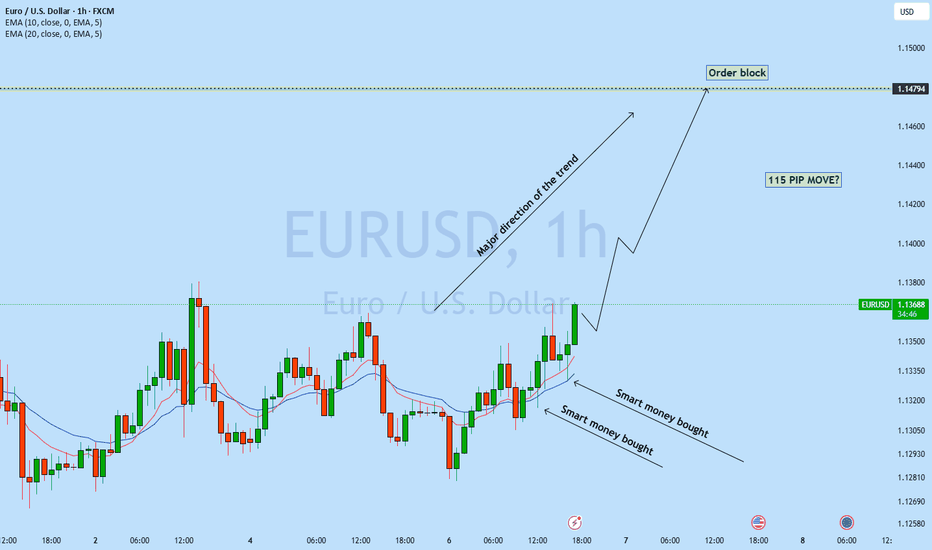

EURUSD is set to move up?EURUSD 1h back to back 2 candle has got rejected from the support level with long wick which is smart money bullish order flow showing potential move back to the resistance line. As Daily trend is bullish we may see EURUSD continue to bounce back to the resistance with newly develop uptrend.

A buy trade is high probable

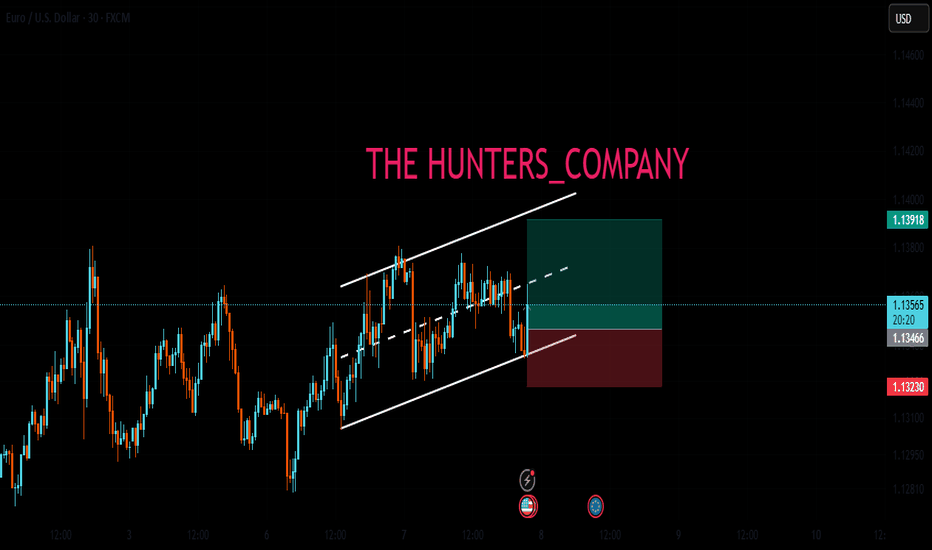

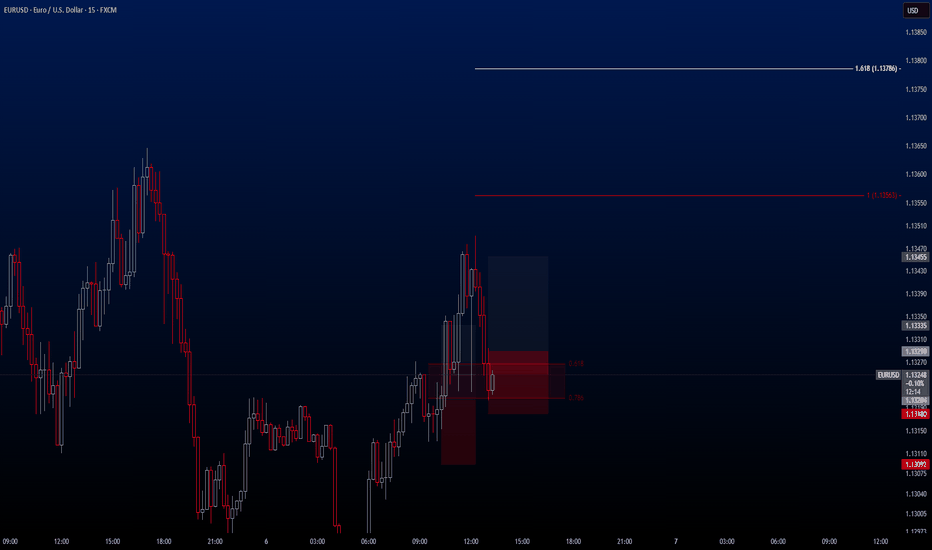

EURUSD EURUSD presents another buy opportunity, and I've just activated the trade.

I wanted to share it with you as well. This trade has three different Take Profit levels, which are:

1.13455 / 1.13563 / 1.13786

However, I personally plan to close the trade at 1.13455 in order to stick to my game plan.

This will be the last trade of the day for me.

🔍 Criteria:

✔️ Timeframe: 15M

✔️ Risk-to-Reward Ratio: 1:1.50 / 1:2.50 / 1:4.50

✔️ Trade Direction: Buy

✔️ Entry Price: 1.13290

✔️ Take Profit: 1.13455

✔️ Stop Loss: 1.13180

🔔 Disclaimer: This is not financial advice. It's a trade I’m taking based on my own system, shared purely for educational purposes.

📌 If you're also interested in systematic and data-driven trading strategies:

💡 Don’t forget to follow the page and subscribe to stay updated on future analyses.

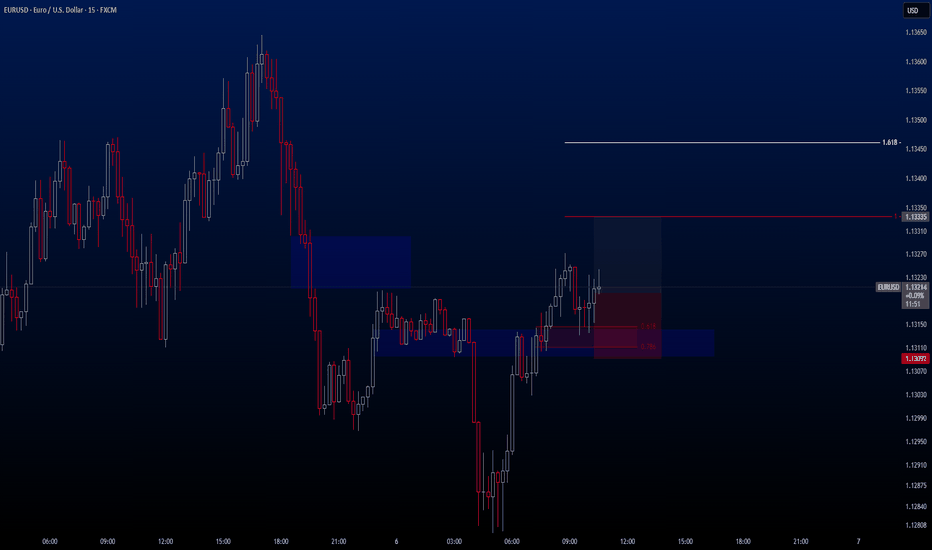

EURUSDHello everyone!

I'd like to share an ideal **Buy opportunity** on the **EURUSD** pair with you. The trade is currently **active** on my side.

🔍 **Criteria:**

✔️ Timeframe: 15M

✔️ Risk-to-Reward Ratio: 1:1.17

✔️ Trade Direction: Buy

✔️ Entry Price: 1.13204

✔️ Take Profit: 1.13335

✔️ Stop Loss: 1.13092

🔔 **Disclaimer:** This is not financial advice. It's a trade I’m taking based on my own system, shared purely for educational purposes.

📌 If you're also interested in systematic and data-driven trading strategies:

💡 Don’t forget to follow the page and subscribe to stay updated on future analyses.

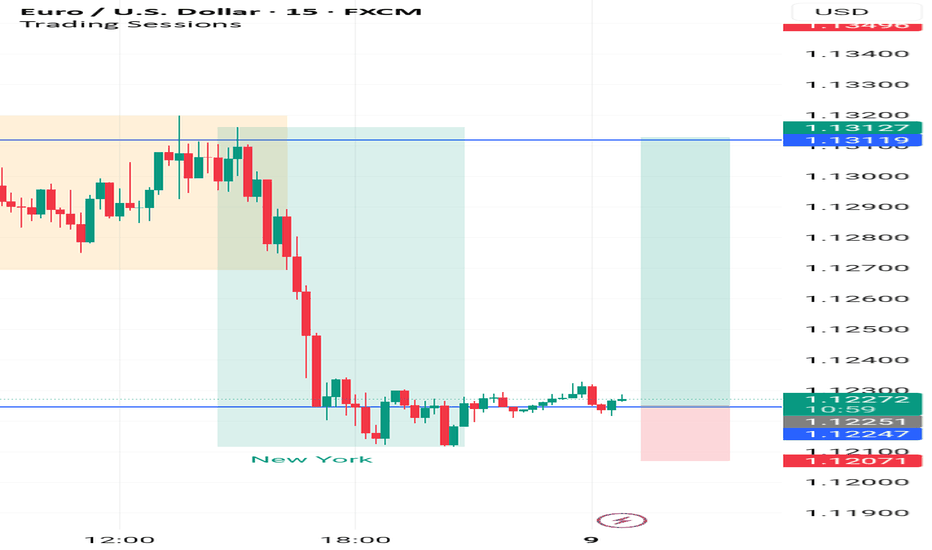

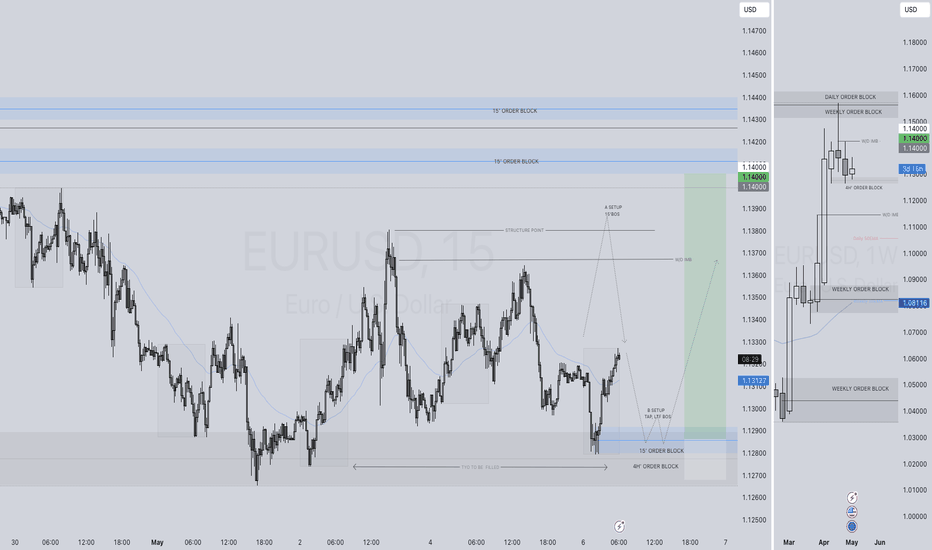

EURUSD LONG FORECAST Q2 W19 D6 Y25EURUSD LONG FORECAST Q2 W19 D6 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅4 hour order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURUSD directional bias: BuyPrice has closed above a key 4h resistance level. Based on the higher timeframe direction, I am expecting price to continue upwards to the recent high (1.5568).

Please be aware that we have a USD Interest Rate release on Wednesday which could cause a lot of volatility in the market. Keep this in mind if you decide to trade this direction.

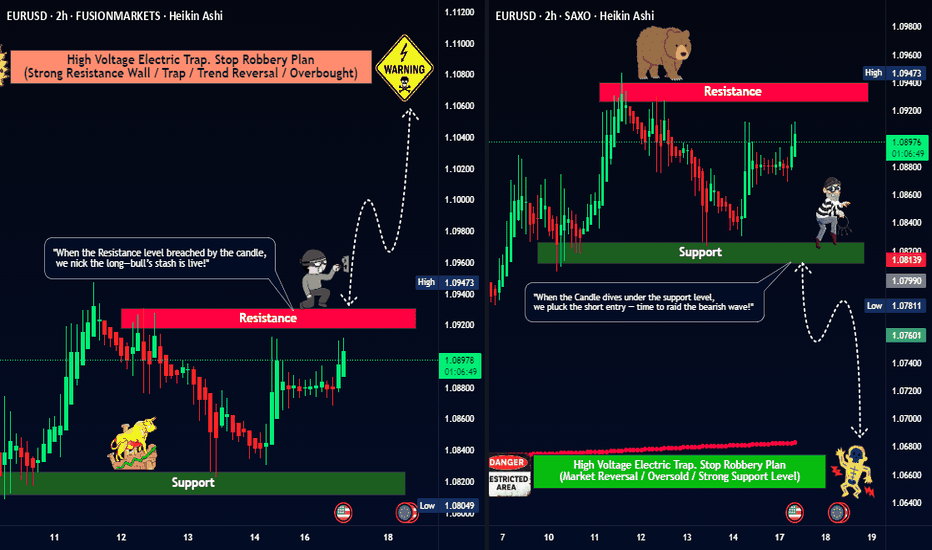

EUR/USD "The Fiber" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/USD "The Fiber" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 1.09400

🏁Sell Entry below 1.08000

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 1.08700 (swing Trade Basis) for Bullish Trade

🚩Thief SL placed at 1.08700 (swing Trade Basis) for Bearish Trade

Using the 2H period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers TP 1.10800 (or) Escape Before the Target

🏴☠️Bearish Robbers TP 1.06800 (or) Escape Before the Target

EUR/USD "The Fiber" Forex Market Heist Plan is currently experiencing a neutral trend,., driven by several key factors.

📰🗞️Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend..👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

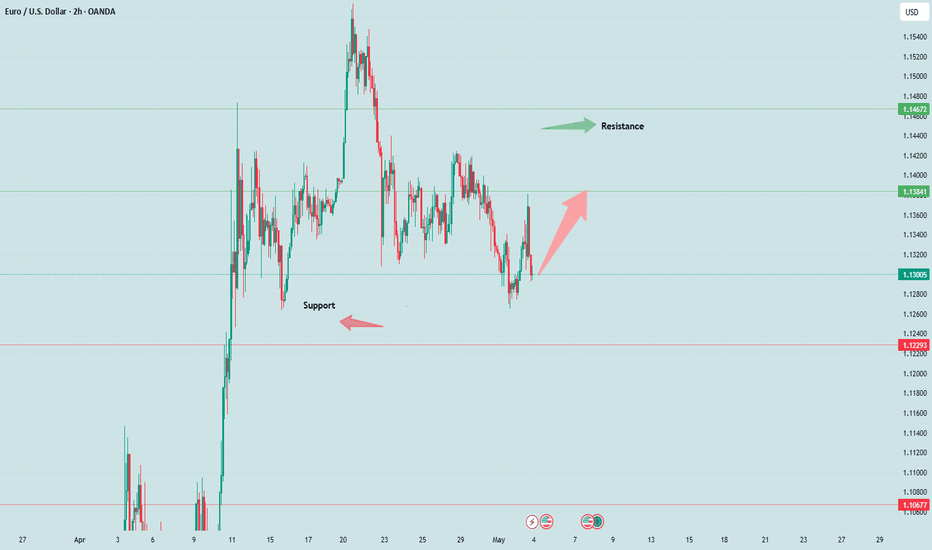

Sharing of the Trading Strategy for Next WeekIn the short term, the trend of the EUR/USD is dominated by the non-farm payrolls data and technical aspects, with a fluctuation range of 1.12-1.16. In the medium to long term, the US dollar faces structural pressures, and the euro is likely to gradually strengthen to 1.30. However, it is necessary to be vigilant against the periodic corrections brought about by policy divergences and geopolitical risks.

Trading Strategy:

buy@1.12800-1.13000

TP:1.15000-1.16000

you are currently struggling with losses, or are unsure which of the numerous trading strategies to follow, at this moment, you can choose to observe the operations within our channel.