Eurusdlongsetup

EURUSD - CURRENT SENTIMENT ANALYSE , DXY #EURUSD

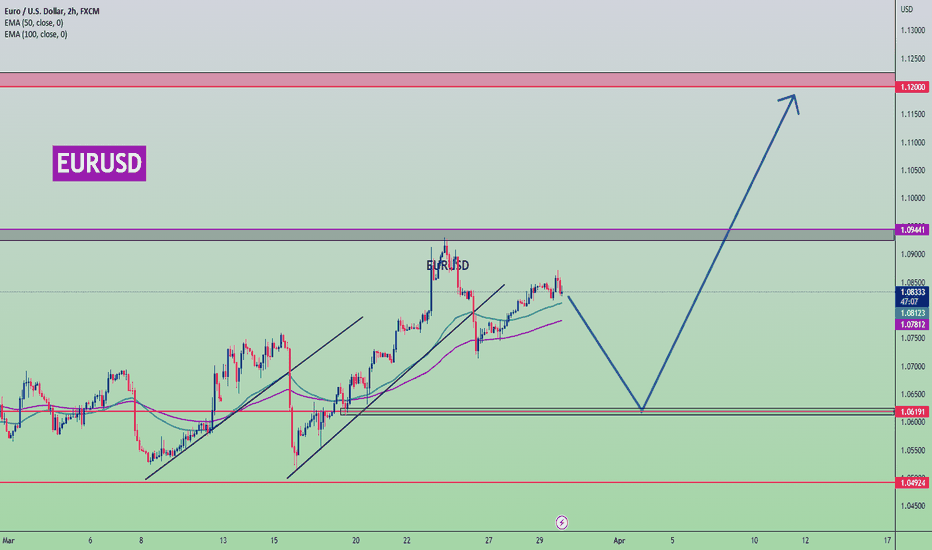

- As of last day, the MARKET SENTIMENT for EUR was slightly on the DOWN SIDE. The main reason for that is that the dollar started getting stronger because of the short-term POSITIVE SENTIMENT for the dollar. Because it came with the NFP REPORT. The dollar weakened slightly after the FOMC last time. But the FED can raise the RATE HIKE or their CEILING RATE whenever necessary. Anyway, it was mentioned in the previous MEETING that the FED is still MONITORING INFLATION DATA.

- Definitely, according to the market structure, EURUSD can go down to the support level of 1.0619 below. At the moment, there is quite a DOWN SIDE BIAS in the MARKET for EUR.

- After that, EURUSD can go up to 1.2000 LEVEL. If the MARKET SENTIMENT changes and STOCKS and COMMODITIES start going UP, there will be more EURUSD BUY. So keep an eye on it.

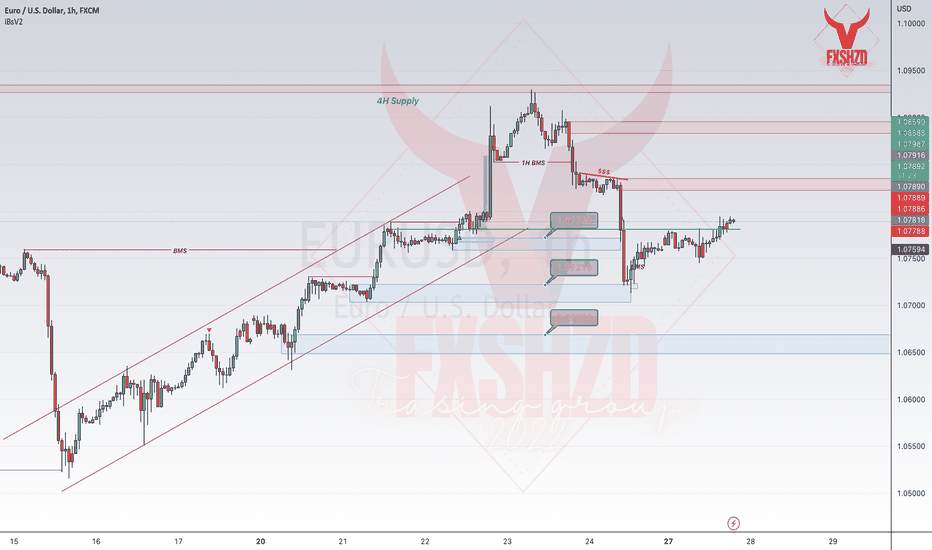

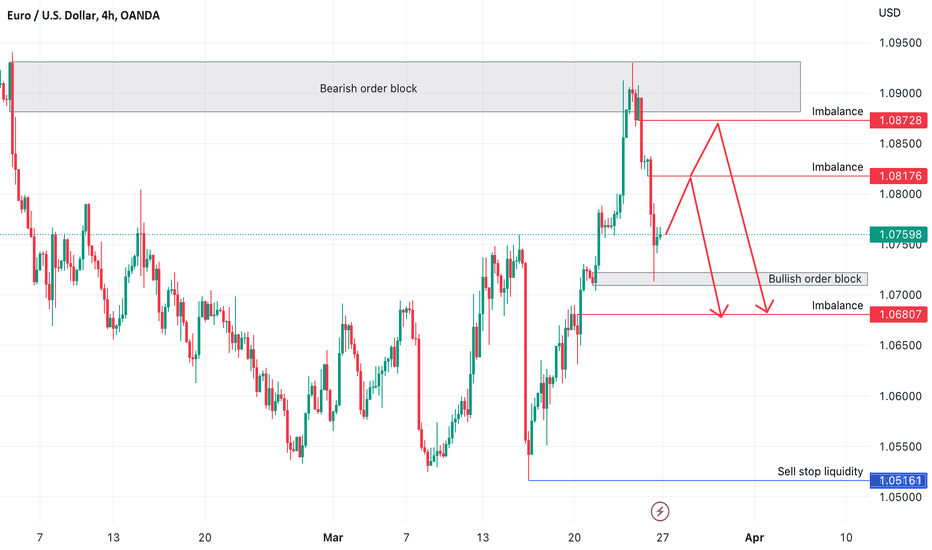

EURUSD top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

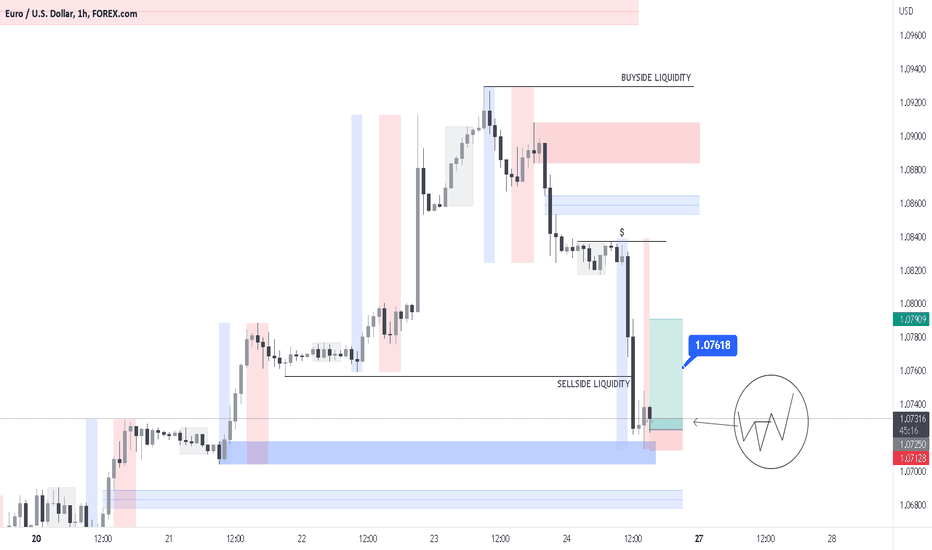

EURUSD LONG OR SHORT???‼️We, the FxShzd team, are back with an update on our previous analysis of the EURUSD pair. As an always-interesting asset, the pair has continued to display precise movements, responding well to each support and resistance level.

Our team has identified new supply areas, presenting an attractive short-term shorting opportunity. Notably, our first supply area contains a significant amount of liquidity just above, which we expect to capture before the price experiences a substantial directional shift at the subsequent supply zone.

To increase trading potential, we always look for confirmational entries in lower timeframes, especially after a BMS. Should we identify a favorable entry point, we will share it with our followers via prompt updates.

To stay up-to-date with our analysis and ensure you do not miss any trading opportunities, we encourage you to follow our updates closely. Thank you for entrusting us with your trading endeavors.

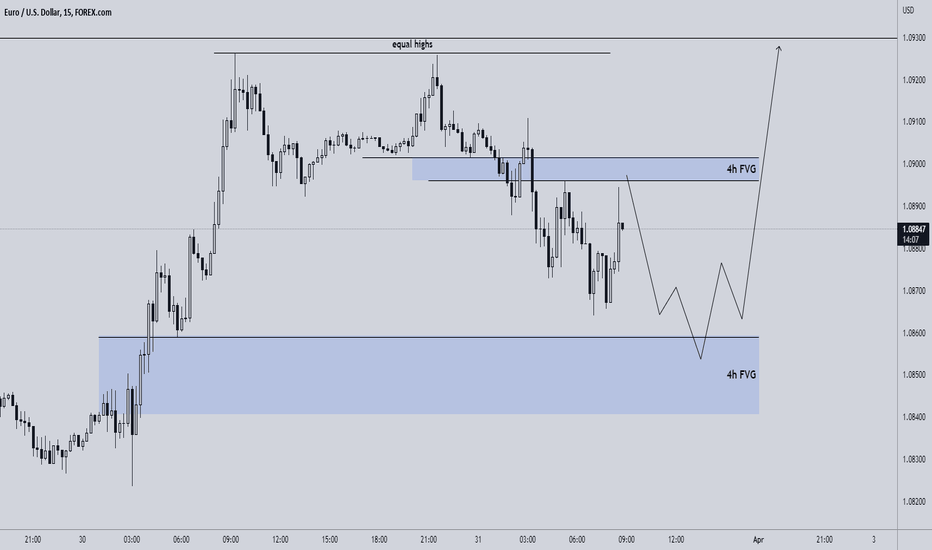

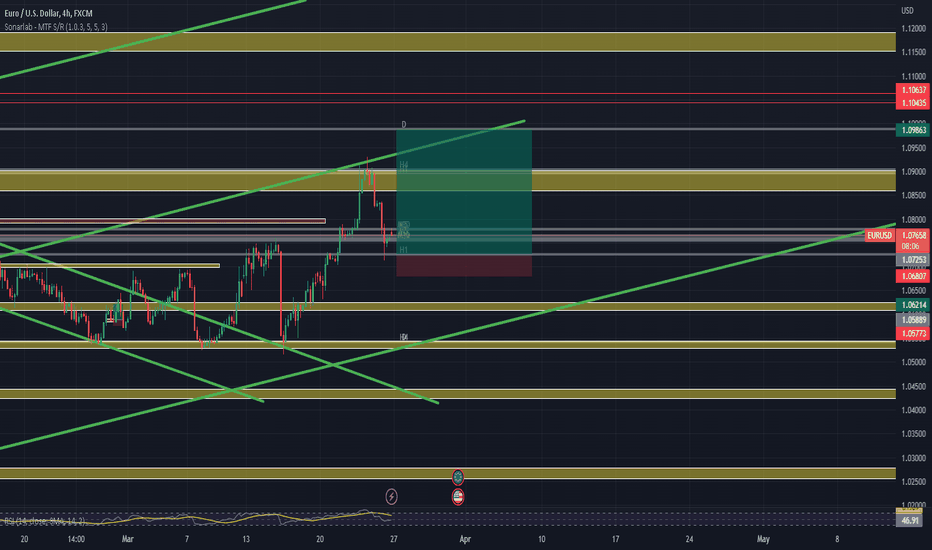

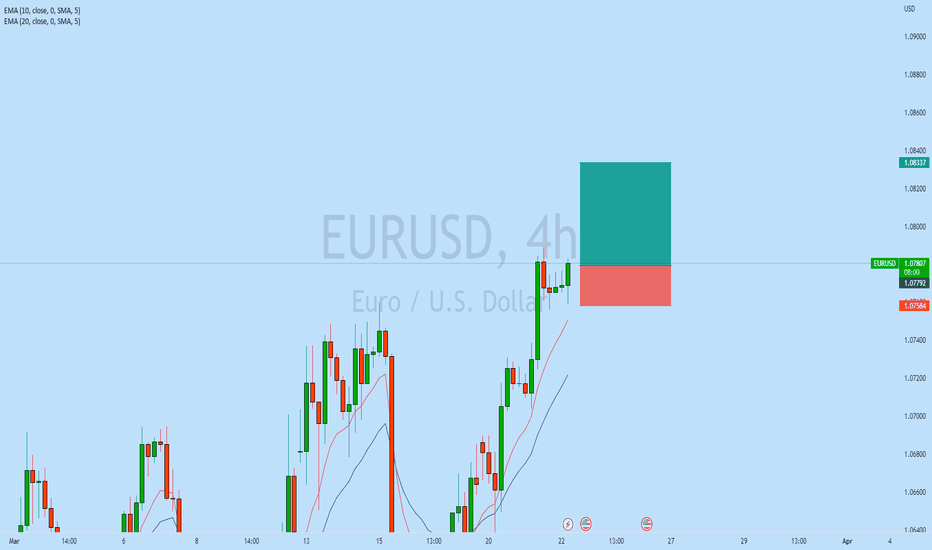

EURUSD LONG After analyzing the EUR/USD chart, it is evident that the currency pair is currently in a bullish move, as it broke the previous high and forming new higher highs. However, we anticipate a minor correction before the pair continues its upward momentum.

We have identified a key level of supply and demands which detemined supply is for 4H. these areas are crucial to monitor for potential trading opportunities, especially for those looking to long the pair.

If you have any questions or comments regarding this analysis, please feel free to share them with us. We always welcome feedback and additional insights from our readers.

Overall, we remain optimistic about the outlook for the EUR/USD in the near term, but as always, we advise traders to exercise caution and ensure they have a solid trading plan in place before entering any positions.

EURUSD - Short after filling the imbalance ✅Hello traders!

‼️ This is my perspective on EURUSD.

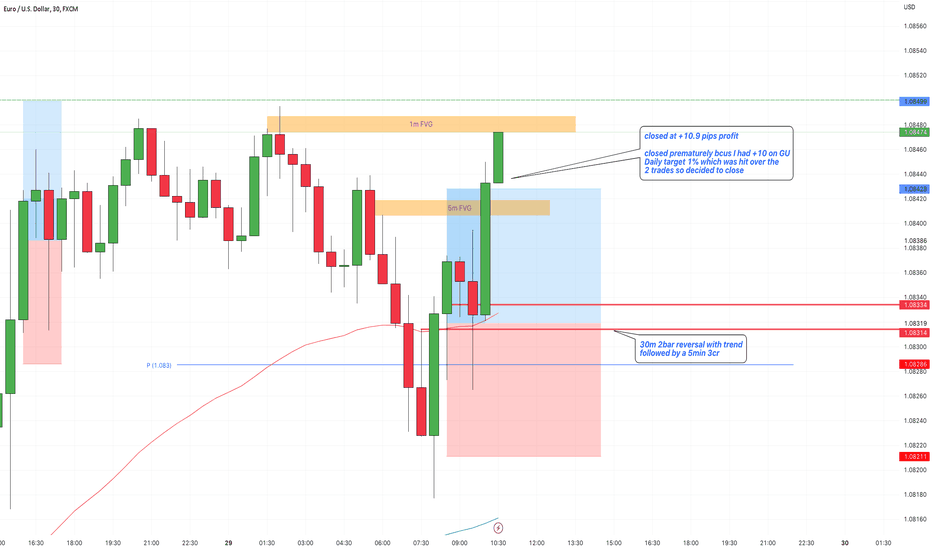

Technical analysis: Here price rejected from bearish order block so I started to look for shorts. I have 2 points of interest, for both of them I expect firstly price to fill the imbalance and then to reject from that zone.

Fundamental analysis: On Thursday 30th of March we have news events on USD, will be released final GDP for first quarter of 2023. The forecast for GDP is to remain the same as per last quarter, which means we would not have such big moves in market, however we should look for the results in order to validate our analysis.

Like, comment and subscribe to be in touch with my content!

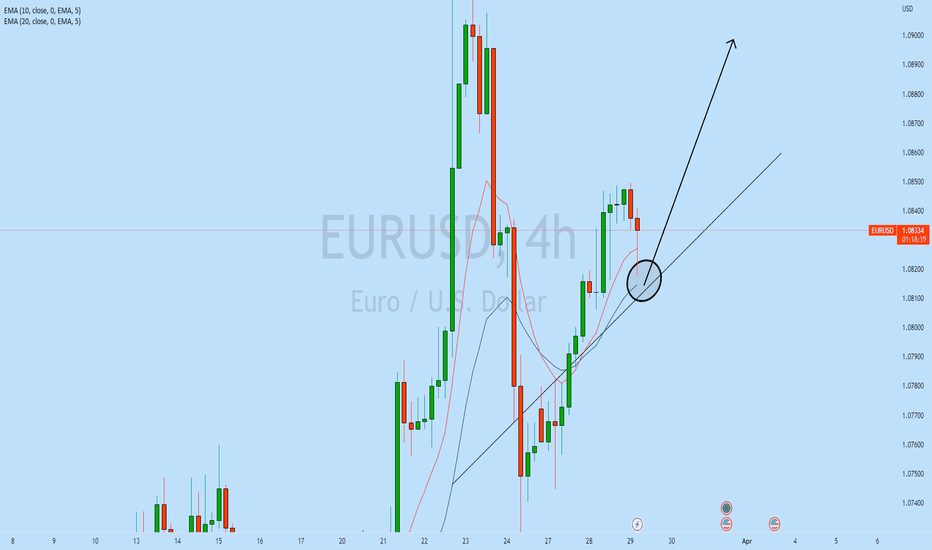

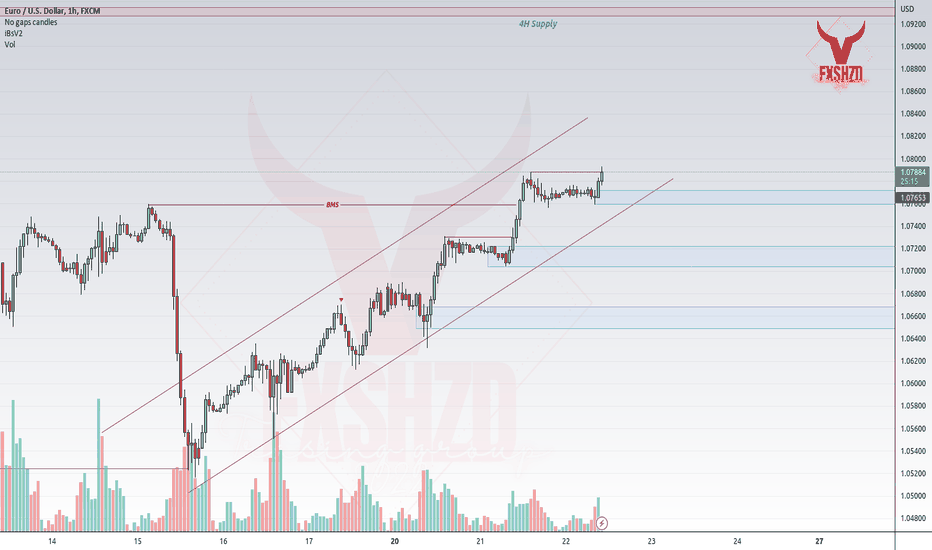

EURUSD BuyThe Federal Reserve (Fed) raised its key interest rate by 25 bps as expected to 4.75% -5.00%. The vote was unanimous. They dropped the forward guidance, mentioning that “some additional policy firming may be appropriate”, instead of “ongoing increases in the target range will be appropriate”. In a few minutes, Chair Powell's press conference will begin.

The US Dollar dropped sharply boosting the EUR/USD to the upside. Markets are looking at the decisions as a “dovish hike”. Wall Street indices printed fresh highs. The improvement in risk sentiment weighs on the US dollar.

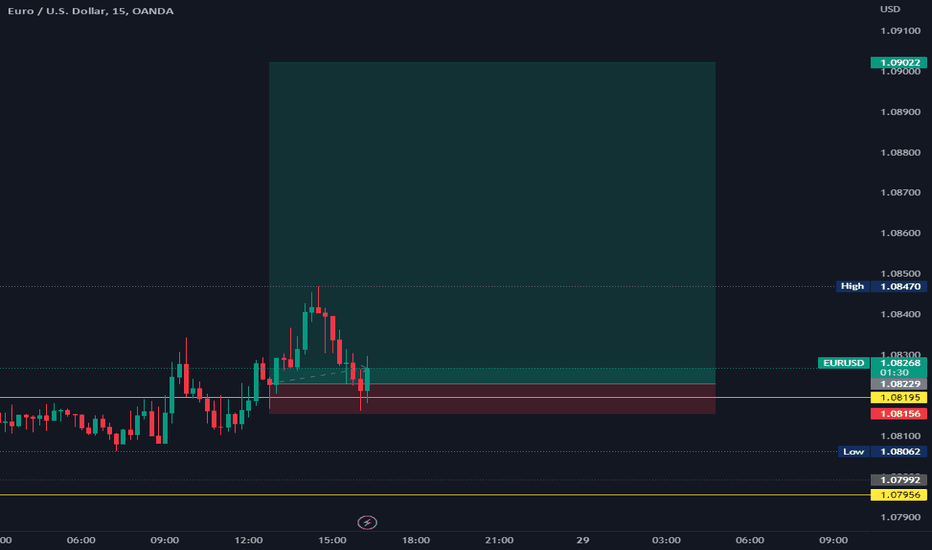

EURUSD h1 price is in an uptrend. However, now traders need to wait for another short correction of this pair to have the best buying opportunity. Recommend waiting to buy around 1.0820, SL: 1.0770, TP: 1.0950

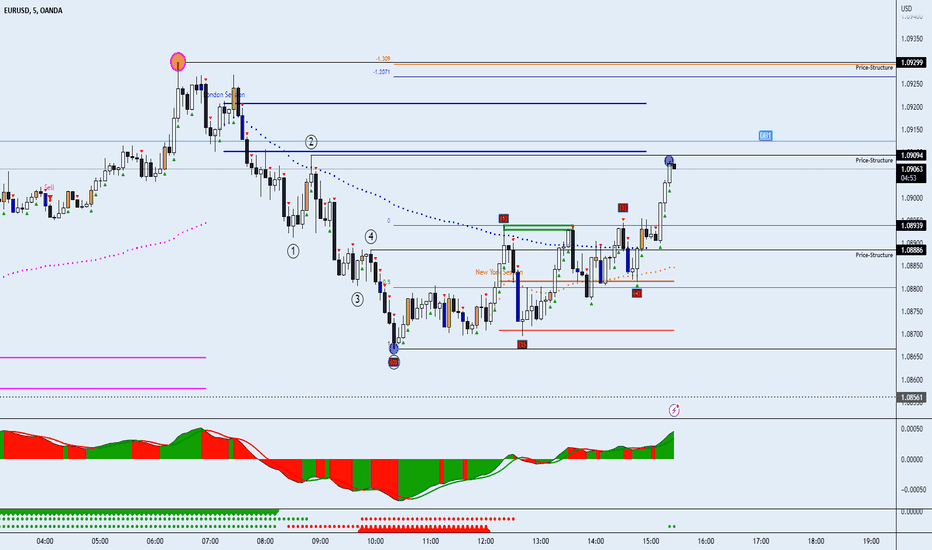

EURUSD top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

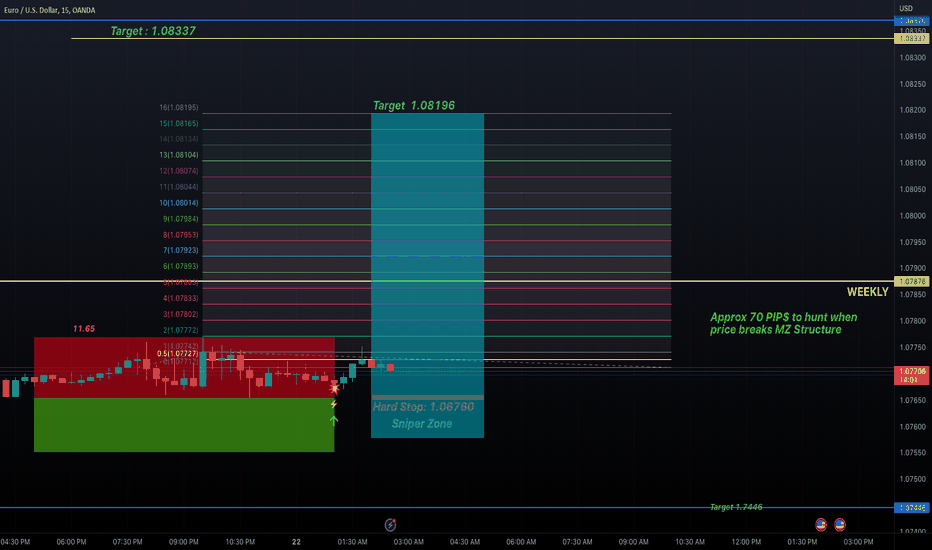

EURUSD BULLISH! Sniper Trading SystemSniper Trading System Narrative:

The 1HR gives Bullish indication while the 15min gives Bearish indication typical on a day of FOMC News at 2 & 2:30PM EST.

Expect Consolidation before news and heavy volatility.

Right now the Bulls want it on the higher time frame.

o for now we will go with the Bullish set up.

Hard stop at 1.06760 a pippet below MZ Structure.

Target 1.08337💰

1 Shot 1 Kill. #SniperGang 🏦🏦🏦

Never over leverage. Trust your trade set up. Have fun!

Now let's see if price follows the script!