EUR/USD — Buyers Still in Control, Eyes on Key US DataEUR/USD continues to hold strong bullish momentum despite the recent recovery in USD (DXY). Traders are now closely watching today’s high-impact US economic releases during the New York session:

📊 USD Prelim GDP q/q → Forecast: 3.1% (Prev. 3.0%)

📊 USD Unemployment Claims → Forecast: 231K (Prev. 235K)

🔎 Market Outlook

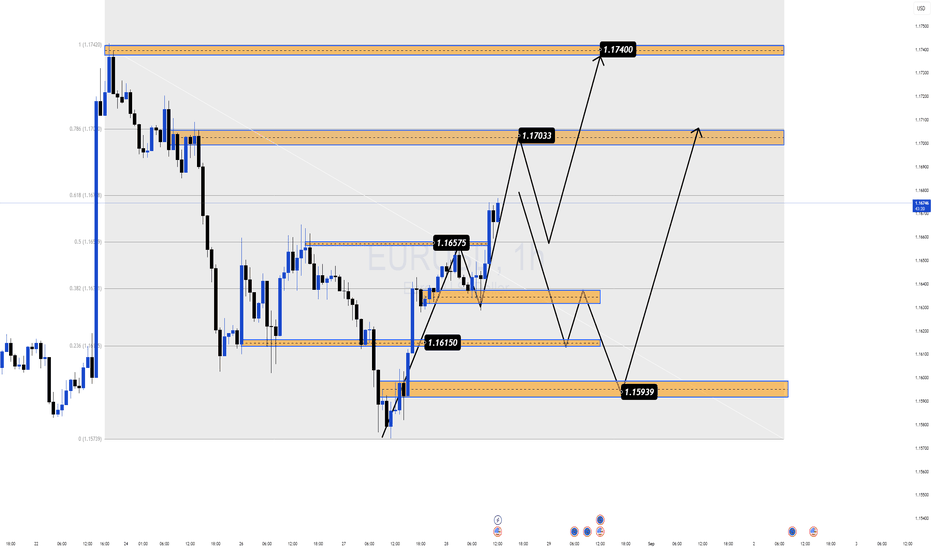

If US data comes out stronger than expected, the USD could regain momentum, putting pressure on EUR/USD. A potential correction may retest lower demand zones around 1.1615 – 1.159x.

If the data is neutral or weaker, buyers could push higher into the 1.1703 zone, and possibly extend towards 1.1740 resistance, a key level aligned with previous supply and Fibonacci retracements.

📌 Key Levels to Watch

Resistance: 1.1703 – 1.1740 (major supply / fib zone)

Support: 1.1657 – 1.1615 (short-term buy zone)

Deep Support: 1.1593 (liquidity grab level)

🎯 MMFLOW Strategy

👉 Focus on reactions to US data release — volatility will be elevated.

👉 Wait for liquidity sweeps into demand zones for clean long setups.

👉 Short-term bias: still bullish as long as 1.1615 holds.

⚡️ Only one major economic event this week — meaning all market attention is on today’s release. Expect strong volatility!

💬 What do you think? Will EUR/USD power through 1.1700+, or will USD strength drag it back towards 1.16xx?

Eurusdoutlook

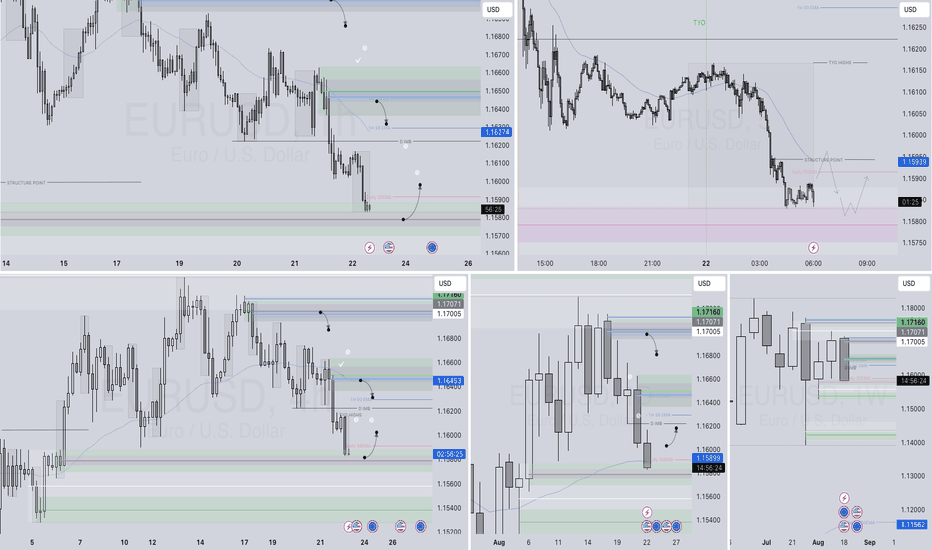

EURUSD – DAILY FORECAST Q3 | W35 | D28 | Y25📊 EURUSD – DAILY FORECAST

Q3 | W35 | D28 | Y25

🔍 Daily Forecast | EURUSD

Here’s a concise breakdown of the current chart setup 🧠📈:

📌 Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

We wait for a confirmed break of structure 🧱✅ before executing any position.

This keeps us disciplined, and in sync with what the price action is actually telling us — not what we want it to say.

📈 Risk Management Protocols

🔑 Core Principles:

Max 1% risk per trade

Execute only at pre-identified levels

Use alerts, not emotion

Stick to your RR plan (minimum 1:2)

🧠 You’re not paid for how many trades you take — you're paid for how well you manage risk.

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work for you. 🎯📊

FRGNT

FX:EURUSD

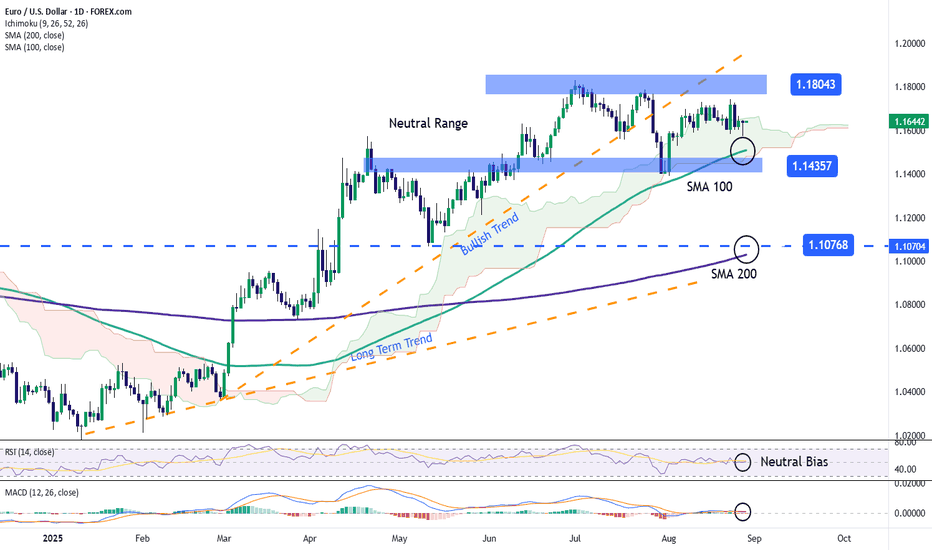

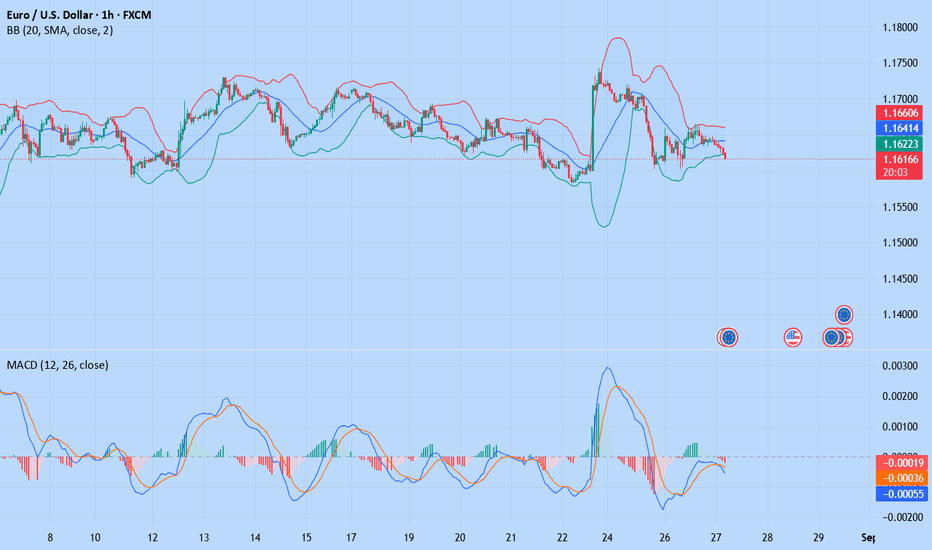

EUR/USD Begins to Consolidate a Significant Neutral BiasOver the last three trading sessions, EUR/USD has shown a variation of just 0.25%. For now, a consistent neutral bias prevails in the short term, as the market continues to digest recent comments from central banks. Attention is now turning to upcoming employment and inflation data, which will be key to gaining a clearer perspective on future monetary policy decisions. In the absence of concrete catalysts this week, neutrality has taken hold and could remain a relevant factor in shaping market movements in the coming sessions.

A Neutral Range Emerges

Recent fluctuations have begun to establish a more defined sideways range, with resistance near 1.18043 and support around 1.14357. So far, short-term movements have not been strong enough to break this structure. Unless a sustained increase in volatility occurs, this lateral formation is likely to remain dominant in the upcoming trading sessions.

Technical Indicators

RSI: this neutral environment is also reflected in RSI movements, which currently hover around the neutral 50 level. This signals an ongoing balance between buying and selling pressure across the last 14 sessions. The indicator suggests that a neutral bias has settled into the chart and could continue to influence price action in the absence of major economic data releases.

MACD: the MACD histogram continues to oscillate around the 0 line, indicating that a neutral sentiment also dominates in the average strength of moving averages.

Key Levels to Watch:

1.18043 – Main Resistance: corresponds to the recent highs in price action. A sustained breakout above this level could reactivate a previously broken uptrend line.

1.14357 – Near-Term Support: aligns with the Ichimoku cloud and the 100-period simple moving average, making it an important reference for potential downside corrections.

1.10768 – Critical Support: a level not seen since May of this year. A decline toward this area could trigger a stronger bearish bias, opening the door to a more extended downward trend.

Written by Julian Pineda, CFA – Market Analyst

EURUSD is in a Downside DirectionHello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURUSD(20250827) Today's AnalysisMarket News:

① Foreign Media: The Trump administration is weighing options to influence regional Federal Reserve banks and strengthening scrutiny of the selection process for regional Fed presidents.

② Cook's lawyers have sought a judicial ruling on Trump's dismissal, and both Fed officials and Trump have stated they will comply with the court's decision. Trump has stated that he has a replacement for Cook in mind and may move Milan to another permanent position at the Fed. Trump has stated that he will soon hold a majority at the Fed.

③ Former White House Economic Council Director Lael Brainard: (Trump's dismissal of Fed Governor Cook) is an unprecedented attack on the Fed and could lead to higher inflation and long-term interest rates.

④ Barkin: Predicts a modest adjustment in interest rates.

Technical Analysis:

Today's Buy/Sell Levels:

1.1635

Support and Resistance Levels:

1.1698

1.1675

1.1659

1.1611

1.1596

1.1573

Trading Strategy:

If the price breaks above 1.1659, consider entering a buy position, with the first target price being 1.1675.

If the price breaks below 1.1635, consider entering a sell position, with the first target price being 1.1611

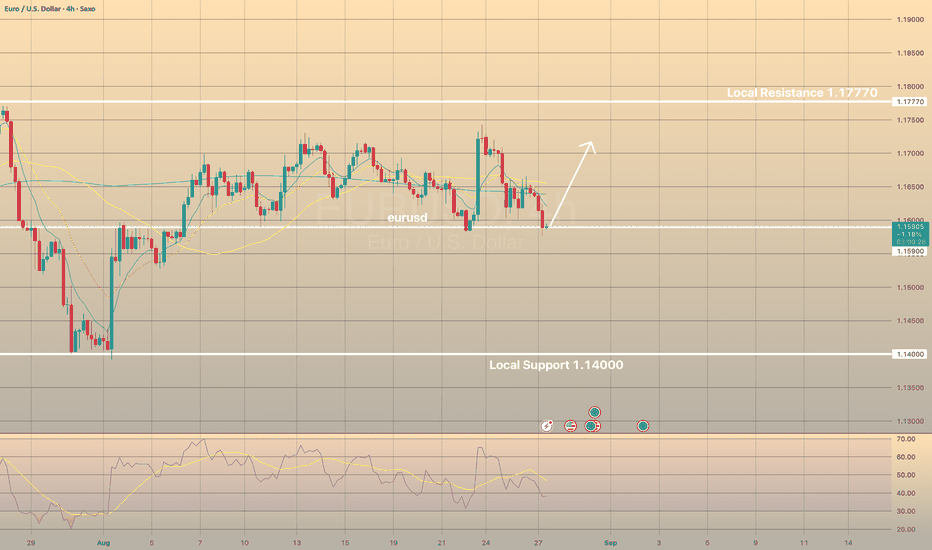

EURUSD Trading Setup: Key Levels and StrategyEURUSD Trading Setup: Key Levels and Strategy

EURUSD has been under strong buying pressure in recent hours, with key support levels at 1.1590 and 1.1400 and resistance at 1.1770. A rebound from support could signal a buying opportunity targeting the resistance level, while a confirmed breakout below support would indicate a selling scenario. No major news is expected to significantly affect trades in the near term.

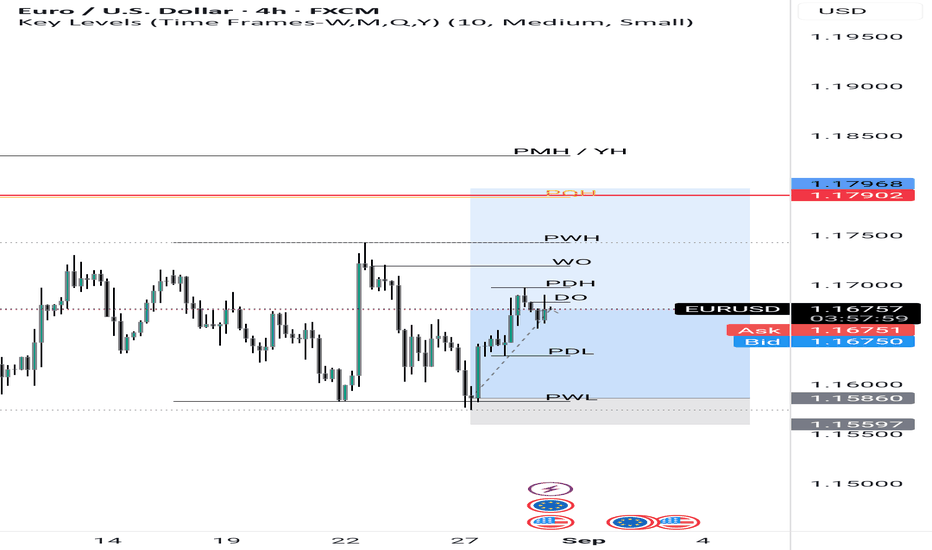

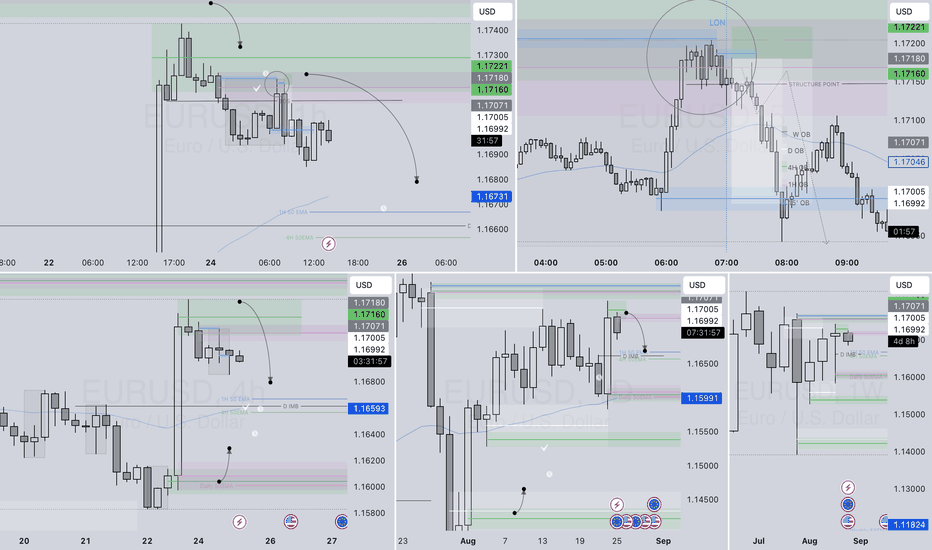

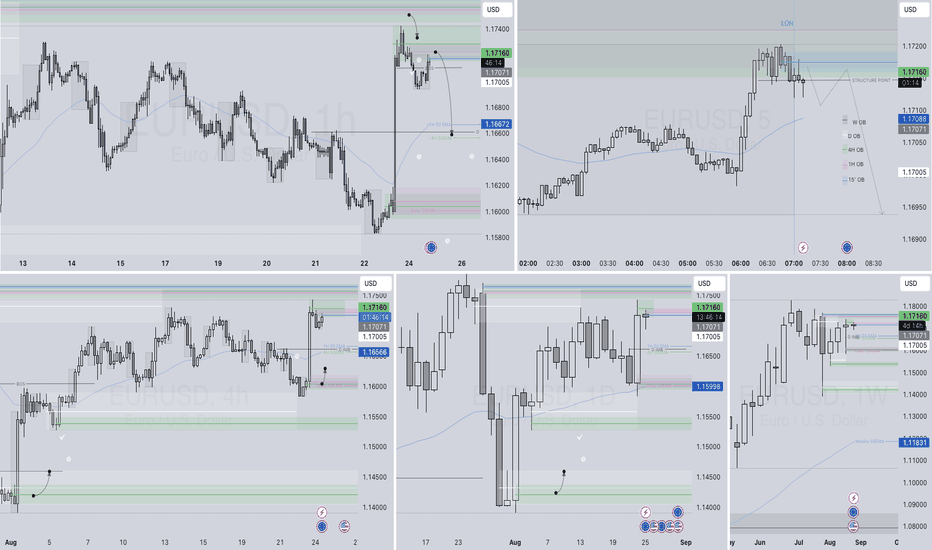

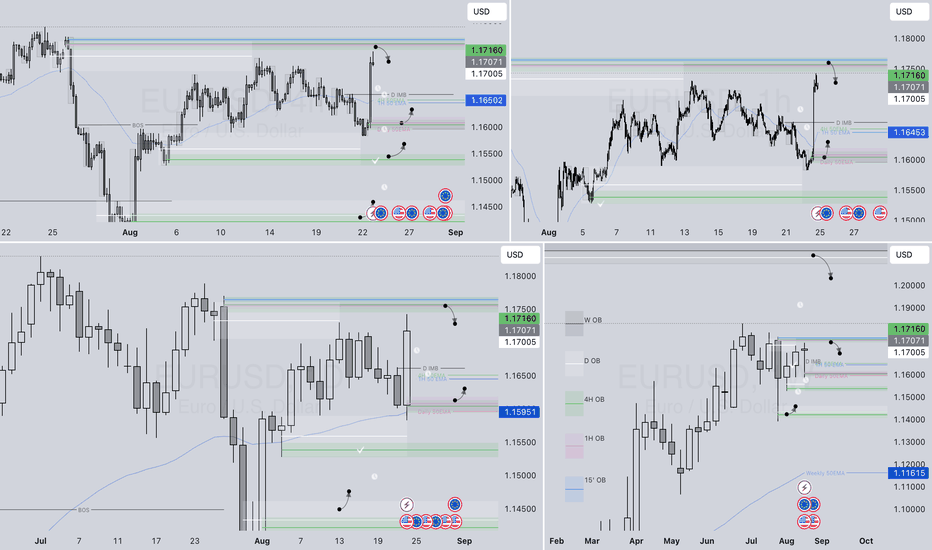

EURUSD Daily Forecast — Q3 W35 D27 Y25📈 EURUSD Daily Forecast — Q3 W35 D27 Y25

Some solid long Points of Interest (POIs) lining up. Here’s the current landscape:

🔹 Technical Overview:

📍 Price is sitting on the Daily 50 EMA

→ A critical support & rejection zone we're closely monitoring.

📊 Break of Structure confirmed on both 1H and 15-min, showing strong bullish intent from our POI.

🔍 Trade Scenarios:

🟢 Aggressive Entry:

Look for a BoS from the 15' Order Block created in Asia

Enter on confirmation, and aim to move to breakeven quickly

🟡 Conservative Entry:

Wait for a 15-min BoS

Enter on a pullback into OBs or imbalances — many align with the Daily 50 EMA

🧭 Both strategies offer a strong Risk-to-Reward (R:R) if executed with discipline.

🌍 Session Outlook — London Open:

Expect London to open at Asia session lows

Watch for a liquidity sweep

Then anticipate a move to fill Asia highs

✅ Even without additional confluence, this is a viable intraday opportunity.

⚠️ Final Notes:

💼 Manage your risk

🎯 Focus on one clean setup at a time

🧠 Stack confluence — then pull the trigger with confidence

FRGNT

FX:EURUSD

EURUSD – trend remains intactYesterday, EURUSD showed little movement and failed to break through key levels.

The price continues to hold above the support zone, confirming the bullish outlook.

The direction remains bullish, with a target of a new rise and a test of 1,1760.

Focus stays on buying opportunities after a pullback!

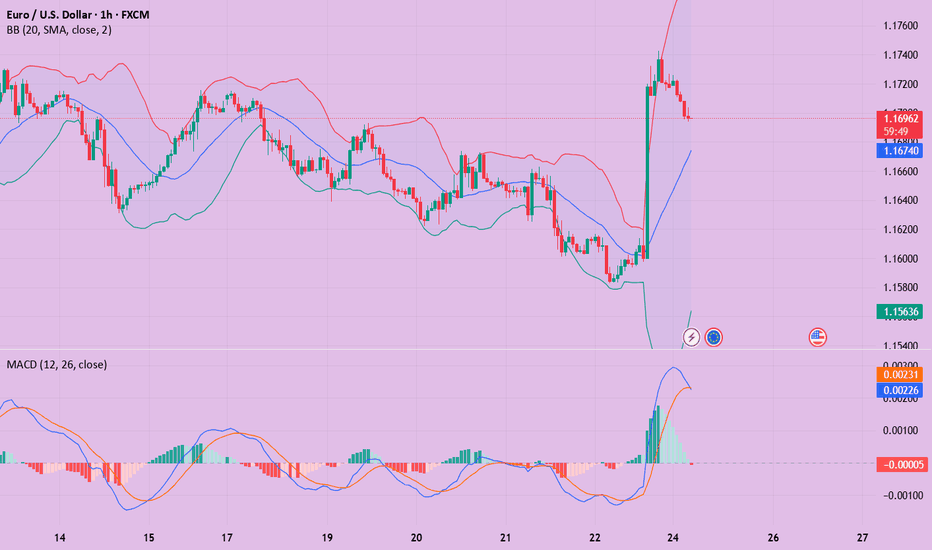

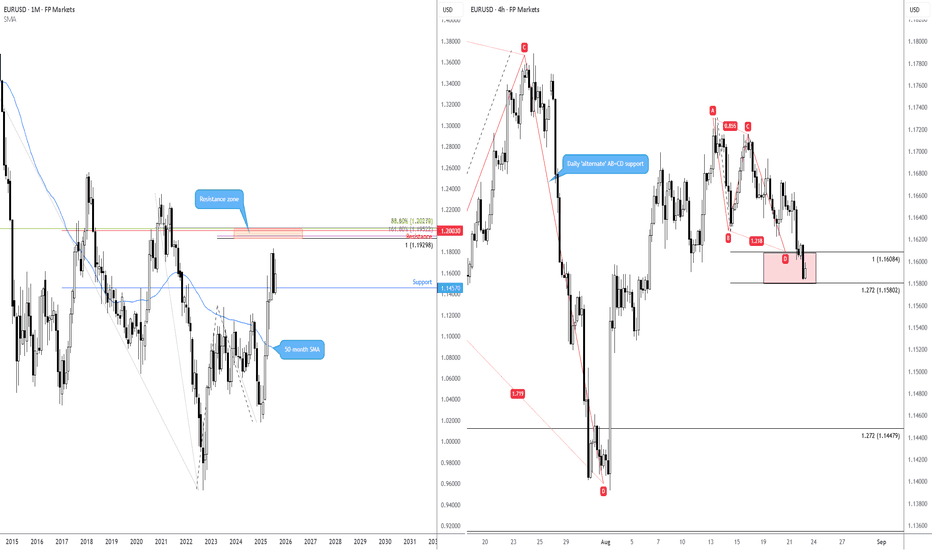

EUR/USD Exchange Rate Shows Increased VolatilityEUR/USD Exchange Rate Shows Increased Volatility

Powell’s speech on Friday had a distinctly dovish tone. Expectations of an interest rate cut strengthened, which led to a sharp weakening of the dollar — on the EUR/USD chart, a bullish impulse A→B was formed.

On Monday, as often happens after an initial emotional reaction to major news, the price corrected as market participants reassessed prospects in light of the Fed Chair’s softened rhetoric.

What is particularly notable is that the correction was most evident on the EUR/USD chart, where the decline B→C almost completely offset Friday’s surge. This could point to underlying weakness in the euro, which seems justified when considering that the euro index EXY (the euro’s performance against a basket of currencies) has risen by roughly 13% since the beginning of the year.

The EUR/USD rate reacted less strongly to the news that President Trump had decided to dismiss Lisa Cook, a member of the Federal Reserve’s Board of Governors. While the media debates whether the President has the authority to remove her, traders may instead assess how EUR/USD could fluctuate following the A→B→C volatility swing.

Technical Analysis of the EUR/USD Chart

Recently, we outlined a descending channel using the sequence of lower highs and lows observed this summer. The upper boundary clearly acted as resistance for EUR/USD’s rise on Friday.

From the bears’ perspective:

→ the price has broken downward through an ascending trajectory (shown in purple), and the lower purple line has already changed its role from support to resistance (as indicated by the arrow);

→ today’s rebound from the 1.1600 support level appears weak, as highlighted by the long upper shadow on the candlestick;

→ if this rebound is merely an interim recovery following the bearish B→C impulse, it fails to reach the 50% Fibonacci retracement level.

In addition, the B peak only slightly exceeded the previous August high (which resembles a bull trap).

Taking all this into account, we could assume that in the near term we may see bears attempt to break the 1.1600 support level and push EUR/USD towards the median line of the primary descending channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

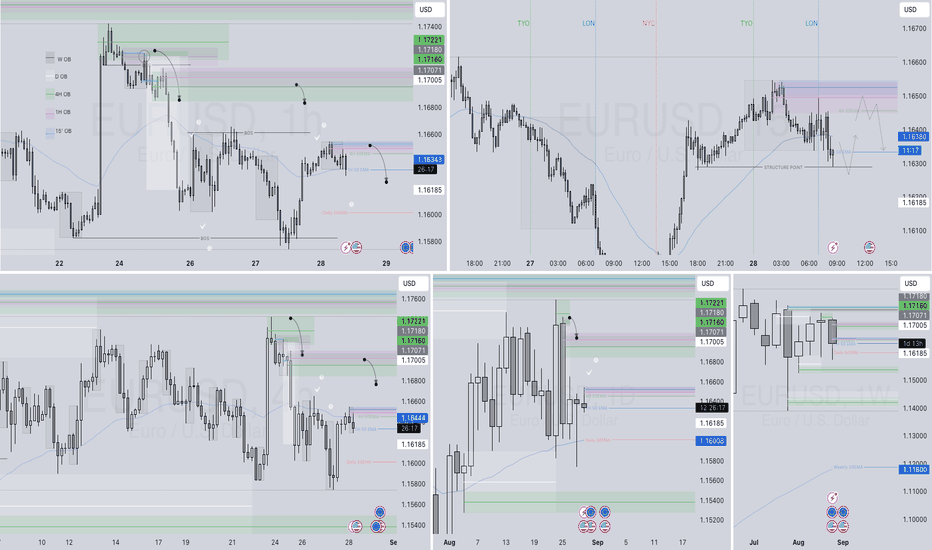

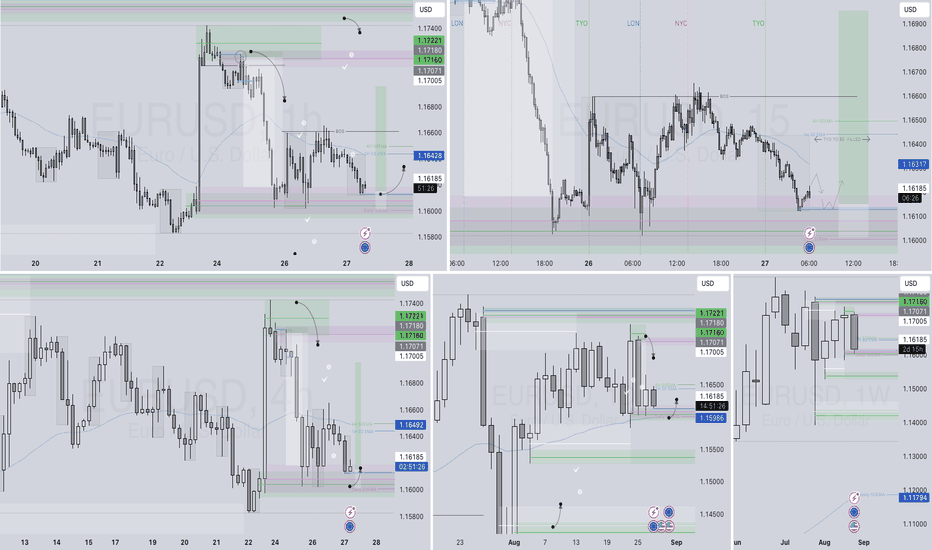

EURUSD SHORT FULL BREAKDOWN FROM WEEKLY - 1' TIME FRAMEOn Sunday 24th Aug 2025 my exact words are quoted below - please also see my recent post to view.

"📊 EURUSD – WEEKLY FORECAST

📈 EURUSD Weekly Forecast – Q3 | W35 | Y25

Much like other USD-cross pairs, EUR/USD ended the week strongly bullish, with the weekly candle closing above the weekly 50 EMA.

This close shifts the higher time frame bias toward long-term buy positions, in line with broader dollar weakness.

🔍 Forecast & Strategy:

Despite the bullish weekly close, I’m anticipating a retracement early in the week — specifically a pullback into the daily imbalance created by Friday’s strong move.

📍 Below that imbalance, there’s a daily order block that aligns with:

The daily 50 EMA

Mid-range and lower-range points of interest

This confluence zone becomes a key area to look for long executions, provided the market gives us confirmation.

🎯 Execution Plan:

Once price enters these zones (both short- and long-term POIs):

Look for a clear Break of Structure (BOS) on the 5M or 15M timeframes before executing.

No BOS = no entry.

📉 Short-Term Shorts – With Caution:

If price offers valid short setups from current highs, target areas will include:

The daily imbalance (first target & partial TP zone)

The daily 50 EMA and the daily order block (final TP and long re-entry zone)

Important: All short positions should be managed aggressively and fully closed by the time price reaches the bullish POI, as the higher time frame bias favors longs.

✅ Bias: Bullish (Higher Time Frame)

⚠️ Shorts are counter-trend and must be managed accordingly

📌 Wait for confirmation before executing either side

Let’s stay patient, let structure lead, and execute only when the market tells us it’s time.

FRGNT "

📉 Trade Breakdown – This Morning’s Entry

My method for taking the trade this morning followed the structure detailed earlier — with a few key additions:

🔹 A 4H order block was formed, providing a strong area of interest.

🔹 This led to a bearish break of structure on the 1H, which confirmed momentum shift and left behind both a void and a new 1H order block.

At that point, the setup was clearly defined.

I then zoomed into the lower time frames (5M & 1M) to fine-tune the entry, using lower time frame structure and precision for execution.

🎥 See the video for a full walk-through of how the trade was executed — step-by-step.

FRGNT

FX:EURUSD

EURUSD – DAILY FORECAST Q3 | W35 | D25 | Y25📊 EURUSD – DAILY FORECAST

Q3 | W35 | D25 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURUSD

EURUSD(20250825) Today's AnalysisMarket News:

① Powell "joined" the dovish camp, opening the door for a September Fed rate cut. Traders increased their bets on a rate cut.

② Hammack: The Fed needs to be cautious about any rate cuts; a significant weakening of the job market could prompt a rate cut; the Fed remains significantly off-track on its inflation mandate.

③ Collins: The risks to the dual mandate are roughly balanced. Job growth is slowing, but there's reason to wait.

④ Musallem: Job market risks are rising but haven't materialized yet. If job market risks intensify, the policy rate may need to be adjusted.

⑤ Trump: Powell should have cut rates a year ago; it's too late to signal a rate cut now. Trump also renewed his threat to fire Fed Governor Tim Cook.

Technical Analysis:

Today's Buy/Sell Levels:

1.1681

Support and Resistance Levels:

1.1839

1.1780

1.1742

1.1620

1.1582

1.1523

Trading Strategy:

If the price breaks above 1.1742, consider entering a buy position, with the first target price at 1.1780.

If the price breaks below 1.1681, consider entering a sell position, with the first target price at 1.1620

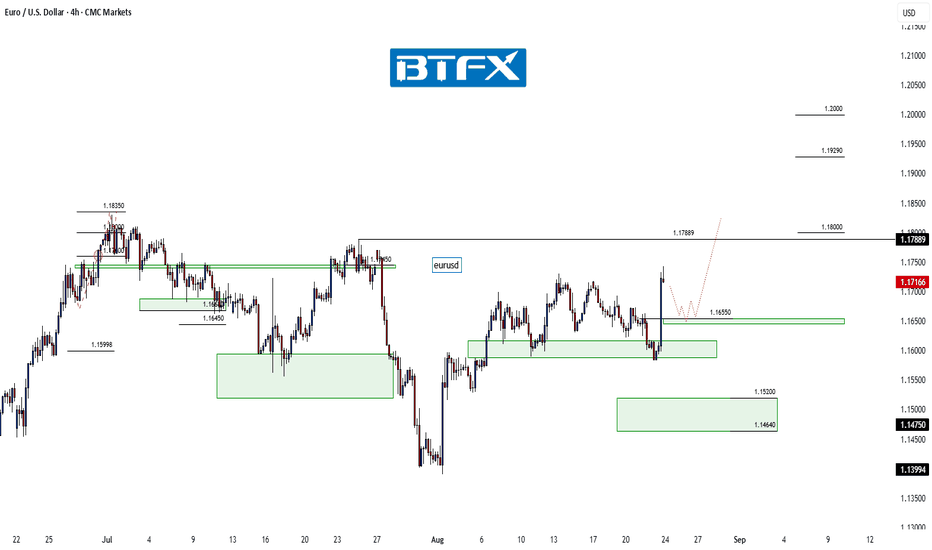

EUR/USD Holds Firm – Eyeing Pullback Before Next Leg HigherHi Everyone,

Despite what was a fundamentally turbulent week in the markets, our trading delivered a flawless run last week!

As highlighted in our previous idea, EUR/USD found support near the 1.16000 zone before mounting a push higher toward the 1.17889 level. Looking ahead into next week, we anticipate a pullback toward the 1.16550 area, which could provide the base for another attempt to reach 1.17889.

The impulsive rally from the 1st August low continues to reinforce our bullish outlook on EUR/USD.

Our broader view remains unchanged: we expect the pair to continue building momentum for another leg to the upside. A decisive break above 1.17889 would open the path toward the 1.18350–1.19290 zone, and ultimately the 1.20000 handle.

We’ll be monitoring price action closely to see whether this recovery gains traction and if buyers can sustain momentum through resistance. The longer-term outlook remains bullish, provided price continues to hold above the key support levels.

We’ll keep updating you throughout the week as the structure develops and share how we’re managing our active positions.

Thanks again for all the likes, boosts, comments, and follows — your support is truly appreciated!

All the best for the rest of the week.

Trade safe.

BluetonaFX

EURUSD: EU IS Strong vs USD Currently. Buy It?Welcome back to the Weekly Forex Forecast for the week of Aug 25 - 29th

In this video, we will analyze the following FX market: EURUSD

The EURUSD is strong. Buy it.

But... be mindful that we are still in corrective territory. The Friday Powell candle notwithstanding, the market has not traded through and closed above the last swing high. Last week's Weekly candle closed within the range of the previous candle. Not a bullish indication. This is the time to be cautious of new trade entries early in the week ahead. Let the market tip its hand before jumping into trades.

The market is more bullish than bearish, and buys on pullbacks are best.

Just be mindful that if a bearish BOS happens, sells will be the highest probability trades to take and hold.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

EURUSD Weekly Forecast – Q3 | W35 | Y25

📊 EURUSD – WEEKLY FORECAST

📈 EURUSD Weekly Forecast – Q3 | W35 | Y25

Much like other USD-cross pairs, EUR/USD ended the week strongly bullish, with the weekly candle closing above the weekly 50 EMA.

This close shifts the higher time frame bias toward long-term buy positions, in line with broader dollar weakness.

🔍 Forecast & Strategy:

Despite the bullish weekly close, I’m anticipating a retracement early in the week — specifically a pullback into the daily imbalance created by Friday’s strong move.

📍 Below that imbalance, there’s a daily order block that aligns with:

The daily 50 EMA

Mid-range and lower-range points of interest

This confluence zone becomes a key area to look for long executions, provided the market gives us confirmation.

🎯 Execution Plan:

Once price enters these zones (both short- and long-term POIs):

Look for a clear Break of Structure (BOS) on the 5M or 15M timeframes before executing.

No BOS = no entry.

📉 Short-Term Shorts – With Caution:

If price offers valid short setups from current highs, target areas will include:

The daily imbalance (first target & partial TP zone)

The daily 50 EMA and the daily order block (final TP and long re-entry zone)

Important: All short positions should be managed aggressively and fully closed by the time price reaches the bullish POI, as the higher time frame bias favors longs.

✅ Bias: Bullish (Higher Time Frame)

⚠️ Shorts are counter-trend and must be managed accordingly

📌 Wait for confirmation before executing either side

Let’s stay patient, let structure lead, and execute only when the market tells us it’s time.

FRGNT

FX:EURUSD

EURUSD Bears Regain Control as Dollar Strength Holds FirmEURUSD is showing fresh signs of exhaustion after its recent bounce, struggling to hold momentum against a resilient U.S. dollar. Price action has rejected trendline resistance and is now threatening to extend lower toward key demand zones. With the ECB battling slowing growth while the Fed remains cautious but firm, EURUSD faces mounting pressure to the downside.

Current Bias

Bearish – rejection at resistance keeps the pair vulnerable to further downside toward 1.1600 and potentially 1.1410.

Key Fundamental Drivers

U.S. dollar demand supported by safe-haven flows and relatively strong U.S. economic data.

ECB’s dovish tilt as growth falters in the Eurozone, limiting scope for additional rate hikes.

Differentials in monetary policy continue to favor the USD over the EUR in the medium term.

Macro Context

Interest rate expectations: The Fed is expected to keep rates higher for longer, maintaining a hawkish edge, while the ECB faces pressure to slow policy tightening given weak Eurozone growth.

Economic growth: U.S. growth remains more resilient than Europe’s, with Eurozone industrial and consumer sectors showing signs of fatigue.

Commodity flows: Lower European energy demand and potential disruptions in global gas/oil trade leave the euro vulnerable.

Geopolitical themes: Trade tariffs, global slowdown risks, and U.S.–EU policy divergence all weigh on the single currency.

Primary Risk to the Trend

A surprise hawkish shift from the ECB or softer-than-expected U.S. data could reignite EUR upside momentum and squeeze shorts.

Most Critical Upcoming News/Event

ECB policy meeting minutes (guidance on growth vs. inflation trade-off)

U.S. PMI & jobless claims (gauging the Fed’s stance on growth resilience)

Leader/Lagger Dynamics

EURUSD is a leader pair in the FX market, often dictating overall USD sentiment.

Movements here influence correlated assets such as DXY, gold, and EUR-crosses like EURJPY and EURNZD.

Key Levels

Support Levels: 1.1606, 1.1410

Resistance Levels: 1.1710, 1.1797

Stop Loss (SL): 1.1800

Take Profit (TP): 1.1606 (first target), 1.1410 (extended target)

Summary: Bias and Watchpoints

EURUSD continues to lean bearish, with rejection from resistance and a weakening Eurozone macro backdrop providing downside pressure. The bias favors further losses toward 1.1606, with extended downside into the 1.1410 region if bearish momentum accelerates. A stop loss above 1.1800 provides protection against a breakout reversal. Traders should closely monitor ECB commentary and U.S. data releases, as any divergence from expectations could quickly shift momentum. Until then, the path of least resistance remains to the downside.

EURUSD – DAILY FORECAST Q3 | W34 | D22 | Y25📊 EURUSD – DAILY FORECAST

Q3 | W34 | D22 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURUSD

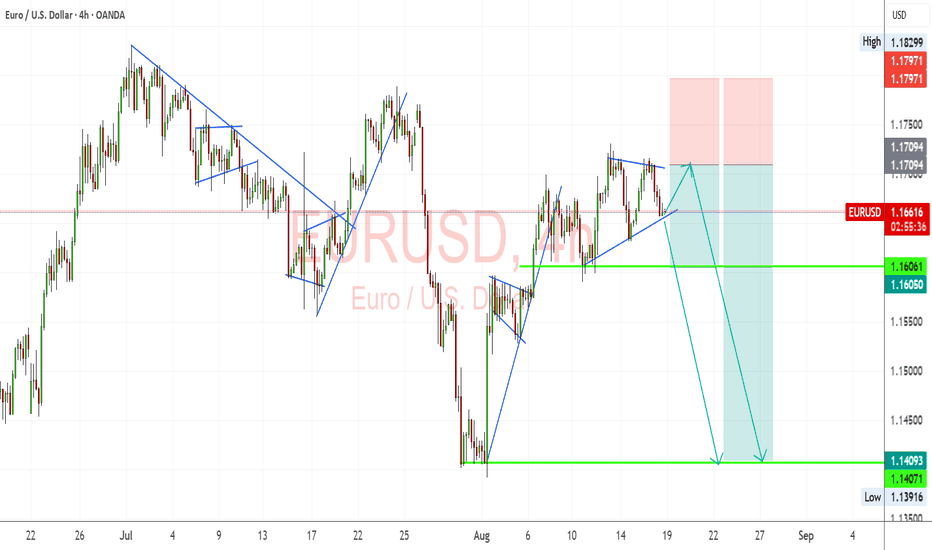

AB=CD patterns on EUR/USD Following the rebound from the monthly support at US$1.1457, overhead resistance calls for attention between US$1.2028 and US$1.1930 (with the lower boundary reinforced by an AB=CD bearish pattern). This means that, at least as of writing, technical studies suggest medium-term outperformance for the EUR/USD (euro versus the US dollar) until the unit reaches the noted resistance zone.

In light of this potential upside, the H4 chart shows a possible AB=CD support area between a 100% projection ratio of US$1.1608 and a 1.272% Fibonacci projection ratio of US$1.1580 to be watchful of.

Written by FP Markets Chief Market Analyst Aaron Hill

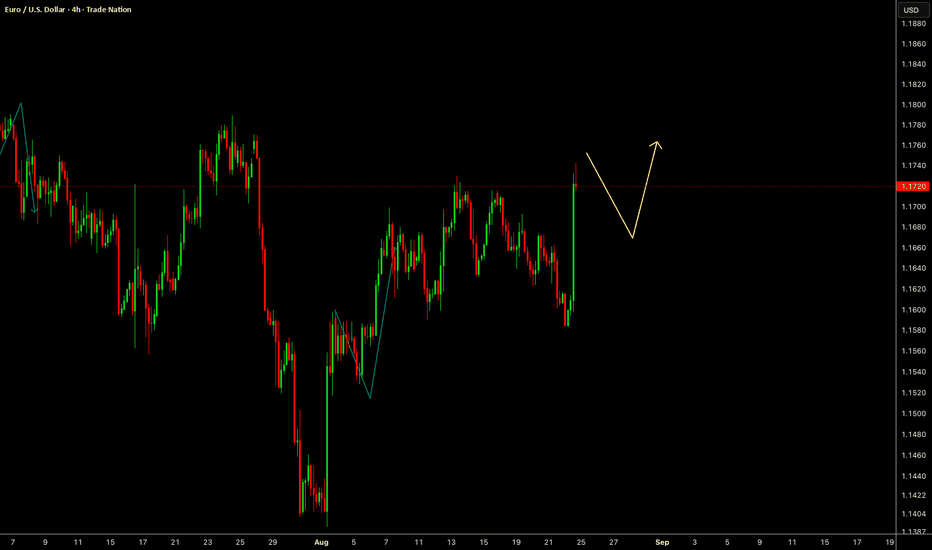

EURUSD: Will Sellers Take Control? Moment Of Truth!Welcome back to the Weekly Forex Forecast for the week of Aug 18 - 22nd.

In this video, we will analyze the following FX market: EURUSD

The EURUSD is at a point in the uptrend it has been on since January where there is some

strong resistance.

July was a very bearish month, but August has corrected about 80% of the move, the last line on a fib retracement. It could keep going higher, of course. Or it could do what it has done the last two time the HTF swing highs reached these levels... turn around.

Wait for the market to decide, which should happen early during next week. Then look for valid entries.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

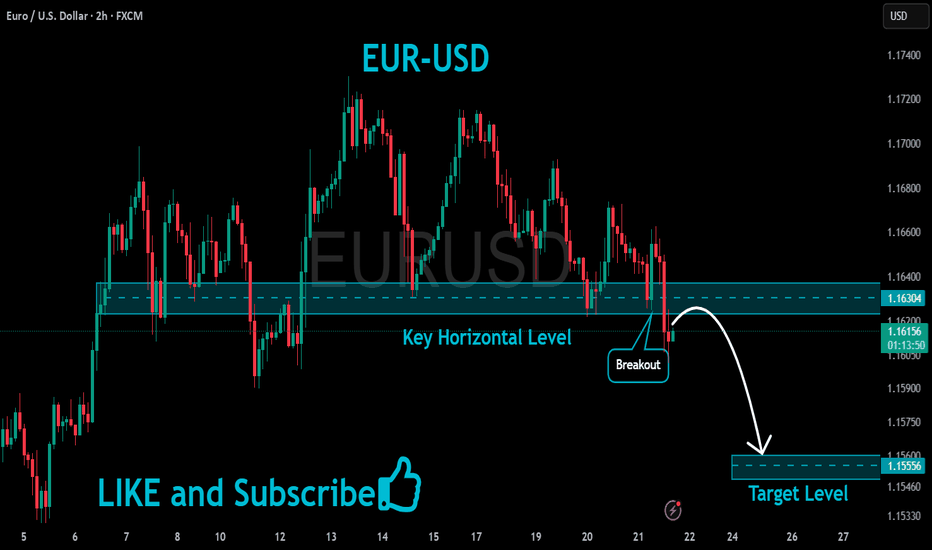

EURUSD Epic Bearish Breakout!

HI,Traders !

#EURUSD made an epic

Bearish breakout of a very

Strong key horizontal level

Of 1.16304 which is now a

Resistance and the breakout

Is confirmed so we are

Bearish biased and we will

Be expecting a further

Bearish move down !

Comment and subscribe to help us grow !

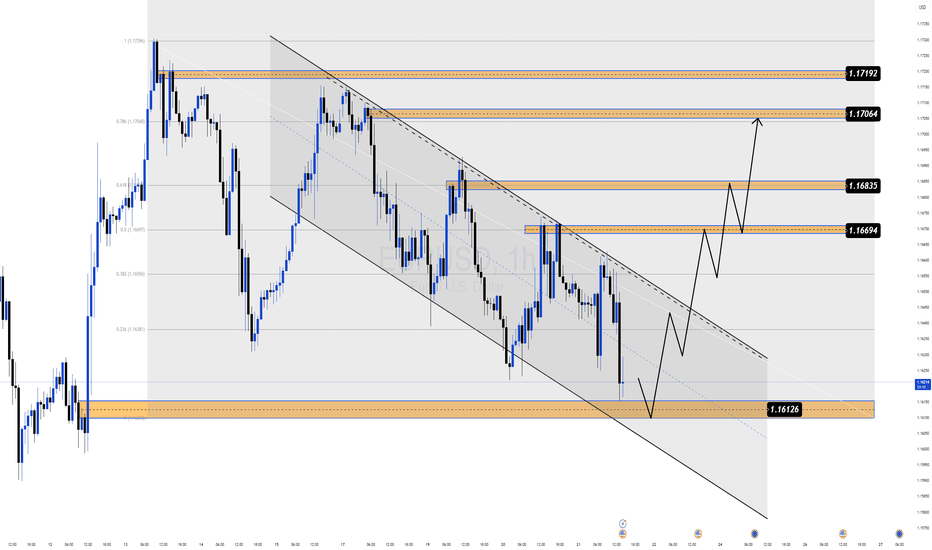

Descending Channel Exhaustion Bullish Reversal on the HorizonEURUSD Descending Channel Exhaustion Bullish Reversal on the Horizon

EURUSD continues to trade inside a clear descending channel, but price action is showing signs of exhaustion as it approaches a key liquidity zone. The structure suggests that buyers may soon take control, pushing price toward higher targets.

📊 MMFLOW Technical Outlook

Liquidity sweep near 1.16126 BUY ZONE signals strong potential for accumulation.

A breakout above the channel trendline will be the trigger for the bullish leg.

Key levels to the upside: 1.16694 – 1.16835 – 1.17064 – 1.17192.

💡 MMFLOW Trading Plan

Primary bias: Bullish – Buy dips near liquidity zones.

Entry ideas: Wait for confirmation at 1.16126 or a clean breakout + retest of 1.16694.

Short-term pullbacks can be scalped, but the main strategy favors swing longs.

📌 Key Levels to Watch:

Supports: 1.16126 – 1.1638

Resistances: 1.16694 – 1.16835 – 1.17064 – 1.17192

🚨 Risk Note:

Failure to hold above 1.16126 could extend the bearish channel lower. Always stick to TP/SL discipline.

✨ MMFLOW Reminder:

👉 Patience at KeyLevels = Profits

👉 Trade with the trend, not against it.