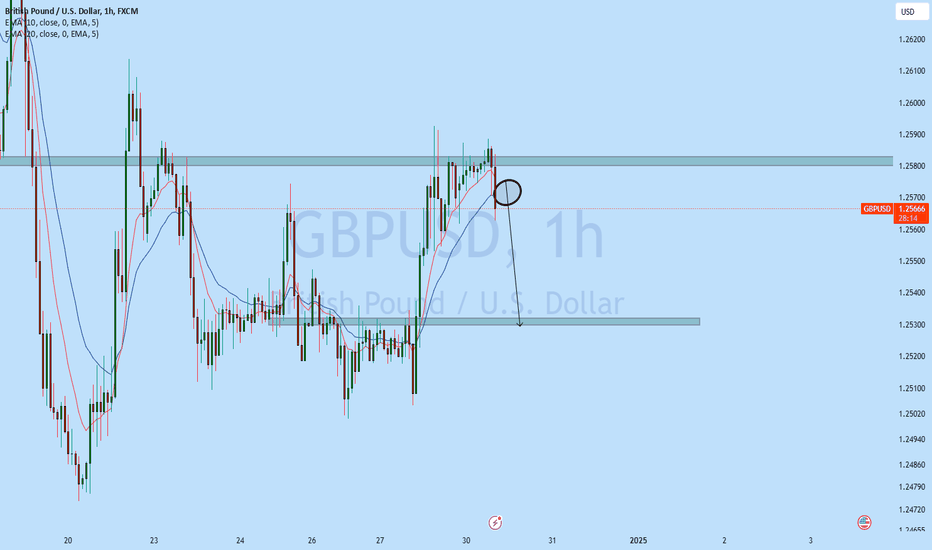

EURUSD and GBPUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Eurusdpriceaction

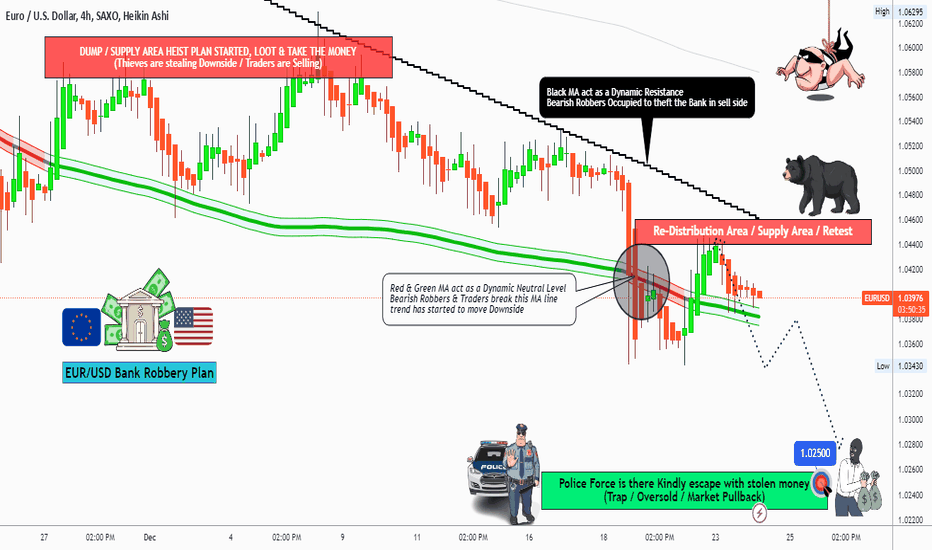

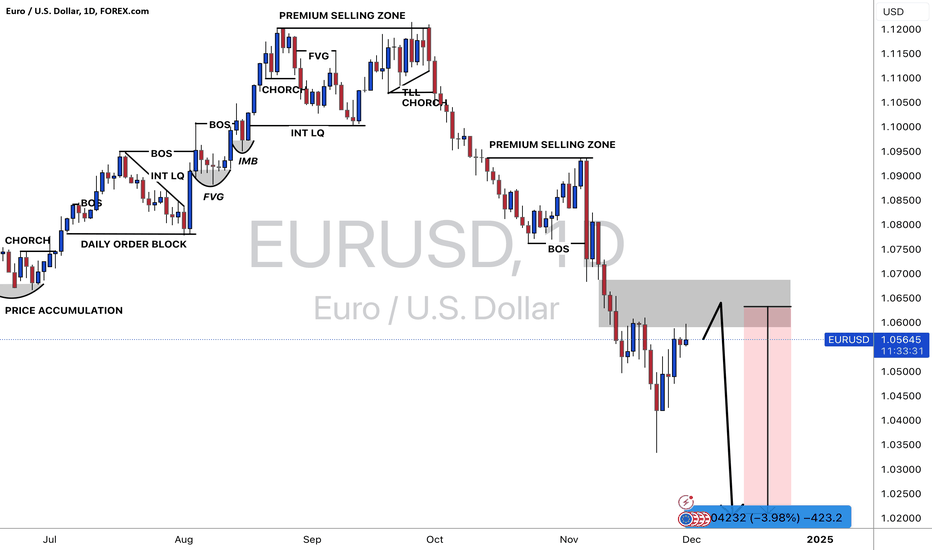

EUR/USD "The Fiber" Forex Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

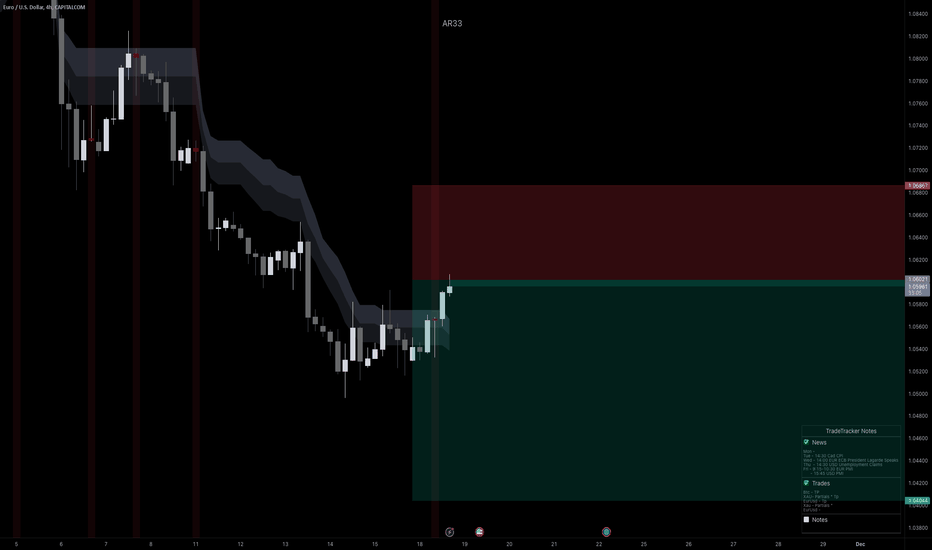

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the EUR/USD "The Fiber" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📉 : You can enter a short trade at any point,

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high/low level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest high level.

Goal 🎯: 1.02500 (or) Escape before the goal

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

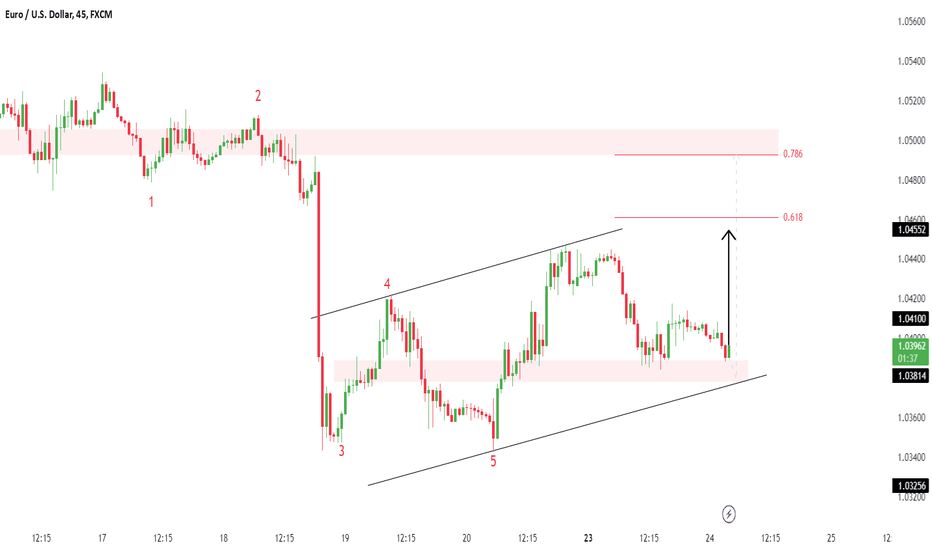

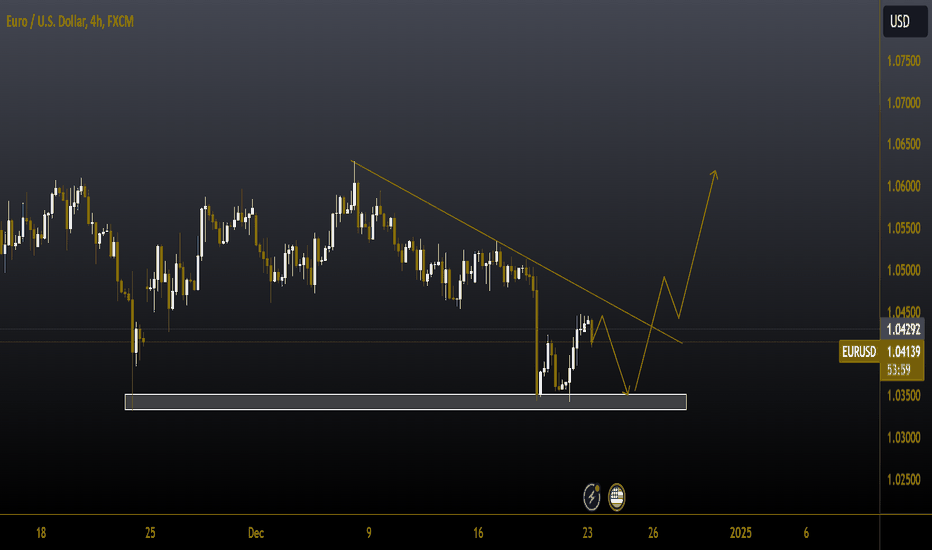

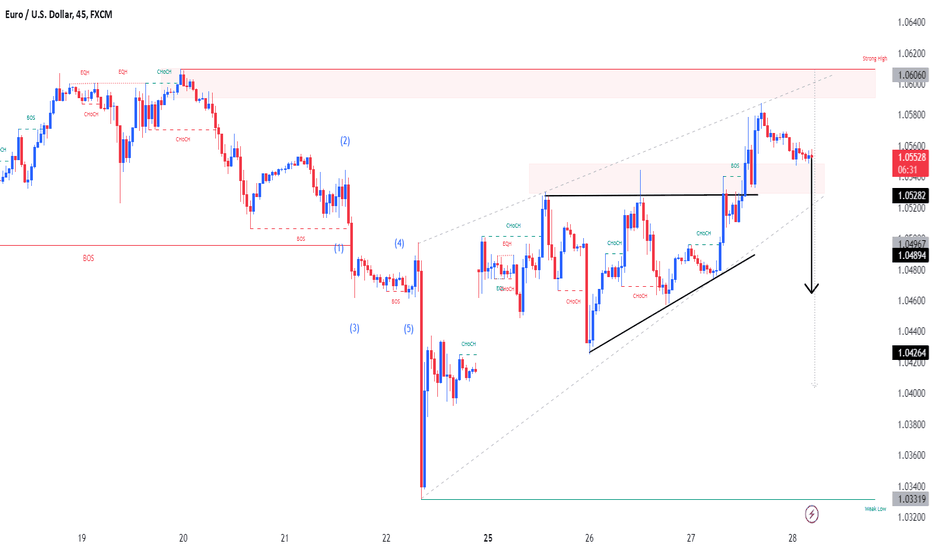

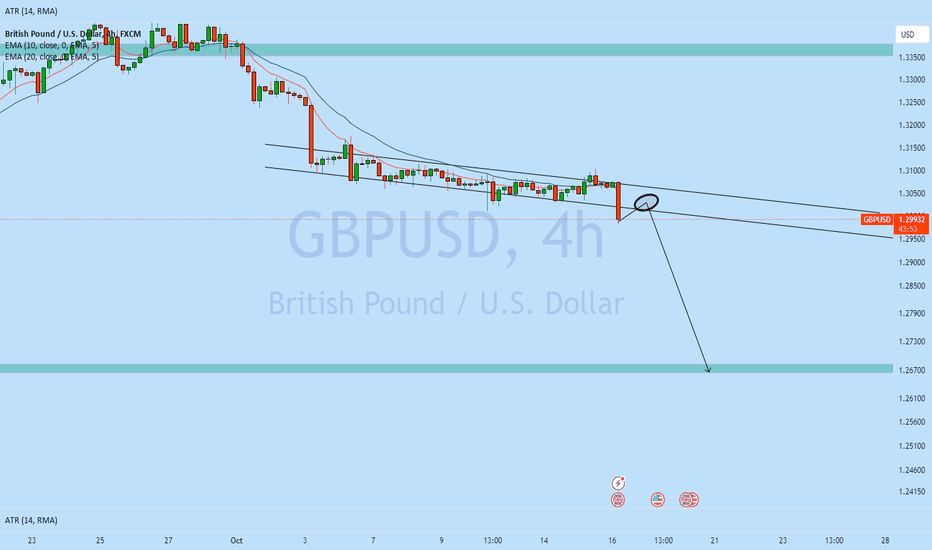

#EURUSD 4HEURUSD (4H Timeframe) Analysis

Pattern Identified:

Trendline Resistance: Price is respecting a descending trendline, indicating selling pressure and a bearish outlook in the short term.

Forecast:

Sell Now: The price is currently near the trendline resistance, providing an opportunity for a short position as the trend remains bearish.

Buy Opportunity: If the price drops and touches the identified support level, a potential buying opportunity may arise, expecting a bounce from support.

Key Levels:

Sell Entry: Near trendline resistance.

Stop Loss (Sell): Above the trendline resistance to limit risk.

Take Profit (Sell): At the next support level.

Buy Entry: At the support zone, once a bullish confirmation is observed.

Stop Loss (Buy): Below the support level in case of a breakout.

Take Profit (Buy): Towards the trendline resistance or next resistance level.

Market Sentiment:*

Short-Term Bearish: Dominated by sellers under trendline resistance.

Reversal Potential: Watch for support zone reactions to switch to a buy setup.

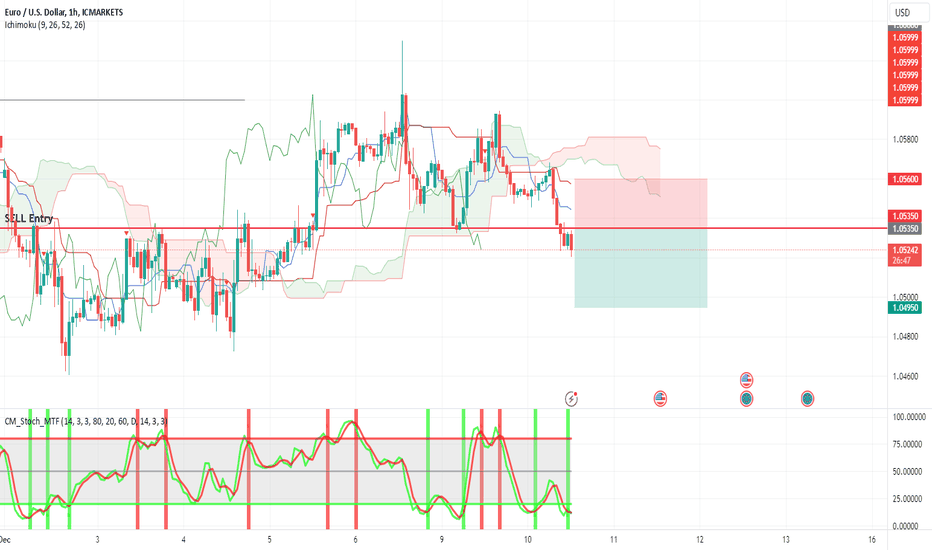

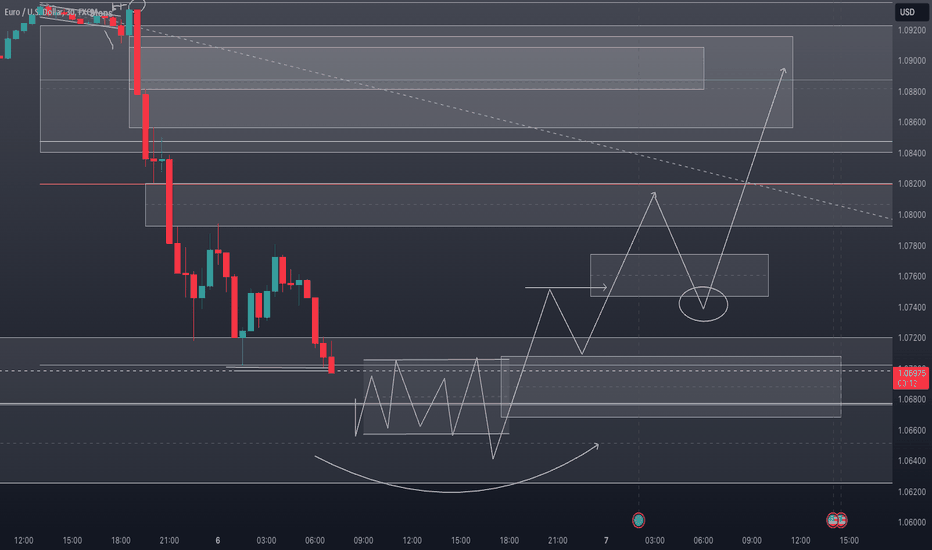

EURUSD H1 10/12/2024 - SELL below 1.0520Multi-Timeframe Analysis

D1 (Daily Timeframe)

Trend Analysis:

Price is in a consolidation phase, hovering just below the Ichimoku Cloud, reflecting bearish dominance.

The 200 SMA is positioned far above current price levels, confirming a longer-term downtrend.

The Stochastic Oscillator is moving out of the overbought zone, suggesting potential bearish continuation.

Key Levels:

Resistance: 1.0580–1.0600.

Support: 1.0520, 1.0490.

H4 (4-Hour Timeframe)

Trend Analysis:

Price has broken below the Ichimoku Cloud and the 50 SMA, signaling bearish pressure.

The RSI (44.3) and Stochastic (13.1) are both oversold, suggesting a short-term pullback might occur.

Key Levels:

Resistance: 1.0550–1.0580 (previous support turned resistance).

Support: 1.0520, 1.0490.

H1 (Hourly Timeframe)

Trend Analysis:

Bearish momentum is dominant, with price making lower highs and lower lows.

The RSI (33.3) is oversold, but there’s no divergence yet.

The MACD histogram is slightly bearish, indicating weakening downside momentum.

Key Levels:

Resistance: 1.0550.

Support: 1.0520, 1.0490.

M30 (30-Minute Timeframe)

Trend Analysis:

Price is consolidating near the 1.0520 support level with signs of potential exhaustion in the bearish move.

Stochastic and RSI are in oversold territory, indicating a potential bounce.

Key Levels:

Resistance: 1.0540, 1.0550.

Support: 1.0520, 1.0490.

Correlated Instruments Analysis

US Dollar Index (DXY):

The DXY is in an uptrend, putting additional pressure on EUR/USD.

If DXY continues higher, it will suppress EUR/USD rallies.

EUR/GBP:

EUR/GBP is neutral to slightly bearish, confirming overall Euro weakness.

US 10-Year Treasury Yield:

Rising Treasury yields support a stronger USD, further increasing bearish bias on EUR/USD.

Trade scenario:

Bearish Continuation After Pullback (Preferred)

Rationale:

The breach of 1.0540 opens room for further downside toward 1.0520 and 1.0495.

A short-term pullback toward resistance (1.0540–1.0550) provides an optimal entry for selling.

Trade Details:

Entry Price: 1.0535–1.0540 (wait for a pullback to resistance).

Stop-Loss: 1.0560 (above recent highs).

Take-Profit Levels:

TP1: 1.0515 (near current support).

TP2: 1.0495 (next key support level).

Risk/Reward Ratio: ~1:2.

Scenario B: Aggressive Breakout Trade

Rationale:

If price breaks decisively below 1.0520, the bearish momentum may accelerate further, targeting 1.0490–1.0480.

Trade Details:

Entry Price: 1.0515 (on a clean break below support).

Stop-Loss: 1.0535 (above broken support).

Take-Profit Levels:

TP1: 1.0495.

TP2: 1.0480.

Risk/Reward Ratio: ~1:2.

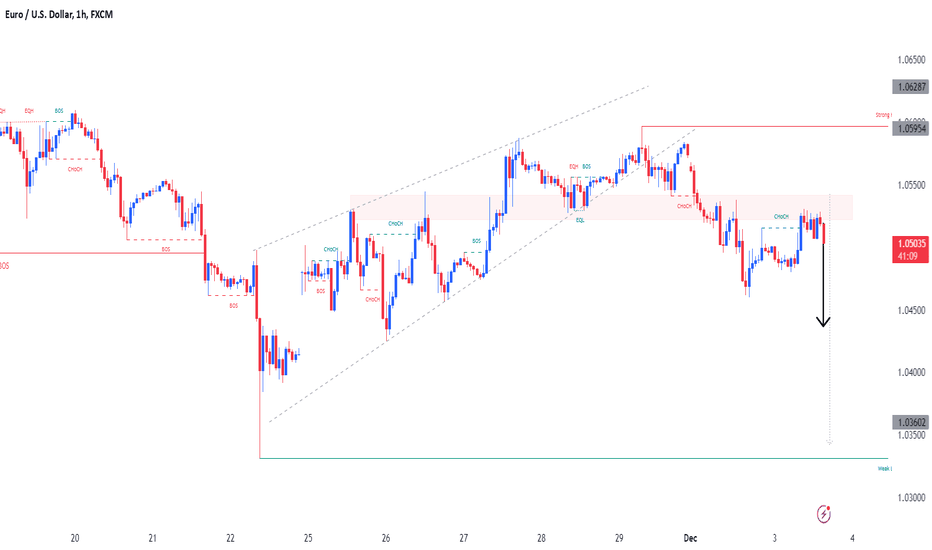

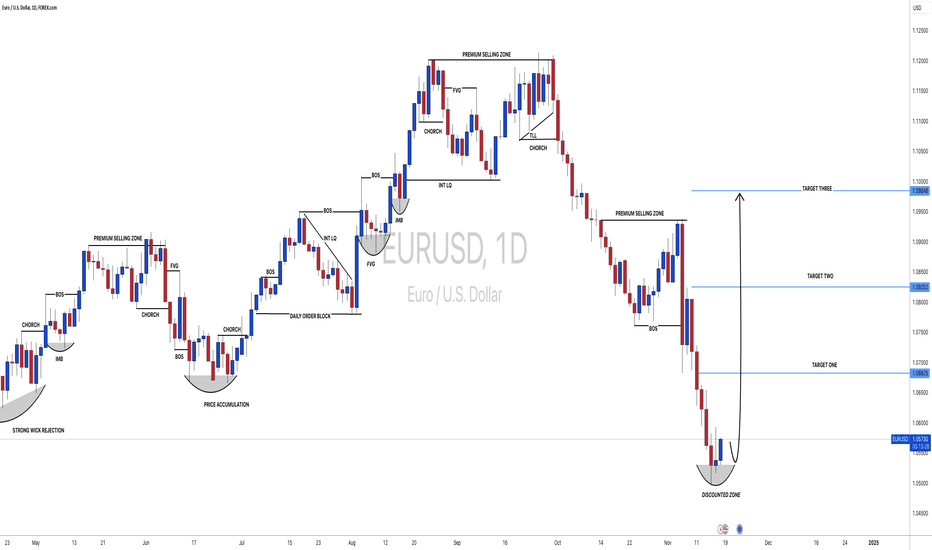

EURUSD: 423+ PiPs Selling Opportunity, one not to miss! Dear Traders

We have a possible selling opportunity on EU, this comes after a strong bearish wicks on daily timeframe. This shows a strong bearish presence in the market. That is why we think there would be a reason for this to have it occurred. And that reason must be a strong sell side correction which will be crucial for big buys/swings bullish move to happen.

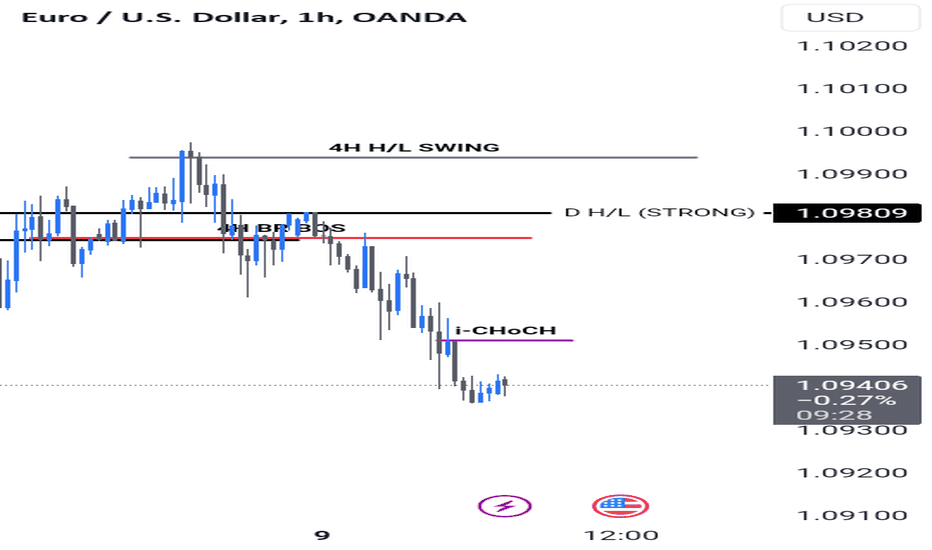

EURUSD Raid On Liquidity? Contemplating the Next Move!👀👉 EURUSD remains in a strong downtrend, evident on the daily and 4-hour charts. Currently, we’re seeing an aggressive pullback on the 4-hour timeframe. I’m eyeing a short entry but holding off early in the week—waiting to see how price develops from the London session into the New York open. In this video, we break down market structure, price action, and blend Wyckoff & ICT concepts in an easy-to-understand way. 🚨 Not financial advice. 📉✅

EUR/USD Short Setup: Leveraging the Retrace for a Downtrend PlayEUR/USD has retraced slightly, offering a good entry point for a short trade. The pair remains bearish, trading below the 200-day MA, with strong resistance near 1.062 holding firm. Targeting the 1.0400 price area, this trade aligns with the broader downtrend, supported by both technical and fundamental factors.

Technical Overview:

The current trend is bearish, with the pair respecting lower highs and significant resistance at the 200-day MA. The initial target is set around 1.0495, with the long-term aim at 1.0400. Price action confirms a sell opportunity as the retrace reaches resistance areas.

Fundamental Context:

The U.S. Dollar has regained strength, driven by optimism around pro-growth policies and a solid DXY rally. Meanwhile, the Fed remains cautious on rate cuts, signaling slower changes ahead. In the Eurozone, the ECB continues a dovish approach, focusing on inflation concerns while speculative short positions on the Euro rise. This reinforces the bearish outlook for EUR/USD. Upcoming speeches and economic data, including Lagarde’s address and U.S. TIC flows, could further influence the pair’s movement.

This short trade aims to capitalize on the retrace within a bearish structure. With clear resistance levels and supportive fundamentals, the setup targets a move toward 1.0400. Risk management remains key as market conditions evolve.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

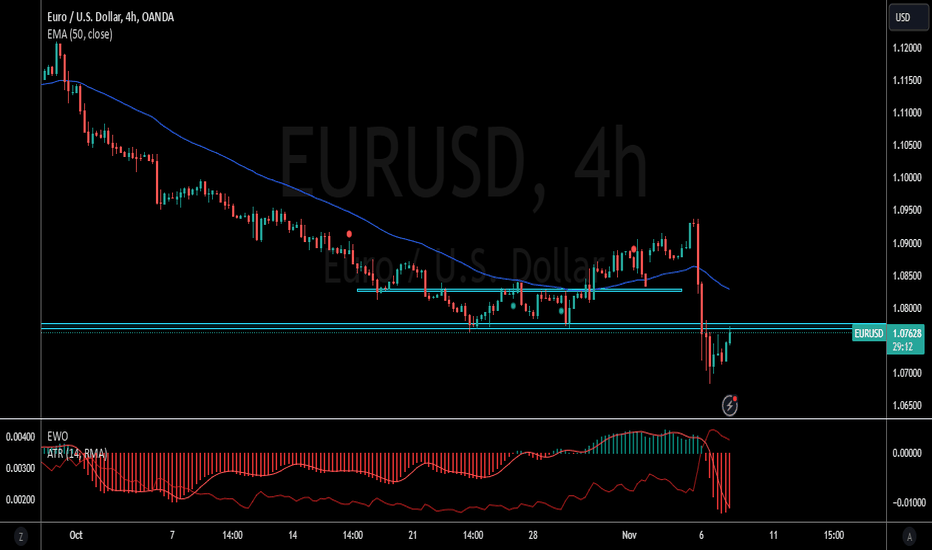

EURUSD POTENTIALLY BEARISHWe saw a massive strength gain to the USD yesterday which shifted a lot of expectations in the market direction. The previous low @1.07682 on FX:EURUSD was broken and now we are seeing market back at the zone again for a retest. If the zone holds as a new found resistance, and we see some form of price action candle to confirm the exhaustion of the retest, I will go in for a short (sell) with targets at 1.05147 and 1.00773. Until then we keep our fingers crossed.

For every position you look to trade, use proper risk management as past results does not guarantee future results. #EURUSD

EURUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Is The EURUSD Set For Possible Bullish Move? Is The EURUSD Set For Possible Bullish Move? Key Price Action Signals to Watch For..

👀👉 EURUSD is displaying strong bearish momentum, but is it over-extended? A significant pullback at a key support level could present a worthwhile opportunity. I'm closely watching this area for a possible buying setup that matches the key criteria covered in the video. In this analysis, we'll highlight crucial price action signals to monitor and discuss strategic positioning for the next potential move. Disclaimer: This analysis is for informational purposes only and is not financial advice. 📊✅

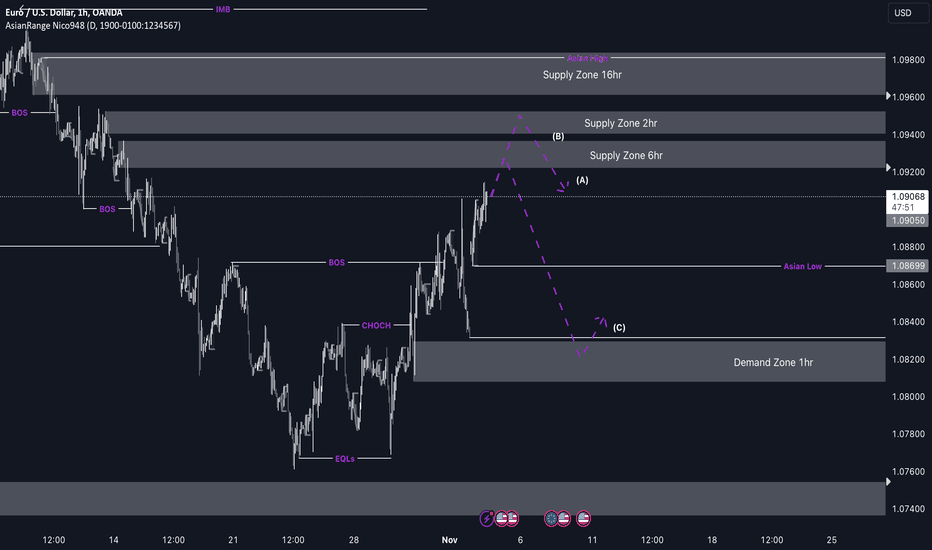

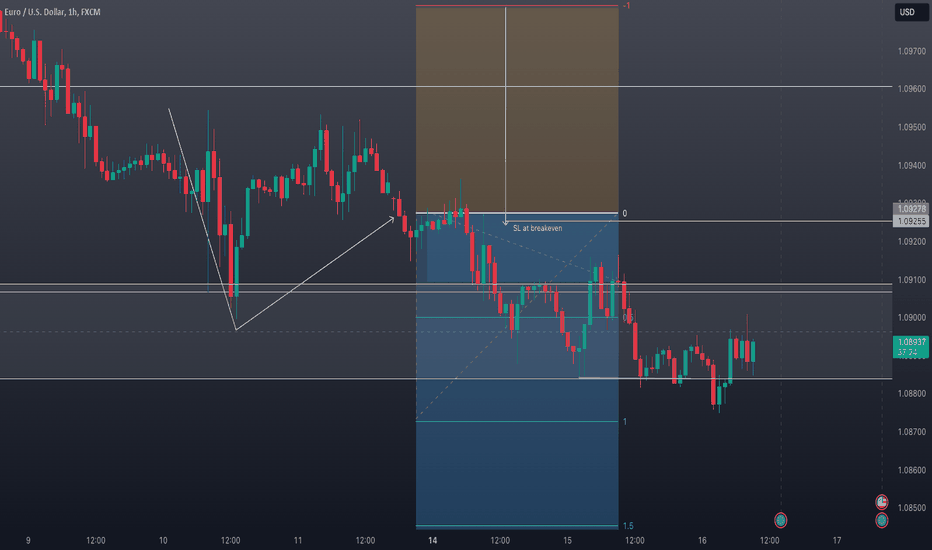

EUR/USD Shorts from 1.09200 back down This week’s analysis for EUR/USD is somewhat different from GBP/USD. I expect price to continue dropping from one of the two supply zones I’ve identified. I’ll be watching for a potential Wyckoff distribution pattern to form at these zones. Once I see signs of distribution, I’ll look to enter short positions, targeting the liquidity pool below.

If, during the week’s election events, price drops to fill the gap left at Sunday’s open, I see potential for buys from the 1-hour demand zone. I’ll wait for signs of price slowing down and accumulating to identify good entry points for long trades.

Confluences for EUR/USD Sells:

- Price is approaching a premium supply area.

- Significant liquidity lies below, including untouched Asian session lows.

- The higher timeframe trend remains bearish.

- The DXY still shows strong bullish pressure.

P.S. Although there’s been a recent shift in character to the upside, I still view EUR/USD as bearish on the higher timeframe, especially with the dollar’s ongoing bullish momentum. I’ll observe price behavior within my points of interest to determine the best entries.

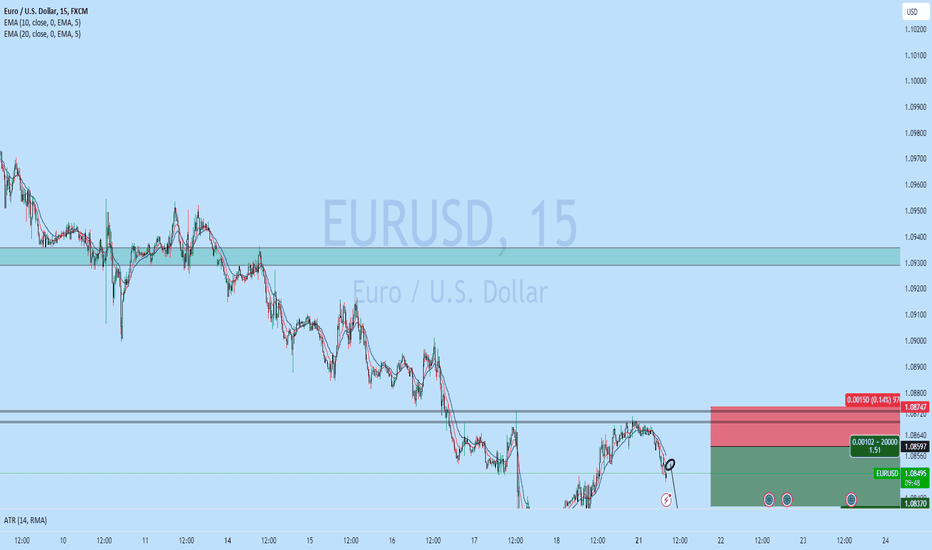

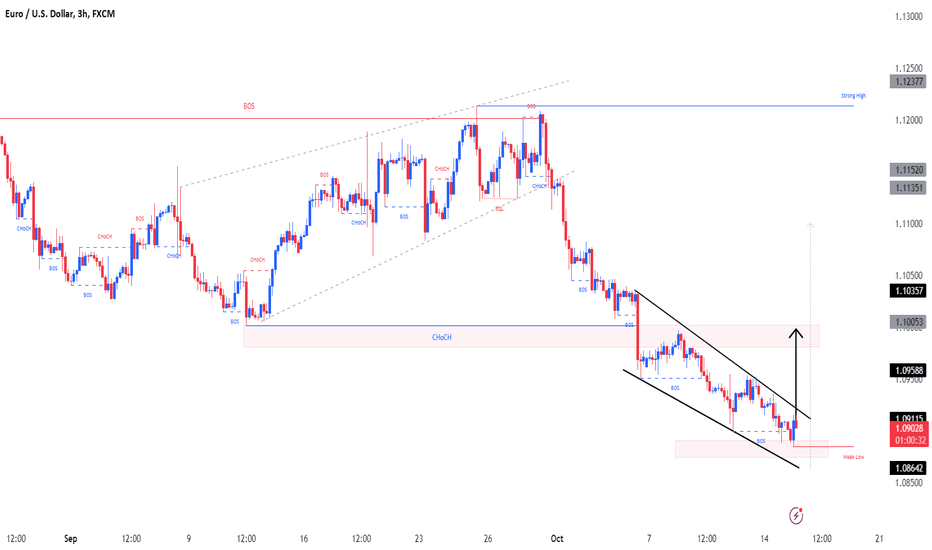

EURUSD Multi Timeframe Analysis 25.10.202415m Swing Bullish , Internal Bullish , but his could be to mitigate current unmitigated 4H supply

Bullish momentum is strong after sweeping daily low liquidity so I assume and will look for longs to stay with the bullish pressure until it turns out the other way

Pricing in 4H supply now so we might see 15m fractal shift to bearish and give us quick short possibilities. But I will look for confirmation longs from 15m demand range nested in 4H demand, which is marked on the chart.

EURUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

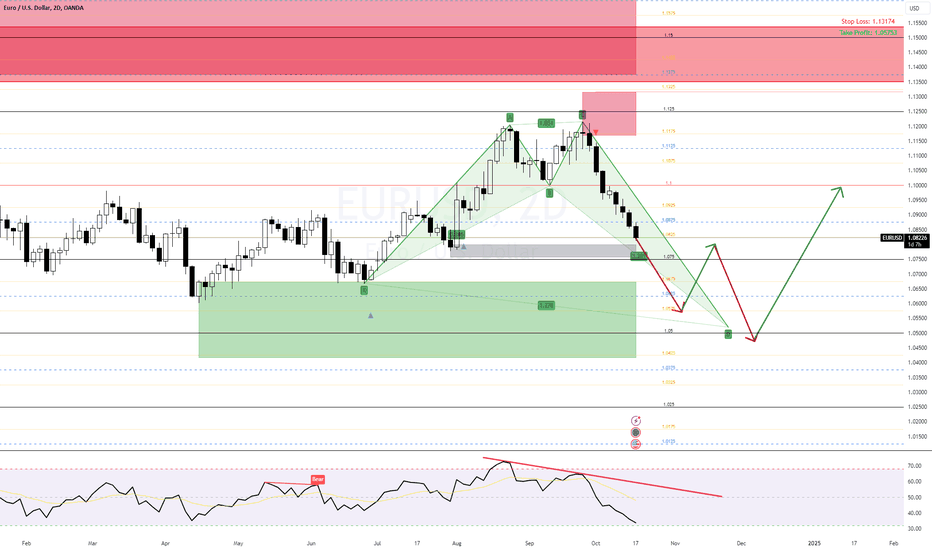

Bullish Butterfly EURUSD DailyLooks like EURUSD is forming a Bullish Butterfly pattern as the Dollar strengthens across most pairs. I'm looking for the pair to continue decline into support around 1.0575-1.0675, consolidate and possibly dead cat bounce before proceeding towards the 1.05 range. I'm also looking for the 14-period RSI to enter oversold territory during this time, which I project may go through the end of November.

I'm currently already short, having racked up ~300 pips. My current stop loss is about 150 pips trailing.

EURUSD Technical Analysis and Managing Your Trade👀👉 EURUSD has faced recent selling pressure, creating a potential opportunity for short-term day traders. In this video, we will break down the price action, assess the current trend and market structure, and look at how we can manage this trade. Risk Disclaimer: Forex trading carries substantial risks, and market conditions can shift unexpectedly. This content is intended for educational purposes only and does not constitute financial advice. 📉✅

XAUUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

PVPSMCSHere is an analysis of EU. HTF is on a Pro Impulse. MTF is Immediate bearish bias. Leaving the LTF i-CHoCH in a good position. Failure to break i-CHoCH will result in short continuation but break of i-CHoCH will result in a buy to sell range of EU market structure. Overall EU is in a Bear Momentum.

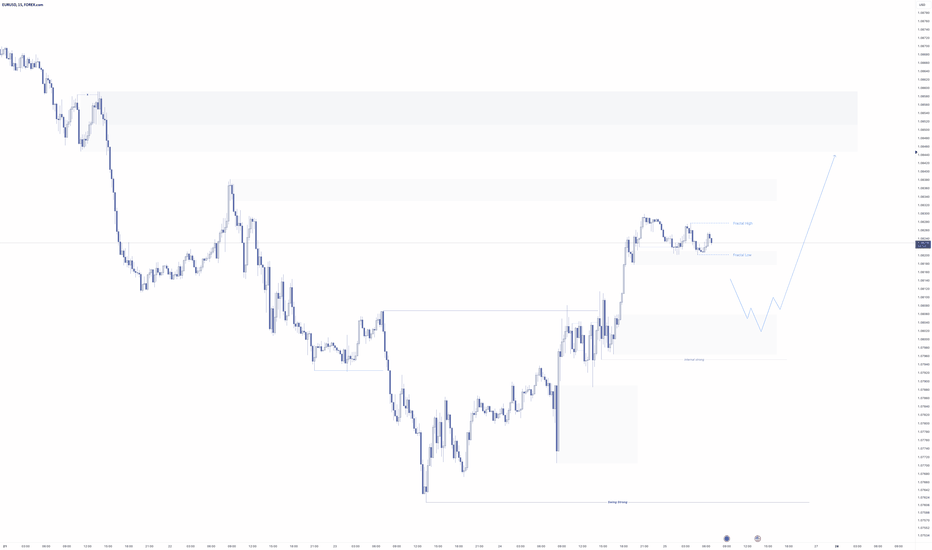

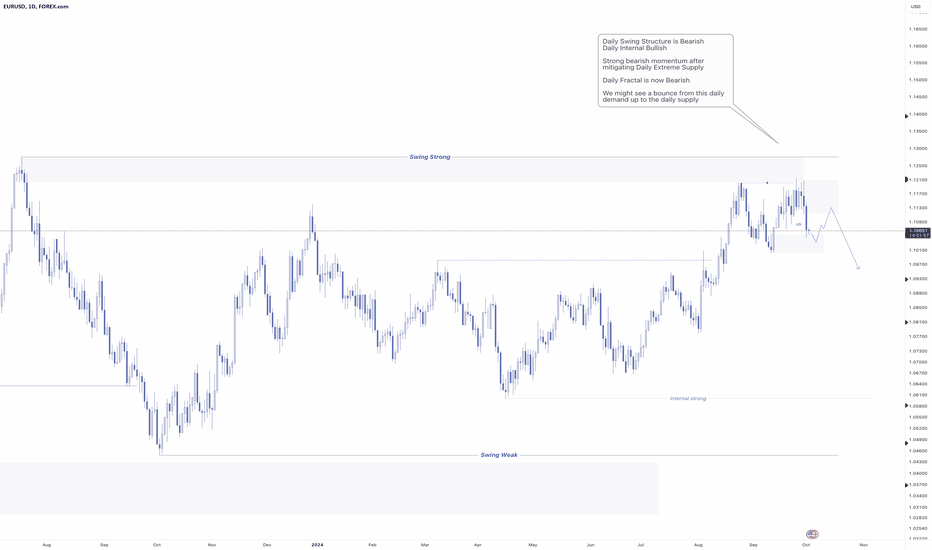

EURUSD Multi Timeframe AnalysisDaily Swing Structure is Bearish

Daily Internal Bullish

Strong bearish momentum after mitigating Daily Extreme Supply + Sweeping the daily BSL in the Supply

Daily Fractal is now Bearish

We might see a bounce from this daily demand up to the daily supply

Plz check 4H and 15m analysis below