Shorting Optimism: EUR/USD Rally vs RealityAfter the spike to 1.1640 driven by temporary ceasefire news and USD weakness, I’ve taken a short position on EUR/USD. The market priced in too much optimism too fast, and I see limited upside beyond this zone in the current macro landscape. I’m positioned for a controlled retracement back toward the 1.1460–1.1520 region.

The play? Fade the overextension, follow structure, and manage from strength.

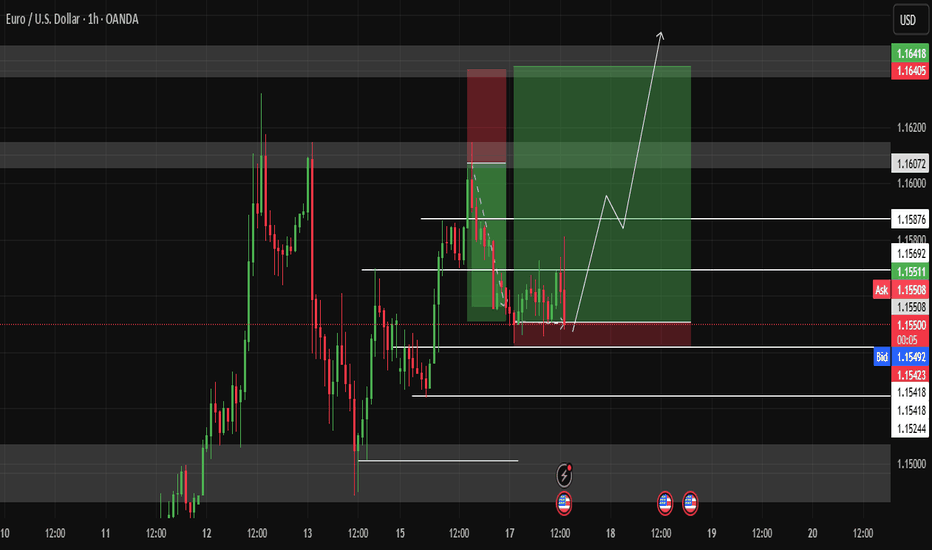

Technicals:

• The pair ran into a strong supply zone near 1.1640, which aligns with a previous liquidity sweep.

• Momentum has slowed visibly on lower timeframes, with candles rejecting highs and wicks printing upper tails.

• Daily and 4H SMAs are overstretched. The 20 SMA on H4 is accelerating upward, but RSI is near overbought and flattening.

• My short entry was taken with a stop above 1.1745 and first target at 1.1540, second at 1.1500.

• A potential retest of the 1.1660 zone could offer additional entries if invalidation remains intact.

Fundamentals:

• ECB vs Fed Divergence: The Fed holds firm on rates amid sticky inflation, while the ECB is under pressure to ease further due to weak growth.

• EU Struggles: PMI data remains in contraction territory; HICP cooling to 1.7% YoY suggests little reason for tightening.

• Political Instability: Germany and France both facing internal political crises — risk premia rising.

• Ceasefire Priced In: EUR rally on Middle East headlines lacks depth — conflict paused, not resolved.

• USD Resilience: Weak recent data aside, the USD remains a safe haven. Fed’s Powell reiterated that cuts aren’t imminent.

⚠️ Bias: Bearish as long as price trades below 1.1640. Watching how the market reacts to Fed testimony and ECB rhetoric this week.

🧠 Reminder: Don’t get emotional after vertical rallies. When everyone gets excited, I look for exhaustion. That’s where trades begin.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

Eurusdtrade

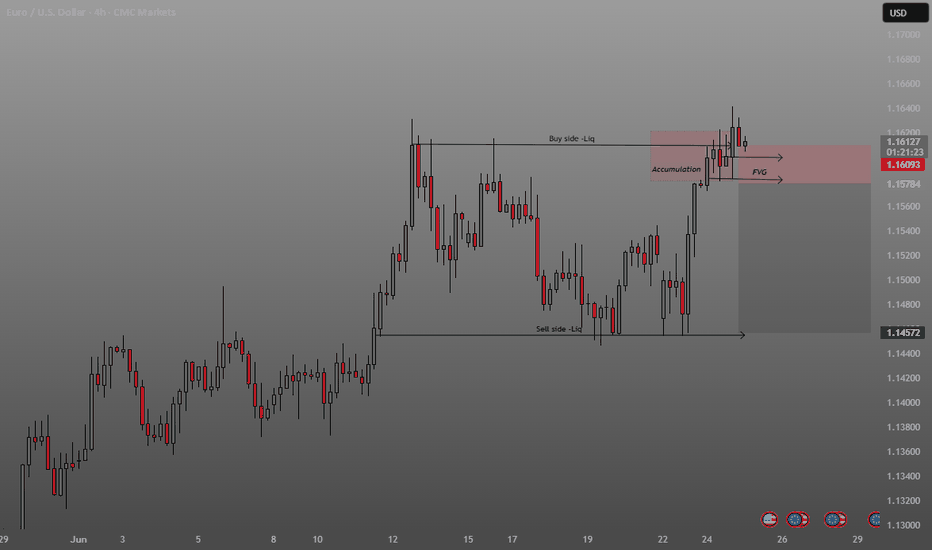

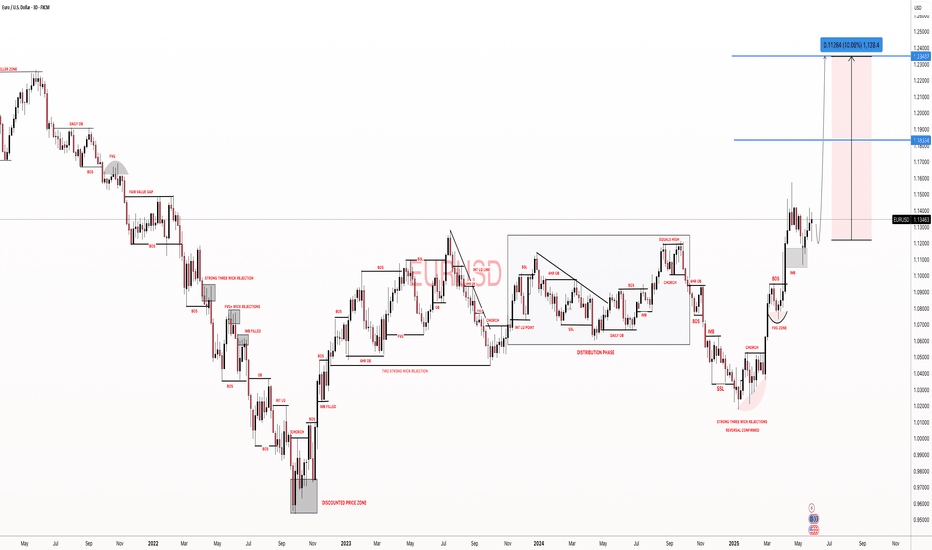

Smart Money Concepts (SMC) principles.Smart Money Concepts (SMC) principles. Here’s a full breakdown of the chart and its annotations:

📊

Chart Details:

Pair: EUR/USD

Timeframe: 4-hour (H4)

Current Price: Around 1.16093 USD

🔍

Key Annotations & Zones:

🟫

Pink Zone (Supply/Resistance Area):

This area includes:

Accumulation

FVG (Fair Value Gap)

Price has recently entered and reacted from this zone.

🔼

Buy Side Liquidity:

Highlighted at the top of the range.

Price swept above recent highs to trigger buy stops (liquidity grab), possibly setting up for a reversal.

🔽

Sell Side Liquidity:

Marked below the previous consolidation range.

Price had previously dipped to collect sell-side liquidity before moving upward.

📈

Accumulation:

This phase occurred before the bullish breakout.

Suggests institutional buying or smart money positioning.

📉

FVG (Fair Value Gap):

Imbalance between buying and selling, typically gets filled.

Marked in the pink zone where price may return before continuing its move.

📌

Price Structure Analysis:

The chart shows a classic liquidity sweep setup:

Price grabs buy-side liquidity.

Enters a supply zone.

May return to fill the FVG.

Potential reversal or bearish reaction from this zone.

✅

Trading Implications:

Bearish Scenario:

Price may reject from the pink supply zone after the buy-side liquidity sweep, filling the FVG and possibly heading toward previous lows.

Bullish Scenario (less likely immediately):

If price holds above the pink zone, it could continue trending upward.

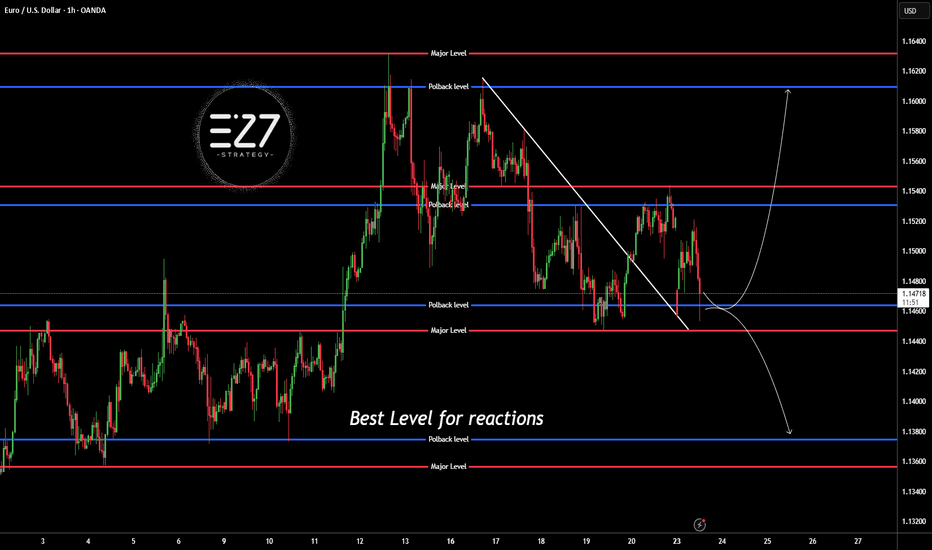

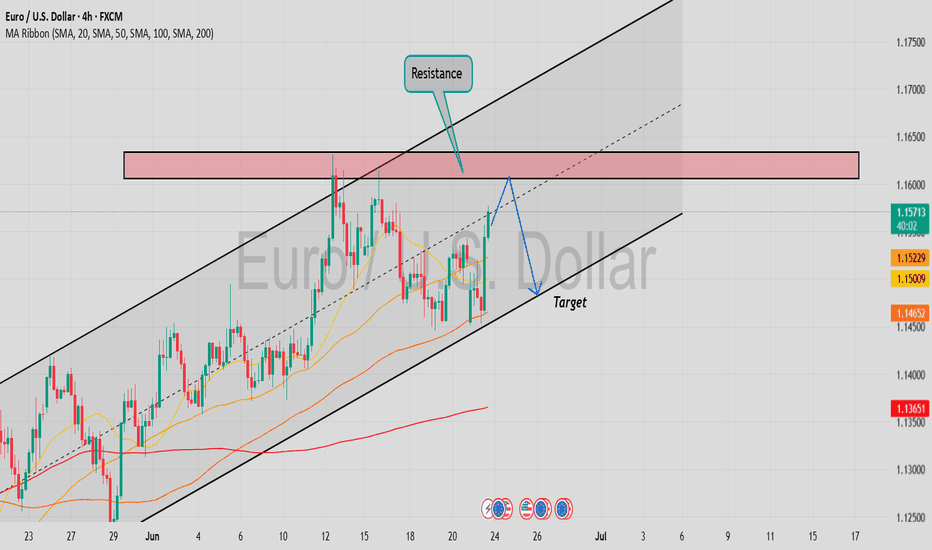

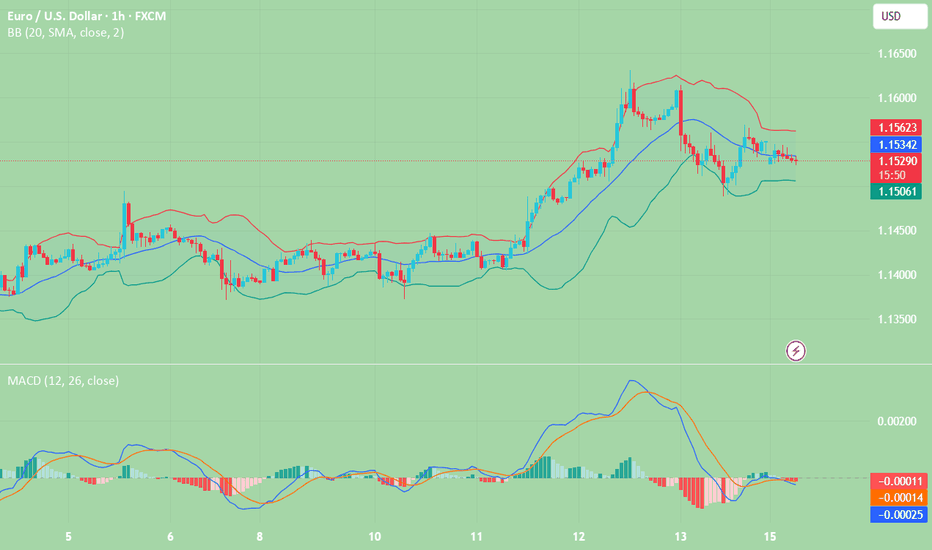

EURUSD Trading Strategy for the WeekEURUSD is reacting at the support zone of 1.14500. This is an important support zone that helps EURUSD continue to maintain its upward momentum. The uptrend in the h4 time frame is still strong and heading towards the peak of 1.161.

Below the support of 1.145 will be the 1.138 zone. When this 1.138 zone is broken, it confirms that a Downtrend is established. The possibility of breaking this zone is not high, so it is still possible to set BUY signals around these support zones. On the other hand, 1.153 is an important resistance zone in the near future where the pair will have a price reaction before finding the peak of last week.

Support: 1.13800

Resistance: 1.16000

Break out: 1.14600-1.15300

Recommended good trading strategy:

Trade when price confirms in Break out zone.

BUY 1.13800-1.13600 Stoploss 1.13300

SELL 1.16000-1.16200 Stoploss 1.16500

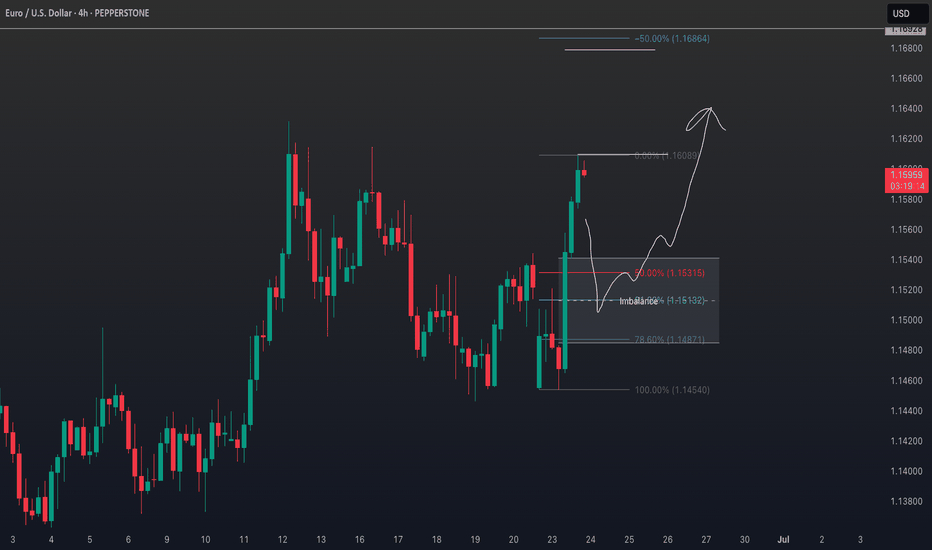

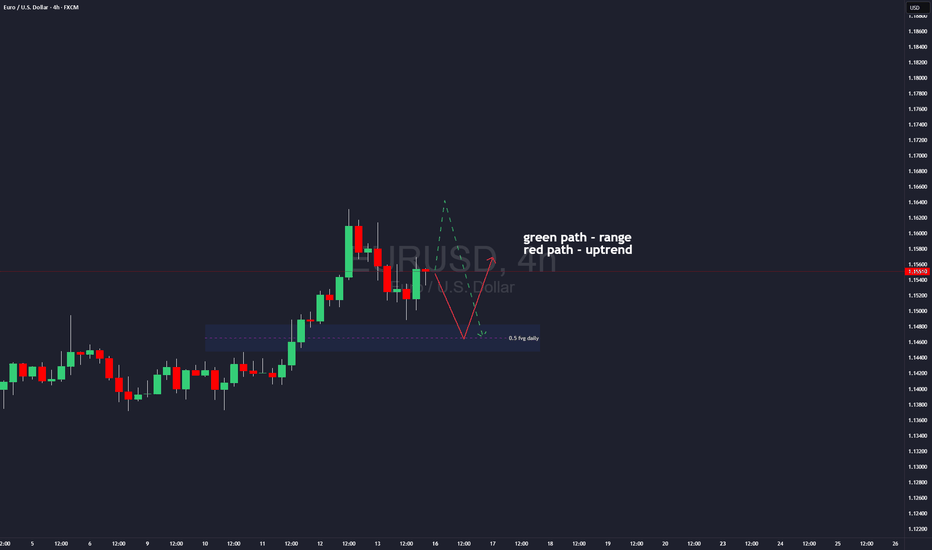

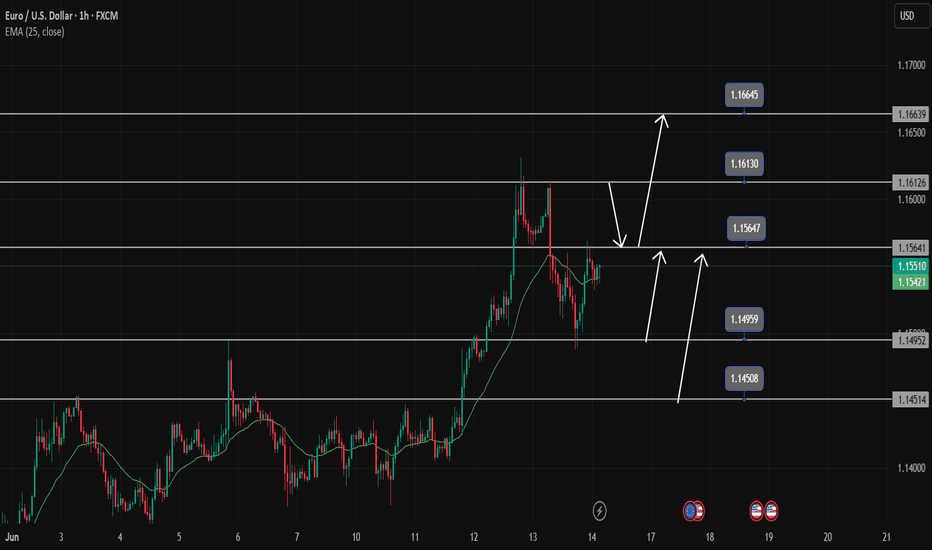

EURUSD Trade Plan: Retracement Into Key Fibo Zone POI.I’m currently watching EURUSD closely 👀. On the daily timeframe, it’s clearly broken structure and is now in a bullish trend 📈. Dropping down to the lower timeframes 🕒, price appears overextended and is now trading into a previous resistance level 🚧.

I’m anticipating a retracement into equilibrium — specifically the 50% level of the current swing, and ideally into the 50–61.8% Fibonacci retracement zone 🔁. If price pulls back into that range, I’ll be watching for a bullish market structure shift 🔄. I don’t want to see it push below the bullish imbalance 📉—I want that zone to hold as support so price can continue north 🔼.

If this plays out, my ideal entry would be around the imbalance and the 50% Fib level, with a stop loss just below the imbalance, and targets set at the current swing high and previous swing high, as detailed in the video 🎯.

⚠️ Disclaimer

This is not financial advice. Trading involves risk and you should only trade with capital you can afford to lose. Please do your own analysis or consult a licensed financial advisor.

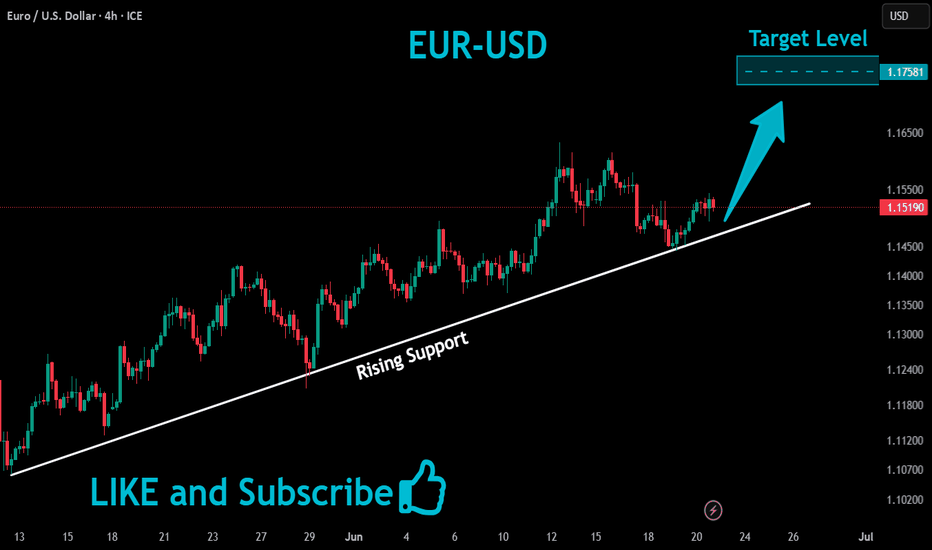

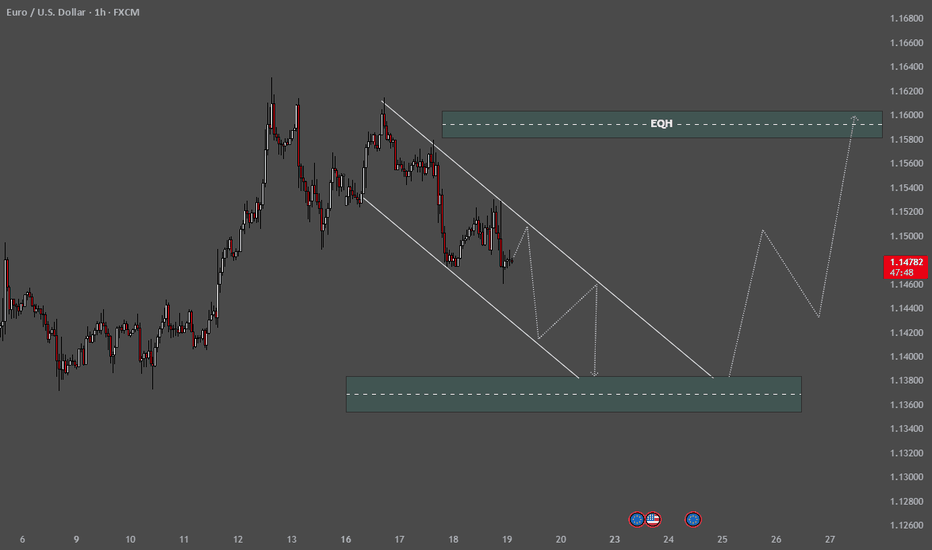

A bullish breakout from the descending channel is anticipated.Chart Breakdown

🔻 Price Action & Structure:

The market is currently trending downward within a descending channel, marked by two parallel white trendlines.

The current price is around 1.14797, with visible lower highs and lower lows, indicating a short-term bearish trend.

🔄 Projected Move:

A bullish breakout from the descending channel is anticipated.

The white projected path shows:

A dip toward the demand zone (highlighted in teal-green) around 1.13400–1.13800.

A reversal from that zone, forming higher highs and higher lows.

A move toward the upper liquidity zone, labeled EQH (Equal Highs) around 1.16000, suggesting a target for buy-side liquidity.

🧠

EQH = Equal High Liquidity

:

The EQH zone marks an area where previous highs are equal or nearly equal — a common target for price manipulation or stop-hunting.

It’s expected that the market will sweep this area for liquidity before possibly reversing or continuing.

💡 Interpretation:

The setup reflects a liquidity-based strategy using smart money concepts.

Bearish short-term → bullish medium-term outlook.

Potential trade idea: Wait for price to tap the lower demand zone, then look for entry confirmation (e.g., bullish engulfing or Ch0CH) to ride toward EQH.

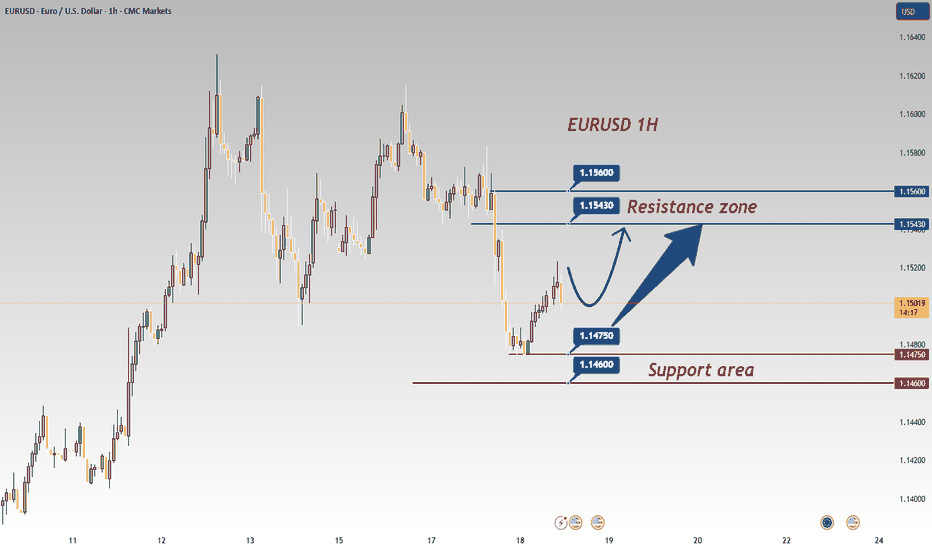

EURUSD is in a Downside DirectionHello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

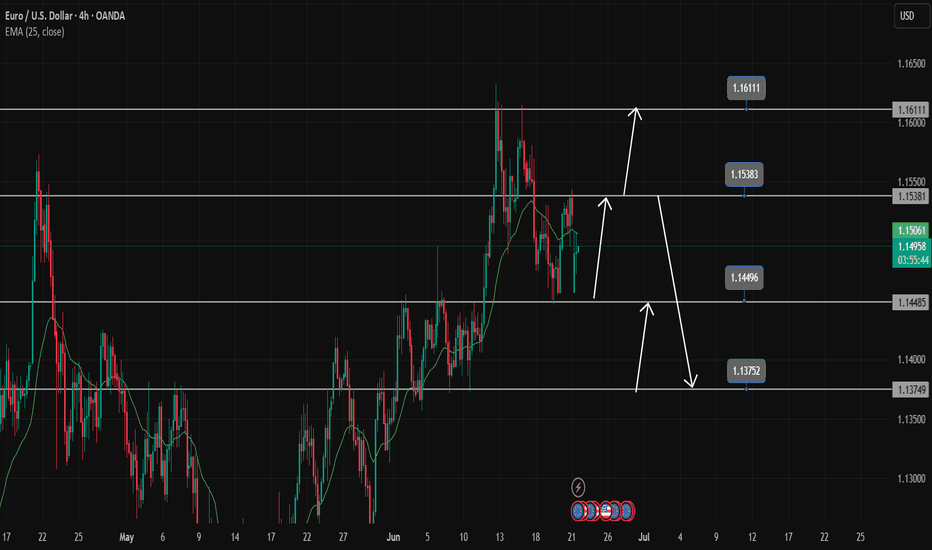

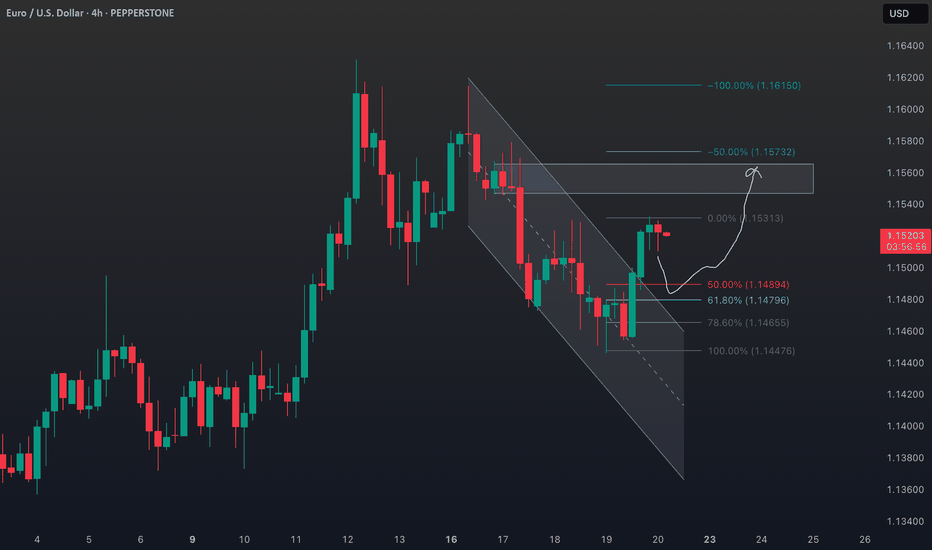

EURUSD Breaks Structure: Bullish Continuation Opportunity💶 EUR/USD Analysis – Bullish Momentum Builds 📈

Taking a look at the EUR/USD on the daily chart, it’s clear the pair is currently in a strong bullish trend 🚀. Momentum has been building consistently, reflecting underlying euro strength and continued USD weakness.

🕓 On the 4H timeframe, we’ve now seen a clear shift in market structure to the upside, confirming bullish intent. Look for a continuation entry after a retracement back into equilibrium — ideally around the 50% level of the current price swing 🔄📐.

🎯 Trade Plan Idea:

Wait for price to pull back into equilibrium 🌀

Entry: Long from the discounted zone 🟩

Stop loss: Just below the recent swing low 🔻

Target: Previous high as a logical take-profit zone 🎯📊

⚠️ Disclaimer:

This content is for educational and informational purposes only and should not be considered financial advice. Always do your own research and consult with a qualified financial advisor before making any trading decisions. 📚💼

Core Impact Logic of the Middle East Situation on EURUSD(I) Energy Transmission Chain: Oil Price Fluctuations → Eurozone Inflation and Economy

The escalation of the Middle East situation (the Iran - Israel conflict, risks in the Strait of Hormuz) directly impacts the global energy supply chain:

If the conflict expands to block the Strait of Hormuz (transports ~20% of global crude oil 🛢️), Brent crude has already soared from recent lows—spiking over 5% on June 17 amid tensions ⛽️. This pushes up imported inflation in the Eurozone.

As a net energy - importing region 🌍, prolonged high oil prices will squeeze corporate profits, suppress consumption, and drag Eurozone economic recovery (German/French manufacturing is acutely energy - cost - sensitive 🏭). This weakens the euro’s fundamental support.

(II) Geopolitical Safe - Haven Sentiment: The "Safe - Haven Balance" Between USD & EUR

Amid Middle East tensions, the US dollar’s traditional safe - haven status competes with Eurozone havens like German bonds 📈:

If the US (e.g., the Trump administration) intervenes militarily 💥, market fears of "America mired in war" rise. USD safe - haven demand may temporarily weaken ⬇️, and the euro benefits as funds shift 🔄

⚡️⚡️⚡️ EURUSD ⚡️⚡️⚡️

🚀 Buy@ 1.14500 - 1.15000

🚀 TP 1.15500 - 1.15600

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

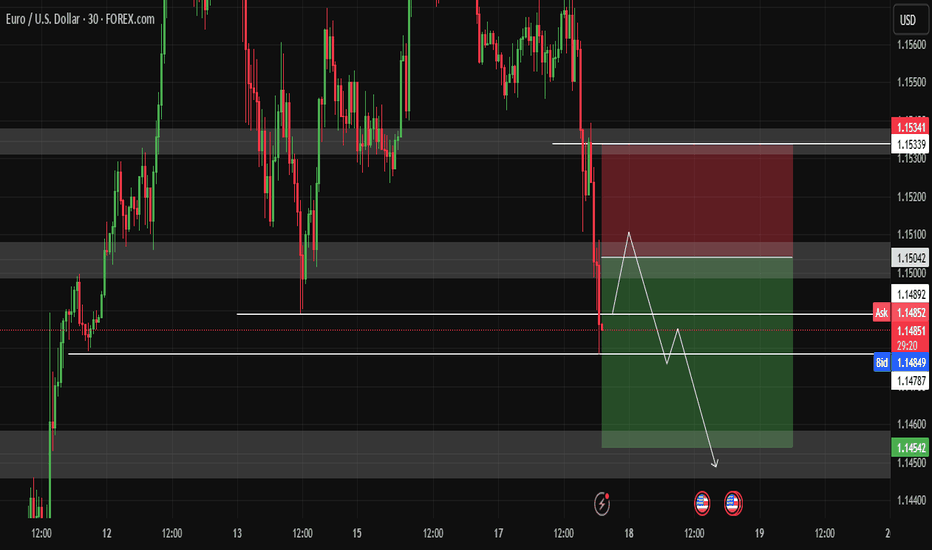

Market Analysis: EUR/USD Faces RejectionMarket Analysis: EUR/USD Faces Rejection

EUR/USD declined from the 1.1640 resistance and traded below 1.1550.

Important Takeaways for EUR/USD Analysis Today

- The Euro started a fresh decline after a strong surge above the 1.1600 zone.

- There is a connecting bearish trend line forming with resistance at 1.1545 on the hourly chart of EUR/USD at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair rallied above the 1.1600 resistance zone before the bears appeared, as discussed in the previous analysis. The Euro started a fresh decline and traded below the 1.1550 support zone against the US Dollar.

The pair declined below 1.1520 and tested the 1.1475 zone. A low was formed near 1.1475 and the pair started a consolidation phase. There was a minor recovery wave above the 1.1495 level.

The pair tested the 23.6% Fib retracement level of the downward move from the 1.1614 swing high to the 1.1475 low. EUR/USD is now trading below 1.1550 and the 50-hour simple moving average. On the upside, the pair is now facing resistance near the 1.1505 level.

The next key resistance is at 1.1545 and the 50% Fib retracement level of the downward move from the 1.1614 swing high to the 1.1475 low. There is also a connecting bearish trend line forming with resistance at 1.1545.

The main resistance is near the 1.1580 level. A clear move above the 1.1580 level could send the pair toward the 1.1615 resistance. An upside break above 1.1615 could set the pace for another increase. In the stated case, the pair might rise toward 1.1650.

If not, the pair might resume its decline. The first major support on the EUR/USD chart is near 1.1475. The next key support is at 1.1450. If there is a downside break below 1.1450, the pair could drop toward 1.1400. The next support is near 1.1350, below which the pair could start a major decline.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

#EURUSD: Nothing to expect from DXY| View Changed Swing Trading|Hey there! So, we were previously thinking EURUSD was going to be bearish, but things have turned around and it’s looking bullish for now.

The extreme bearish pressure on USD has caused all the major USD pairs to be in a range. As the week goes on and we get the NFP data, the market will probably focus more on these economic indicators. So, it’s not surprising to see some market ranges during this time.

We’ll keep a close eye on the market, as there might be some manipulation going on this week.

We recommend waiting until Monday’s daily candle closes to see if the bullish trend is strong enough. Then, based on the price momentum, you can make your decisions.

We hope you have a great week and safe trading! If you like our work and analysis, please consider liking, commenting, and sharing our content.

Cheers,

Team Setupsfx

❤️🚀

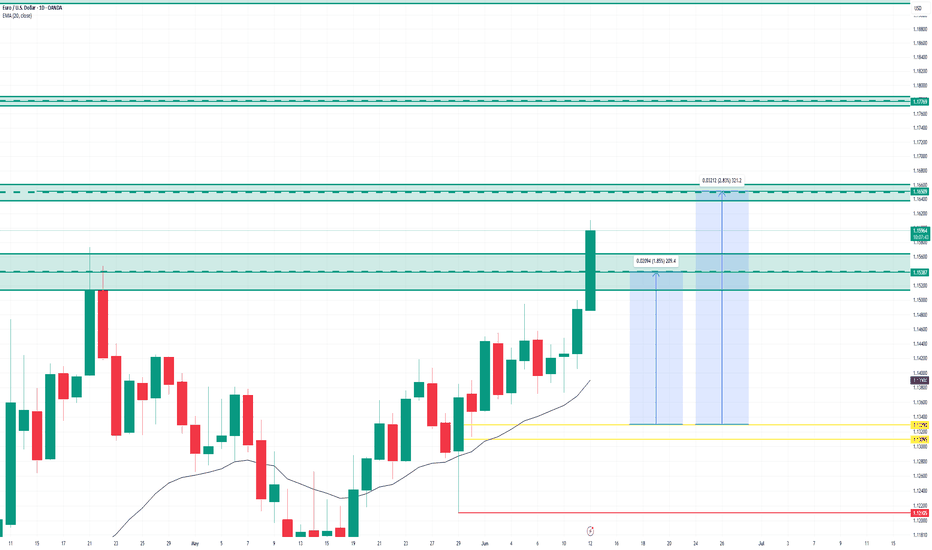

EURUSD(20250616) Today's AnalysisMarket news:

Trump: The United States may still intervene in the Iran-Israel conflict. If Iran launches an attack on the United States, the United States will "fight back with all its strength on an unprecedented scale." Iran and Israel should reach an agreement.

Technical analysis:

Today's buying and selling boundaries:

1.1550

Support and resistance levels:

1.1674

1.1628

1.1598

1.1502

1.1472

1.1426

Trading strategy:

If the price breaks through 1.1550, consider buying, and the first target price is 1.1598

If the price breaks through 1.1502, consider selling, and the first target price is 1.1472

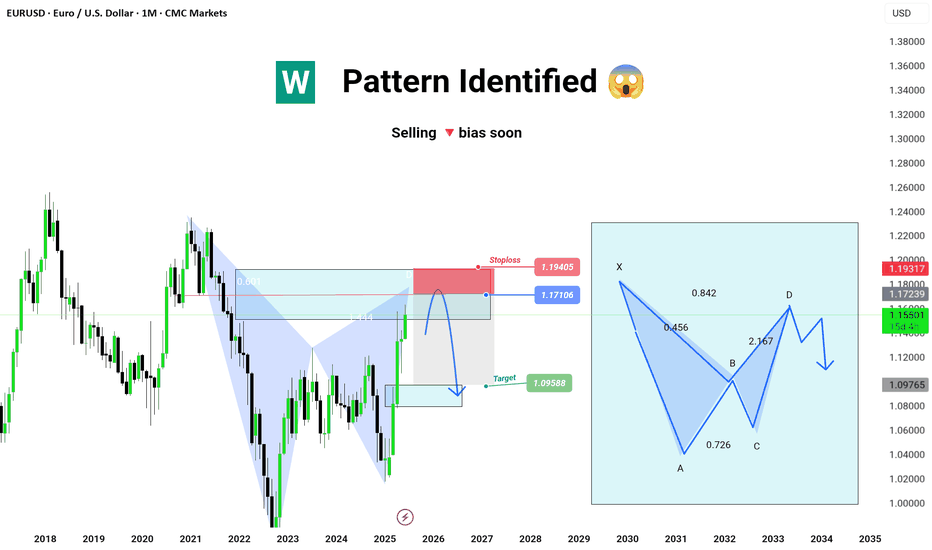

EURUSD ||| '' W '' PATTERN IDENTIFIED . ✅ Harmonic Formation (Bearish Potential)

⚠️ Selling Bias forming soon

---

🧩 Pattern Breakdown:

A Bearish Harmonic Pattern (likely Butterfly or Deep Crab) has been identified and is now nearing completion at the D point.

Current price is approaching key resistance / reversal zone, precisely around the 0.786 - 0.886 fib area (highlighted red).

The Risk-to-Reward is clearly mapped:

🔺 Stop Loss: 1.19405

✅ Entry Zone: Around 1.17106

🎯 Target: 1.09588

Potential short setup if price respects the harmonic symmetry and fails to break above resistance.

EURUSD is continuing its uptrendEURUSD is still in a strong uptrend. There was a drop in the Asian and European sessions on Friday but that was not enough to reverse the pair. The end of the US session saw the price being pushed up by the bulls from the 1.155 price zone and is stuck in this resistance zone.

The price continues to increase when breaking 1.155 will head towards the resistance of 1.161, the highest peak of last week. If there is a retest of 1.155, the price will head towards 1.166 next week to be able to use short-term SELL strategies

The BUY strategy is still prioritized as the EU is still in an uptrend. The main BUY zone of the pair is still waiting for 1.150 and lower is the breakout zone of 1.145

Resistance: 1.161, 1.166

Support: 1.150, 1.145

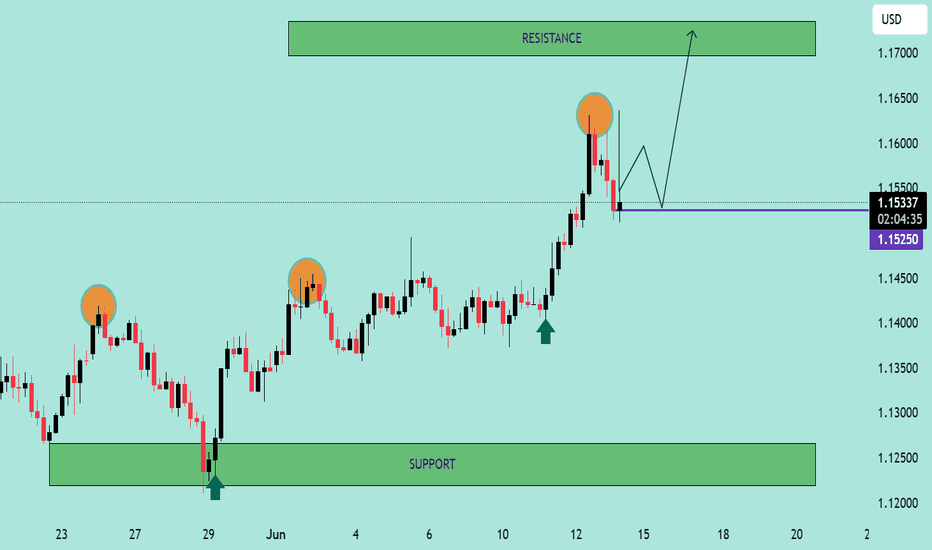

EUR/USD Breakout Retest StrategyEUR/USD Breakout Retest Strategy 🟢📈

📊 Technical Analysis Summary:

The chart illustrates a bullish breakout from a consolidation range with a well-defined support near 1.12500 and resistance between 1.16500–1.17000.

🔍 Key Observations:

🔸 Triple Rejection Zone:

Price faced rejection 3 times (highlighted with orange circles) near the same level before the breakout — classic liquidity sweep above resistance.

🔸 Strong Support Bounce:

Each time price reached the green support zone, it showed strong bullish reaction (green arrows) signaling solid buying interest.

🔸 Break and Retest Formation:

Price broke the previous highs and now seems to be retesting the breakout zone (around 1.15250–1.15300). A successful retest could confirm bullish continuation.

🔸 Projected Bullish Move:

If the retest holds, we may see price pushing up toward the 1.17000 resistance zone as marked.

📌 Trading Plan:

✅ Bullish Bias above 1.15250

✅ Look for bullish candlestick confirmation or breakout structure

🚫 Avoid trades if price drops below 1.15000 with momentum

📈 Target Zone: 1.16500 – 1.17000

🛑 Stop Loss suggestion: Below 1.14750

🧠 Keep patience during the retest — smart money often tests emotions before real moves! 💰📉📈

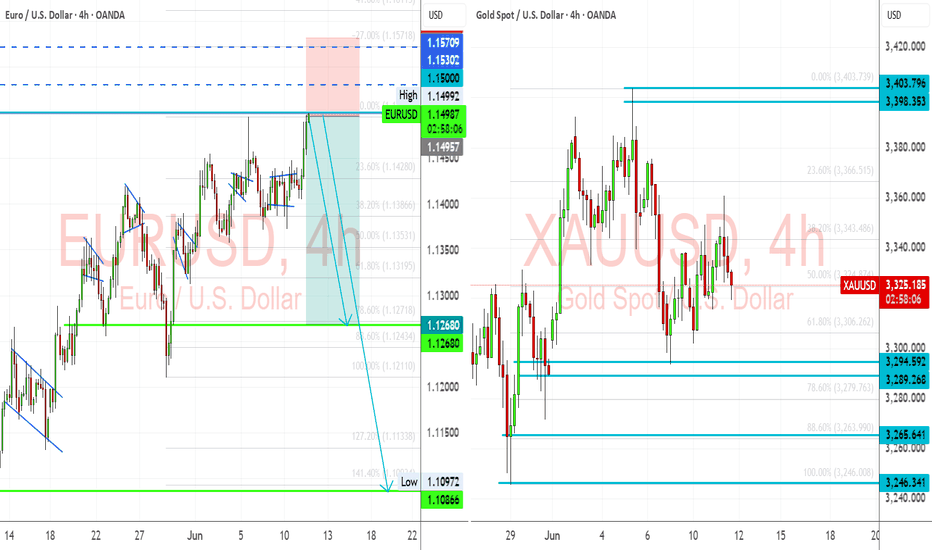

EURUSD Setup | CPI Fades, Fed Focus & Gold Leads Dollar ReboundEURUSD is showing signs of exhaustion after soft US CPI failed to extend the rally beyond 1.1495. While markets initially priced in a dovish Fed response, recent commentary and gold’s rejection from its highs suggest the dollar may be gearing up for a short-term recovery. With Gold pulling back and yields stabilizing, EURUSD could now follow suit lower into key support levels—especially if the Fed maintains a patient tone at this week’s meeting.

🔹 EURUSD (4H) Analysis

📉 Bias: Bearish

💡 Context:

EURUSD stalled just below 1.1500 after the CPI miss and now sits at a high-liquidity reversal zone. With DXY stabilizing and gold already rolling over, EURUSD may lag behind but eventually follow the same path. If the Fed leans hawkish or even neutral (ignoring political pressure), it could catalyze a drop toward 1.1268 and below.

📊 Technical Levels:

Resistance Zone: 1.1495–1.1530

Target 1: 1.1268

Target 2: 1.1086

Invalidation: Daily close above 1.1530 (or strong bullish follow-through after FOMC)

🪙 Leading Asset Clue:

Gold has already rejected major resistance (3,390–3,403) and is now pulling lower. Historically, EURUSD tends to follow when metals stall—especially if driven by real yields and Fed dynamics.

⚠️ Fundamentals to Watch:

🏦 FOMC Rate Decision & Dot Plot (June 12)

📈 US PPI + Jobless Claims (June 13)

💬 Fed Chair Powell's Press Conference

📰 Any shift in ECB or Fed rate cut timelines

🧠 Risk Factors:

Fed surprise dovish shift due to CPI softness

Market overreacts to rate cut expectations

Geopolitical risk-off flows favoring EUR

✅ Summary: Bias and Watchpoints

EURUSD

Bearish

Fed holding firm vs. ECB easing bias

Fed turning dovish post-CPI (Top Risk)

FOMC Rate Decision, PPI, Powell

📌 Final Note:

Gold is leading the turn as dollar strength resurfaces. EURUSD may lag initially but the macro context favors downside from this key resistance zone. Watch the Fed for confirmation—positioning into 1.1268 and 1.1086 looks attractive if the dollar gains traction post-FOMC.

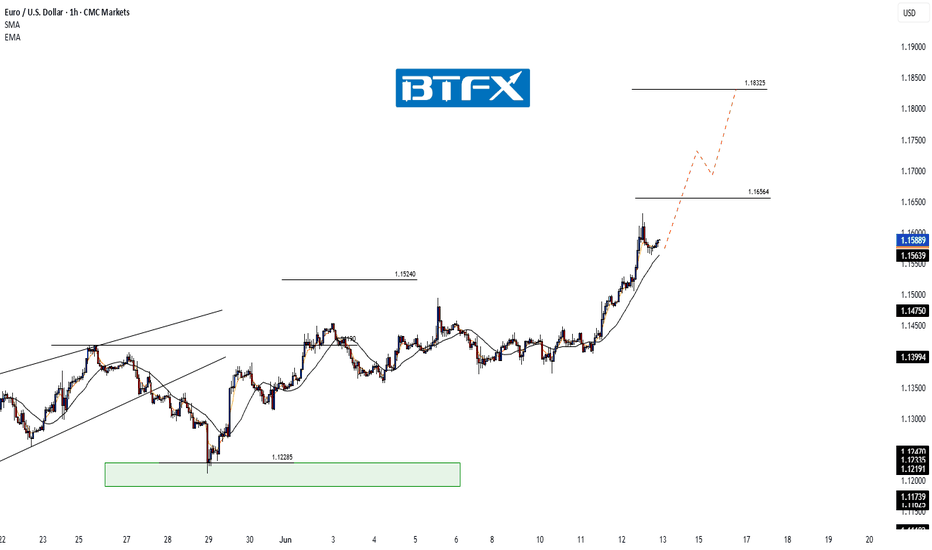

EUR/USD Rally Extends – Eyes on 1.20000 as Momentum BuildsHi Everyone,

As outlined in our analysis last week (idea linked below), EUR/USD continued to the upside and reached the 1.15240 level.

We expect price action to extend further toward the 1.16564 level, which would reinforce our long-term bullish outlook.

A confirmed break above this resistance would likely open the door for a move toward 1.18325, where we anticipate encountering dynamic resistance.

We will provide further updates on the projected path for EUR/USD should price reach this level.

The longer-term outlook remains bullish, with expectations for the rally to extend toward the 1.2000 level, provided the price holds above the key support at 1.10649.

We will continue to update you throughout the week with how we’re managing our active ideas and positions. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for a good end to the week. Trade safe.

BluetonaFX

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.