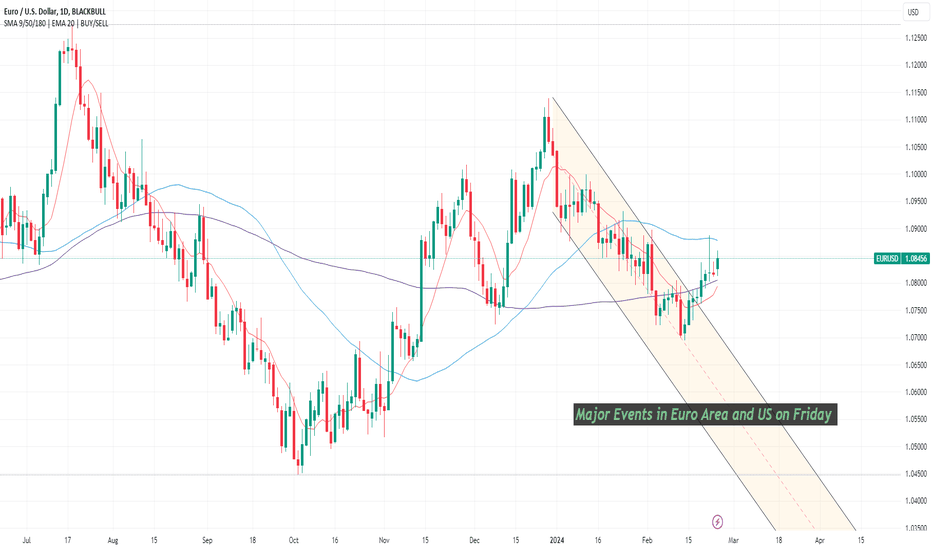

Major Events in Euro Area and US on Friday Major Events in Euro Area and US on Friday

Friday is a significant day with Euro Area Consumer Price Index (CPI) and US Personal Consumption Expenditures (PCE) data on the radar.

Euro Area inflation likely eased to 2.5% in February, and the official report is expected on Friday after a rush of local economic data from the Euro Area. The European Central Bank (ECB) is grappling with the challenge of bringing core inflation down from 3% to 2%.

While the market previously anticipated rate cuts to begin in April, the ECB, emphasizing data reliance, has prompted market adjustments, pushing the expected first rate cut to June.

In the US, the focus this week is on the PCE data. The day before, we do get Q4 GDP second estimate. But unless it is adjusted significantly, this will likely not have an impact.

Anticipating comparable rate cut trajectories in both economies, the dollar could potentially make up recent losses against the euro, particularly if January's PCE data exceeds estimates, thanks to its superior interest rate differential.

Thursday witnessed a surge that touched the 50-day simple moving average (SMA) before a subsequent retreat. Looking at the short term, technical indicators on the 4-hour chart hint at a potential upward bias. EUR/USD is presently trading above all its moving averages, and the 20 SMA appears poised to surpass the mildly bearish 200 SMA.

Eurusdtrade

Long EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles.

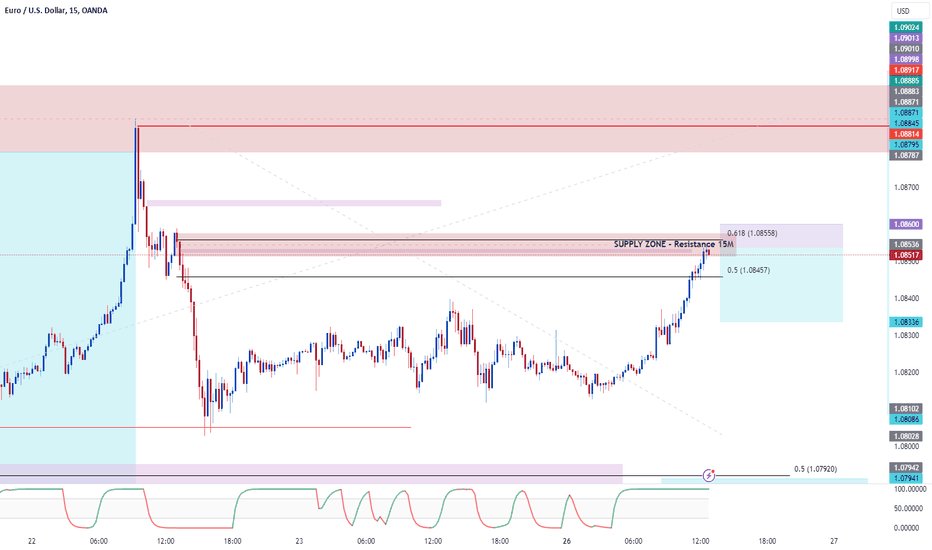

The Euro's recent move higher against the US dollar has stalled today with further progress being kept in check by the 200-day simple moving average. While this technical indicator was broken yesterday, the pair closed below the longer-dated moving average. A confirmed break higher – a close and open above the 200-dsma – would see the 50-dsma and a cluster of recent highs on either side of 1.0900 come into focus. Support is seen at 1.0787 down to 1.0760

Confirm long

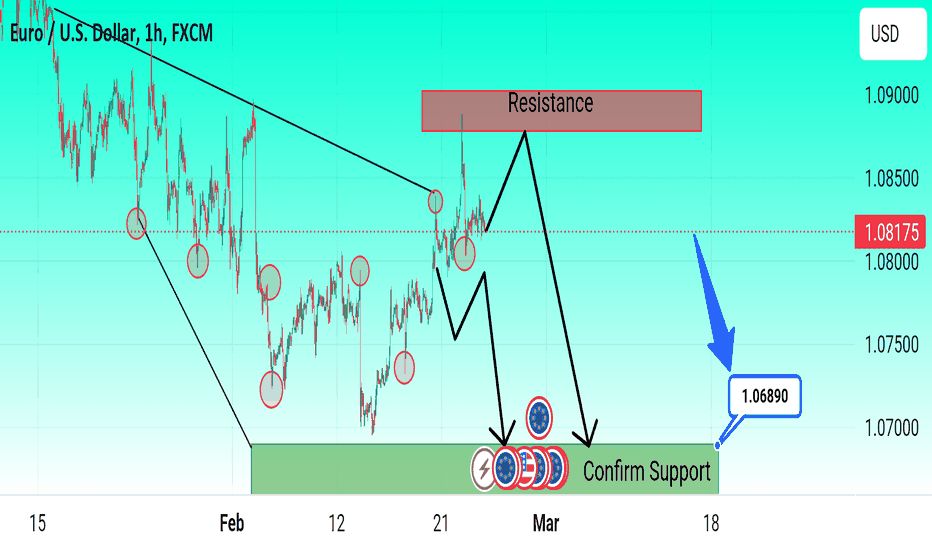

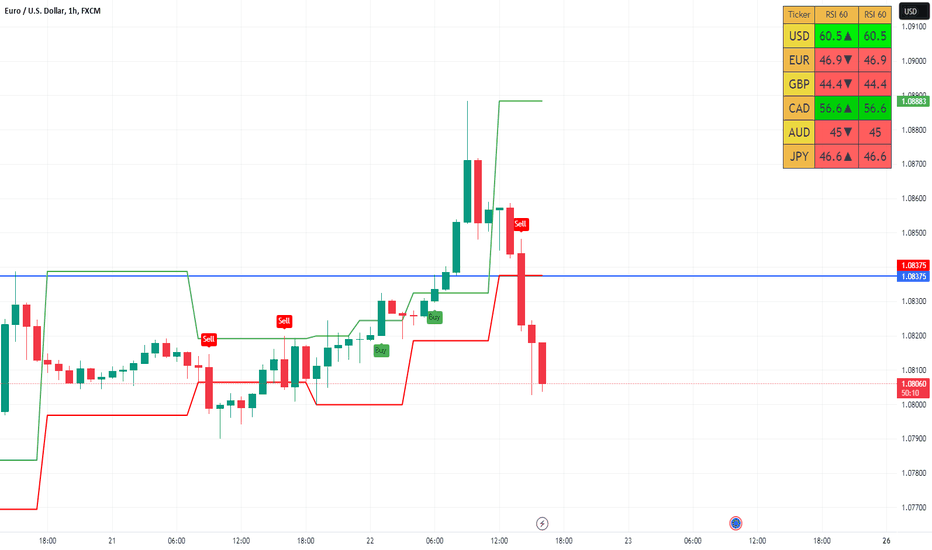

EURUSD - Sell scenario ✅Hello traders!

‼️ This is my perspective on EURUSD.

Technical analysis: Here we have the same scenario as on GOLD, we are in a bearish market structure from 4H timeframe perspective, so I am looking for short. I expect bearish price action from here as price filled the imbalance and rejected from bearish order block.

Like, comment and subscribe to be in touch with my content!

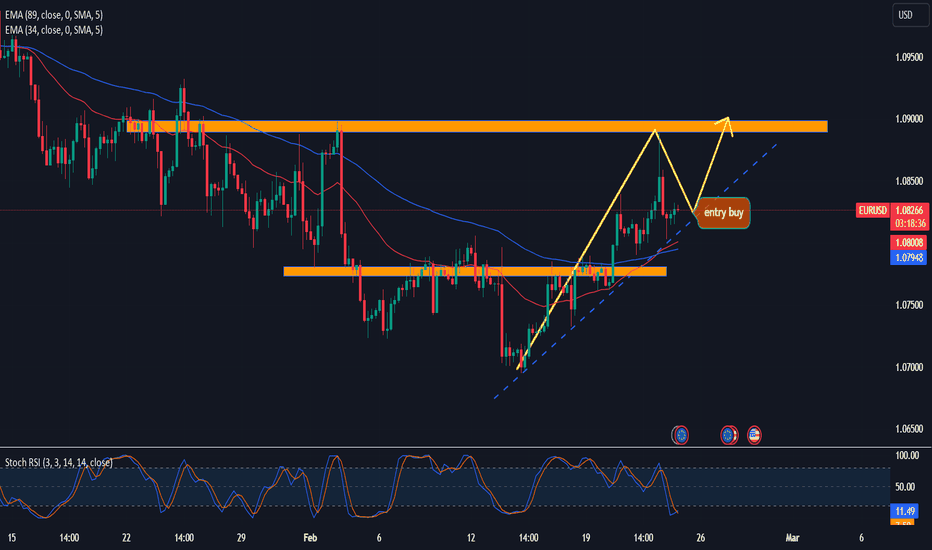

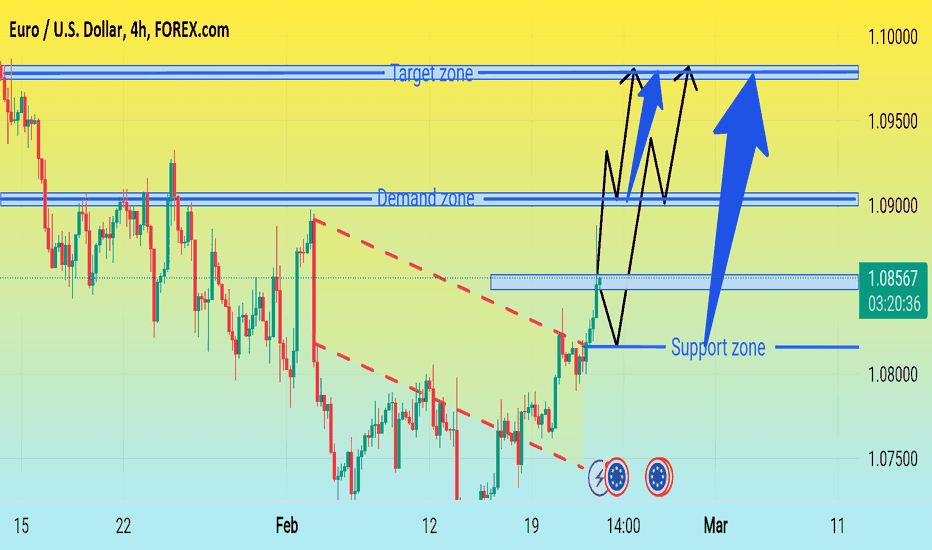

EUR/USD Longs from 1.07800 back up to 2hr supply or above.This week's bias for EU resembles GU's, but I wouldn't be surprised if EU rises slightly to clear the 2-hour refined supply before dropping to remove the trendline liquidity below. Nevertheless, I anticipate price to eliminate the trendline liquidity and fill the small imbalance just above the demand zone.

During this process, I expect price action to slow down after consuming a significant amount of liquidity, signalling a potential Wyckoff accumulation phase. It's worth noting the presence of an Asian low beneath the demand, which warrants caution. However, I want to emphasize that this is a counter-trend notion, and my overall sentiment for EU remains bearish.

Confluences for EU Buys are as follows:

- Price broke structure to the upside and left a clean 10hr demand zone.

- Still some imbalance that still hasn't been filled as well above my demand POI.

- Market also broke major structure to the upside could indicate a bullish trend.

- there's some liquidity above the recent high that needs to be taken as well.

- Triple touch trendline liquidity that needs to be swept.

- for price to go down it must mitigate a supply higher up like that 12hr.

P.S. Ideally, I'm looking for another rally to trigger price action to clear out the significant pool of liquidity located just below the 12-hour demand zone at the top of the chart. However, I anticipate price to establish a new supply once it descends to take out the trendline. This would allow me to wait for a mid-week pullback to sell down towards the demand.

Have a great trading week and lets catch these PIPS!

EURUSD down EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles.

EUR/USD continues to trade in a tight channel above 1.0800 in the second half of the day on Friday, as the improving risk mood makes if difficult for the USD to gather strength. The pair remains on track to snap a five-week losing streak.

Confirm Chart

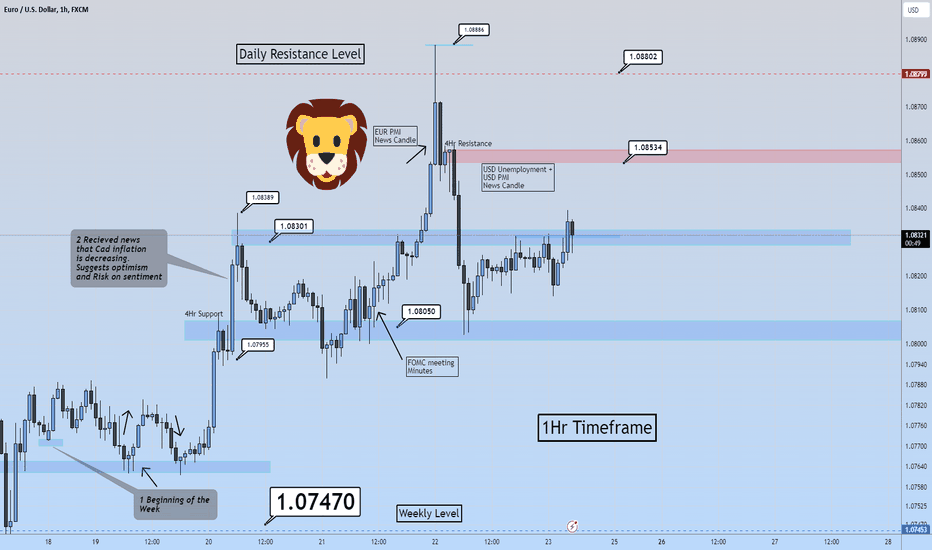

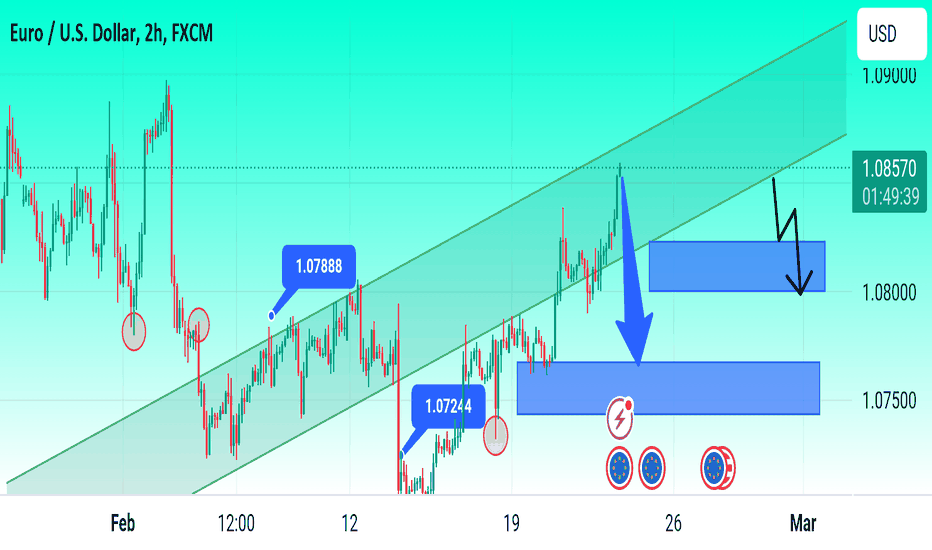

Eur/Usd Friday Today we can observe the end of the week. Price action was uncertain this during London session. At NY open 1hr candle we recieved a candle closure above the consolidation from London session. This suggests a breakout to the upside as we mirror clean traffic candles to the left and head towards 1.08534.

If not, then it is friday and the weekly candle may pull back down into the range to end the week. At that we would be heading back towards 1.0805 with the next 4hr candle.

EURUSD: The USD fell before the PMI data, the Euro and British PThe greenback edged decrease in early European alternate on Thursday, with hazard sentiment buoyed through Nvidia`s sturdy income, at the same time as investors awaited the discharge of enterprise interest surveys. critical for locating clues approximately the fitness of the worldwide economy.

At 04:10 ET (09:10 GMT), the Dollar Index, which tracks the dollar towards a basket of six different currencies, changed into buying and selling 0.4% decrease at 103.472, down almost 1% yr to date. this factor this week.

Strong income from AI favourite Nvidia (NASDAQ:NVDA) boosted international confidence, ensuing withinside the safe-haven greenback taking a hit, favoring greater cyclical currencies .

The dollar hit a excessive this week, however stays greater than 2% better for the yr, as investors eased competitive bets on a sequence of hobby charge cuts through the Federal Reserve this yr.

Minutes of the Fed's overdue January meeting, launched on Wednesday, confirmed that the financial institution is in no hurry to lessen hobby quotes withinside the close to future. Speeches through numerous Fed officers this week additionally reiterated this hawkish stance, with policymakers bringing up worries approximately difficult inflation.

Attention now turns to the discharge of PMI statistics, weekly unemployment statistics and, greater importantly, production and offerings PMI statistics for February, to gauge the economy's underlying strength.

“Our evaluation and statistics shows the greenback will retain to reinforce over the following couple of weeks - we've a sturdy January center PCE launch on February 29 - after which will reduced in March because of a softer payroll document and softer February CPI numbers.” ,” analysts at ING stated in a note.

Euro location offerings PMI impressed

In Europe, EUR/USD rose 0.5% to 1.0869, with the euro supported through a greater tremendous funding climate.

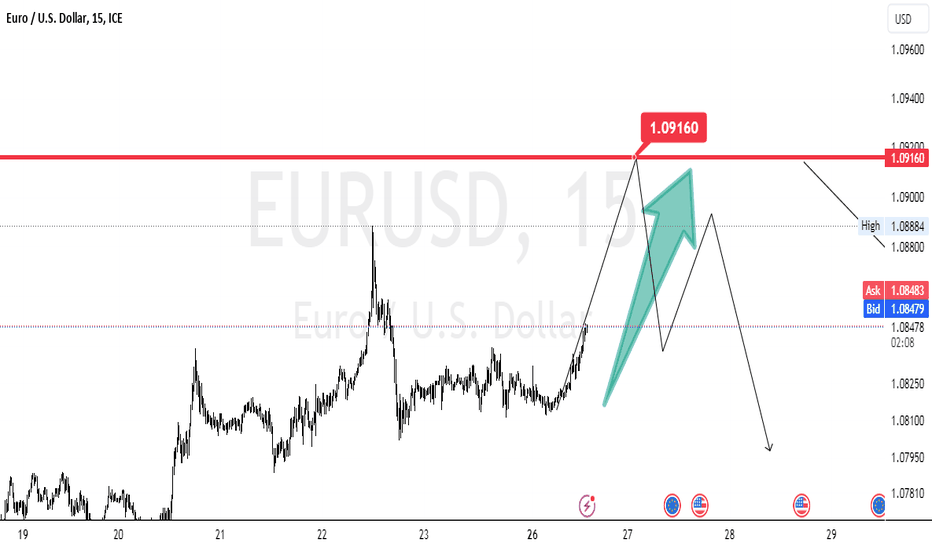

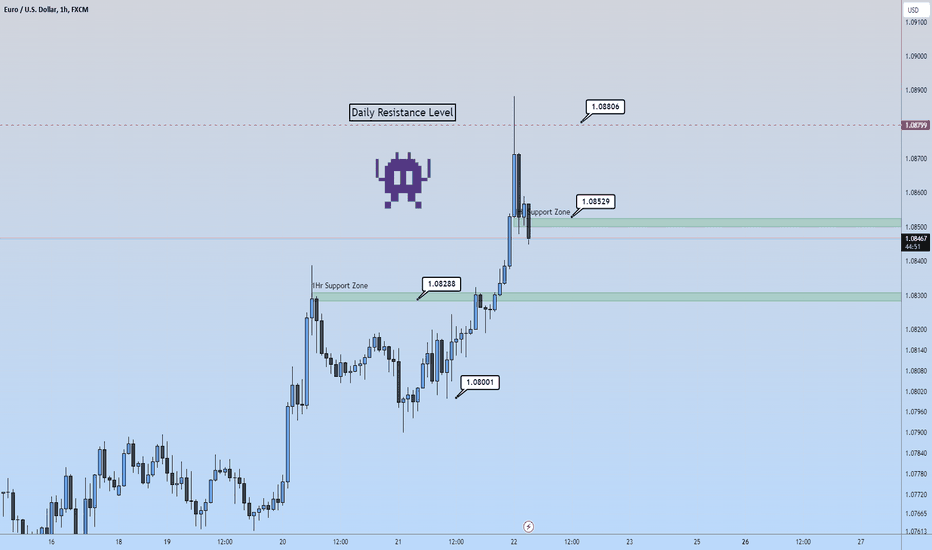

Manufacturing Data turns Manic 👹Welcome back traders to another Top-Down Analysis for Eur/Usd.

We can observe an increase on EU that began on Tuesday of this week. As the week has progressed we have slowly climbed up to the next Daily Level 1.088. Better than expected numbers for EURO manufacturing data has provided a nice boost of bullish momenutm and continuation for the Eurusd to the upside. However, we've now filled the clean traffic range on the 1hr/4hr timeframes that extended from 1.080. In the coming session I am anticipating a selloff away from the Daily level 1.088. We may retest the high that we've created at 1.087 but things are looking a bit manic. Either way we must remain flexible with our bias when executing Intra-day.

EURUSD ready analysis (Read The Caption)Eurusd is in up trend we are monitoring buy Eurusd

Eurusd will restrest again then it will fly

Eurusd price trend to continue fly during session

It is expected that price will continue in the buy trend

If this post is useful to you you can support me with like

boost and advice in comments

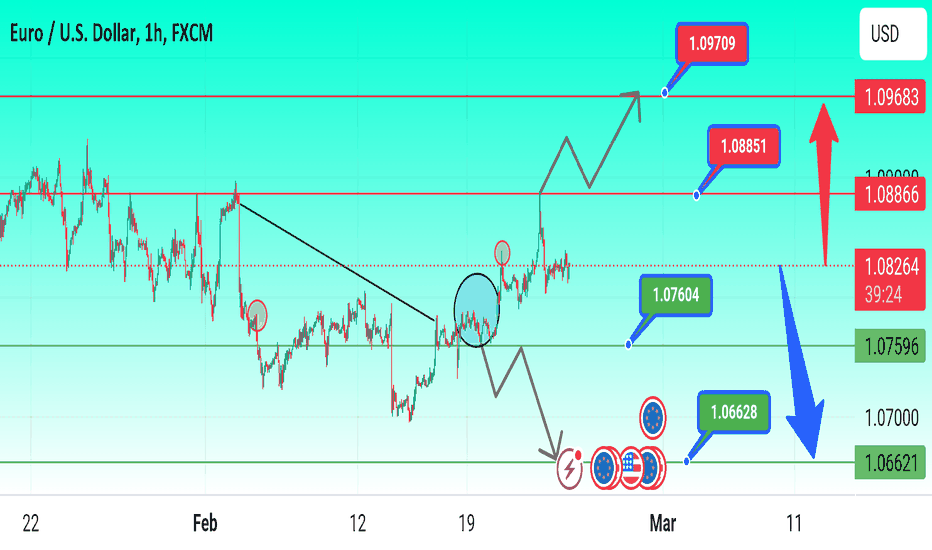

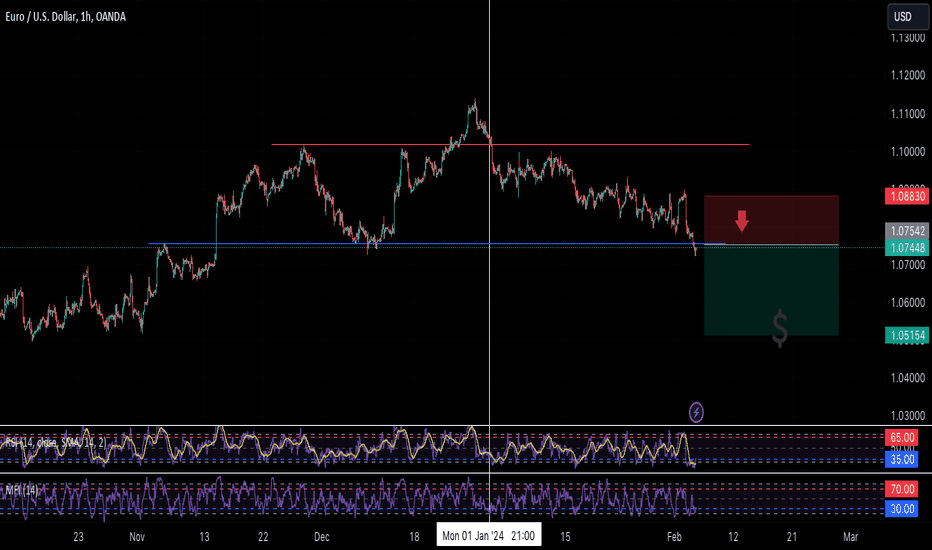

Short EURUSDI'll be looking to see the EURUSD go lower this month. The DXY has been steadily gaining since the beginning of the year, and it seems like that continuation is likely to keep at it. I'll be entering a short position and looking to take profit at the lows of Nov 1st of last year (1.05197). Let me know your thoughts on this pair, if you share a similar analysis or something different I'm open to see all sides. Good luck traders!

EUR USD sell confirm EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles.

According to the Bank for International Settlement (BIS), which compiles statistics in cooperation with world central banks to inform analysis of global liquidity, among other things, the US Dollar and the Euro are the two most traded currencies in the world. And EUR/USD is the most traded pair. It is important to note that the BIS is a good resource to gauge the size of the $6.6 trillion global interbank market, but that non-institutional, or retail and/or individual investors, do not engage in trading directly in the interbank market. Instead retail investors engage in trading with a Registered Foreign Exchange Dealer, which acts as a counterparty to all of its customers’ trades.

EUR/USD stretches higher above 1.0850 ahead of Eurozone PMI data

EUR/USD is continuing its upswing above 1.0850 in European trading on Thursday. A broadly subdued US Dollar and US Treasury bond yields, amid a risk-on mood, are helping the pair ahead of the top-tier preliminary PMI data from the Eurozone and the US.

EUR USD sell

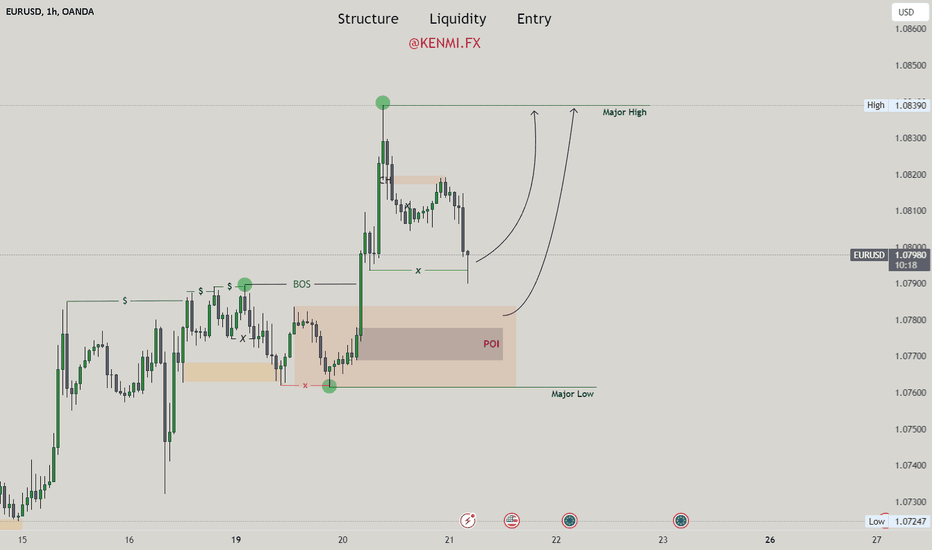

EUR/USD 1H BUY SETUP @KENMIHello traders,today we are analyzing OANDA:EURUSD on 1H TF.

As we can see the market structure is Bullish,market creating HH-s and HL-s

Where we can buy?

1.We can buy after market take out X,with SCOB confirmation...

2.We can buy on Extreme OF or OB,OF have much more probabillity than OB...Wait for LTF confirmation and than buy.

Best regards for entire community,be disciplined and wait

EURUSD could move closer to the 1.0900 markThe FX:EURUSD could move closer to the 1.0900 mark over the course of the week.

EUR/USD saw biggest gain on Tuesday in almost one month (+0.3%).

Nothing in the European or US data suggests a directional shift is imminent or justified.

Technically, EUR/USD is attempting cross above 200-DMA (1.0827). If it overcomes this hurdle, the bounce could extend towards the high achieved so far in February near 1.0900/1.0915.

Right now, there is firm support in the 1.0760/1.0770 zone.

The nearest resistance is at 1.0840/1.0850.

Guys, what do you think? Leave a comment with your thoughts.