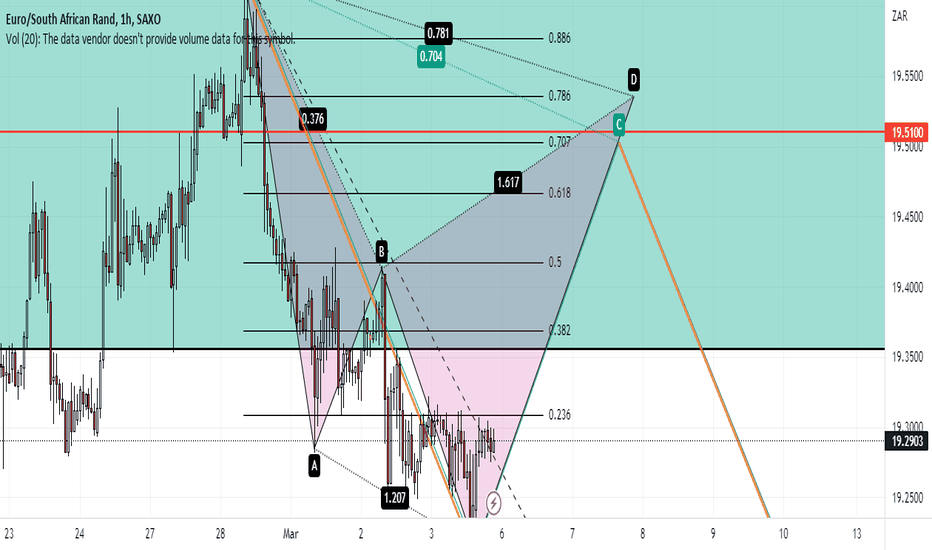

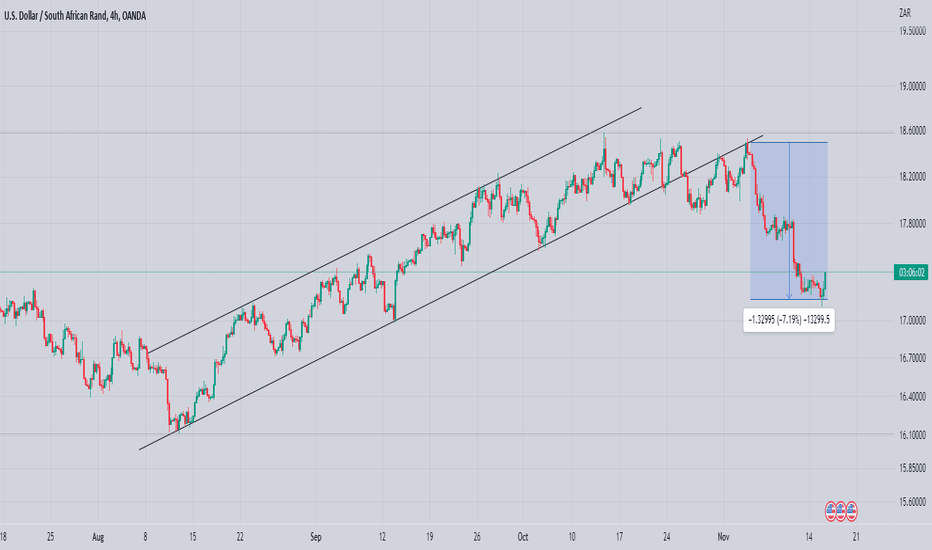

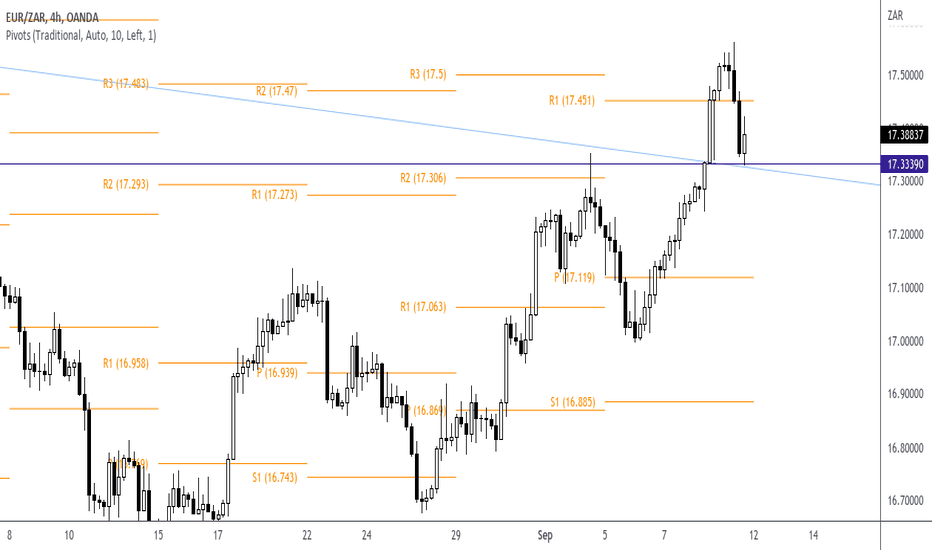

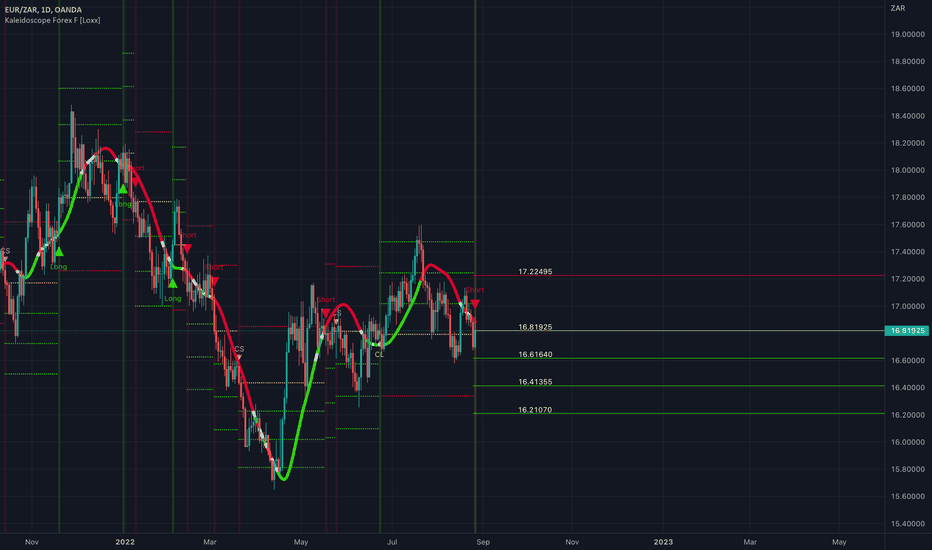

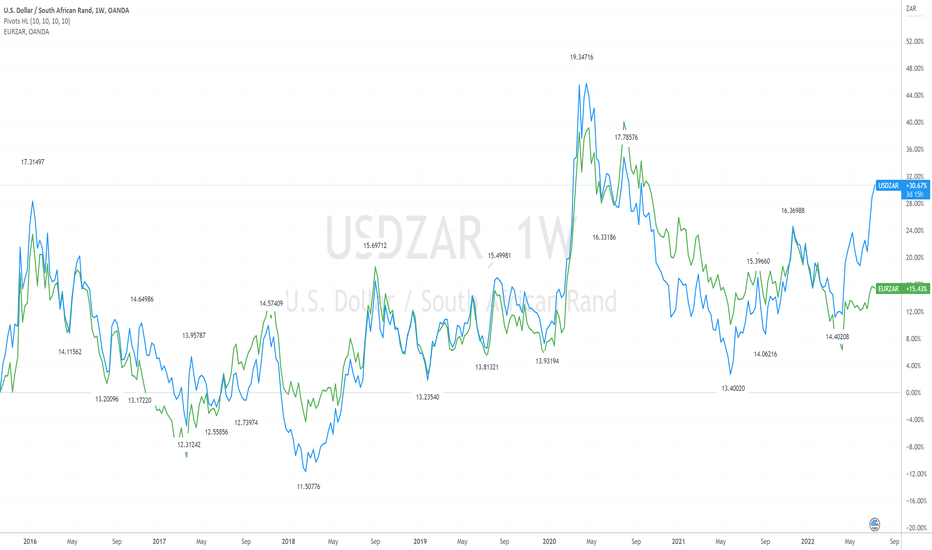

EURZAR H1 Bearish Cypher EURZAR is currently in a Weekly order block. We have vector candles showing a decisive three pushes to the current low. RSi and TDI should read lows and Shark Fins in this region. Look for a Head and shoulder pattern to enter long toward the 70.7Fib retracement of the XC leg. Usually pattern failure may occur around the Fib level around the 19.5100 level. If failure occurs then we look to go short at this region until an ABCD pattern is formed as shown. If price manages to breakthrough to complete the cypher pattern then we are looking at minimum two pins to this region before we enter short. M15 may show significant divergence and a close ofprice below EMA 13 would signal a good entry.

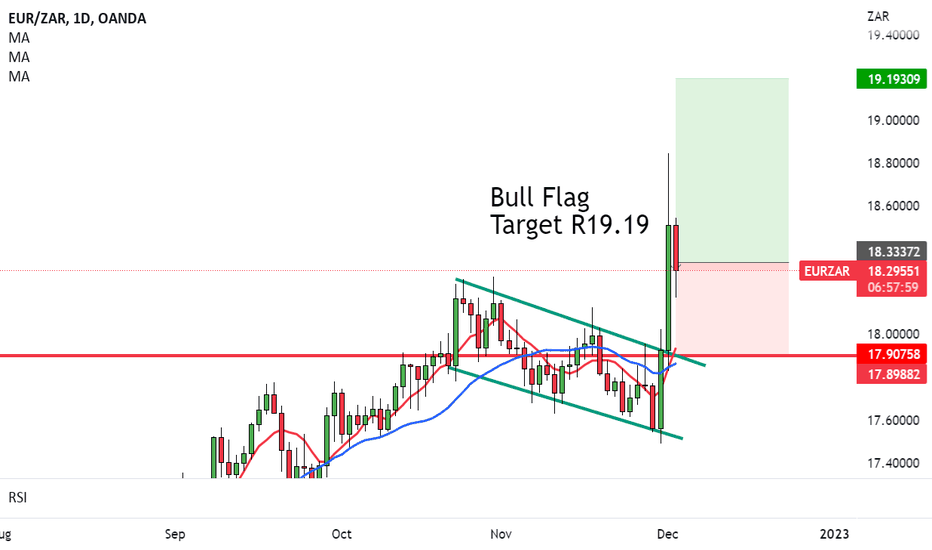

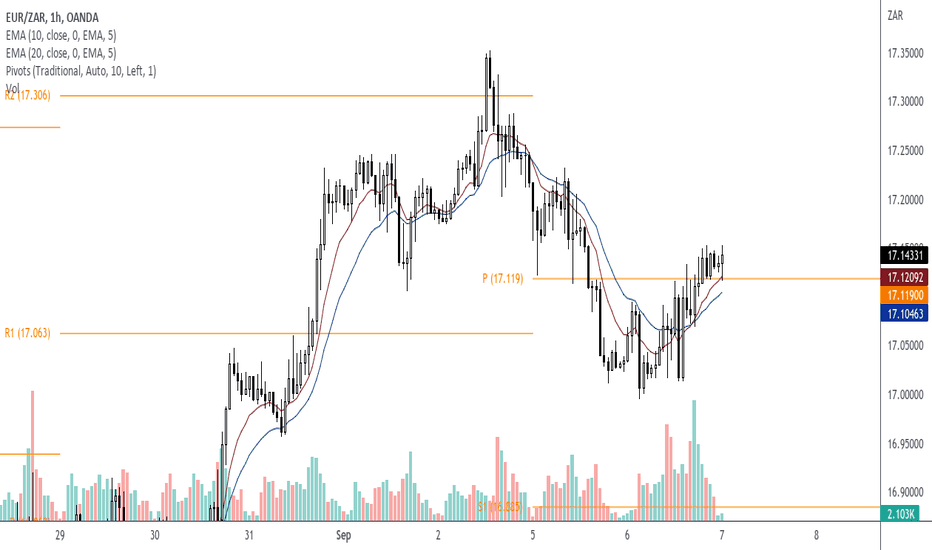

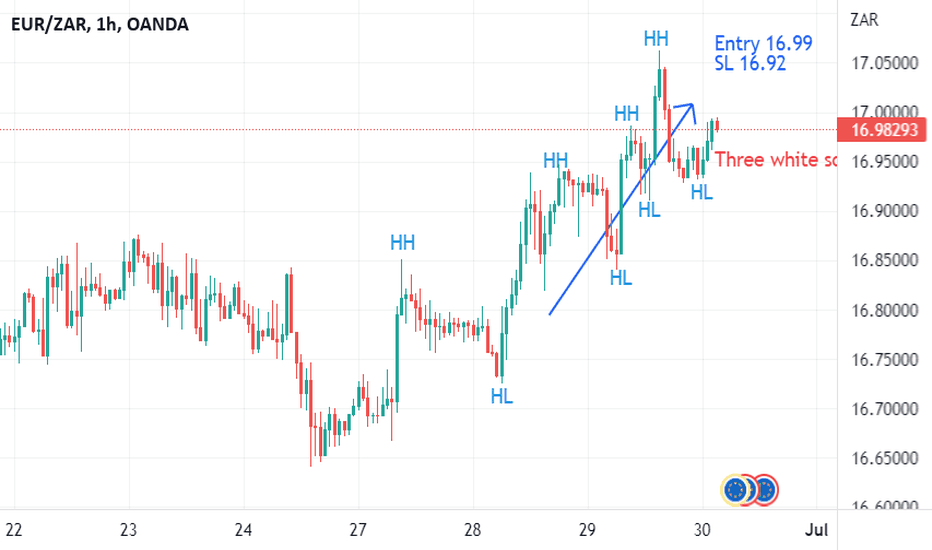

Eurzar!

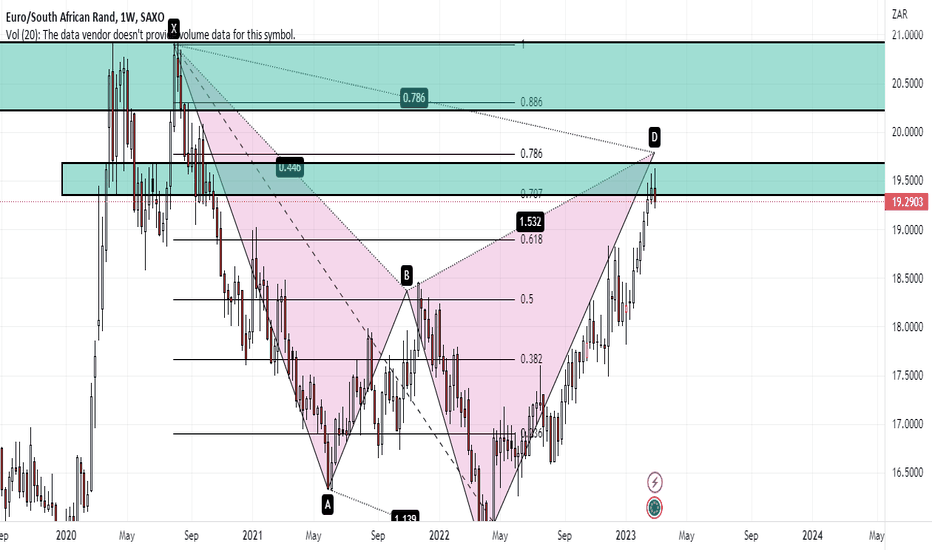

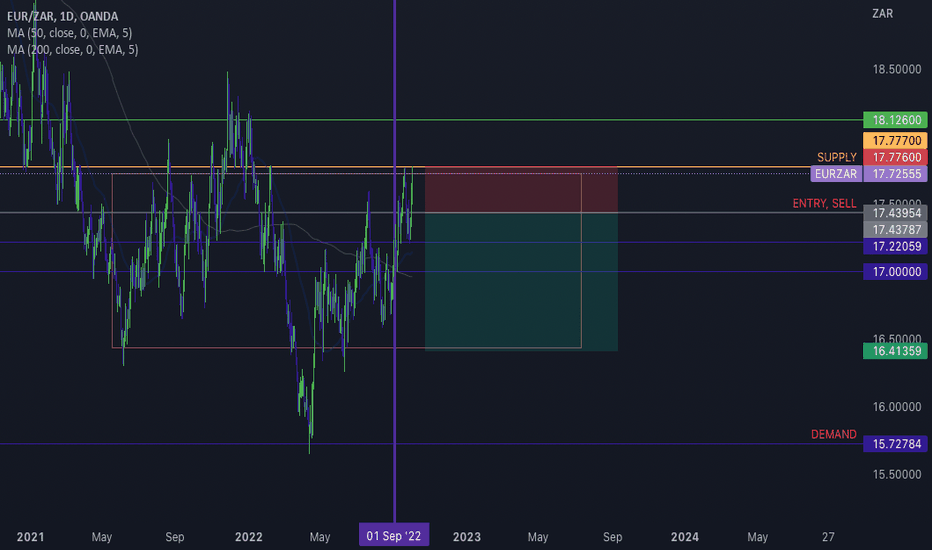

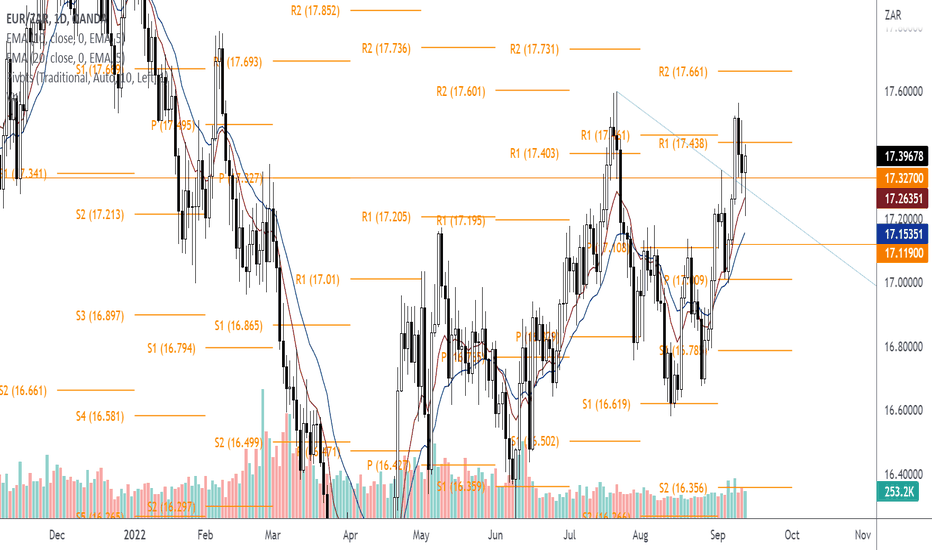

EURZAR Bearish CypherA bearish Cypher on the Weekly timeframe is near completion. Price is currently within a Weekly order block and we will most likely see a lot of trapping behavior in this region. This area is arrived at after a very long bullish trend and so as a result we will most likely find a build-up of both institutional volume as well as day-trader volumes. On the daily time frame, the final bearish trend will only be signaled by a noticeable pattern such as a double top, head, and shoulder pattern with significant confirmations around the AoI- Area of Interest. Please note this is a long-term projection and positions for holding long can only be held after the Daily time frame shows the noticeable pattern.

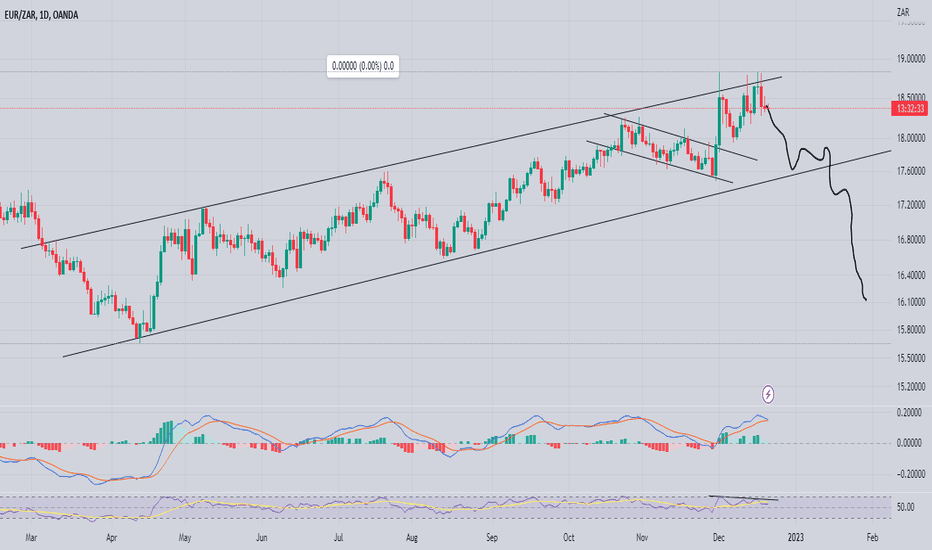

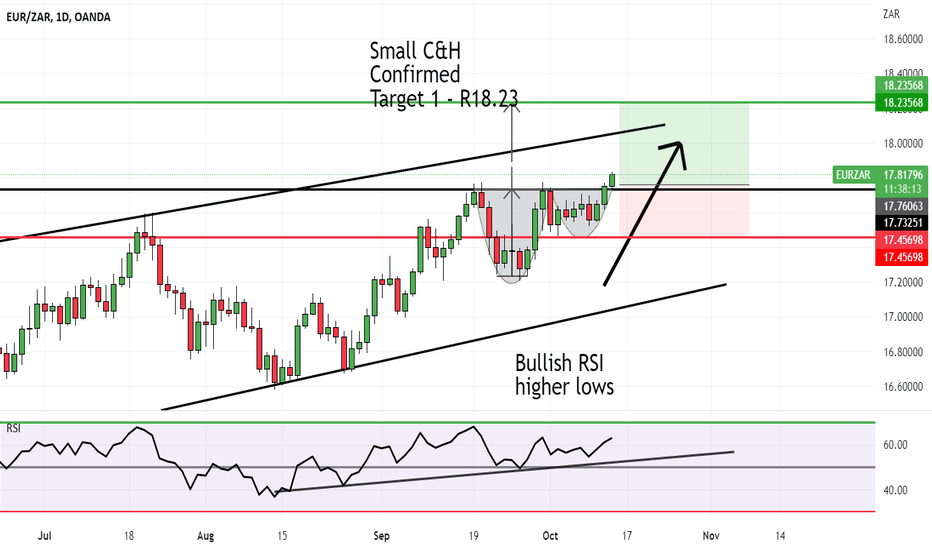

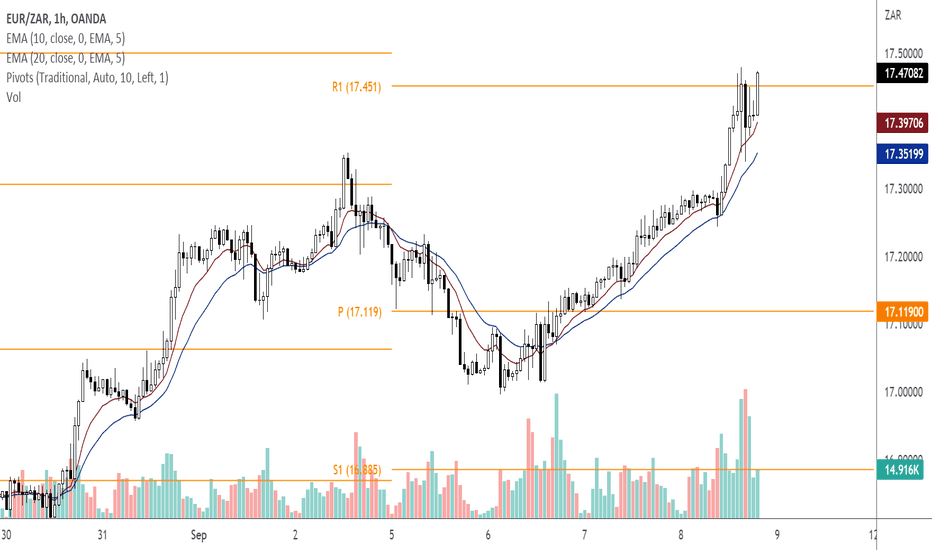

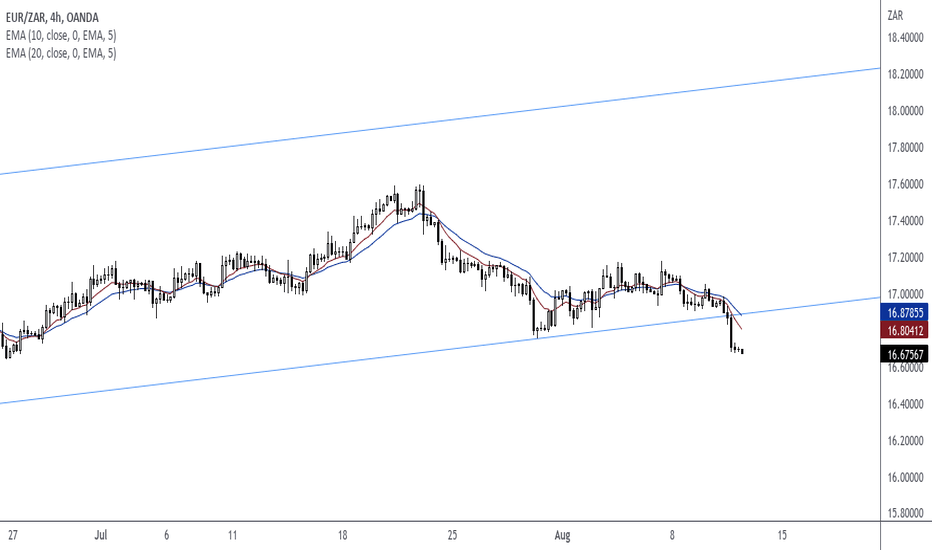

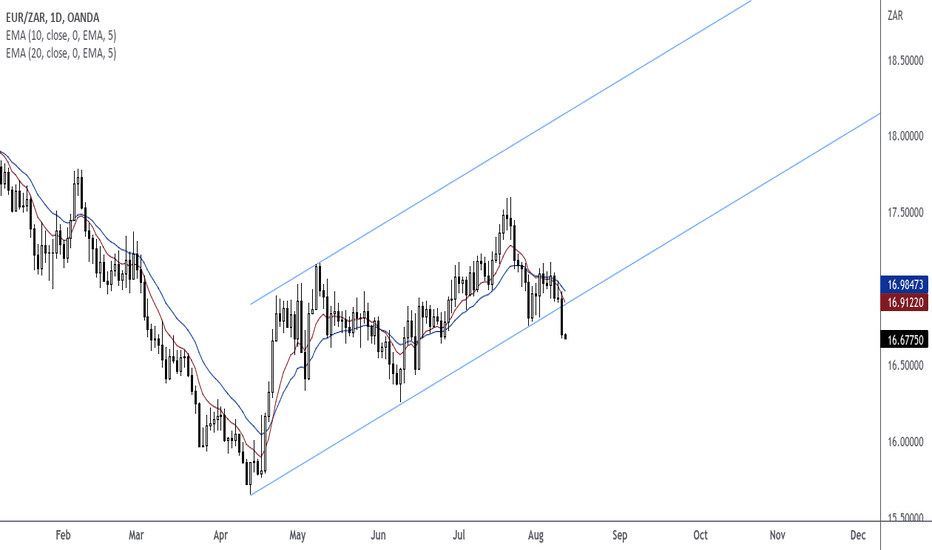

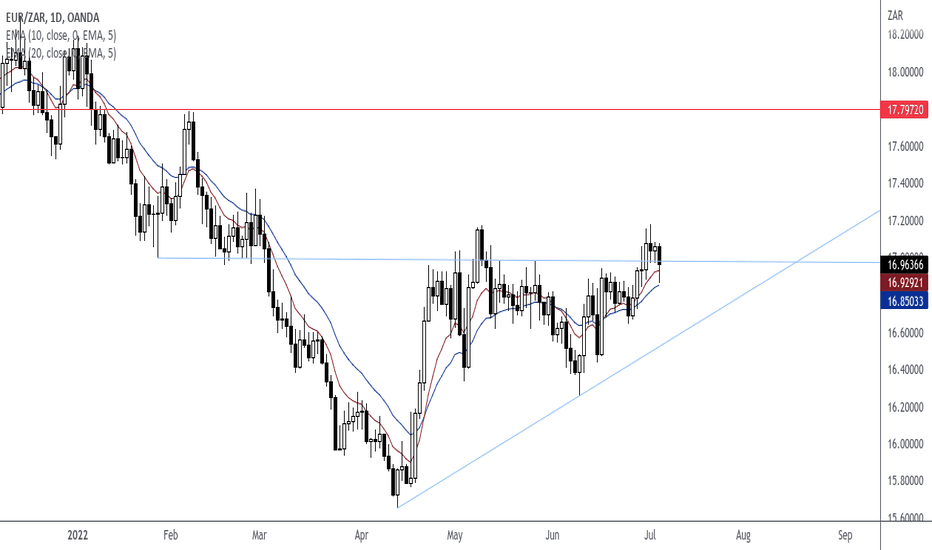

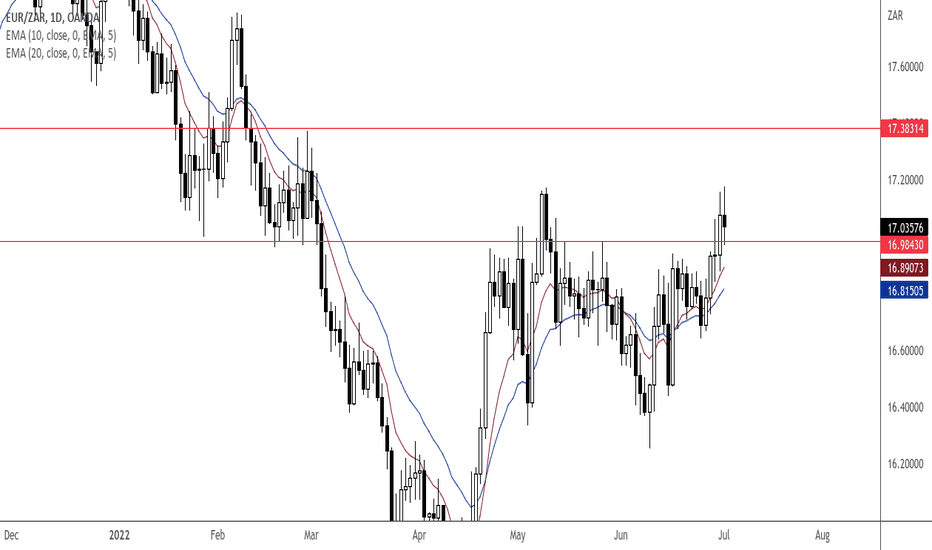

EUR/ZAR Upside to come to R18.23EUR/ZAR is showing classic textbook analysis of a Cup and Handle.

It's broken out of the brim level and is showing strong demand (buying) to come.

The first target is to around R18.23.

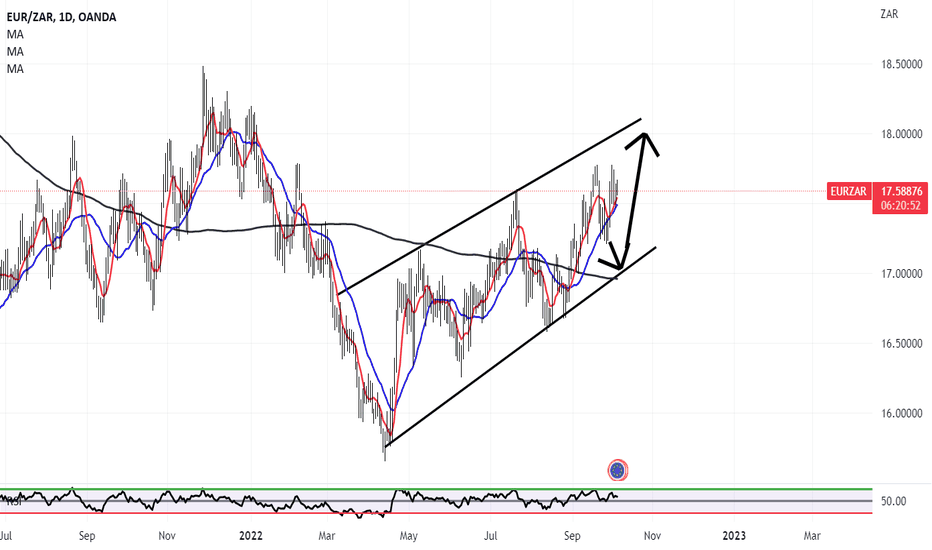

CONCERNS: There is a rising channel which the diagonal line is a strong support.

If the price breaks up and out of this channel, we can expect major downside to come for the rand.

BULLISH for the EUR.