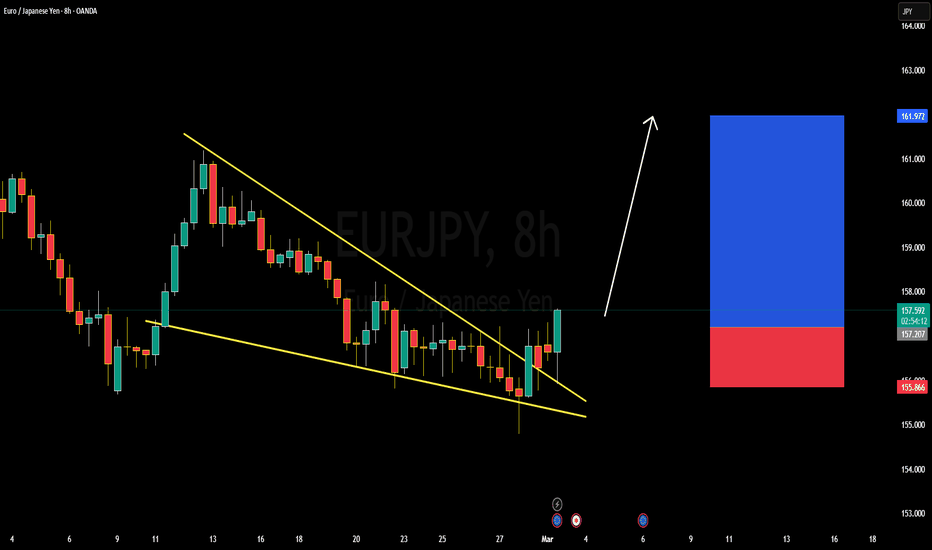

EURJPY Bullish Breakout: Targeting 300 Pips Toward 161.500EURJPY is currently trading at 157.500, having completed a falling wedge breakout and now holding above a key support level. The falling wedge is a strong bullish reversal pattern, indicating that after a period of consolidation, buyers are stepping in to drive the price higher. If this support holds, EURJPY could gain further momentum, targeting the 161.500 level for a potential 300-pip move.

From a technical perspective, the breakout has already been confirmed, and price action suggests that bulls are in control. A strong hold above support, along with increased buying pressure, could push EURJPY toward its next resistance zone near 161.500. Traders should watch for bullish candlestick formations and volume confirmation to strengthen the breakout scenario.

On the fundamental side, the euro’s strength against the yen is largely driven by monetary policy divergence between the European Central Bank (ECB) and the Bank of Japan (BoJ). The ECB remains relatively hawkish, while the BoJ continues its ultra-loose monetary policy, keeping the yen weak. Additionally, risk-on sentiment in global markets tends to favor EURJPY upside.

In summary, EURJPY has broken out of a falling wedge and is holding above a critical support level, with bullish momentum building. If this level remains intact, the pair could see a 300-pip rally toward 161.500. Traders should monitor price action, volume, and any shifts in ECB or BoJ policy for further confirmation of the bullish trend.

Euurjpy

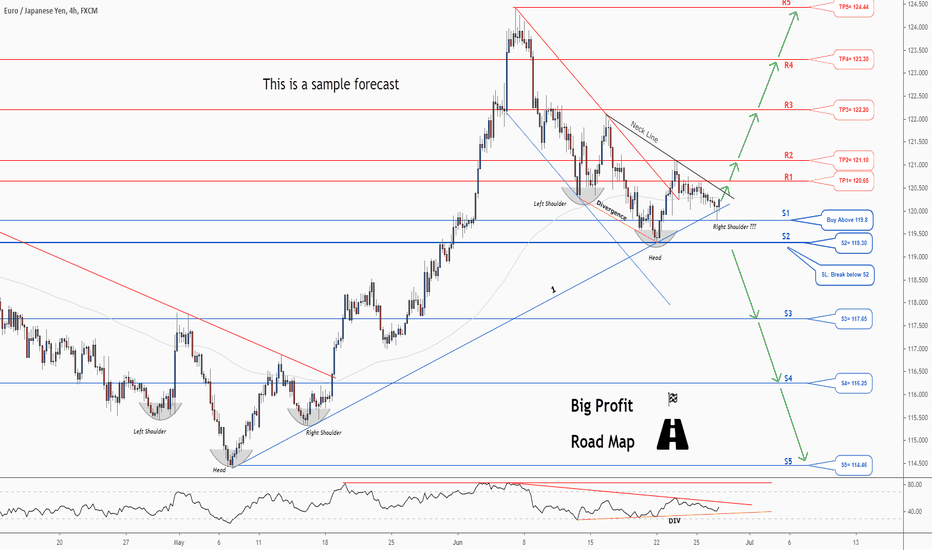

H4 TA Update: Profit=1250 pip SL=350 pip Reward/Risk > 3.5 : 1Trade Setup summary:

Profit targets=1250 pip (85 + 135 + 240 + 350 + 440)

Stop Loss =350 pip

Reward/Risk > 3.5 : 1

Current Status:

Total Profit: 140 pip

Closed trade(s): 0 pip Profit

Open trade(s): 140 pip Profit

Trade Setup:

We opened 5 BUY trade(s) @ 119.8 based on 'previous Forecast' at 2020.06.20 :

Open Profit:

Profit for one trade is 120.18 (current price) - 119.8 (open price) = 38 pip

5 trade(s) still open, therefore total profit for open trade(s) is 38 x 5 = 140 pip

Technical analysis:

.Price rejected from Uptrend (#1) and built a Hammer.

.A Head & Shoulder is taking shape; if price can break above Neckline, we expect to rich all of our targets.

. EURJPY is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 45.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support line (119.8) again. if so, traders can set orders based on Price Action and expect to reach short-term targets.

Take Profits:

TP1= @ 120.65

TP2= @ 121.10

TP3= @ 121.10

TP4= @ 123.30

TP5= @ 124.44

SL= Break below S2

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated! ❤️

💎 Want us to help you become a better Forex trader ?

Now, It's your turn !

Be sure to leave a comment let us know how do you see this opportunity and forecast.

Trade well, ❤️

ForecastCity English Support Team ❤️