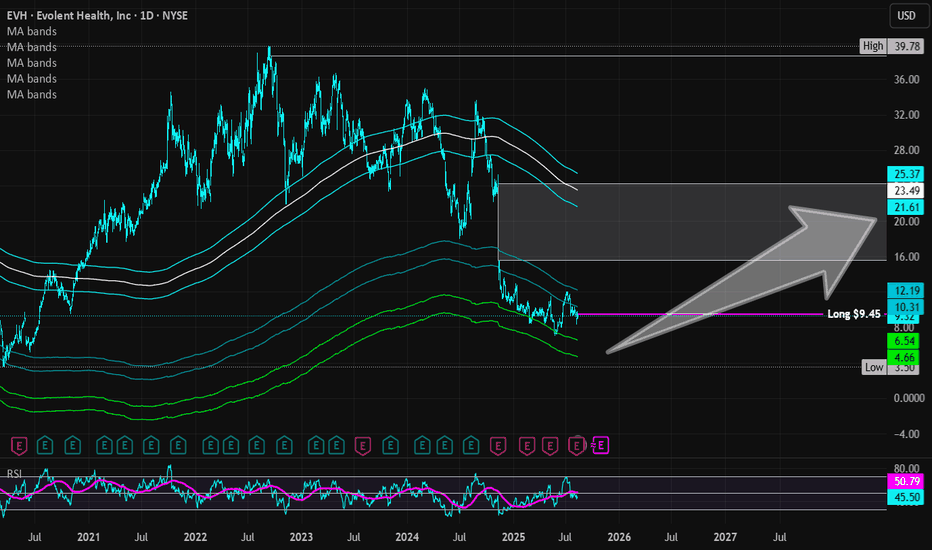

Evolent Health | EVH | Long at $9.45While 2025 is expected, and has been, a bad year for Evolent Heath NYSE:EVH , the growth prospects look very, very promising. However, I will caution that the price could almost be cut in half from its current trading value ($9.45) with another poor earnings in 2025. This definitely isn't an "it's only up from here" stock. The price entered my "crash" simple moving area (green lines) twice and a third time could occur before the end of the year ($4-$5 range as of this writeup).

Regardless of bottom predictions, earnings for NYSE:EVH are expected to rise from $1.9 billion in 2025 to $3.2 billion in 2028. EPS predicted to rise from $0.26 in 2025 to $1.18 in 2028. Debt-to-equity = 1.2x (okay, below 1 is best), Quick Ratio, or the ability to pays current bills is = 1x (okay, between 1.5 and 3 is best), and bankruptcy risk is relatively high (but reduced interest rates may help). Insiders have purchased over $11 million in shares this year with a cost average (~$23): much higher than it's current trading price.

So, while it seems there could be some short-term risks for Evolent Health, the future beyond 2025 is bright (based on company projections). Thus, at $9.45, NYSE:EVH is in a personal buy zone with potential downside risk near $4-5 in the near-term.

Targets into 2028:

$15.00 (+58.7%)

$20.00 (+111.6%)

EVH

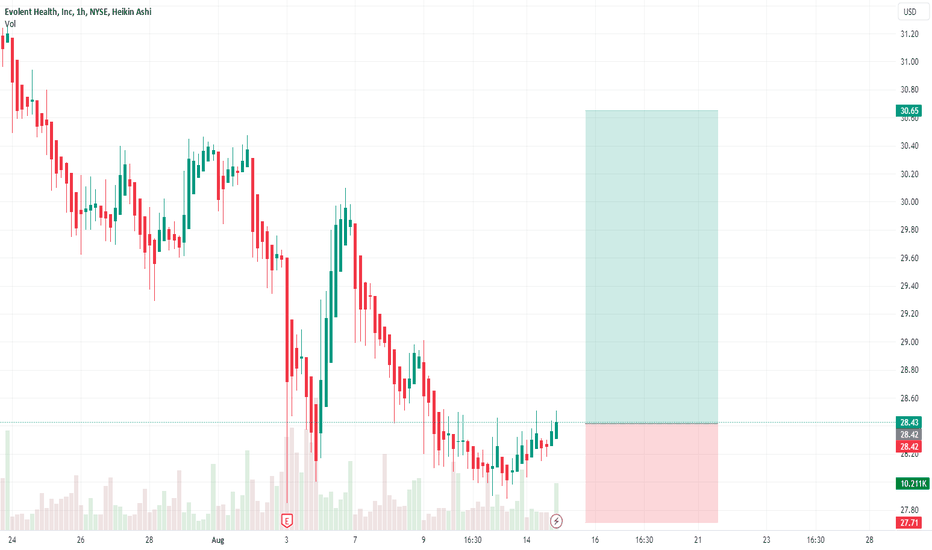

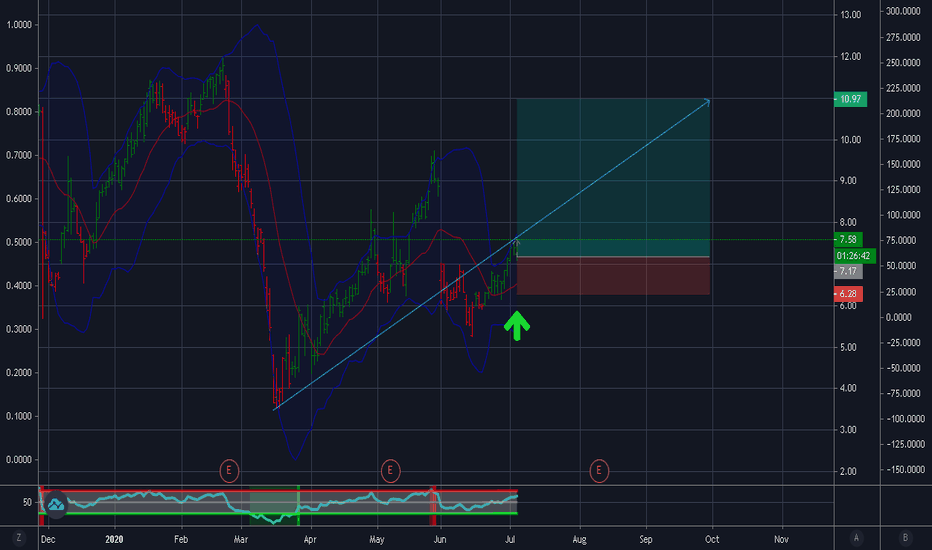

EVH (Evolent Health, Inc. ) Buy TF H1 TP = 30.65On the hour chart the trend started on August 7 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 30.65

But we should not forget about SL = 27.71

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelieveInTrading

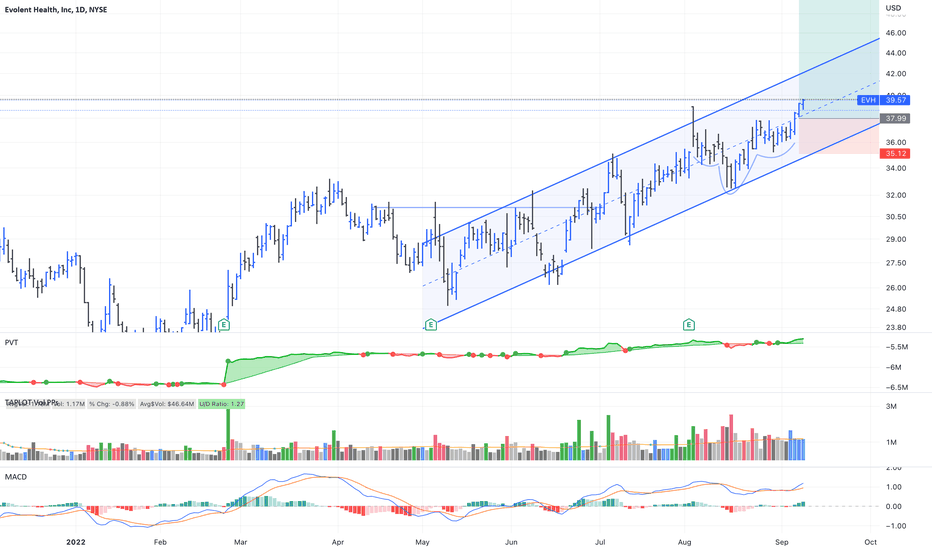

EVH - new 52 week high. Breaking out and holdingBreaking out of one month consolidation. Constructive price and volume action and a market leader.

You don't need to know what's going to happen next to make money ~Mark Douglas

Lose like a pro and keep trading, or lose like a novice and quit ~Mark Ritchie

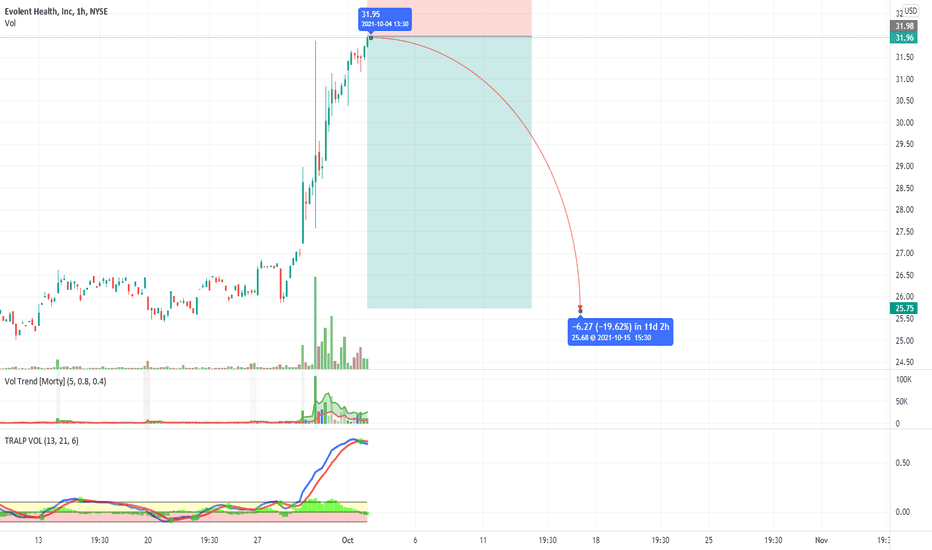

$EVH Merger with Walgreens Will Not Happen Sources SayWe all come here to notice that Walgreens is not interested in the Merger with EVH after digging into the company earnings and realizing there's a conflict of interest in proprietary technology. A Merger makes no sense any more spokesman said. "We'd like to notify private investors today to let them know that the deal doesn't seem to fit our model anymore as far as the health care management software Evolent has to offer" - Walgreens

WACC% 15.48

ROIC -3.73

Operating Margin -4.18

Net Margin -7.28

ROE -11.23

ROA -5.35

3 Year EPS NRI Growth Rate -61.20

Net Income Operations -72.27 70% Worse than 606 companies

Sloan Ratio -42.26

ROCE -4.49

1 Year Asset Growth Rate -7.30

1 Year Debt Growth Rate -21.80

1 Year OCF -881

1 Year Total Growth Rate 8.80

1 Year Revenue Rate Per Share 5.70

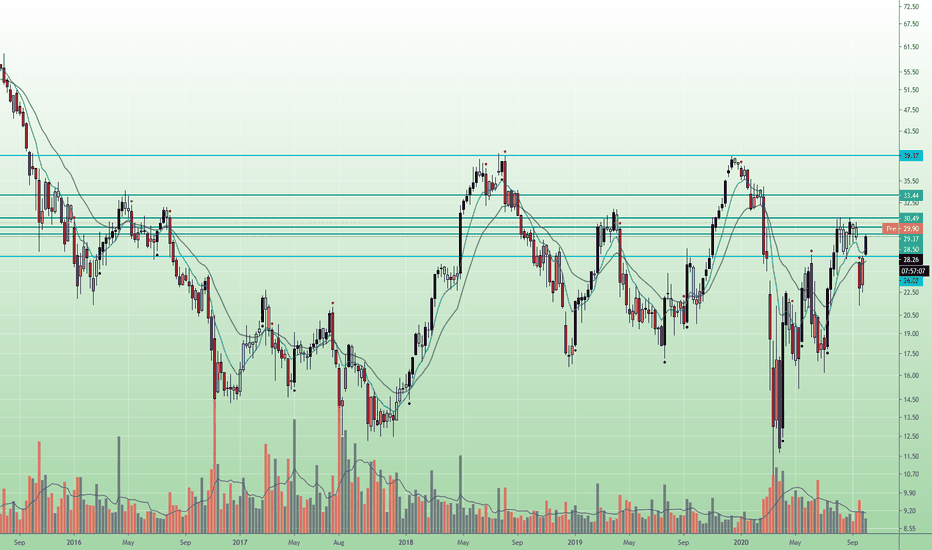

THC (Tenet Healthcare Corp) Like the look of this THC chart. Healthcare has been a "buzz" sector and I think it will really pick up steam after the election. The green horizontal lines indicate 1M/3M areas of resistance, the light blue line weekly level. Trying to do more following of price action on this one rather than attempting to be too predictive. I am long as of now with the intention to hold for a few months.

EVH - Fallen angel type of long from $12.67 to $14.83 & higher

* Trade Criteria *

Date First Found- November 28, 2017

Pattern/Why- Fallen angel

Entry Target Criteria- Break of $12.67

Exit Target Criteria- $14.83

Stop Loss Criteria- $11.83

Please check back for Trade updates. (Note: Trade update is little delayed here.)