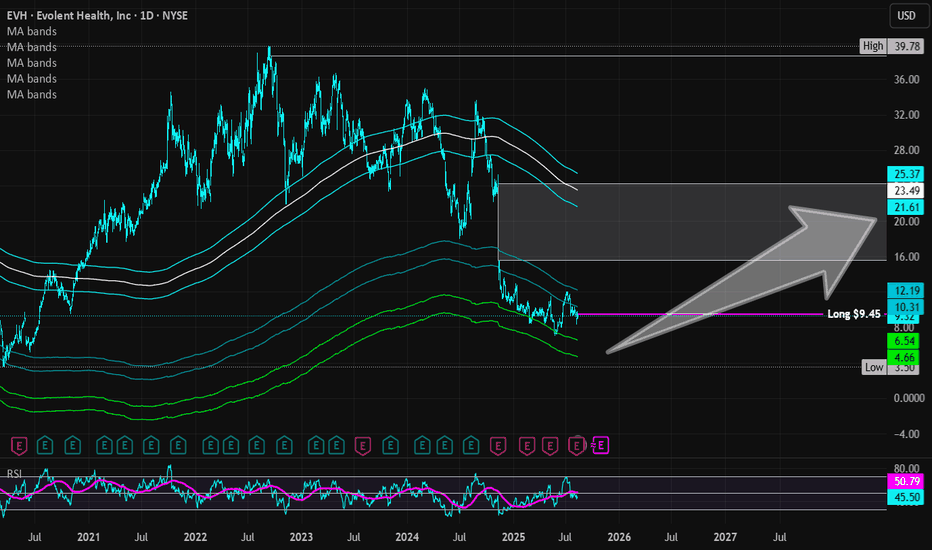

Evolent Health | EVH | Long at $9.45While 2025 is expected, and has been, a bad year for Evolent Heath NYSE:EVH , the growth prospects look very, very promising. However, I will caution that the price could almost be cut in half from its current trading value ($9.45) with another poor earnings in 2025. This definitely isn't an "it's only up from here" stock. The price entered my "crash" simple moving area (green lines) twice and a third time could occur before the end of the year ($4-$5 range as of this writeup).

Regardless of bottom predictions, earnings for NYSE:EVH are expected to rise from $1.9 billion in 2025 to $3.2 billion in 2028. EPS predicted to rise from $0.26 in 2025 to $1.18 in 2028. Debt-to-equity = 1.2x (okay, below 1 is best), Quick Ratio, or the ability to pays current bills is = 1x (okay, between 1.5 and 3 is best), and bankruptcy risk is relatively high (but reduced interest rates may help). Insiders have purchased over $11 million in shares this year with a cost average (~$23): much higher than it's current trading price.

So, while it seems there could be some short-term risks for Evolent Health, the future beyond 2025 is bright (based on company projections). Thus, at $9.45, NYSE:EVH is in a personal buy zone with potential downside risk near $4-5 in the near-term.

Targets into 2028:

$15.00 (+58.7%)

$20.00 (+111.6%)