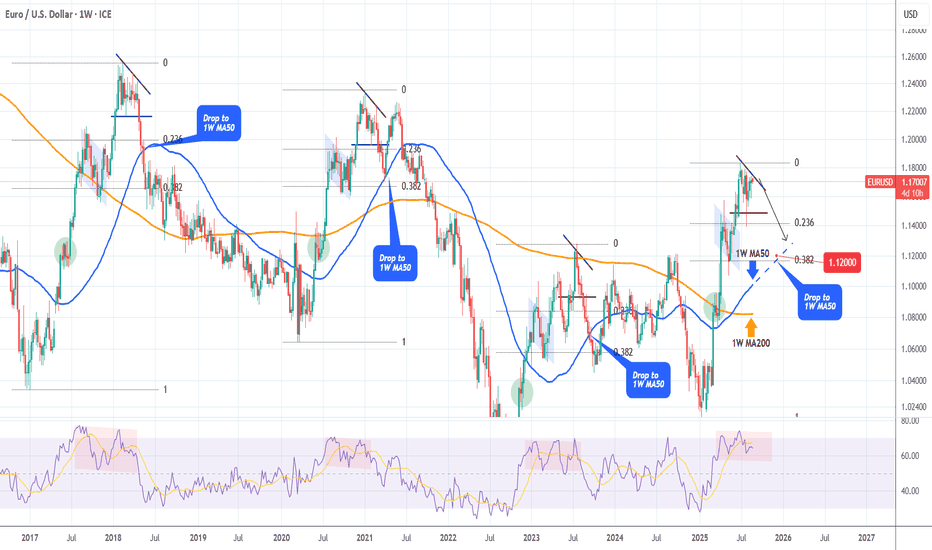

EURUSD Is it about to experience a big drop??The EURUSD pair has been consolidating under moderate pressure since the June 30 (weekly) High with its 1W RSI basically ranged since April 14.

We have seen this sequence of sideways 1W RSI trading after hitting the overbought (70.00) level another 3 times in the past 8 years. All of those times, the market priced a long-term Top there or shortly after.

In all instances, the first Target was the 1W MA50 (blue trend-line), with the price even going as low as the 0.382 Fibonacci retracement level.

If the Top this time was already priced in June, then we should be expecting a Target of at least 1.1200 on the medium-term, which would be a potential contact with the 1W MA50 and marginally above the 0.382 Fib.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

F-EUR

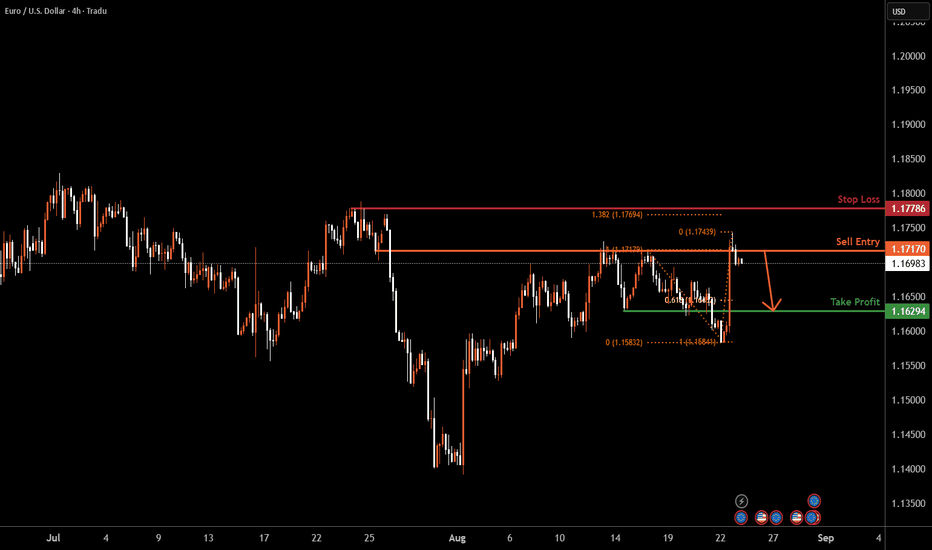

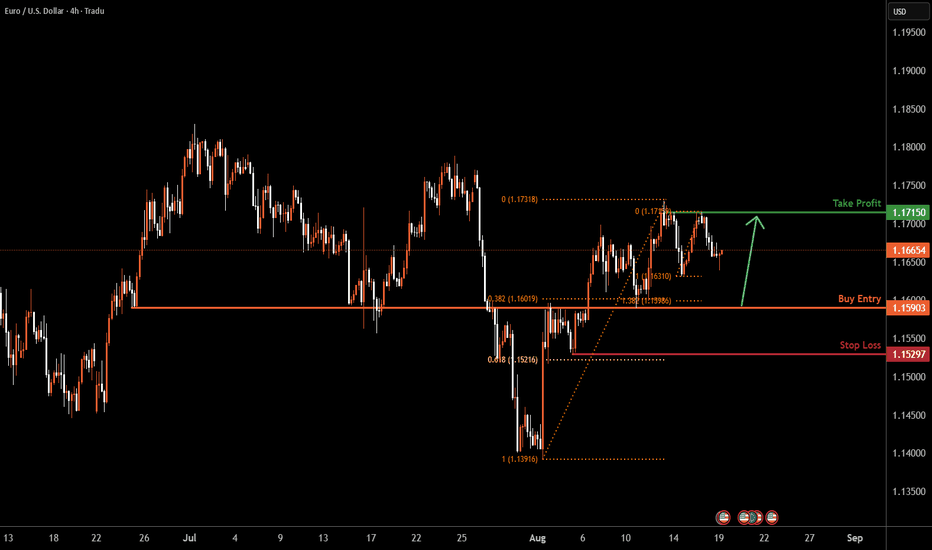

EURUSD H4 | Bearish dropEUR/USD is rising to the sell entry, which acts as a pullback resistance and could reverse from this level to the downside.

Sell entry is at 1.1717, which is a pullback resistance.

Stop loss is at 1.1786, which acts as a swing high resistance that is slightly above the 138.2% Fibonacci extension.

Take profit is at 1.1629, which has been identified as a pullback support that is slightly below the 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

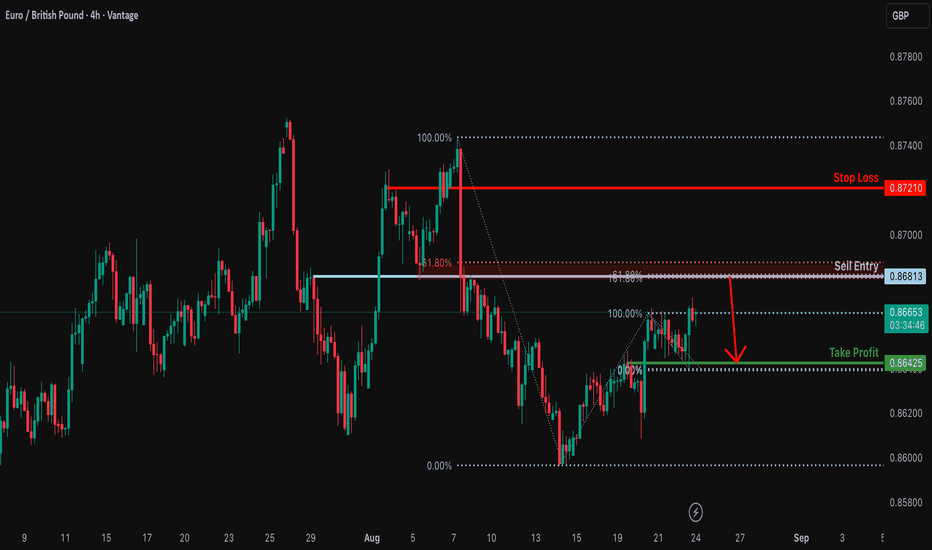

Rising towards Fibonacci confluence?EUR/GBP is rising towards the resistance level, which is an overlap resistance that lines up with the 161.8% Fibonacci extension, 61.8% Fibonacci projection and also slightly below the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 0.8681

Why we like it:

There is an overlap resistance that lines up with the 161.8% Fibonacci extension, 61.8% Fibonacci projection and slightly below the 61.8% Fibonacci retracement.

Stop loss: 0.8721

Why we like it:

There is a pullback resistance.

Take profit: 0.8642

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

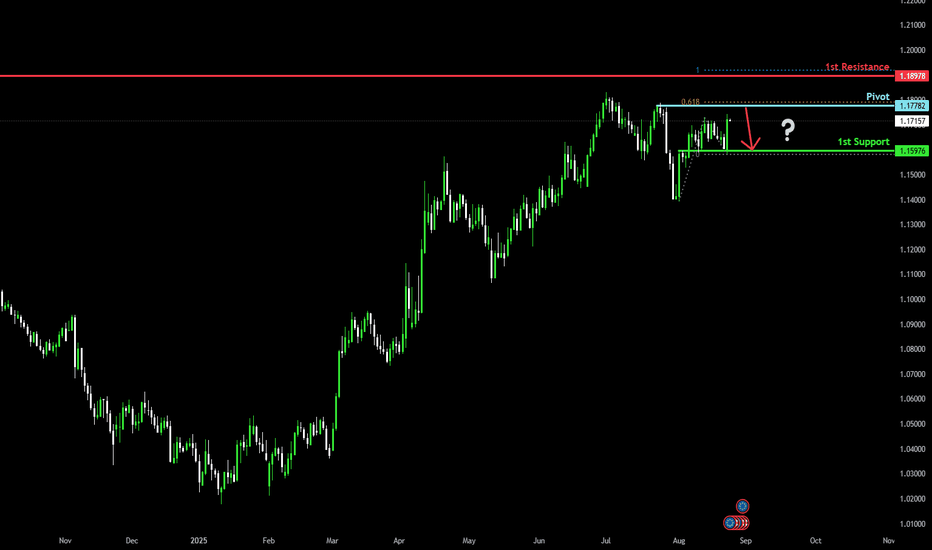

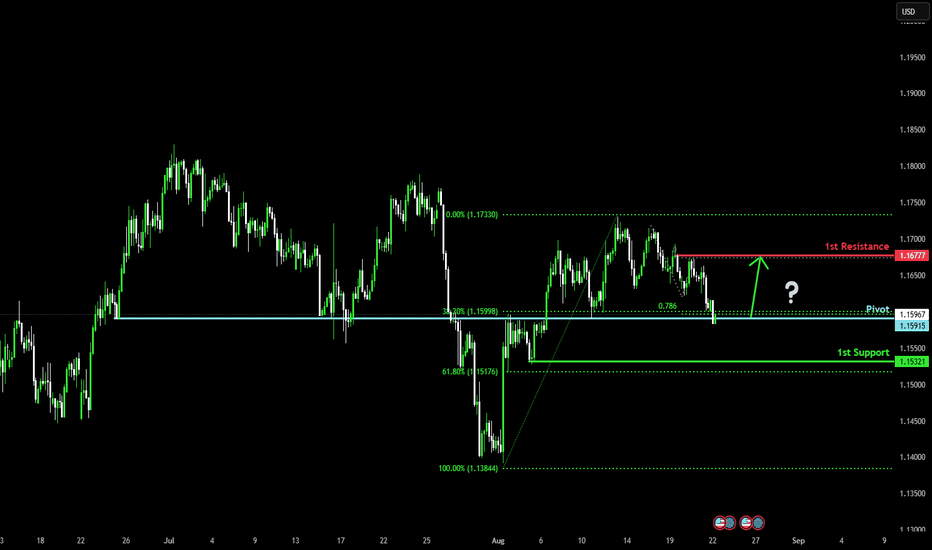

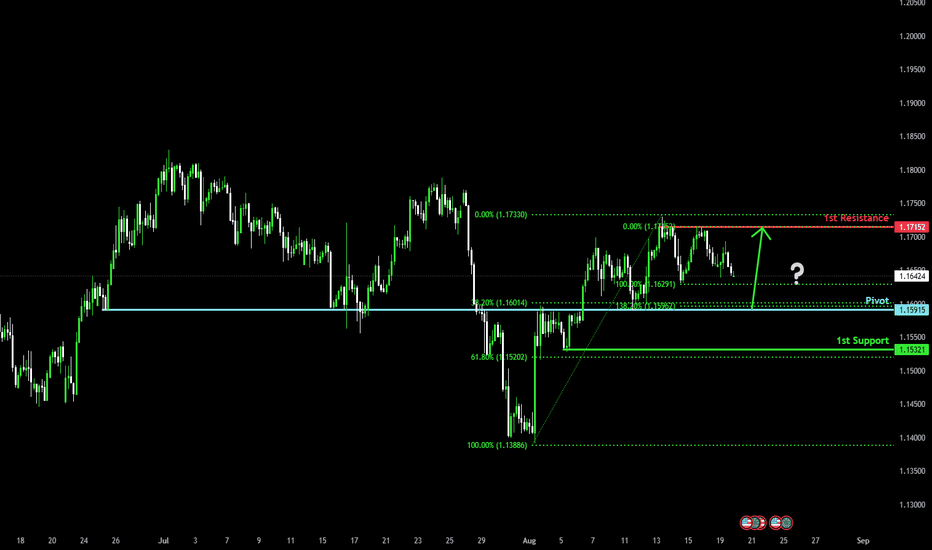

Bearish reversal off pullback resistance?The Fiber (EUR/USD) is rising towards the pivot, which acts as a pullback resistance and could reverse to the 1st support.

Pivot: 1.17782

1st Support: 1.1597

1st Resistance: 1.1897

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

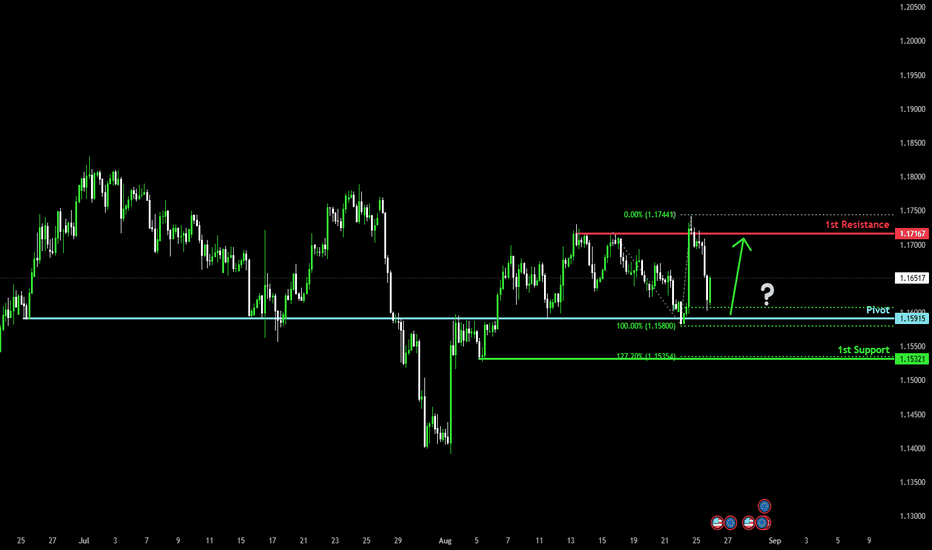

Bullish bounce for the Fiber?The price is falling towards the pivot, which acts as an overlap support and could bounce to the 1st resistance, which is a pullback resistance.

Pivot: 1.1591

1st Suport: 1.1532

1st Resistance: 1.1677

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

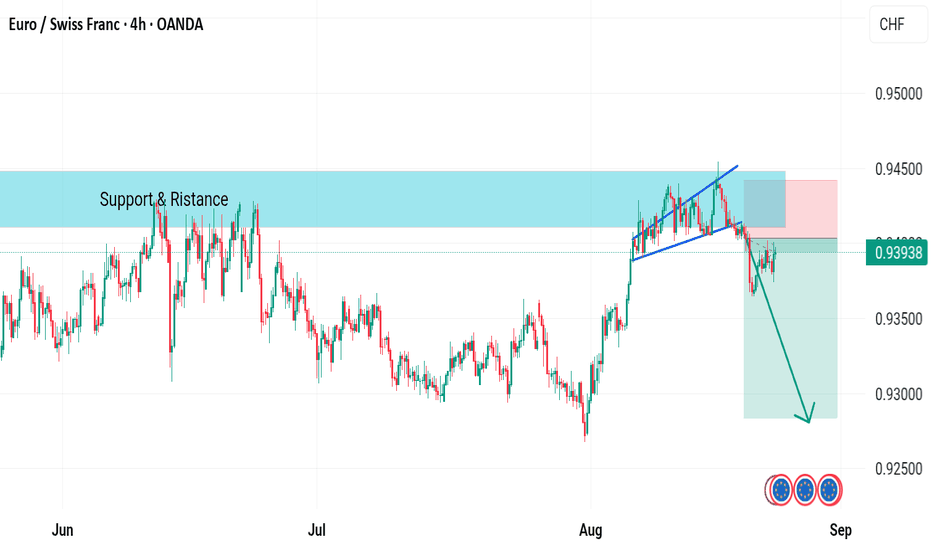

EURCHF SELL SETUP SIGNAL Hello everyone, if we focus on the chart, we will see a possible head and shoulders formation, and we will also see a bullish flag indicating a decline. We also have a consolidation area at the top that was broken downwards to continue the decline, in addition to the German GDP (Sabe), which indicates a decline in the Eurozone, especially the selfish economy, the strongest economy in the Eurozone, which supports our analysis.

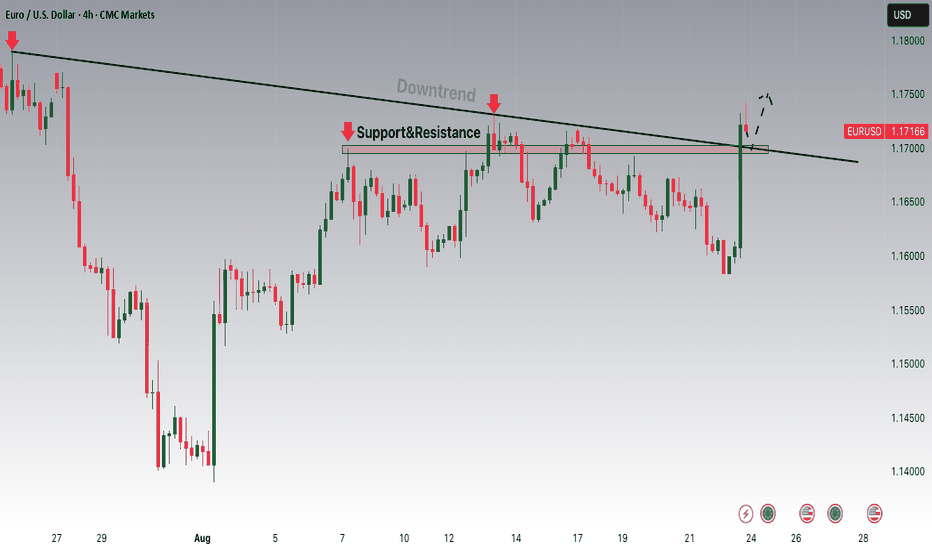

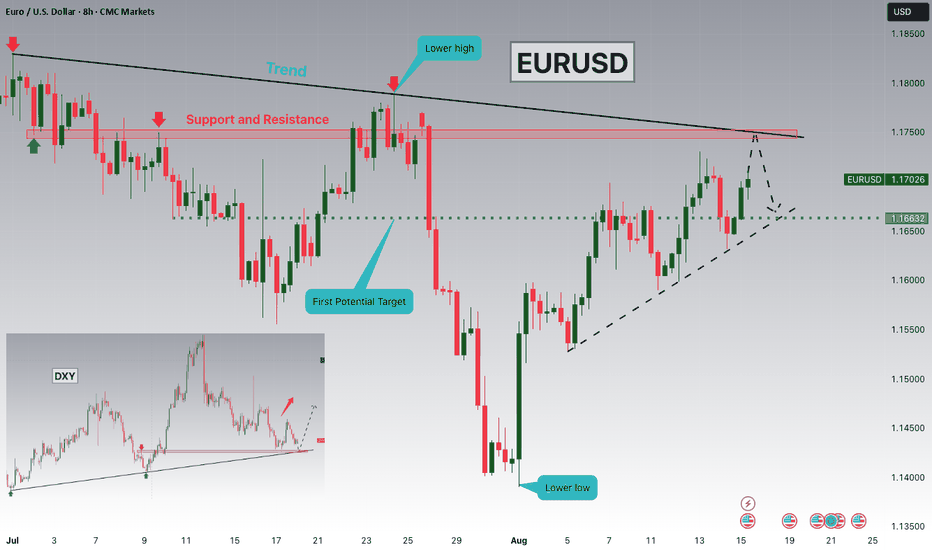

EURUSD Breakout and Potential RetraceHey Traders, in the coming week we are monitoring EURUSD for a buying opportunity around 1.17000 zone, EURUSD was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 1.17000 support and resistance area.

Trade safe, Joe.

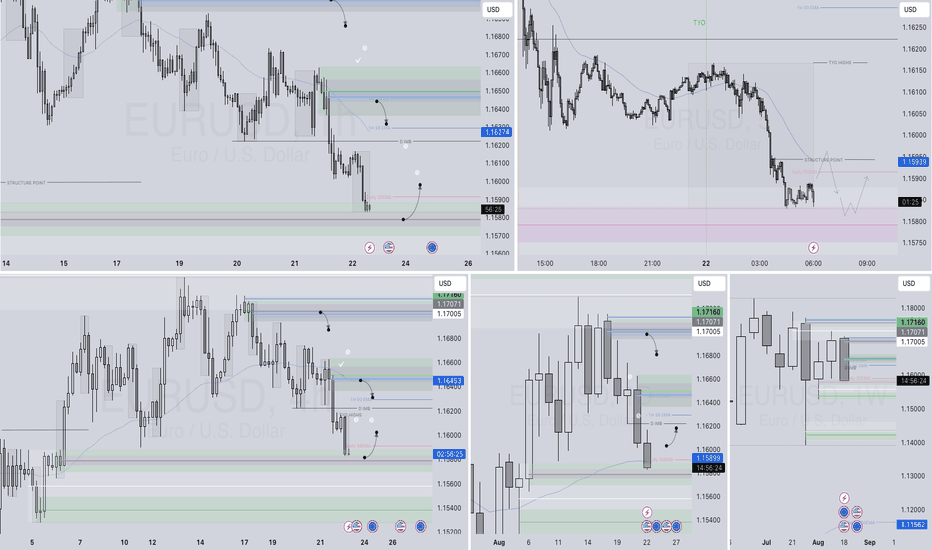

EURUSD – DAILY FORECAST Q3 | W34 | D22 | Y25📊 EURUSD – DAILY FORECAST

Q3 | W34 | D22 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURUSD

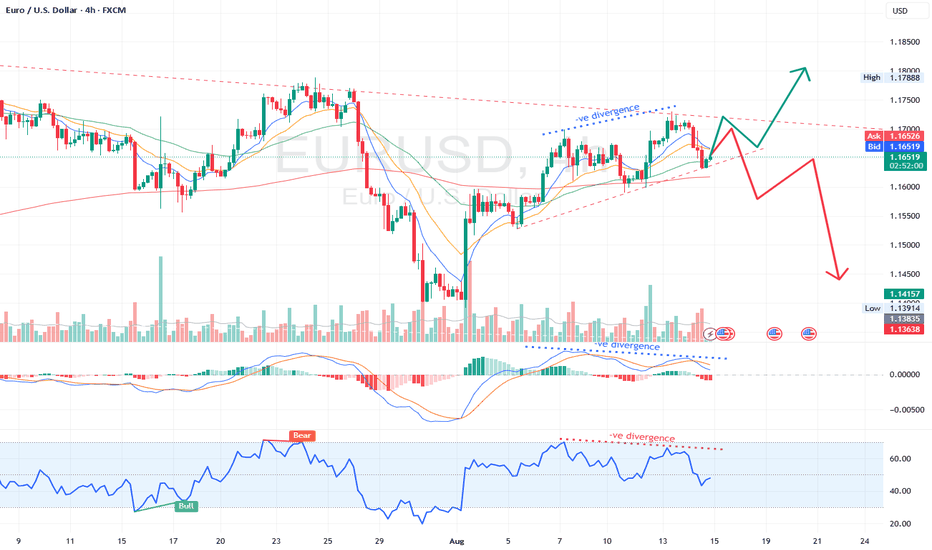

Where is EURUSD heading to ?EURUSD has significantly moved up since 1st August and is rejected at the trend line started from 01st Jul. It is decisively situated in a range as per the trend lines. Based on the current indicators, there are two diferent negative divergences indicated by both RSI and MACD. Strength of the current move is weak as per ADX indicator. But due to Trump and Putin meet planned on Friday and it can move in any direction based on outcome. So be prepared for the volatality accordingly and trade cautiously.

Bullish reversal?The Fiber (EUR/USD) is reacting off the pivot, which acts as an overlap support and could bounce to the 1st reistance.

Pivot: 1.1591

1st Support: 1.1532

1st Resistance: 1.1677

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

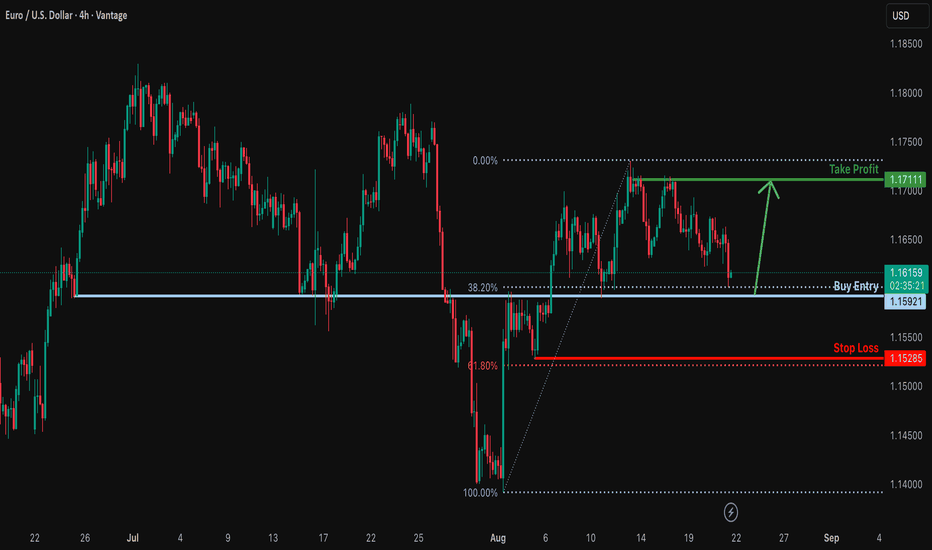

Could the Fiber bounce from here?The price is falling towards the support level, which is an overlap support that aligns with the 38.2% Fibonacci retracement and could bounce from this level to our take-profit.

Entry: 1.1592

Why we like it:

There is an overlap support level that lines up with the 38.2% Fibonacci retracement.

Stop loss: 1.1528

Why we like it:

There is a pullback support that aligns with the 61.8% Fibonacci retracement.

Take profit: 1.1711

Why we like it:

There is a multi-swing high resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

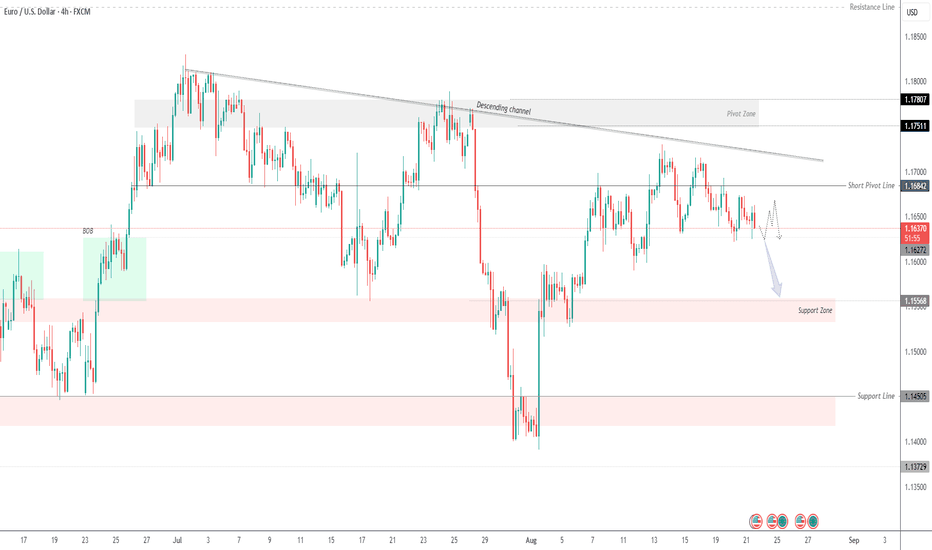

EURUSD Update | Descending Channel Keeps Pressure on EuroEURUSD – Technical Outlook

The pair continues to trade within a descending channel, showing persistent bearish pressure. Price is currently around 1.1638, sitting below the short pivot line at 1.1684.

Bearish Scenario

As long as price trades below 1.1684, momentum favors the downside.

A confirmed break below 1.1627 would strengthen bearish pressure, with the next target at the support zone near 1.1556.

A deeper decline could extend toward 1.1450 if the support zone gives way.

Bullish Scenario

A sustained move above 1.1684 would challenge the pivot zone at 1.1751 – 1.1780.

A breakout of the descending channel would then be needed to confirm a shift toward bullish momentum.

📍 Key Levels

Resistance: 1.1684 – 1.1751 – 1.1780

Support: 1.1627 – 1.1556 – 1.1450 – 1.1372

⚠️ Bias remains bearish while below 1.1684. Watch for volatility around Fed and ECB signals as fundamental drivers.

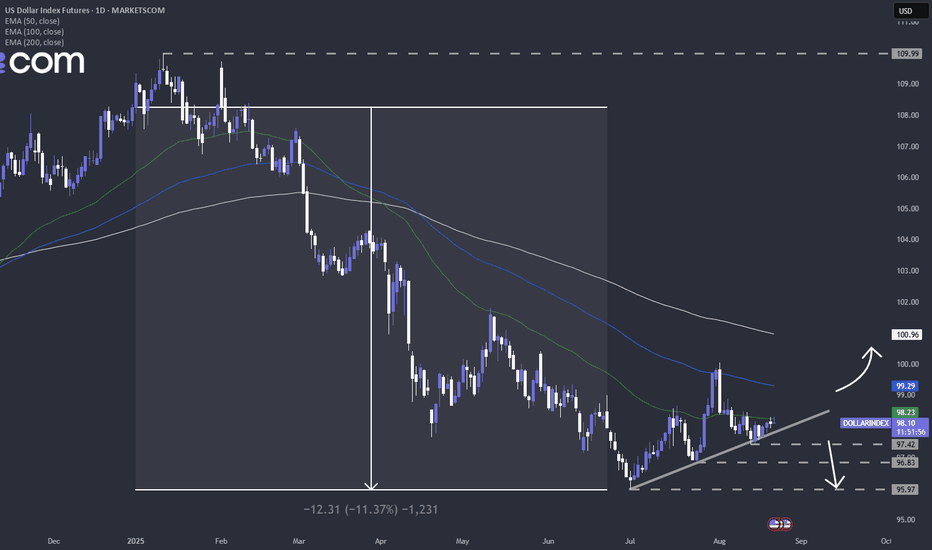

Quick Forex update. Waiting for the Powell speech.Let's have a quick technical look at the top FX pairs before the Jackson Hole Symposium. Let's dig in.

TVC:DXY

FX_IDC:AUDUSD

FX_IDC:NZDUSD

FX_IDC:USDJPY

FX_IDC:USDCAD

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

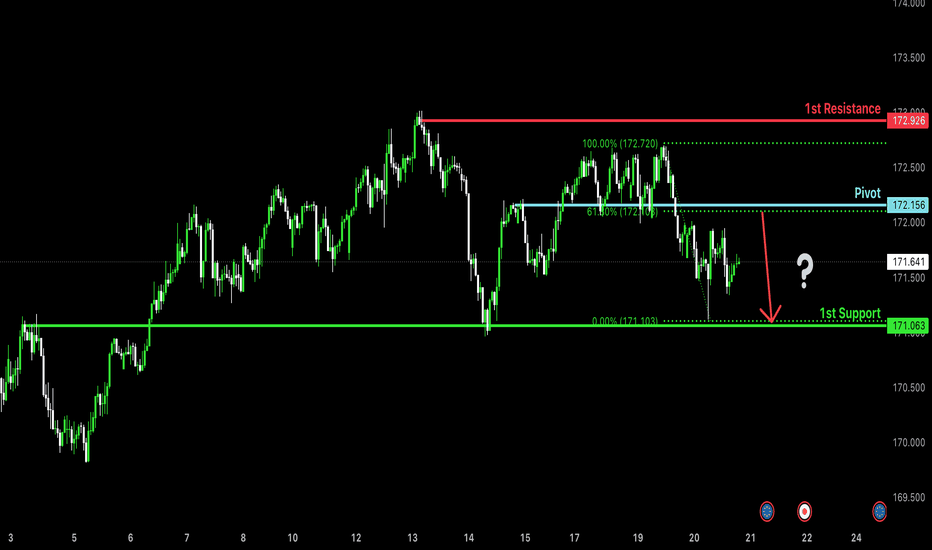

Bearish reversal off overlap resistance?EUR/JPY is rising towards the pivot, which is an overlap resistance, and could reverse to the 1st support, which acts as an overlap support.

Pivot: 172.15

1st Support: 171.06

1st Resistance: 172.92

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

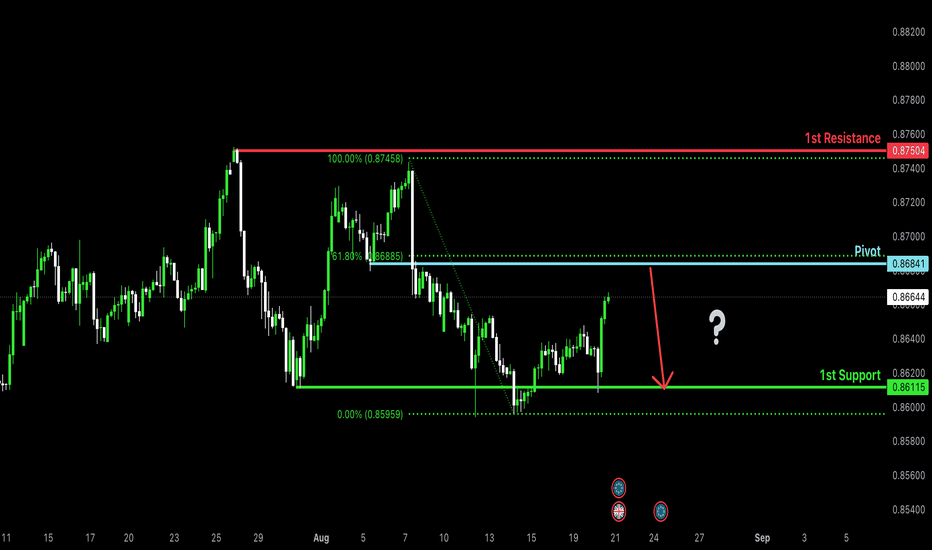

Bearish reversal off 61.8% Fibonacci resistance?EUR/GBP is rising towards the pivot, which acts as a pullback resistance that lines up with the 61.8% Fibonacci retracement and could reverse to the 1st support.

Pivot: 0.8684

1st Support: 0.8611

1st Resistance: 0.8750

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

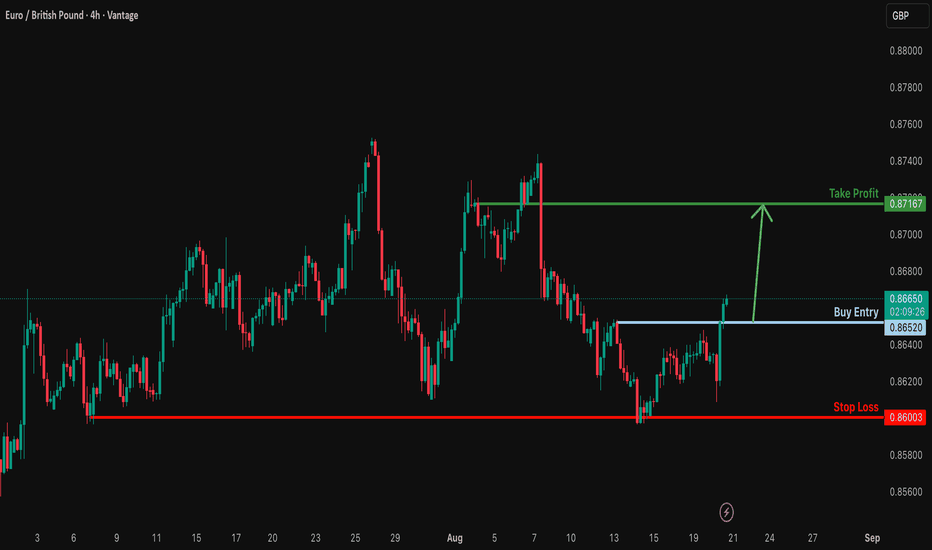

Bullish bounce off?EUR/GBP is falling towards the support level which is a pullback support and could bounce from this level to our take profit.

Entry: 0.8652

Why we like it:

There is a pullback support level.

Stop loss: 0.8600

Why we lilk eit:

There is a multi swing low support.

Take profit: 0.8716

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EURUSD is Nearing 1.17500 Important Resistance!!!Hey traders, in tomorrow's trading session we are monitoring EURUSD for a selling opportunity around 1.17500 zone, EURUSD is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 1.17500 support and resistance area.

Trade safe, Joe.

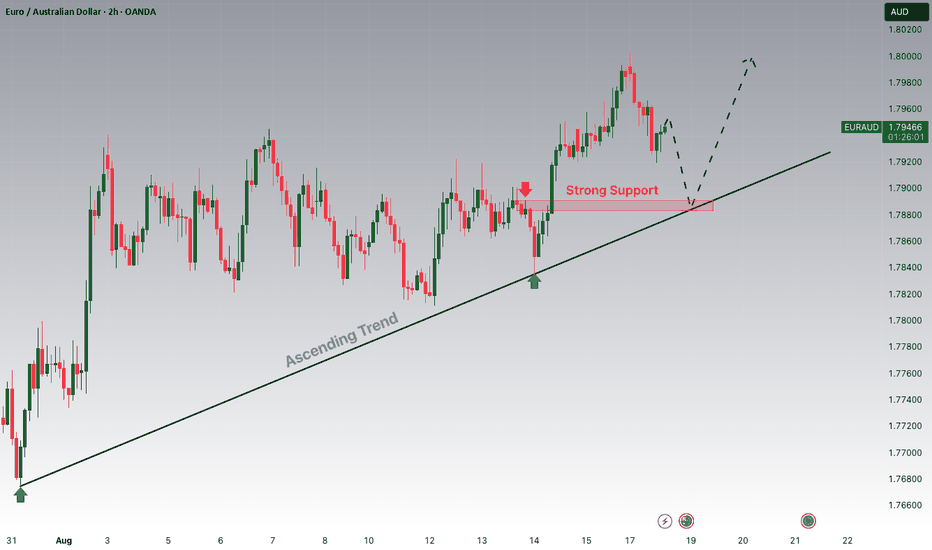

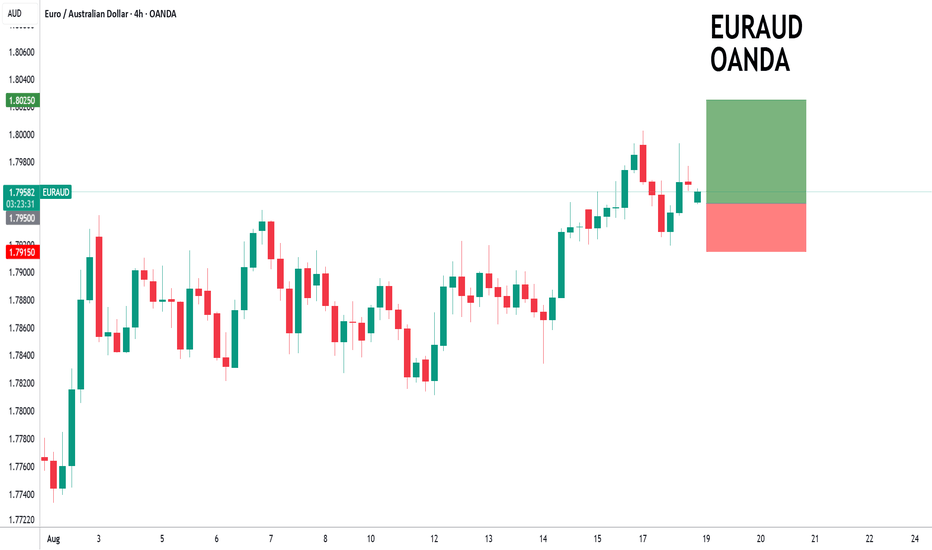

EURAUD is Nearing a Strong Support!!Hey Traders, in today's trading session we are monitoring EURAUD for a buying opportunity around 1.78900 zone, EURAUD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 1.78900 support and resistance area.

Trade safe, Joe.

Bullish bounce for the Fiber?The price is falling towards the pivot and could bounce to the 1st resistance which acts as a multi-swing high resistance.

Pivot: 1.1591

1st Support: 1.1532

1st Resistance: 1.1715

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURUSD H4 | Bullish bounce off overlap supportThe Fiber (EUR/USD) is falling towards the buy entry which is an overlap support that is slightly below the 38.2% Fibonacci retracement and the 138.2% Fibonacci extension and could bounce from this level to the take profit.

Buy entry is at 1.1590, which is an overlap support that is slightly below the 38.2% Fibonacci retracement and the 138.2% Fibonacci extension.

Stop loss is at 1.1529, which is a pullback support that lines up with the 61.8% Fibonacci retracement.

Take profit is at 1.1715, which is a multi swing high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

EURAUD to find support at market price?EURAUD - 24h expiry

There is no clear indication that the upward move is coming to an end.

Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher.

Risk/Reward would be poor to call a buy from current levels.

A move through 1.7975 will confirm the bullish momentum.

The measured move target is 1.8050.

We look to Buy at 1.7950 (stop at 1.7915)

Our profit targets will be 1.8025 and 1.8050

Resistance: 1.7975 / 1.8000 / 1.8025

Support: 1.7950 / 1.7925 / 1.7915

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

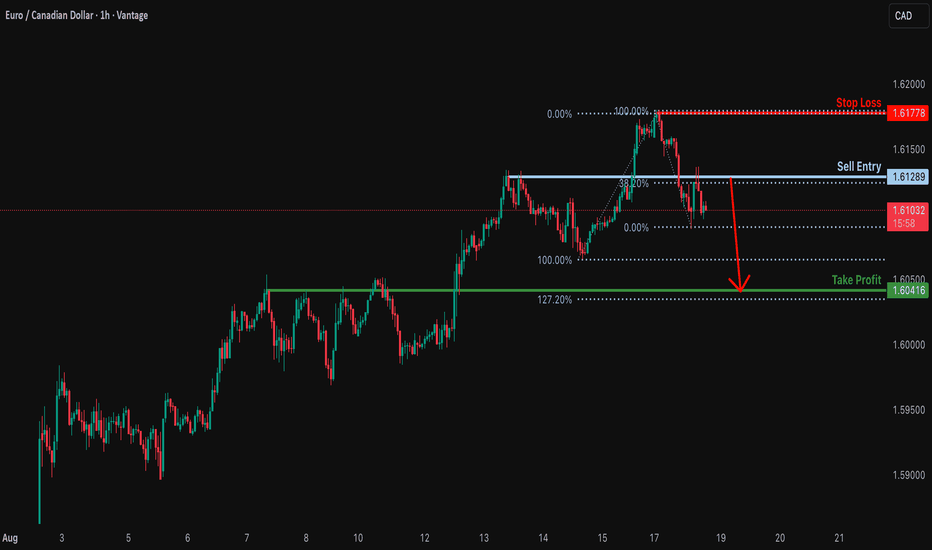

Bearish reversal off pullback resistance?EUR/CAD has rejected off the resistance level which is a pullback resistance that lines up with the 38.2% Fibonacci retracement and could drop from this level to our take profit.

Entry: 1.61289

Why we like it:

There is a pullback resistance that lines up with the 38.2% Fibonacci retracement.

Stop loss: 1.61778

Why we like it:

There is a swing high resistance.

Take profit: 1.60416

Why we like it:

There is a pullback support that is slightly above the 127.2% Fibonacci extension.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

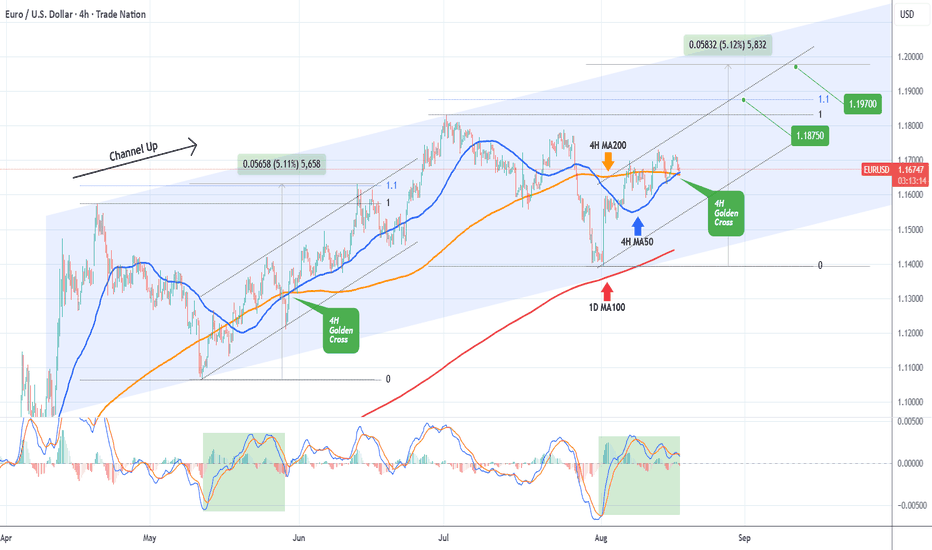

EURUSD 4H Golden Cross kickstarting the next bullish phase.The EURUSD pair just formed its first 4H Golden Cross since May 29. Similar to that formation, this is taking place as the new Bullish Leg of the 4-month Channel Up has already started, following a bottom rebound near its 1D MA100 (red trend-line).

In similar fashion as that sequence, we expect it to reach at least the 1.1 Fibonacci extension on the short-term, which sits at 1.18750. If you're looking for an even higher extension, a +5.11% rise at 1.19700 is possible (also based on he previous Bullish Leg).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇