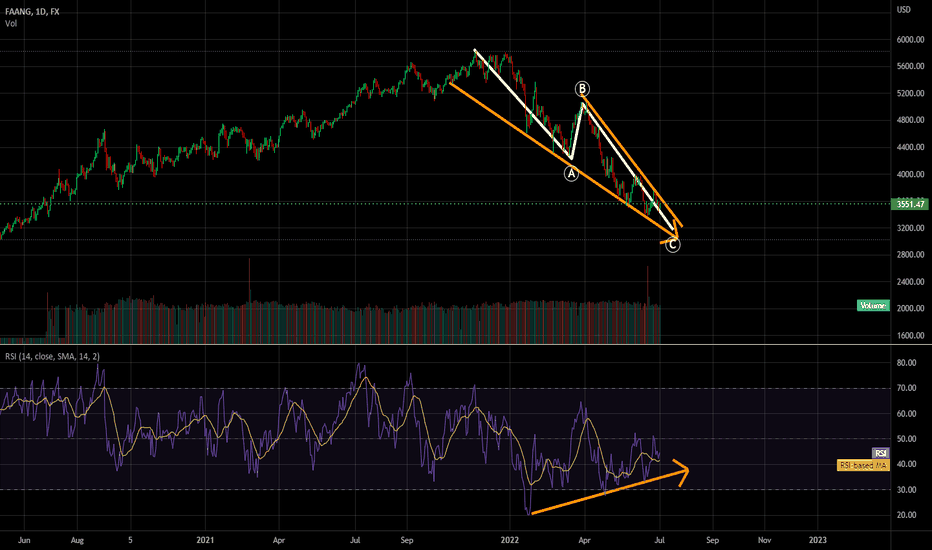

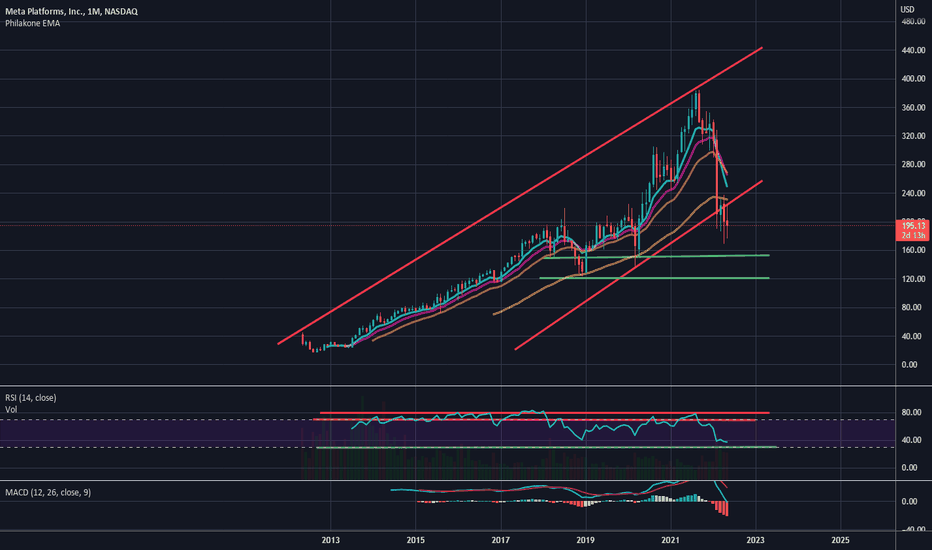

Falling Wedge + Bullish RSI convergence on FAANGAlthough I biased bearish for the past year, the markets are clearly oversold and, furthermore, appear to be showing consolidative pattersn.

FAANG index is also showing bullish consolidation.

We have a falling wedge and a strong bullish RSI convergence.

I believe the recent downturn was also an ABC move.

So, in short, although we are down a lot, we have a very bullish outline despite the bearish macro-narrative.

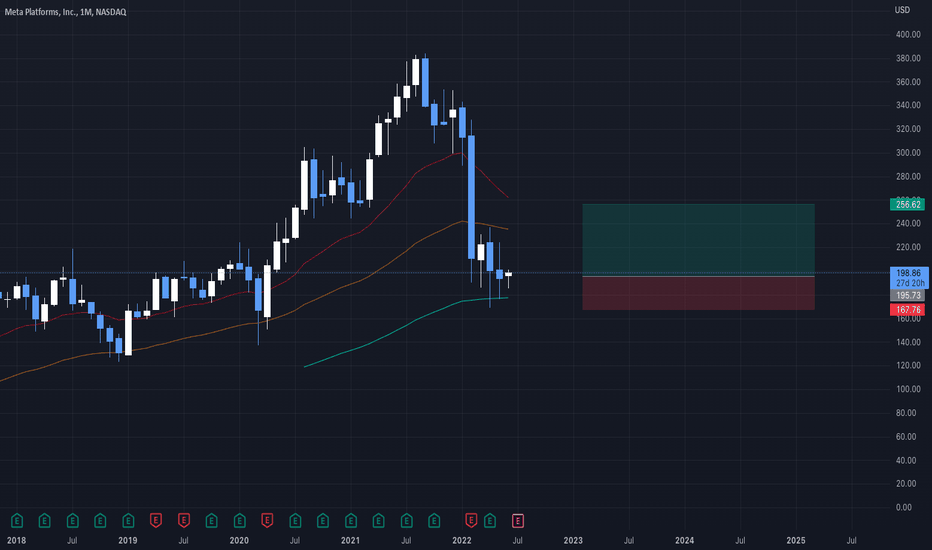

FB

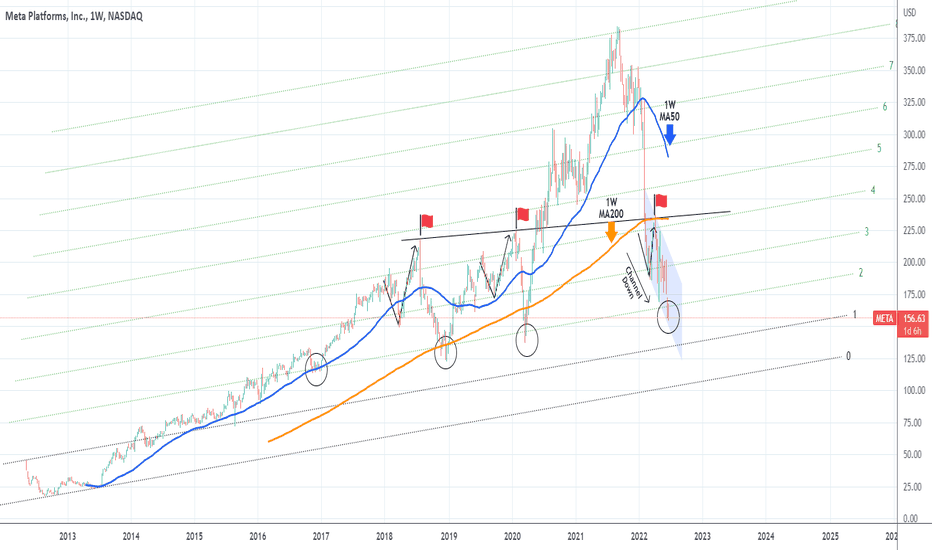

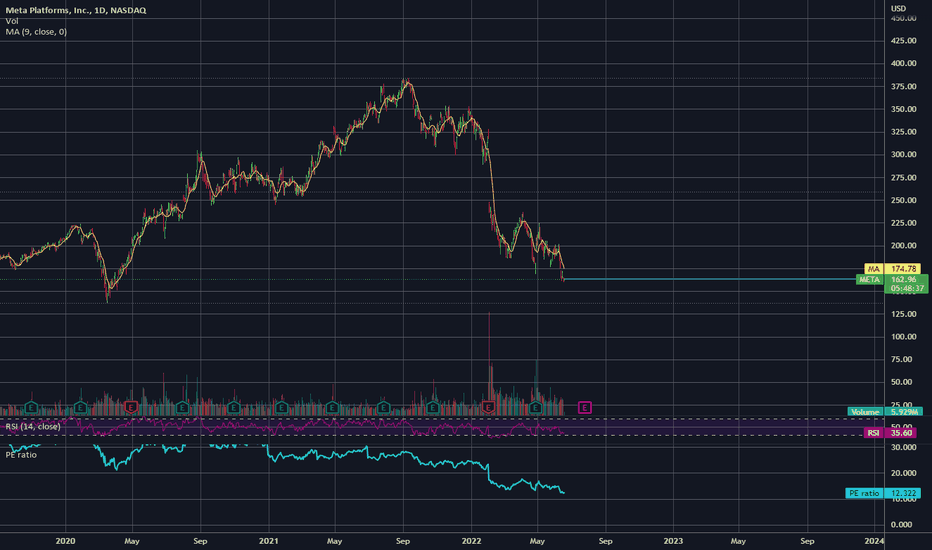

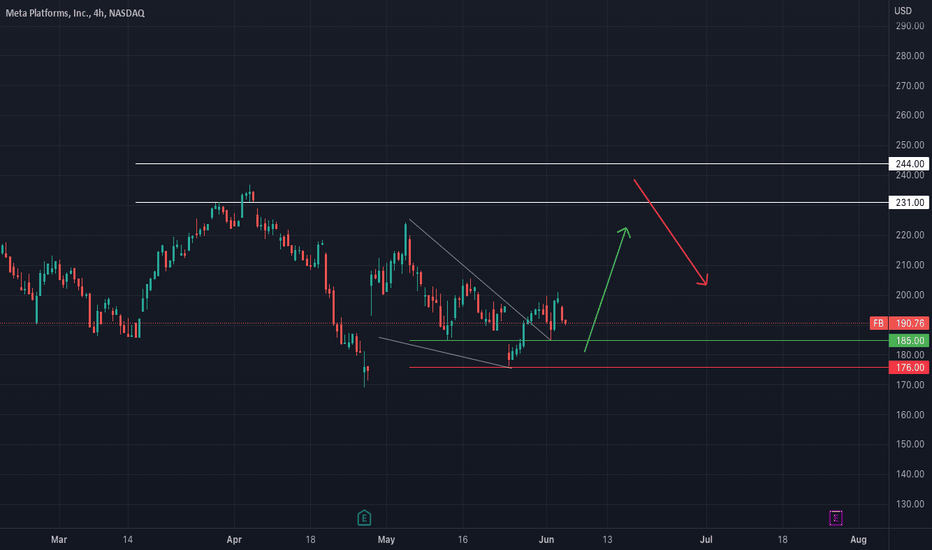

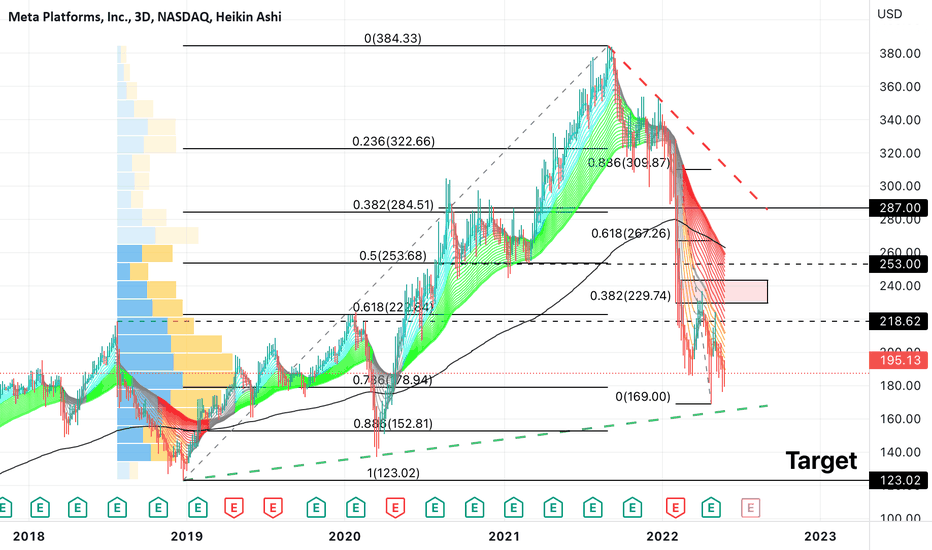

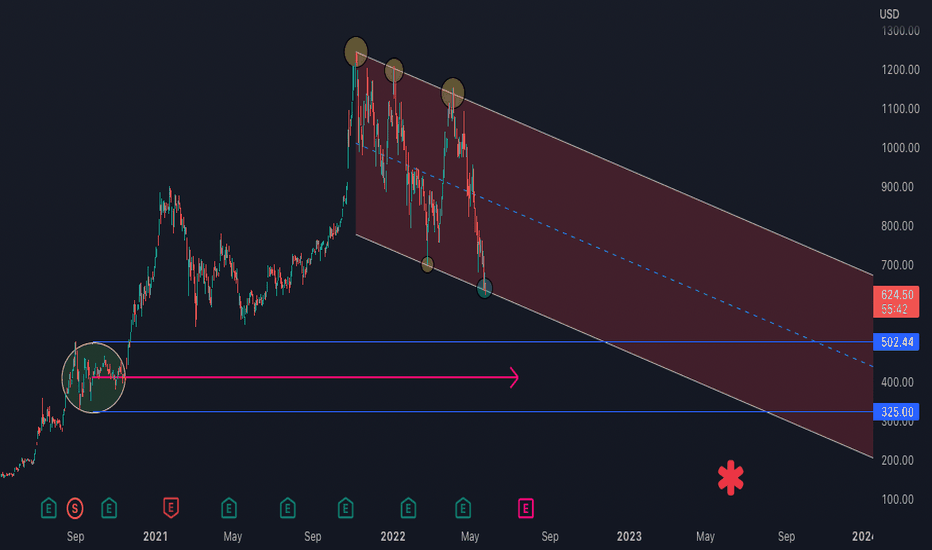

META Last chance to reverse their fortunesMeta Holdings (META) has been trading within a Channel Down ever since the huge early February gap down. The stock has failed to recover its lost 1W MA200 (orange trend-line) on the first rebound attempt and since it has been trading far from it as investors along with other known macro-economical parameters (inflation, war, Fed) are gradually losing faith in the company.

This is Meta's final attempt to reverse this sharp correction and find buyers as the price is now below the 2.0 Fibonacci extension, which is the level that has supported and kickstarted aggressive rebounds since April 2016. In fact you can see that with the application of the Fibonacci Channel extensions, from the moment Meta (formerly FB) started trading, slight breaks below the 2.0 Fib, have initiated three major rallies of +1 year.

If this is the level that saves the day for Meta indeed, investors will still have a Higher Highs trend-line to consider that has rejected the price three times already (red flags) but we will have time to make updates until then. Failure to hold this Support, could mean complete loss of investor confidence and the beginning of the end for the social media giant.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

FBNot financial advice.

The essence of investing & trading is the intelligent and patient preying on the greed, fear, impatience, addiction and ignorance of the majority. It's definitionally Darwinian.

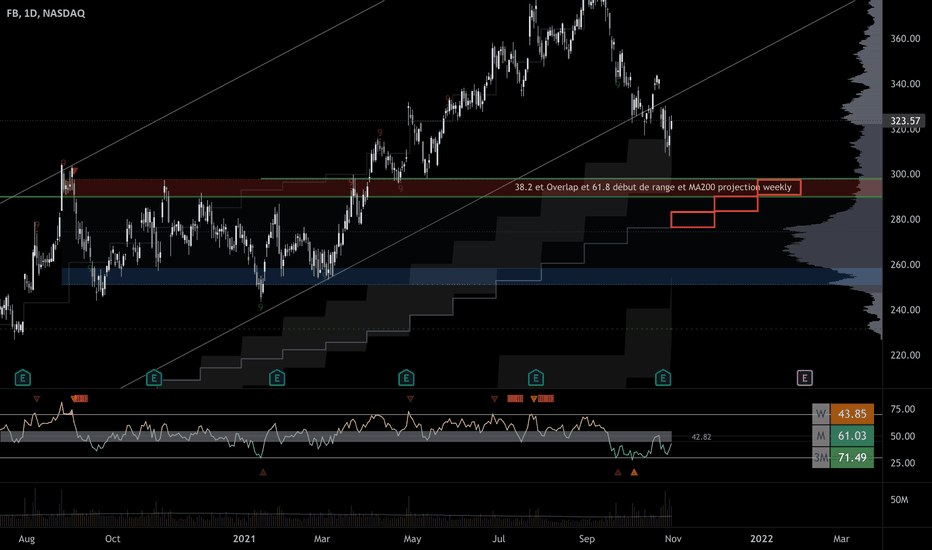

300$ Facebook is a huge buying opportunityLot of stars aligned there

Overlap

38.2% Fibo trend bottom

61.8% Fibo from range

Projection of weekly SMA200

$300 psychological number

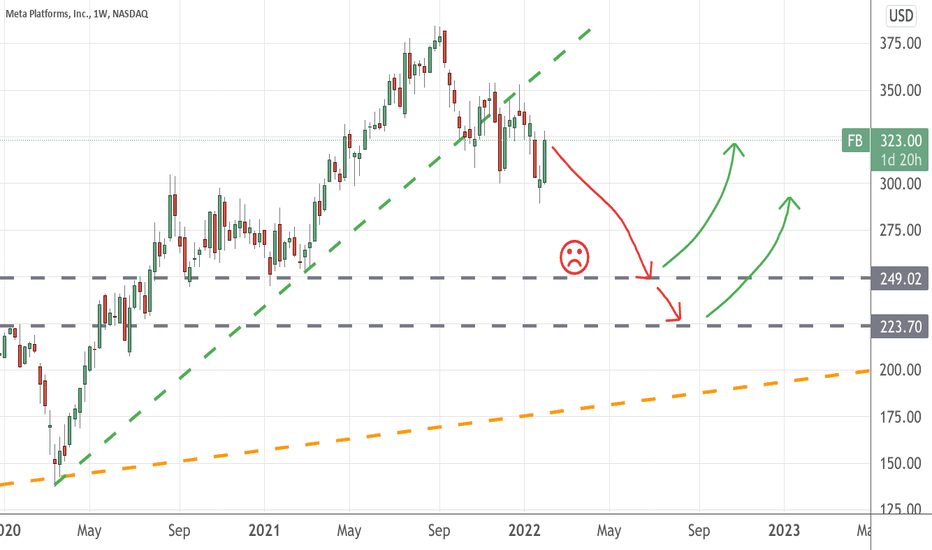

Will you buy Facebook shares now ?Please read this article here

When I review the weekly chart , I see that it has hit a support level at 249.05 level. The last time it was at this price level was in August 2020. I won't be rushing to buy although a 20% drop is a good bargain for a value investor. I will monitor the price over the weeks as I suspect it might drop further to the next support level at 223 level.

The orange dotted line is bullish trend line and we can see if the price hits 200 price level which will be the 3rd time only since Dec 18 and Mar 20. That , I think is quite unlikely and remotely going to happen.

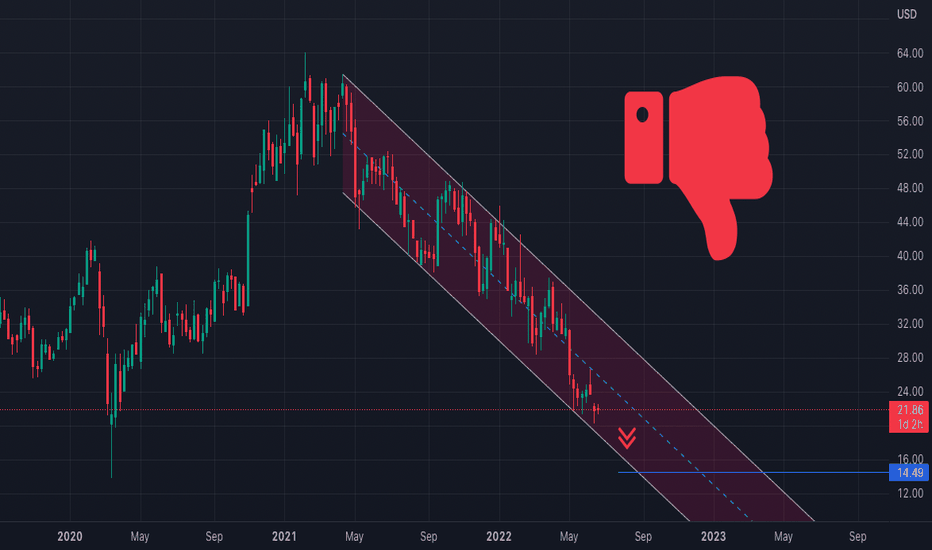

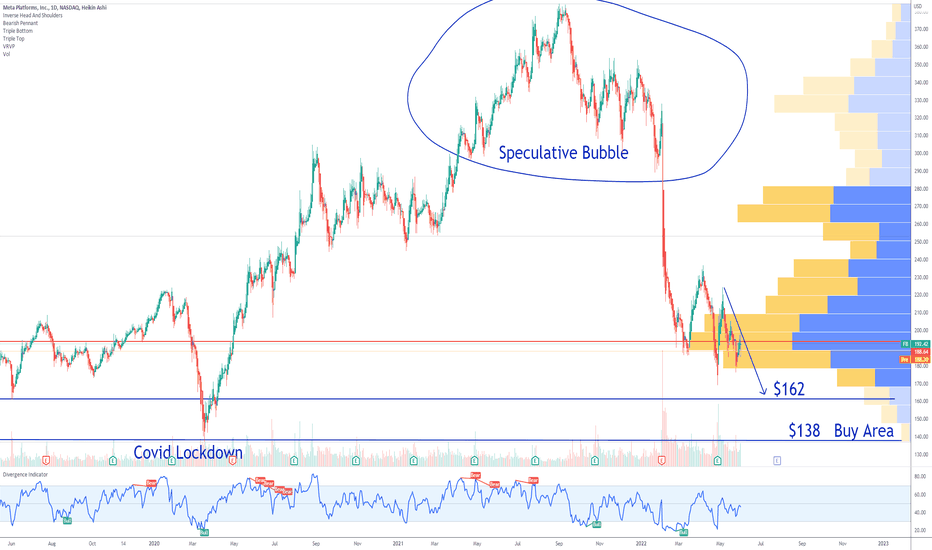

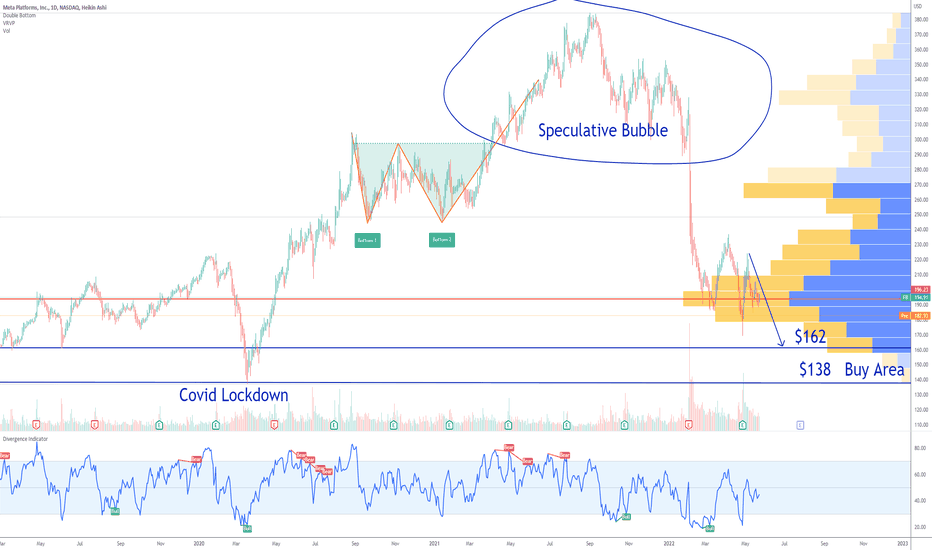

Facebook price overviewThe price is in downtrend since it made it high, so I would expect the price to drop further around 120$ or 130$ , then it would reverse.

Please like share and comment

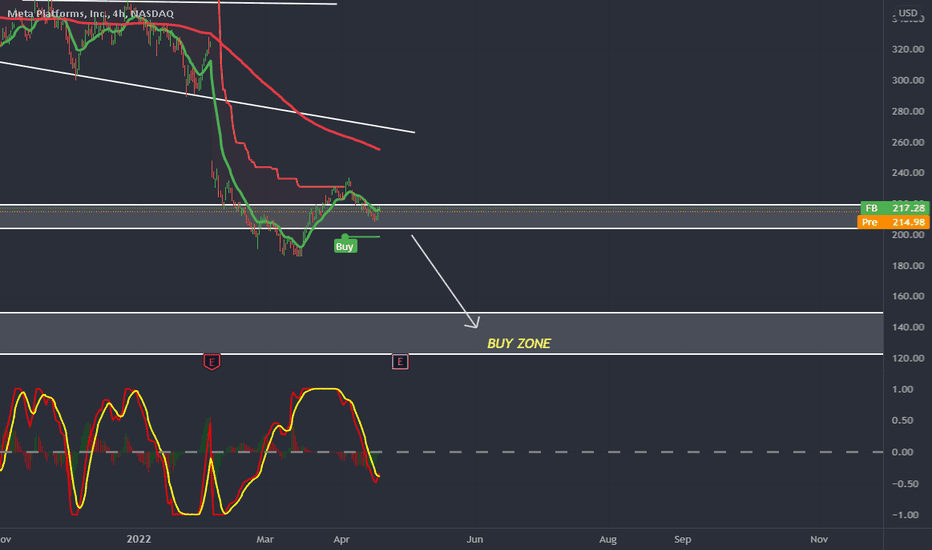

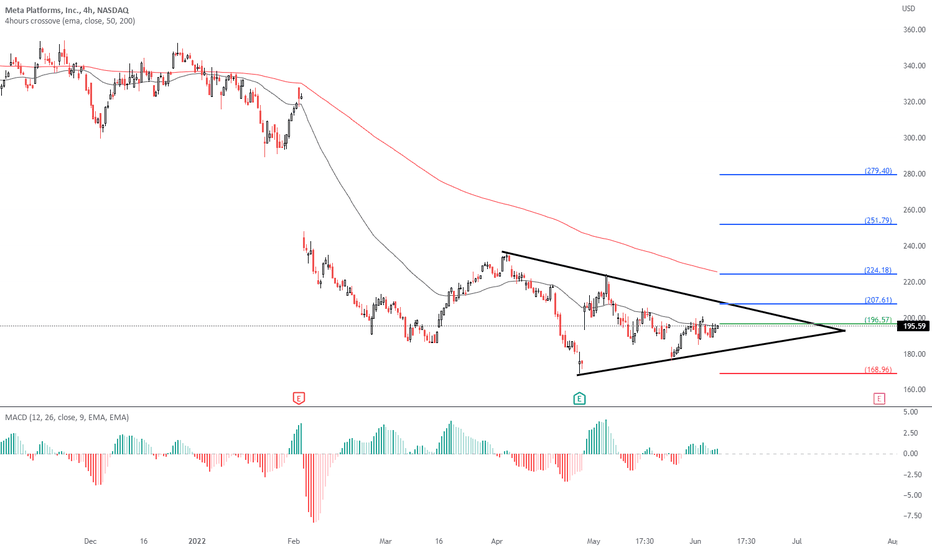

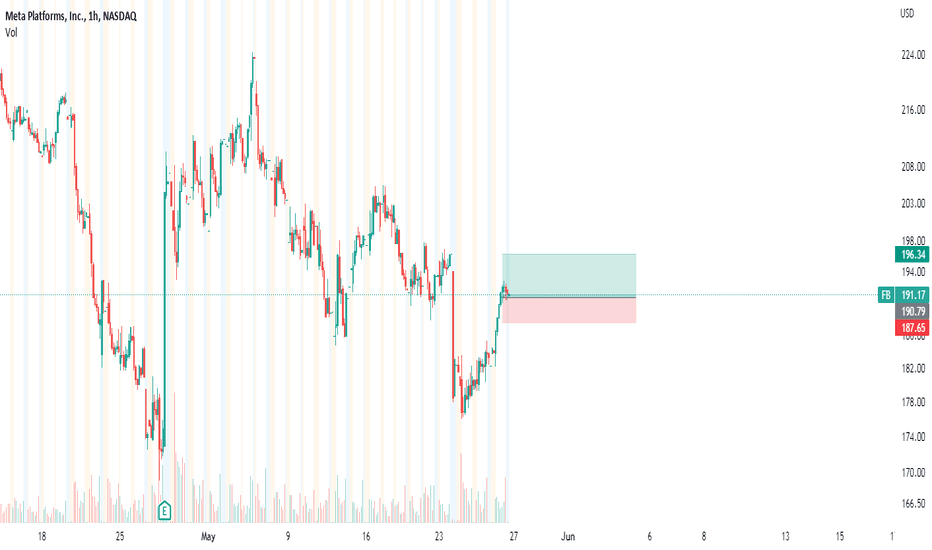

META - Long PositionA triangle formation, it is forming up at the 4 hour chart of Meta Stock, heading to 207 levels breaking above that level will lead to a first confirmation of an upcoming reversal pattern moving to next levels above.

Meta's symmetrical triangle$FB will soon change its ticker to $META. The stock formed a symmetrical triangle around its 8 and 21EMAs. A strong Day 1 candle coupled with higher than normal volume will resolve this recent pattern. In such a case, we expect $FB to get above $200 and reach its 50SMA around $204. For such a move, we need to see the $QQQ at the higher end of their recent channel or preferably above it. Watch the action in $FB as a gauge for overall sentiment in tech.

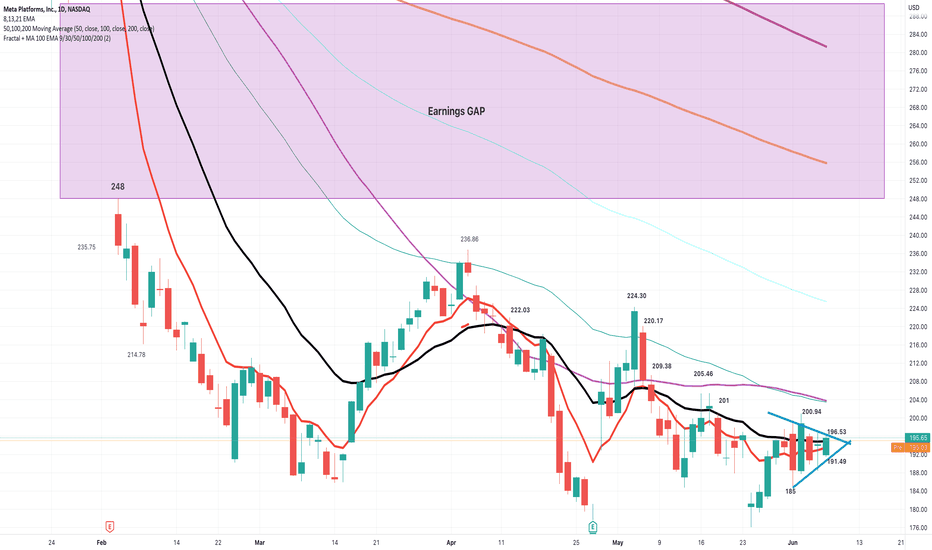

$FB Facebook METALook for dips to be bought in the 231-240 as long as $176 low holds.

FB has formed a daily demand zone in the $179-$185 region.

Below $176 and we most likely test and/or break $169 low and head towards $150-$159

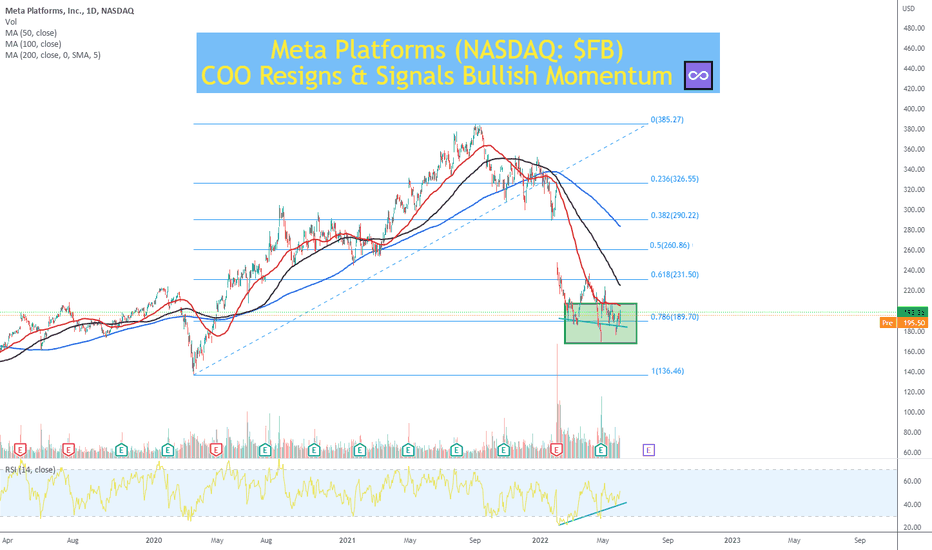

Meta Platforms (NASDAQ: $FB) COO Resigns & Signals Bullish Move!Meta Platforms, Inc. develops products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, wearables, and in-home devices worldwide. It operates in two segments, Family of Apps and Reality Labs. The Family of Apps segment's products include Facebook, which enables people to share, discover, and connect with interests; Instagram, a community for sharing photos, videos, and private messages, as well as feed, stories, reels, video, live, and shops; Messenger, a messaging application for people to connect with friends, family, groups, and businesses across platforms and devices through chat, audio and video calls, and rooms; and WhatsApp, a messaging application that is used by people and businesses to communicate and transact privately. The Reality Labs segment provides augmented and virtual reality related products comprising virtual reality hardware, software, and content that help people feel connected, anytime, and anywhere. The company was formerly known as Facebook, Inc. and changed its name to Meta Platforms, Inc. in October 2021. Meta Platforms, Inc. was incorporated in 2004 and is headquartered in Menlo Park, California.

long $FBnice long setup on facebook/meta. good r/r here. might try and wait to get a closer entry to the 100 day EMA. no real resistance for a while at this level. set a stop under monthly lows.

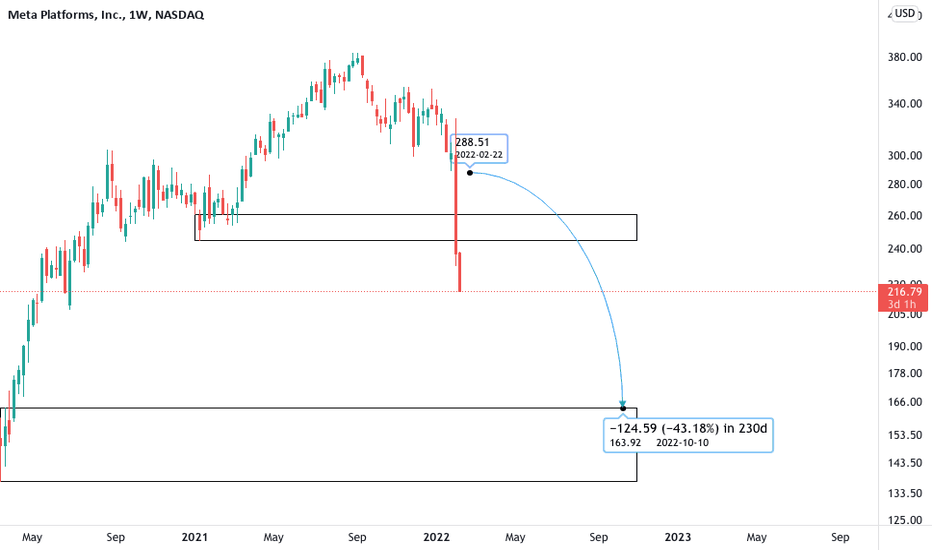

FB Meta COO Sheryl Sandberg is stepping down after 14 yearsIf you haven`t sold FB at $341:

Then you should know that Sheryl Sandberg is stepping down after 14-year tenure at Facebook as COO.

This is not good news in my opinion for what is about to come for FB in the years they are about to spend building the Metaverse.

My price target is $162.

Looking forward to read your opinion about it.

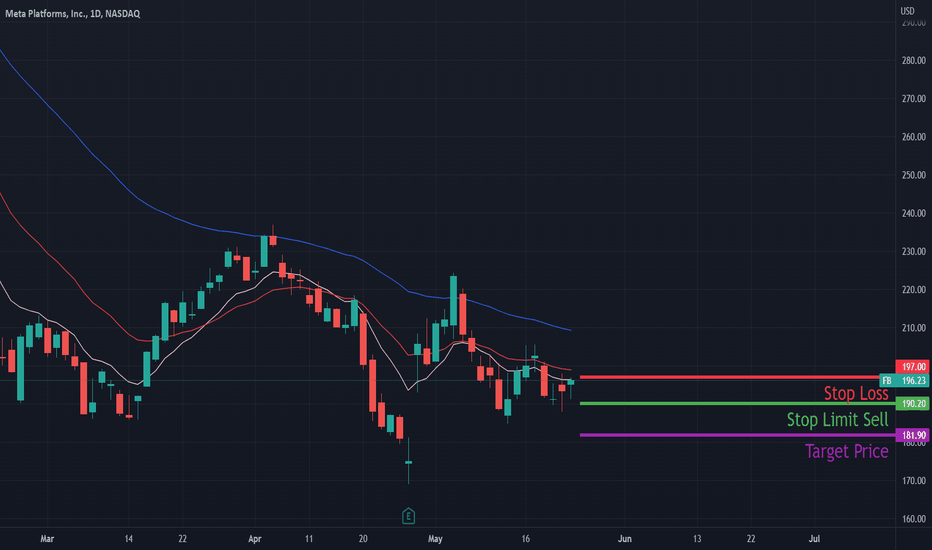

FB Trading PlanSell $205-218

Stop Loss $230-245

1st target $152-178

2nd target $123 or lower

Like and share

Would buy this lowerIf this drops more i would be willing to buy some. I think we might see a bear market rally and drop further. They actually make some money compared to a lot of spacs.

Meta Facebook Buy NowAccording to my chart analysis , Meta Facebook Show strong signal to buy , buy max as you can .

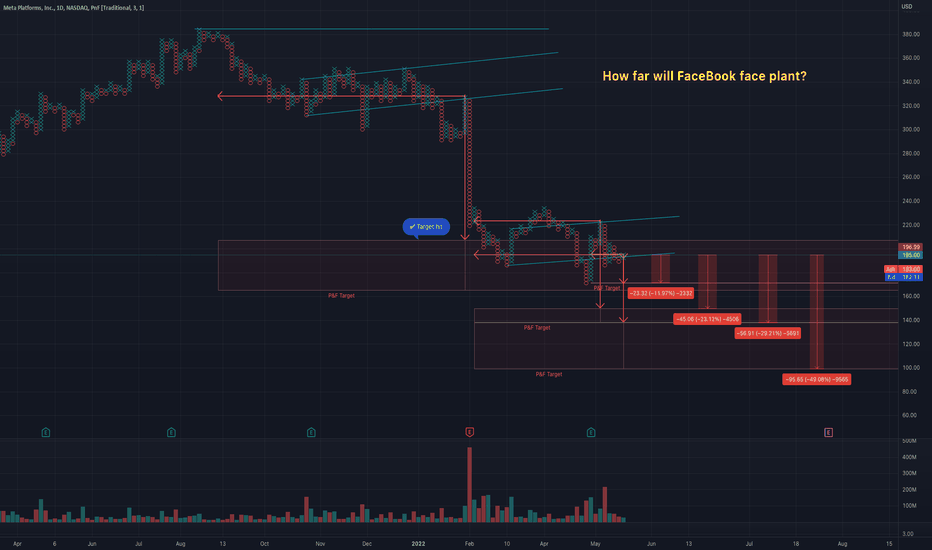

How far could FaceBook face plant? Down to the 2019 low.Firstly, a hat-tip to Wyckoff Analytics for identifying this Meta Platforms short as structural trade, comparing it to the structure of NFLX. Pure genius!

Today, that seems to be paying off with FB down as much as 9.36% in extended hours trading.

The above chart shows my analysis of possible targets using Wyckoff P&F charting method. You can see that the first target from the original apex distribution, which started in August 2021, has been met pretty perfectly by this current (prospective) re-distribution structure. The Wyckoff methodology has us look out for a trading range at the target, and that is exactly what we got.

That trading range is looking a lot like re-distribution, especially given the overnight price action. So, I have added some targets based on this re-distribution structure. Price is already in the zone of the most conservative target. That might mean that there is some consolidation here as a Major Sign of Weakness (MSOW). Two more aggressive counts are provided of 138-150, and 99-138. I will look at some "fine tuning" of these with intra-day counts later.

The structural analog targets around $115, which is the center of my most aggressive P&F count and targets the 2019 low. It's really powerful when two separate techniques confirm each other.

As always, we need to judge the market by its own actions. The analog and P&F counts could both fail, and we might find that the current structure is actually accumulation. So, keep on your toes, but I'm personally short FB and I'm not exiting yet.

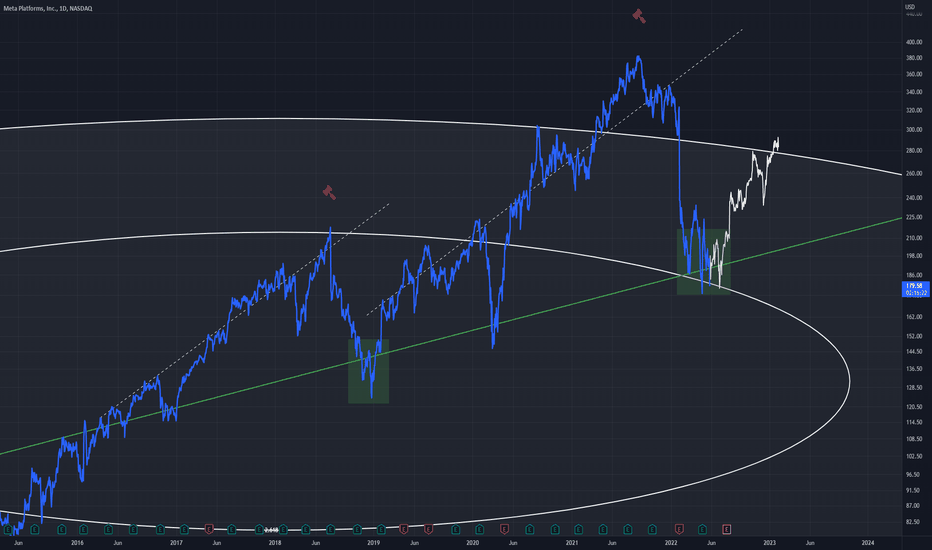

FB (Meta) - Recovery Along Trend Line Similarities can be seen between the first dotted upward trend leading to a rejection, and the second also leading to a rejection

Both retrace to the same uptrend

This is the daily chart, with the first rejection at 2.618 and the second at 4.618

Good buy potential on this daily timeframe

Meta Platforms, Inc. (FB) closer to our Buy areaIf you haven`t shorted FB at $340:

Then you should know that after the SNAP guidance warning, Facebook could face the same problem!

My first price target is $162.

Looking forward to read your opinion about it.

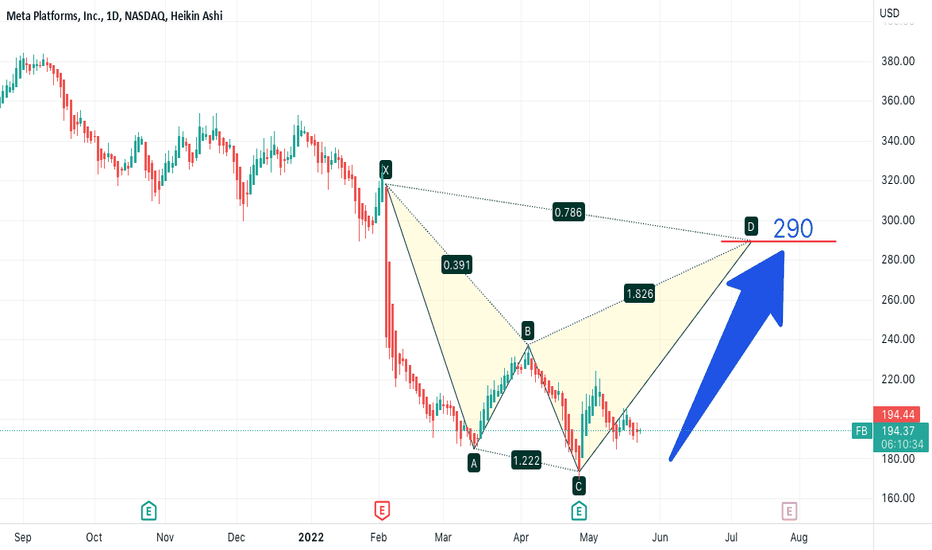

Facebook's stock will continue to riseThrough the wave analysis of the price action, the stock price is expected to reach $290.