Fcpodaily

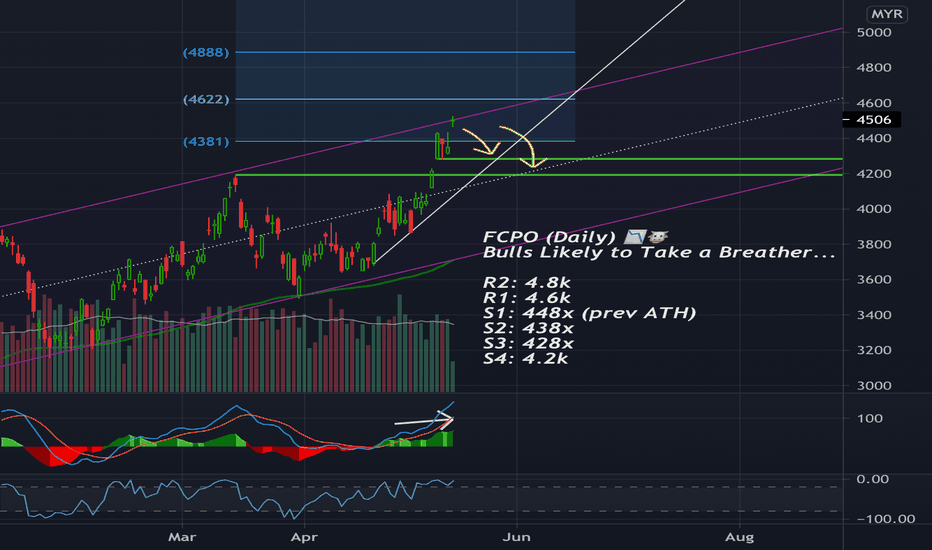

May17: FCPO (Daily) - Bulls Likely Take a Breather...🐮📉CPO: Weekly & Daily Up-Channel top reached last week. 🚀✅

Coupled with slight momentum weakness on Hourly, suggesting an overdue retracement might finally take place.

In case of continued bullish momentum, mainly driven by macro reasons, look to R1: ~4.6k, R2: ~4.8k

Else, price may find support at S1, prev ATH, or UTL1.

❇️April11 Long Call hit R1, next will be R2...

❇️Midterm Bull Cycle: Strong Breakout from R2 marked below from Sept2020...

Happy Hunting! Stay Safe! ⭐️

-JK-

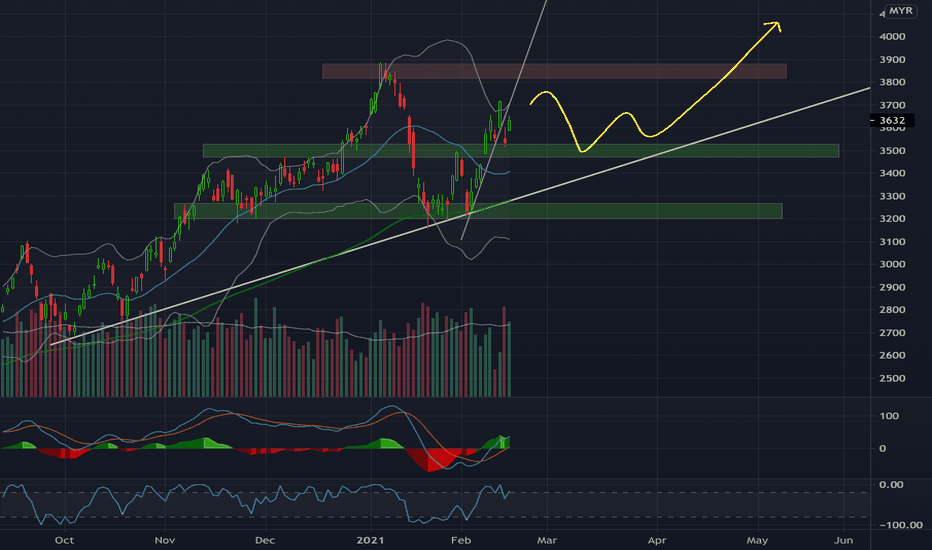

Feb18: FCPO (1D) - Sideways-Up btw 3.5-3.8k before breakout 📈🐮Sideways-Up bias before the eventual Longterm upside breakout to 4k & beyond, commodities are seeing across-the-board rise on hyper-inflationary risk, thanks to massive money printing.

CPO price bounced off major S @ ~3200, subsequently reach R1-R3 upside mentioned in previous post.

Expect further consolidation near wide range top (3500-3800) region, potential retest UTL, before the expected major breakout to 4k & beyond.

🔔Overhead Resistance: 3.6-3.7k, 3.8k

🔔Support Zone: 3.5k, 3.4k

❇️ All R reached on bounce off range low (check out post link below)

❇️❇️ Major Breakout in progress on Longterm chart, link below

Happy Hunting! 🥂🚀

-jk-

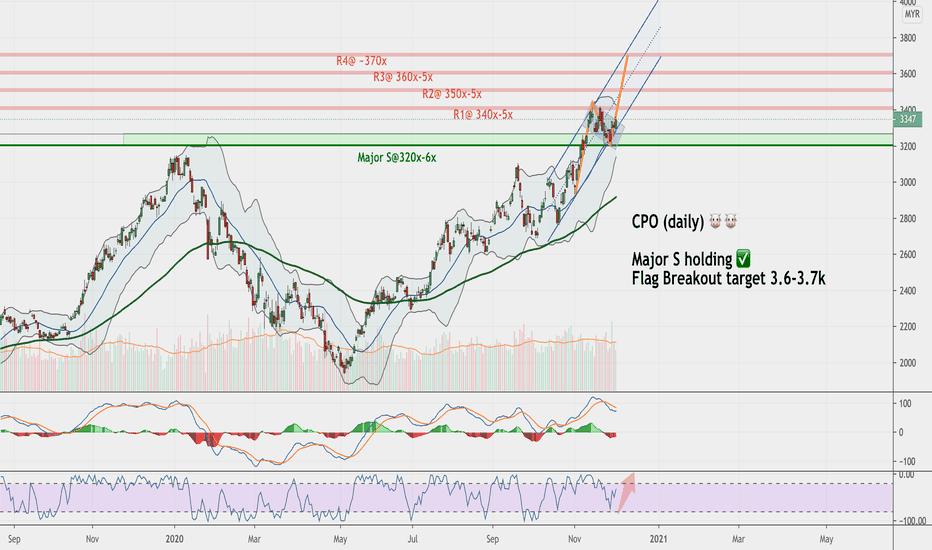

Dec02: FCPO (1D) - Bullish Flag Target Pointing to 3.6-3.7k 🐮CPO price consolidated past 1-2weeks, forming a nice launchpad towards higher price levels -- Bullish Flag pattern. 🚀🚀

Price still running in a mid-term up-channel, with an upside target zone: 3.5-3.6k & 3.7k ; similar to which suggested by the flag.

🔔 Overhead Resistance: 3.4k, 3.5k, 3.6k, 3.7-3.8k

❇️Prev idea still largely intact, only now with added bullishness from potential flag formation.

❇️❇️Longterm Outlook: R1 standing, Heading to R2

In long position for cpo, likely to be my closing trade for yr2020 local futures~ 😎⭐️

Happy Hunting! 🥂🚀

-jk-