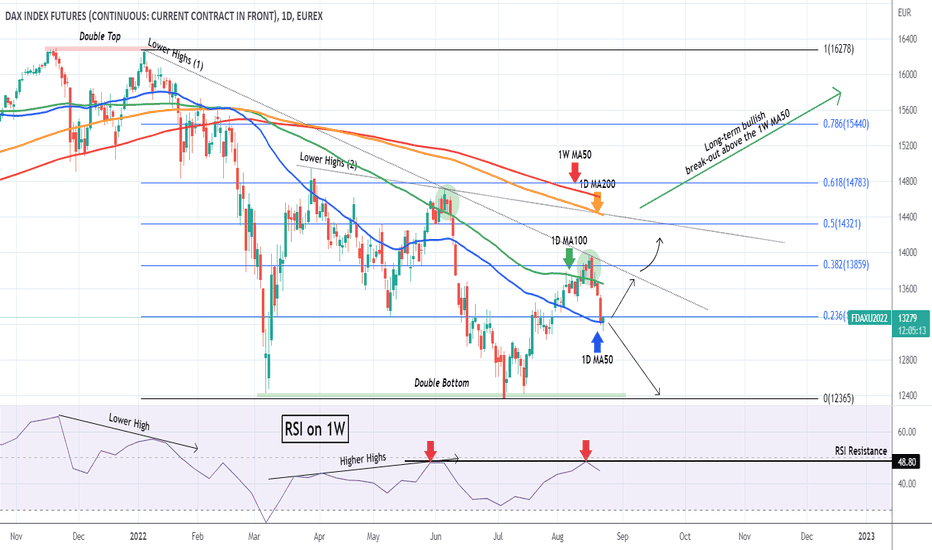

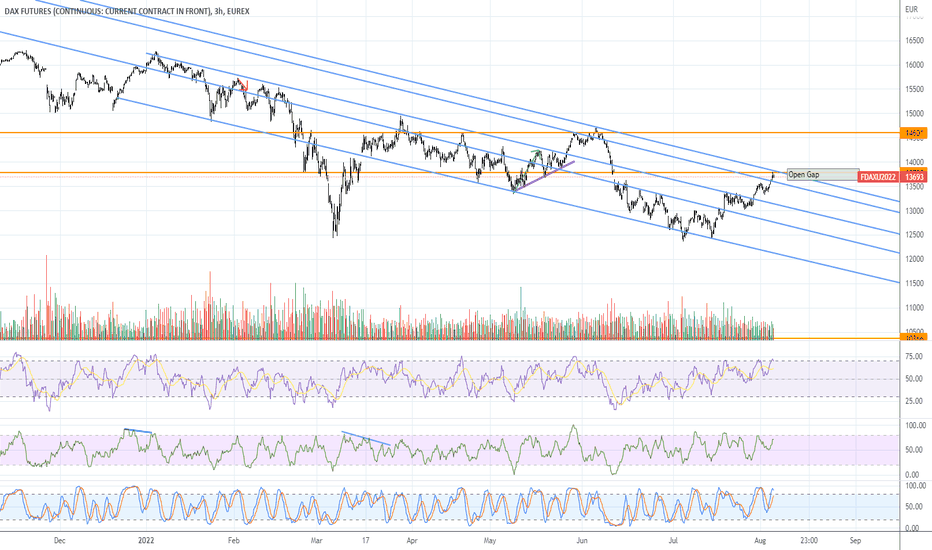

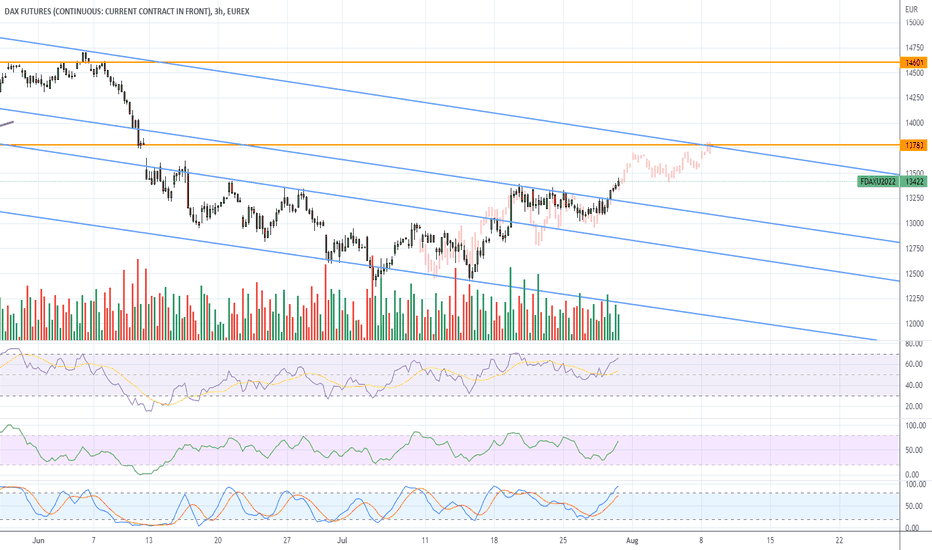

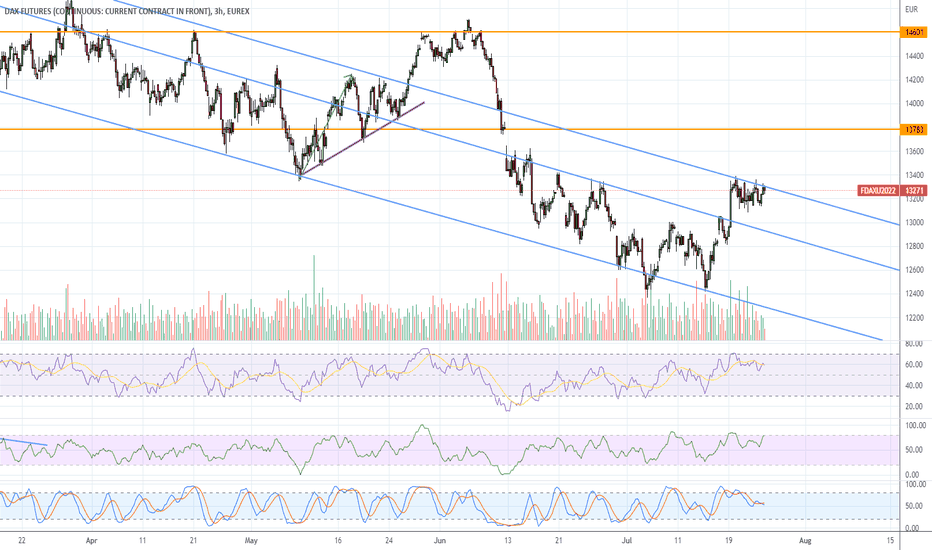

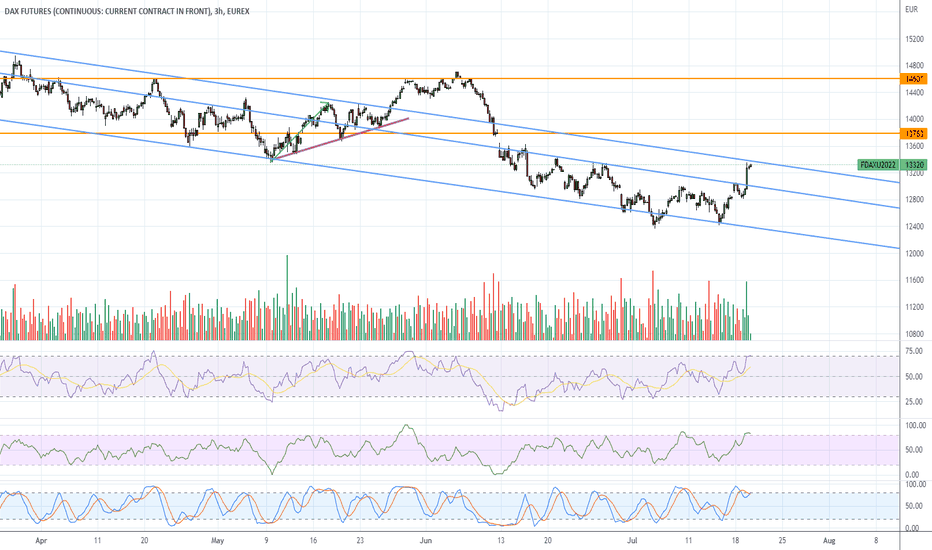

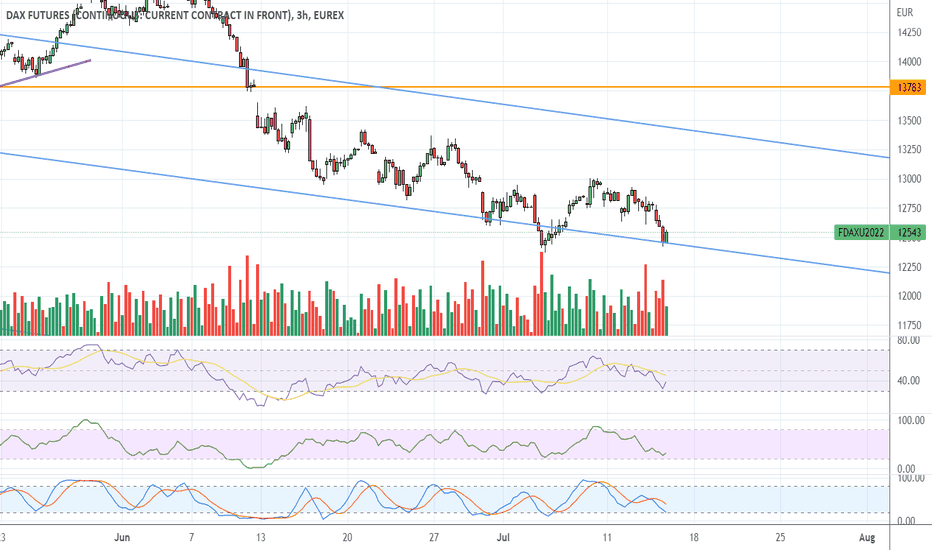

DAX testing its first Support, the 1D MA50The German Stock Index (DAX) got emphatically rejected on its January Lower Highs trend-line, as we anticipated with our previous analysis two weeks ago:

The price broke below the 1D MA100 (green trend-line) and hit the 1D MA50 (blue trend-line), which is the first line of Support. As long as it closes above it, chances are that we will rise and re-test the Lower Highs (1) trend-line. A close below though, calls for a sell extension towards the 12400 Support, currently a Double Bottom.

Notice how the RSI on the 1W time-frame got rejected exactly on the 48.80 Resistance, which was where the June 06 High was made. That matches the Lower Highs as well. A break above this Resistance, would be an additional factor indicating that the long-term trend may be shifting from bearish back to bullish.

Technically, only a break above the 1D MA200 (orange trend-line)/ 1W MA50 (red trend-line) Resistance cluster, constitutes a long-term bullish break-out.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

FDAX1!

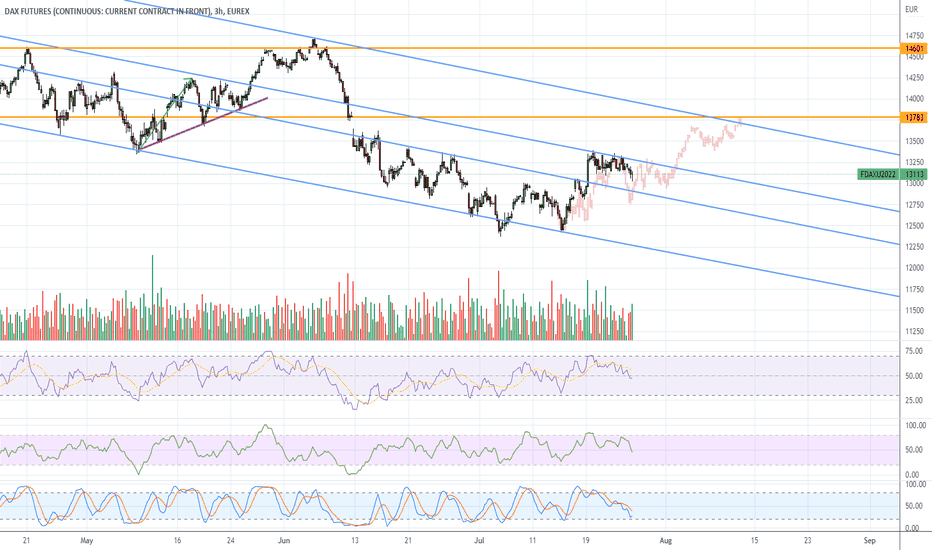

LOVELY BUY ON THE DAX!Don't be scared to take advantage of this lovely buy opportunity on the DAX.

take a buy now with TP at 13941.

Thank me later!

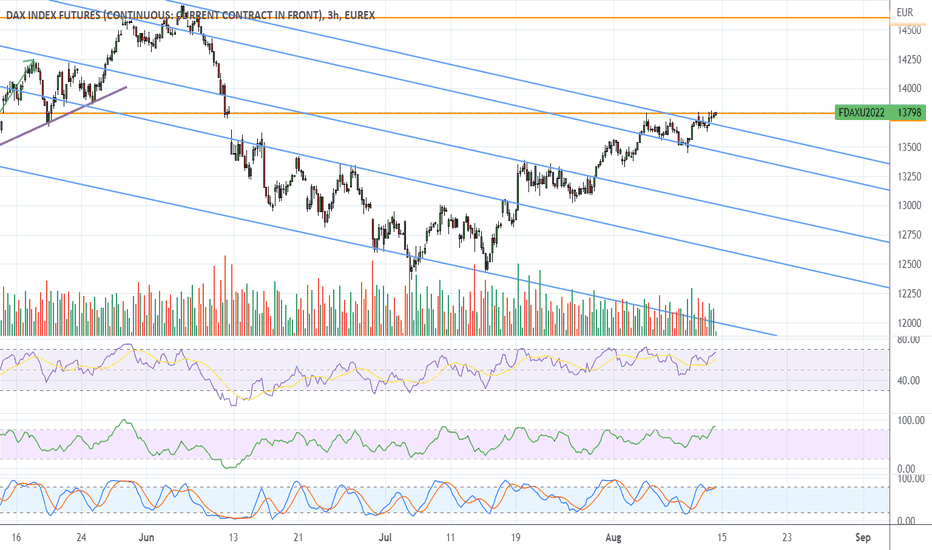

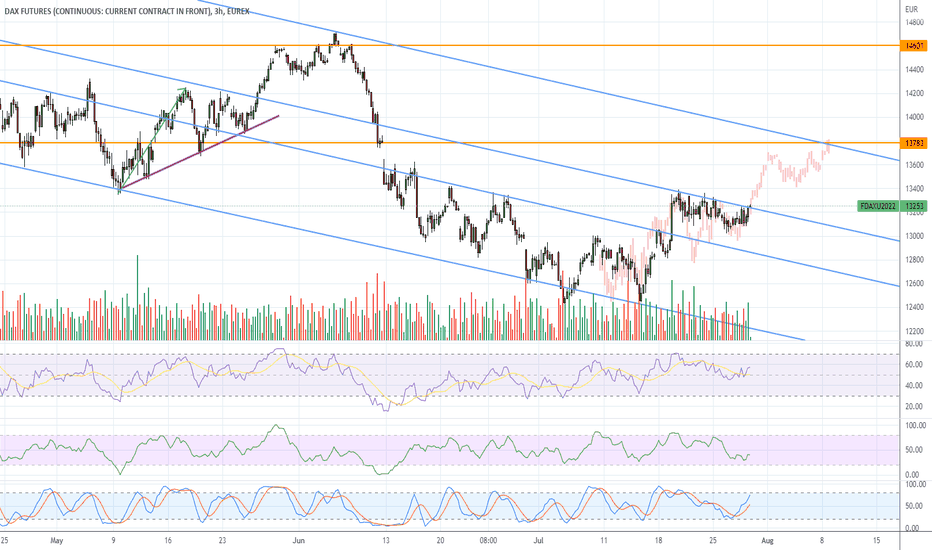

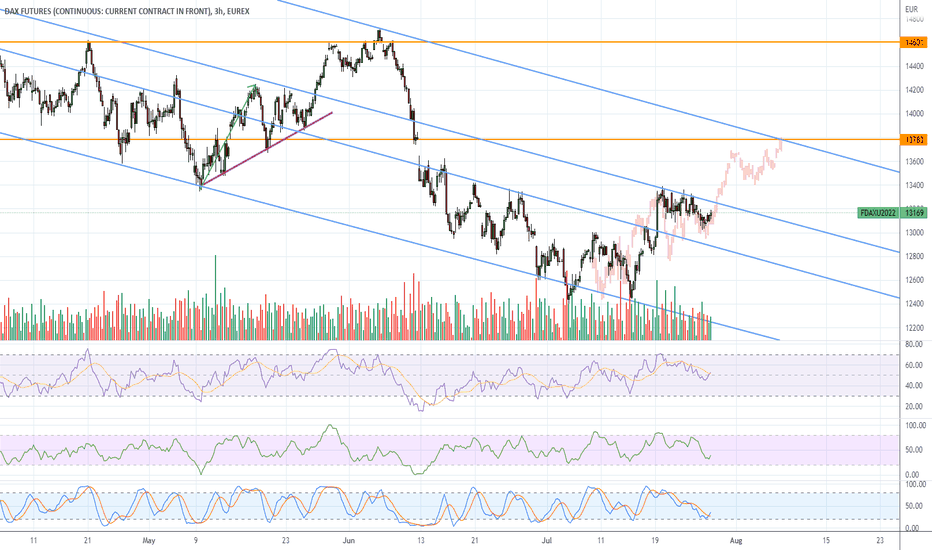

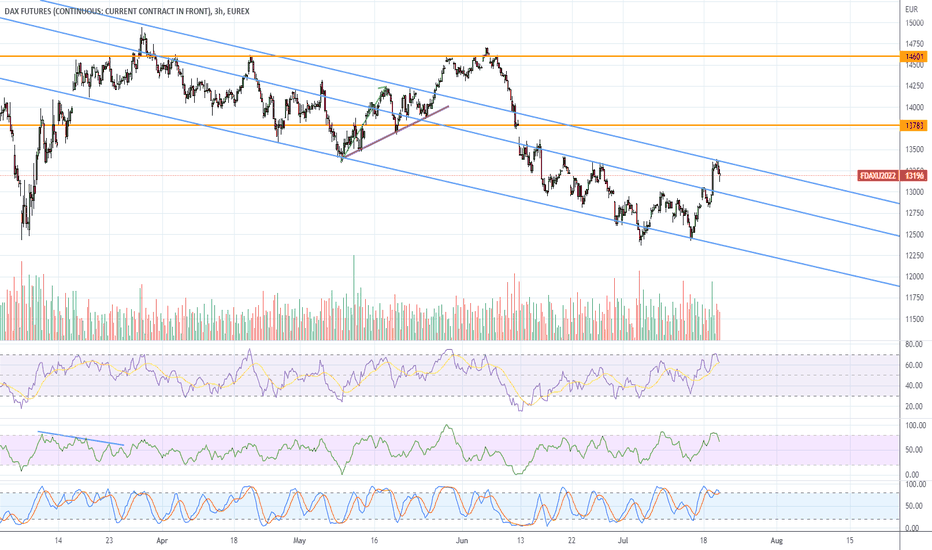

DAX broke above the 1D MA100. Important Lower High test.The German Index DAX (FDAX) is attempting today a 1D candle closing above the 1D MA100 (green trend-line) and if successful it will be the first since June 07. Despite the bullish short-term action, this is not the time to double down on buying as the January 05 Lower Highs trend-line (1) is right above, providing Resistance. On top of that, the 0.382 Fibonacci retracement level is at 13855.

Only a break above the LH (1) can justify further buying, targeting the 1D MA200 (orange trend-line) and the 0.5 Fib. Until then, it is likely to see a rejection and short-term pull-back to test the 1D MA50 (blue trend-line) as Support. Note that if the index breaks above the 1W MA50 (red trend-line), we can claim that the trend will turn bullish on the long-term.

A strong sign that we may be turning bullish on the long-term is the fact that the RSI on the 1W time-frame is on Higher Highs since March 21 with the price rebounding after the Double Bottom. We saw the exact opposite formations right before the 2022 correction started. Price formed a Double Top while the 1W RSI was on Lower Highs.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

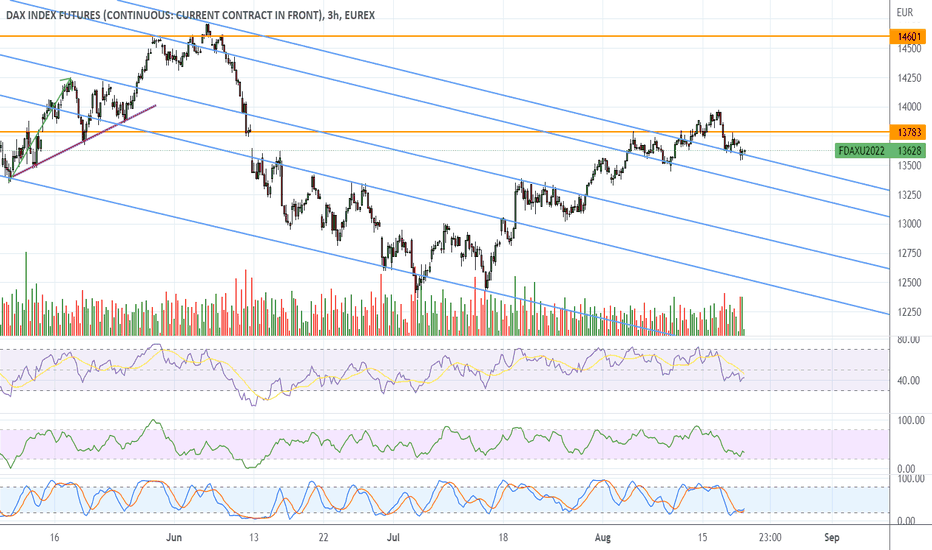

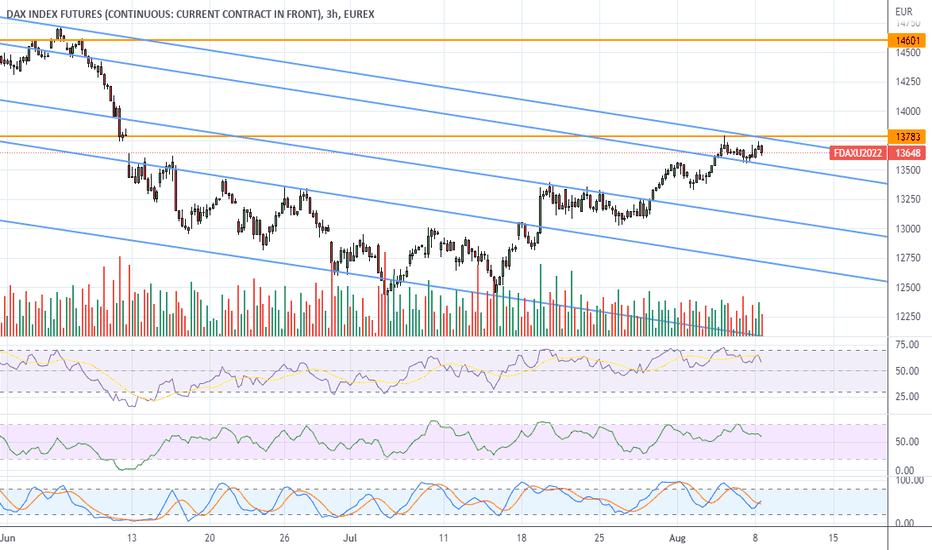

FDAX UpdateAlong with the US market, EUropean market also reversed this morning.

Potential for a gap down tomorrow, especially if the US market finishes red. CPI Wed, and there's really no compelling reason for Europe to rally considering they will go into a recession by winter. I hope they like cold showers in the winter, they've got no natural gas....

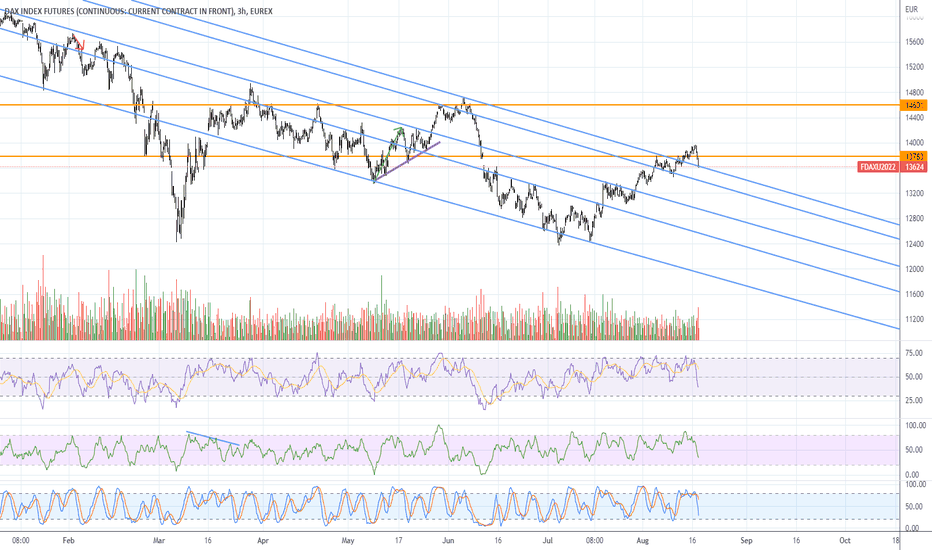

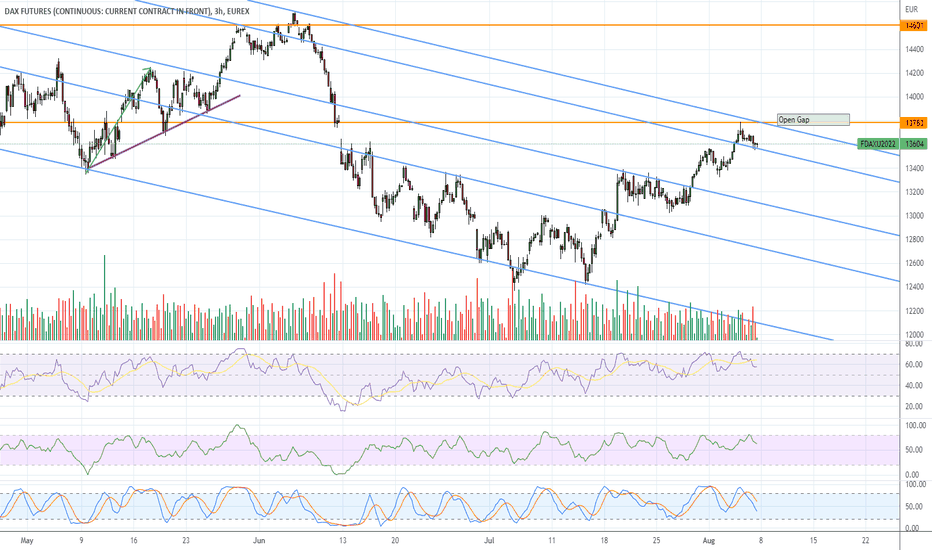

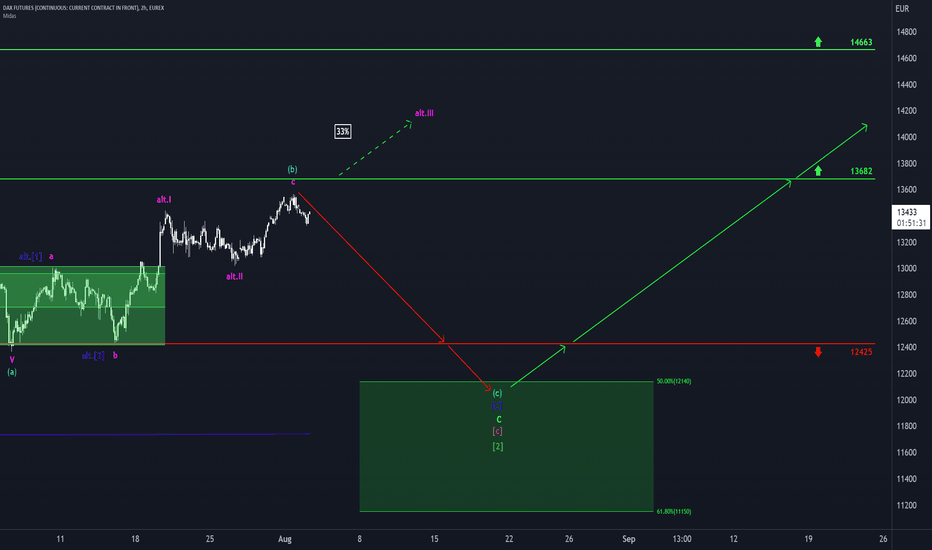

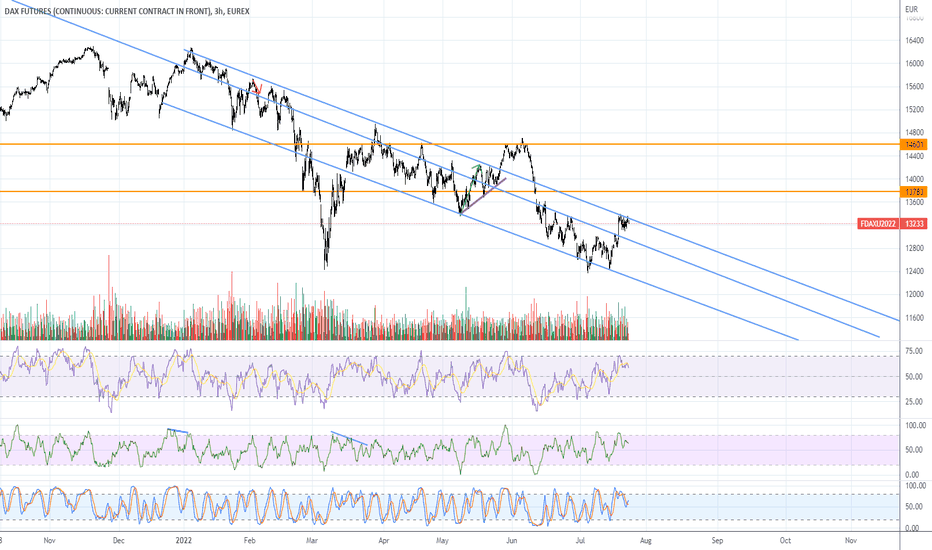

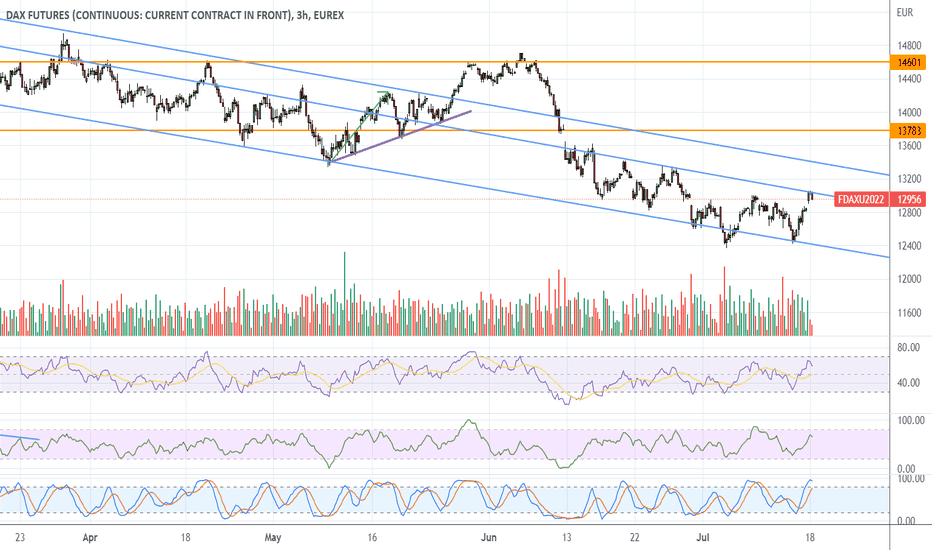

DAX: Deep BreathDAX should draw a deep breath because it has quite the way downwards coming up. We expect the index to head for the support at 12425 points, crossing it to dive into the green zone between 12140 and 11150 points, where it should finish wave 2 in green. Afterwards, DAX should take off again, climbing not only back above 12425 points but also above the resistance at 13682 points. There remains a 33% chance, though, that the index could surmount the resistance at 13682 points earlier already.

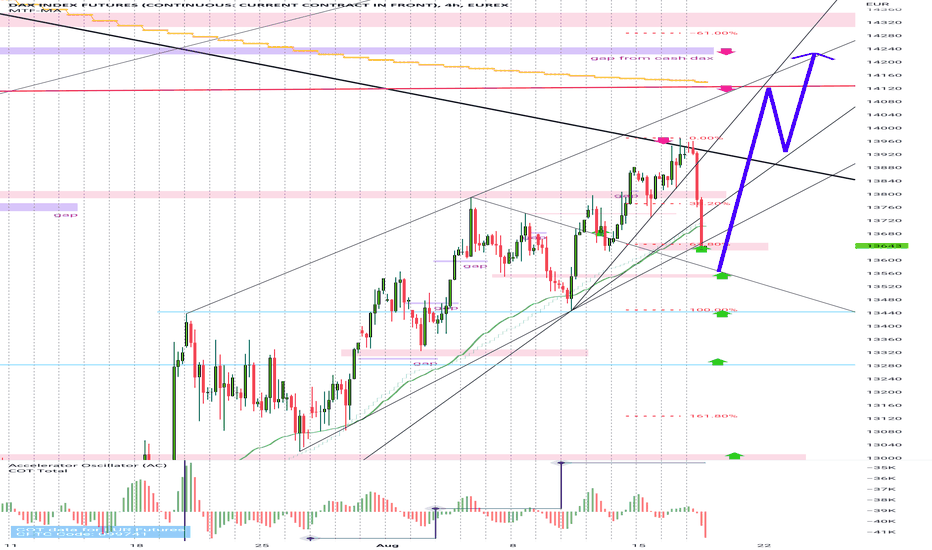

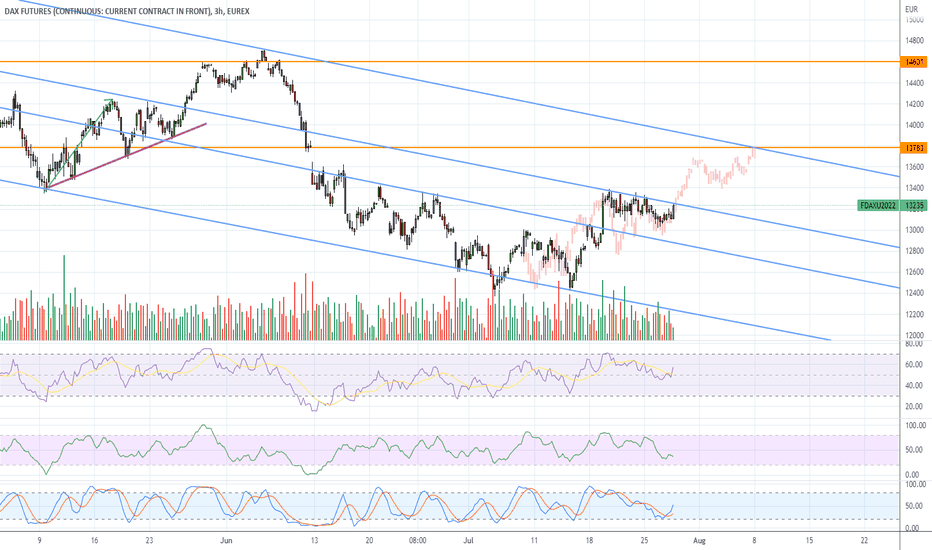

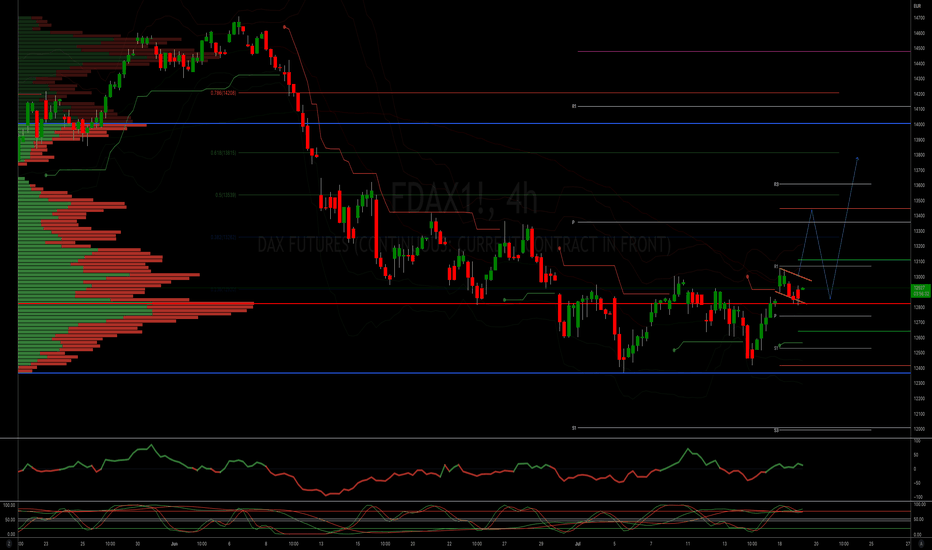

FDAX Bull ScenarioQuite frankly I'm bearish on Europe fundamentals but the market has sown strength even while US tech stocks tank. We haven;t seen a huge gap down because Europe wants to go up.

Anyways, plotted the bull scenario. The bear scenario is obviously a tank, lol. For whatever reason, having no natural gas is bullish for them? LOL.