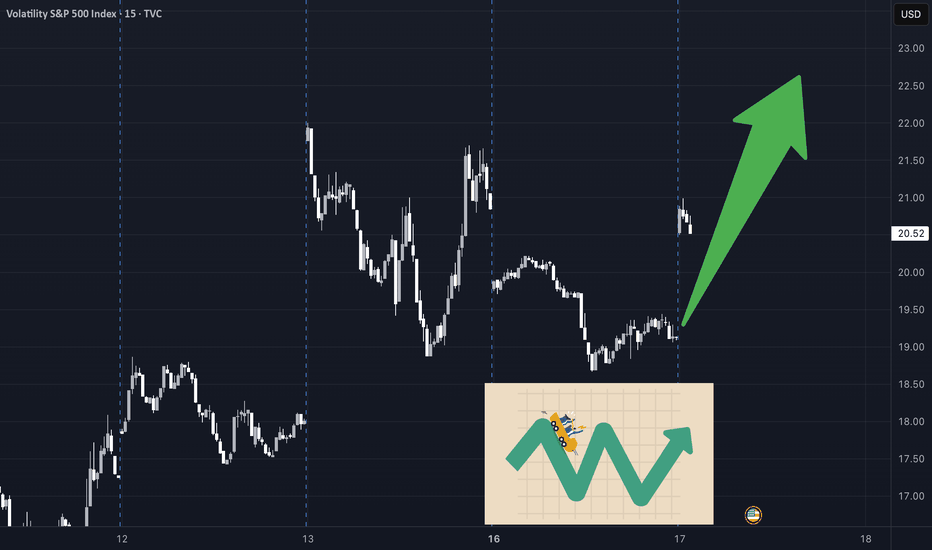

VIX Trade Plan – May 23, 2025⚠️ VIX Trade Plan – May 23, 2025

📊 Instrument: VIX (Volatility Index)

🎯 Strategy: Long Exposure via Direct Shares

📈 Confidence: 70%

📅 Time Horizon: 3–4 Weeks

📌 Technical & Sentiment Snapshot

Price @ Entry: $21.88

Chart Structure:

• M30 / Daily: Bullish – above 10/50/200 EMAs

• Weekly: Mixed, but showing upward bias

• RSI: Neutral to slightly overbought

• MACD: Bullish cross on intraday; flattening on higher timeframes

Volatility Context:

• VIX up +26.9% over 5 days

• Backwardation in VIX futures

• Elevated VIX/VVIX ratio hints at further fear pricing

Headline Risk:

• Geopolitical + macroeconomic uncertainty

• Trade war tensions and surprise policy risk driving implied vol

🔽 TRADE RECOMMENDATION

Parameter Value

🔀 Direction LONG

💵 Entry Price $21.88

🛑 Stop Loss $20.14 (–8%)

🎯 Target Price $25.62 (+17%)

🧮 Size 100 shares

🏦 Risk Level ~1.5% of account

⏰ Entry Timing Market Open

📆 Hold Time 3–4 weeks

🧠 Rationale Behind the Trade

All 5 models agree on a moderately bullish short- to mid-term trend in VIX.

Momentum is supported by:

Rising geopolitical risks

Backwardated futures curve

Technical setups across intraday/daily charts

Entry point near $21.88 gives strong R/R if VIX spikes toward $25–$27 range.

⚠️ Key Risks to Watch

VIX Mean Reversion: VIX tends to drop quickly if risk subsides.

Overbought Intraday: May cause short-term pullbacks even in a bullish context.

Headline Dependency: Any peace deal, central bank surprise, or good news may instantly crush implied vol.

Liquidity Spreads: Use limit orders on open — VIX ETPs (e.g., VXX, UVXY) can see wide bid/ask gaps.

🧾 TRADE_DETAILS (JSON)

json

Copy

Edit

{

"instrument": "VIX",

"direction": "long",

"entry_price": 21.88,

"stop_loss": 20.14,

"take_profit": 25.62,

"size": 100,

"confidence": 0.70,

"entry_timing": "open"

}

💡 If VIX holds above $21.50 with momentum, this setup offers asymmetric upside. Stop placement near $20.14 helps protect against false breakouts or mean reversion traps.

Fears

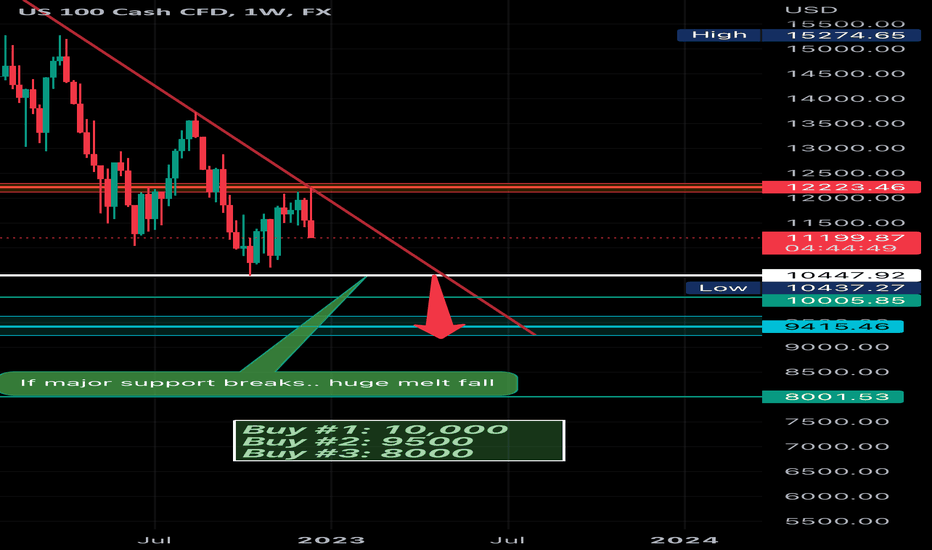

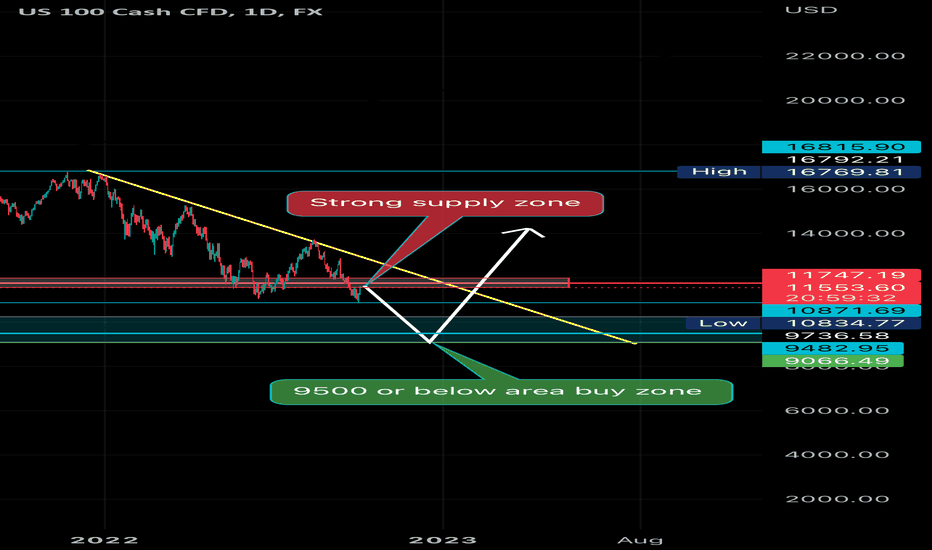

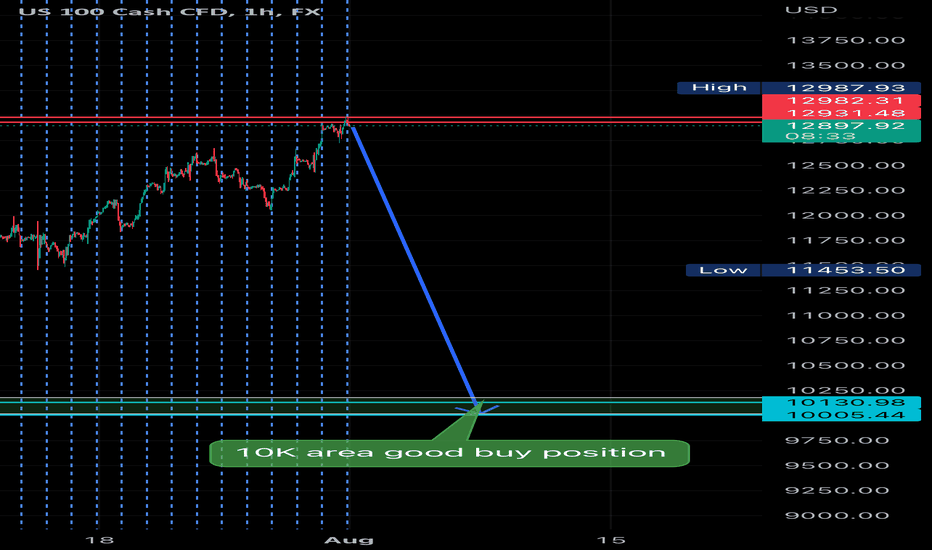

How low NASDAX will go.. RECESSION 2023I hope everyone watches the Feds decision on December 15th morning and Federal Powell speech at 2:30pm. Yes it’s pretty bad.. so at Europe the economy are slowing down and USA economy are slowing down as well.. even though everyone is spending less to avoid the highest expenses.

The Feds will continue to fight against the inflation because it hasn’t reached their goals 2% ..it will be awhile and very far to go. In 15 years in continuing highest rate of all time taking Target between %4.25 & 4.5%, Along with the increase came an indication that officials expect to keep rates higher through next year, with no reductions until 2024.

Yup you know this everyone .. severe Recession is really coming….

For NASDAQ I am keeping my only eye over than US30 because we all know US30 will bottom around 24000 area or lower as we might see.. for NAS buy zone should be at 10K, 9500 or worse about 8000.. big feeling 8000 or 9500 could be the bottom forming for NAS because of the Feds decision because now everything is still going to be expensive. If you still have loans , credit cards or something be sure to pay them off before we be getting a massive hit start into a recession as fears are coming into a close into it.

Hope y’all have a good day .. save lots of money as possible.. invest of your average money .. don’t go all in until we are bottom.

How far nas will go and US30 ? What are your analysis.

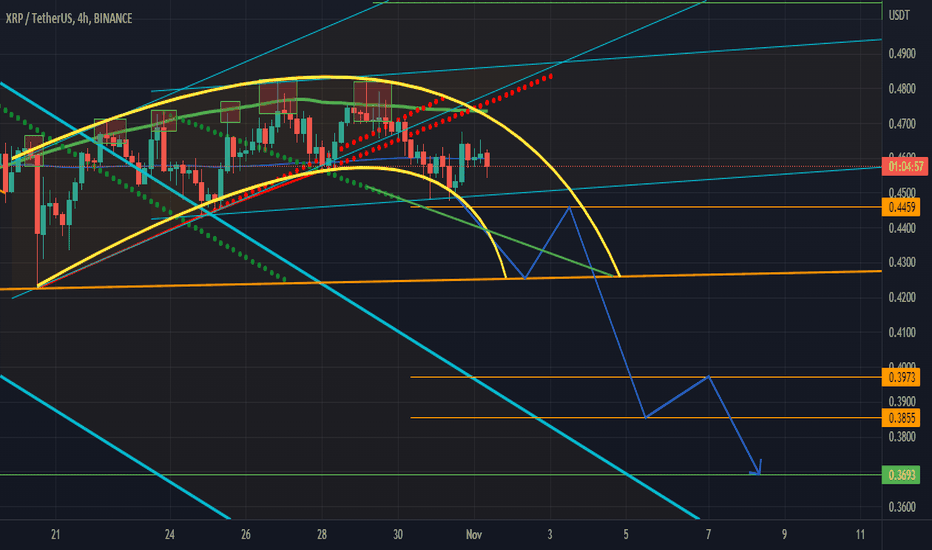

XRP in the short term 2022We are seeing a lot of pressure in conventional markets along with commodity markets with all the inflation and recession numbers involved. With FED moving forward with strong interest rate hikes well into 2023 I can see serious pressure on the XRP price given that there is still no settlement for 2022 or the end of the case until 2023. Fibonacci levels all the way down to $0.3693 and using curves to see the possible path for the XRP price in the short term. If these price points become reality it will become beautiful opportunities for cost averaging and taking advantage of low entry points.

Relief rally isn’t enough for bulls to take over The relief rally of the Feds sends shortage buy and we are not bullish yet.. this isn’t enough for a longterm.

The Feds will go aggressive still against the inflation and we are in a Recession and the CEO’s all over the globe said “ we need to prepare the recession “ this will be worse recession since back in 2007.

As in the recession will go full effect in a start of 2023. Even though the whole market will take the massive hit

Sell high pressure/Recession fearsAs we all know about everyone is talking about the recession.

Looking forward NAS&US30 forward a big drop of a crash.. the economy is slowing down and recession still hold above 40 year all time high. Which means we are already and had been in the recession.

Biden and the White House declined twice and economic isn’t going well. Monkeypox global emergency declared as well and spread all over the globe faster rapidly.

Nas should be heading down 10K

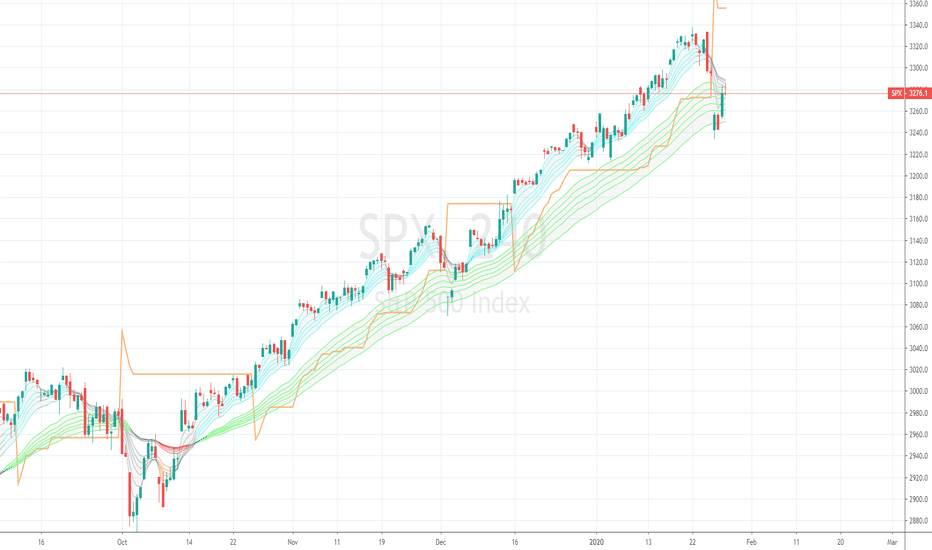

When the S&P500 catches the fluIn this screencast I look at the S&P500 on the 4H time frame only. I show how I estimate the probable direction (this does not mean prediction).

I give some information on why the markets are reacting to a low grade coronavirus called 2019-nCOV (same family as MERS and SARS).

Disclaimer: This is not trading advice. If you make decisions based on this screencast and lose your money, kindly sue yourself.

World Inflation is back. Buy stocks, EUR, OIL and XAU. Sell USDThe Age of deleveraging has come to an end. It is again inflation time now. USDollar uptrend has ended on 18th of March 2015, so does the deflation cycle in the world economy. I adjust my prognosis bases on the latest data in google trends about lower high in the word "deflation", "Dollar collapse" fears turning back on track and rising of yields on government bonds and the increase of money velocity according to shadow stats. It is inflation time again now folks. Similar to what it was 2002-2008. Act accordingly. Stocks has never been able to make a good downward correction during the period of deflation (2008-2015). I think they will not ever do a correction. The correction in stocks was actually a slower uptrend :) Capital has been pouring into the US as a result of rising dollar and stocks simultaneously. Stocks uptrend willl not reverse, even the opposite, Only the USdollar will start to fall. The upward momentum in stocks price is not completed and is about to brake a long-term resistance level shooting up S&P500 high above 1400 even 1500 points.