NZDUSD: Potential for Slight Bullish Bias Amid Key Fundamental !NZDUSD: Potential for Slight Bullish Bias Amid Key Fundamental Drivers (25/10/2024)

Today, the NZDUSD currency pair shows potential for a slight bullish bias, influenced by a blend of fundamental factors and evolving market conditions. Let's dive into the primary drivers impacting the New Zealand Dollar to US Dollar (NZDUSD) pair today and assess whether the bullish sentiment could hold.

1. New Zealand's Economic Data and RBNZ Stance

The Reserve Bank of New Zealand (RBNZ) has maintained a balanced tone on interest rates amid recent economic data. Despite slower-than-expected growth figures, the New Zealand economy demonstrates resilience in key sectors like exports and services, which might provide support for the NZD. Market expectations for RBNZ’s neutral-to-hawkish stance add a slight bullish outlook for the NZD, as investors anticipate steady policy moves that avoid aggressive tightening while also signaling confidence in the economy’s fundamentals.

2. US Dollar Moderation Amid Potential Fed Pause

The US Dollar Index (DXY) has shown signs of consolidation as Federal Reserve officials continue to weigh the potential for a pause in rate hikes. Recently, the USD’s bullish momentum has softened, with investors focusing on US inflation data that suggests a gradual cooling, potentially easing pressure on the Fed to maintain a tight monetary policy stance. This development could limit the USD’s strength, lending support to a slight upside for NZDUSD as investors look for alternative assets.

3. China’s Economic Resilience and Impact on NZD

China, as New Zealand's primary trading partner, influences the NZD through commodity prices and trade flows. Recent signs of resilience in China’s economy, particularly in industrial production and retail sales, may boost market sentiment for currencies like the NZD, as stronger demand for New Zealand’s exports could improve trade dynamics. This positive external factor indirectly supports the NZD, making NZDUSD slightly more appealing in today’s trading landscape.

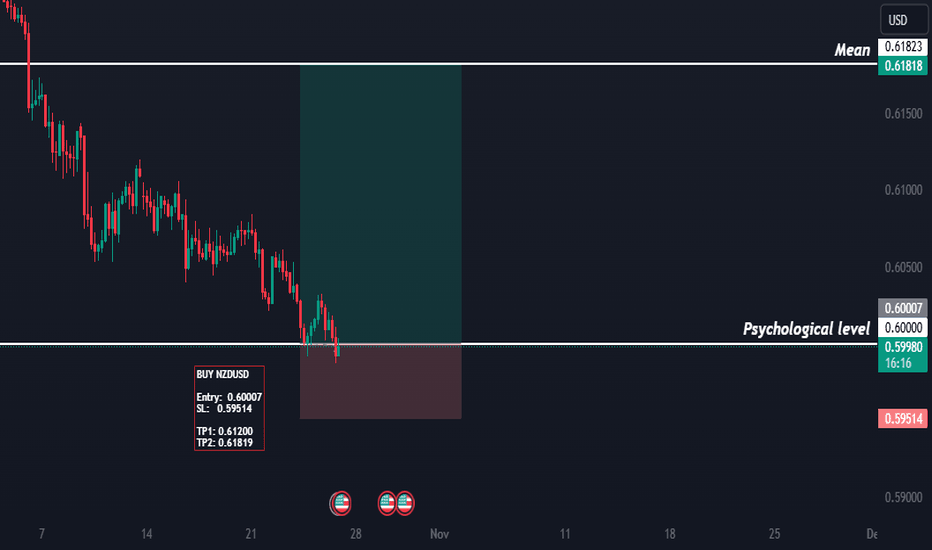

4. Technical Levels and Market Sentiment for NZDUSD

On the technical analysis front, NZDUSD has shown support near the 0.5850 level, with a potential resistance zone around 0.5950. Should the pair break above the 0.5900 mark, we could see momentum strengthening, bolstered by the factors discussed. RSI indicators are also neutral, suggesting room for upward movement without immediate overbought concerns. A slight bullish bias may prevail, provided these technical and sentiment indicators remain supportive.

Summary: Slight Bullish Bias for NZDUSD

In summary, NZDUSD could hold a slight bullish bias today, with influences from New Zealand’s resilient economy, a softer USD, and supportive technical indicators. Traders might find opportunities if bullish momentum strengthens, keeping an eye on US Dollar trends, RBNZ announcements, and China's economic performance for additional cues.

Keywords:

1. NZDUSD forecast

2. New Zealand Dollar analysis

3. US Dollar impact

4. RBNZ policy stance

5. NZDUSD technical levels

6. Forex trading insights

7. Federal Reserve impact

8. China economy influence

9. NZDUSD bullish bias

Federalreserveimpact

A Slightly Bearish Bias Anticipated Today 01/10/2024 on EURUSD.EURUSD Analysis for 01/10/2024: A Slightly Bearish Bias Anticipated

As we step into the month of October, EURUSD continues to exhibit a slightly bearish bias, influenced by the ongoing fundamental factors and current market conditions. In this article, we will explore key drivers behind this sentiment, giving you the insights needed to navigate today’s forex market.

Key Drivers Behind EURUSD Bearish Bias

1. Diverging Central Bank Policies

One of the primary factors weighing on EURUSD is the diverging monetary policies between the European Central Bank (ECB) and the Federal Reserve (Fed). The ECB has recently indicated a more dovish tone, signaling that it may hold off on further rate hikes in the coming months due to slowing economic growth in the Eurozone. In contrast, the Fed’s hawkish stance on inflation continues to support the U.S. dollar, pressuring the euro lower.

2. Eurozone Economic Weakness

The Eurozone economy remains fragile, with disappointing data releases pointing to continued weakness. Recent Manufacturing PMI data came in below expectations, indicating a contraction in industrial activity. This slowdown is particularly concerning as the region faces challenges from rising energy prices and geopolitical tensions, which are hurting consumer and business confidence. As these factors persist, EURUSD is likely to struggle to find upside momentum.

3. U.S. Economic Resilience

On the other hand, the U.S. economy remains resilient, supported by strong labor market data and steady consumer spending. The Fed’s commitment to keeping inflation in check further strengthens the U.S. dollar, adding pressure on EURUSD. As long as the U.S. economy continues to outperform the Eurozone, we expect this currency pair to maintain its bearish bias.

4. Interest Rate Differentials

The widening interest rate differentials between the U.S. and Eurozone play a significant role in driving the bearish outlook for EURUSD. Higher U.S. bond yields are attracting global investors, further boosting demand for the dollar. This interest rate disparity is likely to keep EURUSD on a downward trajectory, especially if the Fed remains committed to its inflation control measures.

5. Geopolitical Concerns in Europe

Geopolitical uncertainty in Europe, particularly the ongoing conflict in Ukraine, continues to weigh heavily on the euro. The instability in the region, coupled with the energy crisis affecting major economies like Germany and France, has heightened concerns about the Eurozone’s economic outlook. These geopolitical factors create an unfavorable environment for the euro, contributing to EURUSD's bearish bias.

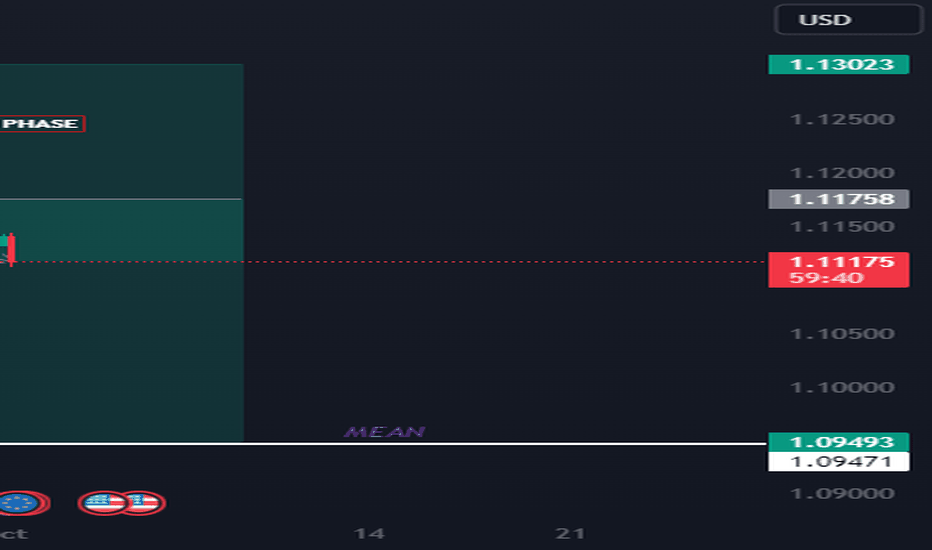

Technical Outlook

From a technical perspective, EURUSD is hovering near key support levels, with the 1.0600 area being a critical zone to watch. A break below this level could signal further downside pressure, pushing the pair towards 1.0500. Short-term resistance is seen around 1.0700, and any rally is likely to be capped unless there is a significant shift in fundamental drivers.

Conclusion: EURUSD Bearish Sentiment Likely to Persist

In summary, EURUSD is expected to maintain a slightly bearish bias today, driven by the combination of weak Eurozone economic data, diverging monetary policies, and a strong U.S. dollar. Traders should remain cautious as the pair tests key support levels, with potential downside risks still looming. For those looking to trade this pair, it’s important to keep an eye on U.S. and Eurozone data releases as they may offer further insight into market sentiment.

Keywords for SEO:

EURUSD analysis, bearish bias, Euro to USD forecast, forex trading EURUSD, EURUSD technical outlook, central bank policies, Eurozone economy, Federal Reserve impact, U.S. dollar strength, EURUSD key levels, EURUSD trend today.