USD/JPY Analysis for October 28, 2024: Bearish Bias Amid Rate !Introduction

The USD/JPY pair faces a potential bearish bias today, October 28, 2024, as market sentiment and fundamental factors weigh on the US Dollar. Below is a detailed analysis of the USD/JPY currency pair, highlighting key economic data, monetary policy signals, and global risk appetite, all of which suggest a downward tilt in USD/JPY for the day.

Key Drivers of Bearish Bias in USD/JPY

1. Federal Reserve Policy Outlook

- Recent Federal Reserve commentary has created a dovish outlook, signaling a likely pause in interest rate hikes. This expectation comes amid signs of slowing US economic momentum, specifically within the labor market and consumer spending.

- Market participants are increasingly factoring in lower yields on US Treasury bonds, reducing the demand for the USD as investors seek higher returns elsewhere. A weaker dollar directly impacts USD/JPY, pressuring it downward as Japanese yen demand remains steady.

2. Japanese Yen as a Safe-Haven

- The Japanese yen, traditionally viewed as a safe-haven currency, often appreciates during times of economic uncertainty or lower US Dollar strength. Current global geopolitical concerns and risk aversion have pushed some investors back into the yen, enhancing its value against a softening USD.

- Additionally, with Japan's recent stability in inflation and the Bank of Japan’s commitment to policy balance, the JPY could see support as the yen maintains strength, despite the BoJ’s dovish stance in recent years.

3. US Economic Data Weakness

- Last week, softer-than-expected data in the US labor market and consumer confidence metrics suggested a slowing economy. With potential headwinds in these key areas, investors may be viewing USD as overvalued at current levels, leading to a weakening of USD/JPY.

- The recent dip in the US Purchasing Managers’ Index (PMI) further underscores concerns of economic slowdown, diminishing demand for the USD and supporting bearish pressure on USD/JPY.

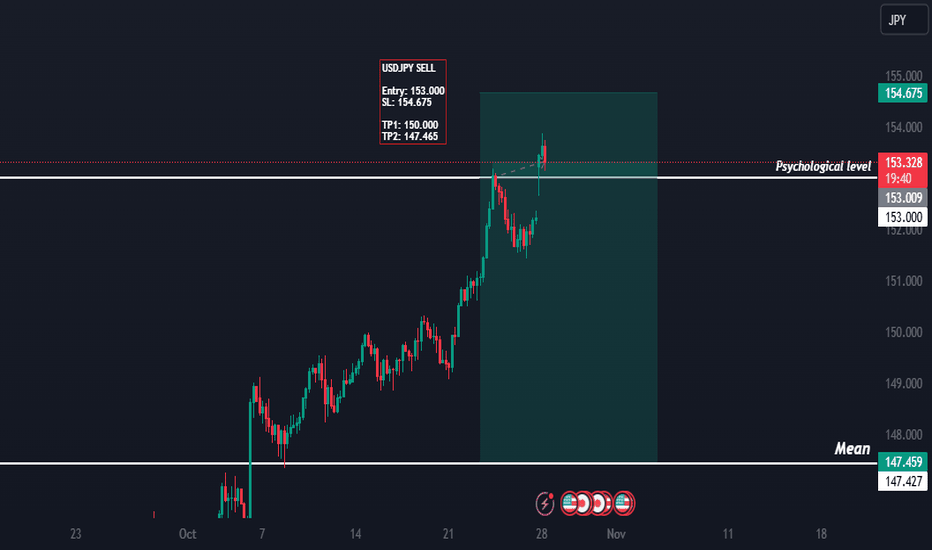

4. Technical Analysis: Support and Resistance Levels

- Support Level: Key support for USD/JPY is currently at 148.50. A move below this level could accelerate bearish momentum for USD/JPY.

- Resistance Level: Resistance around 150.00 remains a psychological barrier for the pair. Failing to break this level strengthens the bearish case as sellers look to capitalize on a potential reversal.

- Moving averages and RSI indicators also show signs of bearish divergence, suggesting that downside potential is present in the short term.

5. Broader Global Risk Sentiment

- Broader market sentiment remains cautious, with some aversion to riskier assets as investors shift focus to more stable options like the yen. With China’s economic recovery wavering and other global uncertainties affecting investor sentiment, a “risk-off” environment typically benefits the yen while weakening USD/JPY.

Conclusion

Given these combined factors, USD/JPY could face a slight bearish bias today, pressured by a dovish Fed outlook, weak US economic data, and steady yen demand. Monitoring global risk sentiment and economic data releases will be essential for traders, as any shifts could further define USD/JPY’s direction in the coming sessions.

---

SEO Keywords for TradingView:

1. USD/JPY forecast

2. USD/JPY today

3. Japanese Yen analysis

4. US Dollar bearish outlook

5. Federal Reserve impact on USD/JPY

6. forex trading USD/JPY

7. USD/JPY support and resistance

8. USD/JPY technical analysis

9. safe-haven currency yen

Federalreserveimpactonusdjpy

USDJPY Analysis for 01/10/2024: A Slightly Bullish Bias ExpectedThe USDJPY currency pair continues to exhibit a slightly bullish bias as of October 1, 2024, driven by the current fundamental factors and prevailing market conditions. In this article, we will explore the key drivers behind this trend, providing forex traders with actionable insights for today’s trading session.

Key Drivers Behind USDJPY Bullish Bias

1. Hawkish U.S. Federal Reserve Policy

One of the key factors supporting the bullish outlook for USDJPY is the ongoing hawkish stance of the Federal Reserve. The Fed remains committed to controlling inflation, which has led to higher interest rates in the U.S. This rate differential favors the U.S. dollar over the Japanese yen, as investors are drawn to the higher returns offered by U.S. assets. The expectation of steady or potentially higher rates from the Fed further boosts demand for the U.S. dollar, pushing USDJPY higher.

2. Weakness in the Japanese Yen

The Bank of Japan (BoJ) continues its ultra-loose monetary policy, with little indication of shifting towards a more hawkish stance. This dovish approach, coupled with a lack of inflationary pressure in Japan, has led to a sustained weakness in the yen. As long as the BoJ maintains its negative interest rate policy and yields remain low, USDJPY is likely to see upward momentum, supported by the widening gap between U.S. and Japanese interest rates.

3. U.S. Economic Strength

Recent U.S. economic data continues to show resilience, particularly in the labor market and consumer spending. This strength provides further justification for the Fed’s hawkish stance and supports a bullish bias for USDJPY. As long as the U.S. economy outperforms its global peers, particularly Japan, the dollar is likely to retain its strength against the yen.

4. Interest Rate Differentials

The widening interest rate differential between U.S. and Japan is another significant factor driving USDJPY higher. U.S. bond yields remain elevated, attracting foreign investment into U.S. markets, while Japan’s government bonds offer little to no yield. This creates a favorable environment for the U.S. dollar, keeping upward pressure on USDJPY.

5. Geopolitical Stability in the U.S.

While geopolitical risks globally remain a concern, the relative stability in the U.S. compared to regions like Europe or Asia continues to attract investors to the dollar as a safe-haven asset. The yen, traditionally viewed as a safe-haven currency, is seeing reduced demand due to Japan’s domestic challenges and the BoJ’s accommodative policy, further boosting USDJPY.

Technical Outlook

From a technical perspective, USDJPY is currently trading near resistance levels, with the 150.00 mark acting as a key psychological barrier. A break above this level could open the door for further gains toward the 151.00 level. Support is seen around 148.50, which could act as a floor for any short-term pullbacks. Traders should monitor these levels closely as the pair’s momentum remains positive.

Conclusion: USDJPY Bullish Sentiment Expected to Continue

In conclusion, USDJPY is likely to maintain a slightly bullish bias today, driven by the ongoing divergence in monetary policies between the U.S. and Japan, strong U.S. economic fundamentals, and interest rate differentials. Traders should look for potential upside opportunities as the pair tests key resistance levels, with U.S. data releases and BoJ policy statements remaining crucial to shaping the pair’s direction.

Keywords for SEO:

USDJPY analysis, bullish bias, USD to JPY forecast, forex trading USDJPY, USDJPY technical outlook, Federal Reserve impact on USDJPY, Bank of Japan policy, interest rate differentials, U.S. dollar strength, USDJPY key levels, USDJPY trend today.